With recent volatility in financial markets, firms need increasingly faster pre-trade and risk calculations to react swiftly to changing markets. Traditional computing methods for these calculations, however, are becoming prohibitively expensive and slow to meet the growing demand. GPU computing has recently garnered significant interest, with advances in the fields of advanced machine learning techniques and generative AI technologies, such as ChatGPT. Financial institutions are now looking at gaining an edge by using GPU computing to accelerate their high-dimensional and time-critical computing challenges.

The MVA Computing Challenge

The timely computation of MVA is essential for pre-trade and post-trade modelling of bilateral and cleared trading. Providing an accurate measure of future margin requirements over the lifetime of a trade requires the frequent revaluation of derivatives with a large volume of intensive nested Monte Carlo simulations. These simulations need to span a high-dimensional space of trades, time steps, risk factors and nested scenarios, making the calculation of MVA complex and computationally demanding. This is further complicated by the need for an increasing frequency of intra-day risk calculations, due to recent market volatility, which is pushing the limits of what can be achieved with CPU-based computing.

An Introduction to GPU Computing

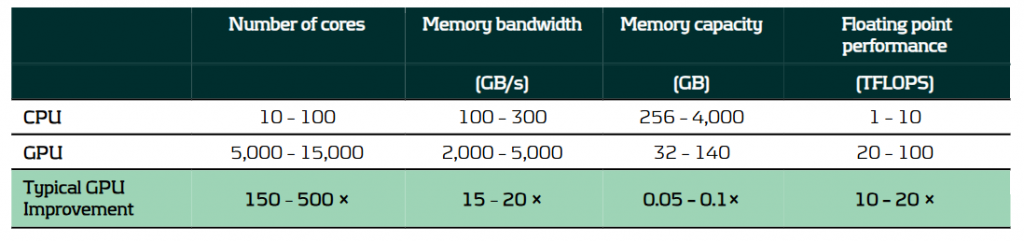

GPU computing utilizes graphics processing units, which are specifically designed to handle large volumes of parallel calculations. This capability makes them ideal for solving programming challenges that benefit from high levels of parallelization and data throughput. Consequently, GPUs can offer substantial benefits over traditional CPU-based computing, thanks to their architectural differences, as outlined in the table below.

A comparison of the typical capabilities of enterprise-level hardware for CPUs and GPUs.

It is because of these architectural differences that CPUs and GPUs excel in different areas:

- CPUs feature fewer but more powerful cores, optimized for general-purpose computing with complex, branching instructions. They excel in performing serial calculations with high single-core performance.

- GPUs consist of a large number of less powerful cores and with higher memory bandwidth. This makes them ideal for handling large volumes of parallel calculations with high throughput.

Solving the MVA Computational Challenge with GPU Computing

The requirement to calculate large volumes of granular simulations makes GPU computing especially well-suited to solving the MVA computational challenge. The use of GPU computing can lead to significant improvements in performance for not only MVA but a range of problems in finance, where it is not uncommon to see improvements in calculation speed of 10 – 100x. This performance increase can be harnessed in several ways:

- Speed: The high throughput of GPUs provides results more quickly, providing faster risk calculations and insights for decision-making, which is particularly important for pre-trade calculations.

- Throughput: GPUs can more quickly and efficiently process large calculation volumes, providing institutions with more peak computing bandwidth, reducing workloads on CPU-grids that can be used for other tasks.

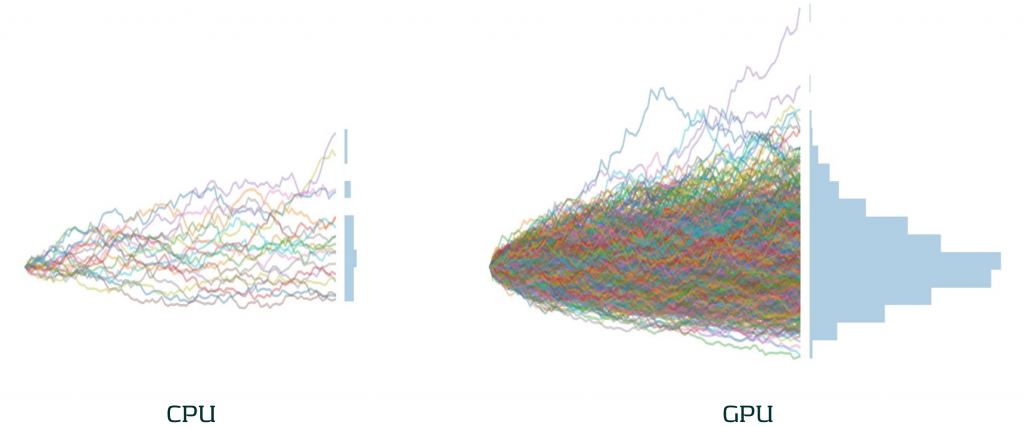

- Accuracy: With greater parallel processing capabilities, the accuracy of models can be improved by using more sophisticated algorithms, greater granularity and a larger number of simulations. As illustrated below, the difference in the number of Monte Carlo simulations that can be achieved by GPUs in the same time as CPUs can be significant.

The difference in the number of Monte Carlo paths than can be simulated in the same time between an equivalent enterprise-level CPU and GPU.

Case Study: Our approach to accelerating MVA with GPUs

To illustrate the impact of GPU computing in a real situation, we present a case study of our work accelerating MVA calculations for a major bank.

Challenge: A large investment bank was seeking to improve the performance of their pre-trade MVA for more timely calculations. This was challenging as they needed to compute their MVA exposures over long time horizons, with a large number of paths. Even with a sensitivity-based approach, this process took close to 10 minutes using a single-threaded CPU calculation.

Solution: Zanders analyzed the solution and identified several bottlenecks. We developed and optimized a GPU-accelerated solution to ensure efficient GPU utilization, parallelizing the calculations across scenarios and risk factors.

Performance: Our GPU implementation improved MVA calculation speed by 51x. Improving calculation time from just under 10 minutes to 10 seconds. This significant increase in speed enabled more timely and frequent assessments and decisions on MVA.

Our Recommendation: A strategic approach to GPU computing implementations

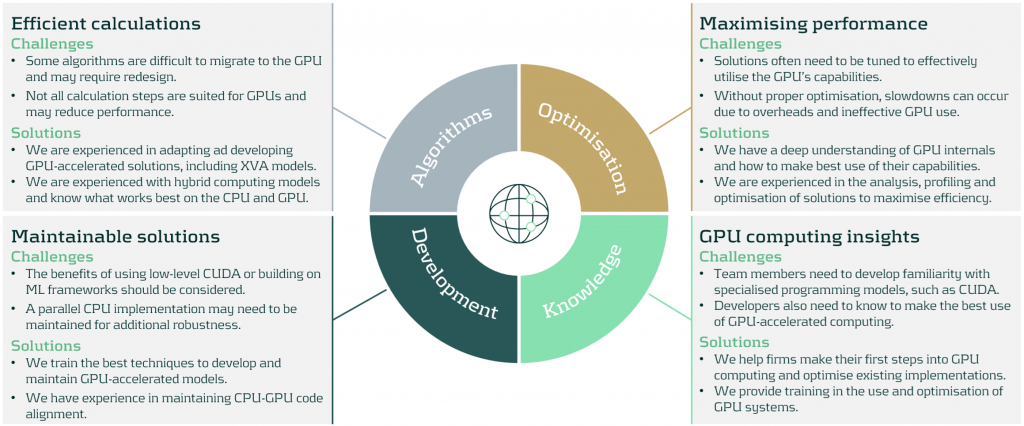

There are significant benefits to be achieved with the use GPU computing. However, there are some considerations to ensure an effective use of resources:

We work with firms to develop bespoke solutions to meet their high-performance computing needs. Zanders can help in all aspects of GPU computing implementation, from initial design to the analysis, development and optimization of your GPU computing implementation.

Conclusion

GPU computing offers significant improvements in the speed and efficiency of financial calculations, typically boosting calculation speeds by factors of 10-100x. This enables financial institutions to manage their risk more effectively, including the computationally demanding calculations of MVA. By replacing CPU-based calculations with GPU computing, banks can dramatically improve their capacity to process greater volumes of calculations with higher frequency. As financial markets continue to evolve, GPU computing will play an increasingly vital role in their calculation infrastructure.

To find out more on how GPU computing can enhance your institution's risk management processes, please contact Steven van Haren (Director) or Mark Baber (Senior Manager).