Managing banking book risk remains a critical challenge in today’s financial markets and regulatory environment. There are many strategic decisions to be made and banks are having trouble applying homogeneous hedging approaches across their balance sheet. As shown in the EBA’s IRRBB implementation heatmap of last February, hedging strategies and NMD modelling practices still vary significantly between banks. In addition, the EBA expects future developments on CSRBB and DRM. Meanwhile, behavioral risks and rapidly changing interest regimes need to be addressed, while balancing the stability of net interest income and economic value.

Treasury departments are at the heart of managing the banking book, with their ‘ALM framework’ serving as the essential blueprint for banking book management. This framework ensures alignment between risk appetite and business objectives. A well-developed ALM framework provides better insights and enhances understanding of the balance between risk and performance.

But, what are the characteristics of a mature ALM framework? What steps can be taken to elevate the maturity of the framework? And how can your framework unlock your full potential? This article explores the components that make up an effective ALM framework and describes what an advanced setup looks like. After inspecting ALM governance, risk frameworks, hedging strategies, ALM modeling and capital & performance management, we offer the opportunity to benchmark the maturity of your own framework against other banks and the ideal setup by filling out this survey.

Governance

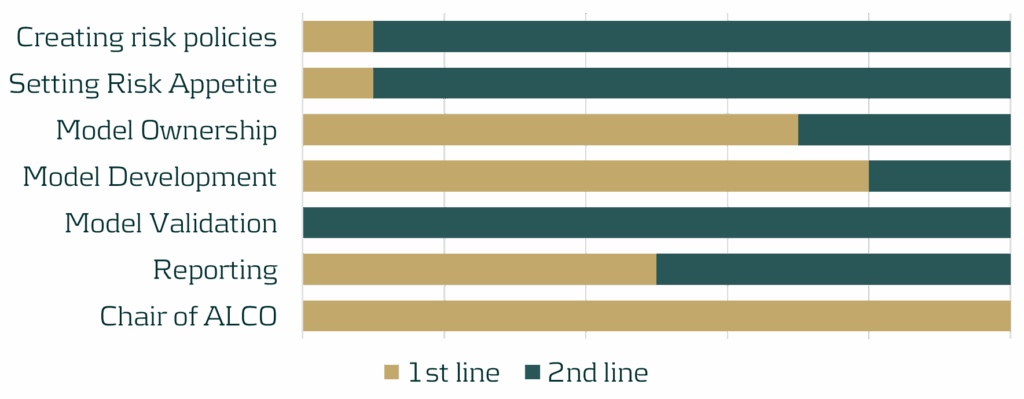

The cornerstone of any effective ALM framework is appropriate governance, much like any well-functioning business activity. Setting up strong governance begins with defining a charter with a clear scope and mandate for the departments involved. It is crucial that the first and second line of defense have accurately defined roles and pro-active knowledge sharing needs to be the standard. Oversight by senior management is essential across all activities within the framework and the Asset-Liability Committee (ALCO) should be composed of members from treasury, risk and the business.

Figure 1: Distribution of roles and responsibilities of the first and second line, based on a survey performed by Zanders.

Another critical element of ALM governance is the ALM strategy and the associated policies. The ALM strategy covers how risk and return are balanced, what interest rate position is ideal and how risks are operationally hedged (granularity, frequency and instruments). Typically, banks operate most effectively when the strategy is owned by the treasury department. The strategy should integrate perspectives on interest rate risk, credit spread risk, (intraday) liquidity risk, FX risk and capital, and must be fully aligned with business objectives and overall risk appetite.

The second line should manage the translation of the strategy into comprehensive risk policies covering the same risk types and ensuring alignment with both global and local regulatory frameworks. As part of the overarching policy framework, a risk identification process must highlight emerging risk and feed into the Risk Appetite Setting (RAS). In turn, the RAS needs to define KPIs for guiding daily risk management, specifying the boundaries within which the first line can balance risk and return.

Risk Framework

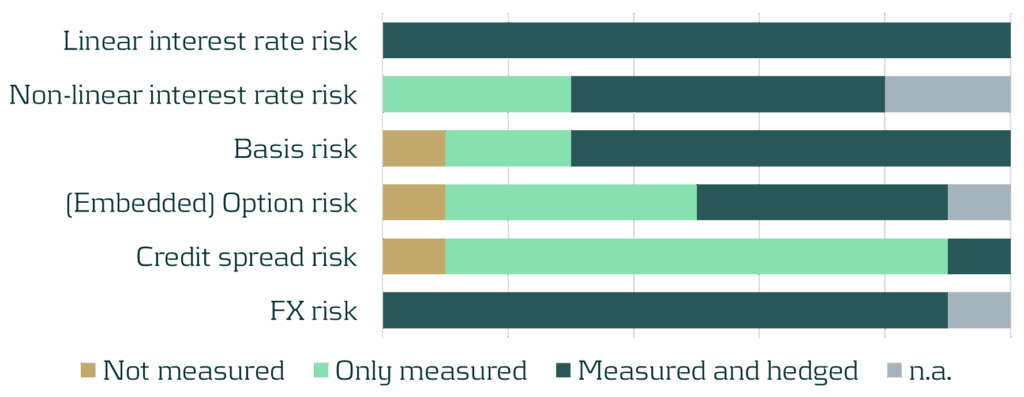

Beyond sound governance, risk policies are integral to the broader risk framework. Within this framework, it is crucial to make informed decisions on measuring and hedging each individual risk type. Ideally, all risk types are managed within a central ALM system that supports risk dashboarding and stress testing.

Figure 2: Risk- scope for a selection of sub-risk types, based on a survey performed by Zanders.

In addition to identifying relevant risks and determining appropriate responses, it is essential to establish an internal operational framework for ongoing management. Centralizing and netting risks in central treasury books is fundamental to an efficient treasury function. While several approaches exist, internal transactions are typically preferred, as they enable accurate measurement of risks over different commercial and/or geographical portfolios.

The strategy for managing interest rate risk in the banking book should ultimately be reflected in a clearly defined target duration of equity. Segregating the structural position into a dedicated book facilitates precise monitoring and agile adjustments to market dynamics and regulatory changes. Market volatility may necessitate revisiting the target based on interest rate expectations, and many banks have been adjusting their target durations accordingly. The structural position is a critical strategic choice in the trade-off between earnings and value stability, and is thereby an essential factor in the hedge strategy.

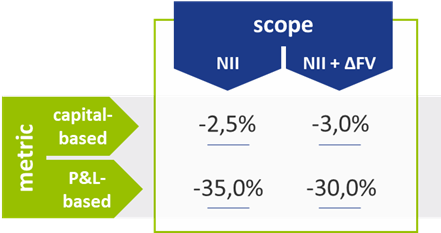

Hedge Strategy

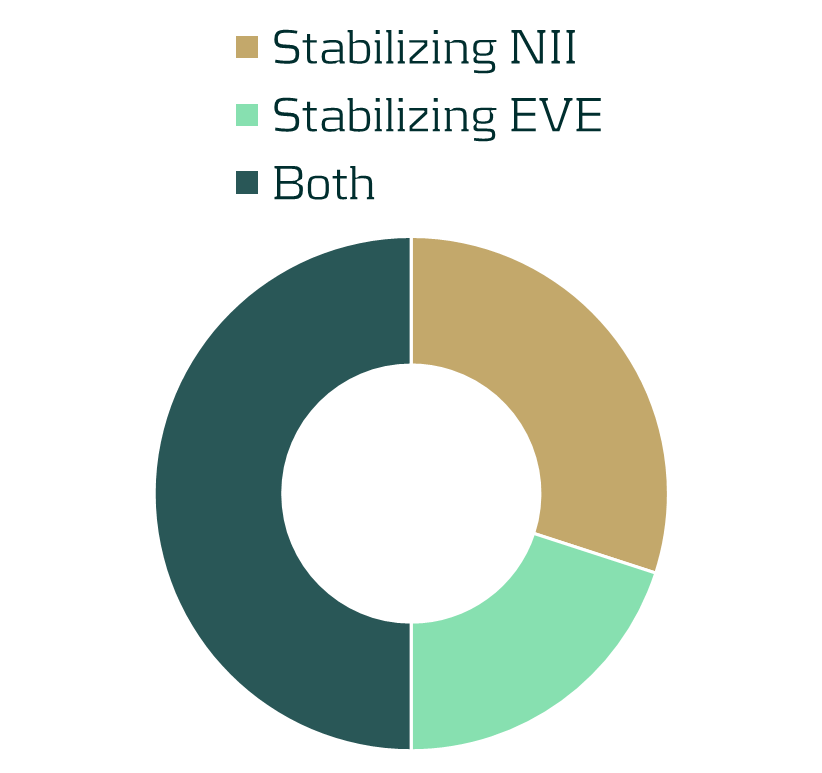

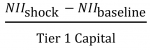

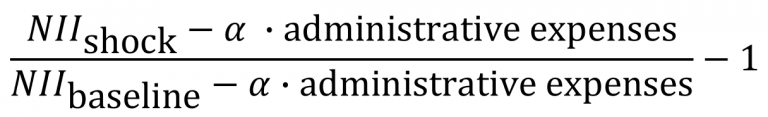

With the risk framework, the treasury strategy, and risk appetite statement as its foundation, a strategy for hedging must be defined. This strategy guides first line processes, stating clear objectives on both earnings and value stability. Striking a balance between these two elements is challenging, but forms the basis for optimizing the balance sheet. The decision to include or exclude margins should be consistent across cashflows and discounting and should be aligned with the primary hedging focus, whether it is stabilizing earnings or value.

Figure 3: Focus of hedging strategies, based on a survey performed by Zanders.

The scope of the hedging strategy must be consistent with the risk scope outlined in the risk framework and encompass the entire balance sheet. The strategy needs to address linear risks, and also explicitly account for non-linear risks that may arise due to convexity or behavioral factors.

While commercial books typically have the objective to stabilize or increase net margins without taking an active position, hedging must be an active steering process. The treasury function should focus on optimizing the economic value of equity and net interest income within defined target limits. It is essential for the hedging process to be dynamic, using real-time analytics to proactively identify opportunities for improvement as market conditions and expectations change. Banks need to make use of scenario planning and predictive modeling to anticipate hedge requirements and adapt accordingly.

Modeling

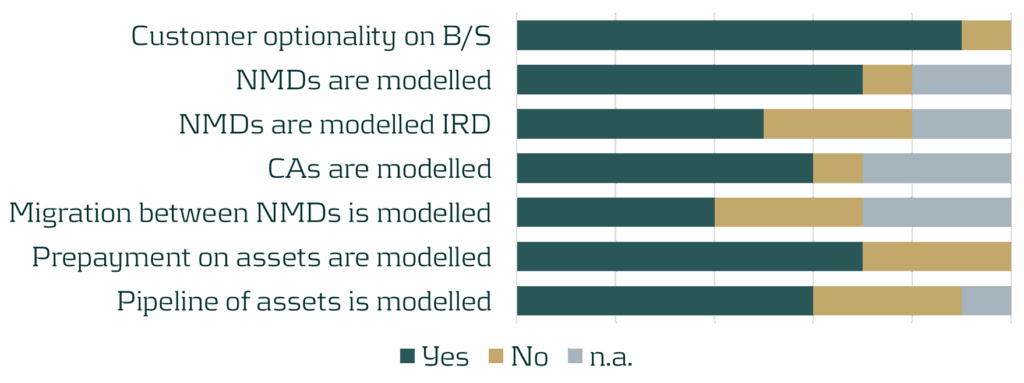

Hedging practices are based on the outcomes of a bank’s models, which should reflect reality as close as possible. A challenging yet essential aspect to modeling is addressing the optionalities inherent to many financial products. These embedded optionalities need to be modeled consistently for all assets and all liabilities. Ideally, banks have advanced interest rate-dependent behavioral models in place to model the interest rate sensitivity of deposits and loans. Pipeline risk, the migration between different deposit types and potential other behavioral characteristics of products also need to be modelled. These models provide banks with realistic insights into expected cashflows. As customer behavior can vary significantly under different market conditions, banks benefit greatly from simulating and analyzing these changes using stochastic models.

Figure 4: Type of behavioral modeling performed by banks, based on a survey performed by Zanders.

From a liquidity perspective, it is important for banks to use consistent methodologies for short and long-term cashflow forecasting. Additionally, integrating liquidity models, such as those for LCR and NSFR, with liquidity stress testing, offers valuable insights into potential future liquidity needs.

Machine learning is gaining more and more traction within the field of ALM and is becoming an integral part of ALM modeling. Using machine learning for client segmentation is increasingly more common and helps in better understanding client behavior. Several machine learning techniques for (reverse) stress testing have been developed, which improve the ability to identify vulnerabilities in balance sheets. Furthermore, predictive analytics helps to optimize balance sheet management, empowering banks to make informed strategic decisions.

Capital and Performance

Final critical elements of strategically steering a bank are the management of capital and performance measurement. Capital management is a fundamental part of modern-day banking and one of the important factors in balance sheet management. Mishandling capital requirements can significantly impact competitiveness and distort the view of risk-adjusted performance. To manage capital effectively, banks need to identify the ex-ante cost of capital for each transaction and incorporate it into pricing. Capital requirements should be allocated at the transaction level, allowing for accurate calculation of capital usage per portfolio. Ongoing capital monitoring and alignment to stress testing exercises and risk appetite is essential for optimal capital allocation and planning.

An effective Funds Transfer Pricing (FTP) framework is essential to assess risk-adjusted performance at the transaction level and to allocate overall performance across business units. In a mature FTP framework, all products are priced using an internally determined FTP curve. At a minimum, this curve needs to reflect the interest rate and liquidity risks inherent to transactions, but it can be extended to incorporate other types of risk. The FTP curve must be dynamic, adapting to portfolios and market conditions. Moreover, the FTP curve should be governed by senior management, who adjust it as needed to steer the balance sheet through (dis)incentivizing specific products or maturities.

Figure 5: Usage and granularity of FTP frameworks, based on a survey performed by Zanders.

Conclusion

The key to successfully managing banking book risks is an effective ALM framework. By leveraging your ALM framework and ensuring it aligns with the bank’s overall strategy, business objectives and complexity, you can enhance treasury’s performance and effectively manage the increased regulatory attention to IRRBB strategies.

At Zanders, we developed a model to assess the maturity level of a bank’s ALM framework. The model provides valuable insights into the maturity of the individual components and the ALM framework as a whole. This facilitates quick and straightforward benchmarking.

We invite you to complete the survey below and participate in the benchmarking exercise, which should take you less than 10 minutes. We will analyze your answers and share the (anonymized) findings with you.

ALM framework benchmarking survey

Please contact Erik Vijlbrief or Jelle Thijssen for more information.