Grip on Your EVE SOT

Following the regime shift towards steeply increased interest rates, banks face the challenge of keeping their outcomes for the supervisory outlier test (SOT) on the economic value of equity (EVE) within regulatory thresholds. What causes this? And what can banks do?

Over the past decades, banks significantly increased their efforts to implement adequate frameworks for managing interest rate risk in the banking book (IRRBB). These efforts typically focus on defining an IRRBB strategy and a corresponding Risk Appetite Statement (RAS), translating this into policies and procedures, defining the how of the selected risk metrics, and designing the required (behavioral) models. Aspects like data quality, governance and risk reporting are (further) improved to facilitate effective management of IRRBB.

Main causes of volatility in SOT outcomes

The severely changed market circumstances evidence that, despite all efforts, the impact on the IRRBB framework could not be fully foreseen. The challenge of certain banks to comply with one of the key regulatory metrics defined in the context of IRRBB, the SOT on EVE, illustrates this. Indeed, even if regularities are assumed, there are still several key model choices that turn out to materialize in today’s interest rate environment:

- Interest rate dependency in behavioral models: Behavioral models, in particular when these include interest rate-dependent relationships, typically exhibit a large amount of convexity. In some cases, convexity can be (significantly) overstated due to particular modeling choices, in turn contributing to a violation of the EVE SOT criterium. Some (small and mid-sized) banks, for example, apply the so-called ‘scenario multipliers’ and/or ‘scalar multipliers’ defined within the BCBS-standardized framework for incorporating interest rate-dependent relationships in their behavioral models. These multipliers assume a linear relationship between the modeled variable (e.g., prepayment rate) and the scenario, whereas in practice this relationship is not always linear. In other cases, the calibration approach of certain behavioral models is based on interest rates that have been decreasing for 10 to 15 years, and therefore may not be capable to handle a scenario in which a severe upward shock is added to a significantly increased base case yield curve.

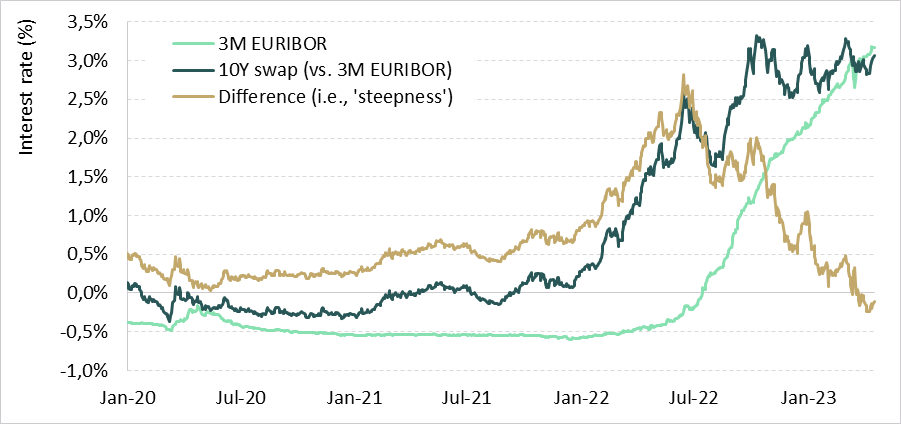

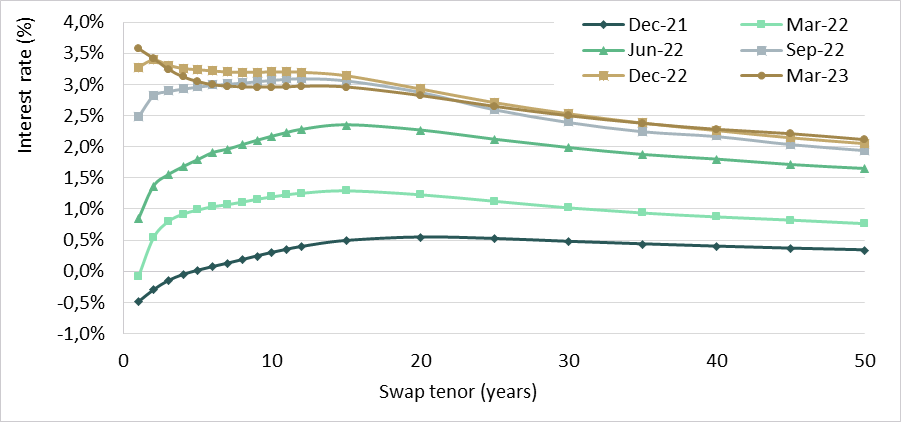

- Level and shape of the yield curve: Related to the previous point, some behavioral models are based on the steepness (defined as the difference between a ‘long tenor’ rate and a ‘short tenor’ rate) of the yield curve. As can be seen in Figure 1, the steepness changed significantly over the past two years, potentially leading to a high impact associated with the behavioral models that are based on it. Further, as illustrated in Figure 2, the yield curve has flattened over time and recently even turned into an inverse yield curve. When calculating the respective forward rates that define the steepness within a particular behavioral model, the downward trend of this variable that results due to the inverse yield curve potentially aggravates this effect.

Figure 1: Development of 3M EURIBOR rate and 10Y swap rate (vs. 3M EURIBOR) and the corresponding 'Steepness'

Figure 2: Development of the yield curve over the period December 2021 to March 2023.

- Hidden vulnerability to ‘down’ scenarios: Previously, the interest rates were relatively close to, or even below, the EBA floor that is imposed on the SOT. Consequently, the ‘at-risk’ figures corresponding to scenarios in which (part of) the yield curve is shocked downward, were relatively small. Now that interest rates have moved away from the EBA floor, hidden vulnerability to ‘down’ scenarios become visible and likely the dominating scenario for the SOT on EVE.

- Including ‘margin’ cashflows: Some banks determine their SOT on EVE including the margin cashflows (i.e., the spread added to the swap rate), while discounting at risk-free rates. While this approach is regulatory compliant, the inclusion of margin cashflows leads to higher (shocked) EVE values, and potentially leads to, or at least contributes to, a violation of the EVE threshold.

What can banks do?

Having identified the above issues, the question arises as to what measures banks should consider. Roughly speaking, two categories of actions can be distinguished. The first category encompasses actions that resolve an inadequate reflection of the actual risk. Examples of such actions include:

- Identify and re-solve unintended effects in behavioral models: As mentioned above, behavioral models are key to determine appropriate EVE SOT figures. Next to revisiting the calibration approach, which typically is based on historical data, banks should assess to what extent there are unintended effects present in their behavioral models that adversely impact convexity and lead to unrepresentative sensitivities and unreliably shocked EVE values.

- Adopt a pure IRR approach: An obvious candidate action for banks that still include margins in their cashflows used for the EVE SOT, is to adopt a pure interest rate risk view. In other words, align the cashflows with its discounting. This requires an adequate approach to remove the margin components from the interest cashflows.

The second category of actions addresses the actual, i.e., economic, risk position of bank. One could think of the following aspects that contribute to steering the EVE SOT within regulatory thresholds:

- Evaluate target mismatch: As we wrote in our article ‘What can banks do to address the challenges posed by rising interest rates’, a bank’s EVE is most likely negatively affected by the rise in rates. The impact is dependent on the duration of equity taken by the bank: the higher the equity duration, the larger the decline in EVE when rates rise (and hence a higher EVE risk). In light of the challenges described above, a bank should consider re-evaluating the target mismatch (i.e. the duration of equity).

- Consider swaptions as an additional hedge instrument: Convexity, in essence, cannot be hedged with plain vanilla swaps. Therefore, several banks have entered into ‘far out of the money’ swaptions to manage negative convexity in the SOT on EVE. From a business perspective, these swaptions result in additional, but accepted costs and P&L volatility. In case of an upward-sloping yield curve, the costs can be partly offset since the bank can increase its linear risk position (increase duration), without exceeding the EVE SOT threshold. This being said, swaptions can be considered a complex instrument that presents certain challenges. First, it requires valuation models – and expertise on these models – to be embedded within the organization. Second, setting up a heuristic that adequately matches the sensitivities of the swaptions to those of the commercial products (e.g., mortgages) is not a straightforward task.

How can Zanders support?

Zanders is thought leader in supporting banks with IRRBB-related topics. We enable banks to achieve both regulatory compliance and strategic risk goals, by offering support from strategy to implementation. This includes risk identification, formulating a risk strategy, setting up an IRRBB governance and framework, policy or risk appetite statements. Moreover, we have an extensive track record in IRRBB and behavioral models, hedging strategies, and calculating risk metrics, both from a model development as well as a model validation perspective.

Are you interested in IRRBB related topics? Contact Jaap Karelse, Erik Vijlbrief (Netherlands, Belgium and Nordic countries) or Martijn Wycisk (DACH region) for more information.