On Thursday, November 14th, SAP Netherlands and Zanders hosted a roundtable focused on upgrading to S/4HANA. Nineteen participants representing nine companies, actively engaged in the discussions. This article will focus on the specifics of the discussions.

Exploring S/4HANA Functionalities

The roundtable session started off with the presentation of SAP on some of the new S/4HANA functionalities. New functionalities in the areas of Cash Management, Financial Risk Management, Working Capital Management and Payments were presented and discussed. In the area of Cash Management, the main enhancements can be found in the management of bank relationships, managing cash operations, cash positioning, and liquidity forecasting and planning. These enhancements provide greater visibility into bank accounts and cash positions, a more controlled liquidity planning process across the organization, increased automation, and better execution of working capital strategies. In Financial Risk Management, the discussion highlighted S/4HANA’s support for smart trading processes, built-in market data integration, and more advanced on-the-fly analysis capabilities. All providing companies with a more touchless, automated and straight through process of their risk management process. The session also covered Working Capital enhancements, including a presentation on the Taulia solution offered by SAP, which provides insights into supporting Payables and Receivables Financing. Finally, the session explored innovations in the Payments area, such as payment verification against sanction lists, format mapping tools, the SAP Digital Payments Add-on, and automated corporate-to-bank cloud connectivity.

Migration Strategies: Getting to S/4HANA

While the potential of S/4HANA was impressive, the focus shifted to migration strategies. Zanders presented various options for transitioning from an ECC setup to an S/4HANA environment, sparking a lively discussion. Four use cases were defined, reflecting the diverse architectural setups in companies. These setups include:

- An integrated architecture, where the SAP Treasury solution is embedded within the SAP ERP system

- A treasury sidecar approach, where the SAP Treasury solution operates on a separate box and needs to integrate with the SAP ERP system box

- Treasury & Cash & Banking side car

- Leveraging Treasury on an S/4HANA Central Finance box

The discussion also covered two key migration strategies: the brownfield approach and the greenfield approach. In a brownfield approach, the existing system setup is technically upgraded to the new version, allowing companies to implement S/4HANA enhancements incrementally. In contrast, a greenfield approach involves building a new system from scratch. While companies can reuse elements of their ECC-based SAP Treasury implementation, starting fresh allows them to fully leverage S/4HANA’s standard functionalities without legacy constraints. However, the greenfield approach requires careful planning for data migration and testing, as legacy data must be transferred to the new environment.

Decoupling Treasury: The Sidecar Approach

The greenfield approach also raised the question of whether treasury activities should migrate to S/4HANA first using a sidecar system. This would involve decoupling treasury from the integrated ECC setup and transitioning to a dedicated S/4HANA sidecar system. This approach allows treasury to access new S/4HANA functionalities ahead of the rest of the organization, which can be beneficial if immediate enhancements are required. However, this setup comes with challenges, including increased system maintenance complexity, additional costs, and the need to establish new interfaces.

However, this setup comes with challenges, including increased system maintenance complexity, additional costs, and the need to establish new interfaces. Companies need to weigh the benefits of an early treasury migration against these potential drawbacks as part of their overall S/4HANA strategy. With this consideration in mind, participants reflected on the broader lessons from companies already using S/4HANA.

Lessons from Early Adopters

Companies that have already migrated to S/4HANA emphasized two critical planning areas: testing and training. Extensive testing—ideally automated—should be prioritized, especially for diverse payment processes. Similarly, training is essential to ensure effective change management, reducing potential issues after migration.

These insights highlight the importance of preparation in achieving a smooth migration. As organizations transition to S/4HANA, another important consideration is the potential impact on the roles and responsibilities within treasury teams.

Impact on Treasury Roles

Participants discussed whether S/4HANA would alter roles and responsibilities within treasury departments. The consensus was that significant changes are unlikely, particularly in a brownfield approach. Even in a greenfield approach, roles and responsibilities are expected to remain largely unchanged.

Conclusion

The roundtable highlighted the significant value S/4HANA brings to treasury operations, particularly through enhanced functionalities in Cash Management, Financial Risk Management, Working Capital Management, and Payments.

Participants discussed the pros and cons of brownfield and greenfield migration strategies, with insights into the sidecar approach for treasury as a potential transitional strategy. Early adopters emphasized the critical importance of thorough testing and training for a successful migration, while noting that treasury roles and responsibilities are unlikely to see major changes

If you would like to hear more about the details of the discussion, please reach out to Laura Koekkoek, Partner at Zanders, [email protected]

SAP Treasury’s Strategy for Seamless Compliance worldwide

In the first half of 2024, European treasurers are confronted with a new item on their agenda: the updated EMIR Refit. The new EMIR reporting rules will be implemented in the EU on the 29th of April 2024, and in the UK on the 30th of September 2024.

The Updated EMIR Refit introduces the following main changes:

- Harmonizing the reporting formats to ISO 20022 XML

- Increasing the number of reporting fields from 129 to 203 (204 in the UK)

- Introducing new fields: UPI (Unique product identifier) and RTN (Report Tracking Number)

For more details about these changes, refer to this article on the implications of the EMIR Refit.

Trade repository reporting in SAP Treasury and Risk management

SAP Treasury users inquire on how to deal with the changes in their solution, what comes out of the box, what adjustments are necessary,and where the challenges are.

Since the introduction of the original EMIR reporting in 2012, SAP has covered the requirements for EMIR reporting in the component Trade repository reporting. It is a robust functionality fully integrated into the SAP Transaction manager environment. Due to varying requirements among the various trade repositories, SAP has ceased to enhance the solution and referred clients to the partner solution of Virtusa. However, the SAP Trade repository solution (“TARO”) is still supported on all current releases in the existing functional extend and can be used and adopted by in-house developments and consulting partners (SAP Note 2384289). Using the Virtusa solution or a custom solution, with EMIR Refit, a number of new required fields needed to be incorporated into the deal management data model.

The following changes have been provided by individual SAPNotes over the course of the past months:

- Unique Product Identifier (ISO 4914 UPI) and Report Tracking Number (RTN) have been introduced. They are available under the tab “Administration” in the deal data.

- These fields have been introduced to the relevant BAPIs, mirror deal functionality, as well as to the SAP TPI interface.

New reporting fields

The EMIR Refit solution utilizes fields, which have already been made available earlier, over the course of the original EMIR Refit in 2018 (Switch FIN_TRM_FX_HMGMT_3), and are present also under the tab “Administration” for the relevant product categories:

- CFI Code (Classification of Financial Instruments, ISO 10692 Classification)

- ISIN on the deal level for OTC deals

- Market Identification Code (MIC)

The recently introduced field is the UPI, which is a classification assigned by ANNA Derivatives Service Bureau. It consists of 12 characters and reflects both the Asset class, Instrument type, Product and the CFI. The CFI itself is an instrument classification which is 6 characters long.

The next consideration is how to populate these fields. In case of external trades, the CFI and UPI can be delivered by the trading platform. SAP Trade platform integration (TPI) covers the transfer of these fields from the trading platforms.

Since 2019, in case of OTC deals, EMIR Refit made financial counterparties (FC) solely responsible and legally liable for reporting on behalf of both counterparties, provided the non-financial counterparty is below the clearing threshold (NFC-). Therefore, this option would be necessary only for large financial entities, as smaller corporates are not obliged to report external OTC deals, as the counterparty reports on their behalf.

Corporates are obligated to report their intercompany deals, under the condition that they cannot apply for an opt out with their regulator. In that case, the CFI and UPI need to be derived in-house.

For that purpose, there are enhancements (BAdIs) available, to implement one's own derivation logic.

The reporting format has been standardized with ISO 20022 based XML. XML output can be easily generated based on a DMEE structure. Unlike the original version from 2012, SAP does not deliver the new report structures needed for the EMIR Refit. This part needs to be set up in a project.

The impact of the EMIR Refit in the trade repository reporting of your organisation can bring up many specific questions. We are happy to help you answer them from both the advisory as well as the technical implementation point of view. Examples on how Zanders can assist is:

- Implementing the new Emir Refit requirements in SAP Treasury

- Assisting in applying for the exemption of reporting internal trades with the various regulators

Reach out to Michal Šárnik to receive assistance on this topic.

Collaboration, trust and growth, how we’re celebrating 25 years of partnership with the market-leading technology platform.

Our technology partnerships are core, foundational elements of our risk and treasury transformations at Zanders. For us to guide our clients through their digitalization journeys and keep pace with technology advancements relies on the right relationships (non-commercial of course, so we maintain our independence) with the best solution providers in our field. To stand the test of time, these relationships need to be mutually advantageous, and this takes both parties to be engaged, committed to continual learning, and driven by a shared vision. Our work with SAP embodies these qualities. And in demonstration of the success of this alliance, in 2024 we’re celebrating 25 years of partnership with the market-leading technology platform.

To mark this anniversary milestone, we invited Christian Mnich, VP, Head of Solution Management, Treasury and Working Capital Management at SAP to join Zanders partners Judith van Paassen and Laura Koekkoek to reflect on how the relationship has developed in this time. As they shared anecdotes and considered the unique characteristics that have shaped this partnership, three key themes emerged – collaboration, trust, and growth.

1. Collaboration: A meeting of minds

From day one, there was an enthusiasm from both companies to collaborate and share expertise. Zanders’ first encounter with SAP was at a trade fair in 1998. Back then, Zanders was four years young and a relative newcomer to the treasury advisory world. SAP was an established standard in business processing software but at this point still a single-product, ERP solution. As the modern technologies lead for Zanders, Judith van Paassen visited the SAP stand at the exhibition curious to see how the platform could extend to support the work Zanders was doing with corporate treasury departments.

“SAP was present at that fair with an early version (2.2F) of the system,” Judith recounts. “I asked some in depth questions at the time about functionalities. Can SAP do this? Can SAP do that? After some further discussion and exchange of knowledge, the idea to join forces was brought up.”

On the basis of this trade fair encounter, SAP and Zanders together started looking into how the system could be customised for treasury, specifically at the time for the Dutch market.

2. Trust: The backbone of successful partnership

The partnership initially focused on the Netherlands, with Judith regularly spending time with SAP colleagues, working with the team on how to position the treasury system to the market and helping them to demonstrate the potential of the solution to support corporate treasury processes.

“It was a very close partnership between the Netherlands and Zanders – where Zanders and SAP worked closely together and were organizing seminars to inform the market on the capabilities in SAP,” Christian remembers. “This model was very unique back then and the partnership model is still working very well for SAP and their partners.”

These early days formed a backbone for the partnership, embedding a commitment to honest and open collaboration into the core of the relationship.

“It’s all been built from trust,” Christian emphasizes. “When building a long-lasting partnership, you need to have open dialogue – on both sides. It’s very important to us as a solution provider that when we roll out new solutions, we get honest feedback. We’ve had lots of sessions with Zanders over the years where you’ve provided this honest feedback. By doing this, you’ve helped us to scale our solutions, develop new solutions and increase the adoption of our services.” “This also comes back in our co-development of regional solutions for local requirements like the connectivity between eBAgent and MBC in the APJ region” says Laura.

3. Growth: Pioneering new environments

As the partnership has expanded from the Netherlands and Benelux to the UK, parts of the DACH region, the US and APJ, it has provided a launchpad for important growth opportunities for both businesses. For Zanders, it’s empowered our team with a much deeper understanding of the role and potential of innovation in our market, enabling us to take a proactive role in guiding our clients through transformation projects.

“We’re consultants – we like to give advice to our clients – but we also really want to implement solutions with our clients,” says Judith. “To do this, we need to not only look at the little details within treasury, but at the end-to-end process and architecture. Our knowledge of treasury in combination with our experience with SAP technology has definitely made us more attractive to expand our services to clients in Asia, the US and APJ. It’s has also allowed us to take a more proactive role in driving large-scale treasury transformations for our clients.”

Christian agreed that the partnership has also been an enabler of growth for SAP, highlighting three transformation projects undertaken jointly by the partnership as key moments:

- Firstly, AkzoNobel. It was the first treasury transformation the partnership worked on where SAP was implemented to replace a best of breed TMS system in the European environment. The size and complexity of this project made it a blueprint for future transformations. In particular, demonstrating the benefits of breaking down product siloes to add treasury capabilities to the SAP ERP system in a more integrated way.

- Secondly, BP. Although not as large and extensive as other projects, it’s notable for its strategic importance. This project represented the first entry into the UK for SAP, paving the way into an important growth market and opening up new opportunities in other regions.

- Thirdly, the implementation of the SAP S/4HANA treasury system for Sony. As a truly global transformation project, the scale and nature of the project (especially given the timing with the pandemic) meant there were many challenges. The success of the deployment is a testament to the strength of the partnership, with the teams working together closely to develop the best solution for the client.

Together, these projects show the relentless commitment from both partners to challenge boundaries, see the bigger picture and prioritize client needs.

“We’ve seen a willingness from Zanders to expand their view from core treasury into other areas,” Christian explains. “This is very important for us from an SAP point of view. Smaller, niche or more boutique partners – they don't leave their comfort zone, whereas there's always interest from Zanders to learn new things. We appreciate how you try to understand the challenges before your customers run into these challenges.”

25 years – A celebration of collaboration, trust, and growth

What our 25 years working with SAP shows us is the success of our partnership comes down to how we work together as a team. This means trusting each other, being collaborative, and relies on both parties being willing to challenge the status quo to pursue ambitious growth. What SAP and Zanders have accomplished together already may have been ground-breaking, but it feels like we’ve still only just scratched the surface of what we can potentially achieve together. For this reason, our journey together will continue long into the future – at pace.

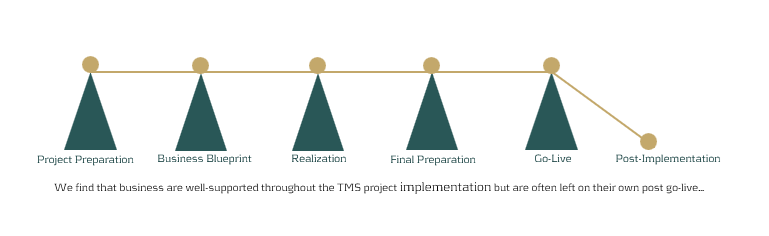

Businesses across the globe invest tens of thousands of dollars in implementing treasury management systems to achieve the accuracy, automation, speed, and reporting they require.

But what happens after implementation, when the project team has packed up and handed over the reins to the employees and support staff?

The first months after a system implementation can be some of the most challenging to a business and its people. Learning a new system is like learning any new skill – it requires time and effort to become familiar with the new ways of working, and to be completely comfortable again performing tasks. Previous processes, even if they were not the most efficient, were no doubt second nature to system users and many would have been experts in working their way through what needed to be done to get accurate results. New, improved processes can initially take longer as the user learns how to step through the unfamiliar system. This is a normal part of adopting a new landscape and can be expected. However, employee frustration is often high during this period, as more mental effort is required to perform day-to-day tasks and avoid errors. And when mistakes are made, it often takes more time to resolve them because the process for doing so is unfamiliar.

High-risk period for the company

With an SAP system, the complexity is often great, given the flexibility and available options that it offers. New users of SAP Treasury Management Software may take on average around 12 – 18 months to feel comfortable enough to perform their day-to-day operations, with minimal errors made. This can be a high-risk period for the company, both in terms of staff retention as well as in the mistakes made. Staff morale can dip due to the changes, frustrations and steep learning curve and errors can be difficult to work through and correct.

In-house support staff are often also still learning the new technology and are generally not able to provide the quick turnaround times required for efficient error management right from the start. When the issue is a critical one, the cost of a slow support cycle can be high, and business reputation may even be at stake.

While the benefits of a new implementation are absolutely worthwhile, businesses need to ensure that they do not underestimate the challenges that arise during the months after a system go-live.

Experts to reduce risks

What we have seen is that especially during the critical post-implementation period – and even long afterward – companies can benefit and reduce risks by having experts at their disposal to offer support, and even additional training. This provides a level of relief to staff as they know that they can reach out to someone who has the knowledge needed to move forward and help them resolve errors effectively.

Noticing these challenges regularly across our clients has led Zanders to set up a dedicated support desk. Our Treasury Technology Support (TTS) service can meet your needs and help reduce the risks faced. While we have a large number of highly skilled SAP professionals as part of the Zanders group, we are not just SAP experts. We have a wide pool of treasury experts with both functional & technical knowledge. This is important because it means we are able to offer support across your entire treasury system landscape. So whether it be your businesses inbound services, the multitude of interfaces that you run, the SAP processes that take place, or the delivery of messages and payments to third parties and customers, the Zanders TTS team can help you. We don’t just offer vendor support, but rather are ready to support and resolve whatever the issue is, at any point in your treasury landscape.

As the leading independent treasury consultancy globally, we can fill the gaps where your company demands it and help to mitigate that key person risk. If you are experiencing these challenges or can see how these risks may impact your business that is already in the midst of a treasury system implementation, contact Warren Epstein for a chat about how we can work together to ensure the long-term success of your system investment.

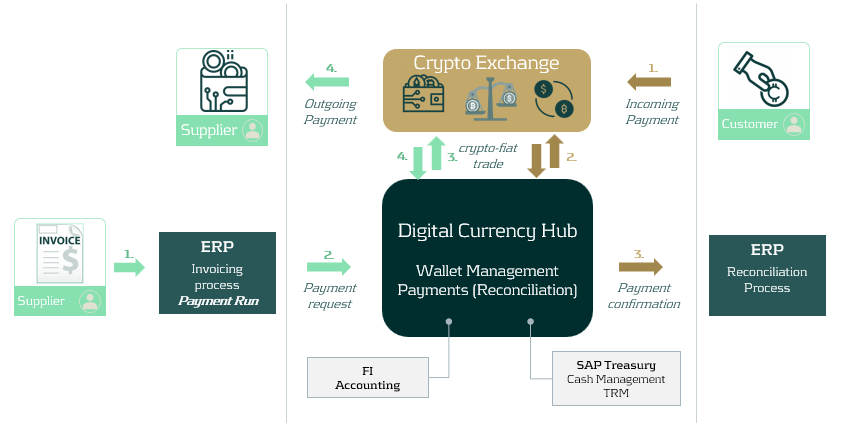

Early 2023, SAP launched its Digital Currency Hub as a pilot to explore the future of cross-border transactions using crypto or digital currencies.

In this article, we explore this stablecoin payments trial, examine the advantages of digital currencies and how they could provide a matching solution to tackle the hurdles of international transactions.

Cross-border payment challenges

While cross-border payments form an essential part of our globalized economy today, they have their own set of challenges. For example, cross-border payments often involve various intermediaries, such as banks and payment processors, which can result in significantly higher costs compared to domestic payments. The involvement of multiple parties and regulations can lead to longer processing times, often combined with a lack of transparency, making it difficult to track the progress of a transaction. This can lead to uncertainty and potential disputes, especially when dealing with unfamiliar payment systems or intermediaries. Last but not least, organizations must ensure they meet the different regulations and compliance requirements set by different countries, as failure to comply can result in penalties or delays in payment processing.

Advantages of digital currencies

Digital currencies have gained significant interest in recent years and are rapidly adopted, both globally and nationally. The impact of digital currencies on treasury is no longer a question of ‘if’ but ‘when’, as such it is important for treasurers to be prepared. While we address the latest developments, risks and opportunities in a separate article, we will now focus on the role digital currencies can play in cross-border transactions.

The notorious volatility of traditional crypto currencies, which makes them less practical in a business context, has mostly been addressed with the introduction of stablecoins and central bank digital currencies. These offer a relatively stable and safe alternative for fiat currencies and bring some significant benefits.

These digital currencies can eliminate the need for intermediaries such as banks for payment processing. By leveraging blockchain technology, they facilitate direct host-to-host transactions with the benefit of reducing transaction fees and near-instantaneous transactions across borders. Transactions are stored in a distributed ledger which provides a transparent and immutable record and can be leveraged for real-time tracking and auditing of cross-border transactions. Users can have increased visibility into the status and progress of their transactions, reducing disputes and enhancing trust. At a more advanced level, compliance measures such as KYC, KYS or AML can be directly integrated to ensure regulatory compliance.

SAP Digital Currency Hub

Earlier this year, SAP launched its Digital Currency Hub as a pilot to further explore the future of cross-border transactions using crypto or digital currencies. The Digital Currency Hub enables the integration of digital currencies to settle transactions with customers and suppliers. Below we provide a conceptual example of how this can work.

- Received invoices are recorded into the ERP and a payment run is executed.

- The payment request is sent to SAP Digital Currency Hub, which processes the payment and creates an outgoing payment instruction. The payment can also be entered directly in SAP Digital Currency Hub.

- The payment instruction is sent to a crypto exchange, instructing to transfer funds to the wallet of the supplier.

- The funds are received in the supplier’s wallet and the transaction is confirmed back to SAP Digital Currency Hub.

In a second example, we have a customer paying crypto to our wallet:

- The customer pays funds towards our preferred wallet address. Alternatively, a dedicated wallet per customer can be set up to facilitate reconciliation.

- Confirmation of the transaction is sent to SAP Digital Currency Hub. Alternatively, a request for payment can also be sent.

- A confirmation of the transaction is sent to the ERP where the open AR item is managed and reconciled. This can be in the form of a digital bank statement or via the use of an off-chain reference field.

Management of the wallet(s) can be done via custodial services or self-management. There are a few security aspects to consider, on which we recently published an interesting article for those keen to learn more.

While still on the roadmap, SAP Digital Currency Hub can be linked to the more traditional treasury modules such as Cash and Liquidity Management or Treasury and Risk Management. This would allow to integrate digital currency payments into the other treasury activities such as cash management, forecasting or financial risk management.

Conclusion

With the introduction of SAP Digital Currency Hub, there is a valid solution for addressing the current pain points in cross-border transactions. Although the product is still in a pilot phase and further integration with the rest of the ERP and treasury landscape needs to be built, its outlook is promising as it intends to make cross-border payments more streamlined and transparent.

In SAP Treasury, business partners represent counterparties with whom a corporation engages in treasury transactions, including banks, financial institutions, and internal subsidiaries.

Additionally, business partners are essential in SAP for recording information related to securities issues, such as shares and funds.

The SAP Treasury Business Partner (BP) serves as a fundamental treasury master data object, utilized for managing relationships with both external and internal counterparties across a variety of financial transactions; including FX, MM, derivatives, and securities. The BP master data encompasses crucial details such as names, addresses, contact information, bank details, country codes, credit ratings, settlement information, authorizations, withholding tax specifics, and more.

Treasury BPs are integral and mandatory components within other SAP Treasury objects, including financial instruments, cash management, in-house cash, and risk analysis. As a result, the proper design and accurate creation of BPs are pivotal to the successful implementation of SAP Treasury functionality. The creation of BPs represents a critical step in the project implementation plan.

Therefore, we aim to highlight key specifics for professionally designing BPs and maintaining them within the SAP Treasury system. The following section will outline the key focus areas where consultants need to align with business users to ensure the smooth and seamless creation and maintenance of BPs.

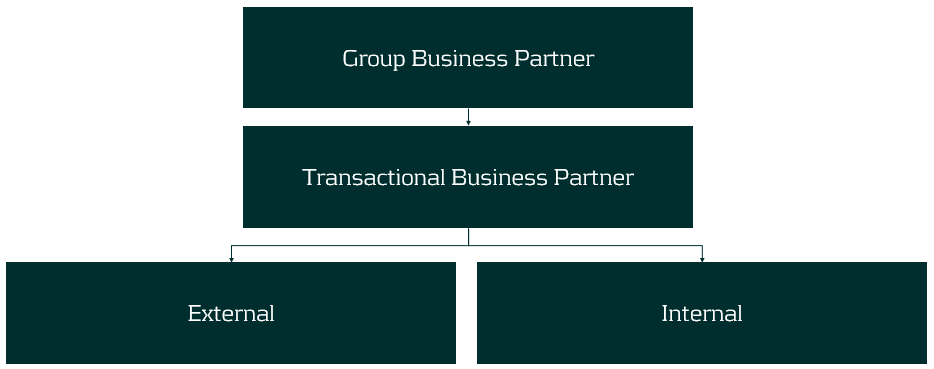

Structure of the BPs:

The structure of BPs may vary depending on a corporation's specific requirements. Below is the most common structure of treasury BPs:

Group BP – represents a parent company, such as the headquarters of a bank group or corporate entity. Typically, this level of BP is not directly involved in trading processes, meaning no deals are created with this BP. Instead, these BPs are used for: a. reflecting credit ratings, b. limiting utilization in the credit risk analyzer, c. reporting purposes, etc.

Transactional BP – represents a direct counterparty used for booking deals. Transactional BPs can be divided into two types:

- External BPs – represent banks, financial institutions, and security issuers.

- Internal BPs – represent subsidiaries of a company.

Naming convention of BPs

It is important to define a naming convention for the different types of BPs, and once defined, it is recommended to adhere to the blueprint design to maintain the integrity of the data in SAP.

Group BP ID: Should have a meaningful ID that most business users can understand. Ideally, the IDs should be of the same length. For example: ABN AMRO Group = ABNAMR or ABNGRP, Citibank Group = CITGRP or CITIBNK.

External BP ID: Should also have a meaningful ID, with the addition of the counterparty's location. For example: ABN AMRO Amsterdam – ABNAMS, Citibank London – CITLON, etc.

Internal BP ID: The main recommendation here is to align the BP ID with the company code number. For example, if the company code of the subsidiary is 1111, then its BP ID should be 1111. However, it is not always possible to follow this simple rule due to the complexity of the ERP and SAP Treasury landscape. Nonetheless, this simple rule can help both business and IT teams find straightforward solutions in SAP Treasury.

The length of the BP IDs should be consistent within each BP type.

Maintenance of Treasury BPs

1. BP Creation:

Business partners are created in SAP using the t-code BP. During the creation process, various details are entered to establish the master data record. This includes basic information such as name, address, contact details, as well as specific financial data such as bank account information, settlement instructions, WHT, authorizations, credit rating, tax residency country, etc.

Consider implementing an automated tool for creating Treasury BPs. We recommend leveraging SAP migration cockpit, SAP scripting, etc. At Zanders we have a pre-developed solution to create complex Treasury BPs which covers both SAP ECC and most recent version of SAP S/4 HANA.

2. BP Amendment:

Regular updates to BP master data are crucial to ensure accuracy. Changes in addresses, contact information, or payment details should be promptly recorded in SAP.

3. BP Release:

Treasury BPs must be validated before use. This validation is carried out in SAP through a release workflow procedure. We highly recommend activating such a release for the creation and amendment of BPs, and nominating a person to release a BP who is not authorized to create/amend a BP.

BP amendments are often carried out by the Back Office or Master Data team, while BP release is handled by a Middle Office officer.

4. BP Hierarchies:

Business partners can have relationships as described, and the system allows for the maintenance of these relationships, ensuring that accurate links are established between various entities involved in financial transactions.

5. Alignment:

During the Treasury BP design phase, it is important to consider that BPs will be utilized by other teams in a form of Vendors, Customers, or Employees. SAP AP/AR/HR teams may apply different conditions to a BP, which can have an impact on Treasury functions. For instance, the HR team may require bank details of employees to be hidden, and this requirement should be reflected in the Treasury BP roles. Additionally, clearing Treasury identification types or making AP/AR reconciliation GL accounts mandatory for Treasury roles could also be necessary.

Transparent and effective communication, as well as clear data ownership, are essential in defining the design of the BPs.

Conclusion

The design and implementation of BPs require expertise and close alignment with treasury business users to meet all requirements and consider other SAP streams.

At Zanders, we have a strong team of experienced SAP consultants who can assist you in designing BP master data, developing tools to create/amend the BPs meeting strict treasury segregation of duties and the clients IT rules and procedures.

With subsidiaries all over the world, ASICS wanted to standardize and make its treasury operations more efficient. To optimize its treasury function, ASICS Europe (AEB) decided to implement the SAP Treasury and Risk Management module in 2017.

With this came the decision to set up a new company code to separate ASICS Europe’s treasury activities from its commercial activities. Apart from the pros, it raised new challenges too.

ASICS stands for ‘Anima Sana In Corpore Sano’, loosely translated ‘a sound mind in a sound body’. This Japanese company was founded by Kihachiro Onitsuka in 1949. He felt that Japanese youth, who had lived through World War II, were in the process of being derailed and had too few pursuits. Onitsuka wanted to bring back the healthy life through sports, which demanded proper sportswear. And so, he decided to produce basketball shoes under the name Onitsuka Tiger.

Inventive like octopus

Onitsuka strived for perfection and innovation. One of the anecdotes about the origin of the ASICS basketball shoes is that he came up with an inventive idea when eating octopus salad from a bowl. During that diner, a leg of the animal stuck to the side of the bowl. When Onitsuka realized this was because of the animal’s suction cups, he decided to design basketball shoes with tiny suction cups on the sole for more grip. It turned out to be a revolutionary idea.

Another remarkable fact is that Nike-founder Phil Knight started his career at ASICS. When he visited the Onitsuka Tiger office in 1963, he was impressed by the inventive sports shoes and asked Onitsuka to become their sales agent in the US. After a few years working for ASICS Knight decided to start his own sports brand.

The tiger stripes go global

During the years after foundation, the range of sports activities provided by Onitsuka expanded to include a variety of Olympic styles used by athletes around the world. The current ASICS brand signature, the crossed stripes that appear on the side of all the shoes, was first introduced in 1966 during the pre-Olympic trials for the 1968 Summer Olympics in Mexico City. Martial arts star Bruce Lee was the first international celebrity to popularize this design. In 1977, Onitsuka Tiger merged with GTO and JELENK to form ASICS Corporation. Despite the name change, a vintage range of ASICS shoes is still produced and sold internationally under the Onitsuka Tiger label.

In 1977, ASICS opened a first small European office in Düsseldorf, in the home garage of a representative. This German city had a relatively large Japanese community and was centrally located in Europe. In 1995, ASICS Europe, Middle East and Africa (EMEA) relocated to a new headquarters in the Netherlands, from where more subsidiaries were established, and the ASICS network further expanded. The company built and rented several large distribution centers in Europe. In addition, the sales channels broadened from traditional wholesale to opening ASICS stores – first outlet stores, followed by a flagship store and e-commerce. Today, the brand sells all items through omnichannel.

The first implementation of the SAP system involved communication with the bank via the SWIFT platform.

Eugene Tjemkes, Head of Global Business Transformation Finance

Challenge

The implementation of SAP modules

In 2017, to further optimize their treasury function, ASICS Europe decided to implement the treasury management functionality of SAP. “That is when our cooperation with Zanders started”, says Eugene Tjemkes, Head of Global Business Transformation Finance. “The first implementation of the SAP system involved communication with the bank via the SWIFT platform, an in-house cash system with all kinds of automatic entries where Treasury acts as a payment factory – also on behalf of the subsidiaries.”

The Japanese headquarters opted for more or less the same treasury solution as those of the EMEA countries. “The other regions did not choose it, either because of their small size, or since they are single country regions (such as Australia) or because foreign currency plays a lesser role, such as in the US. In Europe, on the other hand, we are involved in currency transactions and hedging every day.”

Treasury as a separate company

Besides the SAP Treasury and Risk Management (TRM) module, ASICS Europe also implemented SAP Cash Management (CM), SAP In-House Cash (IHC) and the SAP Bank Communication Manager (BCM) in 2017. With this came the decision to set up a new company code that would separate the treasury functionality of ASICS Europe BV (AEB) from its commercial activities, as tax rules only allowed AEB to provide services and do business in Europe. In addition, the new company code, AEB Treasury, ensured global reach and provided cost savings and standardization due to the foreseen treasury activities in the EMEA region, Japan, and the Americas.

Tjemkes explains: “As a legal part of AEB, it was not possible for Treasury to do anything for ASICS US or ASICS Asia. Transforming our treasury functionality into a separate legal entity would make it possible to develop treasury activities outside the EMEA region too. Therefore, there were plans to separate the treasury functionality from the existing corporate structure and make it a global subsidiary of the Japanese headquarters. From that vision, that treasury functionality would be housed in a separate legal entity, we started implementing our treasury system in 2017. The system was set up accordingly; AEB Treasury became a separate company in SAP, although it was not a legally separated entity.”

Bringing back the treasury activities under AEB

However, the plan to service the company’s entities in other regions with an inhouse bank operating from Europe, did not go as planned. Instead, different regions of ASICS were supported with a local solution. And therefore, splitting into two company codes became irrelevant.

Tjemkes: “Due to the separated treasury functionality, the accounting department had to consolidate the reports to get them into one financial statement. After using SAP TRM, CM, IHC and BCM for a few years, we discovered that a legal entity administered in two different company codes appeared to be time-consuming while executing our day-to-day processes. Initially, the plan was to do this temporarily, with the idea that Treasury would become a separate entity. But unfortunately, the plan was ultimately not adopted by the head office – from their perspective the advantages were not that great.”

This left AEB with the artificial situation that there were still two company codes in which it had to deal with all kinds of currencies, with different balance sheet items, and problems with the redistribution results. “That finally made us decide to remove that artificial separation of company codes and bring the treasury activities back under AEB. That also meant an adjustment in our TMS. We asked Zanders to support us in that project.”

Solution

Streamlining Treasury Processes

To solve the shortcomings of the artificial separation, Zanders proposed various alternatives. After conducting a few workshops with the treasury department, it was decided to discontinue all the current processes (TRM, IHC, GL accounting) in the company code representing AEB Treasury and re-implement it in company code representing AEB. Hence, a single company code for the single legal entity.

Magda Bleker, Treasury Specialist at ASICS EMEA: “This would save us time on labor-intensive activities, such as replicating accounting entries into company code representing AEB. Further, as internal dealing only occurred between company codes representing AEB and AEB treasury, ASICS would no longer have to use the internal dealing functionality by merging the two company codes. Removal of these activities would make the processes more efficient.”

Zanders and ASICS identified that the proposed solution would require high implementation effort. It would also lose the flexibility to quickly split the TRM and IHC processes into a new legal entity. However, as the pros outweighed the cons, ASICS decided to go ahead with the merging of the two company codes. The project started with Zanders updating the decision forms, configuration, and master data conversion documents created in 2017 during the SAP TRM and IHC implementation project, which reflected the changes, risks, and implications of migration. After which, the new functionality was configured and tested in a development system, ensuring that it would not disrupt the treasurers’ daily activities and to keep the payment structure intact and valid. Once the configuration had been updated in the system, the previous configuration documents were also updated to reflect the new changes in the system.

This would save us time on labor-intensive activities, such as replicating accounting entries into company code representing AEB.

Magda Bleker, Treasury Specialist

Performance

Improving further

Tjemkes: “Around 2016, we implemented SAP Fashion management system (FMS) ourselves in our European offices as a pilot for the whole world. FMS is an industry-specific solution, and we were the first company to go live with it. In addition to Europe, our branches in the US, Canada, China and Australia, among others, are now on this platform. But to properly implement the treasury system we really needed a specialist. Zanders is a very professional service provider, who knows very well what modern treasury is and how treasury systems work. We couldn’t have done this without them. They did the project management for us, helped write the project plan and created a test plan.”

Despite the corona pandemic in 2020, ASICS had a turnover of 328,784 million yen, which is more than 2.5 billion euro. The company took a great deal to investigate their current processes and see what was working and what was not. Like in sports, ASICS showed how one can still move forward when taking a step back, improving their processes and making them more efficient.

Next step for AEB is to expand its functionality around hedging. “The hedge contracts are now recorded in the system. We want to further optimize the transparency and efficiency of the closing of our hedge deals with banks, to mitigate all associated risks. We also want to improve the valuation of the hedge contracts. There are functionalities in SAP that allow us to better value hedges. But we have already taken many, very important steps.”

Sanofi successfully implemented a global payment factory based on SAP through meticulous planning, expert guidance, and effective team-building despite the project’s large scale.

When the multinational pharma company Sanofi set out to implement a global payment factory based on SAP, the sheer size and scope of the project made it seem a Herculean task. But with meticulous planning, the right expertise and skilled team-building, the treasury team achieved a very successful outcome.

After a decade of expansion through M&A, Sanofi, the pharmaceuticals company headquartered in Paris, France, with part of its group treasury – the in-house bank team – based in Brussels, decided it was time to bring greater centralization to its payments function. With sales of €37 billion in 2015 and operations in more than 100 countries, the company, active in the research & development, manufacturing, and marketing of pharmaceutical drugs, vaccines, and animal health products, began its journey towards a global payment factory based on SAP.

Need for control and security

This decision was part of an overall initiative to increase centralization in the finance function, according to the company’s head of in-house bank, finance & treasury, Wolfgang Weber. He says: “The reasons for the project went beyond the pharmaceutical industry – the need for control over cash flow, greater security and the pressure for increased efficiency are global trends.”

He explains that Sanofi hoped to gain several benefits from the centralization project, including: lower bank fees and bank connectivity cost; greater transparency over outgoing payments; and an increased level of compliance and control.

Following a selection process to appoint an external consultant, Zanders was asked to work on the SAP global payment factory project at the end of 2012. Mark van Ommen, director at Zanders, explains that the firm used its proprietary design methodology, based on best market practices and years of implementation experience, to design the global payment factory, which included a ‘payments on behalf of’ (PoBo) structure.

Sanofi’s decentralized payments structure presented risks that required attention. The company operated with multiple payment processes, leading to inefficiencies and potential security vulnerabilities. This highlighted the need for global standards and a centralized, harmonized payments system. The project involved issuing a request for proposals (RfP) to select four banking partners.

PoBo and PiNo

The global SAP-based payment factory, currently implemented in the largest countries in Europe and with roll-out almost complete in the US, includes PoBo functionality. This allows Sanofi to channel its payments through a single legal entity, which has obvious benefits for a multinational with a presence in numerous countries. The structure enables treasury to rationalize its bank accounts and simplify cash management structures. Zanders consultant Pieter Sermeus explains that PoBo was a key factor for Sanofi in achieving efficiency and business security. He says: “Payments are now routed to one or (in the case of the euro) very few centralized bank accounts, which are mostly in-country so that cross-border fees can be avoided.”

However, PoBo isn’t practical or possible in some jurisdictions with more complex payments environments, so another solution was needed. Together, Sanofi and Zanders worked on what was internally known as the ‘central forwarding model’, which in effect was a ‘Payments in the Name of’ (PiNo) structure. This model is mainly used in countries with monetary restrictions, such as China, Malaysia and Thailand, as well as in African and Latin American and some eastern European countries. Such countries require the payee to initiate payments from its own bank account. While this does not result in a reduction in the number of bank accounts, the company is able to process payments through a single platform, which brings compliance/security benefits and also allows the harmonization of processes to an extent that makes them more efficient.

The additional security provided by the PiNo structure means there are compelling reasons to extend the use of the payment factory to more countries. Sanofi is currently working on implementing a pilot PiNo structure in Turkey. Weber adds: “Based on Zanders expertise they were well equipped to help us on setting up and designing the PiNo structure.”

Knowledge tranfer and team building

One of the key parts of the project was the transfer of knowledge from the small group of consultants appointed to work on the project to the members of staff in Sanofi’s central treasury and IT departments. Laurens Tijdhof, a partner at Zanders, explains: “Our main goal was to transfer knowledge to key members of staff. We set up training sessions and provided training on the job. This enabled them to really develop their in-house capabilities.”

During the project, there was an emphasis on collaboration between the consultant and the client and preparing Sanofi to become self-sufficient.

Zanders used a ‘train the trainer’ approach, providing training in this way for upwards of 30 key members of staff. The training aspect of the project was a success – an outcome that Weber ascribes in part to the expertise and teaching methods and in part to having the ‘right people’ on Sanofi’s team. He points out that the timing of the training was also important: “We needed to transfer knowledge and IT/SAP expertise to the different departments. This was valuable from two angles: it guarantees stability of the operations and reduces consulting costs over time. The timing of this was crucial because, in a project of this size and scope, you spend a lot of time simply ‘firefighting’ – and you forget about the training. This didn’t happen and Zanders did a good job.” While training was an important part of the project, Sanofi also had to focus on building up its internal team. Weber says: “When hiring for the project, we looked for project management skills and SAP In-House Cash technical skills. We found some very good people. We looked internally – Sanofi has 110,000 employees – as well as externally. We now have a team of 22 hard-working, committed experts. It took a while to get the right team together but I am very pleased with the result.”

Handling the complexity

The nature of the project and the sheer size of Sanofi’s organization meant that planning and coordinating the approach to the global payment factory implementation was no mean feat. Weber says: “It’s easy to underestimate the complexity and size of such a project in such a large organization. The major difficulty is to coordinate internal resources so that people don’t get lost in the complexity of the project.”

There were three defining factors to the project, namely: the size of Sanofi’s organization; the geographical scope of the project (worldwide); and the complexity of Sanofi’s requirements.

Weber underlines that, along with meticulous planning and a very capable team, a flexible approach is also needed to manage an endeavor of this size: “The initial roadmap needs to be adjustable because you may have to reset priorities. Resources may have to be shifted to another area of the project.”

Van Ommen agrees that taking care of the details can be one of the most important aspects of such a complex project: “Sanofi did this really well and they recognized their need for change management – they took a realistic view on the planning and timelines. Wolfgang and his colleague Isabelle really brought the project to the ground, providing a lot of practical input.”

Weber adds: “It’s important to have proper project governance, including senior management support up to board level, in our case represented by the group CFO.”

Security and compliance

The implementation of the payment factory also enables Sanofi to keep tighter control and visibility over its global payments. Regulations around payments are continually changing as problems and conflicts arise or dissipate in different parts of the world. Companies need to be able to react to the ever-evolving regulatory environment. Having a global payment factory in place helps to address these challenges. Cybercrime is also an increasing problem for treasury and the payment factory enables corporates to react quickly, with a centralized, secure platform.

Weber notes that the project will also help his company to keep abreast of regulatory requirements for monitoring third parties: “The implementation of ‘restricted party screening’ – an essential compliance requirement to ensure that Sanofi does not make payments to blacklisted parties – was added to the team’s responsibilities in late 2014. Although it covers master data screening and therefore is only partly related to the payment factory activities, in the Sanofi context the in-house bank team has been identified as the most appropriate place in the organization to both implement the screening as well as carry out the ongoing operations. I believe that we will hear a lot more about restricted party screening in the corporate world going forward.”

Successful outcome

Since the global payment factory was rolled out in Europe and the US, it now processes more than 30,000 fully automated payments each month, from more than 50 affiliates, with an equivalent value of more than €1 billion per month, in 30 different currencies. To help reduce the number of payment rejections, Sanofi also centralized the management of the bank key tables: the master data is constantly updated to avoid rejection due to wrong bank master data.

Weber concludes by expressing his satisfaction with the outcome of the project: “We have really succeeded in implementing a sustainable process that is safer, cheaper, more efficient, providing higher transparency, and which we can roll out across our different areas of operation.”

Would you like to know more about the challenges of implementing a global payment factory? Contact us.

Coca-Cola Hellenic streamlined its treasury operations and improved system integration with Zanders’ expertise, achieving enhanced efficiency and compliance through an upgraded SAP implementation.

When Coca-Cola Hellenic (CCH), one of the biggest bottlers and sellers of Coca-Cola products in the world, implemented SAP in 2008, the treasury team expected great improvements in cash management and financial communication across the 28 countries in which the group operates. The reality was somewhat different, with the implemented version of SAP not interacting in harmony with CCH’s enterprise resource planning (ERP) system, called Wave 1. It was at that point that the newly appointed treasurer, Bart Jansen, decided to re-design and improve the SAP implementation – with help from Zanders.

When Bart Jansen joined CCH treasury in 2008, he might have been forgiven for thinking that he had joined at the perfect time – the company had just gone live with SAP Treasury. So with the latest technology already in place, surely Jansen would be able to focus on the bigger treasury issues?

He soon found that the treasury team in Athens was far from happy with how SAP was running. Treasury operated a stand-alone ERP5 installation that had to integrate with three SAP kernels at different versions of SAP. There was repetition of functions and lack of integration. Jansen explains that there were high levels of dissatisfaction with the functionality of the system among CCH’s users: “I started the new job as treasurer in the midst of the financial crisis with a team that was quite frustrated with their tools and also understaffed. I needed to do something drastic about this, so I called Judith van Paassen at Zanders.”

Jansen’s relationship with Zanders goes back a long way. As a Dutch national, he was previously treasurer at Dutch utility group Nuon, where he carried out a successful system implementation with Zanders. “After that experience, I knew that Zanders were knowledgeable about SAP, so when I moved to CCH in Athens, it was a natural step to call them,” he says. CCH sent out a request for proposal (RFP) and Zanders won the selection process.

Once Zanders had become involved in the project, things started to move quickly. Jansen says: “Bas Rebel and Bart Mol came over and worked with us in early 2009 and helped to identify 70 ‘gaps’, or weaknesses, in our process. While we identified some ‘quick wins’, we also realized that a lot more effort was required to address more structural issues.”

Integrating treasury with Wave 2

The aim of the SAP implementation was to upgrade the system to fit in more coherently with the Wave 2/ECC6 template. Every country treasury unit had its own banking partner and was communicating in its own way, so this also had to be upgraded to Wave 2. Jansen explains how the project team worked to resolve these issues: “With help from Zanders we started to develop a business case that would solve our immediate and long-term structural issues related to the tools we use and the way we interact with our 28 countries. We now have a more integrated solution – particularly for FX and cash management data – that complies with the latest standards and strengthens communications.”

The business case was approved for the implementation project in November 2009 and work started on it in January 2010. As with any major implementation involving many different disciplines, it was not without some challenges. Jansen says: “One of the difficulties was the tight corporate deadlines regarding the Wave 2 roll-out. We had to comply with the Wave 2 deadlines imposed upon us by our own company, so we had to get the project started quickly.”

Communication is key

One of the challenges of working with an international team of consultants, according to Jansen, was getting people together in the same place: “The complexity of the system and the solution meant we had to involve several experts from different fields. Ultimately it was a matter of finding the right experts and getting them together, for example getting the people from Zanders together with our IT people. It wasn’t easy as they were not always in the same country, but we still managed to communicate and address the issues.”

Zanders partner Laura Koekkoek adds: “We’re very pleased with the professional way the project has been run – in particular the testing phase was taken very seriously. We had a lot of people working together on this, so communication has been crucial.”

Complex challenge

The best advice is always to stay as close to the standard version of SAP. Although this isn’t always possible, it helps to keep the complexity at a manageable level. We absolutely benefited from Zanders’ expertise and knowledge of SAP in this regard.

Bart Jansen, Treasurer at CCH

With a complex system, designing the security and access rights has also been a time-consuming operation, as Jansen explains: “We spent a lot of time designing the authorization system, bearing in mind the segregation of duties within the company, and that has been really challenging on an integrated platform. We worked on this with internal auditors, and it was one of the most important aspects before we went live.”

A pleasant working environment

So despite the pressures and complexity of this SAP implementation, is CCH happy with the results? For Bart Jansen, the most important gauge of the project’s success was whether his treasury team in Athens was happy with the tools and system. “It has been a great success from that point of view,” he says. “They were previously spending a lot of time on administration and spreadsheets, whereas now they can spend time on more meaningful tasks. We have been able to streamline processes and thereby reduce time spent on certain tasks by 30–50%, while the controls have significantly improved. So the team has a much more manageable workload and therefore a more pleasant working environment.”

CCH’s treasury is now in the process of rolling out SwiftNet and the SAP Bank Communication Management module to the country units, replacing the local electronic banking system functionality. This year they will begin work on an in-house bank, and once that is completed, they will set up a payments factory as part of the SAP system. Jansen adds: “We are now in the process of fully automating foreign currency accounting. We’re making a significant investment into the Wave2 platform. So we are already seeing significant benefits and hope to see more in the future.”