Blog

IFRS 18: What Treasury Needs to Know Now

IFRS 18 introduces significant changes to FX classification and reporting requirements by January 2027. Despite that this adoption date still feels quite far away, there is quite some time

Find out more

Entities must consider numerous factors when transitioning to the new DRM model, it is crucial for entities to develop a clear implementation plan.

The final article from Zanders on the DRM model presents the lifecycle of the DRM model over a single hedge accounting period and the prospective and retrospective assessments that are required to be carried out to ensure that the entity is correctly mitigating its interest rate risk for the assets/liabilities designated for the Current Net Open Risk Position (CNOP). The cycle will be illustrated by Scenario 1C taken from Agenda Paper 4A – May 20231. This is a relatively simple example, more complex ones can be found within the staff paper.

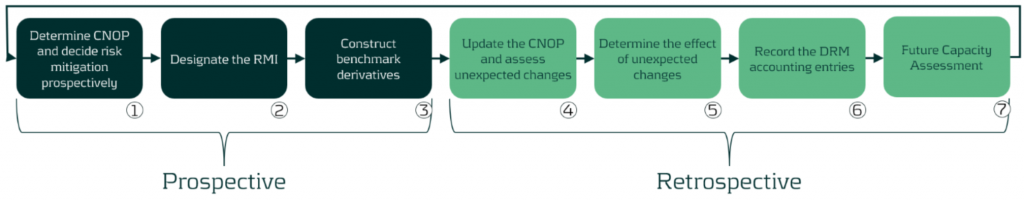

Figure 1: DRM Cycle

The first three steps are related to the prospective assessment in the DRM model cycle.

The use of the prospective assessment is to ensure that the model is being used to mitigate interest rate risk and achieve the target profile that is set out in the RMS. The RMS should include the following:

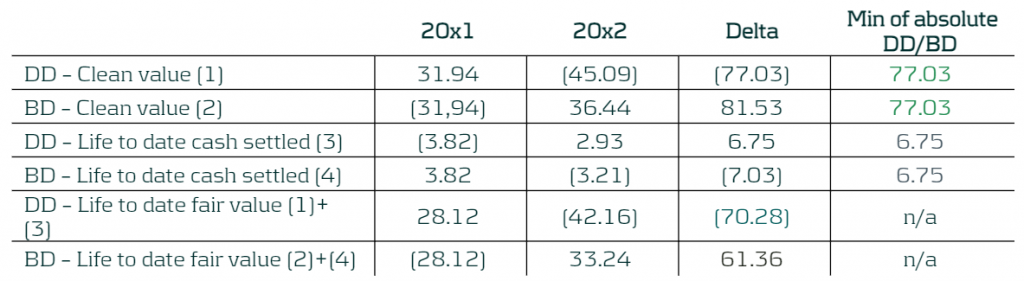

Step 1: The entity decides on the securities to be hedged and calculates the net open risk position (from an outstanding notional perspective) per time bucket.

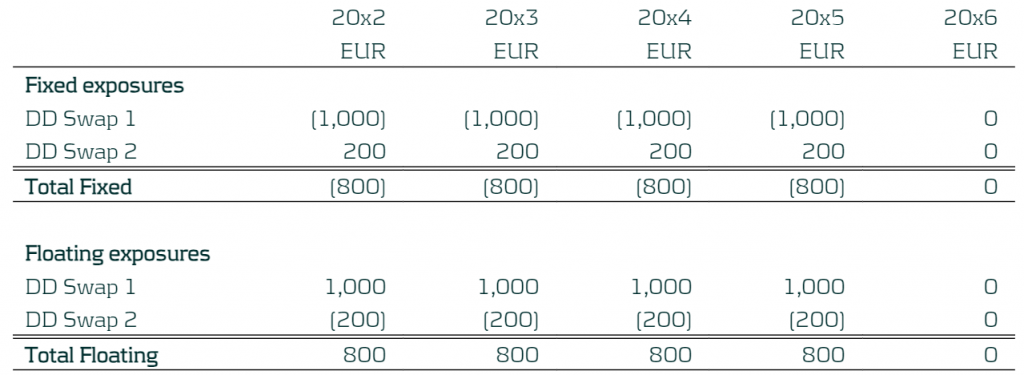

In the example below the company has floating and fixed exposures. The business in this case has a five-year fixed mortgage starting in 20x2 which is fully funded by a five-year floating rate liability. The focus period is 20x2 (start of the hedge accounting period) to 20x3 (end of the hedge accounting period) and so the first period 20x1 has been removed. The entity manages its entity-level interest rate risk for a 5-year time horizon, based on notional exposure in ∆NII and has decided to set the TP to be +/-EUR 500 in each of the repricing periods. Below we present the total fixed and total floating exposures from the product defined above). The individual breakdown of the fixed and floating is not required as each exposure is hedged as a total. The exposure are positions at year end.

Table 1: CNOP of the Entity with yearly buckets

Step 2: The entity will calculate the RMI based on the designated derivatives. The entity decided to mitigate 80% of the risk through the use of the following derivatives (existing and new). Please note that is a combination of derivatives from all the derivatives available in the books:

This leads to the designated derivatives with the following exposures:

Table: Exposures of the Designated Derivatives

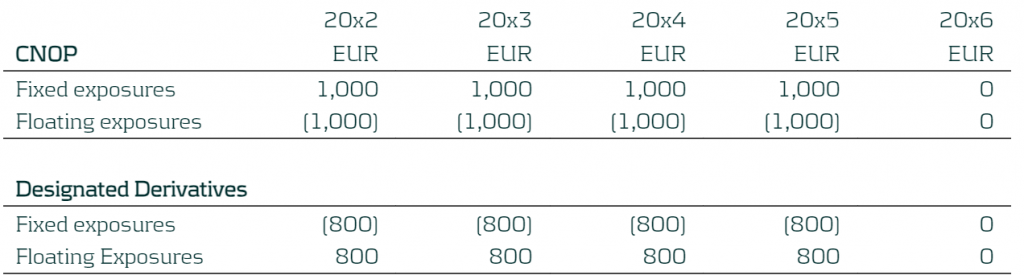

The exposures of the designated derivatives can then be compared to the CNOP as shown below:

Table 2: Exposures of the CNOP and Designated Derivatives

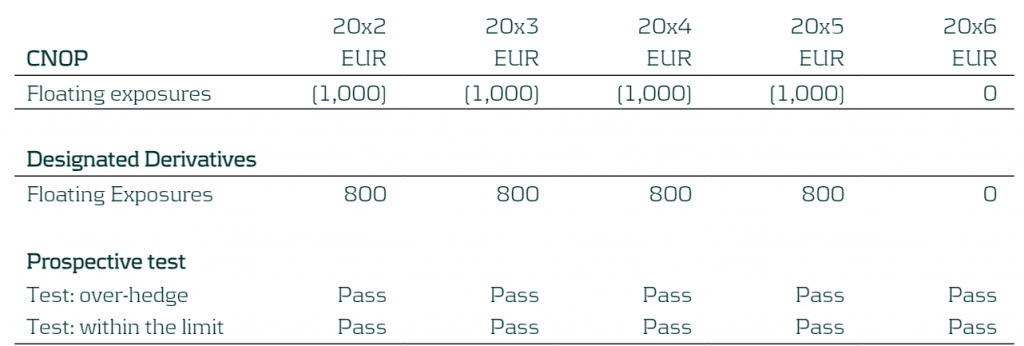

As the entity manages its interest rate risk based on ∆NII, the RMI focuses on the floating exposure.

The prospective test is performed by comparing the CNOP and Designated Derivatives exposures at each time bucket to see whether this moves the residual risk inside the TP (+/- EUR 500) set out within the RMS and not providing an over-hedge position. In this case the residual risk will be 0 (80% of CNOP versus DD exposures) and so the prospective assessments pass for all the time buckets.

Table 3: Prospective test

Step 3: Benchmark derivatives (hypothetical derivatives) are constructed based on the RMI calculated above.

Table 4: Benchmark Derivatives created for the Fixed and Floating Exposures

Retrospective (end of the hedge accounting period)

The following steps are related to the retrospective assessment of the DRM model.

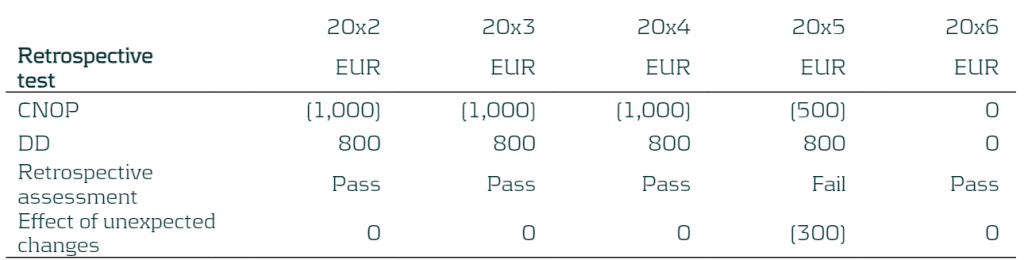

The IASB requires a retrospective assessment, to check that risks have been mitigated, as well as a future capacity assessment for each period2. This is to ensure the company is correctly mitigating its interest rate risk, ensuring the CNOP sits within their TP and to quantify the potential misalignment arising from unexpected changes (during the hedge accounting period).

Step 4: The entity updates the CNOP with the latest ALM information (note that new business is excluded from the updated CNOP).

In this example, the financial asset was repaid fully at the end of 20x5. The revised expectation is that it will be partially repaid per end 20x4 and the rest repaid end 20x5.

Table 5: Updated CNOP

Step 5: The potential misalignment due to unexpected changes is calculated. The new CNOP is compared to the RMI that was set in Step 2. Misalignments can occur due to:

Table 6: Updated CNOP

Table 7: Determining the effect of unexpected changes

If there are misalignments and the entity breaches the retrospective assessment, meaning that it has been over-mitigating its risk, the benchmark derivatives will need to be revised. One way in which this can be achieved is through the creation of additional benchmark derivatives which can represent the misalignment occurring. These will be based on the prevailing benchmark interest rates.

Therefore, for this example, the entity will construct two additional benchmark derivatives to represent these changes:

Table 8: Additional Benchmark Derivatives

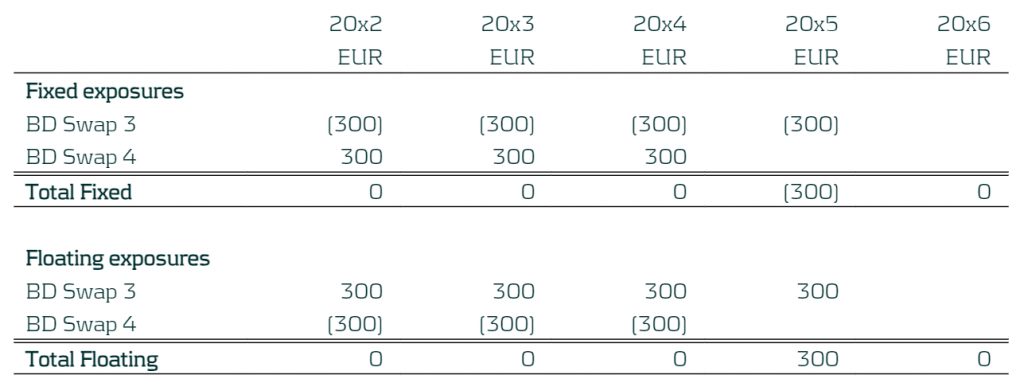

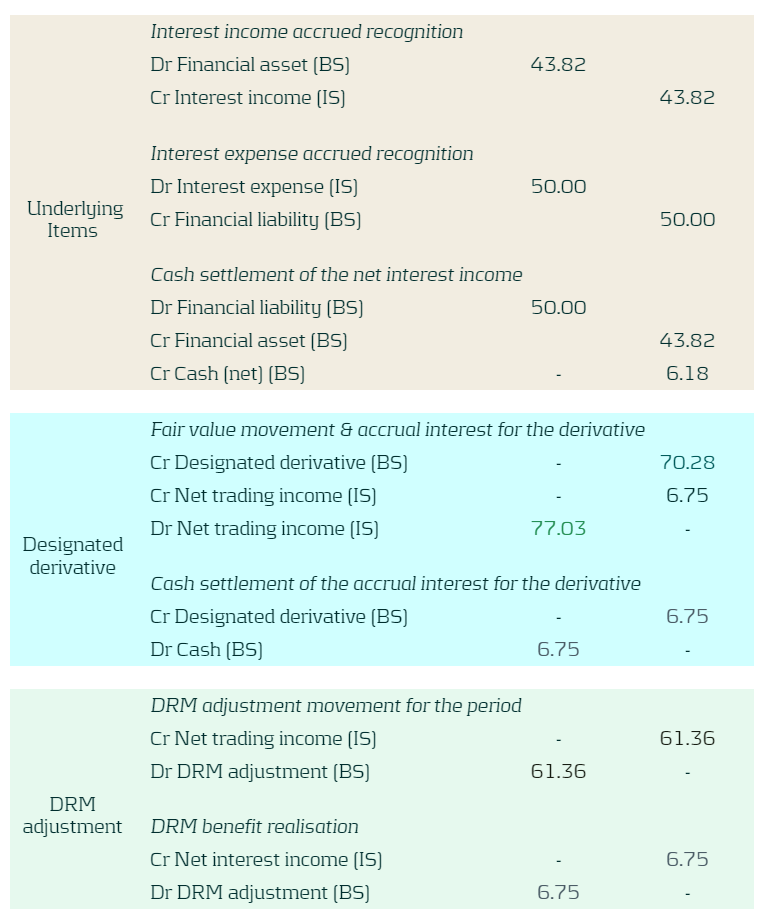

Step 6: The hedge accounting adjustments are calculated, and the DRM model outputs are required to be booked3:

The table below presents the EUR booking figures for this example. Figures are for the period 20x2 to 20x3.

The underlying items block represents the interest rate paid/received for the financial asset and financial liability for the period.

The designated derivative block presents the fair value movement of the designated derivatives for the period and the realised cash flow (net interest rate paid or received) on these instruments (trading income).

The DRM adjustment block presents the fair value movement of the benchmark derivatives for the period and the realised cash flow on these instruments (trading income).

BS represents a balance sheet account when IS represents an income statement account.

Table 9: Booking figures

Table 10: Booking figures calculation

Step 7: The last step is the future capacity assessment which was introduced by the IASB in February 2023 and is still under development so the final implementation of this is still to be released. This step is used to replace the previous retrospective assessment that compared the CNOP sensitivity to the TP. The IASB have yet to release more information on the methodology. The example shown does not assume that the future capacity assessment is carried out.

The IASB plans to publish an exposure draft by 2025 and so companies start thinking about their process for onboarding the DRM model in their accounting process. The DRM model introduces a range of changes to the hedge accounting framework and the transition process will not be an easy switch. Therefore, companies need to ensure that they have a clear and concise implementation plan to ensure a smooth transition. Involvement from stakeholders from across the company such as (IT, Front Office, Risk, Accounting, Treasury) is required to ensure the project is implemented correctly and in time.

Transitioning to the new DRM model can be difficult due to the dynamic nature of the model, especially with a more complex balance sheet. Zanders can provide a wide range of expertise to support in the onboarding of the DRM model into your company’s hedging and accounting. We have supported various clients with hedge accounting– including impact analyses, derivative pricing and model validation, and are familiar with the underlying challenges. Zanders can manage the whole project lifecycle from strategizing the implementation, alignment with key stakeholders and then helping design and implement the required models to successfully carry out the hedge accounting at every valuation period.

For further information, please contact Pierre Wernert, or Alexander Oldroyd.

Read our other blogs and learn more on Rethinking Macro Hedging: Introduction to DRM, and Rethinking Macro Hedging: What are the Key Components of the DRM Model?

IFRS 18 introduces significant changes to FX classification and reporting requirements by January 2027. Despite that this adoption date still feels quite far away, there is quite some time

Find out moreBuilding on the June 2024 launch of the new EU AML/CFT framework and the creation of the Anti-Money Laundering Authority (AMLA), SupTech (short for Supervisory Technology) now stands as a key

Find out moreAs the European Union increasingly emphasizes robust digital resilience within the financial sector as of January 17th 2025, the Digital Operational Resilience Act (DORA) has become a critical

Find out moreManaging banking book risk remains a critical challenge in today’s financial markets and regulatory environment. There are many strategic decisions to be made and banks are having trouble

Find out moreOn July 2nd, the European Banking Authority (EBA) published a Consultation Paper proposing amendments to its 2016 Guidelines on the application of the definition of default (DoD). As part of the

Find out moreArtificial intelligence (AI) is advancing rapidly, particularly with the emergence of large language models (LLMs) such as Generative Pre-trained Transformers (GPTs). Yet, in quantitative risk

Find out moreIn an industry where growth is often measured in multiples, and value creation is expected to be both scalable and repeatable, operational excellence is no longer a supporting function—it’s

Find out moreWith extreme weather events becoming more frequent and climate policy tightening across jurisdictions, banks are under increasing pressure to understand how climate change will impact their

Find out moreWith the introduction of CRR3, effective from January 1, 2025, the ‘extra’ guarantee on Dutch mortgages – known as the Dutch National Mortgage Guarantee (NHG) – will no longer be

Find out moreAccording to the IFRS 9 standards, financial institutions are required to model probability of default (PD) using a Point-in-Time (PiT) measurement approach — a reflection of present

Find out moreInflows from open reverse repos In May 2024 the EBA stated1 that inflows from open reverse repos cannot be recognised in LCR calculations unless the call option has already been

Find out moreThis article is intended for finance, risk, and compliance professionals with business and system integration knowledge of SAP, but also includes contextual guidance for broader audiences. 1.

Find out moreOur team at Zanders has been at the forefront of implementing BACS AUDDIS (Automated Direct Debit Instruction Service) with SAP S/4HANA, helping clients to streamline their direct debit

Find out moreThailand's e-Withholding Tax (e-WHT) system officially launched on October 27, 2020, in collaboration with 11 banks, marking a significant digital transformation with far-reaching benefits for

Find out moreIn today’s rapidly evolving financial landscape, fortifying the Financial Risk Management (FRM) function remains a top priority for CFOs. Zanders has identified a growing trend among

Find out moreEmergence of Artificial Intelligence and Machine Learning The rise of ChatGPT has brought generative artificial intelligence (GenAI) into the mainstream, accelerating adoption across

Find out moreIntroduction In December 2024, FINMA published a new circular on nature-related financial (NRF) risks. Our main take-aways: NRF risks not only comprise climate-related risks,

Find out moreAs mid-sized corporations expand, enhancing their Treasury function becomes essential. International growth, exposure to multiple currencies, evolving regulatory requirements, and increased

Find out moreIndustry surveys show that FRTB may lead to a 60% increase in regulatory market risk capital requirements, placing significant pressure on banks. As regulatory market risk capital requirements

Find out moreFirst, these regions were analyzed independently such that common trends and differences could be noted within. These results were aggregated for each region such that these regions could be

Find out more

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired Fintegral.

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired RiskQuest.

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired Optimum Prime.

You need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More Information