Remote offers global employment services for internationally distributed workforce. It takes care of payroll, benefits, compliance, taxes, equity incentives and more, so that companies can employ someone internationally as easily as they do at home. The company’s vision is to make it simple to manage, employ, and pay anyone, anywhere. Founded in 2019, Remote is growing quickly and expanding into different markets. In 2022, Zanders supported the company to accelerate the onboarding of new banks. Ana de Sousa, Director and Global Head of Treasury at Remote, explains the collaboration in this Q&A.

"We tackle some of the biggest challenges involved in building distributed teams, which are the risk, cost, and complexity of employing international employees and contractors,” De Sousa clarifies. “Our customers include GitLab, DoorDash, Loom, Paystack, and thousands of other companies around the world.”

You have been Director Global Treasurer at Remote for a year now. What attracted you to join the company?

“At Remote we often say that ‘talent is everywhere, but opportunities aren’t.’ I grew up in a very small village in Portugal so I personally identify with this. I saw that Remote is changing the world and I wanted to be part of this change. Beyond the mission, it’s also exciting to be part of a company that is applying technology and automation to bring efficiency to an area as complex as global employment. I am also very aligned with Remote’s values. The value of kindness is very special for me, as I believe that we can always make extraordinary things when we are kind.”

How would you describe the company’s corporate culture?

“Because Remote is a fully distributed virtual company with no offices, most roles are country-agnostic and our employees can work from their chosen locations around the world. That means we have Remoters from 75+ different nationalities, coming from all different cultures, backgrounds and experiences. This contributes to a diverse work environment where everyone is encouraged to share their culture and interests with everyone.”

What would you say drives the need for remote work/remote hiring and remote services in general?

“Over the past few years, many companies turned to remote work as a solution to a problem. What they are discovering now is that it can provide significant business advantages as well. Remote work enables you to build a team without being constrained by geography, meaning companies can tap into wider pools of talent while also supporting greater flexibility and work-life balance.”

What is your experience within different regions/markets?

“Remote has a global presence with around 80 legal entities on six continents. I started my career overseeing cash management for the EMEA region. Later, I moved to a new job with a global scope. Here at Remote, every single member of the Treasury team has global coverage. This means we can leverage asynchronous and flexible work for the entire team to be effective.”

You are working completely remotely, without having a physical company office. What has been your experience with this setup and do you miss meeting your colleagues in person?

“I do miss team birthday parties with cake sometimes. I advocate freedom of choice, based on whatever is best for you. Working from an office is still offered by plenty of companies. For me, remote work has allowed me to keep my career in an international environment while prioritizing family and flexibility. It’s certainly still possible to meet up with colleagues without a company office. I recently met one of my team members in person for the first time, and it was just like catching up with a friend.”

In terms of managing family/work time, are there days where you would prefer to work in a physical company office?

“No, I manage my time according to my priorities. If my kids need me, I will be available for them. If my work is my priority, that is my focus. It is not a physical place that defines my commitment or my capacity of producing results. It is important to have the right structure that supports your professional career independently of the place.”

What are the communication tools you use internally and externally?

“We use tools like Slack, Notion, Loom, and Asana for communication and documentation. Beyond the tools, Remoters are trained in asynchronous communication, documentation, inclusive language, meeting best practices, and even to use the UTC time zone companywide. These are all essential for a team that is as distributed as ours.”

What would you say are treasury-specific challenges when working remotely?

“The biggest challenges of remote work arise when we try to take the old office-centric methods of doing things and expect them to work just as well in a remote setting. Remote work does require some different considerations. Treasury teams in particular need to be rigorous about documentation and practicing ‘overcommunication’ given the critical nature of our work.”

What is the company’s approach for creating an integrated team and what is your personal approach to build a team spirit while working completely remotely?

“As a fully remote company, Remote works hard to build belonging and a sense of community throughout the company. There are numerous opportunities for social connection, including bonding times, games, and even virtual reality time. We have more than 1,700 Slack channels including channels for music, TV, pets, food, sports and much more. At the same time, our culture is asynchronous, so people can participate on their own time and all scheduled events rotate across time zones.”

Expanding into new markets is part of Remote’s core strategy. What role does Treasury play to enable new country operations?

“At Remote, Treasury is part of the backbone of our operations and an enabler of international growth. In the majority of cases, without a bank account, we cannot launch in a country. In addition, domestic bank accounts are also critical to offer better experience to our customers.”

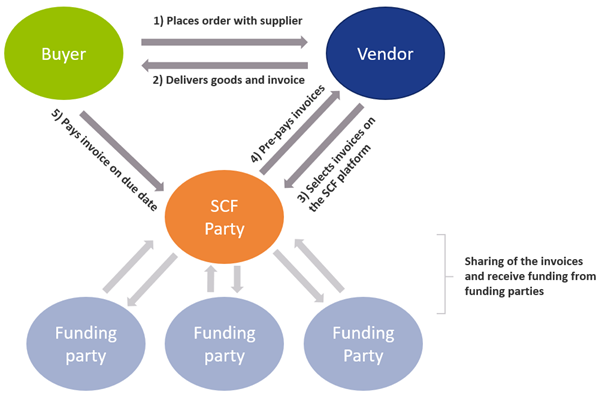

How did Zanders support you to accelerate the onboarding of new banks?

“Zanders helped streamline what could be a very complicated process with banking partners. We appreciated their continuous communication and follow-up on progress, as well as their advocacy on our behalf to challenge some of the requirements we faced and even get a few of them waived.”

How did you perceive the collaboration between Remote and Zanders, given the project was delivered on a fully remote basis?

“It worked very well. We would not have been able to work with a partner that didn’t know how to collaborate remotely. Working with the Zanders team, we were able to apply the same operating principles we use internally – clearly defining guidelines and expectations, overcommunicating, and building a high degree of trust between our teams.”

To round off, what advice would you give anyone starting to work 100% remotely?

“Life is too short to waste time commuting. Remote work is all about freedom, flexibility and happiness. When we do what we like, we’ll get great results, regardless of where the work is done.”

The collaboration between Remote and Zanders

Viktorija Janevska, manager at Zanders: “Account opening and KYC has been a challenge for many corporates in recent years, given the increasing KYC requirements and rather cumbersome onboarding experience. We at Zanders have been happy to support Remote with this interim project, taking the workload from the team and being the first point of contact for the banks with regards to the account opening and onboarding documentation requests. Key success factors for the project were the open and transparent communication between the two teams, regular update calls and priority setting.

Remote not only demonstrates an innovative working approach when it comes to working remotely, but also by using chats for most of their internal communication rather than email communication. During the project, the transition from email to chat communication required some adaptation and from time to time a reminder to use the preferred channel. It has been a great experience to accompany Remote on its journey and are looking forward to see the company’s further success.”