One of the walls in its Amsterdam headquarters shows the evolution of the Philips business. Philips’ roots lie in Eindhoven, where, in 1891 Gerard Philips started producing light bulbs in an empty factory building. When he was later joined by his research-oriented brother Anton, the firm enjoyed its first major business stimulus. Through vertical operation, with their own factories and dependent suppliers, they took their first big steps towards success.

Continuing to develop through the production of radios and TVs, followed by Philishave electrical razors and inventions such as the Compact Cassette and the Compact Disc as new audio media, the company then expanded into professional products, such as medical equipment, studio mixers and computers. Today, Royal Philips is a diversified technology company that focuses on innovation in the healthcare sector.

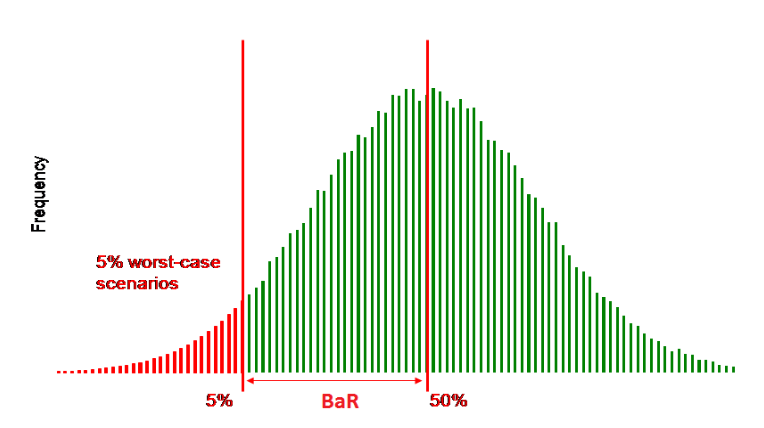

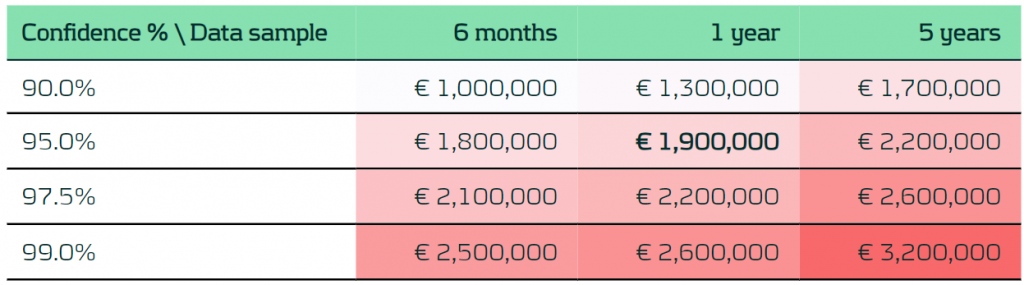

Currency risks

The internal structure of this multinational comprises two axes, the business groups and the markets. The business groups are organized into product types: medical equipment, lighting and domestic appliances – along with variations on these themes. The business groups develop and produce the products and distribute them to their international markets where the products are sold. Together, in a matrix, these two form what’s known as the business-markets combination. Commercial employees (‘the business’) and financial managers (‘finance business partners’) are active in both axes and it’s their joint responsibility to ensure that a healthy and successful business can develop and thrive.

We are active in over 100 countries and we process EUR 100 billion in internal payments every year, so, clearly, we are highly exposed to currency risks.

Gabriel van de Luitgaarden, Senior VP, Head of Financial Risk & Pensions Management at Philips.

In the logistics, financial stream from factories to markets, all manner of invoices are sent back and forth and, eventually, money from customers flows through the market to the Treasury. Hedging currency risks is expensive and prevention is always better than cure, he muses: “If you don’t properly understand what the risk is and what effect it will have, there’s not a lot you can effectively do about it. But by quantifying risks you can get a handle on them and decide whether you want to take any action. You have to consider aspects such as what will happen to EBITA if you do nothing, how much lower will it be if you hedge, and how much will it all cost? It’s all about how much risk you are prepared to accept.”

Currencies fluctuate in relation to one another and this strongly influences a multinational’s earnings and financial reporting. “We deal with risk management every day,” says Van de Luitgaarden. “But the people who work in the business very rarely do so. They see it as a specialism, but that’s not really the case. People in the business should be much more involved with it, asking themselves what is acceptable and what should I do about it?”

Argentinian toothbrushes

Philips initiated a project to define a new FX policy and hedging strategy for currency risks. Above all, it had to give the people in the business much more insight into the impact that fluctuations in exchange rates have on their performance, and show them how important it is for them to understand and manage currency risks.

“In many multinationals the business part thinks that the Treasury will just hedge currency risks, despite the fact that these currency fluctuations cannot simply be neutralized,” says Zanders consultant Lisette Overmars, who was involved in the project. “You can manage it all, but eventually you’ll need to come up with other solutions.”

Van de Luitgaarden adds: “That’s why we explained to the business that we can provide more insight into the risks and buy them time through hedging, but we cannot completely protect them. There’s no magic formula that can shield you from the effects of currency fluctuations.”

This bespoke form of hedging is primarily directed at countries whose currencies typically lose value, sometimes suddenly performing really well, but eventually losing value relative to harder currencies like the euro and the dollar. “That’s because emerging market economies are less solid,” says Van de Luitgaarden. “There is often high inflation and less political stability. If you don’t do anything about the prices in the respective countries, than the fact that their currencies lose value against the euro will progressively erode your income. There are extreme cases where we can lose 30 to 40 per cent in value in a year, which cannot be remedied by hedging. In such cases you have no option but to constantly increase your product prices.” It means, for example, that the price of a toothbrush in Argentina can suddenly rise by 10 per cent from one month to the next. “But not everyone in the business does this, which is why education plays such an important role in the project; it has to be visible. For many people the effect that currencies have on results was far from clear. We therefore developed an FX model to make the currency footprint visible. It shows us which currencies our EBITA is derived from and the extent of our various exposures. Thanks to this new policy we can make EBITA more predictable and less volatile, although we still cannot completely cover the risks.”

The real risk management is mainly to be found in the market; for example, where can you best procure in order to reduce your susceptibility to currency risks? Van de Luitgaarden says: “Take Japan, for example, where we are huge in medical equipment, representing substantial income in Japanese yen. But we don’t spend anything there because we don’t buy there. Three years ago the Bank of Japan began to devaluate the yen to stimulate the country’s economy, and this had huge repercussions for us. A 20 per cent drop in the value of such a currency results in our sales and profit also falling by 20 per cent – that’s just how it works. And if you don’t do anything about it, the situation won’t change. In addition to short-term hedging, to reduce your vulnerability to such currency fluctuations you need to consider procuring more in yen, or even opening a factory in Japan.”

More consistency and efficiency

The old way of working, centered on a policy set up about 18 years ago, was based on a Philips that was both organized very differently and was much bigger than it is today. Van de Luitgaarden continues: “Back then we had 12 product divisions but our performance, in particular, was managed differently. Every factory had its own P&L account and budget. If a factory was exposed to currency risks it had to reduce them itself and if any hedging was necessary that too had to be done by the factory in question. Now we measure our performance at a higher level, via the business-markets combinations. The factory’s P&L is now less important – it’s about the result of the group as a whole. The exposures that you hedge are therefore the ones that affect the result of the group. It’s much more efficient. If you're in a ‘long position’ in a particular currency, you sell it, in a single transaction. In the past this was done factory-by-factory, in several transactions. Given the tens of thousands of transactions that we used to do, this now represents a huge efficiency boost. The spread is no longer paid multiple times by buying and selling the same currency. We hedge currencies in the same way. We’re looking for risk reduction, so it makes little sense if everyone follows their own policy – it has to be done consistently. That’s actually more important than the net group exposure.

It's a combination of the two: hedging at group level and the highly consistent application of our hedging policy. That has an enormous impact on the risk reduction that’s achievable.”

Headwinds and tailwinds

The project was launched in September 2014 and the new FX policy went live in November 2015. Given that it involved the whole organization, which was used to doing things the way they’d been done for the past 18 years, it was a formidable challenge to make the necessary changes. Moreover, three weeks after the start of the project it was announced that the company was to be split into the lighting division (Lighting Solutions) and a combination of the Healthcare and Consumer Lifestyle divisions (Royal Philips). The organization’s focus, particularly at the IT and Treasury departments, was then obviously on the impending split. It affected much more than just the business; it also had repercussions for Tax – which had to be paid in 100 countries – and Accounting and how it would all be technically processed in the books with the use of hedge accounting. All-in-all, it was a sea change.

“Its implementation was indeed quite overwhelming,” concedes Van de Luitgaarden. “It was complex material for which there were no ready-made solutions. We were dealing with people in the business who did not fully understand the situation; they only took into account what they did themselves and didn’t look at the bigger picture. This sometimes made it difficult to explain. Take, for example, a factory in the UK making mother & child-care products.

A high exchange rate of the pound against the euro at the time decimated profitability because procurement and manufacturing costs just kept on rising. But looking at Philips as a whole, the rise in the value of the pound was a good thing; we earned more pounds than we spent. We didn’t have to buy pounds to cover costs; we sold pounds to cover our sales. But try explaining that to the UK factory – at the end of the day currencies influence bonus targets. Sometimes you have a tailwind and at other times a headwind.” Last year was a good year for those who sold in dollars; which rose against the euro. “Thanks to the dollar being so much stronger, our sales in 2015 were EUR 2 billion higher, which is an awful lot on a total of 24 billion. That’s something to take into account, because it was certainly a windfall. This new way of looking at things needs time.”

What else has Zanders done for Philips?

- Treasury management: the extrication of treasury operations and the setting up of new treasury functions for Philips’ former television business (TP Vision) and the lifestyle entertainment business (WOOX Innovations).

- Risk management: the development of a new commodity price risk management framework.

Do you want to know more about risk management for corporations? Contact us.