With support for their long-standing hedge accounting models ending in 2025, global asset finance company, DLL, sought a partner capable of not just replicating their existing models but enhancing and futureproofing them – on a tight timeline. To guide the company’s treasury through this critical crossroad, DLL turned to Zanders.

DLL (De Lage Landen) is a global asset finance company headquartered in Eindhoven, the Netherlands, and a wholly owned subsidiary of Rabobank. Operating in more than 25 countries, it delivers leasing and asset-based financing solutions across a variety of industry sectors, including agriculture, construction, energy transition, food, healthcare, industrial, technology, and transportation. With a strong focus on responsible finance, the company supports businesses to access capital, manage risk, and make the transition to more sustainable business models.

Central to the company’s financial infrastructure is its global treasury function, based in Dublin, Ireland. This team manages the liquidity and Treasury risk management needs of the group. The team consists of an experienced group of highly qualified financial services professionals who are dedicated to meeting the treasury needs of DLL, covering everything from cash management to foreign exchange and interest rate hedging.

A critical turning point

A core element of DLL’s risk strategy is the use of interest rate swaps to mitigate exposure to interest rate volatility. Given the size and complexity of its global lending portfolio and the direct impact that interest rate movements can have on company earnings, these instruments are essential for maintaining financial stability and predictability.

“We have two large portfolios – euro interest rate swaps and US dollar interest rate swaps,” explains Coyle, Head of Hedge Accounting at DLL. “To mitigate the fair value movements of those swaps, we run macro fair value hedge accounting models in euros and dollars.”

These models allow DLL to align the value of derivatives with the risks they offset. This reduces earnings volatility, provides a transparent view of the company’s risk position, and ensures compliance with accounting standards.

For years, DLL’s hedge accounting models were developed and maintained by a previous provider. Due to regulatory requirements they were no longer allowed to support the models beyond 2025.

Faced with a tight deadline to transition to a new solution, DLL launched a competitive tender process to identify a partner capable of building fair value macro hedge accounting models for both their euro and dollar swap portfolios. To prevent disruption to DLL’s hedge accounting process, replacement models needed to be ready for testing in early 2025, ahead of full deployment a few months later. This challenging timeline relied on delivering a complete, fully tested and operational solution as quickly as possible, rather than following a more gradual, phased approach.

Zanders’ approach stood out because they proposed building a Python-based application from the start – delivering the end product we needed, and within the timeline that we wanted.

Coyle, Head of Hedge Accounting at DLL.

“Another provider suggested an Excel build first, then a Python version later – essentially two separate projects, which would not only take a lot longer but also impacted on the price as well.”

Rapid prototyping and agile development

Once selected in late 2024, Zanders began working on replicating the models. Despite having no access to the original model’s codebase, the Zanders team was able to reverse engineer DLL’s hedge accounting methodology in just a few weeks based.

“They started in December, and by the end of January we had our first models ready for testing,” Coyle recalls.

From February to March, both Zanders and DLL conducted independent back testing using the legacy model as a benchmark to validate outputs. This rigorous comparison helped ensure consistency and build confidence in the new models.

“This gave us comfort that we were on the right road,” Coyle says. “We did find a few things that we wanted to change – such as adding certain risk controls – and the Zanders team was very open to suggestions. These were implemented quickly, and it was a very easy process.”

By the end of March, the new Python-based applications was fully operational, enabling a seamless transition with no disruption to DLL’s interest rate risk strategy.

Faster, simpler, more integrated

While the primary focus of the project was the replication of DLL’s existing models, it ultimately evolved into an opportunity to streamline and modernize the company’s hedge accountancy processes.

“The new model is much quicker,” explains Marais, Treasury Hedge Accountant at DLL. “The old model had features we didn’t really use that slowed down performance. This was a chance to simplify and focus on what we needed.”

One of the most valuable technical gains was improved alignment with DLL’s internal treasury systems.

“With the new model, we are now able to utilize reports from our own treasury system – that was a significant improvement,” says Marais. Previously, the team had to rely on reports from Rabobank systems and model calculations, but the new model directly interfaces with DLL's internal system. “This makes our work process much quicker and more efficient compared to previously,” Marais adds.

Beyond the technical delivery, the project also stood out for the way it was executed. Working under a tight deadline, collaboration between the teams was critical and made a real difference to the overall experience. The DLL team particularly appreciated Zanders’ responsive and collaborative approach.

IT projects can be quite stressful, but this one was remarkably stress-free. That’s a reflection of a robust, collaborative process and great people. If someone asked whether we’d recommend the Zanders team for a project like this, we wouldn’t hesitate.

Coyle, Head of Hedge Accounting at DLL.

Interested in transforming your treasury infrastructure?

Whether you're navigating regulatory change, replacing legacy models, or looking to gain deeper insights into your risk exposure, Zanders combines advanced modeling with deep industry expertise to deliver accurate and audit-ready valuations.

Find out more about how Zanders can support your treasury and risk management transformation.

Ready to transform your treasury infrastructure?

Contact us

With IFRS 18 introducing fundamental changes to FX reporting, treasuries must act now to prepare for the 2027 compliance deadline.

IFRS 18 introduces significant changes to FX classification and reporting requirements by January 2027. Despite that this adoption date still feels quite far away, there is quite some time required in order to be compliant. Treasury Management Systems and ERP platforms must be updated to ensure compliance with new operating, investing, and financing categorizations. Introduced by the International Accounting Standards Board (IASB) in April 2024, IFRS 18 is required to be implemented by January 2027 at the latest. The new standard addresses how companies classify foreign exchange (FX) gains and losses, particularly affecting treasury operations.

In the past, for simplicity and pragmatic reasons, many organizations reported all FX results as part of operating income. Under IFRS 18 however, guidance on the treatment of these FX results is more explicit and must now be categorized into three groups: operating, investing, and financing dependent on the nature of the underlying exposure.

While this is a simple requirement conceptually, certain challenges may exist in creating a holistic transparent view on the FX impacts, particularly when considering the treatment of FX derivatives. This shift means that businesses must reassess their accounting practices and treasury and hedging strategies to ensure compliance.

Key Changes Under IFRS 18:The primary change in IFRS 18 is the requirement to classify FX gains and losses based on their source:

- Operating: FX results from accounts payable (AP) and accounts receivable (AR) transactions fall into this category.

- Investing: FX fluctuations linked to investments are recorded here.

- Financing: FX changes related to loans and borrowings belong in this section.

Key Date: Full implementation required by January 2027

The P&L impact from FX derivatives should also be considered in these changes, where the selection of P&L category is determined based on the nature of the exposure. IFRS 18 does allow for the P&L classification from FX derivatives to be entirely posted as Operating in the case where it is not practical to uniquely identify the nature of the underlying exposure.

This may be a common occurrence, specifically in the example of Balance Sheet FX hedging, where it is not common to hedge the individual elements of the balance sheet separately. While posting to Operating for derivatives is easier to achieve, it would create inconsistencies in categorization between the FX result from hedging, and the FX result from source.

The goal of IFRS 18 is to create clearer and more comparable financial statements across different businesses, therefore the treatment of FX results from hedging activities should be carefully considered.

Treasury’s Role in the Transition

The treasury department will play a crucial role in implementing IFRS 18. While the new classification rules are straightforward, their practical application requires an in-depth review of the drivers of FX exposure and the applied hedging strategies. Determining which department takes primary responsibility for IFRS 18 implementation can be challenging. The cross-functional nature of the project requires clear ownership and accountability structures to ensure successful implementation. This coordination challenge makes a strong case for external advisory support to facilitate collaboration between treasury, finance, accounting, and IT teams.

One major challenge of IFRS 18 is the potential mismatch between FX hedging strategies and accounting classifications. Traditionally, companies have managed FX risk through balance sheet hedging, using a single FX deal to cover multiple exposures. However, with the new classification rules, companies may need to adjust their hedging approach to ensure that hedge results align with the appropriate classification.

For example, if a company hedges a foreign currency loan, and the loan’s FX impact is now categorized under financing, the FX gain or loss from the hedge should also be classified under financing. If it remains under operating income, the company may see artificial volatility in financial statements, which could misrepresent its risk management effectiveness.

Operational and Systemic Adjustments

Beyond policy updates, IFRS 18 requires changes to Treasury Management Systems (TMS) and Enterprise Resource Planning (ERP) systems. These systems must be configured to ensure that FX transactions are correctly classified into operating, investing, or financing categories. This may involve adding new data fields, updating existing reporting structures, or even implementing new hedging processes.

Challenges and Considerations:

Companies may face several key challenges in implementing IFRS 18:

- Instance Structure Differences: Companies must determine how to apply classification rules across different subsidiaries and business units. Classification of operating for a finance company like the Treasury center may differ from that of a regular business operation.

- Chart of Accounts Adjustments: Treasury teams must assess whether existing FX hedging strategies need to be revised.

- System Updates: IT teams must modify TMS and ERP systems to support the new classification structure.

- Cross-Department Coordination: Treasury, finance, and accounting teams must work together to ensure a smooth transition.

How Zanders Can Help

Zanders, a leading treasury advisory firm, offers support to companies transitioning to IFRS 18. Our expertise extends beyond compliance, helping organizations develop effective hedging policies, update financial systems, and align their reporting strategies. Our services include:

- Reviewing FX exposure and hedging strategies.

- Identifying and resolving classification challenges.

- Developing a step-by-step plan for IFRS 18 compliance.

- Assisting with system updates and configuration changes in TMS and ERP platforms.

By addressing IFRS 18 proactively, treasury teams can not only comply with the new standard but also enhance their overall risk management approach. Zanders is committed to helping organizations navigate these changes efficiently.

Conclusion

IFRS 18 represents a significant shift in how FX gains and losses are reported and viewed through accounting principles and hedging strategies. While the standard itself is not overly complex, its impact on hedging and financial reporting requires careful planning, BI preparation, and compliance validation.

With the compliance deadline approaching in January 2027, now is the time to act. Zanders is ready to assist companies in this transition, providing both strategic guidance and practical implementation support to ensure a seamless adaptation to IFRS 18.

To find out more about IFRS 18 and key changes for treasury, please contact Jonathan Tomlinson or Mitchell Ponder.

Explore the overlooked role of FX risk management in enhancing portfolio company value.

In the high-stakes world of Private Equity (PE), where exceptional returns are non-negotiable, value creation strategies have evolved far beyond financial engineering. Today, operational improvements, including in treasury and financial risk management, are required to yield high-quality returns. Among these, FX risk management often flies under the radar but holds significant untapped potential to protect and drive value for portfolio companies (PCs). In this article, we explore the importance of identifying and managing FX risks and suggest various quick wins to unlock value for portfolio companies.

The Untapped Potential of FX Risk Management in Value Creation

PCs operating across multiple countries frequently lack a cohesive treasury and financial risk management approach. For example, bolt-on acquisitions often lead to fragmented teams, processes, systems and banking structures, while exposure to an increasing number of currencies creates financial risk that often remains invisible to central teams. This complexity is exacerbated by ad hoc and localized FX hedging practices, where PCs may not have access to competitive FX rates from their banking partners or access to a multi-bank FX dealing platform.

For PE firms, FX risk often represents a hidden drain on EBITDA and cash flow. FX mismanagement can erode margins and impact portfolio company value. Hence the importance of uncovering financial and operational inefficiencies and building streamlined processes to manage FX exposures effectively. Proper FX risk management, which goes beyond hedging by means of financial instruments, not only mitigates financial risk but directly contributes to value creation by reducing cash flow volatility, reducing costs, increasing control, and increasing transparency.

In this simplified example, a private equity-owned manufacturing firm, focused on expansion into emerging markets, was losing millions annually due to unmanaged foreign exchange (FX) exposures. The culprit? Decentralized treasury processes, idle bank balances in multiple currencies, and hidden FX risks within operational flows. The firm can address and manage these inefficiencies by using FX forward contracts to lock in exchange rates for future transactions and employing centralized treasury technology to monitor and control FX exposures across all operations. By addressing the inefficiencies, the firm reduced financial losses, stabilized its margins, and reinvested savings from FX gains into growth initiatives.

Quick Wins in FX Risk Management

In your search of value creation, we suggest two potential quick wins to unlock PC value.

Enhance Exposure Visibility

Check whether your PCs operate with a clear understanding of their FX exposure landscape. Conducting a quick scan early in the investment lifecycle should identify, amongst others:

- Where exposures are originated (e.g., revenues, costs, intercompany transactions) and if there are natural hedging possibilities.

- Idle cash balances or loans in nonfunctional currencies, which create FX volatility.

- The potential impact of these exposures on financial results through FX risk quantification.

Private equity sponsors can facilitate the creation of a centralized treasury function that i) establishes a policy and process for FX risk management, ii) implements an FX dealing platform for efficient and competitive FX trading with banks, iii) monitors balances to reduce cash balances in non-functional currencies, and iv) implements netting arrangements to streamline intercompany payments and minimize cross-border transactions.

Hidden FX Risk Discovery

Business practices, such as allowing customers to pay in multiple currencies or a pricing agreement based on currency conversions, often lead to hidden FX risks and are a common pain point which is overlooked. For instance, a PC may receive customer payments in USD but agree to link the actual payable amount to the EUR/USD exchange rate, creating an implicit EUR exposure that impacts margins and cash flow.

To address hidden FX risks, a private equity sponsor can help portfolio companies achieve a quick win by conducting a thorough analysis of their pricing models and operational agreements to identify implicit currency exposures, then implementing (soft) hedging techniques, such as adjusting pricing strategies to match revenue and cost currencies, renegotiating contracts with suppliers and customers to align payment terms, and utilizing natural hedging opportunities like balancing currency inflows and outflows, thereby minimizing net exposure before deciding to resort to financial instruments.

In summary, as illustrated by the above quick wins, streamlining treasury processes can yield:

- Hard dollar savings: Reduced FX costs by accessing competitive spreads.

- Soft dollar savings: Enhanced decision-making through better visibility on exposures and reduced operational complexity.

Consider this: A PE-owned retail chain expanded into international markets and faced profit erosion due to unmanaged FX risks and fragmented treasury processes. The sponsor conducted a quick scan to map exposures, uncovering mismatched revenue and expense currencies, a scattered landscape of bank accounts with idle balances, and operational inefficiencies. Hidden FX risks, such as supplier pricing tied to EUR/USD rates and uncoordinated customer payment options in multiple currencies, were also identified. Leveraging these insights, the sponsor centralized FX management by consolidating bank accounts, aligning supplier contracts with revenue streams to create natural hedges, and introducing competitive trading for FX transactions. They also established internal multilateral netting to streamline intercompany settlements, reducing FX costs by 20%.

Measurable Results

Integrating exposure identification and quantification, hidden risk discovery, and treasury process optimization into a single strategy enables PE firms to achieve more stable margins, cost savings, improved cash flow predictability and liberates capital for reinvestment. Furthermore, a proactive approach to FX risk management provides improved transparency for decision-making and LP reporting and strengthens financial resilience against market volatility. By embedding these robust treasury and financial risk management practices, PE sponsors can unlock hidden potential, ensuring their portfolio companies are not only protected but also positioned for sustainable growth and profitable exits.

Conclusion

In the dynamic world of private equity, optimizing FX risk management for internationally operating PCs is a crucial strategy for safeguarding and enhancing portfolio value. Reflect on your current FX risk strategies and identify potential areas for improvement. Are there invisible exposures or inefficiencies limiting your portfolio’s growth? Take the initiative today - evaluate your FX risk management practices and make the necessary refinements to unlock substantial value for your portfolio companies. Embrace the opportunity to drive significant improvements in their financial resilience and overall performance.

If you're interested in delving deeper into the benefits of strategic treasury management for private equity firms, please contact Job Wolters.

A recent webinar outlined strategies for optimizing corporate treasury FX programs, addressing recent risk events, potential 2025 challenges, and the importance of strong risk management policies.

Recently, Zanders' own Sander de Vries (Director and Head of Zanders’ Financial Risk Management Advisory Practice) and Nick Gage (Senior VP: FX Solutions at Kyriba) hosted a webinar. During the event, they outlined strategies for optimizing corporate treasury FX programs. The duo analysed risk-increasing events from recent years, identified potential challenges that 2025 may pose, and discussed how to address these issues with a strong risk management policy.

Analyzing 2024 Events

The webinar began with a review of 2024's key financial events, particularly the Nikkei shock. During this period, the Japanese Yen experienced significant appreciation against the USD, driven by concerns over U.S. economic projections and overvalued tech stocks. This sharp rally in the JPY led to a wave of unwinding carry trades, forcing investors to sell assets, including stocks, to cover their positions. Additionally, western central banks continued their gradual reduction of interest rates throughout 2024, further influencing market dynamics. The webinar explored the correlation between these economic shocks and anticipated events, particularly their impact on EUR/USD rate fluctuations. By examining how past events shaped market volatility, risk managers can better prepare for potential future disruptions.

Coincidentally, the webinar was held on November 5, 2024, the same day as the U.S. presidential election—a key topic of discussion among the hosts. The election outcome was expected to have a significant impact on markets, increasing both volatility and complexity for corporate risk managers. Shortly after the session, another Trump victory was announced, leading to a strengthening of the USD against the EUR, even as the Federal Reserve reduced interest rates further in the following days. In addition to the election, rising geopolitical tensions and ongoing reductions in base interest rates were highlighted as potential catalysts for heightened market volatility.

Challenges and Opportunities in 2025

By reflecting on past challenges and looking ahead, risk managers can optimize their policies to better mitigate market shocks while protecting P&L statements and balance sheets. Effective risk management begins with accurately identifying and measuring exposures. Without this foundation, FX risk management efforts often fail—commonly referred to as “Garbage In, Garbage Out.” A complete, measurable picture of exposures enables risk managers to select optimal responses and allocate resources efficiently.

During the webinar, a poll revealed that gathering accurate exposure data is the biggest challenge in FX risk management. Common issues include fragmented system landscapes, incomplete data, and delays in data registration. Tools designed for FX risk planning and exposure analysis can address these gaps by verifying data accuracy and ensuring completeness.

A sound financial risk management strategy considers three core drivers:

1- External Factors: These include the ability to pass FX or commodity rate changes to customers and suppliers, as well as regulatory constraints faced by corporate treasuries.

2- Business Characteristics: Shareholder expectations, business margins (high or low), financial leverage, and debt covenants shape this driver.

3- Risk Management Parameters: These encompass a company’s risk-bearing capacity (how much risk it can absorb) and its risk appetite (how much risk it is willing to take).

By incorporating these drivers into their approach, risk managers can design more effective and strategic responses, ensuring resilience in the face of uncertainty.

Understanding these core risk drivers can enable risk managers to derive a more optimal response to their risk profile. To design an optimal hedging strategy, treasurers need to consider various risk responses, which include:

- Risk Acceptance

- Risk Transfer

- Minimization of Risk

- Avoidance of Risk

- Hedging of Risk

Treasury should serve as an advisory function, ensuring other departments contribute to mitigating risks across the organization. While creating an initial risk management policy is critical, continuous review is equally important to ensure the strategy delivers the desired results. To validate the effectiveness of a financial risk management (FRM) strategy, treasurers must regularly measure risks using tools like sensitivity analysis, scenario analysis, and at-risk analysis.

- Sensitivity analysis and scenario analysis evaluate how market shifts could impact the portfolio, though they do not account for the probability of these shifts.

- At-risk analysis combines the impact of changes with their likelihood, providing a more holistic view of risk. However, these models often rely on historical correlations and volatility data. During periods of sharp market movement, volatility assumptions may be overstated, which can undermine the reliability of results.

We recommend a combined approach: use at-risk analysis to understand typical market conditions and scenario analysis to model the impact of worst-case scenarios on financial metrics.

To further enhance hedging strategies, some corporates are turning to advanced methods such as dynamic portfolio Value-at-Risk (VaR). This sophisticated approach improves risk simulation analysis by integrating constraints that maximize VaR reductions while minimizing hedging costs. It generates an efficient frontier of recommended hedges, offering the greatest risk reduction for a given cost.

Dynamic portfolio VaR requires substantial computing power to process a large number of scenarios, allowing for optimized hedging strategies that balance cost and risk reduction. With continuous backtesting, this method provides a robust framework for managing risks in volatile and complex environments, making it a valuable tool for proactive treasury teams.

Conclusion: Preparing for 2025

2024 was a year that brought many challenges for risk managers. The market uncertainty resulting from many larger economic shocks, such as the U.S. Election and multiple geopolitical tensions made an efficient risk management policy more important than ever. Understanding your organization's risk appetite and bearing capacity enables the selection of the optimal risk response. Additionally, the use of methods such as dynamic portfolio VaR can promote your risk management practices to the next level. 2025 looks to create many challenges, where treasurers should stay vigilant and create robust risk management strategies to absorb any adverse shocks. How will you enhance your FX risk management approach in 2025?

You can view the recording of the webinar here. Contact us if you have any questions.

How can a non-profit organization operating on a global stage safeguard itself from foreign currency fluctuations? Here, we share how our ‘Budget at Risk’ model helped a non-profit client more accurately quantify the currency risk in its operations.

Charities and non-profit organizations face distinct challenges when processing donations and payments across multiple countries. In this sector, the impact of currency exchange losses is not simply about the effect on an organization’s financial performance, there’s also the potential disruption to projects to consider when budgets are at risk. Zanders developed a ‘Budget at Risk’ model to help a non-profit client with worldwide operations to better forecast the potential impact of currency fluctuations on their operating budget. In this article, we explain the key features of this model and how it's helping our client to forecast the budget impact of currency fluctuations with confidence.

The client in question is a global non-profit financed primarily through individual contributions from donors all over the world. While monthly inflows and outflows are in 16 currencies, the organization’s global reserves are quantified in EUR. Consequently, their annual operating budget is highly impacted by foreign exchange rate changes. To manage this proactively demands an accurate forecasting and assessment of:

- The offsetting effect of the inflows and outflows.

- The diversification effect coming from the level of correlation between the currencies.

With the business lacking in-house expertise to quantify these risk factors, they sought Zanders’ help to develop and implement a model that would allow them to regularly monitor and assess the potential budget impact of potential FX movements.

Developing the BaR method

Having already advised the organization on several advisory and risk management projects over the past decade, Zanders was well versed in the organization’s operations and the unique nature of the FX risk it faces. The objective behind developing Budget at Risk (BaR) was to create a model that could quantify the potential risk to the organization’s operating budget posed by fluctuations in foreign exchange rates.

The BaR model uses the Monte Carlo method to simulate FX rates over a 12-month period. Simulations are based on the monthly returns on the FX rates, modelled by drawings from a multivariate normal distribution. This enables the quantification of the maximum expected negative FX impact on the company’s budget over the year period at a certain defined level of confidence (e.g., 95%). The model outcomes are presented as a EUR amount to enable direct comparison with the level of FX risk in the company’s global reserves (which provides the company’s ‘risk absorbing capacity’). When the BaR outcome falls outside the defined bandwidth of the FX risk reserve, it alerts the company to consider selective FX hedging decisions to bring the BaR back within the desired FX risk reserve level.

The nature of the model

The purpose of the BaR model isn’t to specify the maximum or guaranteed amount that will be lost. Instead, it provides an indication of the amount that could be lost in relation to the budgeted cash flows within a given period, at the specified confidence interval. To achieve this, the sensitivity of the model is calibrated by:

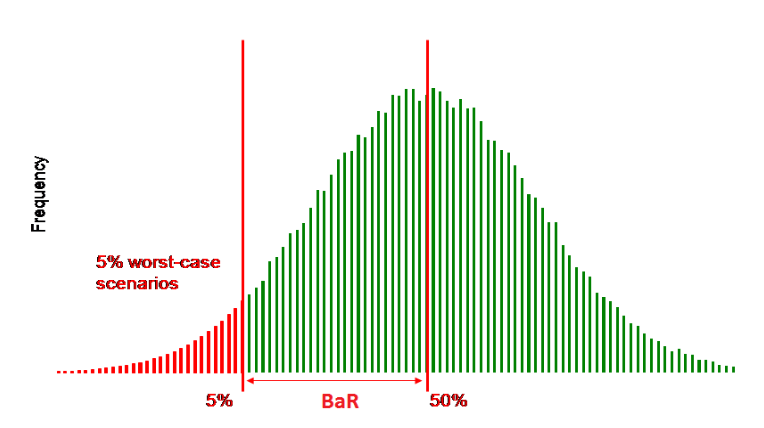

- Modifying the confidence levels. This changes the sensitivity of the model to extreme scenarios. For example, the figure below illustrates the BaR for a 95% level of confidence and provides the 5% worst-case scenario. If a 99% confidence level was applied, it would provide the 1% worst (most extreme) case scenario.

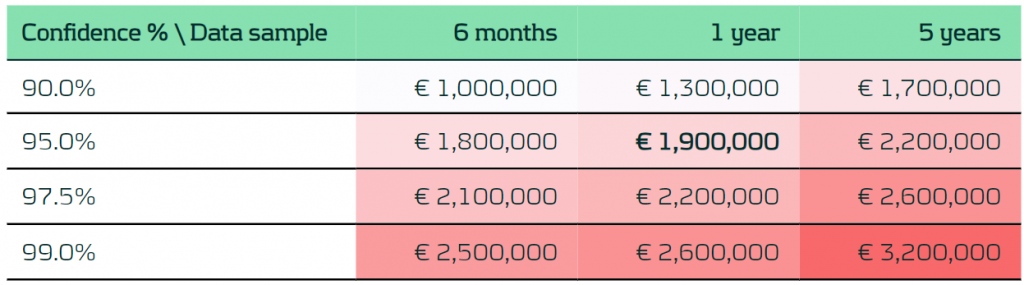

- Selecting different lengths of sample data. This allows the calculation of the correlation and volatility of currency pairs. The period length of the sample data helps to assess the sensitivity to current events that may affect the FX market. For example, a sample period of 6 months is much more sensitive to current events than a sample of 5 years.

Figure 1 – BaR for a 95% level of confidence

Adjusting these parameters makes it possible to calculate the decomposition of the BaR per currency for a specified confidence level and length of data sample. The visual outcome makes the currency that’s generating most risk quick and easy to identify. Finally, the diversification effect on the BaR is calculated to quantify the offsetting effect of inflows and outflows and the correlation between the currencies.

Table 1 – Example BaR output per confidence level and length of data sample

Pushing parameters

The challenge with the simulation and the results generated is that many parameters influence the outcomes – such as changes in cash flows, volatility, or correlation. To provide as much clarity as possible on the underlying assumptions, the impact of each parameter on the results must be considered. Zanders achieves this firstly by decomposing the impact by:

- Changing FX data to trigger a difference in the market volatility and correlation.

- Altering the cash flows between the two assessment periods.

Then, we look at each individual currency to better understand its impact on the total result. Finally, additional background checks are performed to ensure the accuracy of the results.

This multi-layered modeling technique provides base cases that generate realistic predictions of the impact of specific rate changes on the business’ operating budget for the year ahead. Armed with this knowledge, we then work with the non-profit client to develop suitable hedging strategies to protect their funding.

Leveraging Zanders’ expertise

FX scenario modeling is a complex process requiring expertise in currency movements and risk – a combination of niche skills that are uncommon in the finance teams of most non-profit businesses. But for these organizations, where there can be significant currency exposure, taking a proactive, data-driven approach to managing FX risk is critical. Zanders brings extensive experience in supporting NGO, charity and non-profit clients with modeling currency risk in a multiple currency exposure environment and quantifying potential hedge cost reduction by shifting from currency hedge to portfolio hedge.

For more information, visit our NGOs & Charities page here, or contact the authors of this case study, Pierre Wernert and Jaap Stolp.

Managing Capital Adequacy ratios through an open Foreign Exchange position

Since the introduction of the Pillar 1 capital charge for market risk, banks must hold capital for Foreign Exchange (FX) risk, irrespective of whether the open FX position was held on the trading or the banking book. An exception was made for Structural Foreign Exchange Positions, where supervisory authorities were free to allow banks to maintain an open FX position to protect their capital adequacy ratio in this way.

This exemption has been applied in a diverse way by supervisors and therefore, the treatment of Structural FX risk has been updated in recent regulatory publications. In this article we discuss these publications and market practice around Structural FX risk based on an analysis of the policies applied by the top 25 banks in Europe.

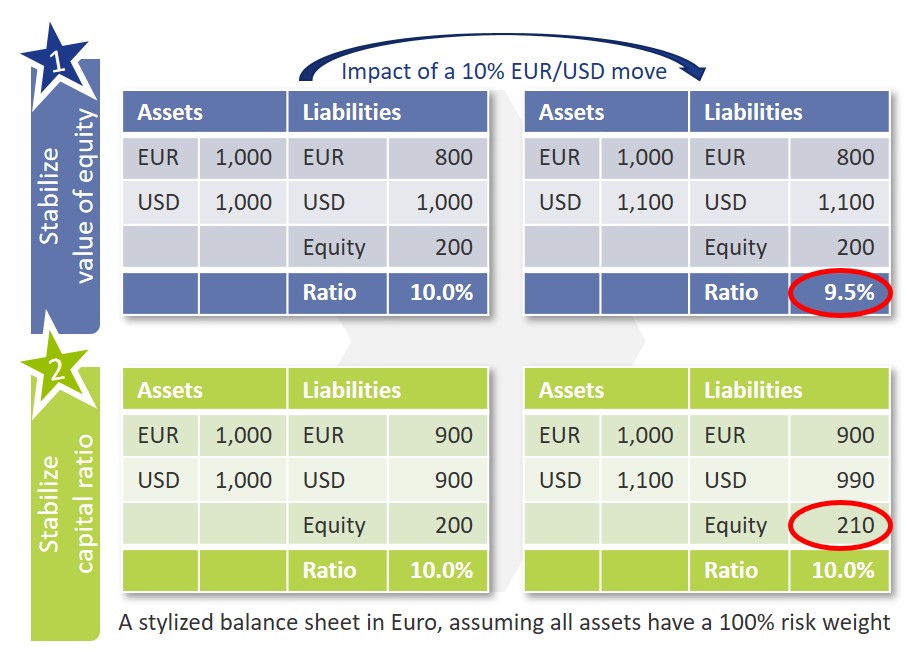

Based on the 1996 amendment to the Capital Accord, banks that apply for the exemption of Structural FX positions can exclude these positions from the Pillar 1 capital requirement for market risk. This exemption was introduced to allow international banks with subsidiaries in currencies different from the reporting currency to employ a strategy to hedge the capital ratio from adverse movements in the FX rate. In principle a bank can apply one of two strategies in managing its FX risk.

- In the first strategy, the bank aims to stabilize the value of its equity from movements in the FX rate. This strategy requires banks to maintain a matched currency position, which will effectively protect the bank from losses related to FX rate changes. Changes in the FX rate will not impact the equity of a bank with e.g. a consolidated balance sheet in Euro and a matched USD position. The value of the Risk-Weighted Assets (RWAs) is however impacted. As a result, although the overall balance sheet of the bank is protected from FX losses, changes in the EUR/USD exchange rate can have an adverse impact on the capital ratio.

- In the alternative strategy, the objective of the bank is to protect the capital adequacy ratio from changes in the FX rate. To do so, the bank deliberately maintains a long, open currency position, such that it matches the capital ratio. In this way, both the equity and the RWAs of the bank are impacted in a similar way by changes in the EUR/USD rate, thereby mitigating the impact on the capital ratio. Because an open position is maintained, FX rate changes can result in losses for the bank. Without the exemption of Structural FX positions, the bank would be required to hold a significant amount of capital for these potential losses, effectively turning this strategy irrelevant.

As can also be seen in the exhibit below, the FX scenario that has an adverse impact on the bank differs between both strategies. In strategy 1, an appreciation of the currency will result in a decrease of the capital ratio, while in the second strategy the value of the equity will increase if the currency appreciates. The scenario with an adverse impact on the bank in strategy 2 is when the foreign currency depreciates.

Until now, only limited guidance has been available on e.g. the risk management framework, (number of) currencies that can be in scope of the exemption and the maximum open exposure that can be exempted. As a result, the practical implementation of the Structural FX exemption varies significantly across banks. Recent regulatory publications aim to enhance regulatory guidance to ensure a more standardized application of the exemption.

Regulatory Changes

With the publication of the Fundamental Review of the Trading Book (FRTB) in January 2019, the exemption of Structural FX risk was further clarified. The conditions from the 1996 amendment were complemented to a total of seven conditions related to the policy framework required for FX risk and the maximum and type of exposure that can be in scope of the exemption. Within Europe, this exemption is covered in the Capital Requirements Regulation under article 352(2).

To process the changes introduced in the FRTB and to further strengthen the regulatory guidelines related to Structural FX, the EBA has issued a consultation paper in October 2019. A final version of these guidelines was published in July 2020. The date of application was pushed back one year compared to the consultation paper and is now set for January 2022.

The guidelines introduced by EBA can be split in three main topics:

- Definition of Structural FX.

The guidelines provide a definition of positions of a structural nature and positions that are eligible to be exempted from capital. Positions of a structural nature are investments in a subsidiary with a reporting currency different from that of the parent (also referred to as Type A), or positions that are related to the cross-border nature of the institution that are stable over time (Type B). A more elaborate justification is required for Type B positions and the final guidelines include some high-level conditions for this. - Management of Structural FX.

Banks are required to document the appetite, risk management procedures and processes in relation to Structural FX in a policy. Furthermore, the risk appetite should include specific statements on the maximum acceptable loss resulting from the open FX position, on the target sensitivity of the capital ratios and the management action that will be applied when thresholds are crossed. It is moreover clarified that the exemption can in principle only be applied to the five largest structural currency exposures of the bank. - Measurement of Structural FX.

The guidelines include requirements on the type and the size of the positions that can be in scope of the exemption. This includes specific formulas on the calculation of the maximum open position that can be in scope of the exemption and the sensitivity of the capital ratio. In addition, banks will need to report the structural open position, maximum open position, and the sensitivity of the capital ratio, to the regulator on a quarterly basis.

One of the reasons presented by the EBA to publish these additional guidelines is a growing interest in the application of the Structural FX exemption in the market.

Market Practice

To understand the current policy applied by banks, a review of the 2019 annual reports of the top 25 European banks was conducted. Our review shows that almost all banks identify Structural FX as part of their risk identification process and over three quarters of the banks apply a strategy to hedge the CET1 ratio, for which an exemption has been approved by the ECB. While most of the banks apply the exemption for Structural FX, there is a vast difference in practices applied in measurement and disclosure. Only 44% of the banks publish quantitative information on Structural FX risk, ranging from the open currency exposure, 10-day VaR losses, stress losses or Economic Capital allocated.

The guideline that will have a significant impact on Structural FX management within the bigger banks of Europe is the limit to include only the top five open currency positions in the exemption: of the banks that disclose the currencies in scope of the Structural FX position, 60% has more than 5 and up to 20 currencies in scope. Reducing that to a maximum of five will either increase the capital requirements of those banks significantly or require banks to move back to maintaining a matched position for those currencies, which would increase the capital ratio volatility.

Conclusion

The EBA guidelines on Structural FX that will to go live by January 2022 are expected to have quite an impact on the way banks manage their Structural FX exposures. Although the Structural FX policy is well developed in most banks, the measurement and steering of these positions will require significant updates. It will also limit the number of currencies that banks can identify as Structural FX position. This will make it less favourable for international banks to maintain subsidiaries in different currencies, which will increase the cost of capital and/or the capital ratio volatility.

Finally, a topic that is still ambiguous in the guidelines is the treatment of Structural FX in a Pillar 2 or ICAAP context. Currently, 20% of the banks state to include an internal capital charge for open structural FX positions and a similar amount states to not include an internal capital charge. Including such a capital charge, however, is not obvious. Although an open FX position will present FX losses for a bank which would favour an internal capital charge, the appetite related to internal capital and to the sensitivity of the capital ratio can counteract, resulting in the need for undesirable FX hedges.

The new guidelines therefore present clarifications in many areas but will also require banks to rework a large part of their Structural FX policies in the middle of a (COVID-19) crisis period that already presents many challenges.

As a big Dutch multinational, Philips is certainly not immune to the risks of global exchange rates. Fluctuations between different currencies have a significant impact on the incomes and financial statements of this diversified technology company. Hedging currency risks is done at group level and for the Group Treasury this represents a drastic operation.

One of the walls in its Amsterdam headquarters shows the evolution of the Philips business. Philips’ roots lie in Eindhoven, where, in 1891 Gerard Philips started producing light bulbs in an empty factory building. When he was later joined by his research-oriented brother Anton, the firm enjoyed its first major business stimulus. Through vertical operation, with their own factories and dependent suppliers, they took their first big steps towards success.

Continuing to develop through the production of radios and TVs, followed by Philishave electrical razors and inventions such as the Compact Cassette and the Compact Disc as new audio media, the company then expanded into professional products, such as medical equipment, studio mixers and computers. Today, Royal Philips is a diversified technology company that focuses on innovation in the healthcare sector.

Currency risks

The internal structure of this multinational comprises two axes, the business groups and the markets. The business groups are organized into product types: medical equipment, lighting and domestic appliances – along with variations on these themes. The business groups develop and produce the products and distribute them to their international markets where the products are sold. Together, in a matrix, these two form what’s known as the business-markets combination. Commercial employees (‘the business’) and financial managers (‘finance business partners’) are active in both axes and it’s their joint responsibility to ensure that a healthy and successful business can develop and thrive.

We are active in over 100 countries and we process EUR 100 billion in internal payments every year, so, clearly, we are highly exposed to currency risks.

Gabriel van de Luitgaarden, Senior VP, Head of Financial Risk & Pensions Management at Philips.

In the logistics, financial stream from factories to markets, all manner of invoices are sent back and forth and, eventually, money from customers flows through the market to the Treasury. Hedging currency risks is expensive and prevention is always better than cure, he muses: “If you don’t properly understand what the risk is and what effect it will have, there’s not a lot you can effectively do about it. But by quantifying risks you can get a handle on them and decide whether you want to take any action. You have to consider aspects such as what will happen to EBITA if you do nothing, how much lower will it be if you hedge, and how much will it all cost? It’s all about how much risk you are prepared to accept.”

Currencies fluctuate in relation to one another and this strongly influences a multinational’s earnings and financial reporting. “We deal with risk management every day,” says Van de Luitgaarden. “But the people who work in the business very rarely do so. They see it as a specialism, but that’s not really the case. People in the business should be much more involved with it, asking themselves what is acceptable and what should I do about it?”

Argentinian toothbrushes

Philips initiated a project to define a new FX policy and hedging strategy for currency risks. Above all, it had to give the people in the business much more insight into the impact that fluctuations in exchange rates have on their performance, and show them how important it is for them to understand and manage currency risks.

“In many multinationals the business part thinks that the Treasury will just hedge currency risks, despite the fact that these currency fluctuations cannot simply be neutralized,” says Zanders consultant Lisette Overmars, who was involved in the project. “You can manage it all, but eventually you’ll need to come up with other solutions.”

Van de Luitgaarden adds: “That’s why we explained to the business that we can provide more insight into the risks and buy them time through hedging, but we cannot completely protect them. There’s no magic formula that can shield you from the effects of currency fluctuations.”

This bespoke form of hedging is primarily directed at countries whose currencies typically lose value, sometimes suddenly performing really well, but eventually losing value relative to harder currencies like the euro and the dollar. “That’s because emerging market economies are less solid,” says Van de Luitgaarden. “There is often high inflation and less political stability. If you don’t do anything about the prices in the respective countries, than the fact that their currencies lose value against the euro will progressively erode your income. There are extreme cases where we can lose 30 to 40 per cent in value in a year, which cannot be remedied by hedging. In such cases you have no option but to constantly increase your product prices.” It means, for example, that the price of a toothbrush in Argentina can suddenly rise by 10 per cent from one month to the next. “But not everyone in the business does this, which is why education plays such an important role in the project; it has to be visible. For many people the effect that currencies have on results was far from clear. We therefore developed an FX model to make the currency footprint visible. It shows us which currencies our EBITA is derived from and the extent of our various exposures. Thanks to this new policy we can make EBITA more predictable and less volatile, although we still cannot completely cover the risks.”

The real risk management is mainly to be found in the market; for example, where can you best procure in order to reduce your susceptibility to currency risks? Van de Luitgaarden says: “Take Japan, for example, where we are huge in medical equipment, representing substantial income in Japanese yen. But we don’t spend anything there because we don’t buy there. Three years ago the Bank of Japan began to devaluate the yen to stimulate the country’s economy, and this had huge repercussions for us. A 20 per cent drop in the value of such a currency results in our sales and profit also falling by 20 per cent – that’s just how it works. And if you don’t do anything about it, the situation won’t change. In addition to short-term hedging, to reduce your vulnerability to such currency fluctuations you need to consider procuring more in yen, or even opening a factory in Japan.”

More consistency and efficiency

The old way of working, centered on a policy set up about 18 years ago, was based on a Philips that was both organized very differently and was much bigger than it is today. Van de Luitgaarden continues: “Back then we had 12 product divisions but our performance, in particular, was managed differently. Every factory had its own P&L account and budget. If a factory was exposed to currency risks it had to reduce them itself and if any hedging was necessary that too had to be done by the factory in question. Now we measure our performance at a higher level, via the business-markets combinations. The factory’s P&L is now less important – it’s about the result of the group as a whole. The exposures that you hedge are therefore the ones that affect the result of the group. It’s much more efficient. If you're in a ‘long position’ in a particular currency, you sell it, in a single transaction. In the past this was done factory-by-factory, in several transactions. Given the tens of thousands of transactions that we used to do, this now represents a huge efficiency boost. The spread is no longer paid multiple times by buying and selling the same currency. We hedge currencies in the same way. We’re looking for risk reduction, so it makes little sense if everyone follows their own policy – it has to be done consistently. That’s actually more important than the net group exposure.

It's a combination of the two: hedging at group level and the highly consistent application of our hedging policy. That has an enormous impact on the risk reduction that’s achievable.”

Headwinds and tailwinds

The project was launched in September 2014 and the new FX policy went live in November 2015. Given that it involved the whole organization, which was used to doing things the way they’d been done for the past 18 years, it was a formidable challenge to make the necessary changes. Moreover, three weeks after the start of the project it was announced that the company was to be split into the lighting division (Lighting Solutions) and a combination of the Healthcare and Consumer Lifestyle divisions (Royal Philips). The organization’s focus, particularly at the IT and Treasury departments, was then obviously on the impending split. It affected much more than just the business; it also had repercussions for Tax – which had to be paid in 100 countries – and Accounting and how it would all be technically processed in the books with the use of hedge accounting. All-in-all, it was a sea change.

“Its implementation was indeed quite overwhelming,” concedes Van de Luitgaarden. “It was complex material for which there were no ready-made solutions. We were dealing with people in the business who did not fully understand the situation; they only took into account what they did themselves and didn’t look at the bigger picture. This sometimes made it difficult to explain. Take, for example, a factory in the UK making mother & child-care products.

A high exchange rate of the pound against the euro at the time decimated profitability because procurement and manufacturing costs just kept on rising. But looking at Philips as a whole, the rise in the value of the pound was a good thing; we earned more pounds than we spent. We didn’t have to buy pounds to cover costs; we sold pounds to cover our sales. But try explaining that to the UK factory – at the end of the day currencies influence bonus targets. Sometimes you have a tailwind and at other times a headwind.” Last year was a good year for those who sold in dollars; which rose against the euro. “Thanks to the dollar being so much stronger, our sales in 2015 were EUR 2 billion higher, which is an awful lot on a total of 24 billion. That’s something to take into account, because it was certainly a windfall. This new way of looking at things needs time.”

What else has Zanders done for Philips?

- Treasury management: the extrication of treasury operations and the setting up of new treasury functions for Philips’ former television business (TP Vision) and the lifestyle entertainment business (WOOX Innovations).

- Risk management: the development of a new commodity price risk management framework.

Do you want to know more about risk management for corporations? Contact us.