SupTech in AML: When Supervisors Shift, Banks Must Move

On August 12, 2025, the European Banking Authority (EBA) released its ‘Report on the Use of AML/CFT SupTech Tools’, offering a clear view of how technology is reshaping financial supervision across Europe.

Building on the June 2024 launch of the new EU AML/CFT framework and the creation of the Anti-Money Laundering Authority (AMLA), SupTech (short for Supervisory Technology) now stands as a key driver of more efficient, data-driven, and collaborative supervision.

To inform the report, the EBA surveyed national authorities and worked with the European Commission’s AMLA Task Force to identify trends, challenges, and best practices. In this blog post, we highlight key insights and explore their impact on the financial sector.

Key Insights from the Report

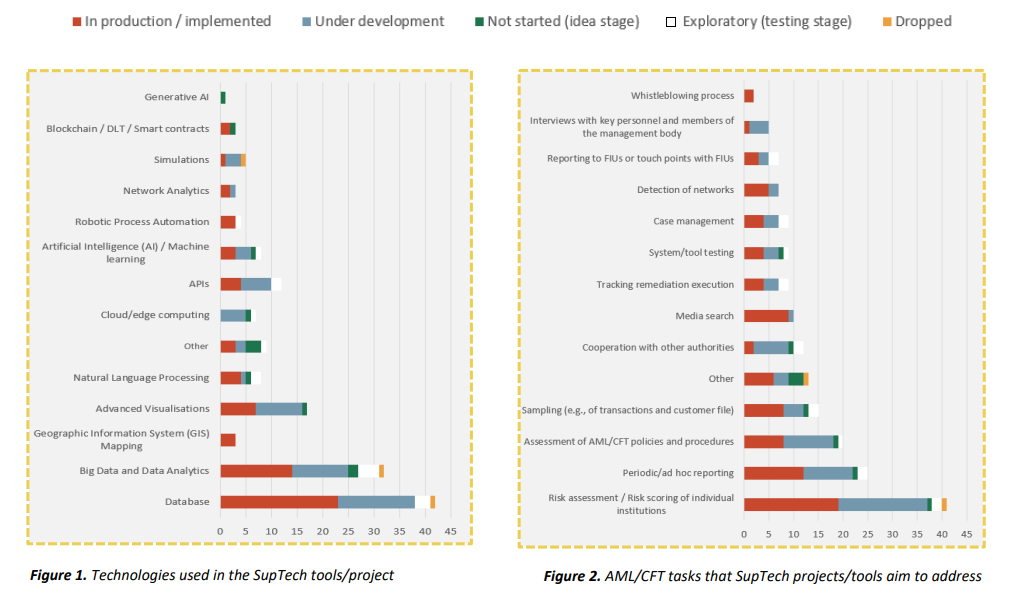

Across the EU, 31 competent authorities reported working on 60 SupTech projects or tools, most of which launched in the last three years. Nearly half are already in production, with others are in development or left as an idea for implementation. The figures below demonstrate the technologies used in SupTech tools, along with the AML/CFT tasks they aim to address.

It’s evident from Figure 1 that current efforts focus primarily on improving data quality and scalability, essential foundations for effective SupTech. More advanced technologies like Generative AI, Blockchain, and network analytics are still in early stages but are expected to play a larger role in the future.

On the task side, presented in Figure 2, most tools are geared toward risk assessment, which appears to be the most straightforward application of SupTech. As the technology matures, other areas of AML/CFT supervision may benefit from more advanced capabilities as well.

Advantages and challenges

The EBA’s survey revealed several benefits from current SupTech initiatives, with most projects targeting improvements in data quality, analytics, adaptability, automation, and collaboration through standardization. SupTech enables supervisors to operate more efficiently, respond faster to emerging risks, and make better-informed decisions in a complex financial landscape.

However, fully embracing a data-driven approach comes with challenges. SupTech tools rely heavily on robust IT infrastructure, skilled personnel, and high-quality data. While these tools can help improve data quality by detecting anomalies, they still require reliable input to function effectively.

Legal risks also emerge, particularly around GDPR compliance and accountability for decisions made by opaque algorithmic models. Resistance to adoption may arise due to concerns about job displacement and trust in AI. Additionally, limited collaboration between institutions can lead to duplicated efforts and inefficiencies. Fortunately, the new AML/CFT framework offers a foundation for improved cooperation and information sharing across borders.

How can banks prepare for a successful transition?

Although the EBA’s report is aimed at supervisory authorities, it has important consequences for banks, payment providers, and other obliged entities. SupTech will help supervisors operate more efficiently and gain deeper insights, but it will also raise expectations for the institutions they oversee. Banks should prepare for increased data requirements, more rigorous scrutiny, and pressure to standardize and respond quickly to regulatory changes. While these requirements may pose short-term challenges, they will ultimately support better compliance, risk management, and operational resilience in the long run. In order to get there, Zanders supports institutions in key areas:

- Increased data demands: AI-driven tools allow supervisors to process and analyze more data, requiring institutions to provide cleaner, more structured datasets.

- Increased detail orientation: SupTech tools detect anomalies and patterns faster, meaning institutions must ensure accuracy and consistency in their reporting.

- Standardisation: EU-wide platforms and data-sharing standards will require institutions to align systems and formats for seamless supervision.

- Change management: For SupTech to be successfully implemented, organizations must actively build a digital-first culture and encourage staff to move away from existing processes and mindsets.

- Rapid adaptation: As technology evolves, supervisors will expect institutions to keep pace. Falling behind could lead to compliance gaps.

These challenges require strategic attention and tailored support.

Are you interested in how Zanders can guide your organization through this transition? Reach out to our Partner Sebastian Marban.