Everyone understands the importance of data in an organization. After all, data is the new oil in terms of its value to a corporate treasury and indeed the wider organization. However, not everyone is aware of how best to utilize data. This article will tell you.

Developing a data strategy depends on using the various types of payment, market, cashflow, bank and risk data available to a treasury, and then considering the time implications of past historical data, present and future models, to better inform decision-making. We provide a roadmap and ‘how to’ guide to becoming a data-driven organization.

Why does this aim matter? Well, in this age of digitization, almost every aspect of the business has a digital footprint. Some significantly more than the others. This presents a unique opportunity where potentially all information can be reliably processed to take tactical and strategic decisions from a position of knowledge. Good data can facilitate hedging, forecasting and other key corporate activities. Having said all that, care must also be taken to not drown in the data lake1 and become over-burdened with useless information. Take the example of Amazon in 2006 when it reported that cross-selling attributed for 35% of their revenue2. This strategy looked at data from shopping carts and recommended other items that may be of interest to the consumer. The uplift in sales was achieved only because Amazon made the best use of their data.

Treasury is no exception. It too can become data-driven thanks to its access to multiple functions and information flows. There are numerous ways to access and assess multiple sets of data (see Figure 1), thereby finding solutions to some of the perennial problems facing any organization that wants to mitigate or harness risk, study behavior, or optimize its finances and cashflow to better shape its future.

Time is money

The practical business use cases that can be realized by harnessing data in the Treasury often revolve around mastering the time function. Cash optimization, pooling for interest and so on often depend on a good understanding of time – even risk hedging strategies can depend on the seasons, for instance, if we’re talking about energy usage.

When we look at the same set of data from a time perspective, it can be used for three different purposes:

I. Understand the ‘The Past’ – to determine what transpired,

II. Ascertain ‘The Present’ situation,

III. Predict ‘The Future’ based on probable scenarios and business projections.

I – The Past

“Study the past if you would define the future”

Confucius

The data in an organization is the undeniable proof of what transpired in the past. This fact makes it ideal to perform analysis through Key Performance Indicators (KPIs), perform statistical analysis on bank wallet distribution & fee costs, and it can also help to find the root cause of any irregularities in the payments arena. Harnessing historical data can also positively impact hedging strategies.

II – The Present

“The future depends on what we do in the present”

M Gandhi

Data when analyzed in real-time can keep stakeholders updated and more importantly provide a substantial basis for taking better informed tactical decisions. Things like exposure, limits & exceptions management, intra-day cash visibility or near real-time insight/access to global cash positions all benefit, as does payment statuses which are particularly important for day-to-day treasury operations.

III – The Future

“The best way to predict the future is to create it.”

Abraham Lincoln

There are various areas where an organization would like to know how it would perform under changing conditions. Simulating outcomes and running future probable scenarios can help firms prepare better for the near and long-term future.

These forecast analyses broadly fall under two categories:

Historical data: assumes that history repeats itself. Predictive analytics on forecast models therefore deliver results.

Probabilistic modeling: this creates scenarios for the future based on the best available knowledge in the present.

Some of the more standard uses of forecasting capabilities include:

- risk scenarios analysis,

- sensitivity analysis,

- stress testing,

- analysis of tax implications on cash management structures across countries,

- & collateral management based on predictive cash forecasting, adjusted for different currencies.

Working capital forecasting is also relevant, but has typically been a complex process. The predication accuracy can be improved by analyzing historical trends and business projections of variables like receivables, liabilities, payments, collections, sales, and so on. These can feed the forecasting algorithms. In conjunction with analysis of cash requirements in each business through studying the trends in key variables like balances, intercompany payments and receipts, variance between forecasts and actuals, this approach can lead to more accurate working capital management.

How to become a data-driven organization

“Data is a precious thing and will last longer than the systems themselves.”

Tim Berners-Lee

There can be many uses of data. Some may not be linked directly to the workings of the treasury or may not even have immediate tangible benefits, although they might in the future for comparative purposes. That is why data is like a gold mine that is waiting to be explored. However, accessing it and making it usable is a challenging proposition. It needs a roadmap.

The most important thing that can be done in the beginning is to perform a gap analysis of the data ecosystem in an organization and to develop a data strategy, which would embed importance of data into the organization’s culture. This would then act as a catalyst for treasury and organizational transformation to reach the target state of being data-driven.

The below roadmap offers a path to corporates that want to consistently make the best use of one of their most critical and under-appreciated resources – namely, data.

We have seen examples like Amazon and countless others where organizations have become data- driven and are reaping the benefits. The same can be said about some of the best treasury departments we at Zanders have interacted with. They are already creating substantial value by analyzing and making the optimum use of their digital footprint. The best part is that they are still on their journey to find better uses of data and have never stopped innovating.

The only thing that one should be asking now is: “Do we have opportunities to look at our digital footprint and create value (like Amazon did), and how soon can we act on it?”

References:

The most recent S/4HANA Finance for cash management completes the bank account management (BAM) functionality with a bank account subledger concept. This final enhancement allows the Treasury team to assume full ownership in the bank account management life-cycle.

With the introduction of the new cash management in S/4HANA in 2016, SAP has announced the bank account management functionality, which treats house bank accounts as master data. With this change of design, SAP has aligned the approach with other treasury management systems on the market moving the bank account data ownership from IT to Treasury team.

But one stumbling block was left in the design: each bank account master requires a dedicated set of general ledger (G/L) accounts, on which the balances are reflected (the master account) and through which transactions are posted (clearing accounts). Very often organizations define unique GL account for each house bank account (alternatively, generic G/L accounts are sometimes used, like “USD bank account 1”), so creation of a new bank account in the system involves coordination with two other teams:

- Financial master data team – managing the chart of accounts centrally, to create the new G/L accounts

- IT support – updating the usage of the new accounts in the system settings (clearing accounts)

Due to this maintenance process dependency, even with the new BAM, the creation of a new house bank account remained a tedious and lengthy process. Therefore, many organizations still keep the house bank account management within their IT support process also on S/4HANA releases, negating the very idea of BAM as master data.

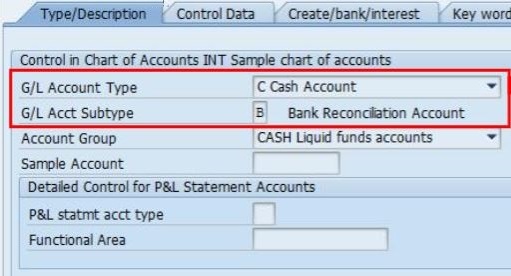

To overcome this limitation and to put all steps in the bank account management life cycle in the ownership of the treasury team completely, in the most recent S/4HANA release (2009) SAP has introduced a new G/L account type: “Cash account”. G/L accounts of this new bank reconciliation account type are used in the bank account master data in a similar way as the already established reconciliation G/L accounts are used in customer and vendor master data. However, two new specific features had to be introduced to support the new approach:

- Distinction between the Bank sub account (the master account) and the Bank reconciliation account (clearing account): this is reflected in the G/L account definition in the chart of accounts via a new attribute “G/L Account Subtype”.

- In the bank determination (transaction FBZP), the reconciliation account is not directly assigned per house bank and payment method anymore. Instead, Account symbols (automatic bank statement posting settings) can be defined as SIP (self-initiated payment) relevant and these account symbols are available for assignment to payment methods in the bank country in a new customizing activity. This design finally harmonizes the account determination between the area of automatic payments and the area of automatic bank statement processing.

In the same release, there are two other features introduced in the bank account management:

- Individual bank account can be opened or blocked for posting.

- New authorization object F_BKPF_BEB is introduced, enabling to assign bank account authorization group on the level of individual bank accounts in BAM. The user posting to the bank account has to be authorized for the respective authorisation group.

The impact of this new design on treasury process efficiency probably makes you already excited. So, what does it take to switch from the old to the new setup?

Luckily, the new approach can be activated on the level of every single bank account in the Bank account management master data, or even not used at all. Related functionalities can follow both old and new approaches side-by-side and you have time to switch the bank accounts to the new setup gradually. The G/L account type cannot be changed on a used account, therefore new G/L accounts have to be created and the balances moved in accounting on the cut-over date. However, this is necessary only for the G/L account masters. Outstanding payments do not prevent the switch, as the payment would follow the new reconciliation account logic upon activation. Specific challenges exist in the cheque payment scenario, but here SAP offers a fallback clearing scenario feature, to make sure the switch to the new design is smooth.

One of the main challenges treasurers face when setting up a cash pool or an in-house bank is setting an appropriate interest rate for the resulting transactions. This topic, among others, has been addressed in the recently published OECD transfer pricing guidelines on financial transactions. As expected, the OECD has left it to the taxpayers and advisors to translate the guidance into concrete methodologies for compliance. Zanders has designed a cloud-based solution that automates the entire process.

The pricing of intercompany treasury transactions is subject to transfer pricing regulation. In essence, treasury and tax professionals need to ensure that the pricing of these transactions is in line with market conditions, also known as the arm’s length principle, thereby avoiding unwarranted profit shifting.

We have has been assisting dozens of multinationals on this topic through our Transfer Pricing Solution (TPS). The TPS enables them to set interest rates on intercompany transactions in a compliant and automated way. Since its go-live, clients have priced over 1000 intercompany loans with a total notional of over EUR 60 billion using this self-service solution.

Cash Pooling Solution

In February 2020, the OECD published the first-ever international consensus on financial transactions transfer pricing. One of the key topics of the document relates to the determination of internal pooling interest rates. As a reaction, Zanders has launched a co-development initiative with key clients to design a Cash Pooling Solution that determines the arm’s length interest rates for physical cash pools, notional cash pools and in-house banks.

The goal of this new solution is to present treasury and tax professionals with a user-friendly workflow that incorporates all compliance areas as well as treasury insights into the pooling structure. The three main compliance areas for treasury professionals are:

- Ensuring that participants have a financial incentive to participate in the pooling structure. Entities participating in the pool should be ‘better off’ than they would be if they went directly to a third-party bank. In other words, participants’ pooled rates should be more favorable than their stand-alone rates. The OECD sets out a step-by-step approach to improve interest conditions for participating entities to distribute the synergies towards the participants.First, the total pooling benefit should be calculated. This total pooling benefit is the financial advantage for a group compared to a non-pooled cash management set-up. The total pooling benefit can be broken down into a netting benefit and an interest rate benefit. The netting benefit arises from offsetting debit and credit balances. The interest rate benefit arises from more beneficial interest rate conditions on the cash pool or in-house bank position, compared to stand-alone current accounts.

Once the total pooling benefit has been calculated, it should be allocated over the leader entity and the participating entities. Therefore, a functional analysis of the pooling structure should be made to identify which entities contribute most in terms of their balances, creditworthiness and the administration of the pool. The allocated amount should be priced into the interest rates. A deposit rate will thus receive a pooling premium. A withdrawal rate will incorporate pooling discount. - Ensuring a correct tax treatment of the cash pool transactions. Pooling structures are primarily in place to optimize cash and liquidity management. Therefore, tax authorities will expect to see the balances of cash pool participants fluctuate around zero. Treasury professionals should monitor positions to prevent participants from having a structural balance in the pool. If the balance has a longer-term character, tax authorities can classify such pooling position as a longer-term intercompany loan. Consequently, monitoring structural balances can lower tax risk significantly.

- Appropriate documentation should be in place for each time treasury determines the pooling interest rates. The documentation should include the methodology as well as all specifics of the transfer pricing analysis. Proper documentation will enable the multinational to substantiate the interest rates during tax audits.

Multinationals are confronted with a significant compliance burden to comply with these new guidelines. Different hurdles can be identified, ranging from access to the appropriate market data to a considerable and recurring time investment in determining and documenting the internal deposit and withdrawal rates for each pooling structure.

It remains to be seen how auditors treat these new guidelines, but the recent increased focus on transfer pricing seems to indicate that this will be a topic that may need additional attention in the coming years.

Zanders Inside solutions

In order to support treasury and tax professionals in this area, Zanders Inside launched its cloud-based Cash Pooling Solution. This solution will focus on each of the three compliance areas as described above. In addition, the solution leverages a high degree of automation to support the entire end-to-end process. It offers a cost-effective alternative for the manual process that multinationals go through. Please watch our video showing how the Cash Pooling Solution tackles the challenge of OECD compliancy.

From managing offline payments to navigating complex global transactions, GlobalCollect overcame the challenge of adopting SWIFT to streamline payments for businesses worldwide, making international transactions simpler and more cost-effective.

A transfer to a new system is usually a complicated and time-consuming process. This particularly rings true for a company like GlobalCollect, which processes hundreds of thousands of online transactions for banks all over the world on a daily basis. How did this payment service provider (PSP) tackle the complicated challenge of adopting SWIFT as its new system?

In 1994, the current GlobalCollect was set up as a division within the old TPG Post company to ensure a well-organized payment system for parcel deliveries. Back then it was dealing with offline payments, such as cash on delivery, but when digitalization took off, the postal company decided to go online with its payment services. Now, GlobalCollect is a fast-growing company, independent of TPG Post, which processes worldwide online payments for retailers operating internationally. This PSP offers them one platform so that they do not have to deal with the complexity of various foreign banks and their payment systems.

Connections and conversions

Michael Roos, vice president of merchant boarding at GlobalCollect, says that the market for PSPs has quickly become ‘professionalized’. “The industry has developed enormously over the past 10 years, also as far as legal and statutory regulations are concerned. We fall under the supervision of the Dutch central bank, De Nederlandsche Bank, and are affected by the EU’s Payment Services Directive (PSD). Companies who conduct business abroad, such as airlines or online retailers, need to receive payments from abroad. That adds to the complexity as it is a huge challenge setting up all the connections. You not only have to deal with the local banker, but also with all sorts of foreign banks.” A PSP not only has all those necessary local connections but is able to offer the client various payment methods via one point of access. “As a company you then have not only the local payment method, such as iDeal in the Netherlands, but also those in other countries where you have customers.”

Since GlobalCollect processes many millions of transactions each month, it is able to compete on price – something a single company cannot do with only several hundred transactions. Customers enjoy a more favorable rate – despite working with an intermediary – than they would with a bank. Besides dealing with the complexity of connections, GlobalCollect’s clients enjoy large-scale benefits for other services, such as currency conversion. “Collection of foreign currency can be outsourced,” Roos adds. “If you get paid in Brazilian real, which is not freely convertible, we do the conversion. Clients then have quicker access to their money in their own currency.”

New for corporates

When GlobalCollect was starting up, it began with a few bank interfaces. “But after about 15 years we had more than 50 interfaces within an out-of-date infrastructure. In order to bring this infrastructure up to a technological standard that was market compliant, we decided that SWIFT was the best solution. But to get started we didn’t have the required know-how and manpower. So when we looked around for a company with plenty of expertise we hit on Zanders. I had spoken to Sander van Tol about three or four years ago and remembered that Zanders knew a lot about SWIFT. In the spring of 2012 I met Jill Tosi and in October the project kicked off.” Zanders taught GlobalCollect about the possibilities and impossibilities of SWIFT. “And Zanders was the right choice,” says Roos. Originally, SWIFT was a connectivity channel for banks, and since 2000 it has also become available to corporates. When GlobalCollect decided to start using SWIFT’s Alliance Lite2, a new cloud-based SWIFT communication tool, it was new to the market. Roos says: “As one of the first adopters, we were working with a completely new SWIFT system.

The interfaces particularly were new and unknown.” GlobalCollect’s reason for acquiring SWIFT was twofold. On the technical side, the number of interfaces had to be reduced. On the other hand, SWIFT had to standardize formats and the provision of information. Roos adds: “In order to be able to profit from the systems we had to have good information. Good information is standardized in IT, and so we ended up with SWIFT. The way information was shared with banks had to be standardized as much as possible. This was our starting point with a kick-off on various workflows.”

Fully-fledged tool

The challenge for GlobalCollect was mainly in connecting to banks. The old interfaces had to be replaced with new ones. Whereas SWIFT has everything standardized, it appeared that the banks did not. Roos explains: “Banks who want to connect via SWIFT each send their own technical implementation document; where one sends a single Excel-sheet with technical details, another sends a 20-page contract.” Roos noticed that SWIFT, banks, and corporations were not necessarily used to dealing with each other in this context. “Particularly outside of developed markets, the banks have not come that far yet and there is a good deal of indifference. This makes project-based work and estimation of turnaround times difficult. We approached a number of banks and looked to see which ones reacted the fastest and in the most professional way, and we started with them. This is not what you would normally do. I think we got off to a good start, but the migration path will take a number of months to complete.” The time required for testing individual connections and carrying out test cases can be very long. Roos says: “SWIFT is a fully-fledged tool and the parties used to working with it are large financial institutions. For us as a young, upcoming, dynamic industry, we really have to adapt to the banks – it’s a completely different culture.”

Change of format

With the huge amount of transactions involved, a transfer to another system is risky. “Therefore we ran the two systems in parallel during the migration,” he explains. “We also deliberately decided to link the largest parties first, leaving the legacy system running as we integrated SWIFT into the organization.” This means that a back-up is not necessary. “SWIFT is a unique system, with relatively large numbers of redundancy channels and recovery scenarios, so that it can guarantee unique processing.”

According to Zanders consultant Jill Tosi, this is because SWIFT is owned by the banks: “They have so much trust in their system that they assume responsibility for payments. SWIFT has such a robust system with minimal failure percentages, that customers can put complete trust in its information process.”

At the time of transferring to the new system, GlobalCollect had a lot of IT projects on the go. The SWIFT implementation was also part of a much larger project, Process Excellence, where several systems had to be modernized in order to meet market standards. “There was a lot of pressure on the IT department at GlobalCollect,” Tosi says. “The electronic banking systems were all stand-alone, i.e. not integrated into the daily processes. There were about 50 electronic banking systems, and someone had to log into each one separately with a different token each day. For one or two that is feasible, but 50 is too many.” And Roos adds: “The whole idea was to continue with significantly fewer interfaces – preferably one. And we are still very busy with that.”

While GlobalCollect was carrying out the migration to the new system, the banks were right in the middle of the SEPA migration. “That had consequences for the introduction of new formats within SWIFT,” Roos says. “We had to make a decision: do we go for MT940, the old standard for bank statements, or do we go for CAMT 053, the XML-successor of MT940? XML is a future-proof format but is not offered by all banks. As a consequence of SEPA, some banks will have to be migrated twice: firstly to MT940 and then to XML. An interesting aside is that where SWIFT offers the version 2.0 solution to corporations, many banks are just not ready for SWIFT connectivity with businesses. A number of large Anglo-Saxon banks have indicated that MT940 interfaces are not yet available for a direct connection to SWIFT Alliance Lite2 with corporates.”

Business as usual

The SWIFT migration to large banks is over and this year other banks will follow. After the first three banks, Zanders withdrew from the process. "It is now more like business as usual,” says Roos. "Zanders not only did the implementation, but was also responsible for the learning curve in our company. We have become self-supporting as far as SWIFT is concerned.” After the SWIFT project, Zanders also helped GlobalCollect with the selection and implementation of a new treasury management system (TMS) and a reconciliation tool. "Messages coming from SWIFT could be uploaded to our TMS straight away,” Roos says. "The same goes for our reconciliation system. If we didn’t have the standardization of the SWIFT system, it would have been much harder. In the banks’ own technical file formats there is a degree of standardization, but it’s not complete. It is clear to us that getting the standard functionality working would not have been possible without the successful implementation of SWIFT Alliance Lite2.”