Biodiversity Footprinting: How Financial Institutions Can Measure Their Impact

Deforestation, pollution, and resource overuse are accelerating biodiversity loss, learn how to quantify your organization’s impact.

Human activities such as deforestation, pollution, and resource over-extraction have caused a dramatic decline in biodiversity, with approximately 1 million species at risk of extinction, highlighting the urgent need for financial institutions to adopt biodiversity footprinting methods to measure and mitigate their environmental impact. According to the 2019 Global Assessment Report on Biodiversity and Ecosystem Services by IPBES, about 1 million species are now threatened with extinction due to these human activities (Brondízio, Settele, Diaz, & Ngo, 2019). Moreover, WWF’s 2024 Living Planet Report documents a 73% decline in wildlife populations since 1970 (World Wildlife Fund, 2024). These findings underscore the urgency for action to conserve and restore natural environments.

We previously published articles exploring the importance of biodiversity risks and opportunities for financial institutions (Biodiversity risks and opportunities for financial institutions explained), and introduced a quantitative approach to scoring biodiversity risks based on sector and location (Biodiversity risks scoring: a quantitative approach). Building on those insights, this blog addresses the challenge of quantifying the biodiversity impact of a financial institution. Specifically, it explains biodiversity footprinting: a method enabling financial institutions to measure, track, and ultimately mitigate their environmental impact on biodiversity.

What is biodiversity and why it matters

A commonly used definition of biodiversity is “the variability among living organisms from all sources including, inter alia, terrestrial, marine and other aquatic ecosystems and the ecological complexes of which they are part; this includes diversity within species, between species and of ecosystems” (Convention on Biological Diversity, 1992). Hence, it represents all living organisms on earth like animals, plants, fungi and microbes, and the complex interactions that form our ecosystems. Biodiversity is the backbone of the earth's life-support systems. It directly affects the air we breathe, the food we eat and the water we drink. Additionally, healthy ecosystems help mitigate climate change by capturing carbon, safeguarding water supplies and maintaining balanced soil nutrients. Furthermore, natural habitats like wetlands, mangroves and forests protect communities from extreme weather events.

Economically, biodiversity is vital too. For example, ENCORE defines ecosystem services as the benefits that nature provides to support economic activities (ENCORE, sd). These services are categorized into provisioning services, which supply resources like food, water, and raw materials; regulating and maintenance services, which include air and water purification, climate regulation, and pest control; and cultural services, offering recreational, educational, and spiritual benefits. Biodiversity is fundamental to the proper functioning of these services.

While many global efforts and investments focus on monitoring and reducing CO2 emissions, much less attention is given to tracking and preventing biodiversity loss. This gap shows a key weakness in our environmental management strategies.

Why it matters for financial institutions

The financial sector plays a critical role in shaping the global economy by directing investments into various ventures, industries, and innovations. Biodiversity loss poses tangible risks (e.g. operational, reputational and regulatory) that financial institutions must address. Ignoring these risks could lead to stranded assets, disrupted supply chains or negative stakeholder reactions (for more about biodiversity risk for financial institutions, see this previous blog. Moreover, integrating biodiversity considerations into decision-making can lead to more resilient investment strategies and unlock new, nature-positive opportunities.

By measuring and monitoring their biodiversity impacts, banks, asset managers, insurers and other financial entities can:

- Learn about and better understand the causes and complexities of biodiversity loss;

- Identify biodiversity hotspots in their portfolios;

- Engage with clients on sustainable practices to reduce their impact;

- Align with global frameworks and evolving regulatory standards.

As awareness of biodiversity risks and opportunities grows, understanding how to measure biodiversity impacts becomes important. Biodiversity footprinting is a helpful tool for this.

What is biodiversity footprinting?

Biodiversity footprinting is a method for quantifying the impact of products, investments, or entire portfolios on natural ecosystems. Similar to measuring a carbon footprint, a biodiversity footprint measures the degree to which an activity affects habitat quality, species abundance, and overall ecological health. This is done by tracking factors like land use, water consumption, greenhouse gas emissions, and pollution. The goal is to pinpoint economic activities with significant environmental impact, so that organizations can set informed targets and policies to promote biodiversity conservation.

Quantifying a biodiversity footprint is more challenging than measuring a carbon footprint, as it involves multiple local factors, diverse habitats and various impact types. The complexity and location-specific nature of biodiversity means that universal benchmarks or standardized datasets are still evolving. Today, multiple initiatives and approaches exist, each with its own methods and metrics for assessing biodiversity impacts.

Zanders’ biodiversity footprinting model

Zanders’ model for biodiversity footprinting provides financial institutions with a first scan and quantification of the impacts their financial activities have on natural ecosystems. The methodology is based on the Biodiversity Footprint for Financial Institutions (BFFI), an approach that enables calculation of biodiversity impacts across multiple asset classes.

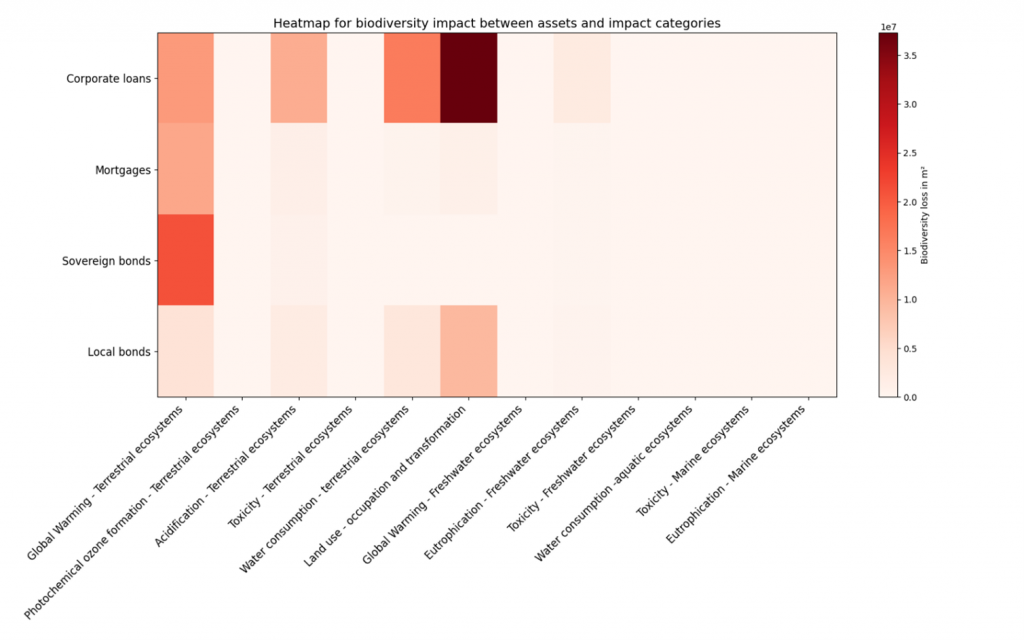

Our model requires input data on the size of economic activities (in euros), the specific sector or asset type, and the location at a country-level granularity. It integrates this data with important environmental pressures derived from a multi-regional environmentally extended input-output database. Using life cycle assessment techniques, the biodiversity footprint is calculated by determining the Potentially Disappeared Fraction (PDF) of species. This is used to express the total biodiversity loss in square meters (m²) resulting from one year of economic activities.

By quantifying these impacts, financial institutions can identify specific biodiversity impact hotspots within their portfolios. This enables them to set informed, science-based targets aimed at effectively reducing their overall biodiversity footprint. The image below illustrates the results for a hypothetical portfolio, highlighting biodiversity impacts across various asset classes and impact categories.

If you are interested in learning more about how Zanders can help you quantify your biodiversity impact, please contact Steyn Verhoeven, Martijn Schouten or Marije Wiersma.

Bibliography

Brondízio, E. S., Settele, J., Diaz, S., & Ngo, H. T. (2019). Global assessment report on biodiversity and ecosystem services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services. Bonn, Germany: IPBES secretariat.

Convention on Biological Diversity. (1992). Article 2: Biodiversity definition. Retrieved from Convention on Biological Diversity: https://www.cbd.int/convention/articles?a=cbd-02

ENCORE. (n.d.). Ecosystem Services. Retrieved from ENCORE: https://www.encorenature.org/en/data-and-methodology/services

Wiersma, M., Blijlevens, S., & Manzanares, M. (2024, October). Biodiversity risks scoring: a quantitative approach. Retrieved from Zanders: https://zandersgroup.com/en/insights/blog/biodiversity-risks-scoring-a-quantitative-approach

Wiersma, M., Gerrits, J., & Fedenko, I. (2023, November). Biodiversity risks and opportunities for financial institutions explained. Retrieved from Zanders: https://zandersgroup.com/en/insights/blog/biodiversity-risks-and-opportunities-for-financial-institutions-explained

World Wildlife Fund. (2024). Living Planet Report 2024. Retrieved from https://www.worldwildlife.org/publications/2024-living-planet-report