Data migration objects: master and transactional

Data migration is the process of transferring data from a source (e.g. a legacy system or other type of data storage) to the target system – SAP. However, data migration is not simply a ‘lift and shift’ exercise, the data must also be transformed and made complete in order to efficiently facilitate the required business operations in the new system.

Since the vast majority of business processes can be supported via SAP, the variety of master data objects that are required becomes extremely large. SAP SCM (Supply Chain Management) module necessitates, for example, information about the materials, production sequencing or routing schedules while HCM (human capital management) requires data regarding employees and organizational structure. This article will focus in detail on the TRM (treasury and risk management) module and the typical master data objects that are required for its successful operation.

Core Treasury related Master data objects include but not limited to:

Business Partners:

Business Partner data contains information about the trading counterparties a corporate operates a business with. This data is very diverse and includes everything starting from names, addresses and bank accounts to types of approved transactions and currencies they should take place in. The business partner data is structured in a specific way. There are several concepts which should be defined and populated with data:

- Business Partner Category: defines what kind of party the business partner (private individual, subsidiary, external organization, etc.) is and basic information such as name and address

- Business Partner Role: defines the business classification of a business partner (Employee”, “Ordering Party” or “Counterparty”). This determines which kinds of transactions can occur with this business partner.

- Business Partner Relationship: This represents the relationship between two business partners.

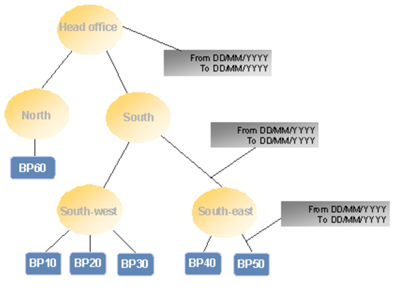

- Business Partner Group Hierarchy: The structure of a complex organization with many subsidiaries or office geographies can be defined here.

Figure 1: the organizational structure of a company with various branches, according to the region to which they belong. Source: SAP Help Portal

House bank accounts:

This master data object contains information regarding the bank accounts at the house banks. It consists of both basic information such as addresses, phone numbers and bank account numbers, as well as more complicated information, such as the assignment of which bank account should be used for transactions within certain currencies.

In-house cash (IHC):

IHC data includes:

- Bank accounts

- Conditions: interest, limits etc.

Another important part of data migration is transactional data, which includes Financial transactions (deals), FX exposure figures etc.

Financial transactions:

Transactional data includes active and expired deals, which have been booked in the legacy system. The migration of such data may also require consolidation of information from several sources and its enhancement meanwhile maintaining its accuracy during the transfer. The amount of data is usually very large, adding another layer of complexity to the migration of this master data object.

The above examples of the master and transactional data objects relevant to SAP TRM give an insight into the complexity and volume of data required for a full and successful data migration. To execute such a task, there are a few approaches that can be utilized, which are supported by the data migration solutions discussed below.

Legacy Data migration solutions

At Zanders, we may propose different solutions for data migration, which are heavily dependent on a client specific characteristics. The following factors are taken into account:

- Specificity of the data migration object (complexity, scope)

- Type and quantity of legacy and target systems (SAP R/3, ECC, HANA, non-SAP, Cloud or on premise etc.)

- Frequency to which the migration solution is to be used (one off or multiple times)

- The solution ownership (IT support or Business)

After analysis of the above factors, the following SAP standard solutions from the below list may be proposed.

SAP GUI Scripting: is an interface to SAP for Windows and Java. Users can automate manual tasks through recording scripts per a specific manual process, and with a complete and correct dataset, the script will create the data objects for you. Scripting is usually used to support the business with different parts of the data migration or enhancement and is often developed and supported in-house for micro and recurrent migration activities.

SAP LSMW (Legacy System Migration Workbench) was a standard SAP data upload solution used in SAP ECC. It allowed the import of data, its required conversion and its export to the target SAP system. LSMW supports both batch and direct input methods. The former required the data to be formatted in a standardized way and stored in a file. This data was then uploaded automatically, with the downside of following a regular process involving transaction codes and processing screens. The latter required the use of an ABAP program, which uploads the data directly into the relevant data tables, omitting the need of transaction codes and processing screens seen in batch input methods.

SAP S/4 HANA Migration cockpit is a recommended standard data migration tool for SAP S/4 HANA. With this new iteration the tool became much more user friendly and simple to use. It supports the following migration approaches:

- Transfer data using files: SAP provides templates for the relevant objects.

- Transfer data using staging tables. Staging tables are created automatically in SAP HANA DB schema. Populate the tables with the business data and load into SAP S/4 HANA.

- Transfer data directly from SAP ERP system to SAP S/4 HANA (new feature from SAP S/4 Hana 1909)

- extra option available from HANA 2020 -> Migrate data using Staging tables which can be pre-populated using with XML templates or SAP / third party ETL (extract, transfer, load) tools.

From HANA 2020 SAP enhances the solution with:

- One harmonized application in Fiori

- Transport concept. The data can be released between SAP clients and systems

- Copying of the migration projects

SAP provides a flexible solution to integrate custom objects and enhancements for data migration via the Migration object modeler.

SAP migration cockpit has a proper set of templates to migrate Treasury deals. Currently SAP supports the following financial transaction types: Guarantees, Cap/Floor, CPs, Deposit at notice, Facilities, Fixed Term Deposits, FX, FX options, Interest Rate Instrument, IRS, LC, Security Bonds, Security Class, Stock.

Standard SAP tools are relatively competent solutions for data migration, however due to the complexity and scope of TRM related master data objects, they prove to not be sophisticated enough for certain clients. For example, they do support basic business partner setup. However, for most clients the functionality to migrate complex business partner data is required. In many cases, implementation partners, including Zanders, develop their own in-house solutions to tackle various TRM master data migration issues.

Zanders pre-developed solution – BP upload tool

Within SAP Treasury and Risk management, the business partner plays an important role in the administration. Unfortunately, with all new SAP installations it is not possible to perform a mass and full creation of the current business partners with the data required for Treasury.

SAP standard tools require enhancements to accommodate for the migration of the required data of Business partners, especially their creation and assignment of finance specific attributes and dependencies, which requires substantial time-consuming effort when performed manually.

Zanders acknowledges this issue and has developed a custom tool to mass create business partners within SAP. Our solution can be adjusted to different versions of SAP: from ECC to S/4 HANA 2020.

The tool consists of:

- Excel pre-defined template with a few tabs which represent different part of the BP master data: Name, Address, Bank data, Payment instructions, Authorizations etc.

- Custom program which can perform three actions: Create basic data for BP, enhance/amend or delete existing BPs in SAP.

- Test and production runs are supported with the full application log available during the run. The log will show if there is any error in the BP creation.

The migration of the master and transaction data is a complex but vital process for any SAP implementation project. This being said, the migration of the data (from planning to realization) should be viewed as a separate deliverable within a project.

Zanders has unique experience with Treasury data transformation and migration, and we are keen to assist our clients in selecting the best migration approach and the best-fit migration tool available from SAP standard. We are also able assist clients in the development of their own in-house solution, if required.

Should you have any questions, queries or interest in SAP projects please contact Aleksei Abakumov or Ilya Seryshev.