Effective liquidity management is essential for businesses of all sizes, yet achieving it is often challenging. Many organizations face difficulties due to fragmented data, inconsistent reporting, and the complexity of managing cash flows across different time horizons. These challenges are amplified in companies with complex cash flow structures, where tailored configurations and precise tracking are crucial for accurate planning and decision-making.

SAP offers two tools to support liquidity management: the Cash Flow Analyzer and the Short-Term Cash Positioning apps. This article examines how these tools address different aspects of liquidity management, helping businesses navigate their financial challenges and make informed decisions.

Exploring the Cash Flow Analyzer

The Cash Flow Analyzer app offers a versatile approach to liquidity management. It enables companies to screen and analyze cash flows with filters, drill-down options, and flexible time horizons—whether for medium or long-term planning.

A key strength of this app lies in its integration across SAP modules like FI (Finance), MM (Materials Management), SD (Sales and Distribution), and TRM (Treasury and Risk Management). This ensures real-time updates through SAP’s One Exposure functionality, giving companies a single source of truth for cash flow data.

SAP continues to enhance this app with updates, such as the Liquidity Calculation: G/L Classification, available in the public cloud. This feature simplifies configurations by replacing the older Define Default Liquidity Items for G/L Accounts while also offering a migration option for existing setups. With this new feature, old document chain stopping functionality in the predecessor version will be replaced by G/L account classification. Also, you will be able to see the prioritization logic behind the liquidity item assignment when there are multiple derivations for the same G/L account. Although currently available only for public cloud users, SAP is expected to bring these enhancements to private cloud and on-premises systems in the future.

Query-Based Liquidity Derivations

For companies with complex cash flow structures, query-based derivations allow for tailored liquidity item configurations in addition to defining default liquidity items for G/L accounts. This feature lets you define rules for assigning liquidity items based on unique needs. You can set different conditions in the query to pull up the correct liquidity item from the different sources which are captured by different origins of queries.

These queries seamlessly integrate data from various SAP modules, such as Finance, Treasury, and Sales, ensuring comprehensive coverage of liquidity-related processes. Additionally, hierarchical rules can be applied to manage overlapping conditions, providing clear prioritization for liquidity item assignments. By accommodating both actual and forecasted cash flows, query-based derivations support precise tracking and planning across different time horizons. Furthermore, the approach enhances transparency by offering visibility into the logic behind liquidity item assignments, enabling finance teams to validate and adapt their configurations effectively.

Cash Flow Analyzer in Action

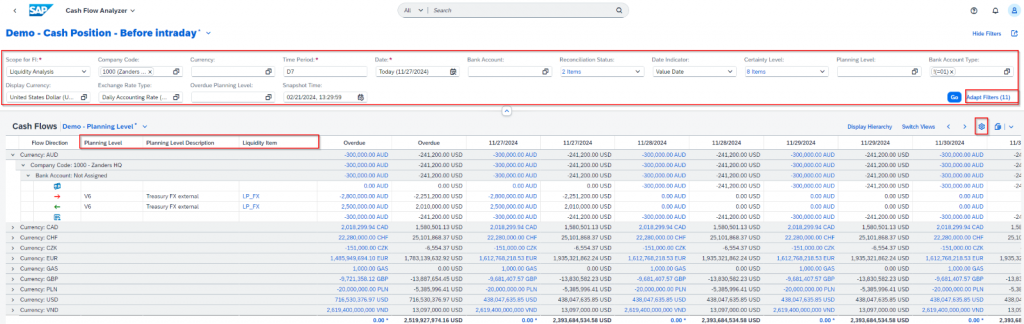

The app’s flexibility doesn’t stop at data collection. It allows users to create custom layouts and views based on filters like liquidity items, company codes, bank accounts, or cash pools. By defining hierarchies, businesses can drill down into the details of their liquidity positions, analyze trends, and make data-driven decisions. Please find a sample screenshot from a demo system:

As shown in the screenshot above, the upper red rectangle allows you to set or remove a variety of filters as needed. The red rectangle below is another element that can be added or removed from your layout. If you want to see more details about cash flows, click the gear button and add or remove more.

Why Use Short-Term Cash Positioning?

With the Cash Flow Analyzer’s extensive capabilities, you may wonder why SAP offers a separate app for short-term cash management. The answer lies in its focus.

Short-Term Cash Positioning (STCP) is an SAP Fiori app designed to give treasury teams a focused view of their immediate cash position. Unlike broader tools like the Cash Flow Analyzer, STCP hones in on short-term liquidity, offering a straightforward way to manage cash inflows and outflows over a defined horizon—usually within a few days or weeks.

At its core, STCP organizes and presents cash flow data based on planning levels and cash position profiles. These profiles help group bank accounts or cash pools, providing treasury teams with a clear snapshot of their short-term liquidity. With intuitive visuals and fast data processing, the app simplifies decision-making in fast-paced environments. While the Cash Flow Analyzer provides a broad, flexible view, the Short-Term Cash Positioning (STCP) app is purpose-built for immediate liquidity analysis.

Here are some reasons to consider using STCP:

1- Speed and Simplicity: Designed for quick, straightforward analysis, the STCP app helps companies handle large volumes of cash flow data without getting bogged down by complexity.

2- Focus on Planning Levels: This app emphasizes planning levels to categorize cash flows for short-term financial planning.

3- Customizable Cash Position Profiles: Users can define hierarchies based on bank account master data, existing bank account hierarchies, or cash pools. These profiles allow for real-time monitoring of cash flows within defined groupings.

4- Clear Visualization: By focusing on shorter time horizons, STCP provides an actionable snapshot of a company’s cash position. This can be helpful for businesses with frequent cash inflows and outflows.

5- Efficient Decision-Making: The STCP app offers a focused approach, helping decision-makers access relevant information to manage liquidity effectively while avoiding unnecessary complexities.

For businesses balancing long-term planning with immediate liquidity needs, the Short-Term Cash Positioning app can complement the Cash Flow Analyzer. Together, they provide a comprehensive set of tools that address various aspects of liquidity management. However, businesses should carefully assess their specific requirements to determine the most effective way to use these tools, ensuring they align with their operational priorities and evolving needs.

A Holistic Approach to Liquidity Management

The Cash Flow Analyzer provides broader liquidity insights, while the Short-Term Cash Positioning app focuses on immediate needs. Together, these tools can help businesses address liquidity challenges across different time horizons, supporting better visibility and informed decision-making in both the short and long term. Since these two tools have distinct capabilities, a thorough evaluation of these differences should be conducted to ensure the chosen solution aligns with the organization’s specific needs and priorities.

If you would like to learn more about the Cash Flow Analyzer and Short-Term Cash Positioning apps - or explore how to customize these tools for your business needs - please reach out to our Senior Consultant Merve Korukcu.