This article explores how newly established treasury functions can lay foundations and go beyond day 1 readiness to establish effective, scalable, and resilient cash and liquidity management for the group, representing a critical lever for long-term financial stability and value creation of the business.

Introduction

In the previous article, From Day 1 to Strategic Partner: Building a Treasury Function for a Carved-Out Business, we highlighted the importance of a tailored target operating model (TOM) to establish a solid strategic and organizational base for the new treasury. Following the definition of the treasury TOM and once day 1 readiness measures are in place, the next priority is to focus on value creation via cash and liquidity management, which represent another key pillar for a successful treasury implementation and treasury process. Cash and liquidity capabilities play a vital role in ensuring treasury delivers both operational continuity and strategic value. This article outlines how to build that foundation by establishing robust and forward-looking cash and liquidity management processes already at the time of the transaction, addressing immediate post-transaction needs, and enabling mid-term process efficiency.

Prepare for Day 1: Managing Liquidity Readiness

When preparing for the closing of an M&A transaction, treasury plays a critical role in ensuring that the new organization operates independently from Day 1. Liquidity planning is essential as cash pressures often peak around the time of legal close.

The following aspects may erase cash reserves if not properly anticipated:

- Upfront costs (transaction fees, legal, advisory, integration).

- Debt financing frameworks still under negotiation.

- Cash repatriation constraints or internal investment requirements to support the separation.

Hence, treasury must address these topics in cash and liquidity planning by:

- Modeling short-term needs under multiple scenarios based on validated assumptions on the business’ structure and liquidity needs.

- Ensuring cash visibility and centralization of cash, where possible to manage funding efficiently.

- Evaluating working capital buffers and the need for interim funding lines.

By addressing these topics before closing, the new entity enters day 1 with visibility on liquidity positions, funding plans, and confidence in its ability to operate independently.

Manage Day 1: Establishing Control, Visibility and Centralization

For a newly independent entity, cash visibility is often fragmented across systems and bank accounts, especially in the early stages after a carve-out. Yet gaining (real-time) transparency is fundamental to effective cash management and decision-making. The foundational elements to achieve at this stage are:

- Set up efficient connectivity with all banking partners.

- Deploy treasury technology (e.g., a TMS or interim solution) to aggregate bank balances and transactions centrally.

- Implement daily cash positioning processes across all relevant bank accounts.

- Define responsibilities and control mechanisms for cash operations, ensuring a clear RACI model.

Cash visibility improves control and reduces risk while enabling better liquidity allocation across the group via a centralized cash management process. The deployment of cash concentration structures, such as cash pooling, allows the unlocking of financial resources and benefits, such as fee reduction or interest optimization. Furthermore, centralized cash management data is a prerequisite for AI-driven cash applications and greater financial risk exposure definition1, which can significantly reduce manual effort in distributing and managing cash across the group.

Early Stabilization: Forecasting and Short-Term Control

Once operational continuity is secured, the focus should move to stabilizing cash and liquidity processes.

Forecasting in a post-carve-out environment is challenging, yet essential. Missing historical data, unclear transaction volumes, and transitional arrangements (e.g., TSAs) often reduce forecast accuracy.

A suitable solution is the deployment of a layered forecasting approach, including:

- Short-term cash flow forecasts (typically 13-week rolling) to guide immediate liquidity needs.

- Medium-term liquidity planning, integrated with business planning (FP&A) and CAPEX cycles.

- Stress-testing and scenario analysis to evaluate performance under simulated business conditions.

In our experience, cash forecasting is an evolving process, which can be optimized and automated over-time through data integration (e.g. from ERP system) and predictive modeling. With data quality as the foundation, cash flow forecasting can begin by establishing the most accurate starting point and committed forecasts under company control, such as opening balances and invoice payables. Once the high-certainty inputs are captured, additional cash flows such as committed accounts receivable and other material forecasts e.g. sales forecast or CAPEX forecast can be integrated.

Carved-out entities must consider the growing maturity and quality of their systems and respective data over the first 12 months after day 1.

Designing a Fit-for-Purpose Liquidity Structure

Once visibility and forecasting are addressed, the focus should immediately shift to structuring liquidity flows across the new organization. The objective is to ensure funding efficiency, mitigate cash drag and trapped cash, and enable flexibility, all within the constraints of the newly formed legal and operational setup.

Key design considerations include:

- Tailored cash pooling and automated cash concentration structures.

- Intercompany funding structures, including currency and transfer pricing alignment and documentation.

- Liquidity buffers tailored to business volatility and seasonality.

- Working capital optimization levers (e.g., payment terms, supplier financing).

Hybrid liquidity management structures, combining centralized oversight with localized autonomy for operational banking, often achieve the best balance. Zanders supports clients based on its wide experience in bank relationship strategy and liquidity optimization for disentanglements.

Optimizing Cash Flow Management towards long-term state

Throughout the transition and towards the steady-state operations, treasury must monitor and manage cash & liquidity against an evolving backdrop of business integration activities and one-off events.

These may include:

- Working capital shifts based on new supply chains or changes in customer behaviour.

- Integration costs linked to systems, people, and process harmonization.

- Divestitures or asset sales to fund operations or sharpen the business focus.

- Cash flow issues caused by system delays or supplier renegotiations.

To address this, Treasury should establish daily cash positioning routines utilizing state-of-the-art technologies and tools, escalation mechanisms, and strong collaboration with FP&A, procurement, and tax. Treasury shall also foster a “Cash First” mindset in the newly created organization. This ensures quick resolution of bottlenecks and reinforce cash flow discipline.

Strategic Liquidity Considerations for Long-Term Success

Cash and liquidity decisions taken during a carve-out will influence the new company’s financial flexibility as it takes quite some time and effort to implement changes in liquidity structures considerably at a later stage. Therefore, treasury should consider as early as possible the following aspects:

- Debt and credit rating impacts, especially if carve-out funding involves leverage.

- Treasury risk centralization (especially FX risk), to reduce cross-border inefficiencies and improve hedging performance.

- Tax and regulatory considerations, such as repatriation limitations, transfer pricing, and cash tax leakage.

- Strategic investment readiness, ensuring adequate liquidity for future M&A, CAPEX, or digital transformation.

The liquidity setup must be scalable, allowing the business to respond confidently to rapid growth, market volatility, or external shocks with resilient measures.

Zanders’ clearly sees a need for treasury functions to evolve into applying strategic enterprise liquidity models providing an efficient framework to link various stakeholders around the office of the CFO, including treasury, FP&A, risk management, accounting and more. A group-wide approach ensures alignment, cooperation and can lead to faster and more informed decision-making processes.

A Roadmap to Liquidity Maturity

The path to liquidity excellence starts with day 1 readiness preparation and implementation but extends far beyond. Treasury should approach this evolution through a structured roadmap that includes:

- Standardization of forecasting processes and technology tools.

- Centralization of liquidity governance, structures, and banking relationships.

- Continuous optimization of working capital, pooling structures, and investment of surplus funds.

- Measurement and benchmarking of liquidity KPIs and stress performance.

We bring a proven methodology and deep experience in day 1 planning and execution, as well as in post-M&A treasury transformation. We help clients design and implement cash and liquidity frameworks that deliver control, flexibility, and strategic value.

In the next edition of this series, we look at implementing effective banking strategy and funding practices within the newly carved-out entity, including key areas of focus and potential challenges.

Citations

- To learn more about this topic, read the whitepaper: Brace for AI-mpact: The six trends driving treasuries forward in 2025 - Zanders ↩︎

Ready to implement cash and liquidity management?

Contact us

The adoption of ISO 20022 XML standards significantly enhances invoice reconciliation and operational efficiency, improving working capital management and Days Sales Outstanding (DSO).

Whether a corporate operates through a decentralized model, shared service center or even global business services model, identifying which invoices a customer has paid and in some cases, a more basic "who has actually paid me" creates a drag on operational efficiency. Given the increased focus on working capital efficiencies, accelerating cash application will improve DSO (Days Sales Outstanding) which is a key contributor to working capital. As the industry adoption of ISO 20022 XML continues to build momentum, Zanders experts Eliane Eysackers and Mark Sutton provide some valuable insights around why the latest industry adopted version of XML from the 2019 ISO standards maintenance release presents a real opportunity to drive operational and financial efficiencies around the reconciliation domain.

A quick recap on the current A/R reconciliation challenges

Whilst the objective will always be 100% straight-through reconciliation (STR), the account reconciliation challenges fall into four distinct areas:

1. Data Quality

- Partial payment of invoices.

- Single consolidated payment covering multiple invoices.

- Truncated information during the end to end payment processing.

- Separate remittance information (typically PDF advice via email).

2. In-country Payment Practices and Payment Methods

- Available information supported through the in-country clearing systems.

- Different local clearing systems – not all countries offer a direct debit capability.

- Local market practice around preferred collection methods (for example the Boleto in Brazil).

- ‘Culture’ – some countries are less comfortable with the concept of direct debit collections and want full control to remain with the customer when it comes to making a payment.

3. Statement File Format

- Limitations associated with some statement reporting formats – for example the Swift MT940 has approximately 20 data fields compared to the ISO XML camt.053 bank statement which contains almost 1,600 xml tags.

- Partner bank capability limitations in terms of the supported statement formats and how the actual bank statements are generated. For example, some banks still create a camt.053 statement using the MT940 as the data source. This means the corporates receives an xml MT940!

- Market practice as most companies have historically used the Swift MT940 bank statement for reconciliation purposes, but this legacy Swift MT first mindset is now being challenged with the broader industry migration to ISO 20022 XML messaging.

4. Technology & Operations

- Systems limitations on the corporate side which prevent the ERP or TMS consuming a camt.053 bank statement.

- Limited system level capabilities around auto-matching rules based logic.

- Dependency on limited IT resources and budget pressures for customization.

- No global standardized system landscape and operational processes.

How can ISO20022 XML bank statements help accelerate and elevate reconciliation performance?

At a high level, the benefits of ISO 20022 XML financial statement messaging can be boiled down into the richness of data that can be supported through the ISO 20022 XML messages. You have a very rich data structure, so each data point should have its own unique xml field. This covers not only more structured information around the actual payment remittance details, but also enhanced data which enables a higher degree of STR, in addition to the opportunity for improved reporting, analysis and importantly, risk management.

Enhanced Data

- Structured remittance information covering invoice numbers, amounts and dates provides the opportunity to automate and accelerate the cash application process, removing the friction around manual reconciliations and reducing exceptions through improved end to end data quality.

- Additionally, the latest camt.053 bank statement includes a series of key references that can be supported from the originator generated end to end reference, to the Swift GPI reference and partner bank reference.

- Richer FX related data covering source and target currencies as well as applied FX rates and associated contract IDs. These values can be mapped into the ERP/TMS system to automatically calculate any realised gain/loss on the transaction which removes the need for manual reconciliation.

- Fees and charges are reported separately, combined a rich and very granular BTC (Bank Transaction Code) code list which allows for automated posting to the correct internal G/L account.

- Enhanced related party information which is essential when dealing with organizations that operate an OBO (on-behalf-of) model. This additional transparency ensures the ultimate party is visible which allows for the acceleration through auto-matching.

- The intraday (camt.052) provides an acceleration of this enhanced data that will enable both the automation and acceleration of reconciliation processes, thereby reducing manual effort. Treasury will witness a reduction in credit risk exposure through the accelerated clearance of payments, allowing the company to release goods from warehouses sooner. This improves customer satisfaction and also optimizes inventory management. Furthermore, the intraday updates will enable efficient management of cash positions and forecasts, leading to better overall liquidity management.

Enhanced Risk Management

- The full structured information will help support a more effective and efficient compliance, risk management and increasing regulatory process. The inclusion of the LEI helps identify the parent entity. Unique transaction IDs enable the auto-matching with the original hedging contract ID in addition to credit facilities (letters of credit/bank guarantees).

In Summary

The ISO 20022 camt.053 bank statement and camt.052 intraday statement provide a clear opportunity to redefine best in class reconciliation processes. Whilst the camt.053.001.02 has been around since 2009, corporate adoption has not matched the scale of the associated pain.001.001.03 payment message. This is down to a combination of bank and system capabilities, but it would also be relevant to point out the above benefits have not materialised due to the heavy use of unstructured data within the camt.053.001.02 message version.

The new camt.053.001.08 statement message contains enhanced structured data options, which when combined with the CGI-MP (Common Global Implementation – Market Practice) Group implementation guidelines, provide a much greater opportunity to accelerate and elevate the reconciliation process. This is linked to the recommended prescriptive approach around a structured data first model from the banking community.

Finally, linked to the current Swift MT-MX migration, there is now agreement that up to 9,000 characters can be provided as payment remittance information. These 9,000 characters must be contained within the structured remittance information block subject to bilateral agreement within the cross border messaging space. Considering the corporate digital transformation agenda – to truly harness the power of artificial intelligence (AI) and machine learning (ML) technology – data – specifically structured data, will be the fuel that powers AI. It’s important to recognize that ISO 20022 XML will be an enabler delivering on the technologies potential to deliver both predictive and prescriptive analytics. This technology will be a real game-changer for corporate treasury not only addressing a number of existing and longstanding pain-points but also redefining what is possible.

The Swift MT-MX migration and global industry adoption of ISO 20022 XML are more than just a simple compliance change.

The corporate treasury agenda continues to focus on cash visibility, liquidity centralization, bank/bank account rationalization, and finally digitization to enable greater operational and financial efficiencies. Digital transformation within corporate treasury is a must have, not a nice to have and with technology continuing to evolve, the potential opportunities to both accelerate and elevate performance has just been taken to the next level with ISO 20022 becoming the global language of payments. In this 6th article in the ISO 20022 XML series, Zanders experts Fernando Almansa, Eliane Eysackers and Mark Sutton provide some valuable insights around why this latest global industry move should now provide the motivation for corporate treasury to consider a cash management RFP (request for proposal) for its banking services.

Why Me and Why Now?

These are both very relevant important questions that corporate treasury should be considering in 2024, given the broader global payments industry migration to ISO 20022 XML messaging. This goes beyond the Swift MT-MX migration in the interbank space as an increasing number of in-country RTGS (real-time gross settlement) clearing systems are also adopting ISO 20022 XML messaging. Swift are currently estimating that by 2025, 80% of the domestic high value clearing RTGS volumes will be ISO 20022-based with all reserve currencies either live or having declared a live date. As more local market infrastructures migrate to XML messaging, there is the potential to provide richer and more structured information around the payment to accelerate and elevate compliance and reconciliation processes as well as achieving a more simplified and standardized strategic cash management operating model.

So to help determine if this really applies to you, the following questions should be considered around existing process friction points:

- Is your current multi-banking cash management architecture simplified and standardised?

- Is your account receivables process fully automated?

- Is your FX gain/loss calculations fully automated?

- Have you fully automated the G/L account posting?

- Do you have a standard ‘harmonized’ payments message that you send to all your banking partners?

If the answer is yes to all the above, then you are already following a best-in-class multi-banking cash management model. But if the answer is no, then it is worth reading the rest of this article as we now have a paradigm shift in the global payments landscape that presents a real opportunity to redefine best in class.

What is different about XML V09?

Whilst structurally, the XML V09 message only contains a handful of additional data points when compared with the earlier XML V03 message that was released back in 2009, the key difference is around the changing mindset from the CGI-MP (Common Global Implementation – Market Practice) Group1 which is recommending a more prescriptive approach to the banking community around adoption of its published implementation guidelines. The original objective of the CGI-MP was to remove the friction that existed in the multi-banking space as a result of the complexity, inefficiency, and cost of corporates having to support proprietary bank formats. The adoption of ISO 20022 provided the opportunity to simplify and standardize the multi-banking environment, with the added benefit of providing a more portable messaging structure. However, even with the work of the CGI-MP group, which produced and published implementation guidelines back in 2009, the corporate community has encountered a significant number of challenges as part of their adoption of this global financial messaging standard.

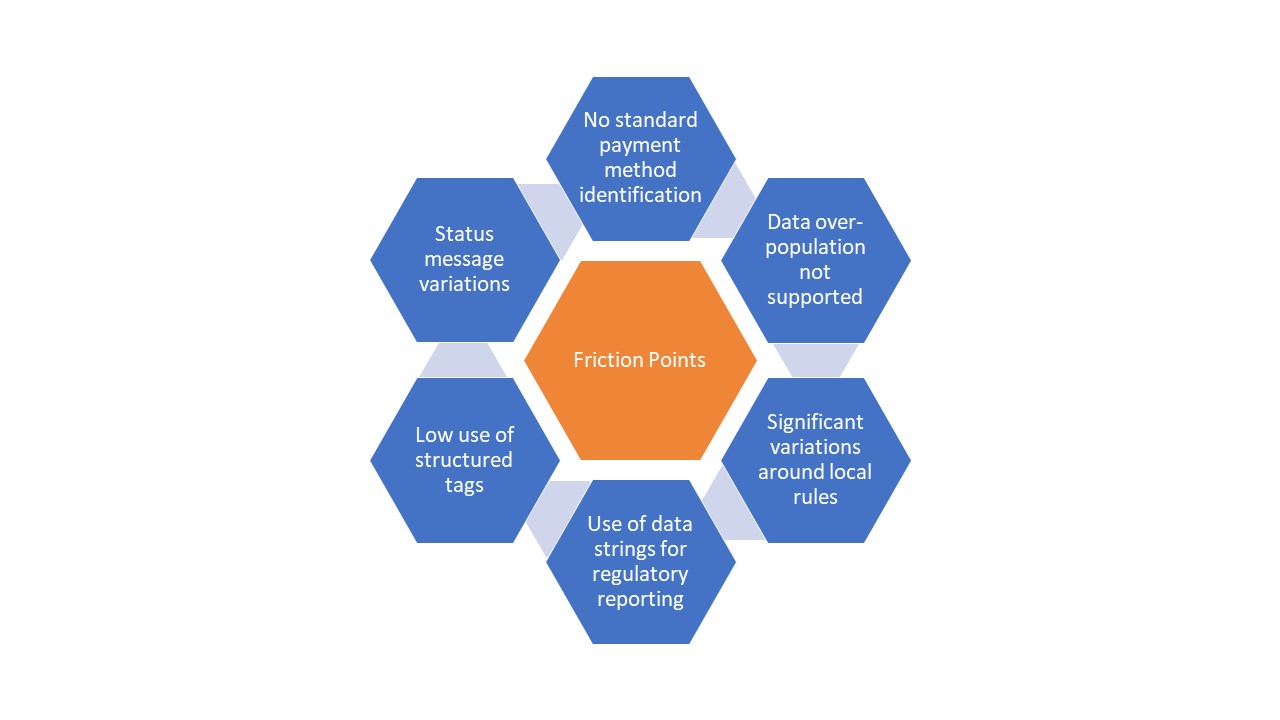

The key friction points are highlighted below:

Diagram 1: Key friction points encountered by the corporate community in adopting XML V03

The highlighted friction points have resulted in the corporate community achieving a sub-optimal cash management architecture. Significant divergence in terms of the banks’ implementation of this standard covers a number of aspects, from non-standard payment method codes and payment batching logic to proprietary requirements around regulatory reporting and customer identification. All of this translated into additional complexity, inefficiency, and cost on the corporate side.

However, XML V09 offers a real opportunity to simplify, standardise, accelerate and elevate cash management performance where the banking community embraces the CGI-MP recommended ‘more prescriptive approach’ that will help deliver a win-win situation. This is more than just about a global standardised payment message, this is about the end to end cash management processes with a ‘structured data first’ mindset which will allow the corporate community to truly harness the power of technology.

What are the objectives of the RFP?

The RFP or RFI (request for information) process will provide the opportunity to understand the current mindset of your existing core cash management banking partners. Are they viewing the MT-MX migration as just a compliance exercise. Do they recognize the importance and benefits to the corporate community of embracing the recently published CGI-MP guidelines? Are they going to follow a structured data first model when it comes to statement reporting? Having a clearer view in how your current cash management banks are thinking around this important global change will help corporate treasury to make a more informed decision on potential future strategic cash management banking partners. More broadly, the RFP will provide an opportunity to ensure your core cash management banks have a strong strategic fit with your business across dimensions such as credit commitment, relationship support to your company and the industry you operate, access to senior management and ease of doing of business. Furthermore, you will be in a better position to achieve simplification and standardization of your banking providers through bank account rationalization combined with the removal of non-core partner banks from your current day to day banking operations.

In Summary

The Swift MT-MX migration and global industry adoption of ISO 20022 XML should be viewed as more than just a simple compliance change. This is about the opportunity to redefine a best in class cash management model that delivers operational and financial efficiencies and provides the foundation to truly harness the power of technology.

Citations

- Common Global Implementation–Market Practice (CGI-MP) provides a forum for financial institutions and non-financial institutions to progress various corporate-to-bank implementation topics on the use of ISO 20022 messages and to other related activities, in the payments domain. ↩︎

Economic instability, a pandemic, geopolitical turbulence, rising urgency to get to net zero – a continuousstream of demands and disruption have pushed businesses to their limits in recent years.

Economic instability, a pandemic, geopolitical turbulence, rising urgency to get to net zero – a continuousstream of demands and disruption have pushed businesses to their limits in recent years. What this has proven without doubt is that treasury can no longer continue to be an invisible part of the finance function. After all, accurate cash flow forecasting, working capital and liquidity management are all critical C-suite issues. So, with the case for a more strategic treasury accepted, CFOs are now looking to their corporate treasurer more than ever for help with building financial resilience and steering the business towards success.

The future form of corporate treasury is evolving at pace to meet the demands, so to bring you up to speed, we discuss in this article five key observations we believe will have the most significant impact on the treasury function in the coming year(s).

1. A sharper focus on productivity and performance

Except for some headcount reductions, treasury has remained fairly protected from the harsh cost-cutting measures of recent years. However, with many OPEX and CAPEX budgets for corporate functions under pressure, corporate treasurers need to be prepared to justify or quantify the added value of their function and demonstrate how treasury technology is contributing to operational efficiencies and cost savings. This requires a sharper focus on improving productivity and enhancing performance.

To deliver maximum performance in 2024, treasury must focus on optimizing structures, processes, and implementation methods. Further digitalization (guided by the blueprint provided by Treasury 4.0) will naturally have an influential role in process optimization and workflow efficiency. But to maintain treasury budgets and escape an endless spiral of cost-cutting programs will take a more holistic approach to improving productivity. This needs to incorporate developments in three factors of production – personnel, capital, and data (in this context, knowledge).

In addition, a stronger emphasis on the contribution of treasury to financial performance is also required. Creating this direct link between treasury output and company financial performance strengthens the function’s position in budget discussions and reinforces its role both in finance transformation processes and throughout the financial supply chain.

2. Treasury resilience, geopolitical risk and glocalization

Elevated levels of geopolitical risk are triggering heightened caution around operational and financial resilience within multinationals. As a result, many corporations are rethinking their geographical footprint and seeking ways to tackle overdependence on certain geographical markets and core suppliers. This has led to the rise of ‘glocalization’ strategies, which typically involve moving away from the traditional approach of offshoring operations to low-cost destinations to a more regional approach that’s closer to the end market.

The rise of glocalization is forcing treasury to recalibrate its target operating model to adopt a more regionalized approach. This typically involves changing from a ‘hub and spoke’ model to multiple hubs. But the impact on treasury is not only structural. Operating in many emerging and frontier markets creates heightened risks around currency restrictions, lack of local funding and the inability to repatriate cash. Geopolitical tensions can also have spillover effects to the financial markets in these countries. This necessitates the application of more financial resilience thinking from treasury.

3. Cash is king, data is queen

Cash flow forecasting remains a top priority for corporate treasurers. This is driving the rise of technology capable of producing more accurate cash flow predictions, faster and more efficiently. Predictive and prescriptive analytics and AI-based forecasting provide more precise and detailed outcomes compared to human forecasting. While interfaces or APIs can be applied to accelerate information gathering, facilitating faster and automated decision-making. But to leverage the benefits of these advanced applications of technology requires robust data foundations. In other words, while technology plays a role in improving the cash flow forecasting process, it relies on an accurate and timely source of real-time data. As such, one can say that cash may still be king, but data is queen.

In addition, a 2023 Zanders survey underscored the critical importance of high-quality data in financial risk management. In particular, the survey highlighted the criticality of accurate exposure data and pointed out the difficulties faced by multinational corporations in consolidating and interpreting information. This stressed the necessity of robust financial risk management through organizational data design, leveraging existing ERP or TMS technology or establishing a data lake for processing unstructured data.

4. The third wave of treasury digitalization

We’ve taken the three waves of digitalization coined by Steve Case (former CEO of US internet giant AOL) and applied them to the treasury function. The first wave was the development of stand-alone treasury and finance solutions, followed by the second wave bringing internal interfaces and external connectivity between treasury systems. The third wave is about how to leverage all the data coming from this connected treasury ecosystem. With generative AI predicted to have an influential role in this third phase, corporate treasurers need to incorporate the opportunities and challenges it poses into their organizations' digital transformation journeys and into discussions and decisions related to other technologies within their companies, such as TMS, ERP, and banking tools.

We also predict the impact and success of this third wave in treasury digitalization will be dependent on having the right regulatory frameworks to support its implementation and operation. The reality is, although we all aspire to work in a digital, connected world, we must be prepared to encounter many analogue frictions – like regulatory requirements for paper-based proof, sometimes in combination with ‘wet’ signatures and stamped documents. This makes the adoption of mandates, such as the MLETR (Model Law on Electronic Transferable Records) a priority.

5. Fragmentation and interoperability of the payment landscape

A side effect of the increasing momentum around digital transformation is fragmentation across the payments ecosystem. This is largely triggered by a rapid acceleration in the use of digital payments in various forms. We’ve now seen successful trials of Central Bank Digital Currency, Distributed Ledger Technology to enable cross border payments, a rise in the use of digital wallets not requiring a bank account, and the application of cross border instant payments. All of these developments lead us to believe that international banking via SWIFT will be challenged in the future and treasurers should prepare for a more fragmented international payment ecosystem that supports a multitude of different payment types. To benefit from this development, interoperability will be crucial.

Conclusion: A turning point for treasury

A succession of black swan events in recent years has exposed a deep need for greater financial resilience. The treasury function plays a vital role in helping their CFO build this. This is accelerating both the scale and pace of transformation across the treasury function, with wide-ranging effects on its role in the C-suite, position in finance, the priorities and structure of the function, and the investment required to support much-needed digitalization.

For more information on the five observations outline here, you can read the extended version of this article.

IUCN’s transformation towards a unified global cash management approach helped streamline banking relationships and improve visibility, supporting its mission to address global conservation challenges more efficiently.

In 2014, the International Union for Conservation of Nature (IUCN) launched their Global Cash Management Project in order to improve cash management policies and processes throughout the organization. IUCN chose Zanders as their trusted advisor to support them on the journey.

IUCN was founded in 1948 and is composed of 1,300 members, including governments and non-governmental organizations. The ability to convene diverse stakeholders and provide the latest science and on-the-ground expertise drives IUCN’s mission of informing and empowering conservation efforts worldwide. IUCN’s work is centered on three key areas: promoting effective and equitable governance of nature’s use, nature-based solutions to global challenges, and valuing and conserving nature.

Combatting the Challenges

From their 40 locations around the world, IUCN works together with local partners to use nature-based solutions to combat the challenges arising from climate change, loss of biodiversity, and food and water security. IUCN is active on an international level, seeking to influence policymakers and governance mechanisms. On a national and local level, they advise governments and stakeholders on translating international commitments into applicable policies and frameworks. Through a network of some 16,000 experts, IUCN gathers and generates knowledge for publicly available databases managed by IUCN. One such database is the IUCN Red List of Threatened Species, which gives an assessment of the extent a species is threatened and an indication of the extinction risk, thereby promoting conservation.

Fragmented Treasury Management Approach

The local nature of IUCN’s project work is reflected in their organizational structure with 32 country offices and 9 regional offices. This has historically given a great deal of independence to the local finance departments in IUCN. “Our regional offices and local offices have a great deal of autonomy, and as a result, finance has followed that autonomy, so each office essentially has its own finance function,” Mike Davis, chief financial officer for the Global IUCN Secretariat, explains.

The decentralized and autonomous nature of the finance department led to a fragmented treasury management approach with each local office taking on cash management and foreign exchange activities themselves. This resulted in a lack of visibility of the global cash position, decentralized collections of donations, and inefficient foreign exchange management performed locally.

Transformation

During the last few years, IUCN transitioned from directing the disparate operations and initiatives across the organization towards a more global and unified approach. “We are moving towards a more integrated organization,” says Davis. “For example, when considering climate change, a global approach is taken with initiatives translating into global programs implemented in several countries, as opposed to each region or each country developing its own projects on a local level. This also impacts how you then organize and manage your resources, which then has an impact on the treasury function as well.”

To support this transformation, IUCN implemented one common Enterprise Resource Planning (ERP) system across their entire organization, which replaced the stand-alone systems used in the local offices around the world. From a treasury perspective, the rollout of the ERP system was the first step towards creating better visibility of the total cash position in the organization.

Global Cash Management Project

Further integration between the global finance operations was initiated when IUCN launched their global cash management project. Zanders supported IUCN by charting a new cash management course to provide insights into market best practices and strategic guidance on future-proofing bank relationship management. Zanders began by conducting a thorough study of the cash management processes at IUCN to create a report of improvement initiatives. The primary recommendations were for the IUCN Finance Department to implement a uniform cash management policy across the organization and to rationalize their broad, diverse, and costly banking portfolio. Davis: “We chose Zanders because of their expertise in treasury and good reputation among other international organizations.”

Bank Rationalization Initiatives

The IUCN banking portfolio consisted of 46 banks and a dispersed bank account structure with approximately 160 bank accounts. The growing bank portfolio inhibited the visibility and control of cash. Furthermore, the dominance of local autonomy and a decentralized organization left IUCN with an inability to leverage banking relationships between the global secretariat, regional, and country offices. IUCN had an ineffective banking structure with regards to the number of bank accounts, service level, and competitiveness on fees provided by the banking partners. Additionally, the magnitude of bank accounts had operational maintenance and management implications because they required excessive manual time and effort to maintain. Introducing a banking landscape that supports efficient processes and reduces internal costs spent on maintaining bank accounts were key objectives for the bank rationalization initiatives. “Our main objective was to have efficient processes and to rationalize our banking structure because with that you can reduce risk, the amount of time in your organization spent on managing different relationships and also reduce the number of bank accounts. As each bank account has an internal cost, I would say the internal costs were far more important to us than the external costs,” Davis says.

Request for Information

By the end of 2015, IUCN issued, with the support of Zanders, a Request for Information (RFI) to eight banks identified to either have a global reach and footprint matching IUCN requirements or otherwise be material for IUCN. In total, 51 countries were included in the RFI. The RFI invited banks with global and regional capabilities to elaborate on their cash management offerings which were relevant for the business and geographical areas of IUCN. This included the services offered for cash management, payment processing, foreign currency disbursement, reporting capabilities, and connectivity solutions. Davis explains: “The Zanders team was very helpful throughout the whole process and very willing to adapt their services to what we needed and to think about different approaches before advising on what would be the best approach for us. We chose a more agile path with the RFI route, as opposed to a more formal RFP, which was then adjusted so it best met our needs and budget.”

Local Offering, Global Presence

To best facilitate and run nature conservation projects around the world, IUCN organizes itself in 9 regions; Asia, West Asia, Eastern & Southern Africa, West & Central Africa, Europe, Eastern Europe and Central Asia, Mexico Central America & Caribbean, Oceania, and South America. This localized, regional structure played a significant role in determining IUCN’s new banking landscape.

“Compared to other international organizations, IUCN has formed their regions in a much more localized manner, which then also becomes key when rationalizing and selecting new global banking partners as one has to balance the local offering with the global presence,” says Liam Ó Caoimh, director at Zanders.

Preferred Banking Partners

IUCN received RFI responses from five international banks. A six-sigma scoring and evaluation tool assessed the five proposals, which IUCN and Zanders evaluated together. IUCN used the results of the assessment to select three banks as the preferred choice for international banking partners. These three banks together cover 70 percent of the countries in scope for IUCN. For the secretariat’s headquarters in Switzerland, the bank relationship was kept with IUCN’s existing Swiss banking partner. By reducing the broad banking landscape to a manageable portfolio of relationships, IUCN’s treasury focuses more on supporting the field offices around the world under the guidance of a lean yet strong global cash management framework.

Would you like to know more? Contact us today.