Zanders helped Royal FloraHolland – the largest B2B floriculture platform in the world – to secure a new debt facility of €210 million with three banks and built a compelling case for their future credit requirements.

How do you get banks on board to provide you with financing on favorable terms when your modus operandi isn’t maximizing profit? Zanders helped Royal FloraHolland find the answer, leading them to secure a new debt facility of €210 million with three banks. Royal FloraHolland is the largest B2B floriculture platform in the world. Operating as a member-owned cooperative has always been the strongest element of Royal FloraHolland’s manifesto - right from its first flower auction back in 1912. But this unique structure also proved to be a complication when it came to refinancing its credit facility. Fortunately, they had Zanders on hand to help frame a compelling case for their future credit requirements.

Harnessing cooperative strength

Royal FloraHolland was first established as a cooperative for growers and sellers more than 110 years ago and is renowned for organizing flower auctions via clock sales. Over the years, as the floriculture trade has become increasingly international and competitive, the role and remit of Royal FloraHolland has expanded beyond flower auctions. Today, it is an international B2B trading platform offering a wide variety of deal-making, logistics, and financial services to its members.

Royal FloraHolland - and as a consequence a large part of the sector - is currently in the midst of a large-scale transformation, focusing on, among other things, migrating to a more digital way of working (via the Floriday platform) and promoting more sustainable practices across the floriculture sector. The refinancing of Royal FloraHolland’s credit facility in 2024 was not only important in terms of securing financial back-up for its day-to-day operations but also to invest in ongoing strategic developments.

Putting in the groundwork

The impending maturity of Royal FloraHolland’s existing credit facility in 2024 prompted the cooperative to appoint Zanders in 2022 to maximize the success of their corporate refinancing process. A process that started with the internal team conducting a lengthy reevaluation of their capital needs in the light of their evolving strategic priorities and ambitions.

“When Royal FloraHolland first reached out to us in 2022, we had a few talks, looked into numbers and analysis, and talked about the questions that they were likely to be asked and where they stood at that point in time,” remembers Zanders' Partner, Koen Reijnders. “This revealed that the future financial projections for the refinancing were not sufficiently substantiated. At this point, there were two options. We could go to the banks straight away with a story that was not finished yet - but this would inevitably lead to questions. Or Royal FloraHolland could take some time to do more homework and go to the banks better prepared. We all agreed the second option was the route to take.”

Due to the scale of Royal FloraHolland’s transformation program, clarifying financial projections and scoping funding requirements was a lengthy process. “We needed to revisit our strategy and really have commitment internally on our strategic implementation route map and corresponding results, which we could present to the banks,” says David van Mechelen, Chief Financial Officer of Royal FloraHolland. “This required the involvement of the total management team of Royal FloraHolland, across all disciplines. It was a burden, but it was also worthwhile because it sharpened our internal planning and alignment and a year later when we came to preparing the pitch for the banks, it was very concrete and thoroughly elaborated.”

With the structure and characteristics of the new facility agreed, in the summer of 2023, the information memorandum was completed. The RFP documents were then issued to the group of banks identified as a good match. In addition to Royal FloraHolland’s existing lenders, a few other banks and the European Investment Bank (EIB) were invited to participate in the process.

Coaxing banks out of their comfort zone

Royal FloraHolland might be midway through a significant transformation strategy, but the ethos at the heart of its business model remains unchanged—connecting growers and buyers to make it easier to trade and do business together, to achieve the best possible market prices for flowers and plants and to unite members to tackle the challenges facing the future of their industry. A large driver behind the organization’s success is its structure as a cooperative. Royal FloraHolland is owned and works primarily in the interest of its members. In order for banks to understand the value of this unique approach required a pitch that was sufficiently compelling to convince banks to step outside of their comfort zone.

“We are a cooperative, and this is not a normal company and that's sometimes hard for banks to understand,” says Wilco van de Wijnboom, Corporate Finance Manager for Royal FloraHolland. “What is it? How does it work? How is our financial model designed? Why are we not making that much profit?”

In addition, unlike more conventional agricultural cooperatives, Royal FloraHolland never owns any products. Because all proceeds from sales through the platform go directly to the growers, funding is not generated through the profit made on selling products. Instead, Royal FloraHolland finances its operations primarily by charging an annual service fee to its members. By removing the cooperative’s interest in the profit derived from trade transactions, it is free to focus its role on enabling the easy exchange of floral products between grower and buyer parties for the best possible price. This is a sound strategy for Royal FloraHolland, but it is not a profit-driven enterprise that fits neatly into the banks’ standard credit rating and modeling processes.

“We have a different business model,” explains David. “Our traded volumes yield €5.5 billion. The service fees derived from the trades generate €500 million. We just raise the tariffs enough every year to breakeven. But the banks want to see profitability. Conceptually, it's very difficult for a bank.”

“Zanders gave us guidelines on how to build the case for the banks, Because many of our investments in the coming years are in sustainability, they advised us to introduce this into the framing of the refinancing and this was an interesting addition to the discussions we had with banks.”

Wilco van de Wijnboom, Corporate Finance Manager for Royal FloraHolland

Building the credit story

Without profit as a leverage for raising finance, Royal FloraHolland needed to carefully frame its refinancing pitch to appeal to the banks and satisfy their due diligence. For this reason, Zanders worked with Royal FloraHolland to demonstrate the soundness of the business, in particular emphasizing its diversification and the crucial role of the cooperative and the platform for the sector. In addition, they introduced sustainability as an extra angle for discussion.

“Zanders gave us guidelines on how to build the case for the banks,” Wilco explained. “Because many of our investments in the coming years are in sustainability, they advised us to introduce this into the framing of the refinancing and this was an interesting addition to the discussions we had with banks.”

Royal FloraHolland is committed to promoting sustainability throughout the floriculture value chain. From reducing CO2 emissions through smarter logistics and investing in more energy-efficient real estate to encouraging the use of more innovative methods to reduce the climate impact of the floriculture sector, such as LED lighting and geothermal and solar energy. The cooperative’s sustainability ambitions became an interesting lever during the refinancing negotiations and made an important contribution to the positive reaction from the banks to the refinancing.

Securing the right terms

The strength of the proposal meant ultimately the refinancing was agreed swiftly, with the agreement signed and sealed in March 2024, well ahead of their previous facility maturing. “From the beginning of the discussions with the banks until we signed the contract was seven months—we did it all in seven months,” Wilco remembers.

This armed Royal FloraHolland with a financing agreement with three banks worth €210 million, giving the group access to both the additional capital they need to invest in its growth strategy and the credit line to absorb fluctuations in liquidity due to business operations. Securing favorable terms (when at times it felt against the odds) is something they largely credit to being able to leverage Zanders’ market knowledge and experience and their handling of the negotiations with banks. This was particularly valuable when it came to addressing the large disparity in the initial quotes received from the banks.

“I realized more than ever during this process how important it is that Zanders was doing most of the negotiations - this was very important,” David adds. “The banks know that Zanders oversees the market so they also know they can't fool Zanders. Plus, it is in the interest of Zanders commercially, to remain a reliable partner and this means not bluffing too much to banks. This adds trust to the negotiation process. And we needed that, especially when working with the banks to adjust their quotes so they were in line with each other.”

The value of independence

This project underscores the value of having an independent debt advisor to navigate your company through the complexities of structuring credit facilities. From developing a compelling business case to present to banks to securing the most beneficial terms for corporate financing agreements, Zanders supports its clients throughout the entire process.

For more information on Zanders’ debt advisory and refinancing expertise, please contact Koen Reijnders.

Embarking on a transformative journey to strengthen its treasury function, an international non-governmental organization turned to Zanders for guidance to elevate its operations to the highest industry standards.

A force for change

The NGO sector today is facing a multitude of conflicting pressures. Growing humanitarian need has heightened the pressure on these organizations to change the world, but a constantly shifting landscape means they also need to radically change themselves in order to remain compliant and able to manage their financial operations effectively.

In mid-2022, a prominent NGO appointed Zanders to conduct a comprehensive review and benchmarking of its treasury function. Operating in more than 80 countries, the NGO’s treasury team of 30 dedicated professionals managed a diverse array of banking relationships and accounts. Finely tuned treasury processes and systems are critical to managing such a sprawling financial ecosystem, and the team was aware they needed a more innovative response to their sector’s ever-evolving treasury landscape.

Despite implementing a Treasury Management System (TMS) two years previously, the team was still relying on a large number of manual processes. Recognizing the imperative of automating more of its treasury operations, they asked Zanders to conduct an in-depth assessment to evaluate their performance, benchmark it against industry best practices and to identify areas for improvement.

Clarifying the current state

The primary objectives of the project were manifold: to evaluate the existing setup, identify potential financial and operational risks, define improvement opportunities, design a roadmap, and ultimately, deliver tangible value to the treasury team. Achieving these goals relied on first gaining the clarity provided by a thorough benchmarking exercise.

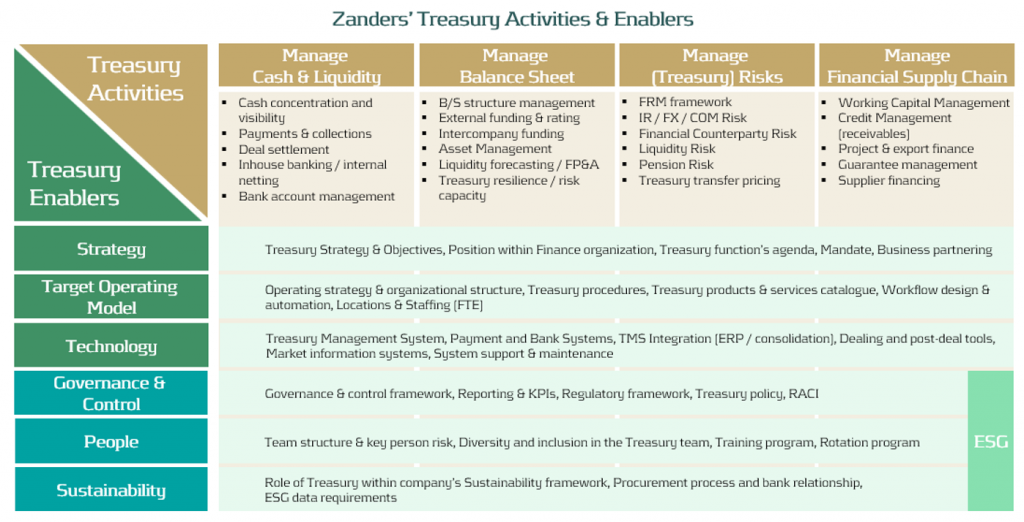

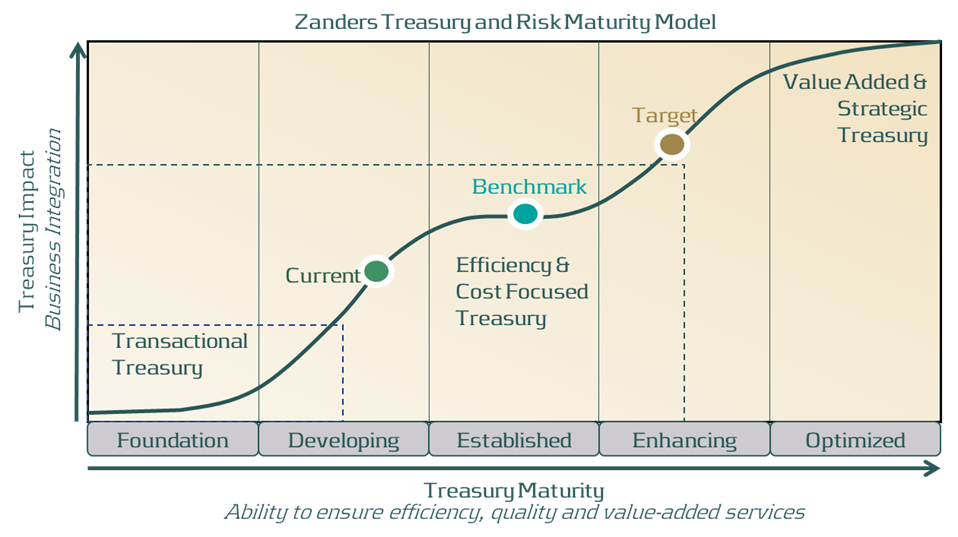

Leveraging its proprietary Treasury and Risk Maturity Model, Zanders performed a deep dive into the organization’s treasury function. By considering and scoring all treasury activities as well as the teams, controls and technologies involved in delivering them, the team modeled the ‘as-is’ situation in a highly structured and meaningful way. When measured against market best practices, this provided a sector-calibrated benchmark from which areas for improvement were identified. The outcomes of this exercise allowed Zanders to develop new targets for the NGO’s treasury function that were then used to design a framework for the future.

A new treasury roadmap

Using Zanders’ Treasury and Risk Maturity Model, the NGO's treasury function was classified as ‘Developing’. This highlighted a number of areas where there was an opportunity to make improvements that would facilitate their advancement towards an ‘Enhancing’ level of treasury maturity. Zanders then collaborated closely with the organization to devise a comprehensive roadmap. This outlined actionable steps designed to elevate performance in the key areas identified and also prescribed follow-up initiatives to provide a structure for their implementation.

This triggered the launch of a series of strategic initiatives aimed at strengthening the NGO’s treasury capabilities. For example, a thorough fit-gap analysis of the existing TMS was undertaken as well as a deep dive into the treasury function’s organizational design. This led to targeted enhancements and optimization measures designed to increase efficiency and resilience within the treasury organization. Central to this endeavor was the prioritization of automating manual processes and streamlining accounting procedures.

From functional to future-ready

By leveraging Zanders' expertise and adopting a proactive approach to treasury management, the NGO has positioned itself on a trajectory of sustained growth and operational excellence. Armed with a strategic roadmap and fortified by targeted improvements, the NGO’s treasury team is not only prepared to navigate the complexities of the global financial landscape with confidence and agility but also fully equipped to transition from a cost-focused to a value-added role. For more information, visit our NGOs & Charities page here, or contact the author of this case study, Joanne Koopman.

When the impending maturity of C. Steinweg’s group credit facility prompted the company to re-evaluate another debt facility at the same time, Zanders provided the expertise to attract a new pool of banks and secure a more flexible financing structure for the business.

C. Steinweg Group is a market-leading logistics and warehousing company with over 6,250 employees and warehouses and terminals that span more than 100 locations in 55 countries worldwide. With 175 years plus experience of storage, handling, forwarding and chartering services throughout the world, the company is a renowned and respected logistics partner for the global commodity trade.

Over its long history, Steinweg has demonstrated agility and resilience, responding to market challenges through innovating its approach to logistics and warehousing services and showing relentless commitment to customer services. Over the years, the business has also diversified into commodity financing as an added value service to its logistics and warehousing activities. At the end of 2022, the company appointed Zanders to advise them on the refinancing of two debt facilities. The aim was to provide the business with the robust and flexible access to capital they needed to continue to support, scale and grow their international operations.

The refinancing project comprised of two core requirements:

- The refinancing of Steinweg’s group credit facility.

- A new, more flexible credit facility for the commodity finance subsidiary.

Due to an overlap in the counterparties invited to participate in the two transactions, Steinweg saw the efficiency potential of taking both of the transactions to market simultaneously. But this also added complexity in terms of arranging and managing the refinancing process and procedures.

It was not a standard refinancing

Pim Van Der Heijden, C. Steinweg Group

“There was a certain complexity to this project, because the refinancings were interrelated from various perspectives,” says Pim Van Der Heijden, Steinweg’s group treasurer and global head of commodity finance. “It was not a standard refinancing. Especially the commodity financing activity, where we didn't go for just a straightforward, typical trade financing credit facility. We were putting something in place which was not only new for us but also for lenders and the legal counsels involved—we had to get them a little bit out of the comfort zone.”

Steinweg recognised early that they would need external support from a debt advisor to help get banks on board with this more innovative structure and also to optimize the value they would get from the refinancing process as well as adding capacity to the team. Zanders had previously worked with Steinweg when its group credit facility was first renewed in 2017, and this experience contributed to the appointment of Zanders to assist them with the new refinancing transactions.

“We approached a few advisors, but we selected Zanders based on track record and pricing,” Van Der Heijden adds. “We know Zanders and we had a good relationship with them, so we had confidence that they could deliver what we were looking for.”

Advice grounded in robust understanding of market practice

As well as their history and established relationship with Steinweg, it was also Zanders’ experience in the market that influenced their appointment on this project. Whereas a company will go to the market every five or seven years to refinance facilities, Zanders is continuously working with lenders on these transactions. This empowers them with current know-how on market practice regarding terms and pricing. Steinweg recognized the value this could bring to their process.

“It really helps to have a debt advisor who has insights into what's happening in the market, what is possible and what is not possible based on actual transactions—they understand how banks work and what is achievable,” Van Der Heijden says. “When Zanders came up with this alternative structure for the commodity financing facility, there was a certain amount of risk involved with going forward with it. This was however one of the reasons that we started the process early, this gave us time to sound and refine the structure. In addition, we knew that we were in good hands, and we ended up getting the results we wanted from it in terms of gaining flexibility that previously wasn't available and might not have been available with a more conventional approach.”

With the maturity of the group credit facility looming in July 2024, this transaction was mission critical and the driving force behind the timing of the combined refinancing project.

“We wanted to start early, and we set the goal to have the new group financing in place before the end of the year 2023,” says Van Der Heijden. “We started preparing by selecting Zanders as a debt advisory partner at the end of 2022, ready to start the process in early 2023, leaving time to complete the transaction by the end of that year.”

A resilient process

The process started with Zanders sitting down with Steinweg to discuss their objectives and requirements for the refinancing. Various scenarios were then modelled before finalizing the structure and characteristics of the new facilities. The RFP documents were then issued to the group of banks identified as a good match. In this case, six banks were invited to pitch—Steinweg’s existing lenders and a selection of additional lenders that matched the required criteria. Zanders’ attention then turned to collecting responses and creating term sheets for the new credit facilities, starting with the group financing.

When it comes to refinancing processes, it’s always wise to prepare for all scenarios. In this case, particularly given the progressive structure of the new facilities, it was important to be prepared for the eventuality that a lender could opt to exit the process. For this reason, more banks than strictly required were invited to participate.

“The new structure was a bit off the beaten track and while we were keen to push new boundaries, we had to be prepared for the reality that some lenders might not share our enthusiasm,” remembers Van Der Heijden. “This approach paid off when an existing lender decided not to participate. Rather than unsettling the process, instead it served to reassure us that the strategy to include more than just our existing bank in the process was good. And it all worked out.”

Due to the highly structured approach and extensive project set-up, when changes occurred there were provisions in place to ensure they caused minimal disruption to the process. This approach ultimately enabled Steinweg to secure competitive pricing and terms for their new group facility. And importantly, this was achieved comfortably ahead of the deadline set by the maturity of their previous agreement.

While the two financing processes ran in parallel, due to the impending maturity of the group facility, securing this was the primary focus initially. Once the group facility was agreed, attention shifted to the commodity financing facility. Steinweg was looking to increase their credit facility, to give them scalable access to more flexible funding to finance commodities on behalf of its clients. Previously, bilateral loan agreements were used to fund this aspect of the business leading to funding inefficiencies. “We had some goals we wanted to achieve with this new funding structure,” says Van Der Heijden. “The most critical was, of course, securing scalable financial headroom, but flexibility was almost as important.”

To deliver this more scalable and flexible access to credit, Zanders modelled a facility that allowed multiple banks to provide funding for commodity financing under the same loan. As an atypical arrangement, it required Zanders to work closely with each counterparty to gain their support for this novel structure.

“The new structure was relatively off the beaten track, but it provided what we needed, which is a lot of flexibility,” says Van Der Heijden. “And the flexibility it gives us is now paying off daily. We can now have three banks participating in a loan and other banks can also be added to the structure as well.”

Reaping the benefits

The new commodity financing facility not only provides essential access to more sources of funding, but also enables Steinweg to react quicker to opportunities and deliver faster, more seamless commodity financing solutions to its customers.

“The group facility was a lifeline, whereas the credit facility for the commodity financing activities was more of a ‘nice to have’ but now it's really adding value in terms of enabling us to pursue growth,” says Van Der Heijden. “We no longer have to talk to our lenders every time we go to market and that really pays off. Previously, if we had a new commodity financing prospect, we sometimes had to wait two weeks to get an answer from our banks to see if we can use the funding. Now, as long as we’re comfortable that it's within the pre-agreed rules, we can pretty much reply to them the same day.”

Conclusion

This project was not only strategically critical for Steinweg but also represented a bold departure from their existing financing agreements. With Zanders’ guidance, they were able to pursue this ambitious approach with confidence and conclude both of the refinancing projects before the end of 2023. This gave the team the peace of mind that their funding was agreed well ahead of their group facility maturing.

This project underscores the value of having an independent debt advisor to navigate your company through the complexities of structuring credit facilities. From ensuring essential deadlines are achieved and developing innovative structures to maintaining the momentum for the process and securing the most beneficial terms with banks. For more information on Zanders' debt advisory and refinancing expertise, contact Koen Reijnders and visit our Corporate finance page.

LyondellBasell, headquartered in the Netherlands, is one of the largest plastics, chemicals and refining companies in the world.

LyondellBasell, with its global presence and significant operations in the United States, the company has been affected by the IBOR reform. The Treasury team was well aware of this impact and proactively approached the transition away from the IBOR rates in order to be ready ahead of time.

While it was a global and multi-functional project, one of the first goals was to ensure the TMS readiness for the calculation with alternative reference rates and the new discounting methodologies. As part of the action plan, the LyondellBasell (LYB) Treasury team (supported by procurement and IT) issued an RfP in Q4 2020 with the aim to get external support for (a) the required system changes, (b) to provide business support for initial transition plans and (c) to adhere to the best-in-class ambition of the company.

Preparing for the transition

LYB selected Zanders as implementation partner and right after the selection the project kicked off in January 2021. Urszula Chwala, was the Treasury Lead for LYB and she outlines why LYB initiated the project earlier than many other corporates: “The project team was already busy since the beginning of 2020. We analyzed the potential global impact of the IBOR reform to LYB. Amongst other impacts we were aware that LYB’s SAP Treasury Management System was highly customized, especially in the area of SAP In-house Cash. As such, we wanted to make sure that we would be ready for the transition to support our business and to enable all teams at LYB to move forward with changes on financial, commercial and legal matters.” Urszula also further comments on the RfP process: “We were looking into the third party that had both technical and business knowledge related to the IBOR reform and could bridge the gap between LYB IT and the Treasury department.”

Appreciated approach

LYB is using SAP ECC EHP8 as their treasury system and as such the standard functionality developed by SAP to support daily compound interest calculation could be implemented. On the Zanders side, SAP consultant Aleksei Abakumov, Adela Kozelova (who fulfilled the role of the business expert and project manager) and Anuja Naiknavare in the role of support consultant have been closely working with LYB’s Treasury and IT teams throughout the project.

Zanders made this project as easy as it could be. What I really appreciated was the approach taken by Zanders team. They have taken all the suggestions from us and tested them and then came up with additional suggestions as well. The Zanders team was thinking with us, taking our best interest in mind. They supported us in every detail and removed concerns and roadblocks. Zanders also acted as business alliance in the project to ensure that all business requirements are now fully translated into the technical solution.

Urszula Chwala, Treasury Lead for LYB

A new functionality

In order to achieve system readiness, the project included configuration and diligent testing of a new data feed source which was required as a base to enable the daily average compound, the simple compound interest calculation and the new evaluation type with enhanced discounting curves. Considering the uncertainty, the availability of the new alternative reference rates, market conventions and the exact timing, the project’s aim was to make sure that the system would be able to support different variations of interest calculation. The project went successfully live in May 2021.

Urszula outlines different challenges encountered in the project: “Technically the biggest challenge was finding the right market data feed for the new rates. The challenge was finding the source and, making it available in SAP and test all scenarios. For the actual transactions, the system is a lot more flexible with respect to entering transactions, which makes a deal capture more complex. But Aleksei has supported the team a lot in navigating through the new functionality and we are confident to enter new deals with overnight risk-free rates. On the business side, the market clarity, especially with regards to market conventions, is still challenging the business cutover.”

Transactions

On the transition side, Treasury was cautiously managing the exposure to the IBOR reform by refraining from entering variable interest rate referencing transactions over the last two years. As a result, there is no need to cutover of any existing transaction. However, there are few intercompany loans that will mature by the end of this year and some of them might be replaced by the deals referencing to the overnight risk-free rates. Having strong presence in the United States, the exposure to the USD LIBOR is considerably higher than to the GBP and CHF LIBOR ceasing at the end of this year. Therefore, the major transition is only expected over the next year, closer to the cessation of the USD LIBOR.

Urszula elaborates on the business transition: “Understanding the logic of how new instruments are going to work gives me a piece of mind for the transition. LYB never meant to be an early adopter of the change. Switching intercompany loans as first seems to be the best approach for us, because there are no corresponding derivatives needed for these products. Also, there is no dependency on the external counterparties, which makes the transition easier.”

Really achieved

LYB and Zanders are currently working on a follow-up project for the cash flow aggregation of interest in SAP. This need emerged from the new daily compounding functionality, which by default creates daily cash flow postings that are difficult to reconcile with the interest settlements. A user-friendly solution to aggregate these daily cash flows has been defined and configured and is currently being validated by the end users. This is the last step for LYB to be ready to create a first deal with daily compounding interest calculation in the system.

The change is coming so you can choose either to embrace it or to postpone it. We decided to embrace it now.

Urszula Chwala, Treasury Lead for LYB

Urszula concludes: “The change is coming so you can choose either to embrace it or to postpone it. We decided to embrace it now. The greatest achievement of this project is that the project was executed within original timelines, without major issues and it gave the whole Treasury team confidence that the system will perform well. What needed to be achieved was really achieved. The complete solution is already implemented for the technical side.”

Donations sometimes have to wait for the right good cause. But as an environmental organization, where can you invest those donations so that they are both safe and not used for purposes that conflict with what you stand for?

Caring for the environment has, for many years, no longer conjured up a vision of living an alternative lifestyle; it’s become an accepted fact of international business life. Our current sustainable mindset owes a great deal to the awareness campaigns carried out by environmental organizations such as Greenpeace. This movement has, for decades, crusaded against commercial and governmental activities that are harmful to the environment and brought ecological anomalies to the attention of the press and the public.

It all started in 1971, on an old trawler. It was manned by a handful of Americans and Canadians who set course for a location off the coast of Alaska to protest US plans to carry out above-ground atomic tests. They failed to reach their destination but succeeded in their campaign, generating so much publicity that the US called off the tests. The trawler was renamed ‘Greenpeace,’ and from then on its popularity grew, thanks largely to its protests against hunting young seals for fur. Demonstrations against whaling, nuclear energy, and chemical discharges quickly strengthened Greenpeace’s influence. In the years that followed, dependencies sprouted up in more and more countries. Then Greenpeace International was founded, first in London, and for pragmatic reasons, its headquarters were moved to Amsterdam, as it wanted to operate from a liberal, progressively minded country.

Too slow

Great strides towards adopting more sustainable solutions have been taken in recent years in various sectors, such as the electronics industry and energy. “But it’s still all moving far too slowly for our liking,” says Radboud van Delft, organization director of Greenpeace International, the umbrella organization of nationally active Greenpeace branches. “We worked out energy scenarios for migrating to fully sustainable energy years ago, scientifically verified by country or continent. What’s more, we’ve already shown that it’s all technically feasible—something which was often disputed in the past. But governmental policies also have to be accommodating. Unfortunately, little is accomplished through climate summits, so we find ourselves having to focus on individual energy companies and governments. Even in Europe, it’s difficult to quickly adopt significant policy changes. Poland, for example, still depends heavily on coal, while France refuses to play ball when it comes to nuclear energy. European policy is very slow and cumbersome, and with certain species facing extinction and people suffering from the consequences of climate change, nature and people need change to happen now.”

Greenpeace can be characterized as an ambitious, action-oriented organization. Its approach is valued throughout the world, as evidenced by its millions of donors and many thousands of volunteers can all bear witness to.

We were looking for a bank that was safe and one we could be sure was investing

our donors’ money responsibly, financing the solutions too.

Radboud van Delft, organization director of Greenpeace International.

Cleaning up

As an organization, Greenpeace prides itself on its use of independent, non-violent, creative confrontation. “We seek neither political nor commercial links, and we have no permanent enemies or allies,” says Van Delft. “We don’t accept money from companies or governments; financial dependence or obligation would make it difficult to be critical, so we avoid such situations. We seek common cause through our work with governments and, of course, our work with companies, like Coca-Cola and McDonald’s, to promote sustainable business. However, while we applaud them for doing the right thing, we never endorse them. We are more than willing to work with any party that shares our objective: protecting the environment. Take Dutch energy supplier Nuon, for example. We are exploring ways with them of producing cleaner energy that will represent a significant step forward in sustainability while maintaining commercial viability.”

Taken in a global context, the situation becomes more complex. As climate summits have shown, it’s the big countries, the ones that use the most energy, that erect the biggest obstacles to far-reaching international agreements. “China is a very interesting example,” says Van Delft. “There’s just so much going on there. Here in the Netherlands, we’ve campaigned strongly against plans to construct five new coal-fired power stations, spread over a period of a few years. In China, they build five such power stations every month. That said, the Chinese government knows it has a lot to do when it comes to the environment; the national government actually uses our reports to put pressure on provincial governments to get things done. Demand for energy is growing very rapidly there, but no other country invests as much in clean energy as China.”

So, given that Greenpeace cannot take action in China, does that mean an increased emphasis on lobbying? “We are a campaign-oriented organization, and there are different ways of campaigning. Over the years, we’ve broadened our campaigning base. We’ve embraced scientific research, for example, and in recent years we’ve become very active on social media, with up to 24 million people who like, share, tweet, sign up, and campaign with us. These efforts have led to wins such as getting Apple to adopt green energy and major fashion brands to drop toxic chemicals from their production processes.”

Green and healthy

During the 1970s and 1980s, Greenpeace gained a lot of brand awareness and donors. Those followers are still faithful, but people in today’s younger generation in the West are more difficult to connect with, which is a problem many other organizations also face. Despite the aging of its donor base, Greenpeace has many supporters worldwide, and in Asia and Latin America, it is growing particularly strongly.

“Our donors make it possible for us to campaign all over the world,” continues Van Delft. Local branches in 40 countries contribute financially to Greenpeace International, which is responsible for worldwide strategy and coordination. Over the past few decades, its worldwide income has grown to approximately EUR 240 million, some EUR 60 million of which is channeled to Greenpeace International. “The money is used to fund global campaigns, our ships, worldwide IT systems, and to pay international employees. We set aside part of our cash reserves for future campaigns and investments. But we want to prevent these reserves from being invested in activities that we typically oppose, such as those of oil and nuclear energy companies. Most mainstream banks do invest in activities like these.”

Greenpeace has, for a while now, used green banks such as Triodos and ASN, but on a very limited scale. Most of their assets have been held by what were considered reliable mainstream banks. The Greenpeace International board was recently looking for a suitable bank and was spurred by a growing need for security. However, it was unfamiliar with the relatively small, Dutch green banks. Van Delft says: “First and foremost, our money had to be secure, and with the smaller banks, it wasn’t clear how secure they were. In a nutshell, we were looking for a bank that was safe and one we could be sure was investing our donors’ money responsibly, financing the solutions too.”

If a bank wants to stay financially sound it must invest in government bonds, but not one government can claim to have a perfect, sustainable energy policy.

Radboud van Delft, organization director of Greenpeace International.

Greenpeace had a few financial institutions in mind, but unfortunately, the smaller banks hadn’t been assessed by the big rating agencies. So, the board decided to have the candidates that showed potential assessed externally, and Van Delft went in search of an independent advisor to help them make a well-founded choice. “Which brought us to Zanders and Sustainalytics.”

Sustainalytics: Sustainalytics is a global provider of environmental, social, governance (ESG) research and analysis. Provided by Sustainalytics, ESG research and analysis enable organizations to assess the potential influence ESG issues will have on the risk and return of their investment portfolios and funds. You can find more information about Sustainalytics on: sustainalytics.com.

Looking further

Coincidentally, these two were already on the same wavelength, and so began a collaboration in which banks could be assessed on both creditworthiness and sustainability. Zanders had experience in financial ratings, for which it had already developed models, such as Eagle, while Sustainalytics had experience in assessing companies on their sustainability.

Zanders and Sustainalytics started by whittling down a long list compiled by Greenpeace into a shortlist. Based on their initial ratings, it was possible to eliminate all candidates outside Western Europe and the US. When further scrutinized for sustainability, even many Western banks failed to meet Greenpeace’s exacting criteria.

“We can easily verify a bank’s creditworthiness,” says Zanders consultant Hans Visser, explaining that over 30,000 banks worldwide can be allocated a credit rating through the Zanders bank risk-rating model.

But Greenpeace wanted to look further than that; they wanted to see where a bank invested its money. We were aware of the need for sustainable investment products, but in this respect, we had to check out the bank as a whole."

The question that had to be linked to the creditworthiness factor was what criteria had to be applied to a sustainability rating. Van Delft adds: "It’s not enough for a bank not to invest in activities that could be detrimental to the environment," he explains. "Investments in the defense industry, for example, or those that rely on child labor are also unacceptable. Sustainability criteria are, of course, very specific, the others are more generic. You can quickly ascertain that a bank doesn’t directly finance dubious activities, but it’s much more difficult to establish exactly what happens to the investments it actually makes."

Tal Ullmann and Joris Laseur were responsible for the assessments of banks on their sustainability performance on behalf of Sustainalytics. "To begin with, we assessed a dozen or so banks on Greenpeace’s sustainability criteria," says Ullmann. "You have to realize that no bank can comply fully, so we weighted each criterion with a number of points that were awarded to banks, and in this way, we came to a ranking." The resulting shortlist was then further analyzed and assessed. "We then checked out the banks that scored the most points on Sustainalytics’ more generic sustainability indicators," adds Laseur. "These included indicators in the area of corporate governance, and those pertaining to policies and environmental and societal programs."

Usually, banks that have high ratings are the ones that have clients with high ratings. And the fact that scores for sustainability criteria will never be 10 out of 10 is quite logical, explains Van Delft: "If a bank wants to stay financially sound, it must invest in government bonds, but here’s the thing: there’s not one government that can claim to have a perfect, sustainable energy policy. And that’s just one of the aspects that have to be taken into account."

Other Organizations

The collaboration between the three parties was excellent, assures Van Delft. "I was particularly pleased with the way both Zanders and Sustainalytics were willing to invest in the development of these tools and adapt them to our specific requirements. Their joint expertise was efficiently exploited and it created a lot of synergies. I believe that this cooperative effort between business and society demonstrates how many of the complex problems we face in the world today can be jointly tackled. To the best of my knowledge, rating the combination of a bank’s financial soundness and sustainability in this way is quite unique. Wouldn’t it be great if it could be done by a lot of other organizations too? Not just NGOs but organizations that are active in both the public and private sectors — in fact, everyone who wants to support a newer, greener economy."

The assessment criteria could be adapted to the values and objectives of the relevant organization. "But at the same time, we have to keep following the criteria used for Greenpeace," insists Visser, "it’s a snapshot and, of course, everything changes." Even the collaboration itself is sustainable: it will be followed up by a Monitoring Service, with which bank ratings can be continuously monitored.

In Van Delft’s opinion, their choice of bank indirectly sends a signal to all banks. "Our motivation to use this combination was mainly for internal use, but it certainly contains useful elements that could influence clients’ behavior. The way we have now invested our money complies with our procurement policy and, for example, the construction of our new ship, Rainbow Warrior III. This too must meet the highest possible sustainability requirements and be safe for all those who sail with her."

If you want to know more about rating the combination of sustainability and financial soundness, contact us.

TU Delft is transforming its campus with smart financial strategies, turning real estate challenges into opportunities for world-class innovation.

The Delft University of Technology (TU) aims to be a world-class institution with excellent research in specific disciplines. In order to achieve this, it needs good research facilities. A substantial part of the current facilities is up for renovation. How can this be financed in times of cost cutting?

More than 5,000 people work at TU Delft, and 17,000 students study there, preparing for professional life. “The TU is a city in a city,” Rianne van der Slot explains. She is the controller of the real estate management team at the University of Delft. “We own 36 buildings with a floor space of approximately 550,000 square meters. We manage all real estate ourselves, as well as the land. We even own the sewerage and have to maintain it ourselves.”

In 1999, the government donated all university real estate to the TU. Most buildings date from the 1960s and ’70s and are in need of thorough, large-scale maintenance or replacement. “The TU Delft will have to finance this itself,” says Mariëlle Vogt, director of finance at the TU. “The estimated costs of possible new buildings, renovation, and large-scale maintenance for the next 10 years amount to approximately half a billion euros.”

The Ministry of Education, Culture, and Science gives a Government Contribution to the TU on a yearly basis, as it does to all Dutch universities. This amount varies as a consequence of different government decisions and adjusted ministerial budgets and is more likely to decrease than to increase despite the growing number of students.

Vogt says: “Unfortunately, we receive no extra government contribution for these investments in real estate. All universities struggle with the combination of real estate in need of renovation and little resources of their own, but for a technical university like ours, it is even more essential. Real estate is a core asset in our primary process. You need a specific building in order to build a sophisticated lab. At universities, you won’t attract renowned scientists with a high salary unless you also have top-rate facilities, so infrastructure is essential. Only then will you be able to attract the right people.”

Role-play

At the end of 2009, the university decided to make extra savings in order to be able to put funds aside for renovations in real estate, education, and science. The plan was to borrow a limited amount and, in addition, put some money aside every year. From 2010 onwards, however, considerable cutbacks were made in the contribution of the government. “As far as revenues are concerned, The Hague is now an uncertain factor,” Vogt says. “It is really difficult to make funding prognoses for the next 30 years. We have to engage in scenario planning and perform sensitivity analyses to ensure that we can pay the loans back in time. That was a reason to look for external help, from Zanders.”

TU Delft preferred funding from the government: Treasury Banking (in Dutch: ‘schatkistbankieren’). Apart from the fact that it is cheaper, it makes more sense for us, as a university, to borrow from another public body. In addition, the government has sufficient resources available, says Ronald van den Bosch, senior business controller of the TU. “We did not know, however, if we could meet the conditions of treasury paper.”

Together with Zanders, a role-play was developed. Vogt explains: “We prepared everything as if we were going to a commercial bank and then asked Koen Reijnders and Hendrik Pons to take the critical position that a bank would take. By doing this, we wanted to submit ourselves to the discipline of a commercial bank – then you know that you are acting in a prudent manner.”

Infrastructure is essential. Only then, will you be able to attract the right people.

Mariëlle Vogt, director of finance at the TU.

Scenarios

It became clear that the TU was able to meet the conditions of Treasury Banking. The business case that Zanders developed with the TU departments for Real Estate and Finance led to a model with which one could calculate the outcome of all kinds of scenarios. An extra investment in one of the buildings, an unexpected interest development, or a higher indexation of building costs: the consequences of all these occurrences will become clear from the model.

“Together we built a toolbox with which we can – so it seems – anticipate developments,” Vogt says. “It is a custom-made model that extends to 2030 and contains a number of scenarios – different financial prognoses in which there is a constant connection between the overall financial prognosis of the TU Delft and its real estate plans.”

The interests of the two departments differ. Real estate feels the pressure of users that require certain facilities. Finance supervises the prudent use of limited funds. “Zanders has connected these two interests,” Van den Bosch states. “In the case of real estate, one argues on project level, whereas the finance department thinks on a balance sheet level. With the model, the consequences on an aggregated level became clear for both sides – a good joint effort of the departments. By constantly setting the costs of certain investments against the funding of those investments, one can decide what the possibilities are within a certain period of time.”

Towards the future

It happens all too often that such a model is built to support funding but afterwards disappears in a drawer. The TU chose to use the model as part of the process to make timely adjustments, when necessary. Vogt says: “Twice a year – also to inform our supervisory council – we update the investment and maintenance plan, including all financial prognoses at TU level. We have subjected ourselves to this discipline; normally you would leave that to the bank. The model safeguards that this happens in a well-thought-out manner.”

At an earlier stage, it was not necessary to use a “model with scenario buttons,” as the costs coincided mostly with the revenues. The real estate investments were the direct cause. Now the model will be used in future. “Together with Zanders, they have the up-to-date knowledge of the market,” Vogt says. “Our two focus areas this year are the finance and risk policy. Of the EUR 500 million that we spend each year, approximately EUR 350 million comes from the government. Every time, you have to carefully consider which investments you will make that year. The model indicates per year the effect of such an investment on your liquidity, amortization, and maintenance costs.”

No vibrations

“In the case of investments in large-scale maintenance, we look for opportunities to reduce costs toward the future,” Van der Slot says. “Certain investments will lead to energy savings or lower CO2 emissions. Renovation will also reduce certain maintenance costs. It is very interesting to see that in such a model.”

Growth is not the purpose of renovation. It is more likely to see fewer TU buildings than more in the future. With the renovations, the ‘New Way of Working’ will be introduced. BK City, the housing complex for the TU faculty of Architecture, has many open spaces and flexible workplaces. We will introduce renewed concepts of education, such as offering digital classes.

All sorts of rankings exist that indicate the relative position of universities. These are not just based on the number of students, but decisive factors are primarily the amount of research and the number of publications. These, then, depend again on the infrastructure that one can offer. Vogt notes: “Some buildings have to satisfy very high standards, like the building of Applied Sciences. In the Nano labs, the passing of a truck should not cause any vibration whatsoever. It is an interesting but complicated matter. We are not a cookie factory.”

How WPP managed its diverse regional needs to select a new TMS and a Swift connection.

WPP has treasury operations on three continents and each center has its own individual needs. The company needed to devise a request for proposals (RFP) for implementing a new treasury management system (TMS) and Swift-based bank communication that would serve the diverse needs of each regional office. Zanders worked on this project from an early stage, helping WPP to write a cohesive RFP and providing objective advice at the selection stage.

The biggest marketing company in the world, with 2,400 offices and operations in 107 countries, WPP has four main treasury centers. With headquarters in London and three regional treasury centers in Brussels, New York, and Hong Kong, the requirements of each hub differed considerably. The process of writing an RFP that would meet, combine, and harmonize the needs across the London, Brussels, and New York treasury offices was the first conundrum.

An RFP to meet all TMS requirements

Zanders was involved in the RFP from the outset, having come through a consultant selection process. Paul Delaney, director of treasury at WPP’s London headquarters, says: “We felt Zanders were best qualified to help us in the project, and they had good feedback from other companies with similar requirements.”

It was Zanders’ task to become very familiar with the organization, processes, and system requirements of each of WPP’s three treasury centers, and they did this by visiting each office and spending three days assessing their needs. Three Zanders consultants were working on the project throughout: Thomas Pels, David Kelin, and Laurens Tijdhof, all of whom worked with the treasury staff at WPP to write up an RFP that would set the company on its way to selecting a new TMS. “It was a joint effort between WPP and ourselves to make sure that we went into great detail and got all the questions we needed for the RFP,” explains Thomas Pels, of the Zanders’ Brussels office.

We felt it was important to bring in an independent view partly because, as a treasury department, we aren’t necessarily up-to-date with the changes in TMSs and aren’t best-placed to make an objective assessment of what best suits our needs.

Paul Delaney, Director of Treasury at WPP.

Paul Delaney believes that bringing Zanders on board was the right way to manage the project. “We felt it was important to bring in an independent view partly because, as a treasury department, we aren’t necessarily up-to-date with the changes in TMSs and aren’t best-placed to make an objective assessment of what best suits our needs,” he says. This is an opinion echoed in each of WPP’s treasury offices. David Hughes, WPP’s director of treasury operations in New York, points out that Zanders facilitated the RFP process between the three offices: “That is something I think we would have had a really hard time doing if we didn’t have Zanders – they were able to take an objective point of view.”

Three treasury centers – one global TMS

The most important requirement for the TMS from the London headquarters’ point of view was to have an updated reporting function, says Felicity Ronayne, UK treasury operations manager in WPP’s London office. “We wanted a system we could all use that was up-to-date, with really good report-writing features and a cash position worksheet that we could access across all regions.”

The heavy reliance on checks, zero-balancing, and WPP’s large number of US operating companies meant that the needs of the US office varied significantly from the offices in Europe. David Hughes notes: “We sometimes have over USD 100 million checks clearing in the morning, so one of our needs was for controlled check disbursement funding notification to be included in the workstation cash positioning. We also need to maintain a lot of inter-company schedules on the treasury workstation and another big difference is our reliance on zero-balancing from the operating company accounts to the main WPP account – in the US it is the basis of everything we do.”

The requirements for the Belgium office were slightly different. Veronique Freymann, European treasury manager at WPP’s Brussels office, notes: “The Belgium team manages more than 2000 accounts of the 750 entities in more than 15 countries. Furthermore, we manage the cash pools (zero-balancing, notional, and multi-currency), the group account structure, inter-company loans, and the group’s guarantees. For this, the possibility to have cash forecast information delivered via the web was one of the major requirements.”

Zanders managed to combine all the different regional requirements into one global RFP document. The RFP resulted in three potential TMS providers, but WPP finally chose IT2. The system is being implemented gradually across the headquarters and two regional centers. It is near completion in New York and Brussels, while implementation in the London office will begin with static data in Q4 2012.

Veronique Freymann says: “The implementation of IT2 is gradual – so we have started to upload data from bank statements, which enables us to use some tools already. We will start with the inter-company loans and it will be a step-by-step process.”

The TMS in the New York office will be fully functional by the first quarter of 2012, although they will be testing it and running parallel with it before then.

Choosing a Swift Service Bureau (SSB) provider

As well as playing an active part in the TMS selection, WPP’s Brussels office also led the process in selecting an SSB provider. David Kelin, director at Zanders’ London office, points out that the TMS selection and the choice of SSB provider were complementary projects. “When we were looking at the TMS, we also assessed WPP’s banking relationships and communications – we established early on that an SSB would be necessary and that Alliance Lite would not be sufficient for WPP’s needs.”

WPP eventually chose Swiss provider BBP to provide their Swift bank communication. The selection of the SSB was completed in August but it has not gone live yet. WPP’s Brussels office is currently transmitting data across to the new SSB system, and it will become effective before the end of 2011.

As with the TMS selection process, Zanders was instrumental in helping WPP to understand their needs for Swift and then choose the right product. “We are the end users, so we know what we want, but we don’t know what advantages one solution offers compared to others,” says Thierry Lenders, European treasury manager at WPP’s Brussels office.

It is expected that the SSB will bring significant benefits for the Brussels office. Veronique Freymann notes: “SwiftNet gives a single channel of communication between us and the banks, so it will be a lot easier for us.” For now, WPP is reserving judgment on whether the SSB will be needed in its other treasury centers. Paul Delaney says: “It was evident that we needed the SSB in Brussels, but it is not yet clear if we will get the same benefits from it in New York and London. We are watching what happens in Brussels closely and we’ll make a proper assessment once it’s fully installed there.”

Bringing the project to a happy conclusion

This has been a long and complex project. What began as a challenging RFP in 2010 then became the selection and implementation of a TMS and an SSB. The project is ongoing, and several months remain before both IT2 and the SSB are fully functional.

We were very impressed with the quality of the people at Zanders and the depth of their knowledge. Most of all, we really appreciate the fact that the same three Zanders consultants have seen the project through from beginning to end.

David Hughes, Director of Treasury Operations.

For more information on selecting a Treasury Management System or on the process of choosing a Swift Service Bureau provider, contact us.