The average car contains 3-5km of cables while a plane has more than 650km and it takes more than 1,000km for an oil platform to function. There are more energy cables around us than we realize, and they are produced to handle extreme temperatures, deep oceans, or high air pressure. One of the industry leaders in energy (and some telecommunication and LAN) cables is a French multinational called Nexans. Worldwide, 26,000 people work for the Nexans group, with yearly sales of around €7 billion.

“We have new markets that need to be equipped, and there are old markets that need to change all the installations they made 40 years ago – for example, in the US,” says Thomas Wagner, financial manager at Nexans. “But the cable industry is quite a mature market. A significant part of our sales are in Europe.”

In 2013, most sales (57%) were in Europe. But like many in the past few years, Nexans had to deal with a complicated environment, with a global market in crisis, higher bank fees, lots of tools, and – of course – regulations.

Customized matrix

In 2010, the Nexans group decided to define the key strategy for its treasury in a global project. Wagner says: “We started with a worldwide survey to see where we could improve our operations. The area of bank relationship management was quickly identified because we were dealing with more than 100 bank groups worldwide, and our subsidiaries had more than 900 different bank accounts. This number was too high for a group of our size.”

The group’s first objective was to start streamlining their banking relationships. Nexans managed the bank selection process in three steps. First of all, it prepared a cash management RFP (request for proposal) to evaluate the capabilities of the different banks. In a ‘request for quotation,’ Nexans received detailed answers from the banks and analyzed whether the proposed solutions were meeting its requirements.

For this analysis, Zanders created a customized evaluation matrix for us, with a scoring model for each bank.

Thomas Wagner, financial manager at Nexans

“Then we sent our additional follow-up questions and remarks to the banks, and they returned precisions on the previous RFP. Subsequently, we came to a shortlist, and we organized face-to-face meetings with the remaining banks. Finally, based on the selected cash management banks, we developed a global cash pooling architecture together with Zanders and started its implementation.

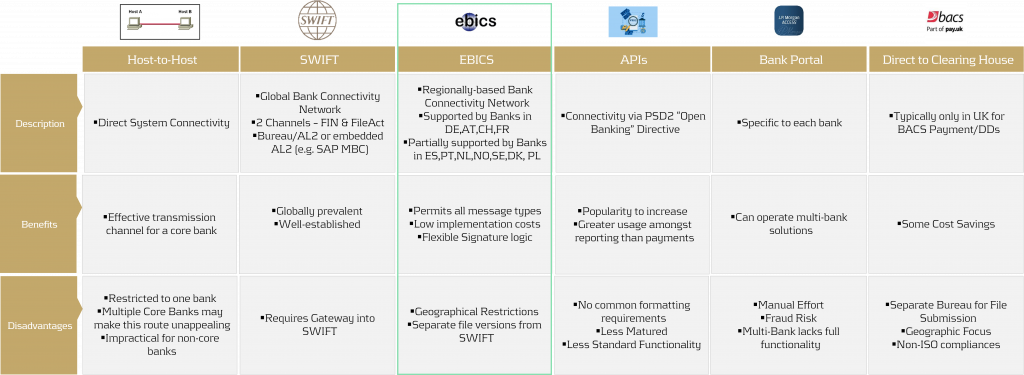

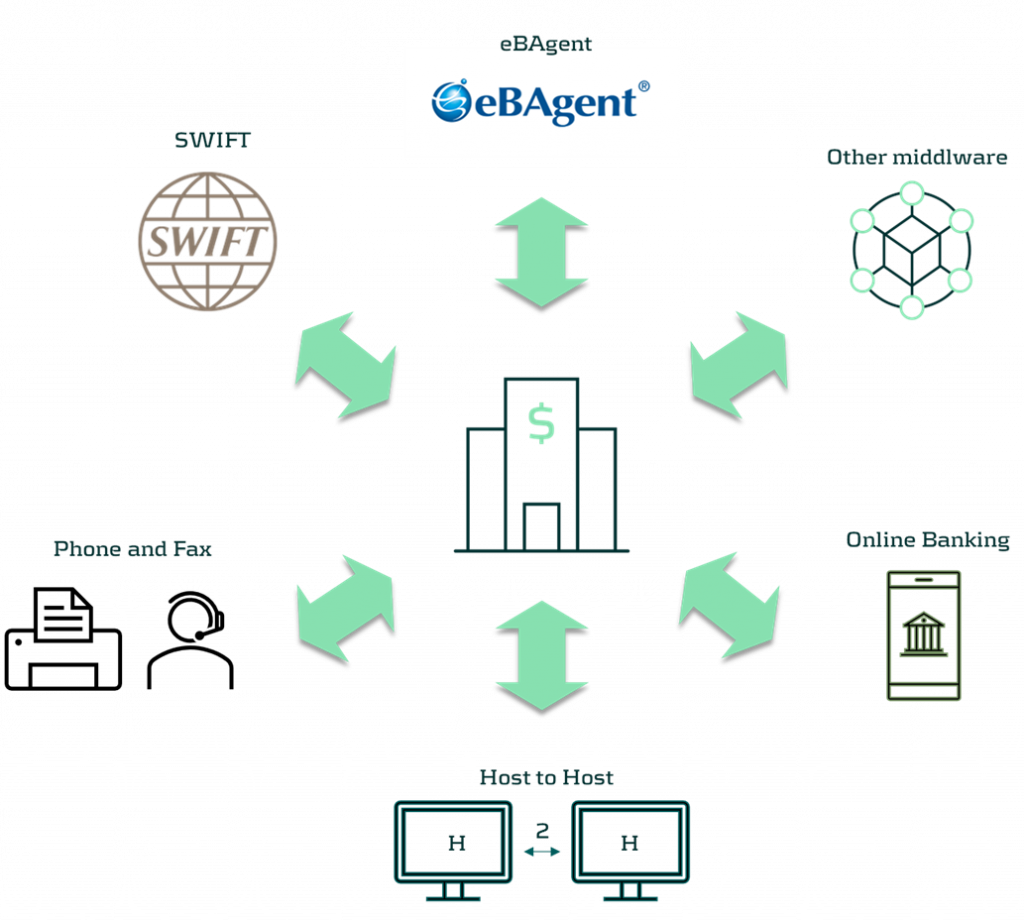

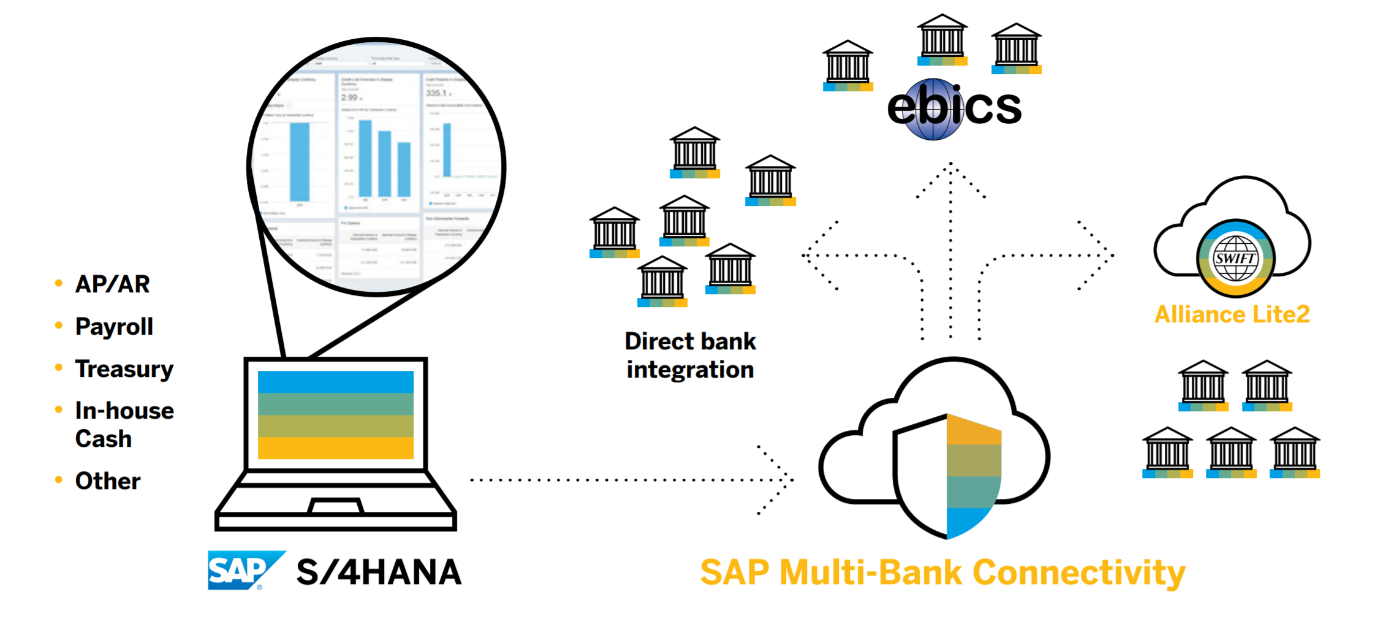

On the technology side, it was important for the project team to check the capacity of the bank to be able to move to Swift. We wanted to standardize and harmonize the format as much as possible.”

Rationalization criteria

The bank rationalization consisted of defining new core banking partners at the group level. “It meant that we had to reduce the number of banks and bank accounts related to that,” says Wagner. For a bank, a larger share of the wallet in the project is attractive and results in lower banking fees for Nexans. However, the number of banks was not only minimized. A trade-off was also needed to reduce the counterparty risk per bank.

Nexans used four criteria for the banks to be eligible for cooperation. Apart from the bank’s credit rating and the banking fees, a condition for the group was that the bank would become a core partner – not only for cash management but also for providing credit to the group when necessary. Also, it was important for Nexans that the bank would be able to answer the company’s technology and service requirements. Based on the criteria, Nexans ended up with a selection of global cash management banks after previously working with mainly local banks – due to a large number of mergers.

“We also needed to optimize the structure of the group’s bank architecture, in order to reduce the fees at the group level.” The main focus was on bank relationships. “Reducing the costs was an important goal, but building a strong win-win relationship with the banks was key. We therefore made the bank selection not only based on price but also wanted a footprint making Nexans able to deal with all its future business,” Wagner explains.

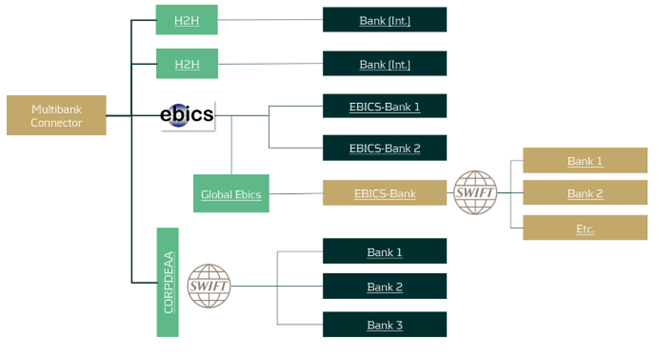

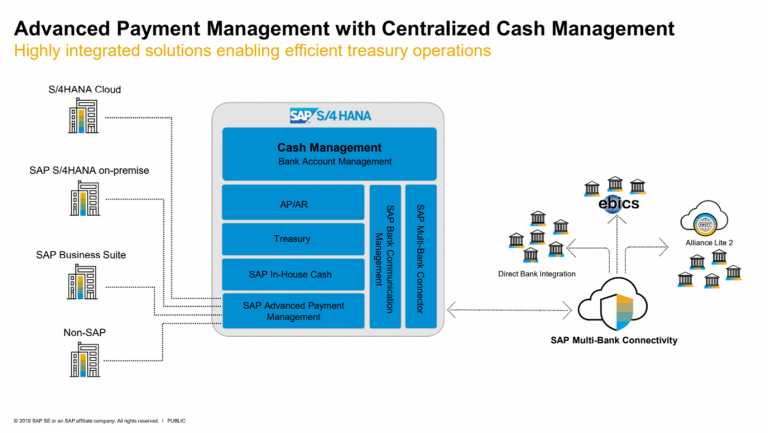

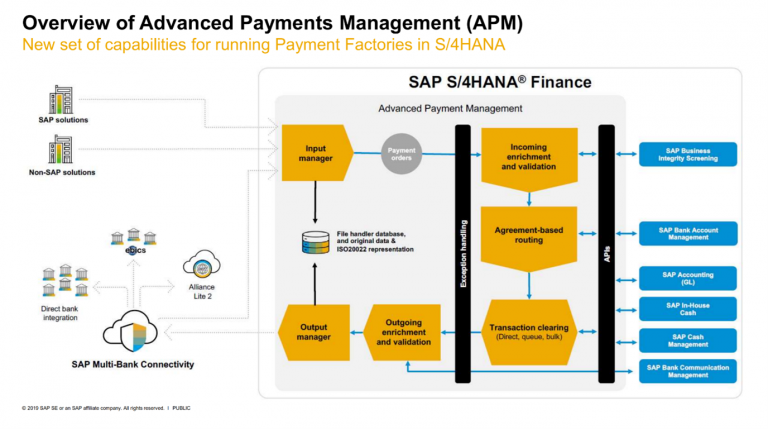

One of the goals was to decrease banking relationships from 100 down to 20 or 30 banks and to reduce the number of accounts to less than 600. Apart from bank rationalization, the other important objectives of this treasury strategy project were improving bank communication, establishing a payment factory and in-house bank, as well as making necessary changes to the current treasury management system.

Wagner adds: “We intend to have around 550 bank accounts, so during the project, we will close roughly 350 accounts. The bank rationalization was the cornerstone for the rest of the project. It was clear that our bank communication had to improve, and in some countries, we needed to change our outdated communication tools. Especially in Europe, with the realization of SEPA, we took the opportunity to implement new technology.”

One bank, one currency

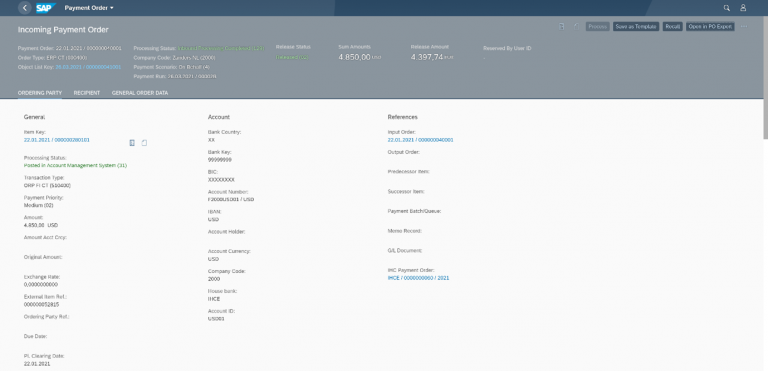

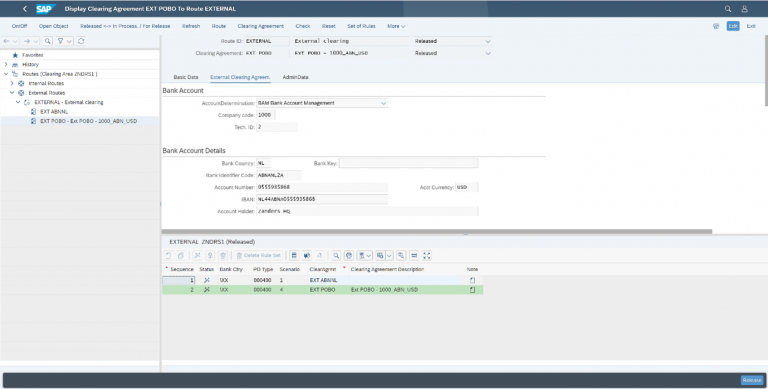

Where Nexans really wanted to improve was on foreign exchange payments. It decided to build a bank organization that would limit cross-border payments. “Without that, we would not have been able to implement a payment factory. We need to leverage the group.” Besides that, a cultural aspect played a role too. The Nexans group was built by buying several entities spread all over the world, each with its own relationships and financial culture. Technologically, it was not possible to control the company on each level of detail.

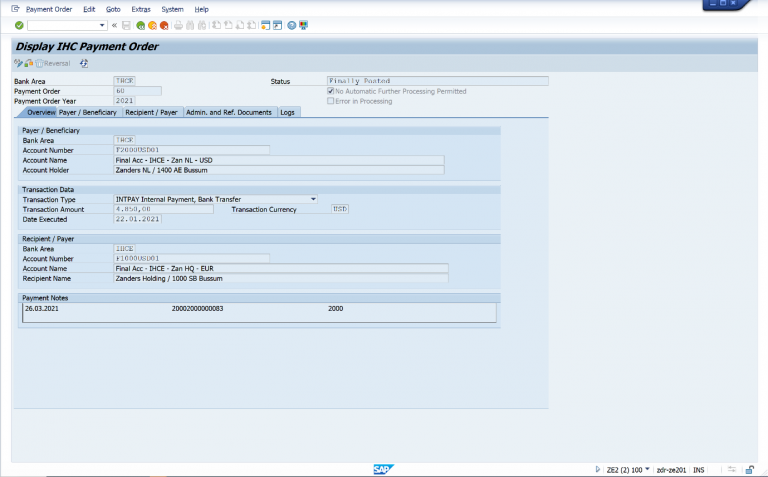

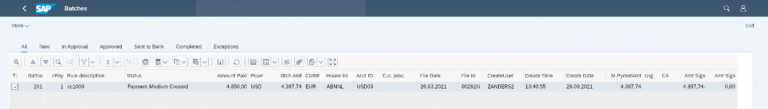

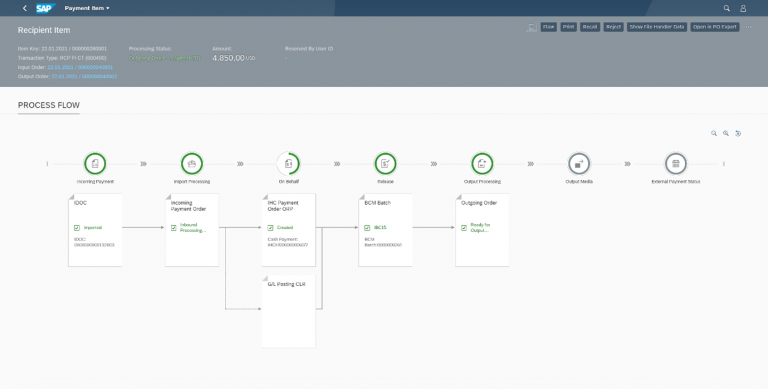

Therefore, new technology was implemented for the payment factory and the in-house bank too. Wagner explains: “When a Nexans entity based in France, for example, needed to pay in US dollars to a client in the US, it was using an account opened in Paris, generating a payment outside of France – so it was cross-border, with a transaction fee of roughly €5-6 per payment. The new situation allows this entity to use an account located in New York. This meant the price became a domestic one. To discover this advantage, we needed help from treasury experts and found that in Zanders’ consultants. They knew that, with the new technology, one entity of the group was able to pay on behalf of the other entities. This payment factory allows Nexans Services to have one account open in each currency country and to offer services to each entity. It opens an account in the US for USD, in London for GBP, etc. In the end, we have one balance per currency.

So, a subsidiary in France paying someone in the US now happens via the payment factory. We then reduce the external fees to these flows; internally, there are only booking flows, no financial flows between the two entities. Because we have a cash pool in place, we also save money on the interest we pay our banks.

Thanks to the new bank architecture, we are now able to pay on behalf of our entities. We are a global group, so the banks must be able to follow us wherever we are. That’s why we decided to give one currency to one bank.

In a treasurer’s way

Most of the banks are now active and around 60% of the sales of the group have been covered. The project was launched in April 2011 and in August Nexans chose its banks. The implementation part, however, was much more complicated and lasted a lot longer. Wagner adds: “The finalizing part will always be the longest one. Implementation is a process that never really ends – we keep on discovering that new changes are needed. In some countries it is very difficult to do the implementation and so in these cases it’s easier to adapt the system.”

Still, in the relationship with its banks Nexans is stronger now, which leads to a more flexible and reactive behavior from the partner banks. Wagner notes: “One of the big returns on investment of this project was the fact that we converted cross-border flows to booking flows. We will have return on this investment after four or five years.”

Zanders consultant Ruud Mullens managed a big part of the project, interpreting the client requirements and, after implementation, structuring the bank relationships too. “It was important for us to have skilled resources that could help,” says Wagner. “We didn’t have the necessary internal resources and needed someone to react to certain developments and to negotiate with the other parties involved. The team that Zanders proposed to us was really pragmatic, had a strong methodology and was able to look at the project from a treasurer’s point of view. In order to improve our treasury organization the global idea had to be clear and Zanders understood that need.”

What did Zanders do for Nexans?

- Assisted in managing the bank rationalization process

- Prepared detailed RfP document, customized to Nexans’ specific requirements

- Provided an evaluation model to validate and evaluate the answers from the banks in the selection process

- Assisted in analyzing and evaluating bank proposals

- Developed account and cash pool architecture

- Followed up contract negotiations with banks

- Helped to implement the new bank infrastructure