Caring for the environment has, for many years, no longer conjured up a vision of living an alternative lifestyle; it’s become an accepted fact of international business life. Our current sustainable mindset owes a great deal to the awareness campaigns carried out by environmental organizations such as Greenpeace. This movement has, for decades, crusaded against commercial and governmental activities that are harmful to the environment and brought ecological anomalies to the attention of the press and the public.

It all started in 1971, on an old trawler. It was manned by a handful of Americans and Canadians who set course for a location off the coast of Alaska to protest US plans to carry out above-ground atomic tests. They failed to reach their destination but succeeded in their campaign, generating so much publicity that the US called off the tests. The trawler was renamed ‘Greenpeace,’ and from then on its popularity grew, thanks largely to its protests against hunting young seals for fur. Demonstrations against whaling, nuclear energy, and chemical discharges quickly strengthened Greenpeace’s influence. In the years that followed, dependencies sprouted up in more and more countries. Then Greenpeace International was founded, first in London, and for pragmatic reasons, its headquarters were moved to Amsterdam, as it wanted to operate from a liberal, progressively minded country.

Too slow

Great strides towards adopting more sustainable solutions have been taken in recent years in various sectors, such as the electronics industry and energy. “But it’s still all moving far too slowly for our liking,” says Radboud van Delft, organization director of Greenpeace International, the umbrella organization of nationally active Greenpeace branches. “We worked out energy scenarios for migrating to fully sustainable energy years ago, scientifically verified by country or continent. What’s more, we’ve already shown that it’s all technically feasible—something which was often disputed in the past. But governmental policies also have to be accommodating. Unfortunately, little is accomplished through climate summits, so we find ourselves having to focus on individual energy companies and governments. Even in Europe, it’s difficult to quickly adopt significant policy changes. Poland, for example, still depends heavily on coal, while France refuses to play ball when it comes to nuclear energy. European policy is very slow and cumbersome, and with certain species facing extinction and people suffering from the consequences of climate change, nature and people need change to happen now.”

Greenpeace can be characterized as an ambitious, action-oriented organization. Its approach is valued throughout the world, as evidenced by its millions of donors and many thousands of volunteers can all bear witness to.

We were looking for a bank that was safe and one we could be sure was investing

our donors’ money responsibly, financing the solutions too.

Radboud van Delft, organization director of Greenpeace International.

Cleaning up

As an organization, Greenpeace prides itself on its use of independent, non-violent, creative confrontation. “We seek neither political nor commercial links, and we have no permanent enemies or allies,” says Van Delft. “We don’t accept money from companies or governments; financial dependence or obligation would make it difficult to be critical, so we avoid such situations. We seek common cause through our work with governments and, of course, our work with companies, like Coca-Cola and McDonald’s, to promote sustainable business. However, while we applaud them for doing the right thing, we never endorse them. We are more than willing to work with any party that shares our objective: protecting the environment. Take Dutch energy supplier Nuon, for example. We are exploring ways with them of producing cleaner energy that will represent a significant step forward in sustainability while maintaining commercial viability.”

Taken in a global context, the situation becomes more complex. As climate summits have shown, it’s the big countries, the ones that use the most energy, that erect the biggest obstacles to far-reaching international agreements. “China is a very interesting example,” says Van Delft. “There’s just so much going on there. Here in the Netherlands, we’ve campaigned strongly against plans to construct five new coal-fired power stations, spread over a period of a few years. In China, they build five such power stations every month. That said, the Chinese government knows it has a lot to do when it comes to the environment; the national government actually uses our reports to put pressure on provincial governments to get things done. Demand for energy is growing very rapidly there, but no other country invests as much in clean energy as China.”

So, given that Greenpeace cannot take action in China, does that mean an increased emphasis on lobbying? “We are a campaign-oriented organization, and there are different ways of campaigning. Over the years, we’ve broadened our campaigning base. We’ve embraced scientific research, for example, and in recent years we’ve become very active on social media, with up to 24 million people who like, share, tweet, sign up, and campaign with us. These efforts have led to wins such as getting Apple to adopt green energy and major fashion brands to drop toxic chemicals from their production processes.”

Green and healthy

During the 1970s and 1980s, Greenpeace gained a lot of brand awareness and donors. Those followers are still faithful, but people in today’s younger generation in the West are more difficult to connect with, which is a problem many other organizations also face. Despite the aging of its donor base, Greenpeace has many supporters worldwide, and in Asia and Latin America, it is growing particularly strongly.

“Our donors make it possible for us to campaign all over the world,” continues Van Delft. Local branches in 40 countries contribute financially to Greenpeace International, which is responsible for worldwide strategy and coordination. Over the past few decades, its worldwide income has grown to approximately EUR 240 million, some EUR 60 million of which is channeled to Greenpeace International. “The money is used to fund global campaigns, our ships, worldwide IT systems, and to pay international employees. We set aside part of our cash reserves for future campaigns and investments. But we want to prevent these reserves from being invested in activities that we typically oppose, such as those of oil and nuclear energy companies. Most mainstream banks do invest in activities like these.”

Greenpeace has, for a while now, used green banks such as Triodos and ASN, but on a very limited scale. Most of their assets have been held by what were considered reliable mainstream banks. The Greenpeace International board was recently looking for a suitable bank and was spurred by a growing need for security. However, it was unfamiliar with the relatively small, Dutch green banks. Van Delft says: “First and foremost, our money had to be secure, and with the smaller banks, it wasn’t clear how secure they were. In a nutshell, we were looking for a bank that was safe and one we could be sure was investing our donors’ money responsibly, financing the solutions too.”

If a bank wants to stay financially sound it must invest in government bonds, but not one government can claim to have a perfect, sustainable energy policy.

Radboud van Delft, organization director of Greenpeace International.

Greenpeace had a few financial institutions in mind, but unfortunately, the smaller banks hadn’t been assessed by the big rating agencies. So, the board decided to have the candidates that showed potential assessed externally, and Van Delft went in search of an independent advisor to help them make a well-founded choice. “Which brought us to Zanders and Sustainalytics.”

Sustainalytics: Sustainalytics is a global provider of environmental, social, governance (ESG) research and analysis. Provided by Sustainalytics, ESG research and analysis enable organizations to assess the potential influence ESG issues will have on the risk and return of their investment portfolios and funds. You can find more information about Sustainalytics on: sustainalytics.com.

Looking further

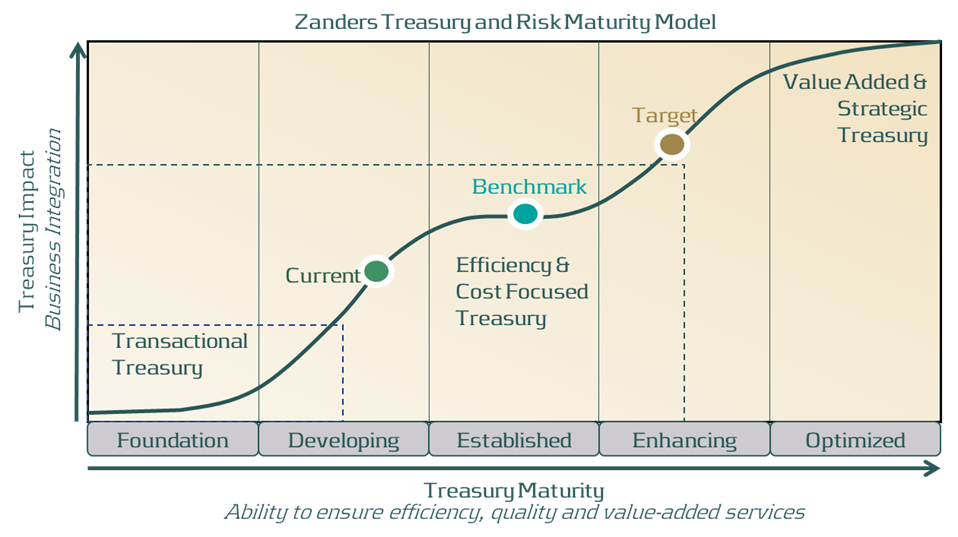

Coincidentally, these two were already on the same wavelength, and so began a collaboration in which banks could be assessed on both creditworthiness and sustainability. Zanders had experience in financial ratings, for which it had already developed models, such as Eagle, while Sustainalytics had experience in assessing companies on their sustainability.

Zanders and Sustainalytics started by whittling down a long list compiled by Greenpeace into a shortlist. Based on their initial ratings, it was possible to eliminate all candidates outside Western Europe and the US. When further scrutinized for sustainability, even many Western banks failed to meet Greenpeace’s exacting criteria.

“We can easily verify a bank’s creditworthiness,” says Zanders consultant Hans Visser, explaining that over 30,000 banks worldwide can be allocated a credit rating through the Zanders bank risk-rating model.

But Greenpeace wanted to look further than that; they wanted to see where a bank invested its money. We were aware of the need for sustainable investment products, but in this respect, we had to check out the bank as a whole."

The question that had to be linked to the creditworthiness factor was what criteria had to be applied to a sustainability rating. Van Delft adds: "It’s not enough for a bank not to invest in activities that could be detrimental to the environment," he explains. "Investments in the defense industry, for example, or those that rely on child labor are also unacceptable. Sustainability criteria are, of course, very specific, the others are more generic. You can quickly ascertain that a bank doesn’t directly finance dubious activities, but it’s much more difficult to establish exactly what happens to the investments it actually makes."

Tal Ullmann and Joris Laseur were responsible for the assessments of banks on their sustainability performance on behalf of Sustainalytics. "To begin with, we assessed a dozen or so banks on Greenpeace’s sustainability criteria," says Ullmann. "You have to realize that no bank can comply fully, so we weighted each criterion with a number of points that were awarded to banks, and in this way, we came to a ranking." The resulting shortlist was then further analyzed and assessed. "We then checked out the banks that scored the most points on Sustainalytics’ more generic sustainability indicators," adds Laseur. "These included indicators in the area of corporate governance, and those pertaining to policies and environmental and societal programs."

Usually, banks that have high ratings are the ones that have clients with high ratings. And the fact that scores for sustainability criteria will never be 10 out of 10 is quite logical, explains Van Delft: "If a bank wants to stay financially sound, it must invest in government bonds, but here’s the thing: there’s not one government that can claim to have a perfect, sustainable energy policy. And that’s just one of the aspects that have to be taken into account."

Other Organizations

The collaboration between the three parties was excellent, assures Van Delft. "I was particularly pleased with the way both Zanders and Sustainalytics were willing to invest in the development of these tools and adapt them to our specific requirements. Their joint expertise was efficiently exploited and it created a lot of synergies. I believe that this cooperative effort between business and society demonstrates how many of the complex problems we face in the world today can be jointly tackled. To the best of my knowledge, rating the combination of a bank’s financial soundness and sustainability in this way is quite unique. Wouldn’t it be great if it could be done by a lot of other organizations too? Not just NGOs but organizations that are active in both the public and private sectors — in fact, everyone who wants to support a newer, greener economy."

The assessment criteria could be adapted to the values and objectives of the relevant organization. "But at the same time, we have to keep following the criteria used for Greenpeace," insists Visser, "it’s a snapshot and, of course, everything changes." Even the collaboration itself is sustainable: it will be followed up by a Monitoring Service, with which bank ratings can be continuously monitored.

In Van Delft’s opinion, their choice of bank indirectly sends a signal to all banks. "Our motivation to use this combination was mainly for internal use, but it certainly contains useful elements that could influence clients’ behavior. The way we have now invested our money complies with our procurement policy and, for example, the construction of our new ship, Rainbow Warrior III. This too must meet the highest possible sustainability requirements and be safe for all those who sail with her."

If you want to know more about rating the combination of sustainability and financial soundness, contact us.