A combination of external market volatility and internal structural change prompted our client, a global energy logistics business, to seek a more disciplined approach to interest rate risk management. Our team from Zanders stepped in, providing expert support to help the treasury benchmark their practices and strengthen their risk management framework.

Global market turbulence and the shifting interest rate environment have intensified uncertainty for corporate treasuries in recent years. This has forced greater attention on financial risk – particularly for businesses operating across multiple continents and managing exposure to volatile financing costs. For our global energy logistics client, these external pressures arrived at the same time as major internal changes, presenting an ideal opportunity to reassess existing treasury practices.

“There were a lot of new faces and new knowledge with the changes at the company – it seemed a logical moment to also review all the policies and procedures in place,” says a company treasurer. “This triggered a discussion on risk management – what policies we had in place and whether they were still fit for purpose.”

Time for pragmatism and validation

While hedging policies existed, they were informal and inconsistently applied. As market volatility increased, it became clear that the company needed a more formal, structured framework to provide the clarity now expected – both internally and by regulators.

“We decided it was time to formalize our policies,” the company treasurer adds. “There was more focus internally on how market volatility could impact our results. We were regularly being asked what was driving revaluations in our financials and how we could smooth this by structuring differently or applying hedge accounting.”

The treasury team embarked on a large-scale project to refresh and refine policies and document their future risk management approach. However, while internal discussions clarified objectives and processes, to have complete confidence in their approach required more than just internal agreement. They also needed to be sure that their policies were aligned with market best practices and that their hedging strategies would withstand the scrutiny of management, auditors and regulators.

“We realized we needed validation,” the client explains. “We wanted to know whether what we were doing was correct, whether we were missing something and how our approach compared to market practice. Were we under-hedged or over-hedged compared to peers?”

Making risk tangible

Zanders was a natural choice to conduct this benchmarking exercise and provide the independent, expert view the company needed. The treasury team trusted them from an earlier transfer pricing project and valued their approach – in particular the blend of technical depth and practical execution.

We like Zanders’ pragmatic approach.

Company Treasurer

“Once you start talking about hedging policies, many consultants immediately ask for SAP dumps going back 15 years and expect you to fill an entire data room. I was afraid of that. We weren’t at the start of a project – we were almost finished – we needed a partner who could validate our work without creating a massive administrative burden. Zanders understood this.”

Instead of a heavy data-driven exercise, Zanders designed a focused, efficient process structured around two interactive workshops: an exploratory session to discuss and map existing processes and a second session to validate conclusions.

It really helped to get validation from an external consultant, you want to know whether what you’ve built actually makes sense, whether you’re missing something, and how competitors approach the same issues.

Company Treasurer

Within just a few months, Zanders delivered a clear validation report accompanied by a set of practical recommendations. One of the most valuable was linking hedge decisions more closely to the company’s financial sensitivities – a shift that has made it far easier to communicate risk to senior management.

“These are really pragmatic solutions that have improved our policies, and our top management can see the results immediately,” says the company treasurer. “When we explain why we hedge, or what happens if we don’t, the impact becomes tangible. It’s no longer abstract. We can show: ‘If you do this, here’s the risk. If you do that, here’s the outcome.’ It makes presenting the figures much easier, and it helps management truly understand the numbers rather than just percentages.”

Reshaping perspectives on risk

By combining structured validation with practical recommendations, the project not only strengthened the company’s interest rate risk framework but also gave the treasury team renewed confidence in their approach.

“Overall, the outcome of the project wasn’t to radically change our approach – it confirmed we were on the right track,” says the company treasurer. “But it also led to changes that have created more awareness and understanding across the company about the importance of risk management.”

Perhaps most importantly, the exercise reframed the company’s view of risk in the core. “We used to think of risk management purely as minimizing risk,” the company treasurer says. “Now we see it as balancing risk, cost and impact – making informed decisions rather than automatic ones on multiple levels.”

Looking to elevate your interest rate risk strategy?

From volatility in global markets to rising expectations from boards, auditors and regulators, interest rate risk management has never been more critical. Zanders brings the expertise, structure and independent perspective needed to strengthen your framework and turn risk insights into strategic clarity.

Get in touch to discover how we can help you build a clearer, more resilient approach to interest rate risk – ensuring transparency, control and confidence across your financial decision-making.

Ready to transform your interest rate risk strategy?

Contact us

We explore the main challenges of computing Margin Value Adjustment (MVA) and share our insights on how GPU computing can be harnessed to provide solutions to these challenges.

With recent volatility in financial markets, firms need increasingly faster pre-trade and risk calculations to react swiftly to changing markets. Traditional computing methods for these calculations, however, are becoming prohibitively expensive and slow to meet the growing demand. GPU computing has recently garnered significant interest, with advances in the fields of advanced machine learning techniques and generative AI technologies, such as ChatGPT. Financial institutions are now looking at gaining an edge by using GPU computing to accelerate their high-dimensional and time-critical computing challenges.

The MVA Computing Challenge

The timely computation of MVA is essential for pre-trade and post-trade modeling of bilateral and cleared trading. Providing an accurate measure of future margin requirements over the lifetime of a trade requires the frequent revaluation of derivatives with a large volume of intensive nested Monte Carlo simulations. These simulations need to span a high-dimensional space of trades, time steps, risk factors and nested scenarios, making the calculation of MVA complex and computationally demanding. This is further complicated by the need for an increasing frequency of intra-day risk calculations, due to recent market volatility, which is pushing the limits of what can be achieved with CPU-based computing.

An Introduction to GPU Computing

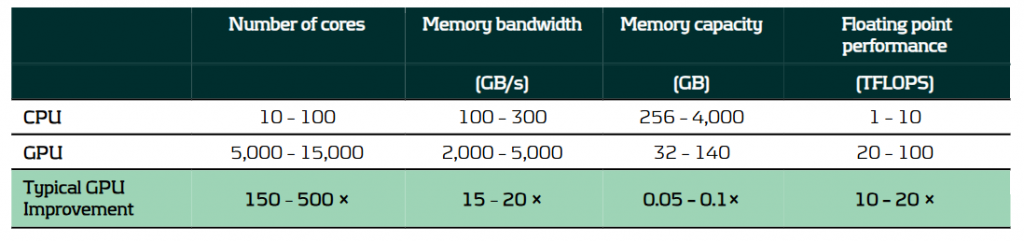

GPU computing utilizes graphics processing units, which are specifically designed to handle large volumes of parallel calculations. This capability makes them ideal for solving programming challenges that benefit from high levels of parallelization and data throughput. Consequently, GPUs can offer substantial benefits over traditional CPU-based computing, thanks to their architectural differences, as outlined in the table below.

A comparison of the typical capabilities of enterprise-level hardware for CPUs and GPUs.

It is because of these architectural differences that CPUs and GPUs excel in different areas:

- CPUs feature fewer but more powerful cores, optimized for general-purpose computing with complex, branching instructions. They excel in performing serial calculations with high single-core performance.

- GPUs consist of a large number of less powerful cores and with higher memory bandwidth. This makes them ideal for handling large volumes of parallel calculations with high throughput.

Solving the MVA Computational Challenge with GPU Computing

The requirement to calculate large volumes of granular simulations makes GPU computing especially well-suited to solving the MVA computational challenge. The use of GPU computing can lead to significant improvements in performance for not only MVA but a range of problems in finance, where it is not uncommon to see improvements in calculation speed of 10 – 100x. This performance increase can be harnessed in several ways:

- Speed: The high throughput of GPUs provides results more quickly, providing faster risk calculations and insights for decision-making, which is particularly important for pre-trade calculations.

- Throughput: GPUs can more quickly and efficiently process large calculation volumes, providing institutions with more peak computing bandwidth, reducing workloads on CPU-grids that can be used for other tasks.

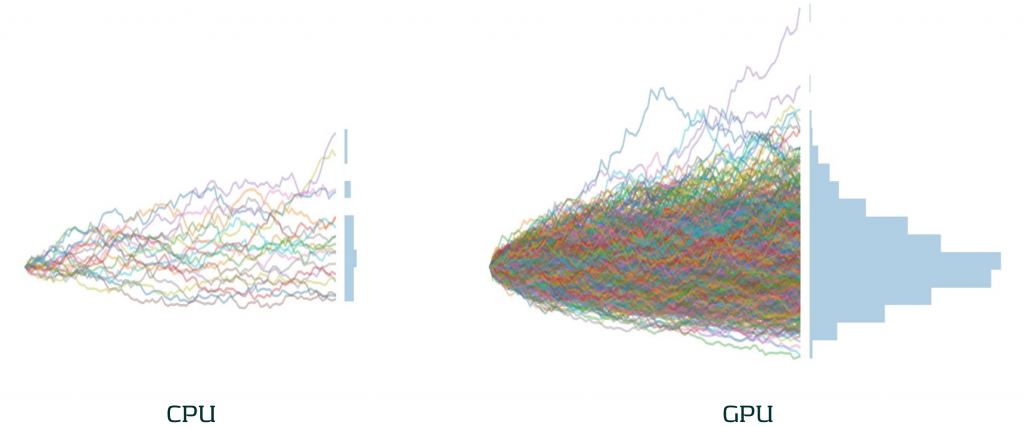

- Accuracy: With greater parallel processing capabilities, the accuracy of models can be improved by using more sophisticated algorithms, greater granularity and a larger number of simulations. As illustrated below, the difference in the number of Monte Carlo simulations that can be achieved by GPUs in the same time as CPUs can be significant.

The difference in the number of Monte Carlo paths than can be simulated in the same time between an equivalent enterprise-level CPU and GPU.

Case Study: Our approach to accelerating MVA with GPUs

To illustrate the impact of GPU computing in a real situation, we present a case study of our work accelerating MVA calculations for a major bank.

Challenge: A large investment bank was seeking to improve the performance of their pre-trade MVA for more timely calculations. This was challenging as they needed to compute their MVA exposures over long time horizons, with a large number of paths. Even with a sensitivity-based approach, this process took close to 10 minutes using a single-threaded CPU calculation.

Solution: Zanders analyzed the solution and identified several bottlenecks. We developed and optimized a GPU-accelerated solution to ensure efficient GPU utilization, parallelizing the calculations across scenarios and risk factors.

Performance: Our GPU implementation improved MVA calculation speed by 51x. Improving calculation time from just under 10 minutes to 10 seconds. This significant increase in speed enabled more timely and frequent assessments and decisions on MVA.

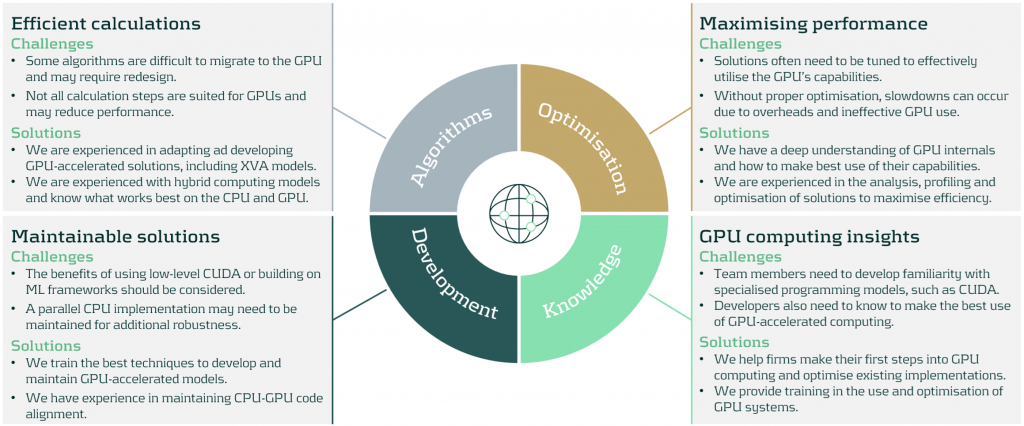

Our Recommendation: A strategic approach to GPU computing implementations

There are significant benefits to be achieved with the use GPU computing. However, there are some considerations to ensure an effective use of resources:

We work with firms to develop bespoke solutions to meet their high-performance computing needs. Zanders can help in all aspects of GPU computing implementation, from initial design to the analysis, development and optimization of your GPU computing implementation.

Conclusion

GPU computing offers significant improvements in the speed and efficiency of financial calculations, typically boosting calculation speeds by factors of 10-100x. This enables financial institutions to manage their risk more effectively, including the computationally demanding calculations of MVA. By replacing CPU-based calculations with GPU computing, banks can dramatically improve their capacity to process greater volumes of calculations with higher frequency. As financial markets continue to evolve, GPU computing will play an increasingly vital role in their calculation infrastructure.

To find out more on how GPU computing can enhance your institution's risk management processes, please contact Steven van Haren (Director) or Mark Baber (Senior Manager).

Asset liability management (ALM) is an important part of banking at any time, but it tends to come more sharply into focus during times of interest rate instability. This is certainly the case in recent years.

After a prolonged period of stable low (and at points even negative) interest rates, 2022 saw the return of rising rates, prompting Dutch digital bank, Knab, to appoint Zanders to reevaluate and reinforce the bank’s approach to risk.

The evolution of Knab

Founded in 2012 as the first fully digital bank in The Netherlands, Knab offers a suite of online banking products and services to support entrepreneurs both in their business and private needs.

“It's an underserved client group,” says Tom van Zalen, Knab’s Chief Risk Officer. “It's a nice niche as there is a strong need for a bank that really is there for these customers. We want to offer products and services that are really tailored to the specific needs of those entrepreneurs that often don’t fit the standard profile used in the market.”

Over time, the bank’s portfolio has evolved to offer a broad suite of online banking and financial services, including business accounts, mortgages, accounting tools, pensions and insurance. However, it was Knab’s mortgage portfolio that led them to be exposed to heightened interest rate risk. Mortgages with relatively long maturities command a large proportion of Knab’s balance sheet. When interest rates started to rise in 2022, increasing uncertainty in prepayments posed a significant risk to the bank. This emphasized the importance of upgrading their risk models to allow them to quantify the impact of changes in interest rates more accurately.

“With mortgages running for 20 plus years, that brings a certain interest rate risk,” says Tom. “That risk was quite well in control, until in 2022 interest rates started to change a lot. It became clear the risk models we were using needed to evolve and improve to align with the big changes we were observing in the interest rate environment—this was a very big thing we had to solve.”

In addition, in the background at around this time, major changes were happening in the ownership of the bank. This ultimately led to the sale of Knab (as part of Aegon NL) to a.s.r. in October 2022 and then to Bawag in February 2024. Although these transactions were not linked to the project we’re discussing here, they are relevant context as they represent the scale of change the bank was managing throughout this period, which added extra layers of complexity (and urgency) to the project.

A team effort

In 2022, Zanders was appointed by Knab to develop an Interest Rate Risk in the Banking Book (IRRBB) Roadmap that would enable them to navigate the changes in the interest rate environment, ensure regulatory compliance across their product portfolio and generally provide them with more control and clarity over their ALM position. As a first stage of the project, Zanders worked closely with the Knab team to enhance the measurement of interest rate risk. The next stage of the project was then to develop and implement a new IRRBB strategy to manage and hedge interest rate risk more comprehensively and proactively by optimizing value risk, earnings risk and P&L.

“The whole model landscape had to be redeveloped and that was a cumbersome and extensive process,” says Tom. “Redevelopment and validation took us seven to eight months. If you compare this to other banks, that sort of execution power is really impressive.”

The swiftness of the execution is the result of the high priority awarded to the project by the bank combined with the expertise of the Zanders team.

Zanders brings a very special combination of experts. Not only are they able to challenge the content and make sure we make the right choices, but they also bring in a market practice view. This combination was critical to the success of the execution of this project.

Tom van Zalen, Knab’s Chief Risk Officer.

Clarity and control

Armed with the new IRRBB infrastructure developed together with Zanders, the bank can now measure and monitor the interest rate risks in their product portfolio (and the impact on their balance sheet) more efficiently and with increased accuracy. This has empowered Knab with more control and clarity on their exposure to interest rate risk, enabling them to put the right measures in place to mitigate and manage risk effectively and compliantly.

“The model upgrade has helped us to reliably measure, monitor and quantify the risks in the balance sheet,” says Tom. “With these new models, the risk that we measure is now a real reflection of the actual risk. This has helped us also to rethink our approach on managing risk.”

The success of the project was qualified by an on-site inspection by the Dutch regulator, De Nederlandsche Bank (DNB), in April 2024. With Zanders supporting them, the Knab team successfully complied with regulatory requirements, and they were also complimented on the quality of their risk organization and management by the on-site inspection team.

Lasting impact

The success of the IRRBB Roadmap and the DNB inspection have really emphasized the extent of changes the project has driven across the bank’s processes. This was more than modeling risk, it was about embedding a more calculated and considered approach to risk management into the workings of the bank.

“It was not just a consultant flying in, doing their work and leaving again, it was really improving the bank,” says Tom. “If we look at where we are now, I really can say that we are in control of the risk, in the sense that we know where it is, we can measure it, we know what we need to do to manage it. And that is, a very nice position to be in.”

For more information on how Zanders can help you enhance your approach to interest rate risk, contact Erik Vijlbrief.

Following the publication of its focus areas for IRRBB in 2024 and 2025, the European Banking Association (EBA) has now published an update regarding the implementation and explains the next steps.

The implementation update covers observations, recommendations and supervisory tools to enhance the assessment of IRRBB risks for institutions and supervisors.1 Main topics include non-maturing deposit (NMD) behavioral assumptions, complementary dimensions to the SOT NII, the modeling of commercial margins for NMDs in the SOT NII, as well as hedging strategies.

Some key highlights and takeaways from the results of sample institutions as per Q4 2023:

- Large dispersion across behavioral assumptions on NMDs is observed. The significant volume of NMDs as part of EU banks’ balance sheets, differences in behavior between customer / product groups and developments in deposit volume distributions, however, underline the need for more solid and aligned modeling. The EBA hence suggests NMD modeling enhancements and recommends (1) banks to consider various risk factors related to the customer, institution and market profile, as well as (2) a supervisory toolkit to monitor parameters / risk factors. Segmentation and peer benchmarking, (reverse) stress testing as well as (combining) expert judgment and historical data are paramount in this regard. The recommendations spark banks to reevaluate forward looking approaches, as shifting deposit dynamics render calibration solely based on historical data insufficient. Establishing a thorough expert judgment governance including backtesting is vital in this respect. Moreover, assessing and substantiating how a bank’s modeling relates to the market is more important than ever.

- Next to the NII SOT that serves as a metric to flag outlier institutions from an NII perspective, the EBA proposes additional dimensions to be considered by supervisors. These dimensions, which aim to reflect internal NII metrics, must complement the assessment and enhance the understanding of IRRBB exposures and management. The proposed dimensions include (1) market value changes of fair value instruments, (2) interest rate sensitive fees/commissions & overhead costs, and (3) interest rate related embedded losses and gains. It is important to note that it is not intended to introduce new limits or thresholds associated with these dimensions.

- Given concerns and dispersion regarding the modeling of commercial margins for NMDs in the NII SOT (38% of sample institutions assumed constant commercial margins versus the remainder not applying constant margins), the EBA now provided additional guidance on the expected approach. They recommend institutions to align the assumptions with those in their internal systems, or apply a constant spread over the risk-free rate when not available. Key considerations include the current spread environment, the context of zero or negative interest rates and lags in pass-through. The EBA’s clarification indicates that banks are allowed to apply a non-constant spread. This serves as an opportunity for banks still applying constant ones, as using non-constant spreads enhances the ability to quantify NII risk under an altering interest rate environment.

- Hedging practices vary significantly across institutions, although hedging instruments (i.e. interest rate swaps) to manage open IRRBB positions are aligned. Hedging strategies have significantly contributed to meeting regulatory requirements, with all institutions meeting the SOT EVE as per Q4 2023, compared to 42% that would not have complied if hedges were disregarded. For the SOT NII, however, 13% of the sample institutions would have been considered outliers if this regulatory measure had been applied in Q4 2023 (versus 21% when disregarding hedges). This result shows that it is key for banks to find a balance between value and earnings stability, and apply hedging strategies accordingly. As compliance with SOTs must be ensured under all circumstances, stressed client behavior and market dynamics must be accounted for.

In the upcoming years, the EBA will continue monitoring the impact of the IRRBB regulatory package, focusing on NMD modeling, hedging strategies, and potential scope extensions to commercial margin modeling. It will also assess Pillar 3 disclosure practices and track key regulatory elements such as the 5-year cap on NMD repricing maturity and Credit Spread Risk in the Banking Book (CSRBB)-related aspects. Additionally, the EBA will contribute to the International Accounting Standards Board’s (IASB's) Dynamic Risk Management (DRM) project and evaluate the impact of recalibrated shock scenarios from the Basel Committee.

The EBA publication triggers banks to take action on the four topics outlined above, as well as on hedge accounting (DRM) in the near future. Zanders has extensive relevant experience, and supported on:

- Numerous NMD topics, including modeling, validation and benchmarking. Furthermore, we published a series of whitepapers regarding NMD modeling concepts and approaches, deposit rate dynamics, forward looking perspectives and migration dynamics in deposits that is particularly relevant following this EBA publication.

- Drafting an IRRBB strategy, advising on coupon stripping and developing a hedging strategy, thereby carefully balancing value and NII risks (SOT EVE / NII).

- Validating a hedge accounting framework, developing a hedge account model and hedge accounting outsourcing. Zanders moreover held a survey on DRM as well as published an extensive series of articles on the DRM project of the IASB and its implications for banks.

Contact Jaap Karelse, Erik Vijlbrief (Netherlands, Belgium and Nordic countries) or Martijn Wycisk (DACH region) for more information.

Citations

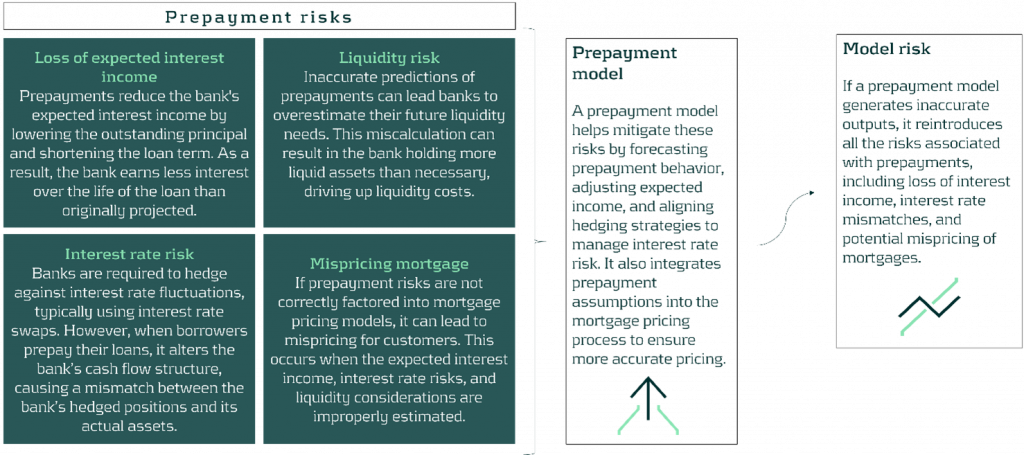

This article examines different methods for quantifying and forecasting model risk in prepayment models, highlighting their respective strengths and weaknesses.

Within the field of financial risk management, professionals strive to develop models to tackle the complexities in the financial domain. However, due to the ever-changing nature of financial variables, models only capture reality to a certain extent. Therefore, model risk - the potential loss a business could suffer due to an inaccurate model or incorrect use of a model - is a pressing concern. This article explores model risk in prepayment models, analyzing various approaches to quantify and forecast this risk.

There are numerous examples where model risk has not been properly accounted for, resulting in significant losses. For example, Long-Term Capital Management was a hedge fund that went bankrupt in the late 1990s because its model was never stress-tested for extreme market conditions. Similarly, in 2012, JP Morgan experienced a $6 billion loss and $920 million in fines due to flaws in its new value-at-risk model known as the ‘London Whale Trade’.

Despite these prominent failures, and the requirements of CRD IV Article 85 for institutions to develop policies and processes for managing model risk,1 the quantification and forecasting of model risk has not been extensively covered in academic literature. This leaves a significant gap in the general understanding and ability to manage this risk. Adequate model risk management allows for optimized capital allocation, reduced risk-related losses, and a strengthened risk culture.

This article delves into model risk in prepayment models, examining different methods to quantify and predict this risk. The objective is to compare different approaches, highlighting their strengths and weaknesses.

Definition of Model Risk

Generally, model risk can be assessed using a bottom-up approach by analyzing individual model components, assumptions, and inputs for errors, or by using a top-down approach by evaluating the overall impact of model inaccuracies on broader financial outcomes. In the context of prepayments, this article adopts a bottom-up approach by using model error as a proxy for model risk, allowing for a quantifiable measure of this risk. Model error is the difference between the modelled prepayment rate and the actual prepayment rate. Model error occurs at an individual level when a prepayment model predicts a prepayment that does not happen, and vice versa. However, banks are more interested in model error at the portfolio level. A statistic often used by banks is the Single Monthly Mortality (SMM). The SMM is the monthly percentage of prepayments and can be calculated by dividing the amount of prepayments for a given month by the total amount of mortgages outstanding.

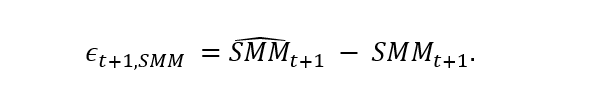

Using the SMM, we can define and calculate the model error as the difference between the predicted SMM and the actual SMM:

The European Banking Authority (EBA) requires financial institutions when calculating valuation model risk to set aside enough funds to be 90% confident that they can exit a position at the time of the assessment. Consequently, banks are concerned with the top 5% and lowest 5% of the model risk distribution (EBA, 2016, 2015). 2 Thus, banks are interested in the distribution of the model error as defined above, aiming to ensure they allocate the capital optimally for model risk in prepayment models.

Approaches to Forecasting Model Risk

By using model error as a proxy for model risk, we can leverage historical model errors to forecast future errors through time-series modeling. In this article, we explore three methods: the simple approach, the auto-regressive approach, and the machine learning challenger model approach.

Simple Approach

The first method proposed to forecast the expected value, and the variance of the model errors is the simple approach. It is the most straightforward way to quantify and predict model risk by analyzing the mean and standard deviation of the model errors. The model itself causes minimal uncertainty, as there are just two parameters which have to be estimated, namely the intercept and the standard deviation.

The disadvantage of the simple approach is that it is time-invariant. Consequently, even in extreme conditions, the expected value and the variance of model errors remain constant over time.

Auto-Regressive Approach

The second approach to forecast the model errors of a prepayment model is the auto-regressive approach. Specifically, this approach utilizes an AR(1) model, which forecasts the model errors by leveraging their lagged values. The advantage of the auto-regressive approach is that it takes into account the dynamics of the historical model errors when forecasting them, making it more advanced than the simple approach.

The disadvantage of the auto-regressive approach is that it always lags and that it does not take into account the current status of the economy. For example, an increase in the interest rate by 200 basis points is expected to lead to a higher model error, while the auto-regressive approach is likely to forecast this increase in model error one month later.

Machine Learning Challenger Model Approach

The third approach to forecast the model errors involves incorporating a Machine Learning (ML) challenger model. In this article, we use an Artificial Neural Network (ANN). This ML challenger model can be more sophisticated than the production model, as its primary focus is on predictive accuracy rather than interpretability. This approach uses risk measures to compare the production model with a more advanced challenger model. A new variable is defined as the difference between the production model and the challenger model.

Similar to the above approaches, the expected value of the model errors is forecasted by estimating the intercept, the parameter of the new variable, and the standard deviation. A forecast can be made and the difference between the production model and ML challenger model can be used as a proxy for future model risk.

The advantage of using the ML challenger model approach is that it is forward looking. This forward-looking method allows for reasonable estimates under both normal and extreme conditions, making it a reliable proxy for future model risk. In addition, when there are complex non-linear relationships between an independent variable and the prepayment rate, an ML challenger can be more accurate. Its complexity allows it to predict significant impacts better than a simpler, more interpretable production model. Consequently, employing an ML challenger model approach could effectively estimate model risk during substantial market changes.

A disadvantage of the machine learning approach is its complexity and lack of interpretability. Additionally, developing and maintaining these models often requires significant time, computational resources, and specialized expertise.

Conclusion

The various methods to estimate model risk are compared in a simulation study. The ML challenger model approach stands out as the most effective method for predicting model errors, offering increased accuracy in both normal and extreme conditions. Both the simple and challenger model approach effectively predicts the variability of model errors, but the challenger model approach achieves a smaller standard deviation. In scenarios involving extreme interest rate changes, only the challenger model approach delivers reasonable estimates, highlighting its robustness. Therefore, the challenger model approach is the preferred choice for predicting model error under both normal and extreme conditions.

Ultimately, the optimal approach should align with the bank’s risk appetite, operational capabilities, and overall risk management framework. Zanders, with its extensive expertise in financial risk management, including multiple high-profile projects related to prepayments at G-SIBs as well as mid-size banks, can provide comprehensive support in navigating these challenges. See our expertise here.

Ready to take your IRRBB strategy to the next level?

Zanders is an expert on IRRBB-related topics. We enable banks to achieve both regulatory compliance and strategic risk goals by offering support from strategy to implementation. This includes risk identification, formulating a risk strategy, setting up an IRRBB governance and framework, and policy or risk appetite statements. Moreover, we have an extensive track record in IRRBB [EU1] and behavioral models such as prepayment models, hedging strategies, and calculating risk metrics, both from model development and model validation perspectives.

Contact our experts today to discover how Zanders can help you transform risk management into a competitive advantage. Reach out to: Jaap Karelse, Erik Vijlbrief, Petra van Meel, or Martijn Wycisk to start your journey toward financial resilience.

Citations

- https://www.eba.europa.eu/regulation-and-policy/single-rulebook/interactive-single-rulebook/11665

CRD IV Article 85: Competent authorities shall ensure that institutions implement policies and processes to evaluate and manage the exposures to operational risk, including model risk and risks resulting from outsourcing, and to cover low-frequency high-severity events. Institutions shall articulate what constitutes operational risk for the purposes of those policies and procedures. ↩︎ - https://extranet.eba.europa.eu/sites/default/documents/files/documents/10180/642449/1d93ef17-d7c5-47a6-bdbc-cfdb2cf1d072/EBA-RTS-2014-06%20RTS%20on%20Prudent%20Valuation.pdf?retry=1

Where possible, institutions shall calculate the model risk AVA by determining a range of plausible valuations produced from alternative appropriate modelling and calibration approaches. In this case, institutions shall estimate a point within the resulting range of valuations where they are 90% confident they could exit the valuation exposure at that price or better. In this article, we generalize valuation model risk to model risk. ↩︎

We investigate different model options for prepayments, among which survival analysis

In brief

- Prepayment modeling can help institutions successfully prepare for and navigate a rise in prepayments due to changes in the financial landscape.

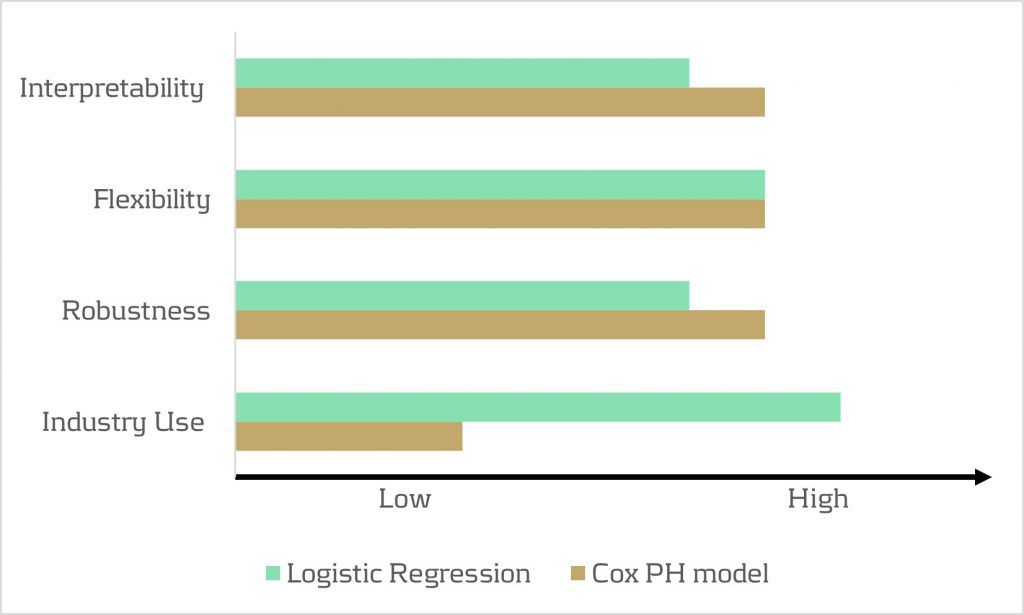

- Two important prepayment modeling types are highlighted and compared: logistic regression vs Cox Proportional Hazard.

- Although the Cox Proportional Hazard model is theoretically preferred under specific conditions, the logical regression is preferred in practice under many scenarios.

The borrowers' option to prepay on their loan induces uncertainty for lenders. How can lenders protect themselves against this uncertainty? Various prepayment modeling approaches can be selected, with option risk and survival analyses being the main alternatives under discussion.

Prepayment options in financial products spell danger for institutions. They inject uncertainty into mortgage portfolios and threaten fixed-rate products with volatile cashflows. To safeguard against losses and stabilize income, institutions must master precise prepayment modeling.

This article delves into the nuances and options regarding the modeling of mortgage prepayments (a cornerstone of Asset Liability Management (ALM)) with a specific focus on survival models.

Understanding the influences on prepayment dynamics

Prepayments are triggered by a range of factors – everything from refinancing opportunities to life changes, such as selling a house due to divorce or moving. These motivations can be grouped into three overarching categories: refinancing factors, macroeconomic factors, and loan-specific factors.

- Refinancing factors

This encompasses key financial drivers (such as interest rates, mortgage rates and penalties) and loan-specific information (including interest rate reset dates and the interest rate differential for the customer). Additionally, the historical momentum of rates and the steepness of the yield curve play crucial roles in shaping refinancing motivations. - Macro-economic factors

The overall state of the economy and the conditions of the housing market are pivotal forces on a borrower's inclination to exercise prepayment options. Furthermore, seasonality adds another layer of variability, with prepayments being notably higher in certain months. For example, in December, when clients have additional funds due to payment of year-end bonusses and holiday budgets. - Loan-specific factors

The age of the mortgage, type of mortgage, and the nature of the property all contribute to prepayment behavior. The seasoning effect, where the probability of prepayment increases with the age of the mortgage, stands out as a paramount factor.

These factors intricately weave together, shaping the landscape in which customers make decisions regarding prepayments. Prepayment modeling plays a vital role in helping institutions to predict the impact of these factors on prepayment behavior.

The evolution of prepayment modeling

Research on prepayment modeling originated in the 1980s and initially centered around option-theoretic models that assume rational customer behavior. Over time, empirical models that cater for customer irrationality have emerged and gained prominence. These models aim to capture the more nuanced behavior of customers by explaining the relationship between prepayment rates and various other factors. In this article, we highlight two important types of prepayment models: logistic regression and Cox Proportional Hazard (Survival Model).

Logistic regression

Logistic regression, specifically its logit or probit variant, is widely employed in prepayment analysis. This is largely because it caters for the binary nature of the dependent variable indicating the occurrence of prepayment events and it moreover flexible. That is, the model can incorporate mortgage-specific and overall economic factors as regressors and can handle time-varying factors and a mix of continuous and categorical variables.

Once the logistic regression model is fitted to historical data, its application involves inputting the characteristics of a new mortgage and relevant economic factors. The model’s output provides the probability of the mortgage undergoing prepayment. This approach is already prevalent in banking practices, and frequently employed in areas such as default modeling and credit scoring. Consequently, it’s favored by many practitioners for prepayment modeling.

Despite its widespread use, the model has drawbacks. While its familiarity in banking scenarios offers simplicity in implementation, it lacks the interpretability characteristic of the Proportional Hazard model discussed below. Furthermore, in terms of robustness, a minimal drawback is that any month-on-month change in results can be caused by numerous factors, which all affect each other.

Cox Proportional Hazard (Survival model)

The Cox Proportional Hazard (PH) model, developed by Sir David Cox in 1972, is one of the most popular models in survival analysis. It consists of two core parts:

- Survival time. With the Cox PH model, the variable of interest is the time to event. As the model stems from medical sciences, this event is typically defined as death. The time variable is referred to as survival time because it’s the time a subject has survived over some follow-up period.

- Hazard rate. This is the distribution of the survival time and is used to predict the probability of the event occurring in the next small-time interval, given that the event has not occurred beforehand. This hazard rate is modelled based on the baseline hazard (the time development of the hazard rate of an average patient) and a multiplier (the effect of patient-specific variables, such as age and gender). An important property of the model is that the baseline hazard is an unspecified function.

To explain how this works in the context of prepayment modeling for mortgages:

- The event of interest is the prepayment of a mortgage.

- The hazard rate is the probability of a prepayment occurring in the next month, given that the mortgage has not been prepaid beforehand. Since the model estimates hazard rates of individual mortgages, it’s modelled using loan-level data.

- The baseline hazard is the typical prepayment behavior of a mortgage over time and captures the seasoning effect of the mortgage.

- The multiplier of the hazard rate is based on mortgage-specific variables, such as the interest rate differential and seasonality.

For full prepayments, where the mortgage is terminated after the event, the Cox PH model applies in its primary format. However, partial prepayments (where the event is recurring) require an extended version, known as the recurrent event PH model. As a result, when using the Cox PH model, , the modeling of partial and full prepayments should be conducted separately, using slightly different models.

The attractiveness of the Cox PH model is due to several features:

- The interpretability of the model. The model makes it possible to quantify the influence of various factors on the likelihood of prepayment in an intuitive way.

- The flexibility of the model. The model offers the flexibility to handle time-varying factors and a mix of continuous and categorical variables, as well as the ability to incorporate recurrent events.

- The multiplier means the hazard rate can’t be negative. The exponential nature of mortgage-specific variables ensures non-negative estimated hazard rates.

Despite the advantages listed above presenting a compelling theoretical case for using the Cox PH model, it faces limited adoption in practical prepayment modeling by banks. This is primarily due to its perceived complexity and unfamiliarity. In addition, when loan-level data is unavailable, the Cox PH model is no longer an option for prepayment modeling.

Logistic regression vs Cox Proportional Hazard

In scenarios with individual survival time data and censored observations, the Cox PH model is theoretically preferred over logistic regression. This preference arises because the Cox PH model leverages this additional information, whereas logistic regression focuses solely on binary outcomes, disregarding survival time and censoring.

However, practical considerations also come into play. Research shows that in certain cases, the logistic regression model closely approximates the results of the Cox PH model, particularly when hazard rates are low. Given that prepayments in the Netherlands are around 3-10% and associated hazard rates tend to be low, the performance gap between logistic regression and the Cox PH model is minimal in practice for this application. Also, the necessity to create a different PH model for full and partial prepayment adds an additional burden on ALM teams.

In conclusion, when faced with the absence of loan-level data, the logistic regression model emerges as a pragmatic choice for prepayment modeling. Despite the theoretical preference for the Cox PH model under specific conditions, the real-world performance similarities, coupled with the familiarity and simplicity of logistic regression, provide a practical advantage in many scenarios.

How can Zanders support?

Zanders is a thought leader on IRRBB-related topics. We enable banks to achieve both regulatory compliance and strategic risk goals by offering support from strategy to implementation. This includes risk identification, formulating a risk strategy, setting up an IRRBB governance and framework, and policy or risk appetite statements. Moreover, we have an extensive track record in IRRBB and behavioral models such as prepayment models, hedging strategies, and calculating risk metrics, both from model development and model validation perspectives.

Are you interested in IRRBB-related topics such as prepayments? Contact Jaap Karelse, Erik Vijlbrief, Petra van Meel (Netherlands, Belgium and Nordic countries) or Martijn Wycisk (DACH region) for more information.

Last year marked a radical change in the status-quo that existed within the financial market, affecting the way banks manage the risks in their banking books.

First and foremost, the long period of low and even negative swap rates was followed by strongly rising rates and a volatile market, which impacted the behavior of both customers and banks themselves. At the same time, regulatory developments, initiated by EBA’s new IRRBB guidelines, have shifted the banks’ focus to managing their earnings and earnings risk, rather than economic value risks.

Non-maturing deposits (NMDs) are of particular interest in this respect, given the uncertainty regarding the future pricing strategy and volume developments involved in these products. Moreover, as NMDs are generally modeled with a rather short maturity, the portfolio plays a significant role in the stability of the NII, making this portfolio even more relevant to evaluate in light of the newly introduced Supervisory Outlier Test (SOT) limits on earnings risk (more specific NII), or the local equivalent.

How does this affect IRRBB management at banks?

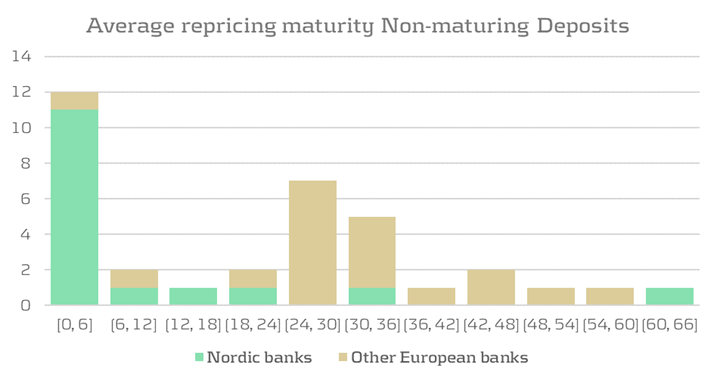

The exact impact of these developments is also heavily dependent on the bank’s local market, and corresponding laws and regulation, as well as the balance sheet composition of the bank. In Nordics countries, banks are affected more heavily, given that loans and mortgages generally have shorter maturities, as compared to other Western European countries like Germany and the Netherlands. This yields a smaller maturity mismatch with on-demand deposits at the liability side, such that a natural hedge exists to some extent within the balance sheet. Earlier on, this effect, combined with the rather stable markets, made active ALM, including IRRBB management, less urgent. The incentive to accurately model NMDs was therefore limited, so most banks simply replicate this funding overnight, while banks in other European countries tend to use a longer maturity, as illustrated by figure 1.

{Figure 1: Difference in average repricing maturity of NMDs between Nordic banks and other European banks, based on Pillar 3 IRRBBA and IRRBB1 disclosures from 2022 annual reports}

While the natural hedge already (partially) mitigates the risks from a value perspective to a large extent, investing the full NMDs portfolio overnight leads to relatively high NII volatility, thereby potentially violating regulatory limitations. The return on overnight investments will directly reflect any changes in the market rates, while deposit rates in reality are usually somewhat slower to include such developments. Although the resulting asymmetry between the investment return and deposit rate to be paid to customers yields a positive result under rising interest rates, it can reduce profits when interest rates start to fall.

Historically, banks in the Nordics experienced less flexibility in the modeling of NMDs, due to regulatory guidelines being somewhat stricter than EBA guidelines. For instance, Sweden’s Finansinspektionen (FI) required banks to replicate these positions overnight. However, relatively recently, the FI updated its regulations (FI dnr 19-4434), allowing banks to somewhat extend the duration of the investment profile, for a limited portion of the portfolio, and up to a maturity of one year. This results in flexibility to update the investment profile to better reflect the expected repricing speed of deposit rates, which could lead to improved NII stability. Additionally, besides applying these revised NMD models for managing banking book risks, they can, when approved, also be used for effective and consistent capital charge calculations under Pillar 2.

How can these developments be properly managed?

Even though the recent market developments create additional challenges in IRRBB management for banks, they also provide opportunities. The margin on deposit products for banks is currently improving, since only part of the interest rate rises is passed through to customers. The increased interest rates also mean that more advanced NMD models, with longer maturity profiles, can have a positive impact on the P&L, while simultaneously improving the interest rate risk management.

In such a rare win-win situation, it is more advantageous than ever to prioritize NMD modeling. In reassessing the interest rate risk management approach towards NMDs, banks should explicitly balance the tradeoff between value and earnings stability when making conceptual choices. These conceptual choices should align with the overall IRBBB strategy, as well as the intended use of the model, to ensure the risk in the portfolio is properly managed.

In weighing these conceptual alternatives, it is essential to take portfolio-specific characteristics into account. This requires an analysis of historical behavior, and an interpretation of how representative this information is. If behavior is expected to change, a common approach is to supplement historical data with expert expectations of forward-looking scenarios to develop a model that reflects both. Periodically reassessing the conceptual choices ensures a proper model lifecycle of NMD portfolios. This is crucial for accurate measurement of interest rate risk as well as for staying competitive in the current market environment.

Would you like to hear more? Contact Bas van Oers for questions on developing a non-maturing deposit model.

Following the regime shift towards steeply increased interest rates, banks face the challenge of keeping their outcomes for the supervisory outlier test (SOT) on the economic value of equity (EVE) within regulatory thresholds. What causes this? And what can banks do?

Over the past decades, banks significantly increased their efforts to implement adequate frameworks for managing interest rate risk in the banking book (IRRBB). These efforts typically focus on defining an IRRBB strategy and a corresponding Risk Appetite Statement (RAS), translating this into policies and procedures, defining the how of the selected risk metrics, and designing the required (behavioral) models. Aspects like data quality, governance and risk reporting are (further) improved to facilitate effective management of IRRBB.

Main causes of volatility in SOT outcomes

The severely changed market circumstances evidence that, despite all efforts, the impact on the IRRBB framework could not be fully foreseen. The challenge of certain banks to comply with one of the key regulatory metrics defined in the context of IRRBB, the SOT on EVE, illustrates this. Indeed, even if regularities are assumed, there are still several key model choices that turn out to materialize in today’s interest rate environment:

- Interest rate dependency in behavioral models: Behavioral models, in particular when these include interest rate-dependent relationships, typically exhibit a large amount of convexity. In some cases, convexity can be (significantly) overstated due to particular modeling choices, in turn contributing to a violation of the EVE SOT criterium. Some (small and mid-sized) banks, for example, apply the so-called ‘scenario multipliers’ and/or ‘scalar multipliers’ defined within the BCBS-standardized framework for incorporating interest rate-dependent relationships in their behavioral models. These multipliers assume a linear relationship between the modeled variable (e.g., prepayment rate) and the scenario, whereas in practice this relationship is not always linear. In other cases, the calibration approach of certain behavioral models is based on interest rates that have been decreasing for 10 to 15 years, and therefore may not be capable to handle a scenario in which a severe upward shock is added to a significantly increased base case yield curve.

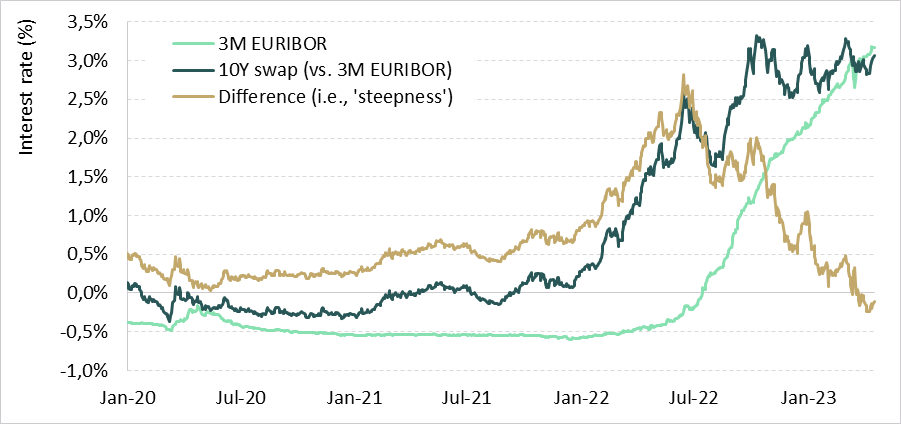

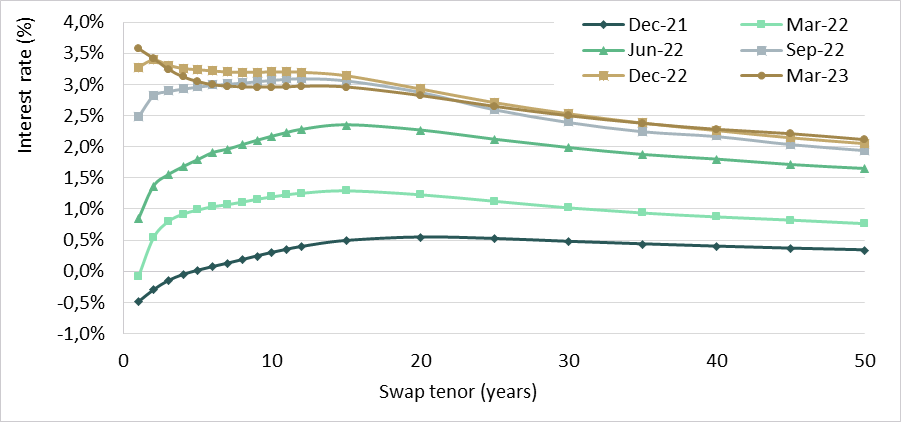

- Level and shape of the yield curve: Related to the previous point, some behavioral models are based on the steepness (defined as the difference between a ‘long tenor’ rate and a ‘short tenor’ rate) of the yield curve. As can be seen in Figure 1, the steepness changed significantly over the past two years, potentially leading to a high impact associated with the behavioral models that are based on it. Further, as illustrated in Figure 2, the yield curve has flattened over time and recently even turned into an inverse yield curve. When calculating the respective forward rates that define the steepness within a particular behavioral model, the downward trend of this variable that results due to the inverse yield curve potentially aggravates this effect.

Figure 1: Development of 3M EURIBOR rate and 10Y swap rate (vs. 3M EURIBOR) and the corresponding 'Steepness'

Figure 2: Development of the yield curve over the period December 2021 to March 2023.

- Hidden vulnerability to ‘down’ scenarios: Previously, the interest rates were relatively close to, or even below, the EBA floor that is imposed on the SOT. Consequently, the ‘at-risk’ figures corresponding to scenarios in which (part of) the yield curve is shocked downward, were relatively small. Now that interest rates have moved away from the EBA floor, hidden vulnerability to ‘down’ scenarios become visible and likely the dominating scenario for the SOT on EVE.

- Including ‘margin’ cashflows: Some banks determine their SOT on EVE including the margin cashflows (i.e., the spread added to the swap rate), while discounting at risk-free rates. While this approach is regulatory compliant, the inclusion of margin cashflows leads to higher (shocked) EVE values, and potentially leads to, or at least contributes to, a violation of the EVE threshold.

What can banks do?

Having identified the above issues, the question arises as to what measures banks should consider. Roughly speaking, two categories of actions can be distinguished. The first category encompasses actions that resolve an inadequate reflection of the actual risk. Examples of such actions include:

- Identify and re-solve unintended effects in behavioral models: As mentioned above, behavioral models are key to determine appropriate EVE SOT figures. Next to revisiting the calibration approach, which typically is based on historical data, banks should assess to what extent there are unintended effects present in their behavioral models that adversely impact convexity and lead to unrepresentative sensitivities and unreliably shocked EVE values.

- Adopt a pure IRR approach: An obvious candidate action for banks that still include margins in their cashflows used for the EVE SOT, is to adopt a pure interest rate risk view. In other words, align the cashflows with its discounting. This requires an adequate approach to remove the margin components from the interest cashflows.

The second category of actions addresses the actual, i.e., economic, risk position of bank. One could think of the following aspects that contribute to steering the EVE SOT within regulatory thresholds:

- Evaluate target mismatch: As we wrote in our article ‘What can banks do to address the challenges posed by rising interest rates’, a bank’s EVE is most likely negatively affected by the rise in rates. The impact is dependent on the duration of equity taken by the bank: the higher the equity duration, the larger the decline in EVE when rates rise (and hence a higher EVE risk). In light of the challenges described above, a bank should consider re-evaluating the target mismatch (i.e. the duration of equity).

- Consider swaptions as an additional hedge instrument: Convexity, in essence, cannot be hedged with plain vanilla swaps. Therefore, several banks have entered into ‘far out of the money’ swaptions to manage negative convexity in the SOT on EVE. From a business perspective, these swaptions result in additional, but accepted costs and P&L volatility. In case of an upward-sloping yield curve, the costs can be partly offset since the bank can increase its linear risk position (increase duration), without exceeding the EVE SOT threshold. This being said, swaptions can be considered a complex instrument that presents certain challenges. First, it requires valuation models – and expertise on these models – to be embedded within the organization. Second, setting up a heuristic that adequately matches the sensitivities of the swaptions to those of the commercial products (e.g., mortgages) is not a straightforward task.

How can Zanders support?

Zanders is thought leader in supporting banks with IRRBB-related topics. We enable banks to achieve both regulatory compliance and strategic risk goals, by offering support from strategy to implementation. This includes risk identification, formulating a risk strategy, setting up an IRRBB governance and framework, policy or risk appetite statements. Moreover, we have an extensive track record in IRRBB and behavioral models, hedging strategies, and calculating risk metrics, both from a model development as well as a model validation perspective.

Are you interested in IRRBB related topics? Contact Jaap Karelse, Erik Vijlbrief (Netherlands, Belgium and Nordic countries) or Martijn Wycisk (DACH region) for more information.

On 2 December 2021, the European Banking Authority (EBA) published three consultation papers related to its ‘Guidelines on the management of interest rate risk arising from non-trading book activities’ (in short, the IRRBB Guidelines). In this article, we focus on one of these consultation papers, concerning the update of the IRRBB Guidelines.

The current version of the IRRBB Guidelines, published in 2018, came into force on 30 June 2019. At that time, the IRRBB Guidelines were aligned with the Standards on interest rate risk in the banking book, published by the Basel Committee on Banking Supervision (in short, the BCBS Standards) in April 2016.

This new update is triggered by the revised Capital Requirements Regulation (CRR2) and Capital Requirements Directive (CRD5). Both documents were adopted by the Council of the EU and the European Parliament in 2019 as part of the Risk Reduction Measures package. The CRR2 and CRD5 included numerous mandates for the EBA to come up with new or adjusted technical standards and guidelines. These are now covered in three separate consultation papers

- The first consultation paper1 describes the update of the IRRBB Guidelines themselves.

- The second paper2 concerns the introduction of a standardized approach (SA) which should be applied when a competent authority deems a bank’s internal model for IRRBB management non-satisfactory. It also introduces a simplified SA for smaller and non-complex institutions.

- The third consultation paper3 offers updates to the supervisory outlier test (SOT) for the Economic Value of Equity (EVE) and the introduction of an SOT for Net Interest Income (NII). Read our analysis on this consultation paper here »

In this article we focus on the first consultation paper. The update of the IRRBB Guidelines can be split up in three topics and each will be discussed in further detail:

- Additional criteria for the assessment and monitoring of the credit spread risk arising from non-trading book activities (CSRBB)

- The criteria for non-satisfactory IRRBB internal systems

- A general update of the existing IRBBB Guidelines

CSRBB

The 2018 IRRBB Guidelines introduced the obligation for banks to monitor CSRBB. However, the publication did not describe how to do this. In the updated consultation paper the EBA defines the measurement of CSRBB as a separate risk class in more detail. The general governance related aspects such as (management) responsibilities, IT systems and internal reporting framework are separately defined for CSRBB, but are similar to those for IRRBB.

Also similar to IRRBB is that banks must express their risk appetite for CSRBB both from an NII as well as an economic value perspective.

The EBA defines CSRBB as:

“The risk driven by changes of the market price for credit risk, for liquidity and for potentially other characteristics of credit-risky instruments, which is not captured by IRRBB or by expected credit/(jump-to-) default risk. CSRBB captures the risk of an instrument’s changing spread while assuming the same level of creditworthiness, i.e. how the credit spread is moving within a certain rating/PD range.”

EBA

Compared to the previous definition, rating/PD migrations are explicitly excluded from CSRBB. Including idiosyncratic spreads could lead to double counting since these are generally covered by a credit risk framework. However, the guidelines give some flexibility to include idiosyncratic spreads, as long as the results are more conservative than when idiosyncratic spreads are excluded. This is because, based on the Quantitative Impact Study of December 2020 (QIS 2020), banks indicated to find it difficult to separate the idiosyncratic spreads from the credit spread.

Also, the scope of CSRBB has changed from the current IRRBB Guidelines. All assets, liabilities and off-balance-sheet items in the banking book that are sensitive to credit spread changes are within the scope of CSRBB whereas the 2018 IRRBB Guidelines focused only on the asset side. Based on the results of the QIS 2020, the EBA concluded that most of the exposures to CSRBB are debt securities which are accounted for at fair value (via Profit and Loss or Other Comprehensive Income). However, this does not rule out that other assets or liabilities could be exposed to CSRBB. It is stated that banks cannot ex-ante exclude positions from the scope of CSRBB. Any potential exclusion of instruments from the scope of CSRBB must be based on the absence of sensitivity to credit spread risk and appropriately documented. At a minimum, banks must include assets accounted at fair value in their scope.

We believe that the obligation to report CSRBB for all assets accounted for at fair value will be challenging for exposures that do not have quoted market prices. Without a deep liquid market, it will be difficult to establish the credits spread risk (even when idiosyncratic risk is included).

Another possible candidate to be included in the scope of CSRBB is the issued funding on the liability side of the banking book, especially in a NII context. When market spreads increase, this could become harmful when the wholesale funding needs to be rolled over against higher credit spread without being able to increase client interest on the asset side. Similar to IRRBB, the exposure to this risk depends on the repricing gap of the assets and liabilities. In this case, however, swaps cannot be used as hedge.

Other products such as consumer loans, mortgages, and consumer deposits, which are typically accounted for at amortized cost, are less likely to be included. This is also stated by the BCBS standards. The BCBS states that the margin (administrative rate) is under absolute control of the bank and hence not impacted by credit spreads. However, it is unclear whether this is sufficient to rule these products out of scope.

Non-satisfactory IRRBB internal systems

The EBA is mandated to specify the criteria for determining an IRRBB internal system as non-satisfactory. The EBA has identified specific items for this that should be considered. At a minimum, banks should have implemented their internal system in compliance with the IRRBB Guidelines, taking into account the principle of proportionality. More specifically:

- Such a system must cover all material interest rate risk components (gap risk, basis risk, option risk).

- The system should capture all material risks for significant assets, liabilities and off-balance sheet type instruments (e.g. non-maturing deposits, loans, and options).

- All estimated parameters must be sufficiently back tested and reviewed, considering the nature, scale and complexity of the bank.

- The internal system must comply with the model governance and the minimum required validation, review and control of IRRBB exposures as detailed by the IRRBB guidelines.

- Competent authorities may require banks to use the standardized approach3 if the internal systems are deemed non-satisfactory.

General update of existing IRRBB Guidelines

Major parts of the guidelines for managing IRRBB have not changed. In the section on IRRBB stress testing, however, a new article (#103) for products with significant repricing restrictions (e.g. an explicit floor on non-maturing deposits – NMDs) is introduced. As part of their stress testing, banks should consider the impact when these products are replaced with contracts with similar characteristics, even under a run-off assumption. The exact intention of this article is unclear. For NII-purposes it is common practice to roll over products with similar characteristics (or use another balance sheet development assumption). Our interpretation of this article is that banks are expected to measure the risk of continued repricing restrictions in an economic value perspective when the maturity of those funding sources is smaller than the maturity of the asset portfolio. This may for example materialize when banks roll over NMDs that are subject to a legally imposed floor.

Another update is the restriction on the maximum weighted average repricing maturity of five years for NMDs. This cap was prescribed for the EVE SOT and is now included for the internal measurement of IRRBB. We believe that the impact of this will be limited since only a few banks will have separate NMD models for internal measurement and the SOT.

Finally, some minor additions have been included in the guidelines. For example, the guidelines emphasize multiple times that when diversification assumptions are used for the measurement of IRRBB, these must be appropriately stressed and validated.

Conclusion

It is expected that the final guidelines will not deviate significantly from the consultation paper. Banks can therefore start preparing for these new expectations. For the measurement of IRRBB, limited changes are introduced in the consultation. Although the exact intention of the EBA is unclear to us, it is interesting to notice that the updated IRRBB Guidelines include the expectation that banks pay special attention in their stress tests to products with significant repricing restrictions. Furthermore, banks must invest in their CSRBB measurement. For their entire banking book, banks need to assess whether market wide credit spread changes will have an impact on an NII and/or economic value perspective. The scope of CSRBB measurement may need to be extended to include the funding issued by the bank. And to conclude, the obligation to measure CSRBB for fair value assets that do not have quoted market prices will be a challenge for banks.

References

On 2 December 2021, the European Banking Authority (EBA) published three consultation papers related to its ‘Guidelines on the management of interest rate risk arising from non-trading book activities’ (in short, the IRRBB Guidelines).

In this article, we focus on one of these consultation papers, which concerns updates to the supervisory outlier test (SOT) for the Economic Value of Equity (EVE) and the introduction of an SOT for Net Interest Income (NII).

The current version of the IRRBB Guidelines, published in 2018, came into force on 30 June 2019. At that time, the IRRBB Guidelines were aligned with the Standards on interest rate risk in the banking book, published by the Basel Committee on Banking Supervision (in short, the BCBS Standards) in April 2016.

The new updates are triggered by the revised Capital Requirements Regulation (CRR2) and Capital Requirements Directive (CRD5). Both documents were adopted by the Council of the EU and the European Parliament in 2019 as part of the Risk Reduction Measures package. The CRR2 and CRD5 included numerous mandates for the EBA to come up with new or adjusted technical standards and guidelines. These are now covered in three separate consultation papers:

- The first consultation paper1 describes an update of the IRRBB Guidelines themselves. The main changes are the specification of criteria to identify “non-satisfactory internal models for IRRBB management” and the specification of criteria to assess and monitor Credit Spread Risk in the Banking Book (CSRBB). Read our analysis on this consultation paper here »

- The second paper2 concerns the introduction of a standardized approach (SA) which should be used when a competent authority deems a bank’s internal model for IRRBB management non-satisfactory. It also introduces a Simplified SA for smaller and non-complex institutions.

- The third consultation paper3 offers updates to the supervisory outlier test (SOT) for the Economic Value of Equity (EVE) and the introduction of an SOT for Net Interest Income (NII).

Please note that we recently also published an article about the new disclosure requirements for IRRBB which is closely related to this topic.

Changes to the supervisory outlier test

Banks have been subject to an SOT already since the 2006 IRRBB Guidelines. The SOT is an important tool for supervisors to perform peer reviews and to compare IRRBB exposures between banks. The SOT measures how the EVE responds to an instantaneous parallel (up and down) yield curve shift of 200 basis points. Changes in EVE that exceed 20% of the institution’s own funds will trigger supervisory discussions and may lead to additional capital requirements.

Some changes to the SOT were included in the 2018 update of the IRRBB Guidelines. Next to further guidance on its calculation, the existing SOT was complemented with an additional SOT. The additional SOT was based on the same metric and guidelines, but the scenarios applied were the six standard interest rate scenarios introduced in the BCBS Standards. Also, a threshold of 15% compared to Tier 1 capital was applied. In the 2018 IRRBB Guidelines, the additional SOT was considered an ‘early warning signal’ only.

The new update of the IRRBB Guidelines includes two important SOT-related changes, which are incorporated through amendments to Article 98 (5) of the CRD: the replacement of the 20% SOT for EVE and the introduction of the SOT for NII. Both changes are discussed in more detail below.

Changes to the supervisory outlier test

Banks have been subject to an SOT already since the 2006 IRRBB Guidelines. The SOT is an important tool for supervisors to perform peer reviews and to compare IRRBB exposures between banks. The SOT measures how the EVE responds to an instantaneous parallel (up and down) yield curve shift of 200 basis points. Changes in EVE that exceed 20% of the institution’s own funds will trigger supervisory discussions and may lead to additional capital requirements.

Some changes to the SOT were included in the 2018 update of the IRRBB Guidelines. Next to further guidance on its calculation, the existing SOT was complemented with an additional SOT. The additional SOT was based on the same metric and guidelines, but the scenarios applied were the six standard interest rate scenarios introduced in the BCBS Standards. Also, a threshold of 15% compared to Tier 1 capital was applied. In the 2018 IRRBB Guidelines, the additional SOT was considered an ‘early warning signal’ only.

The new update of the IRRBB Guidelines includes two important SOT-related changes, which are incorporated through amendments to Article 98 (5) of the CRD: the replacement of the 20% SOT for EVE and the introduction of the SOT for NII. Both changes are discussed in more detail below.

Replacement of the 20% SOT for EVE

The first part of the amended Article 98 (5) concerns the replacement of the original 20% SOT by the 15% SOT. While many banks are probably already targeting levels below 15%, we expect that this change will limit the maneuvering capabilities of banks as they will likely choose to implement a management buffer. Note that not only the threshold is lower (15% instead of 20%), but also the denominator (Tier 1 capital instead of own funds). Furthermore, the worst outcome of all six supervisory scenarios should be used, as opposed to worst outcome of just the two parallel ones. Combined, this leads to a significant reduction in the EVE risk to which a bank may be exposed.

Some other noteworthy updates to the SOT for EVE that are not directly related to the CRD amendment are listed below:

- The post-shock interest floor decreases from -100 to -150 basis points and it increases to 0% over a 50-year instead of a 20-year period.

- In the calibration of the interest rate shocks for currencies for which the shocks have not been prescribed, the most recent 16-year period should be used (instead of the 2000-2015 period which is still underlying the shocks for the other currencies).

- When aggregating the results over currencies, some additional offsetting (80% as opposed to 50%) is granted in case of Exchange Rate Mechanism (ERM) II currencies with a formally agreed fluctuation band narrower than the standard band of +/-15%. Currently, only positions in the Denmark Krona (DKK) qualify for this treatment.

Introduction of the SOT for NII

The second part of the amended Article 98 (5) concerns the introduction of an entirely new SOT. It is aimed at measuring the potential decline in NII for two standard interest rate shock scenarios. Compared to the SOT for EVE, the SOT for NII requires many more modeling assumptions, in particular to determine the expected balance sheet development. The consultation paper provides clarity on the approach the EBA wants to take but two decisions are explicitly consulted.

The SOT for NII compares the NII for a baseline scenario with the NII in a shocked scenario over a one-year horizon. The two shocks that need to be applied are the two instantaneous parallel shocks that are also used in the SOT for EVE. Furthermore, the same requirements that are specified for the SOT for EVE apply, for example the use of the floor and the aggregation approach. The two exceptions are the requirements to use a constant balance sheet assumption (as opposed to a run-off balance sheet) and to include commercial margins and other spread components in the calculations. The commercial margins of new instruments should equal the prevailing levels (as opposed to historical ones).

The two decisions for which the EBA is seeking input are:

The scope/definition of NII

In its narrowest definition, the SOT will focus on the difference between interest income and interest expenses. The EBA, however, also considers using a broader definition where the effect of market value changes of instruments accounted for at Fair Value (∆FV) is added, and possibly also interest rate sensitive fees and commissions.

The definition of the SOT’s threshold

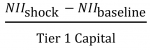

Article 98 (5) requires the EBA to specify what is considered a ‘large decline’ in NII, in which case the competent authorities are entitled to exercise their supervisory powers. This first requires a metric. The EBA is consulting two:

- The first metric is calculating the change in NII (the difference between the shocked and baseline NII) relative to the Tier 1 Capital:

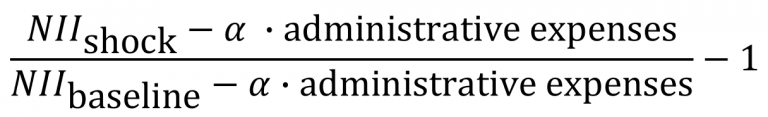

- The second metric is calculating the change in NII relative to the baseline scenario, after correcting for administrative expenses that can be allocated to NII:

- where α is the historical share of NII relative to the operating income as reported based on FINREP input.

The pros of the narrow definition of NII are improved comparability and ease of computation, where the main pro of the broader definition is that it achieves a more comprehensive picture, which is also more in line with the EBA IRRBB Guidelines. With respect to the metrics, the first (capital-based) metric is the simplest and it is comparable to the approach taken for the SOT for EVE. The second metric is close to a P&L-based metric and the EBA argues that its main advantage is that “it takes into account both the business model and cost structure of a bank in the assessment of the continuity of the business operations”. It does involve, however, the application of some assumptions on determining the α parameter.

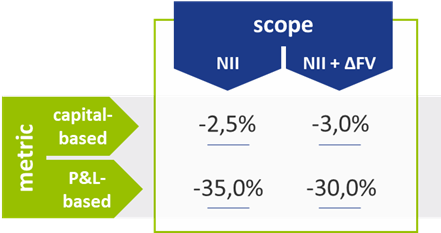

Thresholds for the four possible combinations

For each of the four possible combinations (definition of NII and specification of the metric), the EBA has determined, using data from the December 2020 Quantitative Impact Study (QIS), what the corresponding thresholds should be. Their starting point has been to make the SOT for NII as stringent as the SOT for EVE. Effectively, they reverse engineered the threshold to achieve a similar number of outliers under both measures. We expect that the proposed threshold for any of the four possible combinations will not be constraining for the majority of banks. The resulting proposed thresholds are included in the table below:

Table 1 – Comparison of the proposed thresholds for each combination of metric and scope

The impact of including Fair Value changes seems arbitrary as it increases the threshold for the capital-based metric and decreases the threshold for the P&L-based metric. Also, from a comparability and computational perspective, the narrow definition of NII may be preferred. Furthermore, the capital-based metric is less intuitive for NII than it is for EVE, and consequently, the P&L-based one may be preferred. It is also noted in the consultation paper that if the shocked NII after the correction for administrative expenses (the numerator) is negative, it will also be considered an outlier.

Conclusion

In the past years, many banks have invested heavily in their IRRBB framework following the 2018 update of the IRRBB Guidelines. Once again, an investment is required. Even though there are not many surprises in the proposed updates related to the SOTs, small and large banks alike will need to carefully assess how the changes to the existing SOT and the introduction of the new SOT will impact their interest rate risk management. Banks still have the opportunity to respond to all three consultation papers until 4 April 2022.