Finance and treasury teams spend significant time on repetitive, manual SAP tasks—updating business partner records, managing intercompany pricing, or handling payment cut-offs. These processes are not only time-consuming but prone to errors, operational risk, and compliance challenges.

While SAP S/4HANA provides a strong ERP foundation, standard functionality alone often cannot address complex, organization-specific requirements. Our suite of tools helps organizations automate processes, integrate systems, and optimize finance and treasury operations. From mass uploading business partner data to automating transfer pricing, managing payment cut-offs, and sending accurate exposure data to Kantox through the SAP Kantox Adapter Tool, these solutions save time, reduce errors, and deliver measurable business value—all while fitting seamlessly into existing SAP landscapes.

What many don’t realize is that the SAP S/4HANA Cloud, public edition, can also be tailored to specific business needs. Through extensibility, your ERP system can be enhanced without touching the core code, ensuring full compatibility with SAP’s updates. By enabling organizations to add tailored business logic, extensibility supports innovation, process optimization, and capabilities that go beyond standard cloud functionality.

This article will first explore the bespoke solutions we offer and then shift to the extensibility options available in SAP’s public cloud edition.

SAP Business Partner Upload Tool

The Business Partner (BP) Upload Tool accelerates the creation and maintenance of SAP Business Partner records—traditionally a long, manual, and time-consuming task—by enabling mass uploads of key data such as names, roles, IDs, addresses, settlement instructions, and other master data attributes.

Zanders’ BP Upload Tool streamlines these tasks using a structured Excel template with multiple worksheets, allowing users to choose the level of detail they want to maintain for each Business Partner.

Key features and benefits of the BP Upload Tool:

- Upload unlimited data records

- Process hundreds of BPs within minutes

- Handle thousands of settlement instruction records

- Track and trace upload results through a detailed system log

SAP Integration with Zanders Transfer Pricing Solution (TPS)

In addition to master data management, organizations also face efficiency challenges in other treasury-related areas. One of the most critical is managing intercompany transactions and ensuring accurate, compliant transfer pricing. This is where Zanders’ Transfer Pricing Solution provides additional value.

Zanders’ cloud-based Transfer Pricing Solution automates the pricing of intercompany deposits and withdrawals, reduces manual effort in treasury workflows, and generates detailed audit-ready documentation for every pricing run.

To support this process, we have developed an integration tool that leverages web services and APIs to automatically price cash pool transactions directly from SAP S/4HANA in an OECD-compliant manner.

This integration component is estimated to save our customers around 100 hours of manual work annually, on top of the benefits derived from lowering the risk inherent in transfer pricing calculations.

Zanders SAP Kyriba Interface

Effective treasury operations rely not only on accurate pricing but also on smooth integration between ERP and treasury platforms. To address this, Zanders has developed tools that enhance these processes while minimizing manual effort and operational risk.

Zanders SAP Kyriba Interface is an integration framework that automates payments, accounting, cash forecasting, and internal settlements between SAP and Kyriba. It streamlines data flows end-to-end and reduces the need for manual intervention.

The interface manages key processes across multiple areas:

- Outbound Payments

Enhances SAP’s Data Medium Exchange Engine (DMEE) to generate payment files according to the Kyriba file naming convention. This ensures straight-through processing and control over file routing and payment execution in Kyriba.

- Inbound Accounting

Imports accounting data from Kyriba into SAP via BAPI (Business Application Programming Interface), with validation and duplicate prevention for cash and financial transactions.

- Outbound Cash Forecast

Exports open AP/AR balances and cash flow data from SAP to Kyriba for forecasting and bank mapping.

- Outbound Internal Settlement

Exports SAP AP/AR items eligible for internal settlement to streamline intercompany reconciliation and settlement processes.

SAP Kantox Adapter Tool

Beyond cash management and payment automation, organizations also face challenges in handling currency exposures. Zanders provides a dedicated solution to enhance this process and ensure accurate, consistent data for Kantox.

The SAP Kantox Adapter Tool is a streamlined interface that extracts currency exposure data from SAP sales and purchase orders and sends it to Kantox through a secure API. It standardizes data mapping, automates processing, and provides an intuitive SAP interface for reviewing and transmitting exposures, including updates and cancellations.

Key Features

- Automated extraction and mapping of SAP order data into Kantox-ready JSON

- Secure API communication with token-based authentication

- ALV screen for filtering, reviewing, selecting, and processing exposures

- Handles new, updated, and cancelled items with delta logic

- Customizable configuration for API parameters and filtering rules

Key Benefits

- Reduces manual processing and operational risk

- Ensures accurate, consistent exposure data for Kantox

- Improves transparency through real-time status updates and logs

- Easily adjustable to business requirements via configuration

Automated Cut-Off Time Handling in SAP Payments

In addition to integrations, payment timing is another area where automation can significantly reduce risk. Zanders’ automated cut-off time enhancement addresses this challenge.

This SAP enhancement automates the handling of internal payment cut-off times within SAP In-House Cash. Banks enforce daily cut-off times—deadlines after which payments are processed on the next business day. Standard SAP logic does not always account for these constraints, which can lead to delays or missed payments.

How the solution works:

- Automatically checks if a payment is being made too late in the day

- Adjusts the payment date to ensure it meets the bank’s cut-off time

- Uses SAP’s Business Rules Framework (BRF) to tailor logic to company-specific needs (e.g., currency, bank location, urgency)

Key Benefits:

- Fewer payment delays

- Improved cash flow planning

- Eliminates manual checks

- Seamless fit with existing SAP systems

- Customizable to business rules

These tools are compatible with SAP S/4HANA On-Premises and Private Cloud editions and are deployed under Zanders’ namespace. This ensures they do not interfere with the customer’s own developments and allows Zanders to safely deliver support updates without impacting the customer environment.

While Zanders’ tools streamline SAP processes like payments, currency exposures, and transfer pricing, some clients on SAP S/4HANA Public Cloud may think there’s no room for customization. In the next section, we will explore the platform’s extensibility capabilities, which allow organizations to adapt and extend their cloud system safely, without altering the core code.

Tailor Your Cloud: How Extensibility Empowers SAP S/4HANA Public Edition

SAP S/4HANA Cloud, public edition, is a standardized, continuously updated cloud ERP system. For many organizations, this standardization provides a solid foundation for managing core business processes like finance, procurement, and logistics. However, every business has unique competitive differentiators or regulatory requirements that the standard software simply cannot address.

As adoption of SAP’s cloud solutions grows, organizations increasingly want these platforms to meet their specific business needs.

This is where Extensibility comes in.

Extensibility is the built-in capability that allows users and developers to adapt, extend, and integrate new functionality into S/4HANA Cloud without modifying the core code. This "Clean Core" approach is essential in a public cloud environment, ensuring that custom solutions remain fully compatible with SAP’s quarterly updates. Think of it as installing modern amenities in a historic building—you can add new features without altering the original structure.

The Three Pillars of Cloud Extensibility

The flexibility to build custom solutions on S/4HANA Cloud is delivered through a spectrum of tools designed for different needs and skill sets. These capabilities range from simple key-user adjustments to full developer-driven extensions, with the level of technical proficiency increasing at each stage:

1. In-App Extensibility (Key-User Tools)

This capability empowers business users and functional analysts—Key Users—to make immediate, direct changes within S/4HANA Cloud. These are typically simple, administrative-level modifications that improve day-to-day usability.

- What you can do: Add custom fields to master data records (e.g., a new compliance code for a vendor), rearrange screen layouts, or create custom business logic rules such as a simple approval workflow.

- The Benefit: Agility and self-service. Changes can be implemented quickly by the people who best understand the business need, without traditional programming.

2. Developer Extensibility

For more complex business processes that must be tightly integrated with the S/4HANA core, professional developers use the Embedded Steampunk environment. This allows them to write sophisticated custom code directly within the S/4HANA system while adhering strictly to cloud-compliant APIs (Application Programming Interfaces).

- What you can do: Build custom applications or highly specialized business logic (like a unique pricing algorithm) that needs access to core data in real-time.

- The Benefit: Deep integration and performance. Custom code is co-located with the ERP system, ensuring high-speed data access and seamless operation with core processes.

3. Side-by-Side Extensibility (SAP Business Technology Platform - SAP BTP)

The most innovative and decoupled solutions are created using the SAP Business Technology Platform (SAP BTP). This platform acts as an innovation layer, running custom applications that securely consume and extend S/4HANA Cloud services without being inside the ERP system.

- What you can do: Create entirely new user experiences (e.g., a custom mobile app for field service), build complex data insights, integrate with external cloud services (e.g., a logistics provider), or develop automated workflows using low-code/no-code tools such as SAP Build.

- The Benefit: Innovation and decoupling. Because the custom solution is separate, it can be developed, updated, and scaled independently, offering the highest level of stability for the core ERP and a path to unique digital capabilities.

As organizations evolve their finance and treasury functions, the need for systems that are both efficient and adaptable has never been greater. Zanders’ SAP solutions—ranging from automating master data and transfer pricing to integrating treasury platforms and streamlining payments—demonstrate how targeted enhancements can unlock significant operational value.

At the same time, the extensibility capabilities of SAP S/4HANA Cloud show that innovation can coexist with standardization, allowing companies to tailor their ERP without disrupting core processes.

By combining deep SAP expertise with a clean-core approach, we enable organizations to transform today’s operations while building a flexible, future-proof foundation. This empowers companies to improve efficiency, strengthen compliance, and extract maximum value from their SAP environment.

Contact us to assess fit, request a demo, or learn more about our add-ons and technical capabilities in the public cloud.

Ready to explore a SAP S/4HANA Migration?

Read the whitepaper

Many organizations have the data they need to manage cash, but not the visibility to act on it. We explore how SAP S/4HANA helps finance teams turn fragmented information into real-time insight — and unlock liquidity across the business.

Fragmented systems, manual reconciliations, and delayed reporting make it difficult for finance teams to see the full picture of their liquidity. As a result, valuable cash remains tied up in receivables, payables, or inventory — limiting flexibility and slowing growth.

Recording and tracking working capital solutions within the ERP system ensures transparency, auditability, and control over liquidity. Clear records of financing activities enable better cash flow monitoring, compliance, and financial reporting, while supporting informed decisions and stakeholder trust.

With SAP S/4HANA, organizations can turn visibility into action. By bringing financial, operational, and supply chain data onto a single digital platform, S/4HANA delivers real-time insight into how cash moves through the business. Finance and treasury teams gain the clarity to forecast more accurately, act faster, and unlock liquidity that was once tied up in day-to-day operations. The result is stronger cash flow, lower funding costs, and a more agile, financially resilient organization.

How ECC handled working capital management processes

In ECC, recording working capital management functions relied on limited solutions such as the “Pledging Indicator” in Accounts Receivable, which offered tracking but little automation. This often led to manual workarounds and reduced transparency. The Contract Accounts Receivable and Payable (FI-CA) module offered a factoring solution to sell approved receivables to a factor bank with full accounting integration and automated postings for transfers, payments, and settlements. However, its use was largely restricted to industries such as insurance with high-volume customer billing. SAP S/4HANA changes that by embedding working capital processes directly into the digital core — enabling real-time liquidity visibility, automated settlements, and integrated accounting for financing activities.

Solution options in S/4HANA

Optimizing Working Capital with SAP S/4HANA empowers organizations to strengthen liquidity, reduce funding costs, and enhance operational agility through an integrated digital core. Built on the SAP HANA in-memory platform, it delivers real-time visibility, predictive insights, and automation across financial and operational processes that directly influence working capital performance.

S/4HANA Settlements Management is one such solution that brings together a wide range of financial and commercial settlement processes to streamline how organizations manage payables, receivables, rebates, commissions, and cost allocations. Its functionalities—covering financial settlements, rebates, commissions, freight and cost allocations, factoring, intercompany charges, and chargebacks—come together in one unified system that reduces scattered processes and cuts down manual work across departments. Integration with Accounts Receivable, Accounts Payable, and Treasury enables real-time insight into financial exposure, helping finance teams make informed decisions on funding and liquidity. By consolidating transactions, automating complex calculations, and enabling transparent, rules-based settlements, the solution accelerates cash cycles, improves forecasting accuracy, and enhances liquidity. Among its many capabilities, the factoring functionality is significantly enhanced in S/4HANA compared to ECC, offering a far more integrated and automated approach to managing receivables financing.

Factoring in SAP S/4HANA Settlements Management: An integrated approach

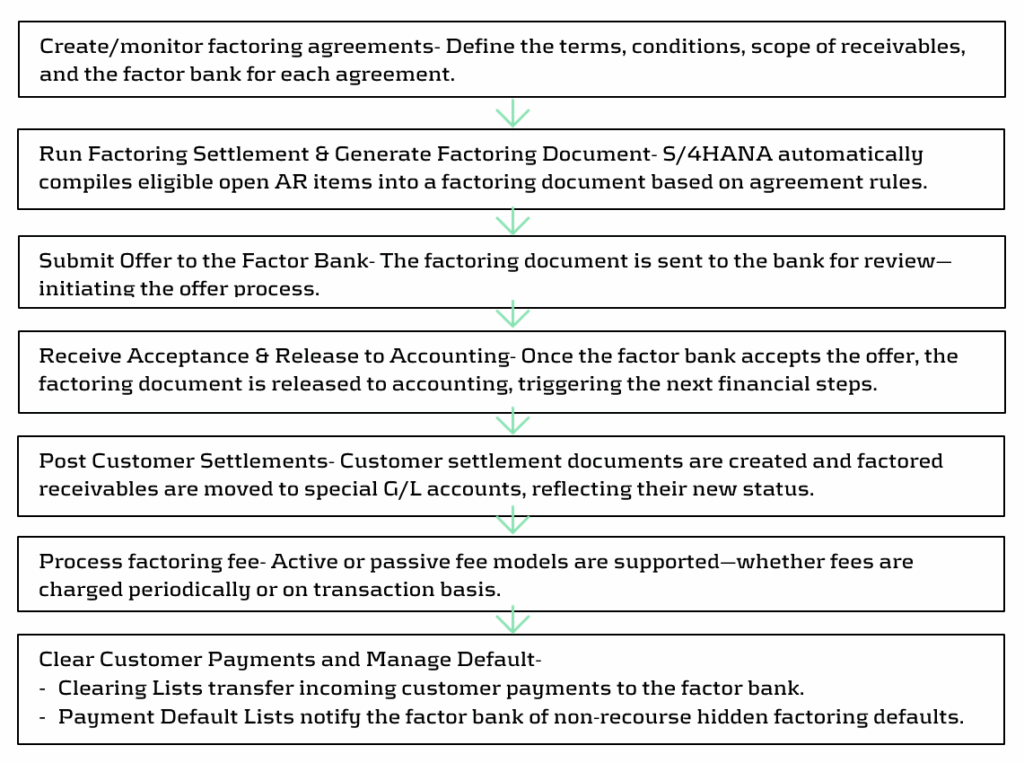

S/4HANA provides an enhanced factoring solution within Settlements Management (for private cloud), that allows organizations to manage factoring agreements with banks in a structured, automated, and auditable way. It brings transparency to the end-to-end process while improving liquidity on short notice. Below steps highlight the overall process under Factoring solution:

SAP’s future innovation strategy for working capital management focuses on delivering integrated solutions like SAP Taulia Working Capital Management which is an embedded solution within SAP’s Treasury and Working Capital portfolio that helps buyers and suppliers optimize cash flow across payables, receivables, and inventory. Built into SAP ERP and Business Network, it enables seamless integration, real-time insights, and scalable liquidity management to unlock cash, reduce costs, and strengthen supplier relationships. Taulia-based factoring capabilities are offered since 2508 for S/4HANA Private and Public Cloud customers.

Building on these operational capabilities, SAP also enables organizations to gain deeper analytical visibility across the entire working capital cycle. To support this, SAP offers Working Capital Insights — a pre-built intelligent application in SAP Business Data Cloud that consolidates data from receivables, payables, inventory, and cash to deliver unified working-capital KPIs, trends, and forecasts. It gives finance teams rapid visibility, liquidity insights, and actionable optimization opportunities with minimal setup.

Choosing the right Working Capital Solution: Drivers for selecting the appropriate option

When comparing different solution options for working capital optimization, the key difference lies in managing financing relationships and the automation that is provided out of the box. Settlements Management provides the customer with a toolset to configure the handling of predefined finance providers, making it suitable for organizations with stable funding arrangements and long-term partners. In contrast, Taulia offers a fully embedded digital marketplace that connects businesses with multiple funders through one platform, enabling flexible, transparent, and competitive financing. This makes it ideal for organizations seeking dynamic or global funding options. For any new S/4HANA Private or Public Cloud customer, selected entitlements from Taulia are included as part of the ERP entitlements at no additional subscription cost. These cover key capabilities such as Factoring, Virtual Cards and Dynamic Discounting. However, organizations that need broader or more advanced Taulia capabilities can unlock the full feature set by opting for the premium version.

Beyond cost and system integration, the choice between the two solutions should be guided by business drivers, such as:

| Business Driver | Considerations |

| Stability of existing funding arrangements | Assess if current financing options are stable and already meet liquidity goals. |

| Choice of funders and financing structures | Evaluate the need for flexibility and visibility in selecting funders or dynamic funding models. |

| Cash Conversion Cycle (CCC) | Review the organization’s CCC and determine if further optimization is required. |

| Agility to external pressures | Assess how quickly the organization needs to adapt to market or liquidity changes. |

| Supplier and buyer onboarding and adoption | Evaluate how easily suppliers and buyers can be onboarded to the chosen platform. |

| Implementation complexity and time | Compare expected implementation effort, timelines, and traceability features. |

| Scalability and geographic reach | Determine if the solution supports multi-country operations and varying business volumes. |

| Integration with existing SAP landscape | Assess how well the solution fits within the current SAP environment and data flows. |

Ultimately, the decision should align with the organization’s strategic liquidity objectives, operational maturity, and supplier ecosystem, ensuring that the selected platform not only optimizes working capital but also enhances transparency and control.

From Insight to Action: Guiding Your Working Capital Strategy with expertise

Choosing the right working capital solution is not just a technical decision — it’s a strategic one. Turning insights into action requires time, focus, and a clear understanding of both business and treasury priorities. Many organizations find it challenging to balance day-to-day operations with the strategic effort needed to evaluate and implement the right solution.

We supporst organizations in navigating this complexity by combining deep treasury expertise with in-depth SAP knowledge. Our consultants take an objective and structured approach; assessing business drivers, current processes, and operational requirements to identify the solution that best aligns with your strategic goals. Beyond technical evaluation, Zanders acts as a strategic partner, ensuring that your chosen solution supports broader liquidity, financing, and operational objectives.

Ready to rethink working capital management with SAP S/4HANA?

Contact us

On May 14th 2025, the European Banking Authority (EBA) published the fourth report on the monitoring of the liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) in the European Union. The report includes an assessment and updated guidance for four topics, which are discussed in this article.

Inflows from open reverse repos

In May 2024 the EBA stated1 that inflows from open reverse repos cannot be recognised in LCR calculations unless the call option has already been exercised, or the institution can demonstrate that the repos would be called under specific circumstances Given the ambiguity and interpretive room in the initial statement, the EBA now provides two approaches that institutions may use to substantiate when such repos would be called.

- The first approach is forward-looking and states that banks can include the inflows in case they clearly specify events whose occurrence triggers the call of the option of the repo. The deadline of calling the option should also be shorter than 30 days.

- The second approach is backward-looking and allows banks to use their historic data. If banks can show that certain events have historically led to calling the option within 30 days, the inflows from the repos can be included in LCR calculations. The EBA stresses that the historical observations must have occurred during a period of stress of at least 30 days to ensure that reputational issues under such scenario are taken into account.

Operational deposits and excess operational deposits

Outflows of operational deposits, defined as deposits received for the purposes of obtaining clearing, custody, cash management or other comparable services, are significantly lower than those of non-operational deposits. Moreover, operational deposits are generally less vulnerable to significant withdrawals during a period of idiosyncratic or market-wide stress. As a result, operational deposits may be treated differently from non-operational deposits in LCR calculations. EBA’s first report (2019)2 on the monitoring of the LCR implementation already provided additional guidance on identifying operational deposits. However, based on a recent survey of competent authorities, the EBA found there may be divergence in the way institutions demonstrate the existence of legal or operational limitations that make significant withdrawals within 30 calendar days unlikely. Additionally, quite some heterogeneity was observed in the modeling techniques used to identify excess operational deposits.

To promote a level-playing field, the EBA now provides further regulatory guidance. It emphasizes the importance that institutions have a framework in place that provides a proper and evidence-based mapping of deposits to the different deposit types recognized in the LCR regulation (i.e. stable retail deposits, non-stable retail deposits and operational deposits). It is also noted that the length of the trade cycle used to identify excess operational deposits should reflect the specific characteristics of the client’s business model. Finally, prudent statistical measures should be applied when analysing historical deposit balances or payment flows.

Retail deposits excluded from outflows

Retail term deposits with a maturity beyond 30 days may be exempted from outflows in LCR calculations. Institution may exclude such deposits if they can demonstrate, on economic or contractual grounds, that the deposits will mature beyond 30 days. EBA’s first report on the monitoring of the LCR implementation (2019) already provided guidance on how to assess whether deposits mature beyond 30 days for economic reasons. Given the significant increase in term deposits in recent years, the EBA has reviewed whether this guidance remains adequate.

Overall, competent authorities report that the 2019 guidelines are properly implemented across the industry. However, the definition of a ‘material’ penalty for early termination under the LCR still leaves room for interpretation. This may lead to wrongly classifying term deposits as having a maturity beyond 30 days. To address this, the EBA now requires that historical data show a material penalty was applied to all early redemptions of exempted retail term deposits, even during periods of rising interest rates.

Interdependent assets and liabilities in NSFR

Under the CRR, banks can exclude assets and liabilities from NSFR calculations if they appear on the balance sheet only because the bank serves as a pass-through unit to channel the funding from the liability into the corresponding asset.3 Often times, these are derivatives from clients that are passed through to Central Counterparties (CCPs) in order to provide the client access to central clearing.

In the report, the EBA highlighted some unclarities around the eligibility of indirect client clearing activities where affiliated institutions are used to clear derivatives. To further clarify when such activities are eligible to be excluded from NSFR calculations, the EBA suggested a slight adjustment to the regulatory CRR text. This does not have any practical implications to the requirements around NSFR.

Conclusion

The fourth report on the monitoring of LCR and NSFR by the EBA provides additional guidance on four regulatory unclarities around LCR and NSFR. For three of the topics, all related to LCR, there is an impact on the implementation of the liquidity metric:

1- Banks may include inflows from open reserve repos when they demonstrate that the repos would be called within 30 days in a period of stress. This can be done by clearly stating this in the liquidity risk management policy or by showing that this has historically been the case.

2- Banks should have proper frameworks in place to map deposits to different deposit types, should ensure that the length of the trade cycle used to identify excess operational deposits reflects the client’s business model and should ensure that prudent statistical measures are applied when analyzing historical deposit balances.

3- Banks have to show with historical data that material penalties were applied to prematurely terminated retail term deposits before the term deposits can be excluded from LCR outflows.

The EBA provided clear instructions to follow up for the inflows from open reverse repos and the outflows from retail term deposits, but the additional guidance for (excess) operational deposits still leaves some ambiguity. Especially the statement that institutions should refer to ‘prudent statistical measures’ leaves room for interpretation. Nevertheless, the additional remarks made by the EBA indicate that competent authorities are likely to increase focus on the (liquidity-typical) modeling of operational deposits and on the calculation of LCRs in general.

Zanders has extensive experience within the field of liquidity risk and supported clients on:

- Developing a model to split operational and non-operational deposits on account-by-account level, together with the incorporation in LCR.

- Validating liquidity risk models (LCR and NSFR) as independent validator, delivering clear reports including substantiated findings and pragmatic recommendations.

- Designing a liquidity risk roadmap to obtain regulatory compliance and to set a solid foundation for managing liquidity risk.

Reach out to Erik Vijlbrief or Jelle Thijssen for more information.

Citations

- See Q&A 2024_7053 for more information. ↩︎

- EBA reports on the monitoring of the LCR implementation in the EU | European Banking Authority ↩︎

- The conditions set out in Article 428f of the CRR must be met. ↩︎

This article explores SAP Treasury and Risk Management (TRM) controls and automation frameworks, with a focus on design and implementation challenges, as well as on the ongoing validation of the controls to ensure they are efficient, seamless and reliable.

This article is intended for finance, risk, and compliance professionals with business and system integration knowledge of SAP, but also includes contextual guidance for broader audiences.

1. Introduction

SAP Treasury and Risk Management (SAP TRM) provides a robust framework to meet the need for enhanced transparency, mitigate financial risks, and ensure regulatory compliance, but its effectiveness depends on the correct implementation of control mechanisms and automated checks.

In Japan, the approach to financial and treasury management is influenced by principles of Kaizen (continuous improvement) and high-quality process control. The core emphasis is on minimizing errors, enhancing efficiency, and ensuring the reliability of Treasury management systems.

The approach aligns with the necessity of seamless internal controls in SAP TRM, where even minor inconsistencies can lead to significant financial risks and losses.

This article outlines key controls within SAP TRM, provides practical implementation steps, and explores AI-driven enhancements that improve compliance, security, and operational efficiency.

2. SAP TRM: Key Areas Requiring Controls

SAP TRM covers a broad range of treasury functions, each requiring specific control mechanisms:

- Transaction Management: Handling financial instruments such as FX, money markets, securities, derivatives, etc.

- Risk Management: Identifying and mitigating market and credit risks.

- Cash and Liquidity Management: Real-time cash positioning and cash flow forecasting, and optimization.

- Hedge Management and Accounting: Compliance with IFRS 9 and other standards.

3. How SAP TRM Supports Real-Time Risk Control

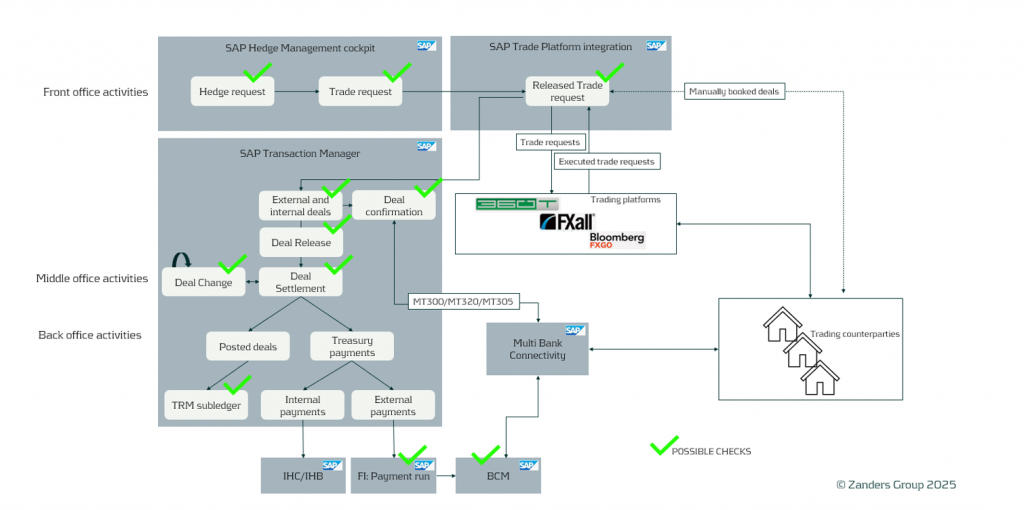

A solid control framework requires detailed analysis, alignment, and structured implementation. Below are some key controls that should be assessed and implemented within transaction management of SAP TRM. In the picture, the areas where possible checks can be applied are highlighted:

Deal Release (Approval) Control

Ensuring proper authorization and validation before a deal is released (approved internally) is essential to prevent unauthorized or erroneous transactions from being booked, modified, and processed in SAP.

Proposed configuration objects to consider:

- Business Rule Framework Plus (BRFplus): Define validation checks, such as ensuring that only authorized users can release deals above a certain value.

Deal Settlement Control

Settlement is SAP term for the deal confirmation with counterparties. The deal status is changed to "Settlement" immediately after confirmation.

Accurate deal confirmation is crucial to avoid financial mismatches or discrepancies in payment details. The settlement process is required for all external deals and may also be needed for intercompany deals. Settlement is required for every key lifecycle step of a deal: creation, NDF fixing, rollover, option exercise, etc. Settlement can be done manually or automatically upon counter-confirmation of the correspondence (MT300, MT320, MT305, or deal confirmation messages).

Proposed configuration objects to consider:

- Set up automated reports to track unsettled deals within a specific timeframe (as of today or as of the current week).

- SAP Fiori app “Display Treasury alerts” is an effective solution for this.

Ensuring Transaction Integrity: Key Checks in SAP

Automating the matching process minimizes manual errors and improves operational efficiency, reducing the time required for this process.

Proposed configuration objects to consider:

- Define a report to show all pending unmatched correspondences. This is often proposed as a control over the matching process. It can be implemented using the Correspondence Monitor or the Fiori app "Display Treasury Alerts."

Restricted Deal Modifications

To prevent unauthorized modifications of the treasury transactions that could lead to fraudulent or erroneous results, deal changes should be strictly controlled. We do not recommend allowing deals in status Settlement (after confirmation matching process) to be changed—especially key matching fields such as amounts, value dates, and currencies. However, modifications may be required from time to time. In such cases, they need to be controlled and may require another round of verification and counter-confirmation matching.

Proposed configuration objects to consider:

- Enable Change Log Activation: Use SAP Audit Information System (AIS) to track modifications and maintain audit trails for TRM.

- Implement SAP TRM Deal Approval Workflow: Require validation and approval for all deal amendments and reversals.

- Restrict critical field modifications: Configure SAP field selection variant to lock key fields of the deals from being altered after deal approval/settlement.

- Enforce Segregation of Duties (SoD): Ensure different users handle deal creation, approval, settlement processing, and modifications to prevent errors or fraud.

Deal Payment Controls Using BCM Approvers

Ensuring that deal payments go through the correct approval process reduces financial risk and enhances security. It is important to define unusual treasury payment scenarios, such as when cash flow processing occurs outside normal business hours.

Proposed configuration objects to consider:

- Implement a Payment Block Mechanism: Ensure that payments are blocked unless predefined criteria are met, or review and approval is done/granted.

- Automated Exception Handling: Configure Bank Communication Management (BCM) rules to flag transactions that deviate from standard payment behavior, requiring manual review before processing (e.g., payments to a new business partner or deals posted outside normal business hours).

4. AI-Driven Enhancements for Treasury Control

AI is transforming treasury processes by automating risk detection, optimizing forecasting, and enhancing decision-making. Key AI-powered enhancements in SAP TRM include:

- Fraud Detection: Machine learning models in SAP Business Technology Platform (BTP) to detect suspicious transactions.

- SAP Business Integrity Screening: AI-driven software from SAP that improves anomaly detection, risk identification, and compliance checks.

- Automated Matching: AI-powered bots in SAP Intelligent RPA match transactions (especially when non-SWIFT correspondence is used), helping eliminate manual errors.

5. Best Practices for SAP TRM Control Optimization

The following best practices are recommended as part of the business-as-usual process:

- Conduct regular Role & Authorization reviews: Update SAP GRC, Governance, Risk, and Compliance, settings to align with changes in Treasury team structure.

- Leverage SAP Fiori apps for real-time analytics and visibility into treasury processes, ensuring that no payments are stuck and that all back-to-back and mirroring deals are in place and processed on time.

- Create and integrate AI-powered tools: Deploy SAP AI solutions to enhance risk analysis, compliance monitoring and decision-making.

- Adopt a Kaizen approach: Continuously monitor and refine TRM controls to improve efficiency and accuracy, as technology is rapidly evolving and controls must remain valid and preventive.

6. Conclusion

Implementing strong controls in SAP TRM is critical for maintaining compliance, minimizing financial risks, and improving operational efficiency.

By leveraging SAP’s built-in functionalities—along with AI-driven enhancements—corporate treasurers can create a secure, transparent, and highly automated treasury management process. By integrating Kaizen principles and AI-driven automation, companies can transform their treasury operations into a continuously improving and highly efficient Treasury Management System.

Zanders consultants are deeply involved in this crucial topic, which can be addressed as a standalone initiative to improve controls, as part of ongoing treasury support, or within an SAP TMS implementation project. We are ready and eager to help your company enhance system controls and checks in SAP TRM.

For more information, please contact Aleksei Abakumov.

Case Study: SAP TRM in Practice

A multinational, multibillion-dollar company operating across the globe, with its HQ in Tokyo, Japan, implemented SAP TRM. By using J-SOX controls (both business and system) in SAP TRM, the company managed to build world-class, secure control mechanisms that are used and applied throughout the entire organization, across all markets. The company regularly validates these controls and challenges them when they are obsolete or adds new controls if needed due to changing external conditions.

In today’s rapidly evolving financial landscape, organizations are seeking efficient and secure solutions for payment processing.

Our team at Zanders has been at the forefront of implementing BACS AUDDIS (Automated Direct Debit Instruction Service) with SAP S/4HANA, helping clients to streamline their direct debit management while ensuring regulatory compliance.

Why BACS AUDDIS Matters

BACS Direct Debit is the UK's electronic direct debit service, enabling organizations to collect payments directly from customers' bank accounts. This service offers numerous advantages, including predictable cash flow, reduced administrative overhead, and improved operational efficiency.

The implementation of AUDDIS enhances this process by allowing organizations to electronically send Direct Debit instructions to the banking system. This digitization eliminates paper-based processes, reduces operational costs, and improves overall processing speed.

The Advantage

Our approach for AUDDIS implementation with SAP S/4HANA provides a bespoke solution that supports AUDDIS requirements, built on top of the standard SAP S/4HANA functionality. What sets our approach apart is our deep expertise in complex, mission-critical financial system implementations specifically tailored for market leading organizations.

The solution development leverages the full range of SAP's Direct Debit (DD) capabilities supplemented by our extensive experience in Treasury and Payment systems. This creates a seamless integration with existing SAP finance processes while ensuring full compliance with BACS standards.

The Solution

The solution developed supports the full cycle of BACS Direct Debit (DD) mandate management in SAP, from new mandate registration to mandate amendments, cancellation, and dormancy assessment.

Mandate information and amendments are automatically interfaced in XML format (PAIN.008) in compliance with BACS requirements, transmitting from the SAP Payment Hub to BACS through a BACSTEL-IP service provider.

Furthermore, to ensure a smooth and streamlined direct debit collection process, the custom solution enhances SAP’s automatic payment program with additional features.

These include verifying the validity of the customer or alternative payee’s mandate status at the payment proposal stage, considering DD collection lead periods.

This ensures that only customers with an active mandate status are included in the payment run. In addition, SAP’s Data Medium Exchange (DME) engine has been extended to include the mandatory mandate reference attributes in the bank interface.

Our Four-Phase Implementation Approach

Every AUDDIS implementation follows four key stages:

1 - Application: The corporate entity applies to its sponsoring payment service provider for AUDDIS approval.

2 - Preparation: After approval, the corporate prepares its internal systems, ensuring software, processes, and infrastructure are in place for AUDDIS integration.

3 - Testing: The corporate submits test files to BACS to validate both compliance and successful transmission.

4 - Go-Live: The corporate transitions to using the AUDDIS service either as a ‘live’ user from the start or by migrating first before going live. This is the final stage of the AUDDIS implementation process, and exactly what this entails depends on whether the corporate is joining AUDDIS with a new Service User Number or with an existing one, and therefore, has a migration (to onboard existing customer mandates to AUDDIS) to complete.

AUDDIS implementation projects require ongoing coordination with Banking Partners, System Integrators and Business Process Teams. This includes the process of creating BACS Service User Numbers, extensively testing bank interfaces for AUDDIS and Direct Debit Instruction files. At go-live, detailed coordination is required to support penny testing.

The results after implementation

Our clients report significant benefits from implementing BACS AUDDIS with our support, including:

- Enhanced management of Direct Debit (DD) mandates

- Reduced processing costs and improved operational efficiency

- Ensured compliance with banking and regulatory requirements

- Accelerated payment cycles through streamlined processes

By partnering with Zanders, organizations gain a trusted advisor in BACS AUDDIS implementations. Our expertise ensures smooth transitions while maintaining business continuity throughout the process.

For more information on how we can support your organization's transition to BACS AUDDIS with SAP S/4HANA, please contact Eliane Eysackers or Nadezda Zanevskaja.

In 2027, SAP will end its support for SAP ECC. Having spent years honing their ERP system to perfectly fit their business needs, this posed a challenge for Dutch network company Alliander – how and when to move to SAP S/4HANA.

There are risks in undertaking any big treasury transformation project, but the risks of not adjusting to the changing world around you can be far bigger. Recognizing the potential pitfalls of relying on an outdated (and soon to be unsupported) SAP ECC system, Alliander embarked on a large-scale, business-wide transition to SAP S/4HANA. Zanders advised on the Central Payments and Treasury phase of this project, which completed in May 2024.

A future-focused perspective

Network company, Alliander, is the Netherlands’ biggest decentralized grid operator, responsible for transporting energy to households and businesses, 24 hours a day, 7 days a week. As a driving force behind the energy transition, the business is committed to investing in innovation - and this extends to how they are future-proofing their business operations as well as their contribution to shaping the sustainable energy agenda.

With their SAP ECC system approaching end of life, Alliander embarked on a company-wide switch to SAP S/4HANA. However, transitioning to SAP’s newest ERP platform is not just another simple upgrade, it’s a completely new system built on top of the software company’s own in-memory database HANA. For a business of Alliander’s size and complexity, this is a huge undertaking and a lengthy process. In order to minimize the disruption and potential risks to mission-critical business systems, Alliander has started the transition early, breaking down the implementation into a series of logically ordered phases. This means individual business areas are migrated to S/4HANA as separate projects.

“In finance, this transition started about four years ago with the transition of Central Finance to S/4—that was the first stepping stone,” says Thijs Lender, Financial Controller and Alliander’s Project Owner for SAP S/4HANA in Finance. “The second major project was Central Payments and Treasury. From a business point of view, this was the first real business finance process that we implemented on S/4.”

Central Payments and Treasury was selected as a critical gateway to moving other business areas to the new target infrastructure, for example, purchasing. It was also an ideal test ground for the migration process from ECC to S/4HANA as Alliander’s cash management processes operate in relative isolation, therefore presenting a lower risk of collateral damage across other business operations when the department moved to the new system. ''Treasury and Central Payments is at end of the of the source-to-pay and order-to-cash process—it’s paying our invoices and collecting money,” explains Guido Tabor, Digital Lead Finance at Alliander. “This means it could be moved to the target architecture without impacting other areas.”

Greenfield or brownfield?

The two most common pathways to SAP S/4HANA are a greenfield approach and a brownfield approach. For a brownfield migration a company’s existing processes are converted into the new architecture. In contrast, the greenfield alternative involves abandoning all existing architecture and starting from scratch. The second is a far more extensive process, requiring a business to often make wide-ranging changes to work practices, reengineering processes in order to optimally standardize their workflows. As Alliander’s business had changed significantly over the period of running SAP ECC, they recognized the benefit of starting from a clean slate, building their new ERP system from scratch to meet their future business needs rather than trying to retro fit their existing system into a new environment.

“We really wanted to bring it back to best practices, challenging them and standardizing our processes in the new system,” adds Thijs. “In the old way, we had some ways of working that were not standard. So, there were sometimes tough discussions, and we had to make choices in order to achieve standard processes.”

A collaborative approach

While the potential benefits of greenfield migrations are substantial, untangling legacy processes and building a new S/4HANA system from scratch is a complex undertaking. Success hinges on the collaboration of various stakeholders, including experts with understanding of the inner workings of the SAP architecture.

“From the very beginning, we didn't see this as an IT project,” Guido says. “IT was involved but also the business - in this case, finance from a functional perspective, and also Zanders and the Alliander technical team. It was really a joint collaboration.”

Zanders worked alongside Alliander right from the early stages of the Central Payments and Treasury project. From helping them to strategically assess their treasury processes through to planning and implementing the transition to SAP S/4HANA. Having worked with the business previously on the ECC implementation for Central Payments and Treasury, Zanders’ knowledge of Alliander’s current environments combined with their specialist knowledge of both treasury and SAP S/4HANA meant the team were well placed to guide the team through the migration process. The strength of the partnership was particularly important when the timing of the deployment was brought forward.

“Initially we wanted to go live shortly before quarter close” Guido recalls “Then at the beginning of January, we had a discussion with our CFO about the deployment. With June 1 being very close to June 30 half year close, we decided we didn't want to take the risk of going live on this date, and he challenged us to move it back to the middle of May.”

What became really important was having a partner [Zanders] who helps you think out of the box. What's the possibility? How can you deal with it? While also being agile in supporting on fast changes and even faster solutions.

Guido Tabor, Digital Lead Finance at Alliander.

Adopting a 'Fix It' mindset

With the new deadline set, the team were encouraged by the CFO to adopt a ‘fix it’ mindset. This empowered them to take a bold, no compromises approach to implementation. For example, they were resolute in insisting on a week-long payment freeze ahead of the transition, despite pleas for leniency from some areas of the business. This confident, no exceptions approach (driven by the ‘fix it’ mentality) ensured the transition was concluded on time leading to a seamless transition of Central Payments and Treasury to the new S/4HANA system.

“This was a totally new perspective for us,” says Guido. “With go live processes or transitions like this, there will be some issues. But it didn't matter what, it didn't matter how, we just had to fix it. What became really important was having a partner [Zanders] who helps you think out of the box. What's the possibility? How can you deal with it? While also being agile in supporting on fast changes and even faster solutions.”

Central Payments and Treasury project went live on S/4HANA in May 2024, on time and with a smooth transition to the new system.

“I was really happy on the first Monday after go-live and in that early week that there weren't big issues,” Guido says. “We had some hiccups, that's normal, but it was manageable and that's what is important.”

This project represented an important milestone in Alliander’s transition to SAP S/4HANA. Successfully and smoothly shifting a core business process into the new architecture clearly progressed the company past the point of turning back. This reinforced momentum for the wider project, laying robust foundations for future phases.

To find out how Zanders could help your treasury make the transition from SAP ECC to SAP S/4HANA, contact our Director Marieke Spenkelink.

On Thursday, November 14th, SAP Netherlands and Zanders hosted a roundtable focused on upgrading to S/4HANA. Nineteen participants representing nine companies, actively engaged in the discussions. This article will focus on the specifics of the discussions.

Exploring S/4HANA Functionalities

The roundtable session started off with the presentation of SAP on some of the new S/4HANA functionalities. New functionalities in the areas of Cash Management, Financial Risk Management, Working Capital Management and Payments were presented and discussed. In the area of Cash Management, the main enhancements can be found in the management of bank relationships, managing cash operations, cash positioning, and liquidity forecasting and planning. These enhancements provide greater visibility into bank accounts and cash positions, a more controlled liquidity planning process across the organization, increased automation, and better execution of working capital strategies. In Financial Risk Management, the discussion highlighted S/4HANA’s support for smart trading processes, built-in market data integration, and more advanced on-the-fly analysis capabilities. All providing companies with a more touchless, automated and straight through process of their risk management process. The session also covered Working Capital enhancements, including a presentation on the Taulia solution offered by SAP, which provides insights into supporting Payables and Receivables Financing. Finally, the session explored innovations in the Payments area, such as payment verification against sanction lists, format mapping tools, the SAP Digital Payments Add-on, and automated corporate-to-bank cloud connectivity.

Migration Strategies: Getting to S/4HANA

While the potential of S/4HANA was impressive, the focus shifted to migration strategies. Zanders presented various options for transitioning from an ECC setup to an S/4HANA environment, sparking a lively discussion. Four use cases were defined, reflecting the diverse architectural setups in companies. These setups include:

- An integrated architecture, where the SAP Treasury solution is embedded within the SAP ERP system

- A treasury sidecar approach, where the SAP Treasury solution operates on a separate box and needs to integrate with the SAP ERP system box

- Treasury & Cash & Banking side car

- Leveraging Treasury on an S/4HANA Central Finance box

The discussion also covered two key migration strategies: the brownfield approach and the greenfield approach. In a brownfield approach, the existing system setup is technically upgraded to the new version, allowing companies to implement S/4HANA enhancements incrementally. In contrast, a greenfield approach involves building a new system from scratch. While companies can reuse elements of their ECC-based SAP Treasury implementation, starting fresh allows them to fully leverage S/4HANA’s standard functionalities without legacy constraints. However, the greenfield approach requires careful planning for data migration and testing, as legacy data must be transferred to the new environment.

Decoupling Treasury: The Sidecar Approach

The greenfield approach also raised the question of whether treasury activities should migrate to S/4HANA first using a sidecar system. This would involve decoupling treasury from the integrated ECC setup and transitioning to a dedicated S/4HANA sidecar system. This approach allows treasury to access new S/4HANA functionalities ahead of the rest of the organization, which can be beneficial if immediate enhancements are required. However, this setup comes with challenges, including increased system maintenance complexity, additional costs, and the need to establish new interfaces.

However, this setup comes with challenges, including increased system maintenance complexity, additional costs, and the need to establish new interfaces. Companies need to weigh the benefits of an early treasury migration against these potential drawbacks as part of their overall S/4HANA strategy. With this consideration in mind, participants reflected on the broader lessons from companies already using S/4HANA.

Lessons from Early Adopters

Companies that have already migrated to S/4HANA emphasized two critical planning areas: testing and training. Extensive testing—ideally automated—should be prioritized, especially for diverse payment processes. Similarly, training is essential to ensure effective change management, reducing potential issues after migration.

These insights highlight the importance of preparation in achieving a smooth migration. As organizations transition to S/4HANA, another important consideration is the potential impact on the roles and responsibilities within treasury teams.

Impact on Treasury Roles

Participants discussed whether S/4HANA would alter roles and responsibilities within treasury departments. The consensus was that significant changes are unlikely, particularly in a brownfield approach. Even in a greenfield approach, roles and responsibilities are expected to remain largely unchanged.

Conclusion

The roundtable highlighted the significant value S/4HANA brings to treasury operations, particularly through enhanced functionalities in Cash Management, Financial Risk Management, Working Capital Management, and Payments.

Participants discussed the pros and cons of brownfield and greenfield migration strategies, with insights into the sidecar approach for treasury as a potential transitional strategy. Early adopters emphasized the critical importance of thorough testing and training for a successful migration, while noting that treasury roles and responsibilities are unlikely to see major changes

If you would like to hear more about the details of the discussion, please reach out to Laura Koekkoek, Partner at Zanders, [email protected]

A webinar by SAP and Zanders explored optimizing treasury processes with SAP S/4HANA, focusing on enhanced cash management, automation, and compliance.

On the 22nd of August, SAP and Zanders hosted a webinar on the topic of optimizing your treasury processes with SAP S/4HANA, with the focus on how to benefit from S/4HANA for the cash & banking processes at a corporate. In this article, we summarize the main topics discussed during this webinar. The speakers came from both SAP, the software supplier of SAP S/4HANA, and from Zanders, which is providing advisory services in Treasury, Risk and Finance.

The ever-evolving Treasury landscape demands modern solutions to address complex challenges such as real-time visibility, regulatory compliance, and efficient cash management. Recognizing this need, the webinar offered an informative platform to discuss how SAP S/4HANA can be a game-changer for Treasury operations and, in specific, to bring efficiency and security to cash & banking processes.

To set the stage, the pressing issues faced by today's Treasury departments are navigating an increasingly complex regulatory environment, achieving real-time cash visibility, automating repetitive tasks, and managing banking communications efficiently. This introduction underscored the indispensable role that a robust technology platform like SAP S/4HANA can play in overcoming these challenges. The maintenance of consistent bank master data was given as an example of how challenging this management can be with a scattered ERP landscape.

Available below: Webinar Slides & Recording.

SAP S/4HANA: A New Era in Treasury Management

SAP S/4HANA, a next-generation enterprise resource planning (ERP) suite, stands out by offering integrated modules designed to handle various facets of treasury management, thus providing a consolidated view of financial data and enabling a single source of truth.

SAP S/4HANA's Treasury and Risk Management capabilities encompass cash management, financial risk management, payment processing, and liquidity forecasting. These tools are critical for a contemporary Treasury function looking to enhance visibility and control over financial operations.

Streamlined Cash Management

The core of the webinar focused on how SAP S/4HANA revolutionizes cash management. Real-time data analytics and predictive modeling were emphasized as the cornerstones of the platform’s cash management capabilities. The session elaborated on:

- Enhanced Cash Positioning: SAP S/4HANA provides real-time cash positioning, allowing Treasury departments to track cash flows across multiple bank accounts instantly. With the development of the new Fiori app, instant balances can be retrieved directly into the Cash Management Dashboard. This immediate visibility helps in making informed decisions regarding investments or borrowing needs.

- Liquidity Planning and Forecasting: By leveraging historical data and machine learning algorithms, SAP S/4HANA can provide accurate liquidity forecasts. The use of advanced analytics ensures you can anticipate cash shortages and surpluses well ahead of time, thereby optimizing working capital.

Efficient Banking Communications & Payment Processing

Managing communications with multiple banking partners can be a daunting task. SAP S/4HANA’s capabilities in automating and streamlining these communications through seamless integration. In addition to this integration, SAP S/4HANA facilitates efficient payment processing by consolidating payment requests and transmitting them to relevant banks through secure channels. This integration not only accelerates transaction execution but also ensures compliance with global payment standards.

Security and Compliance

Data security and compliance with regulatory standards are pivotal in Treasury operations. The experts detailed SAP S/4HANA’s robust security protocols and compliance tools designed to safeguard sensitive financial information. The features highlighted were:

- Data Encryption: End-to-end data encryption ensures that financial data remains secure both in transit and at rest. This is critical for protecting against data breaches and unauthorized access.

- Compliance Monitoring: The platform includes built-in compliance monitoring tools that help organizations adhere to regulatory requirements. Automated compliance checks and audit trails ensure that all Treasury activities are conducted within the legal framework.

S/4HANA sidecar for C&B processes

But how to make use of all these new functionalities in a scattered landscape corporates often have and how to efficiently execute such a project. By integrating with existing ERP systems, the sidecar facilitates centralized bank statement processing, automatic reconciliation, and efficient payment processing. Without disrupting the core functionality in the underlying ERP systems, it supports bank account and cash management, as well as Treasury operations. The sidecar's scalability and enhanced data insights help businesses optimize cash utilization, maintain compliance, and make informed financial decisions, ultimately leading to more streamlined and efficient cash and banking operations. The sidecar allows for a step-stone approach supporting an ultimate full migration to S/4HANA. This was explained again by a business case on how users can now update the posting rules themselves in S/4HANA, supported by AI, running in the background, making suggestions for an improved posting rule.

Conclusion & Next Steps

The webinar concluded with a strong message: SAP S/4HANA provides a transformative solution for Treasury departments striving to enhance their cash and banking processes. By leveraging its comprehensive suite of tools, organizations can achieve greater efficiency, enhanced security, and improved strategic insight into their financial operations.

To explore further how SAP S/4HANA can support your Treasury processes, we encourage you to reach out for personalized consultations. Embrace the future of treasury management with SAP S/4HANA and elevate your cash and banking operations to unprecedented levels of efficiency and control. If you want to further discuss how to make use of SAP S/4HANA or to discuss deployment options and how to get there, please contact Eliane Eysackers.

With subsidiaries all over the world, ASICS wanted to standardize and make its treasury operations more efficient. To optimize its treasury function, ASICS Europe (AEB) decided to implement the SAP Treasury and Risk Management module in 2017.

With this came the decision to set up a new company code to separate ASICS Europe’s treasury activities from its commercial activities. Apart from the pros, it raised new challenges too.

ASICS stands for ‘Anima Sana In Corpore Sano’, loosely translated ‘a sound mind in a sound body’. This Japanese company was founded by Kihachiro Onitsuka in 1949. He felt that Japanese youth, who had lived through World War II, were in the process of being derailed and had too few pursuits. Onitsuka wanted to bring back the healthy life through sports, which demanded proper sportswear. And so, he decided to produce basketball shoes under the name Onitsuka Tiger.

Inventive like octopus

Onitsuka strived for perfection and innovation. One of the anecdotes about the origin of the ASICS basketball shoes is that he came up with an inventive idea when eating octopus salad from a bowl. During that diner, a leg of the animal stuck to the side of the bowl. When Onitsuka realized this was because of the animal’s suction cups, he decided to design basketball shoes with tiny suction cups on the sole for more grip. It turned out to be a revolutionary idea.

Another remarkable fact is that Nike-founder Phil Knight started his career at ASICS. When he visited the Onitsuka Tiger office in 1963, he was impressed by the inventive sports shoes and asked Onitsuka to become their sales agent in the US. After a few years working for ASICS Knight decided to start his own sports brand.

The tiger stripes go global

During the years after foundation, the range of sports activities provided by Onitsuka expanded to include a variety of Olympic styles used by athletes around the world. The current ASICS brand signature, the crossed stripes that appear on the side of all the shoes, was first introduced in 1966 during the pre-Olympic trials for the 1968 Summer Olympics in Mexico City. Martial arts star Bruce Lee was the first international celebrity to popularize this design. In 1977, Onitsuka Tiger merged with GTO and JELENK to form ASICS Corporation. Despite the name change, a vintage range of ASICS shoes is still produced and sold internationally under the Onitsuka Tiger label.

In 1977, ASICS opened a first small European office in Düsseldorf, in the home garage of a representative. This German city had a relatively large Japanese community and was centrally located in Europe. In 1995, ASICS Europe, Middle East and Africa (EMEA) relocated to a new headquarters in the Netherlands, from where more subsidiaries were established, and the ASICS network further expanded. The company built and rented several large distribution centers in Europe. In addition, the sales channels broadened from traditional wholesale to opening ASICS stores – first outlet stores, followed by a flagship store and e-commerce. Today, the brand sells all items through omnichannel.

The first implementation of the SAP system involved communication with the bank via the SWIFT platform.

Eugene Tjemkes, Head of Global Business Transformation Finance

Challenge

The implementation of SAP modules

In 2017, to further optimize their treasury function, ASICS Europe decided to implement the treasury management functionality of SAP. “That is when our cooperation with Zanders started”, says Eugene Tjemkes, Head of Global Business Transformation Finance. “The first implementation of the SAP system involved communication with the bank via the SWIFT platform, an in-house cash system with all kinds of automatic entries where Treasury acts as a payment factory – also on behalf of the subsidiaries.”

The Japanese headquarters opted for more or less the same treasury solution as those of the EMEA countries. “The other regions did not choose it, either because of their small size, or since they are single country regions (such as Australia) or because foreign currency plays a lesser role, such as in the US. In Europe, on the other hand, we are involved in currency transactions and hedging every day.”

Treasury as a separate company

Besides the SAP Treasury and Risk Management (TRM) module, ASICS Europe also implemented SAP Cash Management (CM), SAP In-House Cash (IHC) and the SAP Bank Communication Manager (BCM) in 2017. With this came the decision to set up a new company code that would separate the treasury functionality of ASICS Europe BV (AEB) from its commercial activities, as tax rules only allowed AEB to provide services and do business in Europe. In addition, the new company code, AEB Treasury, ensured global reach and provided cost savings and standardization due to the foreseen treasury activities in the EMEA region, Japan, and the Americas.

Tjemkes explains: “As a legal part of AEB, it was not possible for Treasury to do anything for ASICS US or ASICS Asia. Transforming our treasury functionality into a separate legal entity would make it possible to develop treasury activities outside the EMEA region too. Therefore, there were plans to separate the treasury functionality from the existing corporate structure and make it a global subsidiary of the Japanese headquarters. From that vision, that treasury functionality would be housed in a separate legal entity, we started implementing our treasury system in 2017. The system was set up accordingly; AEB Treasury became a separate company in SAP, although it was not a legally separated entity.”

Bringing back the treasury activities under AEB

However, the plan to service the company’s entities in other regions with an inhouse bank operating from Europe, did not go as planned. Instead, different regions of ASICS were supported with a local solution. And therefore, splitting into two company codes became irrelevant.

Tjemkes: “Due to the separated treasury functionality, the accounting department had to consolidate the reports to get them into one financial statement. After using SAP TRM, CM, IHC and BCM for a few years, we discovered that a legal entity administered in two different company codes appeared to be time-consuming while executing our day-to-day processes. Initially, the plan was to do this temporarily, with the idea that Treasury would become a separate entity. But unfortunately, the plan was ultimately not adopted by the head office – from their perspective the advantages were not that great.”

This left AEB with the artificial situation that there were still two company codes in which it had to deal with all kinds of currencies, with different balance sheet items, and problems with the redistribution results. “That finally made us decide to remove that artificial separation of company codes and bring the treasury activities back under AEB. That also meant an adjustment in our TMS. We asked Zanders to support us in that project.”

Solution

Streamlining Treasury Processes

To solve the shortcomings of the artificial separation, Zanders proposed various alternatives. After conducting a few workshops with the treasury department, it was decided to discontinue all the current processes (TRM, IHC, GL accounting) in the company code representing AEB Treasury and re-implement it in company code representing AEB. Hence, a single company code for the single legal entity.

Magda Bleker, Treasury Specialist at ASICS EMEA: “This would save us time on labor-intensive activities, such as replicating accounting entries into company code representing AEB. Further, as internal dealing only occurred between company codes representing AEB and AEB treasury, ASICS would no longer have to use the internal dealing functionality by merging the two company codes. Removal of these activities would make the processes more efficient.”

Zanders and ASICS identified that the proposed solution would require high implementation effort. It would also lose the flexibility to quickly split the TRM and IHC processes into a new legal entity. However, as the pros outweighed the cons, ASICS decided to go ahead with the merging of the two company codes. The project started with Zanders updating the decision forms, configuration, and master data conversion documents created in 2017 during the SAP TRM and IHC implementation project, which reflected the changes, risks, and implications of migration. After which, the new functionality was configured and tested in a development system, ensuring that it would not disrupt the treasurers’ daily activities and to keep the payment structure intact and valid. Once the configuration had been updated in the system, the previous configuration documents were also updated to reflect the new changes in the system.

This would save us time on labor-intensive activities, such as replicating accounting entries into company code representing AEB.

Magda Bleker, Treasury Specialist

Performance

Improving further

Tjemkes: “Around 2016, we implemented SAP Fashion management system (FMS) ourselves in our European offices as a pilot for the whole world. FMS is an industry-specific solution, and we were the first company to go live with it. In addition to Europe, our branches in the US, Canada, China and Australia, among others, are now on this platform. But to properly implement the treasury system we really needed a specialist. Zanders is a very professional service provider, who knows very well what modern treasury is and how treasury systems work. We couldn’t have done this without them. They did the project management for us, helped write the project plan and created a test plan.”

Despite the corona pandemic in 2020, ASICS had a turnover of 328,784 million yen, which is more than 2.5 billion euro. The company took a great deal to investigate their current processes and see what was working and what was not. Like in sports, ASICS showed how one can still move forward when taking a step back, improving their processes and making them more efficient.

Next step for AEB is to expand its functionality around hedging. “The hedge contracts are now recorded in the system. We want to further optimize the transparency and efficiency of the closing of our hedge deals with banks, to mitigate all associated risks. We also want to improve the valuation of the hedge contracts. There are functionalities in SAP that allow us to better value hedges. But we have already taken many, very important steps.”

Sony Group implemented the SAP S/4HANA Treasury system successfully around the world in 2020. This project is called METRO Project in Sony Group.

Sony decided to start Digital Transformation (DX) of global treasury functions by launching the METRO Project officially in May 2018 and completed it by October 2020, working remotely under the COVID-19 global pandemic.

One of the biggest achievements of this project is the automation of the FX trading process. It is impressive to see how Sony’s FX dealers can trade large volume of FX deals with banks efficiently and effectively within a few minutes by using SAP S/4HANA Treasury and SAP’s TPI (Trading Platform Integration) connecting automatically with 360T Trading platform.

In this article, Sony’s project management team and Zanders partners will explain about this project.

Power of creativity and technology

Sony strives to fulfil its purpose to “fill the world with emotion, through the power of creativity and technology”, under its corporate direction of “getting closer to people”. To evolve and grow further, Sony strives to provide innovative products and contents full of emotional experiences in order to enrich people’s lives through the power of technology, across its six business segments consist of Game & Network Services, Music, Pictures, Electronics Products & Solutions, Imaging & Sensing Solutions, and Financial Services.

New-generation technologies made it possible for Sony Group to improve the global treasury platforms such as Payment-On-Behalf Of (POBO), Zero Balance Accounts (ZBA) sweeping, and Internal cash-less payments, Internal FX and Money Market deals settled via In-House-Cash accounts.

To improve FX hedging process, Sony introduced cutting-edge technologies such as SAP S/4HANA Treasury, SAP’s TPI connecting automatically with 360T Trading platform, to achieve the end-to-end automation of FX trading process.

To improve banking connectivity, Sony adopted the most advanced generation of banking technologies such as SWIFT for Corporates and ISO 20022 standards to connect with global banks smoothly for payment requests and bank statements via SWIFT network, which makes it possible for Sony’s cash management teams to grasp the latest status of cash position in a timely manner, even when the employees are forced to work from home in a tele-commuting era under COVID-19.

Additionally, Sony has implemented SAP In-House-Cash (IHC) for its treasury centers as In-House-Banks to support Sony subsidiaries in each region.

Sony’s journey for global treasury transformation

Sony Group has been making impressive efforts in the field of finance and treasury for a long time. Since 2000, Sony Global Treasury Services Plc (SGTS UK) has been established and operated in the United Kingdom as a global treasury center for Sony Group. SGTS UK has been providing POBO, ZBA sweeping, Internal cash-less payments, Internal FX and MM deals settled via internal accounts for Sony Group companies based on in-house treasury system developed by the Sony IS team. Cash and FX risk management were centralized in SGTS UK.

As Sony’s business grew in various business segments globally, it was necessary and rational to centralize funds and foreign exchange risks into SGTS UK. Before 1999, each regional finance/treasury center had managed FX and cash management individually, so it was a significant improvement by centralizing into SGTS UK. SGTS UK was deemed to be one of the most advanced in-house-bank of its kind around the world.

In 2016, SGTS UK transferred cash management functions for group companies in the USA to Sony Capital Corporation (SCC), to strengthen access to the US capital market, and to enhance flexibility to any changes in laws and regulations in the USA.

We departed from single global treasury center model and transformed into three main treasury center models by standardizing, simplifying, and automating treasury operations across all the treasury centers.

Hiroyuki Ishiguro, General Manager of Sony Group Corporation HQ Finance

Challenge

Decision to transform

In October 2017, Sony started a project planning to rebuild its global treasury management structures across the globe. By December 2017, after an RFP process among the shortlisted SAP consultants, Sony decided that Zanders would be the best SAP Treasury expert to advise and support in this project. Together with Zanders, Sony opted for SAP S/4HANA Treasury based on ‘Fit & Gap’ analysis.

In May 2018, Sony decided to start the METRO Project officially.

Mr. Hiroyuki Ishiguro, General Manager of Sony Group Corporation HQ Finance (‘SGC HQ Fin’), explains: “We decided to start DX in Sony’s global treasury operations, considering more diversified business segments in Sony Group, rapid changes of corporate treasury and banking activities in each region, innovations of financial technologies, and limitations of legacy treasury systems that could not so effectively support Sony’s group companies especially in the USA and Japan. We departed from single global treasury center model and transformed into three main treasury center models by standardizing, simplifying, and automating treasury operations across all the treasury centers.”