The adoption of ISO 20022 XML standards significantly enhances invoice reconciliation and operational efficiency, improving working capital management and Days Sales Outstanding (DSO).

Whether a corporate operates through a decentralized model, shared service center or even global business services model, identifying which invoices a customer has paid and in some cases, a more basic "who has actually paid me" creates a drag on operational efficiency. Given the increased focus on working capital efficiencies, accelerating cash application will improve DSO (Days Sales Outstanding) which is a key contributor to working capital. As the industry adoption of ISO 20022 XML continues to build momentum, Zanders experts Eliane Eysackers and Mark Sutton provide some valuable insights around why the latest industry adopted version of XML from the 2019 ISO standards maintenance release presents a real opportunity to drive operational and financial efficiencies around the reconciliation domain.

A quick recap on the current A/R reconciliation challenges

Whilst the objective will always be 100% straight-through reconciliation (STR), the account reconciliation challenges fall into four distinct areas:

1. Data Quality

- Partial payment of invoices.

- Single consolidated payment covering multiple invoices.

- Truncated information during the end to end payment processing.

- Separate remittance information (typically PDF advice via email).

2. In-country Payment Practices and Payment Methods

- Available information supported through the in-country clearing systems.

- Different local clearing systems – not all countries offer a direct debit capability.

- Local market practice around preferred collection methods (for example the Boleto in Brazil).

- ‘Culture’ – some countries are less comfortable with the concept of direct debit collections and want full control to remain with the customer when it comes to making a payment.

3. Statement File Format

- Limitations associated with some statement reporting formats – for example the Swift MT940 has approximately 20 data fields compared to the ISO XML camt.053 bank statement which contains almost 1,600 xml tags.

- Partner bank capability limitations in terms of the supported statement formats and how the actual bank statements are generated. For example, some banks still create a camt.053 statement using the MT940 as the data source. This means the corporates receives an xml MT940!

- Market practice as most companies have historically used the Swift MT940 bank statement for reconciliation purposes, but this legacy Swift MT first mindset is now being challenged with the broader industry migration to ISO 20022 XML messaging.

4. Technology & Operations

- Systems limitations on the corporate side which prevent the ERP or TMS consuming a camt.053 bank statement.

- Limited system level capabilities around auto-matching rules based logic.

- Dependency on limited IT resources and budget pressures for customization.

- No global standardized system landscape and operational processes.

How can ISO20022 XML bank statements help accelerate and elevate reconciliation performance?

At a high level, the benefits of ISO 20022 XML financial statement messaging can be boiled down into the richness of data that can be supported through the ISO 20022 XML messages. You have a very rich data structure, so each data point should have its own unique xml field. This covers not only more structured information around the actual payment remittance details, but also enhanced data which enables a higher degree of STR, in addition to the opportunity for improved reporting, analysis and importantly, risk management.

Enhanced Data

- Structured remittance information covering invoice numbers, amounts and dates provides the opportunity to automate and accelerate the cash application process, removing the friction around manual reconciliations and reducing exceptions through improved end to end data quality.

- Additionally, the latest camt.053 bank statement includes a series of key references that can be supported from the originator generated end to end reference, to the Swift GPI reference and partner bank reference.

- Richer FX related data covering source and target currencies as well as applied FX rates and associated contract IDs. These values can be mapped into the ERP/TMS system to automatically calculate any realised gain/loss on the transaction which removes the need for manual reconciliation.

- Fees and charges are reported separately, combined a rich and very granular BTC (Bank Transaction Code) code list which allows for automated posting to the correct internal G/L account.

- Enhanced related party information which is essential when dealing with organizations that operate an OBO (on-behalf-of) model. This additional transparency ensures the ultimate party is visible which allows for the acceleration through auto-matching.

- The intraday (camt.052) provides an acceleration of this enhanced data that will enable both the automation and acceleration of reconciliation processes, thereby reducing manual effort. Treasury will witness a reduction in credit risk exposure through the accelerated clearance of payments, allowing the company to release goods from warehouses sooner. This improves customer satisfaction and also optimizes inventory management. Furthermore, the intraday updates will enable efficient management of cash positions and forecasts, leading to better overall liquidity management.

Enhanced Risk Management

- The full structured information will help support a more effective and efficient compliance, risk management and increasing regulatory process. The inclusion of the LEI helps identify the parent entity. Unique transaction IDs enable the auto-matching with the original hedging contract ID in addition to credit facilities (letters of credit/bank guarantees).

In Summary

The ISO 20022 camt.053 bank statement and camt.052 intraday statement provide a clear opportunity to redefine best in class reconciliation processes. Whilst the camt.053.001.02 has been around since 2009, corporate adoption has not matched the scale of the associated pain.001.001.03 payment message. This is down to a combination of bank and system capabilities, but it would also be relevant to point out the above benefits have not materialised due to the heavy use of unstructured data within the camt.053.001.02 message version.

The new camt.053.001.08 statement message contains enhanced structured data options, which when combined with the CGI-MP (Common Global Implementation – Market Practice) Group implementation guidelines, provide a much greater opportunity to accelerate and elevate the reconciliation process. This is linked to the recommended prescriptive approach around a structured data first model from the banking community.

Finally, linked to the current Swift MT-MX migration, there is now agreement that up to 9,000 characters can be provided as payment remittance information. These 9,000 characters must be contained within the structured remittance information block subject to bilateral agreement within the cross border messaging space. Considering the corporate digital transformation agenda – to truly harness the power of artificial intelligence (AI) and machine learning (ML) technology – data – specifically structured data, will be the fuel that powers AI. It’s important to recognize that ISO 20022 XML will be an enabler delivering on the technologies potential to deliver both predictive and prescriptive analytics. This technology will be a real game-changer for corporate treasury not only addressing a number of existing and longstanding pain-points but also redefining what is possible.

The Swift MT-MX migration and global industry adoption of ISO 20022 XML are more than just a simple compliance change.

The corporate treasury agenda continues to focus on cash visibility, liquidity centralization, bank/bank account rationalization, and finally digitization to enable greater operational and financial efficiencies. Digital transformation within corporate treasury is a must have, not a nice to have and with technology continuing to evolve, the potential opportunities to both accelerate and elevate performance has just been taken to the next level with ISO 20022 becoming the global language of payments. In this 6th article in the ISO 20022 XML series, Zanders experts Fernando Almansa, Eliane Eysackers and Mark Sutton provide some valuable insights around why this latest global industry move should now provide the motivation for corporate treasury to consider a cash management RFP (request for proposal) for its banking services.

Why Me and Why Now?

These are both very relevant important questions that corporate treasury should be considering in 2024, given the broader global payments industry migration to ISO 20022 XML messaging. This goes beyond the Swift MT-MX migration in the interbank space as an increasing number of in-country RTGS (real-time gross settlement) clearing systems are also adopting ISO 20022 XML messaging. Swift are currently estimating that by 2025, 80% of the domestic high value clearing RTGS volumes will be ISO 20022-based with all reserve currencies either live or having declared a live date. As more local market infrastructures migrate to XML messaging, there is the potential to provide richer and more structured information around the payment to accelerate and elevate compliance and reconciliation processes as well as achieving a more simplified and standardized strategic cash management operating model.

So to help determine if this really applies to you, the following questions should be considered around existing process friction points:

- Is your current multi-banking cash management architecture simplified and standardised?

- Is your account receivables process fully automated?

- Is your FX gain/loss calculations fully automated?

- Have you fully automated the G/L account posting?

- Do you have a standard ‘harmonized’ payments message that you send to all your banking partners?

If the answer is yes to all the above, then you are already following a best-in-class multi-banking cash management model. But if the answer is no, then it is worth reading the rest of this article as we now have a paradigm shift in the global payments landscape that presents a real opportunity to redefine best in class.

What is different about XML V09?

Whilst structurally, the XML V09 message only contains a handful of additional data points when compared with the earlier XML V03 message that was released back in 2009, the key difference is around the changing mindset from the CGI-MP (Common Global Implementation – Market Practice) Group1 which is recommending a more prescriptive approach to the banking community around adoption of its published implementation guidelines. The original objective of the CGI-MP was to remove the friction that existed in the multi-banking space as a result of the complexity, inefficiency, and cost of corporates having to support proprietary bank formats. The adoption of ISO 20022 provided the opportunity to simplify and standardize the multi-banking environment, with the added benefit of providing a more portable messaging structure. However, even with the work of the CGI-MP group, which produced and published implementation guidelines back in 2009, the corporate community has encountered a significant number of challenges as part of their adoption of this global financial messaging standard.

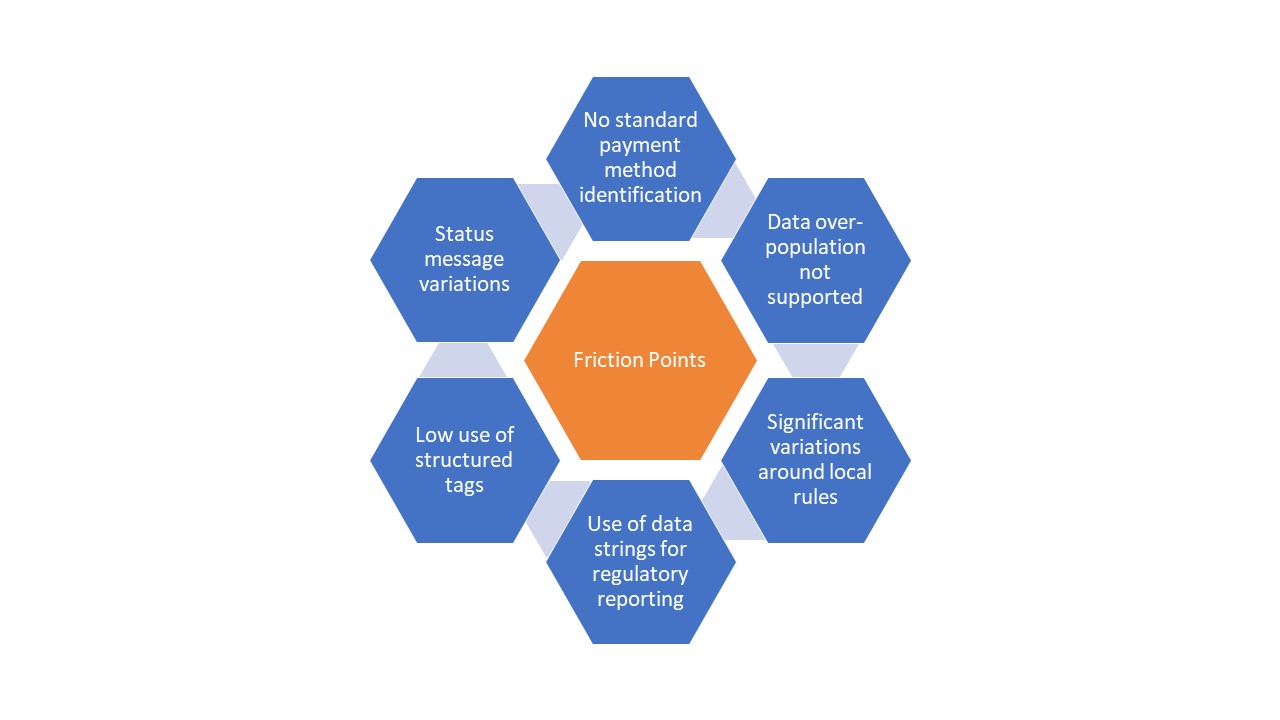

The key friction points are highlighted below:

Diagram 1: Key friction points encountered by the corporate community in adopting XML V03

The highlighted friction points have resulted in the corporate community achieving a sub-optimal cash management architecture. Significant divergence in terms of the banks’ implementation of this standard covers a number of aspects, from non-standard payment method codes and payment batching logic to proprietary requirements around regulatory reporting and customer identification. All of this translated into additional complexity, inefficiency, and cost on the corporate side.

However, XML V09 offers a real opportunity to simplify, standardise, accelerate and elevate cash management performance where the banking community embraces the CGI-MP recommended ‘more prescriptive approach’ that will help deliver a win-win situation. This is more than just about a global standardised payment message, this is about the end to end cash management processes with a ‘structured data first’ mindset which will allow the corporate community to truly harness the power of technology.

What are the objectives of the RFP?

The RFP or RFI (request for information) process will provide the opportunity to understand the current mindset of your existing core cash management banking partners. Are they viewing the MT-MX migration as just a compliance exercise. Do they recognize the importance and benefits to the corporate community of embracing the recently published CGI-MP guidelines? Are they going to follow a structured data first model when it comes to statement reporting? Having a clearer view in how your current cash management banks are thinking around this important global change will help corporate treasury to make a more informed decision on potential future strategic cash management banking partners. More broadly, the RFP will provide an opportunity to ensure your core cash management banks have a strong strategic fit with your business across dimensions such as credit commitment, relationship support to your company and the industry you operate, access to senior management and ease of doing of business. Furthermore, you will be in a better position to achieve simplification and standardization of your banking providers through bank account rationalization combined with the removal of non-core partner banks from your current day to day banking operations.

In Summary

The Swift MT-MX migration and global industry adoption of ISO 20022 XML should be viewed as more than just a simple compliance change. This is about the opportunity to redefine a best in class cash management model that delivers operational and financial efficiencies and provides the foundation to truly harness the power of technology.

Citations

- Common Global Implementation–Market Practice (CGI-MP) provides a forum for financial institutions and non-financial institutions to progress various corporate-to-bank implementation topics on the use of ISO 20022 messages and to other related activities, in the payments domain. ↩︎

Managing over 80 intercompany loans annually and with a wide geographical scope, Royal Philips faced the challenge of complying with their Transfer Pricing obligations.

Zanders Transfer Pricing Suite is an innovative, cloud-based solution designed for companies looking to automate the Transfer Pricing compliance of financial transactions. With over five years of experience and trusted by more than 60 multinational corporations, the platform is the market-leading solution for financial transactions Transfer Pricing. On March 31, 2023, Zanders and Royal Philips jointly presented the conference "How Philips Automated Its Transfer Pricing Process for Group Financing" at the DACT (Dutch Association of Corporate Treasurers) Treasury Fair 2023.

Context

The publication of Chapter X of Financial Transactions by the OECD, as well as its incorporation into the 2022 OECD Transfer Pricing Guidelines, has led to an increased scrutiny by tax authorities. Consequently, transfer pricing for financial transactions, such as intra-group loans, guarantees, cash pools, and in-house banks, has become a critical focus for treasury and tax departments.

ZANDERS TRANSFER PRICING SOLUTION

As compliance with Transfer Pricing regulations gains greater significance, many companies find that the associated analyses consume excessive time and resources from their in-house tax and treasury departments. Several struggle to automate the end-to-end process, from initiating intercompany loans to determining the arm's length interest, recording the loans in their Treasury Management System (TMS), and storing the Transfer Pricing documentation.

Since 2018, Zanders Transfer Pricing Solution has supported multinational corporations in automating their Transfer Pricing compliance processes for financial transactions.

ROYAL PHILIPS CASE STUDY

Managing over 80 intercompany loans annually and with a wide geographical scope, Royal Philips faced the challenge of complying with their Transfer Pricing obligations. During the conference, Joris Van Mierlo, Corporate Finance Manager at Philips, detailed how Royal Philips implemented a fully integrated solution to determine and record the arm's length interest rates applicable to its intra-group loans.

Insurance Treasury is evolving into Treasury 4.x, a forward-thinking paradigm integrating advanced technology and strategic foresight to enhance efficiency and resilience in the digital era.

The productivity and performance of the treasury function within insurance companies have undergone a transformative evolution, driven by the emergence of what is now termed Treasury 4.x. In this digital era, characterized by rapid technological advancements, Insurance Treasury is transitioning towards a more dynamic and strategic role. Treasury 4.x is distinguished by its capacity to envision and operate within various financial scenarios, reflecting a forward-thinking approach. The contemporary Insurance Treasury aligns itself with the principles of "Fit-for-purpose" – emphasizing a centralized organizational structure embedded seamlessly within the financial supply chain. Highly automated processes, often referred to as "exception-based management," are integral to this paradigm shift, enabling treasuries to focus resources on critical issues and exceptions, thereby enhancing efficiency and minimizing manual intervention. This evolution underscores the imperative for insurance treasuries to leverage cutting-edge technologies and embrace a proactive, scenario-driven mindset, ensuring adaptability and resilience in the face of dynamic market conditions.

Innovation of Payment Landscape

In the ever-evolving landscape of payment innovation within the treasury functions of insurance companies, a pivotal focus has been placed on migrating to the ISO 20022 XML messaging standard and moving away from FIN MT messages. This migration, driven by SWIFT, is not just a strategic choice but an industry-wide mandate, compelling all financial institutions, including insurance companies, to transition to the ISO standard by November 2025. This migration is a cornerstone in revolutionizing payment processes, offering a standardized and enriched data format that not only enhances interoperability but also facilitates more robust and information-rich communication. As insurance companies navigate this time-sensitive transition, a review of address logic within payment files becomes even more critical. The insurance companies are mandated to review and refine address logic within payment files by November 2026. Ensuring that the company is compliant with evolving financial messaging standards will not only improve the overall efficiency, speed and compliance of payments, but it will also provide the opportunity to redefine the best-in-class cash management operating model.

In additional to the industry migration to a new messaging standard, the introduction of Central Bank Digital Currency (CBDC) could impact the traditional roles of treasuries by offering new means of payment, settlement, and potentially altering liquidity management strategies. CBDCs could enhance efficiency in cross-border transactions, simplify reconciliation processes, and influence investment strategies. Insurance treasuries might need to adapt their systems and processes to incorporate CBDCs effectively, ensuring compliance with regulatory requirements and taking advantage of potential benefits associated with this digital form of currency. We are also witnessing an increase in momentum around the use of distributed ledger technology within the wholesale banking domain. In December, JP Morgan announced it was live on Partior, the Singapore-based interbank payment network that uses blockchain and is designed as a multi-bank, multi-currency system for wholesale use, with each bank controlling its own node. This is clear evidence we are starting to gain real traction around potential solutions using both blockchain and CBDC’s that will further increase the number of payment rails available to support the payments ecosystem.

Finally, the payment landscape of insurance companies sees further innovation with Faster Claims Payment (FCP). This solution streamlines the disbursement of claims, decoupling it from traditional monthly processes. FCP integrates seamlessly with the Vitesse payment platform, ensuring direct access to insurer funds and significantly reducing delays in payments. This paradigm shift promotes efficiency and enhances customer satisfaction through its accelerated claims payment system. The innovative payment landscape, however, could highlight a potential impact for processes of insurance treasuries. Increased application of faster and real-time payments requires insurance treasuries to have sufficient liquidity readily available to meet the immediate financial obligations. This demands careful planning of cash reserves to ensure uninterrupted claim processing while maintaining financial stability and stresses the importance of effective cash management for navigating any potential downside impact of FCP.

Changing Macroeconomic Environment

The insurance treasury is profoundly influenced by macroeconomic events, and the convergence of several geopolitical challenges has introduced heightened uncertainty and downside risks. Elevated geopolitical tensions, particularly the intensified strategic rivalry between the United States and China, the Russia-Ukraine war, and the recent Middle East conflict, pose significant threats to the insurance industry's stability. These events bring the potential for energy price shocks, amplifying concerns about increased insurance industry losses stemming from geopolitical and economic upheavals. Furthermore, the scheduled elections in 76 countries, with pivotal ones in the United States, Taiwan, and India, add an additional layer of uncertainty. Political transitions can introduce policy shifts, impacting regulatory environments and potentially altering economic landscapes, further complicating risk assessment for insurance treasuries. As the global geopolitical landscape remains dynamic, insurance treasuries must navigate these challenges prudently, emphasizing resilience and adaptability in their financial strategies to mitigate potential adverse impacts.

Interest rate changes command a substantial impact on the treasury functions of insurance companies, and the recent shifts in central bank policies have introduced a dynamic landscape. The conclusion of the central banks' rate tightening cycle, coupled with the Federal Reserve's announcement of rate cuts for 2024 and beyond, signals a pivotal change. While these rate cuts are aimed at supporting economic recovery, they pose challenges for insurance treasuries that traditionally benefit from higher interest rates. The insurance industry faces the paradox of modest GDP growth across advanced economies, with the downside risk of a potential rebound in inflation and further geopolitical shocks. The relatively elevated interest rates, however, offer a silver lining for (re)insurers, providing a boost to future recurring income. As maturing assets are reinvested at higher rates, this strategic advantage could help mitigate some of the challenges posed by the shifting interest rate environment, fostering resilience and adaptability in the treasury functions of insurance companies.

Taking into account the aforementioned macroeconomic changes, insurance treasuries must ensure they possess local treasury experts capable of supporting multiple regions with adapting to shifting business dynamics.

Changing Market Rates

The impact of changing market rates on the asset management activities of insurers is profound, extending to collateral management practices. Market rate fluctuations exert direct influence on the valuation and performance of their investment portfolios, notably affecting the required Variation Margin (VR) and Uncleared Margin Rules (UMR) on derivatives holdings. As rates oscillate, the value of derivative positions can vary significantly, necessitating adjustments in margin requirements to effectively manage risk exposures and collateral obligations.

Additionally, these changes in market rates affect the liquidity position of insurers, prompting the need for more dynamic models to optimize liquidity management. Given the importance of maintaining sufficient cash and liquid assets, insurers must adapt their strategies to ensure they can meet obligations promptly, especially considering the impact of FX fluctuations on assets denominated in non-base currencies. This entails employing more dynamic models to gauge liquidity needs accurately and employing strategies such as RePo agreements to enhance flexibility in accessing cash when required. Thus, navigating the complexities of changing market rates requires insurers to employ a comprehensive approach that integrates risk management, liquidity optimization, and currency hedging strategies.

Data Analytics and Predictive Modeling

The integration of artificial intelligence (AI) and predictive analytics has revolutionized the treasury function within insurance companies, particularly in the realm of cash flow forecasting. These advanced technologies enable insurance treasuries to analyze vast datasets, identify patterns, and make more accurate predictions regarding future cash flows. AI algorithms can process information rapidly, taking into account a multitude of variables, such as market trends, policyholder behavior, and economic indicators. This enhanced predictive capability is instrumental in optimizing liquidity management, allowing insurance companies to proactively anticipate cash needs and allocate resources efficiently. The importance of AI and predictive analytics in cash flow forecasting cannot be overstated, as it empowers treasuries to make informed decisions, mitigate financial risks, and navigate the complexities of the insurance landscape with greater precision and agility.

Regulatory Compliance

Regulatory compliance is pivotal for insurance company treasuries, significantly influencing financial strategies and operations. The complex regulatory landscape, including directives like the Insurance Recovery and Resolution Directive, Solvency II, and EMIR Refit, aims at ensuring financial stability, consumer protection, and market integrity. These requirements, from solvency standards to reporting obligations, impact how treasuries manage assets, liabilities, and capital. Non-compliance can lead to severe consequences, prompting insurance treasuries to invest in sophisticated systems for continuous monitoring. Striking a balance between compliance and strategic financial goals is crucial for navigating the regulatory environment and ensuring long-term organizational sustainability.

Additionally, insurance companies operating across different jurisdictions face fragmented compliance regulations, consisting of local laws and regulations. This has become a prominent challenge experienced by insurance company treasuries and visible in various treasury processes, from payments to liquidity management. Establishing robust processes and conducting regular compliance reviews could help insurance companies to address the fragmented compliance framework. By proactively addressing compliance challenges and embracing innovative solutions, insurance companies could achieve robust global operations and success in an increasingly interconnected world.

For more information about Treasury 4.x, download our latest whitepaper: Treasury 4.x - The age of productivity, performance and steering.

Is the grass always greener on the other side? Observing a tendency to change from “best of breed treasury management systems” to best “integrated treasury management systems” and vice versa.

In large organizations, the tendency is to select large scale ERP systems to support as much of the organization's business processes within this system. This is a goal that is driven typically by the IT department as this approach reduces the number of different technologies and minimizes the integration between systems. Such a streamlined and simplified system architecture looks to mitigate risk by reducing the potential points of failure and total cost of ownership.

Over the years the treasury department has at times chosen to rather deploy “best of breed” treasury management systems and integrate this separate system to the ERP system. The treasury business processes and therefore systems also come with some significant integration points in terms of trading platforms, market data and bank integration for tasks such as trade confirmations, payments, bank statements and payment monitoring messaging.

The IT department may view this integration complexity as an opportunity for simplification if the ERP systems are able to provide acceptable treasury and risk management functionalities. Especially if some of the integrations that the treasury requires does overlap with the needs of the rest of the business – i.e. payments, bank statements and market data.

Meanwhile, the treasury department will want to ensure that they have as much straight through processing and automation as possible with robust integration. Since their high value transactions are time sensitive, a breakdown in processing would result in negative transactional cost implications with their bank counterparts.

Deciphering Treasury System Selection: Below the Surface

The decision-making process for selecting a system for treasury operations is complex and involves various factors. Some are very much driven by unique financial business risks, leading to a functional based decision process. However, there are often underlying organizational challenges that play a far more significant role in this process than you would expect. Some challenges stem from behavioral dimensions like the desire for autonomy and control from the treasury. While others are based on an age-old perception that the “grass is greener on the other side” – meaning the current system frustrations result in a preference to move away from current systems.

An added and lesser appreciated perspective is that most organizations tend to mainly focus on technical upgrades but not often functional upgrades on systems that are implemented. Meaning that existing systems tend to resemble the version of the system based on when the original implementation took place. This will also lead to a comparison of the current (older version) system against the competing offerings latest and greatest.

Another key observation is that with implementing integrated TMS solutions like the SAP TRM solution in the context of the same ERP environment, the requirements can become more extensive as the possibilities for automating more with all source information increase. Consider for example the FX hedging processes where the source exposure information is readily available and potential to access and rebalance hedge positions becomes more dynamic.

Closing thoughts

There is no single right answer to this question for all cases. However, it is important to ensure that the process you follow in making this decision is sound, informed and fair. Involving an external specialist with experience in navigating such decisions and exposure to various offerings is invaluable.

To support these activities, Zanders has also built solutions to make the process as easy as it can possibly be, including a cloud-based system selection tool.

Moreover for longer term satisfaction, enabling the evolution of the current treasury system (be it best of breed or integrated) is essential. The system should evolve with time and not remain locked into its origin based on the original implementation. Here engaging with a specialist partner with the right expertise to support the treasury and IT organizations is key. This can improve the experience of the system and this increased satisfaction can ensure decision making is not driven or led by negativity.

In support of this area Zanders has a dedicated service called TTS which can come alongside your existing IT support organization and inject the necessary skill and insight to enable incremental improvements alongside improved resolution timeframes for day-to-day systems issues.

For more information about out Treasury Technology Service, reach out to Warren Epstein.

Economic instability, a pandemic, geopolitical turbulence, rising urgency to get to net zero – a continuousstream of demands and disruption have pushed businesses to their limits in recent years.

Economic instability, a pandemic, geopolitical turbulence, rising urgency to get to net zero – a continuousstream of demands and disruption have pushed businesses to their limits in recent years. What this has proven without doubt is that treasury can no longer continue to be an invisible part of the finance function. After all, accurate cash flow forecasting, working capital and liquidity management are all critical C-suite issues. So, with the case for a more strategic treasury accepted, CFOs are now looking to their corporate treasurer more than ever for help with building financial resilience and steering the business towards success.

The future form of corporate treasury is evolving at pace to meet the demands, so to bring you up to speed, we discuss in this article five key observations we believe will have the most significant impact on the treasury function in the coming year(s).

1. A sharper focus on productivity and performance

Except for some headcount reductions, treasury has remained fairly protected from the harsh cost-cutting measures of recent years. However, with many OPEX and CAPEX budgets for corporate functions under pressure, corporate treasurers need to be prepared to justify or quantify the added value of their function and demonstrate how treasury technology is contributing to operational efficiencies and cost savings. This requires a sharper focus on improving productivity and enhancing performance.

To deliver maximum performance in 2024, treasury must focus on optimizing structures, processes, and implementation methods. Further digitalization (guided by the blueprint provided by Treasury 4.0) will naturally have an influential role in process optimization and workflow efficiency. But to maintain treasury budgets and escape an endless spiral of cost-cutting programs will take a more holistic approach to improving productivity. This needs to incorporate developments in three factors of production – personnel, capital, and data (in this context, knowledge).

In addition, a stronger emphasis on the contribution of treasury to financial performance is also required. Creating this direct link between treasury output and company financial performance strengthens the function’s position in budget discussions and reinforces its role both in finance transformation processes and throughout the financial supply chain.

2. Treasury resilience, geopolitical risk and glocalization

Elevated levels of geopolitical risk are triggering heightened caution around operational and financial resilience within multinationals. As a result, many corporations are rethinking their geographical footprint and seeking ways to tackle overdependence on certain geographical markets and core suppliers. This has led to the rise of ‘glocalization’ strategies, which typically involve moving away from the traditional approach of offshoring operations to low-cost destinations to a more regional approach that’s closer to the end market.

The rise of glocalization is forcing treasury to recalibrate its target operating model to adopt a more regionalized approach. This typically involves changing from a ‘hub and spoke’ model to multiple hubs. But the impact on treasury is not only structural. Operating in many emerging and frontier markets creates heightened risks around currency restrictions, lack of local funding and the inability to repatriate cash. Geopolitical tensions can also have spillover effects to the financial markets in these countries. This necessitates the application of more financial resilience thinking from treasury.

3. Cash is king, data is queen

Cash flow forecasting remains a top priority for corporate treasurers. This is driving the rise of technology capable of producing more accurate cash flow predictions, faster and more efficiently. Predictive and prescriptive analytics and AI-based forecasting provide more precise and detailed outcomes compared to human forecasting. While interfaces or APIs can be applied to accelerate information gathering, facilitating faster and automated decision-making. But to leverage the benefits of these advanced applications of technology requires robust data foundations. In other words, while technology plays a role in improving the cash flow forecasting process, it relies on an accurate and timely source of real-time data. As such, one can say that cash may still be king, but data is queen.

In addition, a 2023 Zanders survey underscored the critical importance of high-quality data in financial risk management. In particular, the survey highlighted the criticality of accurate exposure data and pointed out the difficulties faced by multinational corporations in consolidating and interpreting information. This stressed the necessity of robust financial risk management through organizational data design, leveraging existing ERP or TMS technology or establishing a data lake for processing unstructured data.

4. The third wave of treasury digitalization

We’ve taken the three waves of digitalization coined by Steve Case (former CEO of US internet giant AOL) and applied them to the treasury function. The first wave was the development of stand-alone treasury and finance solutions, followed by the second wave bringing internal interfaces and external connectivity between treasury systems. The third wave is about how to leverage all the data coming from this connected treasury ecosystem. With generative AI predicted to have an influential role in this third phase, corporate treasurers need to incorporate the opportunities and challenges it poses into their organizations' digital transformation journeys and into discussions and decisions related to other technologies within their companies, such as TMS, ERP, and banking tools.

We also predict the impact and success of this third wave in treasury digitalization will be dependent on having the right regulatory frameworks to support its implementation and operation. The reality is, although we all aspire to work in a digital, connected world, we must be prepared to encounter many analogue frictions – like regulatory requirements for paper-based proof, sometimes in combination with ‘wet’ signatures and stamped documents. This makes the adoption of mandates, such as the MLETR (Model Law on Electronic Transferable Records) a priority.

5. Fragmentation and interoperability of the payment landscape

A side effect of the increasing momentum around digital transformation is fragmentation across the payments ecosystem. This is largely triggered by a rapid acceleration in the use of digital payments in various forms. We’ve now seen successful trials of Central Bank Digital Currency, Distributed Ledger Technology to enable cross border payments, a rise in the use of digital wallets not requiring a bank account, and the application of cross border instant payments. All of these developments lead us to believe that international banking via SWIFT will be challenged in the future and treasurers should prepare for a more fragmented international payment ecosystem that supports a multitude of different payment types. To benefit from this development, interoperability will be crucial.

Conclusion: A turning point for treasury

A succession of black swan events in recent years has exposed a deep need for greater financial resilience. The treasury function plays a vital role in helping their CFO build this. This is accelerating both the scale and pace of transformation across the treasury function, with wide-ranging effects on its role in the C-suite, position in finance, the priorities and structure of the function, and the investment required to support much-needed digitalization.

For more information on the five observations outline here, you can read the extended version of this article.

Revolutionizing Bolt’s Treasury: Efficiency, Reliability, and Growth

Mid 2023, Bolt successfully implemented its new full-fledged treasury management system (TMS). With assistance of Zanders consultants, the mobility company implemented Kyriba – a necessity to support Bolt’s small treasury team. As a result, all daily processes are almost completely automated. “It's about reliability.”

Bolt is the leading European mobility platform that’s focused on more efficient, convenient and sustainable solutions for urban travelling. With more than 150 million customers in at least 45 countries, it offers a range of mobility services including ride-hailing, shared cars and scooters, food and grocery delivery. “Bolt was founded by Markus Villig, a young Estonian guy who quit his school to start this business with €5,000 that he borrowed from his parents,” says Mahmoud Iskandarani, Group Treasurer at Bolt. “He built an app and started to ask drivers on the street to download it and try it out. Now we have millions of drivers and passengers, almost 4,000 employees and several business lines. Last August, we celebrated our 10th anniversary. So, we have one of the fastest growing businesses in Europe. And our ambition is to grow even faster than so far.”

Driven by technology

Because of its fast growth, Bolt’s Treasury team decided to look for a scalable solution to cope with the further expansion of the business. Freek van den Engel, Treasury manager at Bolt: “We needed a system that could automate most of our daily processes and add value. Doing things manually is not efficient and risks are high. To help us scale up while maintaining efficiency, we needed our Treasury to be driven by technology.”

Iskandarani adds: “Meanwhile, our macro environment is changing and we had some bank events. In the past years, startups or scale-ups have seen big growth and didn't focus too much on working capital management. Interest rates were low, which made it easy to raise money from investors. Now, we need to make sure that we manage our working capital the right way so that we can access our money, mitigate risks, and that we get a decent return on our cash. That’s when it's controlled by Treasury and invested correctly.”

Choosing Kyriba

Van den Engel led a treasury system selection process three years ago for his previous employer, where he also worked together with Iskandarani. “That experience helped us to come up with a shortlist of three providers, instead of having a very long RfP process looking at a long list of vendors. We started the selection process in June 2022 and two months later we chose Kyriba because of its strong functionality. Also, it’s a solution offered as SaaS, which means we don't have to worry about upgrades – a very important reason for us. Kyriba has been working with tech companies similar to ours. Another decisive factor was their format library, called Open Format Studio. It allows us to use self-service when it comes to configuring payment formats, reducing our costs and turn-around time when expanding to new geographies.”

Implementation partner

For Bolt, Kyriba will function as in-house bank system, and support its European cash pool. During the selection process, the team had some reference calls with other Kyriba users to discuss experiences with the system and the implementation. “One piece of feedback we received was that it works very well to bring in implementation partners to complete such a project successfully. Zanders stood out, because of its proven track record and the awards it had won. Also, Mahmoud and I both had experience with Zanders during some projects at our previous employer. That’s why we asked them to be our implementation partner.”

In October 2022, the implementation process started. In July 2023, the system went live. Kyriba’s TMS solution covered all treasury core processes, including cash position reporting (including intra-day balance information), liquidity management, funding, foreign exchange with automatic integration to 360T and Finastra, investments, payment settlements and risk management.

Trained towards independency

As part of the implementation process, Zanders trained Bolt on how to use the new tool, and assisted in using the Open Format Studio. In this way, the team built the knowledge and experience needed to roll out to new countries more independently.

Van den Engel: “We aimed to be independent and do as much as possible ourselves to reduce costs and build up in-house expertise on the system. Zanders helped us figuring out what we wanted, explained and guided us, and showed what the system can do and how to align that with our needs in the best possible way. Once we were clear on the blueprint, they helped us with our static data, connectivity and initial system set-up. After the training they led, we were able to do most of it ourselves, including the actual system configuration work, for which Zanders had laid the foundation.”

Rolling out the payment hub

With assistance of Zanders consultants, Bolt also set up a framework to roll out the payment hub, for the vendor payments from its ERP system called Workday and its payroll provider, Immedis. The consultants assisted with configuration of initial payment scenarios and workflows. “We made the connections, tested them and did a pilot with Workday last summer. After training and with the experience that we've built up using Open Format Studio, we can roll out to new countries and expand it ourselves. Starting in August, we continued to roll out Kyriba’s payment hub to more countries, and to implement Payroll. With the payment hub we are now live in 16 countries and that's basically fully self-serviced. Apart from some support for specialized cases, we don’t need support anymore for the payment hub.”

Many material benefits

Having a small hands-on project team meant no need for a complex project management organization to be set-up. Naturally Bolt and Zanders started using agile project management, with refocus of priorities to different streams as necessary. The Kyriba implementation project was closed within the set budget in 9 months’ time.

Iskandarani is happy with the results. “It is clear there are benefits of this implementation when it comes to efficiency and risk management. We now have the visibility over our cash and the fact that we have a system telling us that there’s an exposure that we should get rid of, that has a lot of value. Also, we have some financial benefits that we could not have achieved without the system. Today we can pool our cash better, we can invest it better, and we can handle our foreign exchange in a better way. Before this, we have overpaid banks.”

Reliability and control

“We could have hired more people”, Van den Engel adds. “But some things are just very difficult to do without this system. It's also about reliability. Even if you have a manual process in place that works, you will see it breaking down from time to time. If someone deletes a formula, or a macro stops working, that becomes very risky. It’s also about the control environment. As a company we're looking to become more mature and implement controls that should be there – that too is very difficult to do without a proper system that can generate these reports, be properly secured with all the right standards that we need to adhere to, or do fraud detection based on machine learning in the future. It's impossible to do all that manually. Those are material benefits, but hard to quantify.”

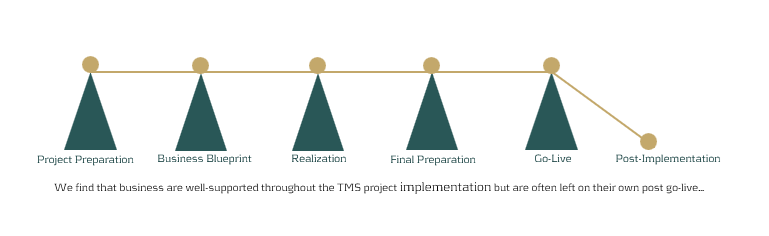

Businesses across the globe invest tens of thousands of dollars in implementing treasury management systems to achieve the accuracy, automation, speed, and reporting they require.

But what happens after implementation, when the project team has packed up and handed over the reins to the employees and support staff?

The first months after a system implementation can be some of the most challenging to a business and its people. Learning a new system is like learning any new skill – it requires time and effort to become familiar with the new ways of working, and to be completely comfortable again performing tasks. Previous processes, even if they were not the most efficient, were no doubt second nature to system users and many would have been experts in working their way through what needed to be done to get accurate results. New, improved processes can initially take longer as the user learns how to step through the unfamiliar system. This is a normal part of adopting a new landscape and can be expected. However, employee frustration is often high during this period, as more mental effort is required to perform day-to-day tasks and avoid errors. And when mistakes are made, it often takes more time to resolve them because the process for doing so is unfamiliar.

High-risk period for the company

With an SAP system, the complexity is often great, given the flexibility and available options that it offers. New users of SAP Treasury Management Software may take on average around 12 – 18 months to feel comfortable enough to perform their day-to-day operations, with minimal errors made. This can be a high-risk period for the company, both in terms of staff retention as well as in the mistakes made. Staff morale can dip due to the changes, frustrations and steep learning curve and errors can be difficult to work through and correct.

In-house support staff are often also still learning the new technology and are generally not able to provide the quick turnaround times required for efficient error management right from the start. When the issue is a critical one, the cost of a slow support cycle can be high, and business reputation may even be at stake.

While the benefits of a new implementation are absolutely worthwhile, businesses need to ensure that they do not underestimate the challenges that arise during the months after a system go-live.

Experts to reduce risks

What we have seen is that especially during the critical post-implementation period – and even long afterward – companies can benefit and reduce risks by having experts at their disposal to offer support, and even additional training. This provides a level of relief to staff as they know that they can reach out to someone who has the knowledge needed to move forward and help them resolve errors effectively.

Noticing these challenges regularly across our clients has led Zanders to set up a dedicated support desk. Our Treasury Technology Support (TTS) service can meet your needs and help reduce the risks faced. While we have a large number of highly skilled SAP professionals as part of the Zanders group, we are not just SAP experts. We have a wide pool of treasury experts with both functional & technical knowledge. This is important because it means we are able to offer support across your entire treasury system landscape. So whether it be your businesses inbound services, the multitude of interfaces that you run, the SAP processes that take place, or the delivery of messages and payments to third parties and customers, the Zanders TTS team can help you. We don’t just offer vendor support, but rather are ready to support and resolve whatever the issue is, at any point in your treasury landscape.

As the leading independent treasury consultancy globally, we can fill the gaps where your company demands it and help to mitigate that key person risk. If you are experiencing these challenges or can see how these risks may impact your business that is already in the midst of a treasury system implementation, contact Warren Epstein for a chat about how we can work together to ensure the long-term success of your system investment.

Early 2023, SAP launched its Digital Currency Hub as a pilot to explore the future of cross-border transactions using crypto or digital currencies.

In this article, we explore this stablecoin payments trial, examine the advantages of digital currencies and how they could provide a matching solution to tackle the hurdles of international transactions.

Cross-border payment challenges

While cross-border payments form an essential part of our globalized economy today, they have their own set of challenges. For example, cross-border payments often involve various intermediaries, such as banks and payment processors, which can result in significantly higher costs compared to domestic payments. The involvement of multiple parties and regulations can lead to longer processing times, often combined with a lack of transparency, making it difficult to track the progress of a transaction. This can lead to uncertainty and potential disputes, especially when dealing with unfamiliar payment systems or intermediaries. Last but not least, organizations must ensure they meet the different regulations and compliance requirements set by different countries, as failure to comply can result in penalties or delays in payment processing.

Advantages of digital currencies

Digital currencies have gained significant interest in recent years and are rapidly adopted, both globally and nationally. The impact of digital currencies on treasury is no longer a question of ‘if’ but ‘when’, as such it is important for treasurers to be prepared. While we address the latest developments, risks and opportunities in a separate article, we will now focus on the role digital currencies can play in cross-border transactions.

The notorious volatility of traditional crypto currencies, which makes them less practical in a business context, has mostly been addressed with the introduction of stablecoins and central bank digital currencies. These offer a relatively stable and safe alternative for fiat currencies and bring some significant benefits.

These digital currencies can eliminate the need for intermediaries such as banks for payment processing. By leveraging blockchain technology, they facilitate direct host-to-host transactions with the benefit of reducing transaction fees and near-instantaneous transactions across borders. Transactions are stored in a distributed ledger which provides a transparent and immutable record and can be leveraged for real-time tracking and auditing of cross-border transactions. Users can have increased visibility into the status and progress of their transactions, reducing disputes and enhancing trust. At a more advanced level, compliance measures such as KYC, KYS or AML can be directly integrated to ensure regulatory compliance.

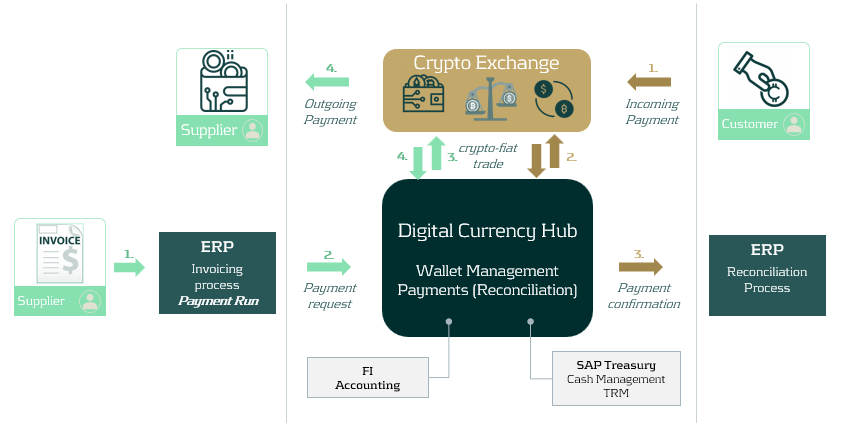

SAP Digital Currency Hub

Earlier this year, SAP launched its Digital Currency Hub as a pilot to further explore the future of cross-border transactions using crypto or digital currencies. The Digital Currency Hub enables the integration of digital currencies to settle transactions with customers and suppliers. Below we provide a conceptual example of how this can work.

- Received invoices are recorded into the ERP and a payment run is executed.

- The payment request is sent to SAP Digital Currency Hub, which processes the payment and creates an outgoing payment instruction. The payment can also be entered directly in SAP Digital Currency Hub.

- The payment instruction is sent to a crypto exchange, instructing to transfer funds to the wallet of the supplier.

- The funds are received in the supplier’s wallet and the transaction is confirmed back to SAP Digital Currency Hub.

In a second example, we have a customer paying crypto to our wallet:

- The customer pays funds towards our preferred wallet address. Alternatively, a dedicated wallet per customer can be set up to facilitate reconciliation.

- Confirmation of the transaction is sent to SAP Digital Currency Hub. Alternatively, a request for payment can also be sent.

- A confirmation of the transaction is sent to the ERP where the open AR item is managed and reconciled. This can be in the form of a digital bank statement or via the use of an off-chain reference field.

Management of the wallet(s) can be done via custodial services or self-management. There are a few security aspects to consider, on which we recently published an interesting article for those keen to learn more.

While still on the roadmap, SAP Digital Currency Hub can be linked to the more traditional treasury modules such as Cash and Liquidity Management or Treasury and Risk Management. This would allow to integrate digital currency payments into the other treasury activities such as cash management, forecasting or financial risk management.

Conclusion

With the introduction of SAP Digital Currency Hub, there is a valid solution for addressing the current pain points in cross-border transactions. Although the product is still in a pilot phase and further integration with the rest of the ERP and treasury landscape needs to be built, its outlook is promising as it intends to make cross-border payments more streamlined and transparent.

In SAP Treasury, business partners represent counterparties with whom a corporation engages in treasury transactions, including banks, financial institutions, and internal subsidiaries.

Additionally, business partners are essential in SAP for recording information related to securities issues, such as shares and funds.

The SAP Treasury Business Partner (BP) serves as a fundamental treasury master data object, utilized for managing relationships with both external and internal counterparties across a variety of financial transactions; including FX, MM, derivatives, and securities. The BP master data encompasses crucial details such as names, addresses, contact information, bank details, country codes, credit ratings, settlement information, authorizations, withholding tax specifics, and more.

Treasury BPs are integral and mandatory components within other SAP Treasury objects, including financial instruments, cash management, in-house cash, and risk analysis. As a result, the proper design and accurate creation of BPs are pivotal to the successful implementation of SAP Treasury functionality. The creation of BPs represents a critical step in the project implementation plan.

Therefore, we aim to highlight key specifics for professionally designing BPs and maintaining them within the SAP Treasury system. The following section will outline the key focus areas where consultants need to align with business users to ensure the smooth and seamless creation and maintenance of BPs.

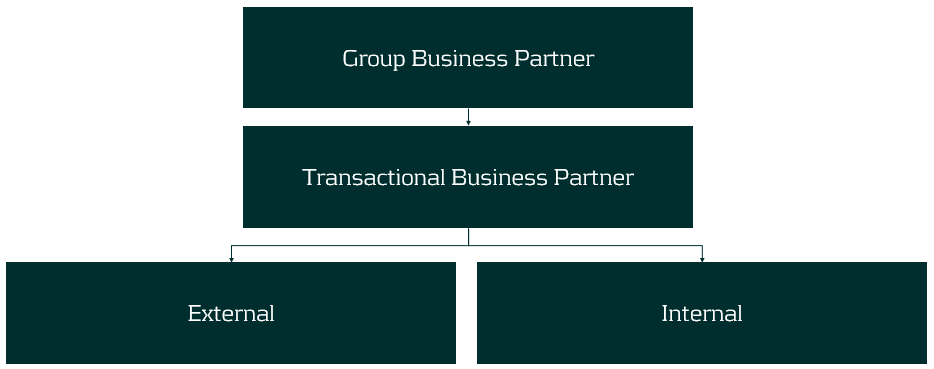

Structure of the BPs:

The structure of BPs may vary depending on a corporation's specific requirements. Below is the most common structure of treasury BPs:

Group BP – represents a parent company, such as the headquarters of a bank group or corporate entity. Typically, this level of BP is not directly involved in trading processes, meaning no deals are created with this BP. Instead, these BPs are used for: a. reflecting credit ratings, b. limiting utilization in the credit risk analyzer, c. reporting purposes, etc.

Transactional BP – represents a direct counterparty used for booking deals. Transactional BPs can be divided into two types:

- External BPs – represent banks, financial institutions, and security issuers.

- Internal BPs – represent subsidiaries of a company.

Naming convention of BPs

It is important to define a naming convention for the different types of BPs, and once defined, it is recommended to adhere to the blueprint design to maintain the integrity of the data in SAP.

Group BP ID: Should have a meaningful ID that most business users can understand. Ideally, the IDs should be of the same length. For example: ABN AMRO Group = ABNAMR or ABNGRP, Citibank Group = CITGRP or CITIBNK.

External BP ID: Should also have a meaningful ID, with the addition of the counterparty's location. For example: ABN AMRO Amsterdam – ABNAMS, Citibank London – CITLON, etc.

Internal BP ID: The main recommendation here is to align the BP ID with the company code number. For example, if the company code of the subsidiary is 1111, then its BP ID should be 1111. However, it is not always possible to follow this simple rule due to the complexity of the ERP and SAP Treasury landscape. Nonetheless, this simple rule can help both business and IT teams find straightforward solutions in SAP Treasury.

The length of the BP IDs should be consistent within each BP type.

Maintenance of Treasury BPs

1. BP Creation:

Business partners are created in SAP using the t-code BP. During the creation process, various details are entered to establish the master data record. This includes basic information such as name, address, contact details, as well as specific financial data such as bank account information, settlement instructions, WHT, authorizations, credit rating, tax residency country, etc.

Consider implementing an automated tool for creating Treasury BPs. We recommend leveraging SAP migration cockpit, SAP scripting, etc. At Zanders we have a pre-developed solution to create complex Treasury BPs which covers both SAP ECC and most recent version of SAP S/4 HANA.

2. BP Amendment:

Regular updates to BP master data are crucial to ensure accuracy. Changes in addresses, contact information, or payment details should be promptly recorded in SAP.

3. BP Release:

Treasury BPs must be validated before use. This validation is carried out in SAP through a release workflow procedure. We highly recommend activating such a release for the creation and amendment of BPs, and nominating a person to release a BP who is not authorized to create/amend a BP.

BP amendments are often carried out by the Back Office or Master Data team, while BP release is handled by a Middle Office officer.

4. BP Hierarchies:

Business partners can have relationships as described, and the system allows for the maintenance of these relationships, ensuring that accurate links are established between various entities involved in financial transactions.

5. Alignment:

During the Treasury BP design phase, it is important to consider that BPs will be utilized by other teams in a form of Vendors, Customers, or Employees. SAP AP/AR/HR teams may apply different conditions to a BP, which can have an impact on Treasury functions. For instance, the HR team may require bank details of employees to be hidden, and this requirement should be reflected in the Treasury BP roles. Additionally, clearing Treasury identification types or making AP/AR reconciliation GL accounts mandatory for Treasury roles could also be necessary.

Transparent and effective communication, as well as clear data ownership, are essential in defining the design of the BPs.

Conclusion

The design and implementation of BPs require expertise and close alignment with treasury business users to meet all requirements and consider other SAP streams.

At Zanders, we have a strong team of experienced SAP consultants who can assist you in designing BP master data, developing tools to create/amend the BPs meeting strict treasury segregation of duties and the clients IT rules and procedures.