As the SWIFT MT-MX migration gains momentum, we are now starting to see more questions from the corporate community around the potential impact of this industry migration.

But the adoption of ISO 20022 XML messaging goes beyond SWIFT’s adoption in the interbank financial messaging space – SWIFT are currently estimating that by 2025, 80% of the RTGS (real time gross settlement) volumes will be ISO 20022 based with all reserve currencies either live or having declared a live date. What this means is that ISO 20022 XML is becoming the global language of payments. In this fourth article in the ISO 20022 series, Zanders experts Eliane Eysackers and Mark Sutton provide some valuable insights around what the version 9 payment message offers the corporate community in terms of richer functionality.

A quick recap on the ISO maintenance process?

So, XML version 9. What we are referencing is the pain.001.001.09 customer credit transfer initiation message from the ISO 2019 annual maintenance release. Now at this point, some people reading this article will be thinking they are currently using XML version 3 and now we talking about XML version 9. The logical question is whether version 9 is the latest message and actually, we expect version 12 to be released in 2024. So whilst ISO has an annual maintenance release process, the financial industry and all the associated key stakeholders will be aligning on the XML version 9 message from the ISO 2019 maintenance release. This version is expected to replace XML version 3 as the de-facto standard in the corporate to bank financial messaging space.

What new functionality is available with the version 9 payment message?

Comparing the current XML version 3 with the latest XML version 9 industry standard, there are a number of new tags/features which make the message design more relevant to the current digital transformation of the payment’s ecosystem. We look at the main changes below:

- Proxy: A new field has been introduced to support a proxy or tokenisation as its sometimes called. The relevance of this field is primarily linked to the new faster payment rails and open banking models, where consumers want to provide a mobile phone number or email address to mask the real bank account details and facilitate the payment transfer. The use of the proxy is becoming more widely used across Asia with the India (Unified Payments Interface) instant payment scheme being the first clearing system to adopt this logic. With the rise of instant clearing systems across the world, we are starting to see a much greater use of proxy, with countries like Australia (NPP), Indonesia (BI-FAST), Malaysia (DuitNow), Singapore (FAST) and Thailand (Promptpay) all adopting this feature.

- The Legal Entity Identifier (LEI): This is a 20-character, alpha-numeric code developed by the ISO. It connects to key reference information that enables clear and unique identification of legal entities participating in financial transactions. Each LEI contains information about an entity’s ownership structure and thus answers the questions of 'who is who’ and ‘who owns whom’. Simply put, the publicly available LEI data pool can be regarded as a global directory, which greatly enhances transparency in the global marketplace. The first country to require the LEI as part of the payment data is India, but the expectation is more local clearing system’s will require this identifier from a compliance perspective.

- Unique End-to-end Transaction Reference (commonly known as a UETR): This is a string of 36 unique characters featured in all payment instruction messages carried over the SWIFT network. UETRs are designed to act as a single source of truth for a payment and provide complete transparency for all parties in a payment chain, as well as enable functionality from SWIFT gpi (global payments innovation)1, such as the payment Tracker.

- Gender neutral term: This new field has been added as a name prefix.

- Requested Execution Date: The requested execution date now includes a data and time option to provide some additional flexibility.

- Structured Address Block: The structured address block has been updated to include the Building Name.

In Summary

Whilst there is no requirement for the corporate community to migrate onto the XML version 9 message, corporate treasury should now have the SWIFT ISO 20022 XML migration on their own radar in addition to understanding the broader global market infrastructure adoption of ISO 20022. This will ensure corporate treasury can make timely and informed decisions around any future migration plan.

Notes:

- SWIFT gpi is a set of standards and rules that enable banks to offer faster, more transparent, and more reliable cross-border payments to their customers.

As per March 2023, SWIFT has taken a major step in its MT/MX migration journey. How does this impact your activities in SAP?

SWIFT now supports the exchange of ISO 20022 XML or MX message via the so-called FINplus network. In parallel, the legacy MT format messages remain to be exchanged over the ‘regular’ FIN network; The MT flow for message categories 1 (customer payments), 2 (FI transfers) and 9 (statements) through the FIN network will be decommissioned per November 2025.

As such, between March 2023 and November 2025, financial institutions need to be able to receive and process MX messages through FINplus on the inbound side, and optionally send MX messages or MT messages for outbound messaging. After that period, only MX will be allowed.

CBPR+ and HVPS+

Another important aspect of the MX migration is the development of the CBPR+ and HVPS+ specifications within the ISO20022 XML standard. These specifications dictate how an XML message should be populated in terms of data and field requirements for Cross Border Payments (CBPR+) and Domestic High Value Payments (HVPS+). Note that HVPS+ refers to domestic RTGS clearing systems and a number of countries are in the process of making the domestic clearing systems native ISO20022 XML-compliant.

Impact for Corporates

As of today, there should be no immediate need for corporates to change. However, it is advised to start assessing impact and to start planning for change if needed. We give you some cases to consider:

- A corporate currently exchanging e.g. MT101/MT103/MT210 messages towards its house bank via SWIFT FIN Network to make cross border payments, e.g. employing a SWIFT Service Bureau or an Alliance connection. This flow will cease to work after November 2025. If this flow is relevant to your company, it needs attention to be replaced.

- Another case is where, for example, an MT101 is exchanged with a house bank as a file over the FileAct network. Now it depends purely on the house bank’s capabilities to continue supporting this flow after 2025; it could offer a service to do a remapping of your MT message into an MX. This needs to be checked with the house banks.

- The MT940 message flow from the house bank via FIN also requires replacement.

- With respect to the MT940 file flow from house bank via FileAct, we expect little impact as we think most banks will continue supporting the MT940 format exchange as files. We do recommend to check with your house bank to be sure.

- High Value Payments for Domestic Japanese Yen using Zengin format; the BOJ-NET RTGS clearing system has already completed the migration to ISO20022 XML standard. Check with your house bank when the legacy payment format will become unsupported and take action accordingly.

These were just some examples and should not be considered an exhaustive list.

In addition, moving to the ISO20022 XML standard can also provide some softer benefits. We discussed this in a previously published article.

Impact on your SAP implementation

So you have determined that the MT/MX migration has impact and that remediating actions need to be taken. What does that look like in SAP?

First of all, it is very important to onboard the bank to support you with your change. Most typically, the bank needs to prepare its systems to be able to receive a new payment file format from your end. It is good practice to first test the payment file formatting and receive feedback from the banks implementation manager before going live with it.

On the incoming side, it is advisable to first request a number of production bank statements in e.g. the new CAMT.053 format, which can be analyzed and loaded in your test system. This will form a good basis for understanding the changes needed in bank statement posting logic in the SAP system.

PAYMENTS

In general, there are two ways of generating payment files in SAP. The classical one is via a payment method linked to a Payment Medium Workbench (PMW) format and a Data Medium Exchange (DME) tree. This payment method is then linked to your open items which can be processed with the payment run. The payment run then outputs the files as determined in your DME tree.

In this scenario, the idea is to simply setup a new payment method and link it to a desired PMW/DME output like pain.001.001.03. These have long been pre-delivered in standard SAP, in both ECC and S/4. It may be necessary to make minor mapping corrections to meet country- or bank-specific data requirements. Under most circumstances this can be achieved with a functional consultant using DME configuration. Once the payment method is fully configured, it can be linked to your customer and vendor master records or your treasury business partners, for example.

The new method of generating payment files is via the Advanced Payment Management (SAP APM) module. SAP APM is a module that facilitates the concepts of centralizing payments for your whole group in a so-called payment factory. APM is a module that’s only available in S/4 and is pushed by SAP AG as the new way of implementing payment factories.

Here it is a matter of linking the new output format to your applicable scenario or ‘payment route’.

BANK STATEMENTS

Classical MT940 bank statements are read by SAP using ABAP logic. The code interprets the information that is stored in the file and saves parts of it to internal database tables. The stored internal data is then interpreted a second time to determine how the posting and clearing of open items will take place.

Processing of CAMT.053 works a bit differently, interpreting the data from the file by a so-called XSLT transformation. This XSLT transformation is a configurable mapping where a CAMT.053 field maps into an internal database table field. SAP has a standard XSLT transformation package that is fairly capable for most use cases. However, certain pieces of useful information in the CAMT.053 may be ignored by SAP. An adjustment to the XSLT transformation can be added to ensure the data is picked up and made available for further interpretation by the system.

Another fact to be aware of is the difference in Bank Transaction Codes (BTC) between MT940 and CAMT.053. There could be a different level of granularity and the naming convention is different. BTC codes are the main differentiator in SAP to control posting logic.

SAP Incoming File Mapping Engine (IFME)

SAP has also put forward a module called Incoming File Mapping Engine (IFME). It serves the purpose as a ‘remapper’ of one output format to another output format. As an example, if your current payment method outputs an MT101, the remapper can take the pieces of information from the MT101 and save it in a pain.001 XML file.

Although there may be some fringe scenarios for this solution, we do not recommend such an approach as MT101 is generally weaker in terms of data structure and content than XML. Mapping it into some other format will not solve the problems that MT101 has in general. It is much better to directly generate the appropriate format from the internal SAP data directly to ensure maximum richness and structure. However, this should be considered as a last resort or if the solution is temporary.

On 17–19 July 2023, Zanders participated as a proud sponsor at the SAP Treasury conference in Chicago.

As the first conference in the US since its 4-year hiatus, there was good attendance among corporates and partners. The SAP Treasury conference is an excellent opportunity for customers to see the latest developments within the S/4 HANA Treasury suite.

Christian Mnich, VP and Head of Solution Management Treasury and Working Capital Management at SAP, gave the opening keynote titled: "SAP Opening Keynote: Increase Financial Resiliency with SAP Treasury and Working Capital Management Solutions."

Corporate Structure changes

Ronda De Groodt, Applications Integration Architect at Leprino Foods, presented a case study that covered how Leprino Foods embarked on a company-wide migration from SAP ECC to S/4HANA, specifically implementing SAP Treasury, Cash Management, and Payments solutions in a 6-month time frame. The presentation also had a focus on leveraging SAP S/4HANA Cash Management and SAP machine learning capabilities while migrating to S/4 HANA.

Trading Platform Integration

In a joint presentation, Justin Brimfield from ICD and Jonathon Kluding from SAP discussed the strategic partnership between the two companies in developing a streamlined Trading Platform Integration. This presentation went into detail on how SAP leverages Trading Platform Integration between SAP and ICD and the efficiencies this integration can create for Treasury.

Multi-Bank Connectivity (MBC)

Another area of focus at the conference was the capabilities of SAP Multi-Bank Connectivity and how it can simplify and automate financial processes associated while having multiple banks. This was presented by Kweku Biney-Assan from HanesBrands. The presentation focused on answering some crucial questions corporates may have about SAP MBC, ranging from the possible improvements MBC can make to your Treasury Operations and Cash Management processes, to the typical timeline for an implementation.

Cash Management & Liquidity Forecasting

Renee Fan from Freeport LNG, gave a presentation overviewing the challenges the company faced in terms of cash management, reporting, and analytics. She gave an overview of Freeport LNG’s Treasury Transformation Journey and insights into the upgrades they had made, as well as a further focus on the benefits they have seen as a result of their new cash and liquidity solution.

In addition, the conference offered attendees the opportunity to share ideas, build networks, and discuss topics face-to-face. All this made this edition of the event a success!

On 20-22 June 2023, Zanders joined the SAP Treasury conference in Amsterdam as proud sponsor.

Of the many attending corporates and partners were offered the opportunity to hear the latest ins and outs of treasury transformation with S/4HANA.

Next to the enhancements in S/4HANA Treasury, customers had a clear need to understand what it could means for their Treasury and how they could achieve it. The conference provided an excellent opportunity to exchange ideas with each other and learn from the many case studies presented on treasury transformation.

Treasury Transformation with SAP S/4HANA

Alongside Ernst Janssen, Digital Treasury and Banking Manager at dsm-firmenich, Zanders director Deepak Aggarwal presented the value drivers for treasury in an S/4HANA migration. The presentation also included the different target architecture and deployment options, as Ernst talked about the choices made at dsm-firmenich and the rationale behind them in a real-life business case study. Zanders has a long-standing relationship with DSM going back as far as 2001, and has supported them in a number of engagements within SAP treasury.

In addition, there were similar other presentations on treasury transformation with S/4HANA. BioNTech presented the case study on centralization of their bank connectivity via APIs for both inbound and outbound bank communication. They are also the first adopters of the new In-House Bank under Advanced Payment Management (APM) solution and integrate the Morgan Money trading platform for money market funds. ABB and PwC talked about their treasury transformation journey on centralization of cash management in a side-car, functionality enhancement through APM, and integration with Central Finance system for balance sheet FX management. Alter Domus and Deloitte presented their treasury transformation via S/4HANA Public Cloud including integrated market data feed and Multi-Bank Connectivity.

Digital and Streamlined Treasury Management System

Christian Mnich from SAP laid out the vision of SAP Treasury and Working Capital Management solution as an agile, resilient and sustainable solution delivering end-to-end business processes to all customers in all industries. Christian referred to the market challenges of high inflation and rising interest rates calling for a greater need of bank resiliency and cash forecasting to reduce dependencies on business partners and improve cash utilization while avoiding dipping into debt facilities. The sustainability duties like ESG reporting and carbon offsetting appear to be more relevant than ever to meet global assignments. SAP’s 2023 product strategy was presented with Cloud ERP (public or private) at the core, Business Technology Platform as integration and extension layer, and the surrounding SAP and ecosystem applications, delivering end-to-end integrated processes to the business.

Trading Platform Integration

Another focus area was SAP Integration with ICD for Money Market Funds (MMFs) through Trading Platform Integration (TPI) application. MMFs are seen as an attractive alternative to deposits, yielding better returns and diversifying risk through investment in multiple counterparties. Quite often the business is restricted on MMF dealing as a result of system limitations and overhead due to the manual processes. Integration with ICD via TPI offers benefits of single sign on, automated mapping from ICD to SAP Treasury, auto-creation of securities transaction in SAP, email notification and integrated reporting in SAP Treasury.

Embedded Receivables Finance

Lastly, SAP integration with Taulia was another focus area to facilitate liquidity management in the companies. Taulia was presented as driving Working Capital Management (WCM) in the companies through its WCM platform and Taulia Multi Funder for efficient share of wallet or discovery of new liquidity. The embedded receivables finance solution in Taulia automates the receivables sales process by automating the status updates of all invoices in Taulia platform and the seller ERP.

If you are interested in joining SAP Treasury conferences in future, or any of the topics covered, please do reach out to your Zanders’ contacts.

In this article, we will delve deeper into some of the key offerings of SAP BTP for treasury and explore how it can contribute to driving innovation within treasury.

The SAP Business Technology Platform (BTP) is not just a standalone product or a conventional module within SAP's suite of ERP systems; rather, it serves as a strategic platform from SAP, serving as the foundational underpinning for all company-wide innovations. In this article, we will delve deeper into some of the key offerings of SAP BTP for treasury and explore how it can contribute to driving innovation within treasury.

The platform is designed to offer a versatile array of tools and services, aiming to enhance, extend, and seamlessly integrate with your existing SAP systems and other applications. Ultimately enabling a more efficient realization of your business objectives, delivering enhanced operational efficacy and flexibility.

Analytics and AI

One of the standout features of SAP BTP for treasury is its analytics and planning solution, SAP Analytics Cloud (SAC). This feature seamlessly connects with different data sources and other SAP applications. It supports Extended Planning & Analysis and Predictive Planning using machine learning models.

At the core of SAC, various planning areas – like finance, supply chain, and workforce – are combined into a cloud-based interconnected plan. This plan is based on a single version of the truth, bringing planning content together. Enhanced by predictive AI and ML models, the plan achieves more accurate forecasting and supports near-real-time planning. Users can also compare different scenarios and perform what-if analysis to evaluate the impact of changes on the plan equipping organizations to prepare for uncertainties effectively.

Application Development and Integration

An organization's treasury architecture landscape often involves numerous systems, custom applications, and enhancements. However, this complexity can result in challenges related to maintenance, technical debt, and operational efficiency.

Addressing these challenges, SAP BTP offers a solution known as the SAP Build apps tool. The tool enables users to adapt standard functionalities and create custom business applications through intuitive no-code/low-code tools. This allows that all custom development takes place outside your SAP ERP system, thereby preserving a ‘clean core’ of your SAP system. This will allow for a simpler, more streamlined maintenance process and a reduced risk of compatibility issues when upgrading to newer versions of SAP.

In addition, SAP BTP facilitates seamless connectivity through a range of connectors and APIs integrated within the SAP Integration Suite. Enabling a harmonious integration of data and processes across diverse systems and applications, whether they are on-premise or cloud-based.

Process Automation and Workflow Management

Efficient process automation and workflow management play a pivotal role in enhancing treasury operations. SAP BTP offers an efficient solution named SAP Build Process Automation which enables users to design and oversee business processes using either low-code or no-code methods. It combines workflow management, robotic process automation, decision management, process visibility, and AI capabilities, all consolidated within a user-friendly interface.

A significant advantage of SAP BTP's workflow approach over conventional SAP workflows is the unification of workflows across diverse systems, including non-SAP systems and increased flexibility, enabling smoother interaction between processes and systems.

The integration of SAP BTP for workflow with different SAP modules such as TRM, IHC, BAM is facilitated through the SAP Workflow Management APIs within your SAP S/4 HANA system.

In the context of treasury functions, SAP Build Process Automation proves invaluable for automating and refining diverse processes such as cash management, risk management, liquidity planning, payment processing, and reporting. For instance, users can leverage the integrated AI functionalities for tasks like collecting bank statements/account balance information from different systems, consolidating information, saving and/or distributing the cash position information to the appropriate people and systems. Furthermore, the automation recorder can be employed to mechanize the extraction and input of data from diverse systems. Finally, the SAP Build Process Automation can also be utilized to create workflows for complex payment approval scenarios, including exceptions and escalations.

Extensions to the Treasury Ecosystem

SAP BTP extends the treasury ecosystem with multiple treasury-specific developed solutions, seamlessly enhancing your treasury SAP S/4 HANA system functionality. These extensions include: Multi-Bank Connectivity for simplified and secure banking interactions, SAP Digital Payment Add-On for efficiently connecting to payment service providers. Trading Platform Integration for streamlined financial instrument trading, SAP Cloud for Credit Integration to assess business partner credit risk, SAP Taulia for Working Capital Management, Cash Application for automatic bank statement processing and cash application, and lastly, SAP Market Rates Management for the reliable retrieving of market data.

Empowering organizations with extensive treasury needs by enabling them to selectively adopt these value-added capabilities and solutions offered by SAP.

Alternatives to SAP BTP

The primary driving factor to consider integrating SAP BTP as an addon to your SAP ERP is when there is an integrated company-wide approach towards adopting BTP. Furthermore, if the standard SAP functionalities fall short of meeting the specific demands of the treasury department, or if the need for seamless integration with other systems arises.

It's important to prioritize the optimization of complex processes whenever feasible first, avoiding the pitfall of optimizing inherently flawed processes using advanced technologies such as SAP BTP. It is worth noting that the standard SAP functionality, which is already substantial, could very well suffice. Consequently, we recommend conducting an analysis of your processes first, utilizing the Zanders best practices process taxonomy, before deciding on possible technology solutions.

Ultimately, while considering technology options, it's wise to explore offerings from best-of-breed treasury solution providers as well – keeping in mind the potential need for integration with SAP.

Getting Started

The above highlights just a glimpse of SAP BTP's capabilities. SAP offers a free trial that allows users to explore its services. Instead of starting from scratch, you can leverage predefined business content such as intelligent RPA bots, workflow packages, predefined decision and business rules and over 170 open connectors with third-party products to get inspired. Some examples relevant for treasury include integration with Trading Brokers, S4HANA SAP Analytics Cloud, workflows designed for managing free-form payments and credit memos, as well as connectors linking to various accounting systems such as Netsuite Finance, Microsoft Dynamics, and Sage.

Conclusion

SAP BTP for Treasury is a powerful platform that can significantly enhance treasury. Its advanced analytics, app development and integration, and process automation capabilities enable organizations to gain valuable insights, automate tasks, and improve overall efficiency. If you are looking to revolutionize your treasury operations, SAP BTP is a compelling option to consider.

In a changing global floriculture market, Royal FloraHolland created a new digital platform where buyers and growers can connect internationally. As part of its strategy to offer better international payment solutions, the cooperative of flower growers decided to look for an international cash management bank.

Royal FloraHolland is a cooperative of flower and plant growers. It connects growers and buyers in the international floriculture industry by offering unique combinations of deal-making, logistics, and financial services. Connecting 5,406 suppliers with 2,458 buyers and offering a solid foundation to all these players, Royal FloraHolland is the largest floriculture marketplace in the world.

The company’s turnover reached EUR 4.8 billion (in 2019) with an operating income of EUR 369 million. Yearly, it trades 12.3 billion flowers and plants, with an average of at least 100k transactions a day.

The floriculture cooperative was established 110 years ago, organizing flower auctions via so-called clock sales. During these sales, flowers were offered for a high price first, which lowered once the clock started ticking. The price went down until one of the buyers pushed the buying button, leaving the other buyers with empty hands.

The floriculture market is changing to trading that increasingly occurs directly between growers and buyers. Our role is therefore changing too.

Wilco van de Wijnboom, Manager Corporate Finance

Challenge

The Floriday platform

Around twenty years ago, the clock sales model started to change. “The floriculture market is changing to trading that increasingly occurs directly between growers and buyers. Our role is therefore changing too,” Wilco van de Wijnboom, Royal FloraHolland’s manager corporate finance, explains. “What we do now is mainly the financing part – the invoices and the daily collection of payments, for example. Our business has developed both geographically and digitally, so we noticed an increased need for a platform for the global flower trade. We therefore developed a new digital platform called Floriday, which enables us to deliver products faster, fresher and in larger amounts to customers worldwide. It is an innovative B2B platform where growers can make their assortment available worldwide, and customers are able to transact in various ways, both nationally and internationally.”

The Floriday platform aims to provide a wider range of services to pay and receive funds in euros, but also in other currencies, and across different jurisdictions. Since it would help treasury to deal with all payments worldwide, Royal FloraHolland needed an international cash management bank too. Van de Wijnboom: “It has been a process of a few years. As part of our strategy, we wanted to grow internationally, and it was clear we needed an international bank to do so. At the same time, our commercial department had some leads for flower business from Saudi-Arabia and Kenya. Early in 2020, all developments – from the commercial, digital and financing points of view – came together.”

Solution

RfP track record

Royal FloraHolland’s financial department decided to contact Zanders for support. “Selecting a cash management bank is not something we do every day, so we needed support to find the right one,” says Pim Zaalberg, treasury consultant at Royal FloraHolland. “We have been working together with Zanders on several projects since 2010 and know which subject matter expertise they can provide. They previously advised us on the capital structure of the company and led the arranging process of the bank financing of the company in 2017. Furthermore, they assisted in the SWIFT connectivity project, introducing payments-on-behalf-of. They are broadly experienced and have a proven track record in drafting an RfP. They exactly know which questions to ask and what is important, so it was a logical step to ask them to support us in the project lead and the contact with the international banks.”

Zanders consultant Michal Zelazko adds: “We use a standardized bank selection methodology at Zanders, but importantly this can be adjusted to the specific needs of projects and clients. This case contained specific geographical jurisdictions and payment methods with respect to the Floriday platform. Other factors were, among others, pre-payments and the consideration to have a separate entity to ensure the safety of all transactions.”

Strategic partner

The project started in June 2020, a period in which the turnover figures managed to rebound significantly, after the initial fall caused by the corona pandemic. Van de Wijnboom: “The impact we currently have is on the flowers coming from overseas, for example from Kenya and Ethiopia. The growers there have really had a difficult time, because the number of flights from those countries has decreased heavily. Meanwhile, many people continued to buy flowers when they were in lockdown, to brighten up their new home offices.”

Together with Zanders, Royal FloraHolland drafted the goals and then started selecting the banks they wanted to invite to find out whether they could meet these goals. All questions for the banks about the cooperative’s expected turnover, profit and perspectives could be answered positively. Zaalberg explains that the bank for international cash management was also chosen to be a strategic partner for the company: “We did not choose a bank to do only payments, but we needed a bank to think along with us on our international plans and one that offers innovative solutions in the e-commerce area. The bank we chose, Citibank, is now helping us with our international strategy and is able to propose solutions for our future goals.”

The Royal FloraHolland team involved in the selection process now look back confidently on the process and choice. Zaalberg: “We are very proud of the short timelines of this project, starting in June and selecting the bank in September – all done virtually and by phone. It was quite a precedent to do it this way. You have to work with a clear plan and be very strict in presentation and input gathering. I hope it is not the new normal, but it worked well and was quite efficient too. We met banks from Paris and Dublin on the same day without moving from our desks.”

Van de Wijnboom agrees and stresses the importance of a well-managed process: “You only have one chance – when choosing an international bank for cash management it will be a collaboration for the next couple of years.”

We have been working together with Zanders on several projects since 2010 and know which subject matter expertise they can provide.

Pim Zaalberg, Treasury Consultant

Performance

Future plans

The future plans of the company are focused on venturing out to new jurisdictions, specifically in the finance space, to offer more currencies for both growers and buyers. “This could go as far as paying growers in their local currency,” says Zaalberg. “Now we only use euros and US dollars, but we look at ways to accommodate payments in other currencies too. We look at our cash pool structure too. We made sure that, in the RfP, we asked the banks whether they could provide cash pooling in a way that was able to use more currencies. We started simple but have chosen the bank that can support more complex setups of cash management structures as well.” Zelazko adds: “It is an ambitious goal but very much in line with what we see in other companies.”

Also, in the longer term, Royal FloraHolland is considering connecting the Floriday platform to its treasury management system. Van de Wijnboom: “Currently, these two systems are not directly connected, but we could do this in the future. When we had the selection interviews with the banks, we discussed the prepayments situation – how do we make sure that the platform is immediately updated when there is a prepayment? If it is not connected, someone needs to take care of the reconciliation.”

There are some new markets and trade lanes to enter, as Van de Wijnboom concludes: ”We now see some trade lanes between Kenya and The Middle East. The flower farmers indicate that we can play an intermediate role if it is at low costs and if payments occur in US dollars. So, it helps us to have an international cash management bank that can easily do the transactions in US dollars.”

After taking a long hard look at its treasury function, Accell Group took the plunge by investing in a treasury management system (TMS) and improving bank connectivity with a payment hub solution.

So how exactly did the European market leader in bicycles achieve these goals? Accell Group is the European market leader in the mid- and upper-segments for high-quality bicycles and associated parts and accessories (XLC). Employing over 3,000 people across 18 countries, Accell Group manages a strong portfolio of national and international (sports) brands, each with its own distinctive positioning.

In 2018 the company sold 1.1 million bicycles, realizing a turnover of €1.1 billion and a net profit of €20.3 million. The bicycle brands in the Accell Group stable include Haibike, Winora, Ghost, Lapierre, Babboe, Batavus, Sparta, Koga, Diamondback and Raleigh. They are manufactured in several locations in the Netherlands, Hungary, Turkey and China.

Bicycles, and particularly e-bikes, are increasingly being seen as a key contributor in addressing issues such as urban congestion, hazardous city traffic, rising CO₂ emissions and our desire to live healthier lifestyles. For this reason, the bicycle market represents excellent potential for further worldwide growth.

“Given that we focus on new, clean and safe mobility solutions, we are certainly in the right business in terms of market potential,” agrees Jonas Fehlhaber, Treasurer at Accell Group, “Furthermore, there is a growing trend for large cities to adapt their infrastructures to offer cyclists more space and make them safer.”

Given that we focus on new, clean and safe mobility solutions, we are certainly in the right business in terms of market potential.

Jonas Fehlhaber, Treasurer at Accell Group

Omnichannel approach

Initially, Accell Group was a small holding company with decentralized management. Fehlhaber joined the Group in 2013 as its first treasurer, but his responsibilities soon expanded to encompass cash management, currency risk management and credit insurance. At the same time, the structure of the company changed. Based on a new strategy defined in 2016, the most important change was that the company wanted to shift from a manufacturing-driven approach to a consumer-centric one. In other words, everything must revolve around the consumer.

“In the past our sales channel was mainly defined by the dealers but now, thanks to experience centers and the use of e-commerce, this is changing into an omnichannel approach,” says Fehlhaber. “The dealers still play the most important role, but with more and more functions being provided centrally, the size of the holding has grown substantially. For the past two-and-a-half years we have had a strong supply chain organization, and our finance team, just like the Treasury, has expanded.”

Challenge

Treasury roadmap

After centralizing several components and rationalizing the bank portfolio, Accell asked Zanders to carry out a quick scan of the Treasury department. In the context of this scan, the treasury function was examined and several potential risks and possible improvement areas were identified.

“To further professionalize the Treasury, we worked with Zanders to start a project in 2017 to establish a treasury roadmap,” adds Fehlhaber. “In this project our strategic goals, along with what we wanted to achieve with them, were laid out. All in all it was an intensive undertaking in which all the respective processes were documented.”

The outcome was reconciled into three pillars: organization, systems and treasury policy. To limit the organizational vulnerability of what would otherwise have been a single-person department, Accell used Zanders’ Treasury Continuity Service (TCS) and appointed an additional treasury employee. An element of the Treasury Continuity Service is a TMS, Integrity, with which processes can be automated and standardized, while risks are simultaneously minimized.

“The Treasury Continuity Service allowed us to implement the system quickly, without the need to go through an RfP [Request for Proposal] process,” says Fehlhaber. “Zanders had already made advance agreements with the supplier, FIS, giving us a partially pre-configured system that could be quickly implemented. Moreover, the support days that we are allocated can be used for advice, for example, or if there is temporary understaffing. We acted on the advice to start up our new payment hub, from the RfP to the actual selection and, if necessary, the implementation too.”

The final improvement was to set up a comprehensive treasury policy, which has injected more structure and transparency into the daily treasury activities.

Solution

More Complete and more interactive

The new TMS and the extra support have meant that Accell’s treasury department is now less vulnerable. “While Excel allows you to work flexibly, sharing information is more difficult because it is much more personal,” continues Fehlhaber. “The owner of the Excel file will be aware of all the details, but issues can quickly arise during transfer. A complicating factor is that there is no audit trail in Excel, making it generally more risky to work with. A TMS, on the other hand, is more complete and interactive, and the transfer is much easier. It has more functionalities and provides daily bank updates, so you always have a good overview of your latest cash positions. What’s more, it records all transactions, such as FX instruments and bank- and inter-company loans, with settlements being done from within Integrity. Above all, though, the TMS offers the option of creating bespoke reports, which in itself saves a lot of time.”

Payments via TIS

A key requirement of Accell was for the payment landscape to be organized more efficiently and controlled more centrally. What we tend to see is that corporates have masses of bank cards, for everyone involved in the authorization of payments. Not only is this very inefficient, it also makes it difficult to effectively manage these processes centrally. This is why Accell decided to implement a payment hub solution [TIS; Treasury Intelligence Solutions]. The payment hub serves as an interface, to replace the banking applications. A further advantage is that TIS offers the option of single sign-on, greatly improving the on-and off-boarding process for users.

Rolling out a TIS project takes between 18 and 24 months. It is a separate system to FIS Integrity, but they are connected in terms of infrastructure. “Bank statements arrive through the payment hub and then interface software distributes them to the systems that need the information, such as the ERP system and Integrity,” explains Fehlhaber. “Furthermore, all systems are fed current market data from our terminal, while payment files, for example, are sent from Integrity via TIS to the bank.”

The once-humble bicycle has evolved into a true lifestyle product.

Tjitze Auke Rijpkema, Treasury Team

Performance

The road to the future

The increasing need to reduce exhaust emissions in major urban areas is fuelling further growth potential for the bicycle market. “The market is still growing,” agrees Fehlhaber, “especially when it comes to e-bikes. We are focusing on the mid- and upper-market segments and doing particularly well with the so-called e-performance bikes, the power-assisted mountain bikes catered for by brands such as Haibike, Ghost and Lapierre.”

In 2018, Accell acquired Velosophy, a fast-growing innovative player in e-cargo biking solutions that serves both consumer and business markets. The Velosophy stable includes Babboe, the market leader in Europe for family cargo bikes, CarQon, the new premium cargo bike brand, and Centaur Cargo. The latter of these three is a specialist in B2B cargo bikes for the so-called ‘last-mile deliveries‘. These are typically to locations that are either impossible or very difficult to reach by car, such as city centers, for example. The acquisition of Velosophy has enabled Accell Group to accelerate its innovation strategy, which is focused, among other things, on the development of urban mobility solutions.

Bicycles are becoming increasingly bespoke products, reveals Fehlhaber. Mobility as a service (offering a service concept rather than just a bicycle), lease options or special, self-selected elements are all maintaining the current momentum in the bicycle market.

“The once-humble bicycle has evolved into a true lifestyle product,” insists Tjitze Auke Rijpkema, who joined the treasury team in 2018. “Smart internet technology and handy connectivity apps are further enriching the cycling experience and making bicycles better and safer in all kinds of ways. Just like treasury, the bicycle is constantly moving with the times.”

Remote partnered with Zanders to simplify bank onboarding, enabling seamless global operations and innovative remote work solutions.

Remote offers global employment services for internationally distributed workforce. It takes care of payroll, benefits, compliance, taxes, equity incentives and more, so that companies can employ someone internationally as easily as they do at home. The company’s vision is to make it simple to manage, employ, and pay anyone, anywhere. Founded in 2019, Remote is growing quickly and expanding into different markets. In 2022, Zanders supported the company to accelerate the onboarding of new banks. Ana de Sousa, Director and Global Head of Treasury at Remote, explains the collaboration in this Q&A.

"We tackle some of the biggest challenges involved in building distributed teams, which are the risk, cost, and complexity of employing international employees and contractors,” De Sousa clarifies. “Our customers include GitLab, DoorDash, Loom, Paystack, and thousands of other companies around the world.”

You have been Director Global Treasurer at Remote for a year now. What attracted you to join the company?

“At Remote we often say that ‘talent is everywhere, but opportunities aren’t.’ I grew up in a very small village in Portugal so I personally identify with this. I saw that Remote is changing the world and I wanted to be part of this change. Beyond the mission, it’s also exciting to be part of a company that is applying technology and automation to bring efficiency to an area as complex as global employment. I am also very aligned with Remote’s values. The value of kindness is very special for me, as I believe that we can always make extraordinary things when we are kind.”

How would you describe the company’s corporate culture?

“Because Remote is a fully distributed virtual company with no offices, most roles are country-agnostic and our employees can work from their chosen locations around the world. That means we have Remoters from 75+ different nationalities, coming from all different cultures, backgrounds and experiences. This contributes to a diverse work environment where everyone is encouraged to share their culture and interests with everyone.”

What would you say drives the need for remote work/remote hiring and remote services in general?

“Over the past few years, many companies turned to remote work as a solution to a problem. What they are discovering now is that it can provide significant business advantages as well. Remote work enables you to build a team without being constrained by geography, meaning companies can tap into wider pools of talent while also supporting greater flexibility and work-life balance.”

What is your experience within different regions/markets?

“Remote has a global presence with around 80 legal entities on six continents. I started my career overseeing cash management for the EMEA region. Later, I moved to a new job with a global scope. Here at Remote, every single member of the Treasury team has global coverage. This means we can leverage asynchronous and flexible work for the entire team to be effective.”

You are working completely remotely, without having a physical company office. What has been your experience with this setup and do you miss meeting your colleagues in person?

“I do miss team birthday parties with cake sometimes. I advocate freedom of choice, based on whatever is best for you. Working from an office is still offered by plenty of companies. For me, remote work has allowed me to keep my career in an international environment while prioritizing family and flexibility. It’s certainly still possible to meet up with colleagues without a company office. I recently met one of my team members in person for the first time, and it was just like catching up with a friend.”

In terms of managing family/work time, are there days where you would prefer to work in a physical company office?

“No, I manage my time according to my priorities. If my kids need me, I will be available for them. If my work is my priority, that is my focus. It is not a physical place that defines my commitment or my capacity of producing results. It is important to have the right structure that supports your professional career independently of the place.”

What are the communication tools you use internally and externally?

“We use tools like Slack, Notion, Loom, and Asana for communication and documentation. Beyond the tools, Remoters are trained in asynchronous communication, documentation, inclusive language, meeting best practices, and even to use the UTC time zone companywide. These are all essential for a team that is as distributed as ours.”

What would you say are treasury-specific challenges when working remotely?

“The biggest challenges of remote work arise when we try to take the old office-centric methods of doing things and expect them to work just as well in a remote setting. Remote work does require some different considerations. Treasury teams in particular need to be rigorous about documentation and practicing ‘overcommunication’ given the critical nature of our work.”

What is the company’s approach for creating an integrated team and what is your personal approach to build a team spirit while working completely remotely?

“As a fully remote company, Remote works hard to build belonging and a sense of community throughout the company. There are numerous opportunities for social connection, including bonding times, games, and even virtual reality time. We have more than 1,700 Slack channels including channels for music, TV, pets, food, sports and much more. At the same time, our culture is asynchronous, so people can participate on their own time and all scheduled events rotate across time zones.”

Expanding into new markets is part of Remote’s core strategy. What role does Treasury play to enable new country operations?

“At Remote, Treasury is part of the backbone of our operations and an enabler of international growth. In the majority of cases, without a bank account, we cannot launch in a country. In addition, domestic bank accounts are also critical to offer better experience to our customers.”

How did Zanders support you to accelerate the onboarding of new banks?

“Zanders helped streamline what could be a very complicated process with banking partners. We appreciated their continuous communication and follow-up on progress, as well as their advocacy on our behalf to challenge some of the requirements we faced and even get a few of them waived.”

How did you perceive the collaboration between Remote and Zanders, given the project was delivered on a fully remote basis?

“It worked very well. We would not have been able to work with a partner that didn’t know how to collaborate remotely. Working with the Zanders team, we were able to apply the same operating principles we use internally – clearly defining guidelines and expectations, overcommunicating, and building a high degree of trust between our teams.”

To round off, what advice would you give anyone starting to work 100% remotely?

“Life is too short to waste time commuting. Remote work is all about freedom, flexibility and happiness. When we do what we like, we’ll get great results, regardless of where the work is done.”

The collaboration between Remote and Zanders

Viktorija Janevska, manager at Zanders: “Account opening and KYC has been a challenge for many corporates in recent years, given the increasing KYC requirements and rather cumbersome onboarding experience. We at Zanders have been happy to support Remote with this interim project, taking the workload from the team and being the first point of contact for the banks with regards to the account opening and onboarding documentation requests. Key success factors for the project were the open and transparent communication between the two teams, regular update calls and priority setting.

Remote not only demonstrates an innovative working approach when it comes to working remotely, but also by using chats for most of their internal communication rather than email communication. During the project, the transition from email to chat communication required some adaptation and from time to time a reminder to use the preferred channel. It has been a great experience to accompany Remote on its journey and are looking forward to see the company’s further success.”

LyondellBasell, headquartered in the Netherlands, is one of the largest plastics, chemicals and refining companies in the world.

LyondellBasell, with its global presence and significant operations in the United States, the company has been affected by the IBOR reform. The Treasury team was well aware of this impact and proactively approached the transition away from the IBOR rates in order to be ready ahead of time.

While it was a global and multi-functional project, one of the first goals was to ensure the TMS readiness for the calculation with alternative reference rates and the new discounting methodologies. As part of the action plan, the LyondellBasell (LYB) Treasury team (supported by procurement and IT) issued an RfP in Q4 2020 with the aim to get external support for (a) the required system changes, (b) to provide business support for initial transition plans and (c) to adhere to the best-in-class ambition of the company.

Preparing for the transition

LYB selected Zanders as implementation partner and right after the selection the project kicked off in January 2021. Urszula Chwala, was the Treasury Lead for LYB and she outlines why LYB initiated the project earlier than many other corporates: “The project team was already busy since the beginning of 2020. We analyzed the potential global impact of the IBOR reform to LYB. Amongst other impacts we were aware that LYB’s SAP Treasury Management System was highly customized, especially in the area of SAP In-house Cash. As such, we wanted to make sure that we would be ready for the transition to support our business and to enable all teams at LYB to move forward with changes on financial, commercial and legal matters.” Urszula also further comments on the RfP process: “We were looking into the third party that had both technical and business knowledge related to the IBOR reform and could bridge the gap between LYB IT and the Treasury department.”

Appreciated approach

LYB is using SAP ECC EHP8 as their treasury system and as such the standard functionality developed by SAP to support daily compound interest calculation could be implemented. On the Zanders side, SAP consultant Aleksei Abakumov, Adela Kozelova (who fulfilled the role of the business expert and project manager) and Anuja Naiknavare in the role of support consultant have been closely working with LYB’s Treasury and IT teams throughout the project.

Zanders made this project as easy as it could be. What I really appreciated was the approach taken by Zanders team. They have taken all the suggestions from us and tested them and then came up with additional suggestions as well. The Zanders team was thinking with us, taking our best interest in mind. They supported us in every detail and removed concerns and roadblocks. Zanders also acted as business alliance in the project to ensure that all business requirements are now fully translated into the technical solution.

Urszula Chwala, Treasury Lead for LYB

A new functionality

In order to achieve system readiness, the project included configuration and diligent testing of a new data feed source which was required as a base to enable the daily average compound, the simple compound interest calculation and the new evaluation type with enhanced discounting curves. Considering the uncertainty, the availability of the new alternative reference rates, market conventions and the exact timing, the project’s aim was to make sure that the system would be able to support different variations of interest calculation. The project went successfully live in May 2021.

Urszula outlines different challenges encountered in the project: “Technically the biggest challenge was finding the right market data feed for the new rates. The challenge was finding the source and, making it available in SAP and test all scenarios. For the actual transactions, the system is a lot more flexible with respect to entering transactions, which makes a deal capture more complex. But Aleksei has supported the team a lot in navigating through the new functionality and we are confident to enter new deals with overnight risk-free rates. On the business side, the market clarity, especially with regards to market conventions, is still challenging the business cutover.”

Transactions

On the transition side, Treasury was cautiously managing the exposure to the IBOR reform by refraining from entering variable interest rate referencing transactions over the last two years. As a result, there is no need to cutover of any existing transaction. However, there are few intercompany loans that will mature by the end of this year and some of them might be replaced by the deals referencing to the overnight risk-free rates. Having strong presence in the United States, the exposure to the USD LIBOR is considerably higher than to the GBP and CHF LIBOR ceasing at the end of this year. Therefore, the major transition is only expected over the next year, closer to the cessation of the USD LIBOR.

Urszula elaborates on the business transition: “Understanding the logic of how new instruments are going to work gives me a piece of mind for the transition. LYB never meant to be an early adopter of the change. Switching intercompany loans as first seems to be the best approach for us, because there are no corresponding derivatives needed for these products. Also, there is no dependency on the external counterparties, which makes the transition easier.”

Really achieved

LYB and Zanders are currently working on a follow-up project for the cash flow aggregation of interest in SAP. This need emerged from the new daily compounding functionality, which by default creates daily cash flow postings that are difficult to reconcile with the interest settlements. A user-friendly solution to aggregate these daily cash flows has been defined and configured and is currently being validated by the end users. This is the last step for LYB to be ready to create a first deal with daily compounding interest calculation in the system.

The change is coming so you can choose either to embrace it or to postpone it. We decided to embrace it now.

Urszula Chwala, Treasury Lead for LYB

Urszula concludes: “The change is coming so you can choose either to embrace it or to postpone it. We decided to embrace it now. The greatest achievement of this project is that the project was executed within original timelines, without major issues and it gave the whole Treasury team confidence that the system will perform well. What needed to be achieved was really achieved. The complete solution is already implemented for the technical side.”

As sustainability is gaining momentum as a business priority, numerous corporates are re-assessing their business models and strategic goals.

One of the key subjects in this re-assessment is the implementation of tangible and transparent Environment, Social, and Governance (ESG) factors into the business.

Treasury can drive sustainability throughout the company from two perspectives, namely through initiatives within the Treasury function and initiatives promoted by external stakeholders, such as banks, investors, or its clients. When considering sustainability, many treasurers first port of call is to investigate realizing sustainable financing framework. This is driven by the high supply of money earmarked for sustainable goals. However, besides this external focus, Treasury can strive to make its own operations more sustainable and, as a result, actively contribute to company-wide ESG objectives.

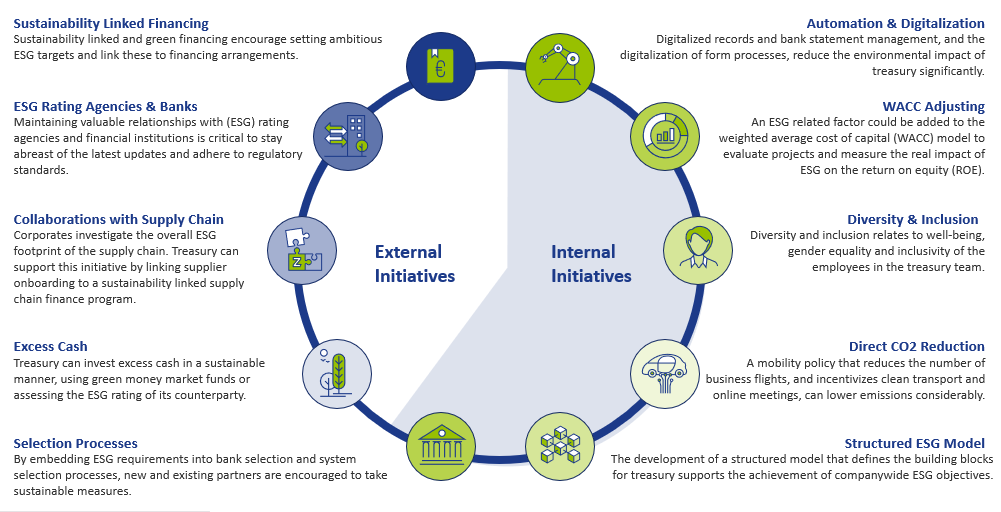

Figure 1: ESG initiatives in scope for Treasury

Treasury holds a unique position within the company because of the cooperation it has with business areas and the interaction with external stakeholders. Treasury can leverage this position to drive ESG developments throughout the company, stay informed of latest updates and adhere to regulatory standards. This article shows how Treasury can become a sustainable support function in its own right, highlights various initiatives within and outside the Treasury department and marks the benefits for Treasury – on top of realising ESG targets.

Internal initiatives

Automation and digitalization drive certain environmental initiatives within the Treasury department. Full digitalized records and bank statement management and the digitalization of form processes reduce the adverse environmental impact of the Treasury department. Besides reducing Treasury’s environmental footprint, digitalization improves efficiency of the Treasury team. By reducing the number of manual, cumbersome operational activities, time can be spent on value-adding activities rather than operational tasks.

Another great example of how Treasury can contribute to the ESG goals of the company, is to incorporate ESG elements in the capital allocation process. This can be done by adding ESG related risk factors to the weighted average cost of capital (WACC) or hurdle investment rates. By having an ESG linked WACC, one can evaluate projects by measuring the real impact of ESG on the required return on equity (ROE). By adjusting the WACC to, for example, the level of CO2 that is emitted by a project, the capital allocation process favours projects with low CO2 emissions.

An additional internal initiative is the design of a mobility policy with the objective to lower CO2 emissions. On one hand, this relates to decreasing the amount of business trips made by the Treasury department itself. On the other hand, it relates to the reduction of business travel by stakeholders of treasury such as bankers, advisors and system vendors. A framework that offsets the added value of a real-life meeting against the CO2 emission is an example of a measure that supports CO2 reduction on both sides. Such a framework supports determination whether the meeting takes place online or in person.

Furthermore, embedding ESG requirements into bank selection, system selection and maintenance processes is a valuable way of encouraging new and existing partners to undertake ESG related measures.

When it comes to social contributions, the focus could be on the diversity and inclusion of the Treasury department, which includes well-being, gender equality and inclusivity of the employees. Pursuing these policies can increase the attractiveness of the organization when hiring talent and make it easier to retain talent within the company, which is also beneficial to the Treasury function.

The development of a structured model that defines the building blocks for Treasury to support the achievement of companywide ESG objectives is a governance initiative that Treasury could undertake. An example of such a model is the Zanders Treasury and Risk Maturity Model, which can be integrated in any organization. This framework supports Treasury in keeping track of its ESG footprint and its contribution to company-wide sustainable objectives. In addition, the Zanders sustainability dashboard provides information on metrics and benchmarks that can be applied to track the progress of several ESG related goals for Treasury. Some examples of these are provided in our ‘Integration of ESG in treasury’ article.

External initiatives

Besides actions taken within the Treasury department, Treasury can boost company-wide ESG performance by leveraging their collaboration with external stakeholders. One of these external initiatives is sustainability linked financing, which is a great tool to encourage the setting of ambitious, company-wide ESG targets and link these to financing arrangements. Examples of sustainability linked financing products include green loans and bonds, sustainability-linked loans, and social bonds. To structure sustainability-linked financing products, corporates often benefit from the guidance of external parties when setting KPIs and ambitious targets and linking these to the existing sustainability strategy. Besides Treasury’s strong relationships with banks, retaining good relationships with (ESG) rating agencies and financial institutions is critical to stay abreast of the latest updates and adhere to regulatory standards. Additionally, investing excess cash in a sustainable manner, using green money market funds or assessing the ESG rating of counterparties, is an effective way of supporting sustainability.

Apart from financing instruments, Treasury can drive the ESG strategy throughout the organization in other ways. Treasury can seek collaborations with business partners to comply with ESG targets, which is another effective manner to achieve ESG related goals throughout the supply chain. An increasing number of corporates is looking to reduce the carbon footprint of their supply chain, for which collaboration is essential. Treasury can support this initiative by linking supplier onboarding on its supply chain finance program to the sustainability performance of suppliers.

To conclude

As developments in ESG are rapidly unfold9ing, Zanders has started an initiative to continuously update our clients to stay ahead of the latest trends. Through the knowledge and network that we have built over the years, we will regularly inform our clients on ESG trends via articles on the news page on our website. The first article will be devoted to the revision of the Sustainability Linked Loan Principles (SLLP) by the Loan Market Association (LMA) and its American and Asian equivalents.

We are keen to hear which topics you would like to see covered. Feel free to reach out to Joris van den Beld or Sander van Tol if you have any questions or want to address ESG topics that are on your agenda.