In today's dynamic economic landscape, optimizing portfolio composition to fortify against challenges such as inflation, slower growth, and geopolitical tensions is ever more paramount. These factors can significantly influence consumer behavior and impact loan performance. Navigating this uncertain environment demands banks adeptly strike a delicate balance between managing credit risk and profitability.

Why does managing your risk reward matter?

Quantitative techniques are an essential tool to effectively optimize your portfolio’s risk reward profile, as this aspect is often based on inefficient approaches.

Existing models and procedures across the credit lifecycle, especially those relating to loan origination and account management, may not be optimized to accommodate current macro-economic challenges.

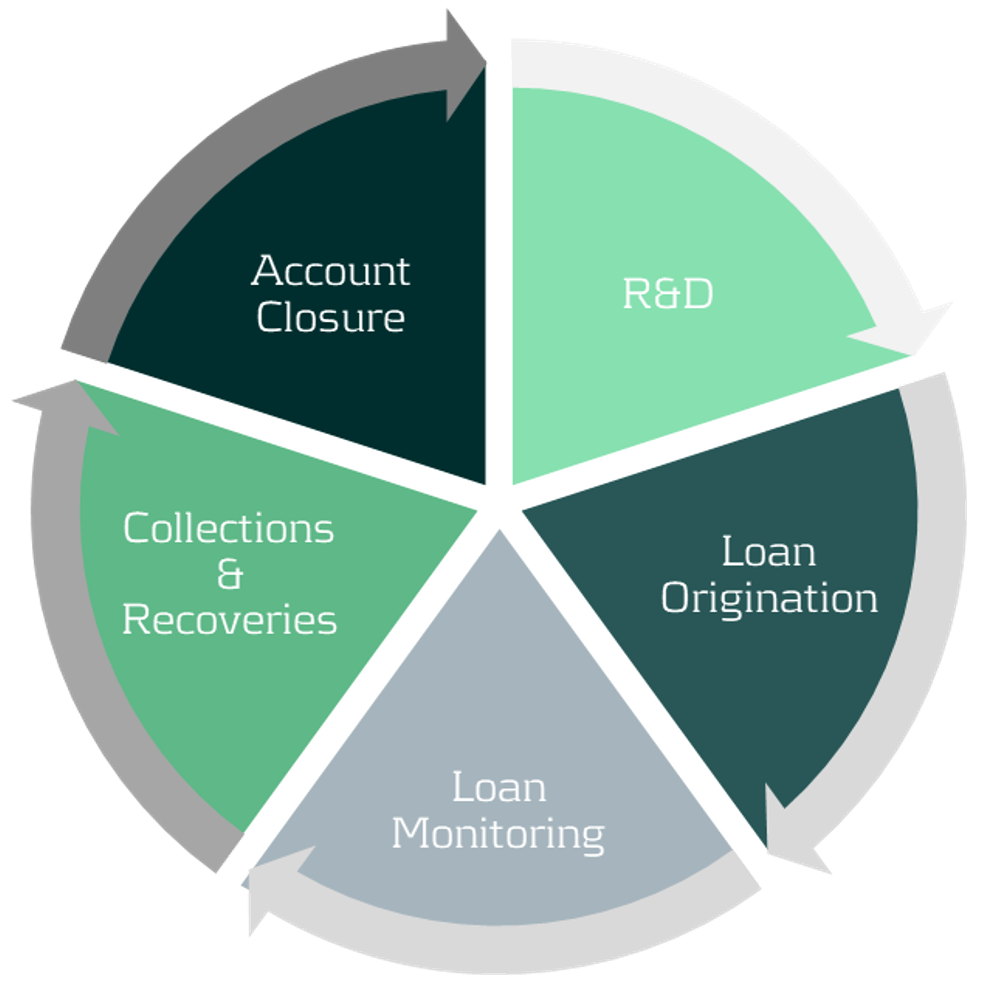

Figure 1: Credit lifecycle.

Current challenges facing banks

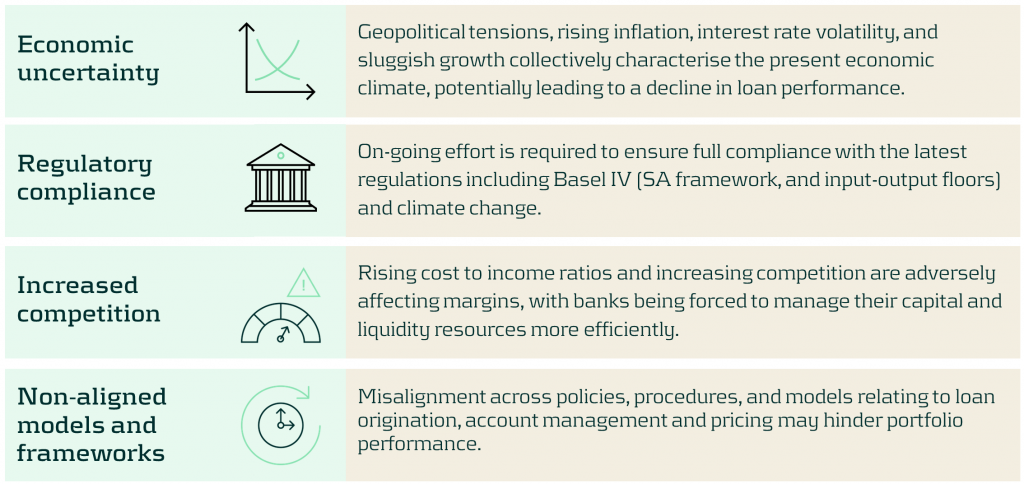

Some of the key challenges banks face when balancing credit risk and profitability include:

Our approach to optimizing your risk reward profile

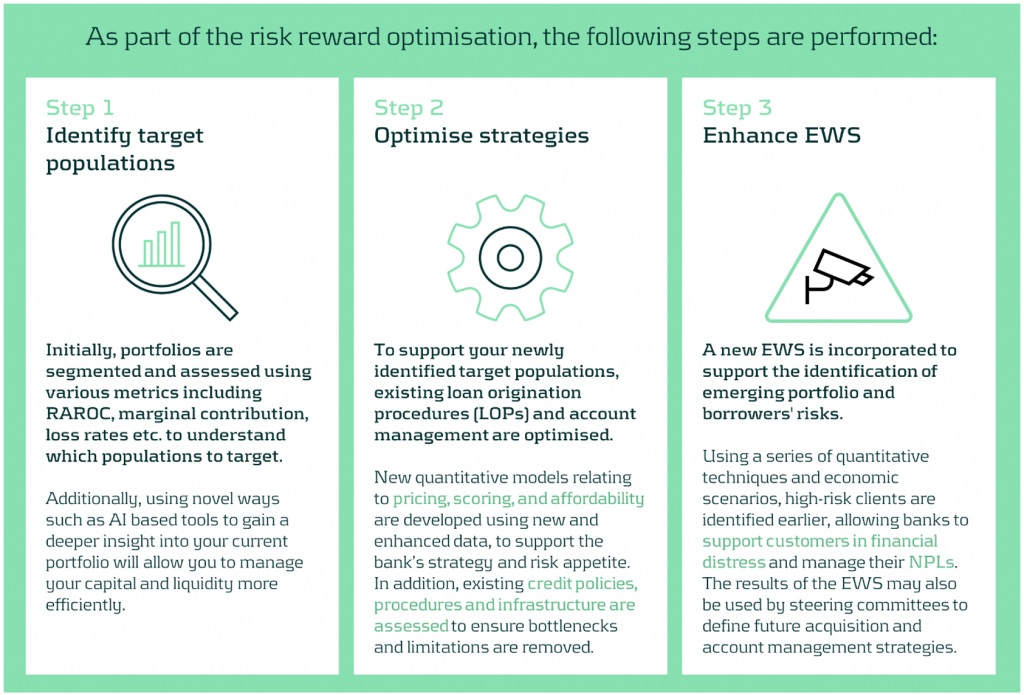

Our optimization approach consists of a holistic three step diagnosis of your current practices, to support your strategy and encourage alignment across business units and processes.

The initial step of the process involves understanding your current portfolio(s) by using a variety of segmentation methodologies and metrics. The second step implements the necessary changes once your primary target populations have been identified. This may include reassessing your models and strategies across the loan origination and account management processes. Finally, a new state-of-the-art Early Warning System (EWS) can be deployed to identify emerging risks and take pro-active action where necessary.

A closer look at redefining your target populations

With the proliferation of advanced data analytics, banks are now better positioned to identify profitable, low-risk segments. Machine Learning (ML) methodologies such as k-means clustering, neural networks, and Natural Language Processing (NLP) enable effective customer grouping, behavior forecasting, and market sentiment analysis.

Risk-based pricing remains critical for acquisition strategies, assessing segment sensitivity to different pricing strategies, to maximize revenue and reduce credit losses.

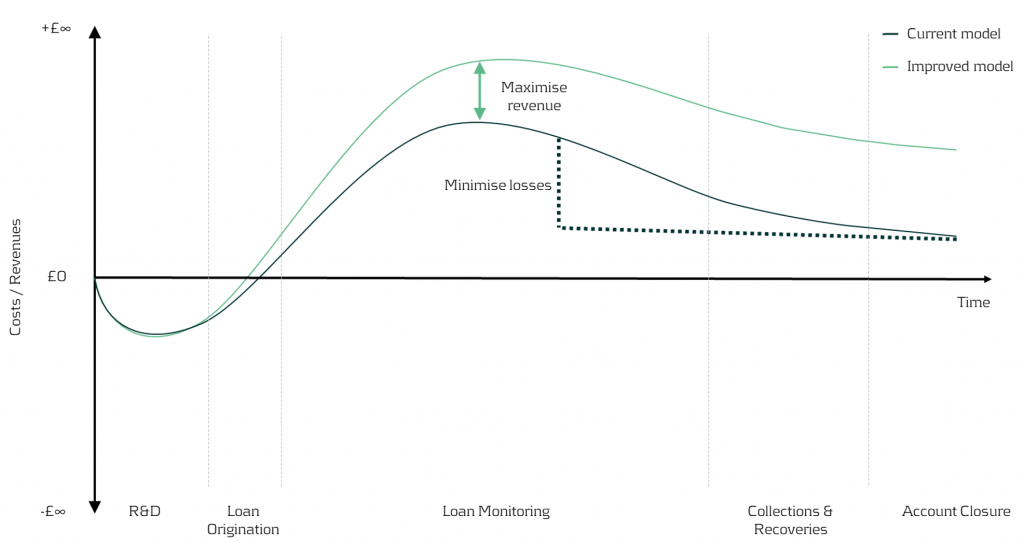

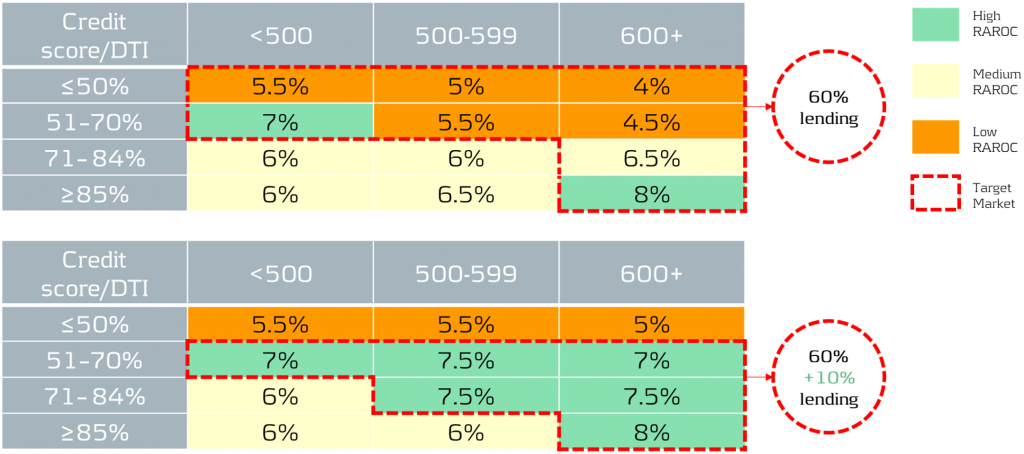

Figure 2: In the illustration above, we can visually see the impact on earnings throughout the credit lifecycle driven by redefining the target populations and application of different pricing strategies.

In our simplified example, based on the RAROC metric applied to an unsecured loans portfolio, we take a 2-step approach:

1- Identify target populations by comparing RAROC across different combinations of credit scores and debt-to-income (DTI) ratios. This helps identify the most capital efficient segments to target.

2- Assess the sensitivity of RAROC to different pricing strategies to find the optimal price points to maximize profit over a select period - in this scenario we use a 5-year time horizon.

Figure 3: The top table showcases the current portfolio mix and performance, while the bottom table illustrates the effects of adjusting the pricing and acquisition strategy. By redefining the target populations and changing the pricing strategy, it is possible to reallocate capital to the most profitable segments whilst maintaining within credit risk appetite. For example, 60% of current lending is towards a mix of low to high RAROC segments, but under the new proposed strategy, 70% of total capital is allocated to the highest RAROC segments.

Uncovering risks and seizing opportunities

The current state of Early Warning Systems

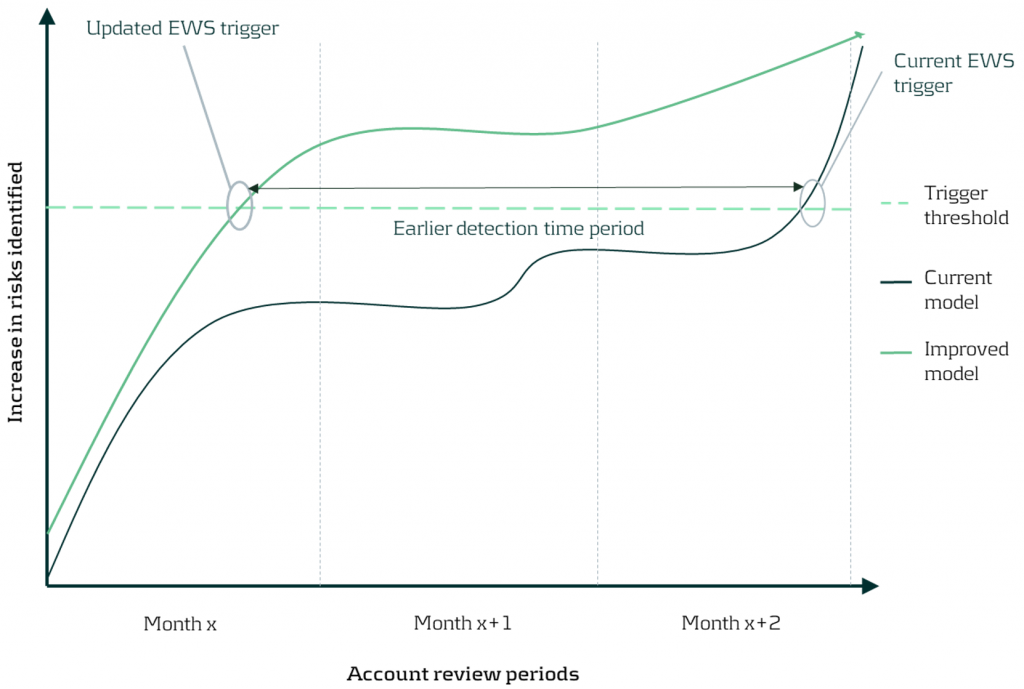

Many organizations rely on regulatory models and standard risk triggers (e.g., no. of customers 30 day past due, NPL ratio etc.) to set their EWS thresholds. Whilst this may be a good starting point, traditional models and tools often miss timely deteriorations and valuable opportunities, as they typically use limited and/or outdated data features.

Target state of Early Warning Systems

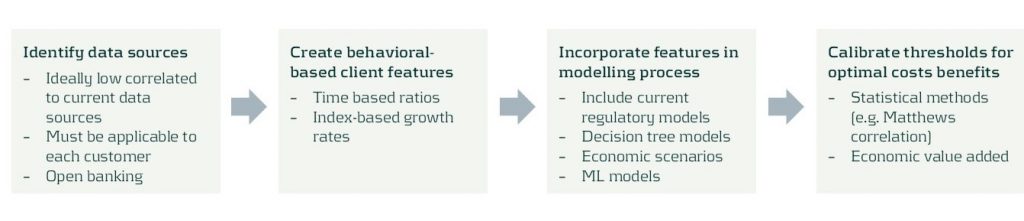

Leveraging timely and relevant data, combined with next-generation AI and machine learning techniques, enables early identification of customer deterioration, resulting in prompt intervention and significantly lower impairment costs and NPL ratios.

Furthermore, an effective EWS framework empowers your organization to spot new growth areas, capitalize on cross-selling opportunities, and enhance existing strategies, driving significant benefits to your P&L.

Figure 4: By updating the early warning triggers using new timely data and advanced techniques, detection of customer deterioration can be greatly improved enabling firms to proactively support clients and enhance the firm’s financial position.

Discover the benefits of optimizing your portfolios

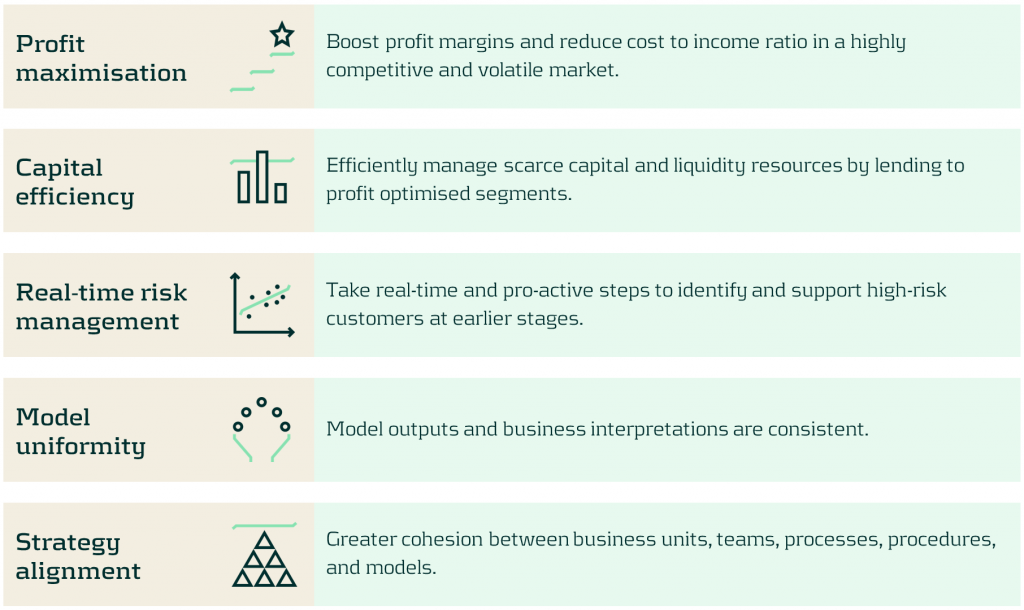

Discover the benefits in optimizing your portfolios’ risk-reward profile using our comprehensive approach as we turn today’s challenges into tomorrow’s advantages. Such benefits include:

Conclusion

In today's rapidly evolving market, the need for sophisticated credit risk portfolio management is ever more critical. With our comprehensive approach, banks are empowered to not merely weather economic uncertainties, but to thrive within them by striking the optimal risk-reward balance. Through leveraging advanced data analytics and deploying quantitative tools and models, we help institutions strategically position themselves for sustainable growth, and comply with increasing regulatory demands especially with the advent of Basel IV. Contact us to turn today’s challenges into tomorrow’s opportunities.

For more information on this topic, contact Martijn de Groot (Partner) or Paolo Vareschi (Director).