At Zanders, we are proud to announce the promotion of Tobias Westermaier as our newest partner.

At Zanders, we are proud to announce the promotion of Tobias Westermaier as our newest partner. With a rich background in Corporate Finance and Treasury, he brings a wealth of experience and a clear vision to support the growth of our Treasury Advisory Group in the DACH region. We caught up with him to learn more about his career journey, aspirations, and insights into the future of our industry.

A Career Built on Global Expertise

“I’ve spent my whole career in Corporate Finance and Treasury roles, working within corporates, banks, and consulting,” Tobias shares. “I joined Zanders Switzerland in 2014 after returning from Asia and was fortunate to work on a variety of projects both in Switzerland and internationally. In 2021, I rejoined Zanders, after gaining further experience in Corporates and Investment Banking in Zurich, to lead the Swiss Treasury Advisory team and help expand Zanders’ footprint in Switzerland and the broader DACH region.”

This journey, marked by diverse experiences and consistent growth, has prepared Tobias for his new role as a partner at Zanders.

Excitement for the New Role

When asked about what excites him most about becoming a partner, Tobias highlights two key areas: growth and collaboration. “I am very much looking forward to actively shaping the Zanders growth story. In particular, I am excited to build and lead our Treasury Advisory Group in the DACH region. Working towards ambitious goals with my outstanding colleagues gives me the most energy. Empowering the team to unlock their full potential will be key to delivering great results for our clients.”

What Makes Zanders Unique

For Tobias, Zanders stands out as a company that truly lives its values of Freedom, Fun, and Collaboration. “The entrepreneurial spirit at Zanders allows everyone to contribute, evolve, and implement ideas. We see opportunities, not obstacles. Cross-departmental and regional collaboration is part of our DNA - we operate as One Zanders. And while we’re passionate about delivering high-quality results for our clients, we never forget to have fun as a group!”

Mentors and Influences

Reflecting on his career, Tobias emphasizes the importance of having trusted mentors and colleagues. “Fortunately, from most of my career steps, colleagues or mentors have remained part of my journey. Having trustful relationships with people who can provide unbiased opinions, new perspectives, or hold up a mirror is invaluable. I encourage everyone to seek such external reflections.”

Industry Trends and Developments

Looking ahead, Tobias is particularly excited about the transformative potential of Artificial Intelligence (AI). “AI is on top of my mind. It will fundamentally change how we work, especially in the consulting industry, and open new opportunities for us and our clients’ business cases.”

Vision for Zanders’ Future

With a steep growth trajectory, Zanders is poised to become the financial performance partner of choice globally. Tobias sees his role as instrumental in achieving this vision. “My contribution focuses on two key areas: (i) growing our presence in the DACH region, and (ii) expanding our service offering for the Office of the CFO. With our expertise, project track record, and global presence, Zanders is well-positioned to achieve its ambitious goals.”

Celebrating the Future

We are very excited to have Tobias join the partner team and contribute to Zanders’ mission of delivering exceptional value to our clients. His leadership, vision, and expertise will undoubtedly propel us forward as we continue to grow and innovate. Congratulations, on this well-deserved promotion!

In 2020, Médecins Sans Frontières (MSF) experienced a significant negative FX impact, putting their ability to transfer funding to their field operations at risk. This experience prompted the humanitarian organization to request the assistance of Zanders to review and enhance their FX risk management process to safeguard their vital work from future currency fluctuations.

Médecins Sans Frontières (MSF)/Doctors Without Borders is an international humanitarian organization, best known for their medical assistance in conflict zones and in countries affected by endemic diseases. MSF manages operations in more than 70 countries, providing medical support in the afore-mentioned areas. As a non-profit organization, MSF receives funding from individual donors and private institutions from all around the world. This global footprint generates significant cash flows and financial transactions in multiple currencies, resulting in high foreign exchange (FX) exposures. Previously, these were not adequately managed through a structured FX risk management process.

Three key problem areas

The decentralized and informal nature of MSF’s FX risk management process increased their exposure to currency uncertainty, with both inflows and outflows lacking an aligned approach. Zanders highlighted the following three problem areas:

- No centralized FX hedging strategy. Incoming flows, such as funds and grants, received globally by MSF entities with fund-raising activities (“funding entities”) were directed to one of the five Operational Centers headquartered in Europe to fund field operations. Funds were transferred in their received currency which often differed from the functional currency of the Operational Centers (EUR). The Operational Centers then bore high FX exposures on the received funds as there was no FX hedging strategy in place. The market fluctuations of unhedged currencies resulted in deviations from MSF’s annual target budget.

- Funding of field operations with limited FX risk management. From the Operational Centers, quick transfer of funds to the relevant field operations was prioritized, often without considering FX implications. This posed challenges to the Operational Centers when applying FX risk management techniques as date and amount of outgoing funds was not always known.

- Insufficient provisions for funding unpredictability. Managing the FX exposure at the Operational Center level was challenging due to uncertainties in the timing and size of grants, variation in income due to inconsistent global performance, lack of internal communication on currency needs, seasonal income peaks and unpredictable funding requirements from their field operations.

A two-step solution

Through discussions, it became clear that MSF’s priority when it came to FX risk management was to safeguard the income from grants and the distribution to field operations, by protecting their annual budget rate. We applied two-steps from our Zanders’ Financial Risk Management Framework to deliver this objective.

- Step one: Identification and Measurement

In the first step, our objective was to identify the FX exposures to determine the correct approach to manage the FX risks. This led to a high-level quantification of the FX risk for each of the five Operational Centers.

To manage this risk, we advised MSF to establish an FX risk management function to manage the FX risk in a coordinated and centralized manner. This allowed for the creation of an FX hedging program consisting of a 12-month rolling forecast of inflows and outflows. This enabled MSF to hedge their net exposures for the next budget year. If the forecast had a high level of accuracy, MSF could hedge a high ratio of this forecast.

By centralizing the FX exposure, net amounts could be hedged centrally to protect the organization from large FX volatility. The hedging contracts would then determine the annual budget rate for that year, and thereby achieving the objective of protecting the annual budget rate.

- Step two: Strategy & Policy

Here, we designed a future FX risk management process and guidelines, incorporating best market practices. We developed an ‘in-common platform’ concept, enabling MSF to centralize and standardize their FX risk management process. This was formalized in an FX risk management policy.

A structured approach to FX risk management

The introduction of an FX hedging program has given the MSF team more clarity on their FX risk exposure. This enables them to manage fluctuations in currency more proactively and pragmatically to minimize the impact on their budgets and optimize funding for their field operations.

“The result is extremely positive,” says MSF’s Treasury Lead. “We used the FX hedging program to determine the annual budget rate for next year. With this, we are very close to our budget, and we have managed to protect at least 80% of the funds and grants for the budget.” Furthermore, the FX hedging program inspired MSF entities to tackle other treasury challenges collectively as opposed to addressing them individually.

However, there are still further improvements ahead. “There are challenges we still face around the accuracy of the forecast,” added the Treasury Lead. “This is something we still need to work on. MSF is now sometimes over hedged or underhedged. To accommodate this, I ask the entities to update the rolling forecast on a regular basis.”

For the future, MSF is considering hedging more than 80% of their budget, but this is dependent on further analysis and improved accuracy of the forecast and performing variance analysis comparisons on the forecast.

The introduction of a comprehensive FX risk management policy has also been crucial in giving MSF more control over their cashflows. By clearly defining stakeholder roles and responsibilities and emphasizing the principle of segregation of duties, MSF has introduced a centralized approach for managing their FX exposures. The group-wide FX hedging program promises significant financial and operational benefits. This strategic shift empowers MSF with greater control over its financial landscape. With a solid variance analysis mechanism on the horizon, MSF is assured to enhance cash flow forecasting and expand its FX hedging program with confidence.

Leverage our FX risk expertise

For organizations eager to navigate the complexities of FX risk and enhance their financial resilience, Zanders stands ready to share its insights and expertise. Contact us today to explore tailored strategies that can transform your financial operations and secure your organization's future. Together, let's unlock the potential of strategic FX management.

For more information, visit our NGOs & Charities page here, or contact Daan de Vries.

UGI International partnered with Zanders to transform their cash management by enhancing their Kyriba system and transitioning to Swift. This is how they boosted visibility and control over their complex, multinational cashflows.

When UGI International, a supplier of liquid gases across Europe and in the US, faced challenges in obtaining real-time visibility on its cash positions, they partnered with Zanders to elevate the performance of their Kyriba system. This started with the transition to the Swift banking system.

A quest for transparency

UGI International (UGI) is a leading supplier of liquid gases, operating under 6 brands across 16 countries. Every day, the business generates a consistent stream of high value and high volume in-country and cross-border transactions. This feeds into a complex network of disparate, multinational cashflows that the business’ treasury team is responsible for managing. When Nuno Ferreira joined as Head of Treasury in 2021, Kyriba was already in place, but it quickly became apparent that there was considerable scope to increase the use of the treasury management system to tackle persistent inefficiencies in their processes.

“Lack of visibility was one of our key issues,” says Nuno. “We didn't have access to accurate cash positions or forecasts, so we were lacking visibility on how much cash we had at the end of each specific day. The second thing was that the payment flows were very decentralized. In the majority of countries, payments were still being done manually.”

Lack of centralization was something that needed to be addressed and this demanded an overhaul of UGI’s approach to bank connectivity. The company’s use of the EBICS (Electronic Banking Internet Communication Standard) protocol had become a significant obstacle to them improving cash transparency and automating more of their payment processes. This was due to EBICS only allowing file exchanges with banks in a limited number of UGI European countries (France). Payments and transactions that extended beyond these geographies had to be managed separately and manually.

“We had Kyriba but because it was only connected with our French banks with EBICS it wasn’t able to serve all of the countries we operate in,” Nuno explains. “We recognized that going forward, to get the full software benefits from Kyriba, to reduce operational risk, and to get more visibility and control over our cashflows, we needed to connect our treasury management system to all of our main banks. These were the drivers for us to start looking for a new bank connectivity solution.”

The transition to Swift

The Swift (Society for Worldwide Interbank Financial Telecommunication) banking system offered broader international coverage, supporting connectivity to all of UGI’s core banks across Europe and in the US. But making the transition to Swift was a substantial undertaking, requiring a multi-phased implementation to bring all of the company’s banks and payments onto the new protocol. Recognizing the knowledge of Swift and resource to oversee such a large project wasn’t available in their internal treasury team of 6 people, UGI appointed Zanders to bring the technical knowledge and capacity to support with the project.

“In this day and age, where a lot of technology is standard technology, what you get out of a TMS system depends on who helps you implement it, how much they listen to you, and how they adapt it to meet your needs,” explains Nuno. “You can find technical people easily now, but what we needed was an advisor that not only provides the technical implementation, but also helps with other areas—even if they are outside of the project. There is a lot of knowledge in Zanders about Swift and Kyriba but also about treasury in general. I knew if there were problems or issues, or even questions that fell outside of what we were implementing, there would always be someone at Zanders with knowledge in that specific area.”

This access to wider expertise was particularly relevant given there was not only a complex implementation to consider but also the compulsory Swift security attestation and assessment. The Swift Customer Security Controls Framework (CSCF) was first published in 2017 and is updated annually. This outlines a catalogue of mandatory and advisory controls designed to protect the Swift network infrastructure by mitigating specific cybersecurity risks and minimizing the potential for fraud in international transactions. Each year, all applicable users of the banking system must submit an attestation demonstrating their level of compliance with Swift’s latest standards, which must be accompanied by an independent assessment. This spans everything from physical security of IT equipment (e.g., storage lockers for laptops) and policies around processes (e.g., payment authorization) to IT system access (e.g., two-factor authentication) and security (e.g., firewall protection).

“We were not just talking about technical and system controls—we also needed to ensure that there were process controls in place,” says Nuno. “We didn’t have the right skillset to undertake this security assessment ourselves and we needed consultants to help us to provide the standalone reports showing that UGI follows best practices and has controls in place. This is where the second project came in. Zanders helped ensure everything was in place - the technical parts and the process parts - for the security assessment.”

Driving change, unlocking efficiency

With the migration to Swift, Zanders has been able to work with the UGI team to centralize their treasury processes, unlocking new functionality and elevated performance from their Kyriba system. This has dramatically reduced the manual effort demanded from the team to administer cash management.

“While before I was getting information from all the legal entities over Excel spreadsheets, now we don't need to reach out to our local entities to request this information – this information is centralized and automated,” explains Nuno. “This reduces operational risk because instead of uploading files or creating manual transfers within the online banking systems, it is fully integrated and so fully secured. Which also means we don't need to continuously monitor this process. This also reduces the manual activities and hence the number of FTEs required locally to run daily cash management processes. The intention was to have a secure straight-through processing of payments.”

The Swift security assessment facilitated by Zanders, not only ensured UGI achieved the baseline standards set by Swift, it also helped to raise awareness of Kyriba and the importance of security protocols both within treasury and in the IT and Security teams.

“Kyriba isn’t just a system to provide a report - if something goes wrong, it really goes wrong and creating this awareness was an added benefit,” says Nuno. “Doing this assessment forced us to make time to really look at our approach to security in detail. Internally, this prompted us to start discussing points that we would never normally address - simple things like closing your laptop when you’re away from your desk. This then starts to become part of the culture.”

The initial drivers behind the project were to tackle lack of visibility in UGI’s treasury systems. These outcomes were accomplished. The transition to Swift and the integration with the business’ Kyriba system has provided the accurate, real-time visibility on cash positions Nuno and the wider treasury team needed.

“When you don't have this visibility, you can’t manage your liquidity properly. There is value leakage and this impacts your P&L negatively on a daily basis,” says Nuno. “I now have this control and my cash position is accurate, so any excess cash or even FX exposure can be properly managed and generate higher yield to our shareholders.”

There is a lot of knowledge in Zanders about Swift and Kyriba but also about treasury in general. I knew if there were problems or issues, or even questions that fell outside of what we were implementing, there would always be someone at Zanders with knowledge in that specific area.

Nuno Ferreira, Head of Treasury at UGI

Advice delivered with commercial empathy

Overall, this project underscores the value of having an advisor that not only brings deep technical expertise to a project but also understands the realities of implementing treasury technology in a large, international corporate environment.

“One of the things I really liked was the flexibility of the Zanders team,” says Nuno. “They have a very structured approach, but it’s still flexible enough to take into account things that you cannot control - the unknown unknowns. They understand that within the corporate space, and with banks, it’s sometimes hard to predict when things are going to happen.”

This collaborative approach also unlocked additional unexpected benefits for the UGI team that will help them to continue to build on the Kyriba system performance and efficiency improvements achieved.

“The technical capability of our team has grown with these projects,” says Nuno. “From a technical standpoint, we now understand what we can do ourselves and how to do it, and when we need to go to Zanders for help. This knowledge transfer has enabled us to do a lot of things by ourselves that before we needed to go to an external partner for help with, and at the end of the day, this saves us costs.”

For more information, please contact our Partner Judith van Paassen.

On Thursday, November 14th, SAP Netherlands and Zanders hosted a roundtable focused on upgrading to S/4HANA. Nineteen participants representing nine companies, actively engaged in the discussions. This article will focus on the specifics of the discussions.

Exploring S/4HANA Functionalities

The roundtable session started off with the presentation of SAP on some of the new S/4HANA functionalities. New functionalities in the areas of Cash Management, Financial Risk Management, Working Capital Management and Payments were presented and discussed. In the area of Cash Management, the main enhancements can be found in the management of bank relationships, managing cash operations, cash positioning, and liquidity forecasting and planning. These enhancements provide greater visibility into bank accounts and cash positions, a more controlled liquidity planning process across the organization, increased automation, and better execution of working capital strategies. In Financial Risk Management, the discussion highlighted S/4HANA’s support for smart trading processes, built-in market data integration, and more advanced on-the-fly analysis capabilities. All providing companies with a more touchless, automated and straight through process of their risk management process. The session also covered Working Capital enhancements, including a presentation on the Taulia solution offered by SAP, which provides insights into supporting Payables and Receivables Financing. Finally, the session explored innovations in the Payments area, such as payment verification against sanction lists, format mapping tools, the SAP Digital Payments Add-on, and automated corporate-to-bank cloud connectivity.

Migration Strategies: Getting to S/4HANA

While the potential of S/4HANA was impressive, the focus shifted to migration strategies. Zanders presented various options for transitioning from an ECC setup to an S/4HANA environment, sparking a lively discussion. Four use cases were defined, reflecting the diverse architectural setups in companies. These setups include:

- An integrated architecture, where the SAP Treasury solution is embedded within the SAP ERP system

- A treasury sidecar approach, where the SAP Treasury solution operates on a separate box and needs to integrate with the SAP ERP system box

- Treasury & Cash & Banking side car

- Leveraging Treasury on an S/4HANA Central Finance box

The discussion also covered two key migration strategies: the brownfield approach and the greenfield approach. In a brownfield approach, the existing system setup is technically upgraded to the new version, allowing companies to implement S/4HANA enhancements incrementally. In contrast, a greenfield approach involves building a new system from scratch. While companies can reuse elements of their ECC-based SAP Treasury implementation, starting fresh allows them to fully leverage S/4HANA’s standard functionalities without legacy constraints. However, the greenfield approach requires careful planning for data migration and testing, as legacy data must be transferred to the new environment.

Decoupling Treasury: The Sidecar Approach

The greenfield approach also raised the question of whether treasury activities should migrate to S/4HANA first using a sidecar system. This would involve decoupling treasury from the integrated ECC setup and transitioning to a dedicated S/4HANA sidecar system. This approach allows treasury to access new S/4HANA functionalities ahead of the rest of the organization, which can be beneficial if immediate enhancements are required. However, this setup comes with challenges, including increased system maintenance complexity, additional costs, and the need to establish new interfaces.

However, this setup comes with challenges, including increased system maintenance complexity, additional costs, and the need to establish new interfaces. Companies need to weigh the benefits of an early treasury migration against these potential drawbacks as part of their overall S/4HANA strategy. With this consideration in mind, participants reflected on the broader lessons from companies already using S/4HANA.

Lessons from Early Adopters

Companies that have already migrated to S/4HANA emphasized two critical planning areas: testing and training. Extensive testing—ideally automated—should be prioritized, especially for diverse payment processes. Similarly, training is essential to ensure effective change management, reducing potential issues after migration.

These insights highlight the importance of preparation in achieving a smooth migration. As organizations transition to S/4HANA, another important consideration is the potential impact on the roles and responsibilities within treasury teams.

Impact on Treasury Roles

Participants discussed whether S/4HANA would alter roles and responsibilities within treasury departments. The consensus was that significant changes are unlikely, particularly in a brownfield approach. Even in a greenfield approach, roles and responsibilities are expected to remain largely unchanged.

Conclusion

The roundtable highlighted the significant value S/4HANA brings to treasury operations, particularly through enhanced functionalities in Cash Management, Financial Risk Management, Working Capital Management, and Payments.

Participants discussed the pros and cons of brownfield and greenfield migration strategies, with insights into the sidecar approach for treasury as a potential transitional strategy. Early adopters emphasized the critical importance of thorough testing and training for a successful migration, while noting that treasury roles and responsibilities are unlikely to see major changes

If you would like to hear more about the details of the discussion, please reach out to Laura Koekkoek, Partner at Zanders, [email protected]

How can a non-profit organization operating on a global stage safeguard itself from foreign currency fluctuations? Here, we share how our ‘Budget at Risk’ model helped a non-profit client more accurately quantify the currency risk in its operations.

Charities and non-profit organizations face distinct challenges when processing donations and payments across multiple countries. In this sector, the impact of currency exchange losses is not simply about the effect on an organization’s financial performance, there’s also the potential disruption to projects to consider when budgets are at risk. Zanders developed a ‘Budget at Risk’ model to help a non-profit client with worldwide operations to better forecast the potential impact of currency fluctuations on their operating budget. In this article, we explain the key features of this model and how it's helping our client to forecast the budget impact of currency fluctuations with confidence.

The client in question is a global non-profit financed primarily through individual contributions from donors all over the world. While monthly inflows and outflows are in 16 currencies, the organization’s global reserves are quantified in EUR. Consequently, their annual operating budget is highly impacted by foreign exchange rate changes. To manage this proactively demands an accurate forecasting and assessment of:

- The offsetting effect of the inflows and outflows.

- The diversification effect coming from the level of correlation between the currencies.

With the business lacking in-house expertise to quantify these risk factors, they sought Zanders’ help to develop and implement a model that would allow them to regularly monitor and assess the potential budget impact of potential FX movements.

Developing the BaR method

Having already advised the organization on several advisory and risk management projects over the past decade, Zanders was well versed in the organization’s operations and the unique nature of the FX risk it faces. The objective behind developing Budget at Risk (BaR) was to create a model that could quantify the potential risk to the organization’s operating budget posed by fluctuations in foreign exchange rates.

The BaR model uses the Monte Carlo method to simulate FX rates over a 12-month period. Simulations are based on the monthly returns on the FX rates, modelled by drawings from a multivariate normal distribution. This enables the quantification of the maximum expected negative FX impact on the company’s budget over the year period at a certain defined level of confidence (e.g., 95%). The model outcomes are presented as a EUR amount to enable direct comparison with the level of FX risk in the company’s global reserves (which provides the company’s ‘risk absorbing capacity’). When the BaR outcome falls outside the defined bandwidth of the FX risk reserve, it alerts the company to consider selective FX hedging decisions to bring the BaR back within the desired FX risk reserve level.

The nature of the model

The purpose of the BaR model isn’t to specify the maximum or guaranteed amount that will be lost. Instead, it provides an indication of the amount that could be lost in relation to the budgeted cash flows within a given period, at the specified confidence interval. To achieve this, the sensitivity of the model is calibrated by:

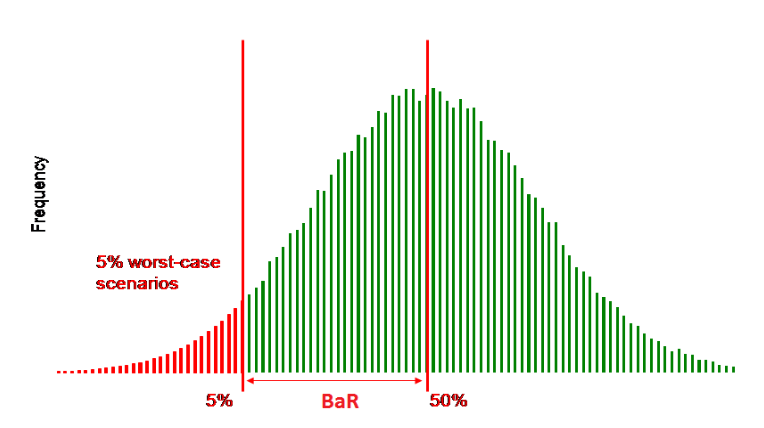

- Modifying the confidence levels. This changes the sensitivity of the model to extreme scenarios. For example, the figure below illustrates the BaR for a 95% level of confidence and provides the 5% worst-case scenario. If a 99% confidence level was applied, it would provide the 1% worst (most extreme) case scenario.

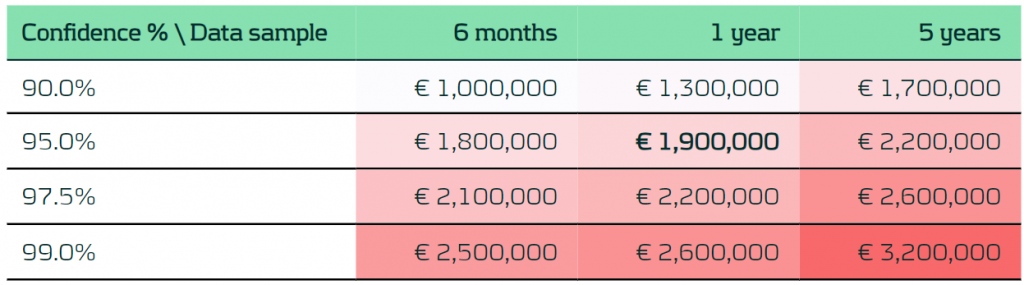

- Selecting different lengths of sample data. This allows the calculation of the correlation and volatility of currency pairs. The period length of the sample data helps to assess the sensitivity to current events that may affect the FX market. For example, a sample period of 6 months is much more sensitive to current events than a sample of 5 years.

Figure 1 – BaR for a 95% level of confidence

Adjusting these parameters makes it possible to calculate the decomposition of the BaR per currency for a specified confidence level and length of data sample. The visual outcome makes the currency that’s generating most risk quick and easy to identify. Finally, the diversification effect on the BaR is calculated to quantify the offsetting effect of inflows and outflows and the correlation between the currencies.

Table 1 – Example BaR output per confidence level and length of data sample

Pushing parameters

The challenge with the simulation and the results generated is that many parameters influence the outcomes – such as changes in cash flows, volatility, or correlation. To provide as much clarity as possible on the underlying assumptions, the impact of each parameter on the results must be considered. Zanders achieves this firstly by decomposing the impact by:

- Changing FX data to trigger a difference in the market volatility and correlation.

- Altering the cash flows between the two assessment periods.

Then, we look at each individual currency to better understand its impact on the total result. Finally, additional background checks are performed to ensure the accuracy of the results.

This multi-layered modeling technique provides base cases that generate realistic predictions of the impact of specific rate changes on the business’ operating budget for the year ahead. Armed with this knowledge, we then work with the non-profit client to develop suitable hedging strategies to protect their funding.

Leveraging Zanders’ expertise

FX scenario modeling is a complex process requiring expertise in currency movements and risk – a combination of niche skills that are uncommon in the finance teams of most non-profit businesses. But for these organizations, where there can be significant currency exposure, taking a proactive, data-driven approach to managing FX risk is critical. Zanders brings extensive experience in supporting NGO, charity and non-profit clients with modeling currency risk in a multiple currency exposure environment and quantifying potential hedge cost reduction by shifting from currency hedge to portfolio hedge.

For more information, visit our NGOs & Charities page here, or contact the authors of this case study, Pierre Wernert and Jaap Stolp.

Embarking on a transformative journey to strengthen its treasury function, an international non-governmental organization turned to Zanders for guidance to elevate its operations to the highest industry standards.

A force for change

The NGO sector today is facing a multitude of conflicting pressures. Growing humanitarian need has heightened the pressure on these organizations to change the world, but a constantly shifting landscape means they also need to radically change themselves in order to remain compliant and able to manage their financial operations effectively.

In mid-2022, a prominent NGO appointed Zanders to conduct a comprehensive review and benchmarking of its treasury function. Operating in more than 80 countries, the NGO’s treasury team of 30 dedicated professionals managed a diverse array of banking relationships and accounts. Finely tuned treasury processes and systems are critical to managing such a sprawling financial ecosystem, and the team was aware they needed a more innovative response to their sector’s ever-evolving treasury landscape.

Despite implementing a Treasury Management System (TMS) two years previously, the team was still relying on a large number of manual processes. Recognizing the imperative of automating more of its treasury operations, they asked Zanders to conduct an in-depth assessment to evaluate their performance, benchmark it against industry best practices and to identify areas for improvement.

Clarifying the current state

The primary objectives of the project were manifold: to evaluate the existing setup, identify potential financial and operational risks, define improvement opportunities, design a roadmap, and ultimately, deliver tangible value to the treasury team. Achieving these goals relied on first gaining the clarity provided by a thorough benchmarking exercise.

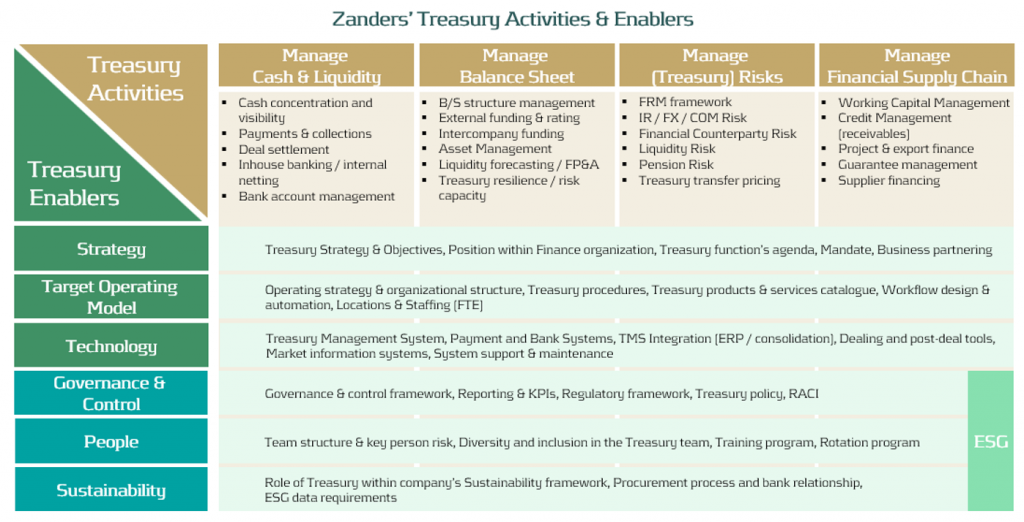

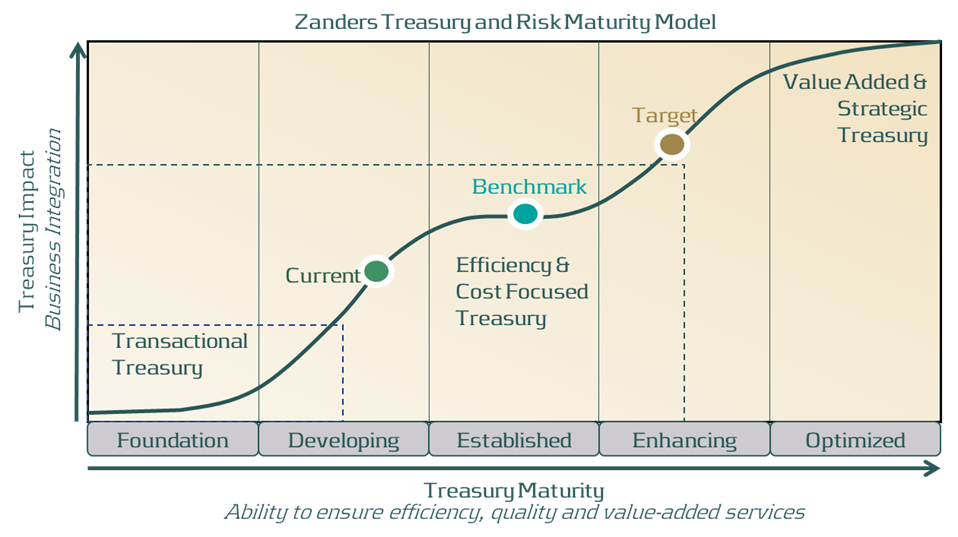

Leveraging its proprietary Treasury and Risk Maturity Model, Zanders performed a deep dive into the organization’s treasury function. By considering and scoring all treasury activities as well as the teams, controls and technologies involved in delivering them, the team modeled the ‘as-is’ situation in a highly structured and meaningful way. When measured against market best practices, this provided a sector-calibrated benchmark from which areas for improvement were identified. The outcomes of this exercise allowed Zanders to develop new targets for the NGO’s treasury function that were then used to design a framework for the future.

A new treasury roadmap

Using Zanders’ Treasury and Risk Maturity Model, the NGO's treasury function was classified as ‘Developing’. This highlighted a number of areas where there was an opportunity to make improvements that would facilitate their advancement towards an ‘Enhancing’ level of treasury maturity. Zanders then collaborated closely with the organization to devise a comprehensive roadmap. This outlined actionable steps designed to elevate performance in the key areas identified and also prescribed follow-up initiatives to provide a structure for their implementation.

This triggered the launch of a series of strategic initiatives aimed at strengthening the NGO’s treasury capabilities. For example, a thorough fit-gap analysis of the existing TMS was undertaken as well as a deep dive into the treasury function’s organizational design. This led to targeted enhancements and optimization measures designed to increase efficiency and resilience within the treasury organization. Central to this endeavor was the prioritization of automating manual processes and streamlining accounting procedures.

From functional to future-ready

By leveraging Zanders' expertise and adopting a proactive approach to treasury management, the NGO has positioned itself on a trajectory of sustained growth and operational excellence. Armed with a strategic roadmap and fortified by targeted improvements, the NGO’s treasury team is not only prepared to navigate the complexities of the global financial landscape with confidence and agility but also fully equipped to transition from a cost-focused to a value-added role. For more information, visit our NGOs & Charities page here, or contact the author of this case study, Joanne Koopman.

At TAC’s recent SAP for Treasury and Working Capital Management in Brussels, SAP alongside some of their clients present several topics that rank highly on the treasurer’s agenda.

SAP highlighted their public vs. private cloud offerings, RISE and GROW products, new AI chatbot applications, and their SAP Analytics Cloud solution. In addition to SAP's insights, several clients showcased their treasury transformation journeys with a focus on in-house banking, FX hedge management, and payment factory implementation. This article provides a brief overview of SAP's RISE and GROW offerings, with a larger focus on SAP’s public vs. private cloud offerings and their new AI virtual assistant, Joule.

SAP RISE and GROW

The SAP RISE solution seeks to help companies transition to cloud-based services. It is designed as a comprehensive offering that combines software, services, and support into a single package, including the core components of SAP S/4HANA cloud, Business Process Intelligence (BPI), SAP Business Network, and SAP Business Technology Platform (BTP). On the other hand, SAP GROW is a program that facilitates the implementation and organization of SAP solutions. This offering is more tailored towards optimizing, rather than transitioning, company processes. SAP GROW still includes S/4HANA public cloud solution, enabling growing companies to manage their operations without requiring extensive on-site infrastructure.

Ultimately, companies experiencing significant growth and seeking scalable, efficient solutions would benefit most from the SAP GROW offering, while SAP RISE is more suited for companies looking to accelerate their digital transformation with a focus on agility, rapid innovation, and business resilience.

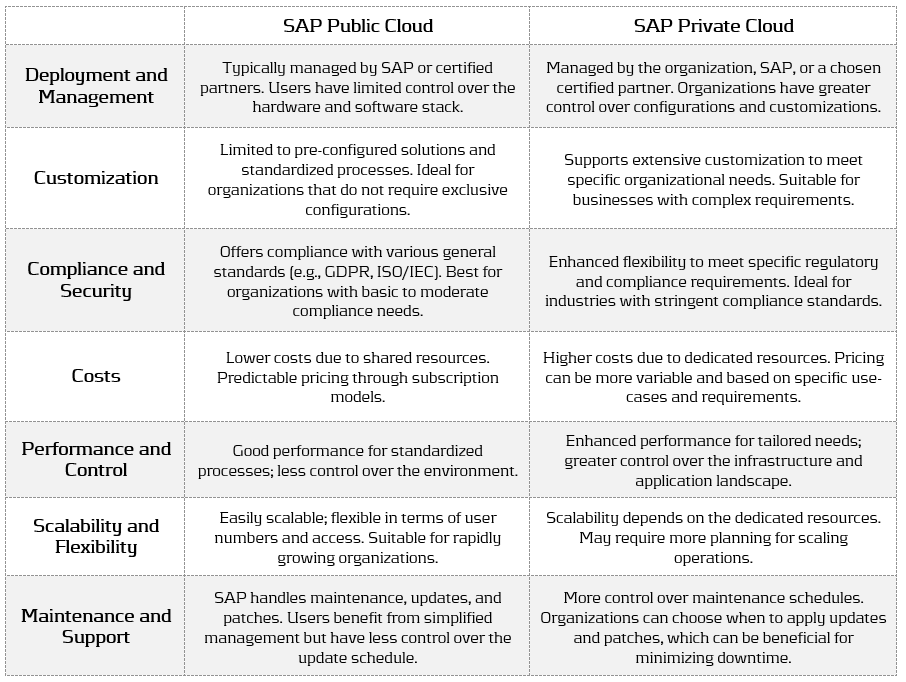

Public Cloud vs. Private Cloud

SAP systems can be hosted both on the public and private cloud. The public cloud delivers greater scalability, whereas the private cloud provides enhanced security and complete control of data and governance. Often the choice between SAP public or private cloud is driven by business requirements, budget, compliance needs, and desired levels of customization. These variables, along with other important factors, are compared in Figure 1.

Figure 1: SAP Public Cloud vs. SAP Private Cloud

In summary, organizations considering SAP should carefully weigh these differences when choosing between public and private cloud. SAP is actively developing the functionality within its public cloud offering, making it an increasingly suitable option for both small-to-medium enterprises seeking rapid deployment and cost efficiency, as well as larger enterprises that require powerful solutions with limited customization needs. On the other hand, SAP private cloud remains a preferred choice for larger enterprises with complex, unique process requirements, extensive customization needs, and strict data compliance regulations.

Joule's Virtual Assistant

SAP's Business AI solutions initiative is introducing its newest member, the Joule Copilot. Similar to OpenAI's ChatGPT, the Joule virtual assistant is available at the user's command. Users simply need to ask the copilot questions or explain a particular issue, and Joule will provide intelligent answers drawn from the vast amount of business data stored across the SAP systems and third-party sources.

Joule Key Features

Contextual Recommendations

Provide personalized, context-specific suggestions based on the user's role and activities. Joule can help users by suggesting possible next steps, identifying potential issues, and offering insights that can be actioned upon by users.

Enhanced User Experience

Offers an intuitive, interactive interface designed to simplify user interaction with SAP applications. Joule aims to reduce complexity and streamline workflows, allowing users to simplify their daily processes.

Real-Time Insights

Artificial Intelligence and Machine Learning capabilities enable Joule to analyze vast amounts of data in real-time, providing predictive insights and analytics to support the user's decision-making process.

Integration with SAP Ecosystem

Joule is fully integrated with SAP’s existing products, such as S/4HANA and SAP Business Technology Platform (BTP), ensuring seamless data flow and interconnectivity across various SAP solutions.

Customization and Extensibility

Joule can be tailored to the specific needs of different industries and business processes. It also accounts for the specific role of the user when providing recommendations and can be customized to align with a company’s organizational requirements and workflows within their system.

Applications of Joule in Finance

SAP Joule can significantly enhance financial operations by leveraging AI-driven insights, automation, and predictive analytics. Joule has many applications within finance, the most important being:

Automated Financial Reporting

SAP Joule can automatically generate and distribute financial reports, offering insights based on real-time data. Joule uses its AI and ML capabilities to identify trends, flag anomalies, and provide explanations for variances, ultimately helping finance teams to make informed decisions quickly. Not only does Joule provide insight, but it also increases operational efficiency, allowing finance professionals to focus on strategic activities rather than report gathering and distribution.

Predictive Analytics and Forecasting

SAP Joules embedded ML capabilities enable the prediction of future financial outcomes based on historical data and current trends. Whether you are forecasting revenues, cash flows, or expenses, Joule provides the ideal tools for an accurate forecast. Alongside the forecasting capabilities, Joule can also assess financial risks by analyzing market conditions, historical data, and other relevant factors, which allows risk management to take a proactive approach to risk mitigation.

Accounts Receivable and Payable Management

Joule can predict payment behaviors, which can help organizations optimize their cash flows by forecasting when payments are likely to be received or when outgoing payments will occur. In addition to this, Joule has automatic invoice processing capabilities, which can reduce errors and speed up the accounts payable process.

Investment Analysis

For organizations managing investments, Joule can analyze portfolio performance and suggest adjustments to maximize return while still complying with risk limits. Embedded scenario analysis capabilities assist finance teams to assess the potential impact of various investment decisions on their portfolio.

Real-Time Financial Monitoring

Finance teams can use Joule to create real-time dashboards that provide an overview of key financial metrics, enabling quick responses to emerging issues or opportunities. Joule can set up alerts for critical financial thresholds, such as reserves dropping below a certain level, to ensure timely intervention.

All in all, SAP Joule represents a significant step forward in SAP’s strategy to embed AI and ML into its core products, empowering business users with smarter, data-driven capabilities.

Conclusion

This conference summary briefly highlights SAP’s RISE and GROW offerings, with RISE driving cloud-based digital transformation and GROW striving to optimize operations. It contrasts the scalability and cost-efficiency of the public cloud with the control and customization offered by the private cloud. Lastly, it introduces SAP’s new virtual assistant seeking to enhance financial operations through AI-driven insights, automation, and scalability to improve productivity while still maintaining user control over decisions and data security. If you have any further questions regarding the SAP conference or any information in this article, please contact [email protected].

An introduction to IHB for companies planning a new implementation, along with key considerations for those transitioning from IHC.

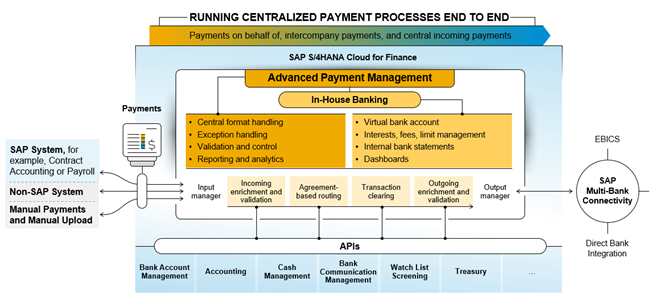

SAP In-House Cash (IHC) has enabled corporates to centralize cash, streamline payment processes, and recording of intercompany positions via the deployment of an internal bank. S/4 HANA In-House Banking (IHB) , released in 2022, in combination with Advanced Payment Management (APM), is SAP’s revamped internal banking solution.

This article will introduce IHB for corporates planning a new implementation and highlight some key considerations for those looking to transition from IHC.

IHB is embedded in APM and included in the same license. It leverages APM’s payment engine functionality and benefits from direct integration for end-to-end processing, monitoring/reporting, and exception handling.

Figure 1: Solution architecture / Integration of In-House Banking (SAP, 2023)

IHC and IHB share several core functionalities, including a focus on managing intercompany financial transactions and balances effectively and ensuring compliance with regulatory requirements. Both solutions also integrate seamlessly with the broader SAP ecosystem and offer robust reporting capabilities.

However, there are significant differences between the two. While IHC relies on the traditional SAP GUI interface, IHB runs on the more modern and intuitive SAP Fiori interface, offering a better user experience. IHB overcomes limitations of IHC, namely in areas such as cut-off times and payment approval workflows and provides native support for withholding tax. Moreover, it also offers tools for managing master data, including the mass download and upload of IHB accounts, features that are otherwise missing in IHC.

Two key distinctions exist in payment routing flexibility and the closing process. IHB, when deployed with APM, manages payment routing entirely as master data, enabling organizations to more easily adapt to evolving business requirements, whereas IT involvement for configuration changes is required for those running IHC exclusively. Lastly, IHB supports multiple updates throughout the day, such as cash concentration, statement reporting, and transfers to FI, and is hence more in tune with the move towards real-time information, whereas IHC is restricted to a rigid end-of-day closing process.

Intrigued? Continue reading to delve deeper into how IHB compares with IHC.

Master data

2.1 Business Partners

The Business Partner (BP) continues to be a pre-requisite for the opening of IHB accounts, but new roles have been introduced.

Tax codes for withholding tax applicable to credit or debit interest can now be maintained at the BP level and feed into the standard account balancing process for IHB. The Withholding Tax set up under FI is leveraged and hence avoids the need for custom development as currently required for IHC.

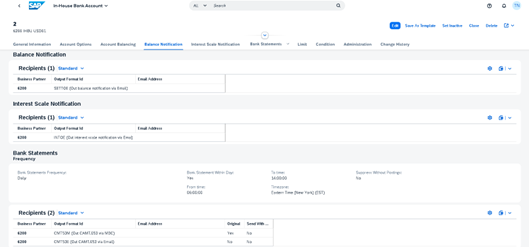

2.2 In-House Bank Accounts

Relative to IHC, the process of maintaining accounts in IHB is simplified and more intuitive.

Statements can be sent to various recipients and in different formats (e.g., CAMT.53, PDF) based on settings maintained at account level. Intraday statement reporting functionality is included, as well as PDF notifications for balances on accounts and interest calculated as part of the account balancing process.

Figure 2: Maintaining IHB Account Correspondence

IHB offers native functionality for mass account download/upload, a feature that is missing in IHC. The mass download option allows data to be exported to Excel, adjusted offline, and subsequently loaded into BAM .

In the upcoming release, the bank account subledger concept will also be supported for IHB accounts managed in BAM.

2.3 Conditions

The underlying setup has been simplified and can now be performed entirely as master data, unlike for IHC, which in comparison requires some customization to be done as part of the implementation.

IHC technically offers slightly more interest conditions (e.g., commitment interest), but IHB covers the fundamentals for account balancing. More importantly, average/linear compound interest calculation methodology is available with IHB to support risk-free rates.

2.4 Workflows

Unlike IHC, which only offers the option of activating “dual control” for some processes (e.g., closure of IHC accounts), IHB introduces flexible workflows for all core master data attributes (e.g., accounts, conditions, limits, etc.).

IHB's flexible workflows allow for multiple approval steps and dynamic workflow recipient determination based on predefined conditions.

Transactional Data

3.1 Scenarios & payment integration/routing

The following set of scenarios are in scope for IHB:

- Intercompany payments

- Payments On-Behalf-Of (POBO)

- Central Incoming

- Cash Pooling

Payment integration is achieved via APM and supports several options, namely IDocs, connectors for Multi-Bank Connectivity (MBC ), file uploads, etc. Moreover, the connector for MBC can be used to support more elaborate integration scenarios, such as connecting decentralized AP systems or a public cloud instance to APM.

More noteworthy is that the flexible payment routing in APM is used to handle the routing of payments and is managed entirely according to business needs as master data. This is particularly relevant for corporates running IHC as a “payment factory” who are considering the adoption of APM & IHB, as routing is entirely configuration-based when using IHC exclusively. There are additional advantages of using APM as a payment factory, especially in terms of payment cut-offs and approval workflows. However, these benefits can be obtained by using APM in conjunction with IHB or IHC.

3.2 Foreign Currency Payments

A distinct set of bid/offer rates can be assigned per transaction type and used to convert between payment currency and IHC account currency at provisional and final posting stages. In contrast, for IHB, a single exchange rate type is maintained at the IHB Bank Area level and drives the FX conversion.

Compared to IHC, applying different rates depending on the payment scenario will require a different design, and special consideration is needed for corporates running complex multilateral netting processes in IHC that are planning to transition to IHB.

Intraday/End of Day Processing

4.1 End of Day Sequence

The end-of-day closing concept applies to IHB as well. Unlike IHC, IHB allows many of the related steps, such as intraday statement reporting, cash concentration, and transfers to FI, to be triggered throughout the day.

A dedicated app further streamlines processing by enabling the scheduling and management of jobs via pre-delivered templates.

4.2 Bank Statements

APM converters are leveraged to produce messages in the desired format (MT940, CAMT.53, or PDF ). Unlike IHC, FINSTA IDocs are no longer supported, which is an important factor to consider when migrating participants that are still on legacy ERP systems.

The settings maintained under the bank statement section of the IHB account drive the format and distribution method (e.g., delivery via MBC or email) to the participants.

4.3 General Ledger Transfer

The new Accounting Business Transaction Interface (ABTI) supports general ledger transfers from IHB to FI several times a day, unlike IHC, which is triggered only once at the end of the day.

Overall, the accounting schemas are more straightforward, which is reflected in the underlying setup required to support IHB. However, relative to IHC, there is technically less flexibility in determining the relevant G/Ls for end-of-day transfers to FI. Due diligence is recommended for corporates moving from IHC to ensure that existing processes are adapted to the new ways of working.

Conclusion

There is no official end-of-life support date for IHC, so corporates can still implement it with or without APM, though this approach presents challenges. Key considerations include

the lack of ongoing development for IHC, SAP’s focus on ensuring IHB matches IHC’s capabilities, and the fact that IHB is already included in the APM license, while IHC requires a separate license.

Initial issues with IHB are expected but will likely be resolved as more companies adopt the functionality and additional features are rolled out. For corporates with moderately complex requirements or those willing to align their processes with standard functionality, IHB is ultimately easier to implement and manage operationally.

To ensure a smooth transition to or adoption of IHB, Zanders offers expert implementation services and works with a variety of technology partners, including SAP. If your organization is contemplating IHB or transitioning from IHC, contact Zanders for guidance and support with any questions you may have.

References

SAP, 2023. Solution architecture - Integration of In-House Banking [Online] SAP. Available from: https://help.sap.com/docs/SAP_S4HANA_ON-PREMISE/e200555127f24878bed8d1481c9d5a0b/3dbe688b4c8840da8567f811be2bc1b4.html?locale=en-US&version=2023.001

Are you aware of the advancements in centralized processing of custom payment formats within SAP systems?

Historically, SAP faced limitations in this area, but recent innovations have addressed these challenges. This article explores how the XML framework within SAP’s Advanced Payment Management (APM) now effectively handles complex payment formats, streamlining and optimizing treasury functions.

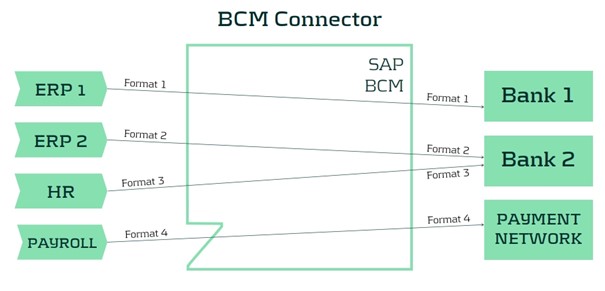

SAP Bank Communication Management (BCM) has been SAP’s solution for integrating a corporate’s SAP system with their banks. It is offering a seamless and secure connection to either a payment network or directly to the bank’s host-to-host solution. Payment and collection files generated from the Payment Medium Workbench can be transferred directly to the external systems, and status messages and bank statements can be received and processed into the SAP application.

The BCM solution has proven to be successful, and corporates wanted to leverage the solution also for transferring messages that do not have their origin in the SAP itself. For example, payment files coming from an HR system or from a legacy ERP system need to be transferred via the same connection that has been established with the BCM setup. For this requirement, SAP introduced the SAP Bank Communication Management option for multisystem payment consolidation, more commonly referred to as the BCM Connector. This add-on made it possible to process payment files generated in external modules or systems into SAP BCM.

However, the BCM Connector has an important limitation: it can only forward the exact format received to external parties. This means that if a legacy system provides a payment file in a proprietary format, it cannot be converted to a more commonly accepted (e.g., XML) format. As a result, compliance with bank requirements regarding payment formats lies with the originating application, limiting the ability to manage payment formats centrally from within the SAP system.

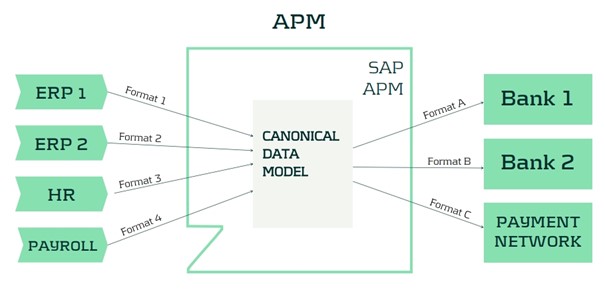

SAP has recognized this limitation and has been focusing on developing a new module to support organizations with a need for centralized payment processing. This solution is called SAP Advanced Payment Management (APM) and offers support for several scenarios for managing payments and payment formats in a centralized environment.

One of the main features of the APM solution is the file handling, which is implemented through an XML Framework. In short, this means that all payment files that need to be processed are handled as an XML message in a canonical data model. This allows for standardized payment processing across various incoming formats.

The main advantages of the XML framework are:

- Parsing into easy formats

- Complex message structures are mapped into generic XML structures that are aligned to the most used message standards (ISO20022). These structures also match to a large extent to the internal data structure of the business objects within SAP APM.

- Embedded XML schema validation

- The XSD schema files for the input structures can be loaded into APM to be used for validation of incoming messages. This takes a way the burden of defining and implementing custom-built validations for these files.

- Interface for easy implementation

- Transferring the data elements from the incoming messages into the canonical data structures can be achieved via predefined Badi's and using several easy-to-use methods for retrieving and analyzing the source message.

- Parallel processing for large messages

- The XML Framework offers functionality to divide large messages into smaller building blocks and process them in parallel. This makes APM a very powerful solution that is able to process large numbers of payments in a timely manner.

- The XML Framework offers functionality to divide large messages into smaller building blocks and process them in parallel. This makes APM a very powerful solution that is able to process large numbers of payments in a timely manner.

The solution can also be used for non-XML messages. This requires a preprocessing step where the source file is converted to an XML representation of the file. After this step, the message can be processed like any other XML file including the validation and parallel processing options.

Implementing this solution for XML and non-XML formats is a technical exercise that requires ABAP-skills and knowledge of the SAP enhancement framework . However, SAP has made it easier to implement custom formats with the framework while fully utilizing the capabilities of the APM module.

For organizations seeking to enhance their payment processing capabilities through centralized management and innovative solutions like SAP Advanced Payment Management, our team is equipped to provide expert guidance. To explore how APM can support your treasury operations and ensure seamless financial integration, please reach out to us at [email protected].

Strengthen strategic decision-making by bridging the FX impact gap. Empower Treasury as a proactive partner in predicting and minimizing global and local FX risks through advanced analytics

In a world of persistent market and economic volatility, the Corporate Treasury function is increasingly taking on a more strategic role in navigating the uncertainties and driving corporate success.

Even in the most mature organizations, the involvement of the Treasury center in FX risk management often begins with collecting forecasted exposures from subsidiaries. However, to fundamentally enhance the performance of the FX risk management process, it is crucial to understand the nature of these FX exposures and their impacts on the upstream business processes where they originate.

Enabling this requires the optimization of the end-to-end FX hedging lifecycle, from subsidiary financial planning and analysis (FP&A) that identifies the exposure to Treasury hedging. Improvements in the exposure identification process and FX impact analytics necessitate the use of intelligent systems and closer cooperation between Treasury and business functions.

Traditional models

While the primary goal of local business units is to enhance the performance of their respective operations, fluctuating FX rates will always directly impact the overall financial results and, in many cases, obscure the true business performance of the entity. A common strategy to separate business performance from FX impacts is to use constant budgeting and planning rates for management reporting, where the FX impact is nullified. These budgeting and planning rates typically reflect the most likely hedged rates achieved by Treasury, considering the hedging policies and forecasted hedging horizons. However, this strategy can lead to unexpected shocks in financial reporting and obscure the impacts of FX exposure forecasting and hedging performance.

When these shocks occur, conclusions about their causes, such as over or under-hedging or unrealistic planning rates, can only be drawn through retrospective analysis of the results. Unfortunately, this analysis often comes too late to address the underlying issues.

The most common Treasury tools used to measure the accuracy of business forecasting are Forecast vs. Forecast and Actual vs. Forecast accuracy reporting. These tools help identify recurring trouble areas that may need improvement. However, while these metrics indicate where forecasting accuracy can be improved, they do not easily translate into a quantification of the predicted or actual financial impact required for business planning purposes.

End-to-End FX risk management in a Treasury 4.x environment

Finance transformation projects, paired with system centralization and standardization, may offer an opportunity to create better integration between Treasury and its business partners, bridging the information gap and providing better insight and early analysis of future FX results. Treasury systems data related to hedging performance, together with improved up-to-date exposure forecasting, can paint a clearer picture of the up-to-date performance against the plan.

While some principles may remain the same, such as using planning and budgeting rates to isolate the business performance for analysis, the expected FX impacts at a business level can equally be analyzed and accounted for as part of the regular FP&A processes, answering questions such as:

- What is the expected impact of over- or under-hedging on the P&L?

- What is the expected impact from late hedging of exposures?

- What is the expected impact from misaligned budgeting and planning rates compared to the achieved hedging rates?

The Zanders Whitepaper, "Treasury 4.x – The Age of Productivity, Performance, and Steering," outlines the enablers for Treasury to fulfill its strategic potential, identifying Productivity, Performance, and Steering as key areas of focus.

In the area of Performance, the benefits of enhanced insights and up-to-date metrics for forecasting the P&L impacts of FX are clear. Early identification of expected FX impacts in the FP&A processes provides both time and opportunity to respond to risks sooner. Improved insights into the causes of FX impacts offer direction on where issues should be addressed. The outcome should be enhanced predictability of the overall financial results.

In addition to increased Performance, there are additional benefits in clearer accountability for the results. In the three questions above, the first two address timely forecasting accuracy, while the third pertains to the Treasury team's ability to achieve the rates set by the organization. With transparent accountability for the FX impact, Treasury gains an additional tool to steer the organization toward improved budgeting processes and create KPIs to ensure effective strategy implementation. This provides a valuable addition to the commonly used forecast vs. forecast exposure analysis, as the FX impacts resulting from that performance can be easily identified.

Conclusion

Although FP&A processes are crucial for clear strategic decision-making around business operations and financial planning, the FX impact—potentially a significant driver of financial results—is not commonly monitored with the same extent and detail as business operations metrics.

Improving the FX analytics of these processes can largely bridge the information gap between business performance and financial performance. This also allows Treasury to be utilized as a more engaged business partner to the rest of the operations in the prediction and explanation of FX impact, while providing strategic direction on how these impacts can be minimized, both globally and at local operations levels.

Implementing such an end-to-end process may be intimidating, but data and technology improvements embraced in the context of finance transformation projects may open the door to exploring these ideas. With cooperation between Treasury and the business, a true end-to-end FX risk management process may be within reach.