Sony decided to start Digital Transformation (DX) of global treasury functions by launching the METRO Project officially in May 2018 and completed it by October 2020, working remotely under the COVID-19 global pandemic.

One of the biggest achievements of this project is the automation of the FX trading process. It is impressive to see how Sony’s FX dealers can trade large volume of FX deals with banks efficiently and effectively within a few minutes by using SAP S/4HANA Treasury and SAP’s TPI (Trading Platform Integration) connecting automatically with 360T Trading platform.

In this article, Sony’s project management team and Zanders partners will explain about this project.

Power of creativity and technology

Sony strives to fulfil its purpose to “fill the world with emotion, through the power of creativity and technology”, under its corporate direction of “getting closer to people”. To evolve and grow further, Sony strives to provide innovative products and contents full of emotional experiences in order to enrich people’s lives through the power of technology, across its six business segments consist of Game & Network Services, Music, Pictures, Electronics Products & Solutions, Imaging & Sensing Solutions, and Financial Services.

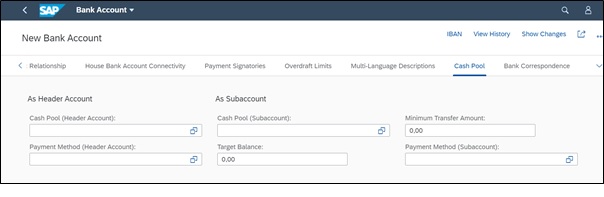

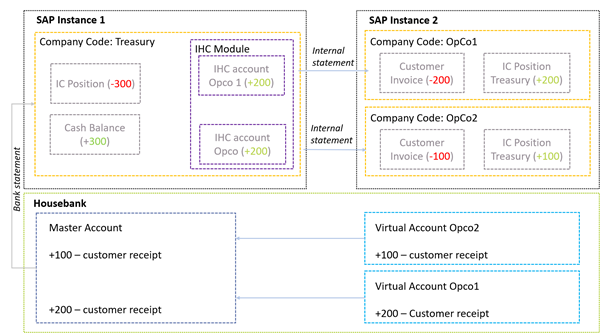

New-generation technologies made it possible for Sony Group to improve the global treasury platforms such as Payment-On-Behalf Of (POBO), Zero Balance Accounts (ZBA) sweeping, and Internal cash-less payments, Internal FX and Money Market deals settled via In-House-Cash accounts.

To improve FX hedging process, Sony introduced cutting-edge technologies such as SAP S/4HANA Treasury, SAP’s TPI connecting automatically with 360T Trading platform, to achieve the end-to-end automation of FX trading process.

To improve banking connectivity, Sony adopted the most advanced generation of banking technologies such as SWIFT for Corporates and ISO 20022 standards to connect with global banks smoothly for payment requests and bank statements via SWIFT network, which makes it possible for Sony’s cash management teams to grasp the latest status of cash position in a timely manner, even when the employees are forced to work from home in a tele-commuting era under COVID-19.

Additionally, Sony has implemented SAP In-House-Cash (IHC) for its treasury centers as In-House-Banks to support Sony subsidiaries in each region.

Sony’s journey for global treasury transformation

Sony Group has been making impressive efforts in the field of finance and treasury for a long time. Since 2000, Sony Global Treasury Services Plc (SGTS UK) has been established and operated in the United Kingdom as a global treasury center for Sony Group. SGTS UK has been providing POBO, ZBA sweeping, Internal cash-less payments, Internal FX and MM deals settled via internal accounts for Sony Group companies based on in-house treasury system developed by the Sony IS team. Cash and FX risk management were centralized in SGTS UK.

As Sony’s business grew in various business segments globally, it was necessary and rational to centralize funds and foreign exchange risks into SGTS UK. Before 1999, each regional finance/treasury center had managed FX and cash management individually, so it was a significant improvement by centralizing into SGTS UK. SGTS UK was deemed to be one of the most advanced in-house-bank of its kind around the world.

In 2016, SGTS UK transferred cash management functions for group companies in the USA to Sony Capital Corporation (SCC), to strengthen access to the US capital market, and to enhance flexibility to any changes in laws and regulations in the USA.

We departed from single global treasury center model and transformed into three main treasury center models by standardizing, simplifying, and automating treasury operations across all the treasury centers.

Hiroyuki Ishiguro, General Manager of Sony Group Corporation HQ Finance

Challenge

Decision to transform

In October 2017, Sony started a project planning to rebuild its global treasury management structures across the globe. By December 2017, after an RFP process among the shortlisted SAP consultants, Sony decided that Zanders would be the best SAP Treasury expert to advise and support in this project. Together with Zanders, Sony opted for SAP S/4HANA Treasury based on ‘Fit & Gap’ analysis.

In May 2018, Sony decided to start the METRO Project officially.

Mr. Hiroyuki Ishiguro, General Manager of Sony Group Corporation HQ Finance (‘SGC HQ Fin’), explains: “We decided to start DX in Sony’s global treasury operations, considering more diversified business segments in Sony Group, rapid changes of corporate treasury and banking activities in each region, innovations of financial technologies, and limitations of legacy treasury systems that could not so effectively support Sony’s group companies especially in the USA and Japan. We departed from single global treasury center model and transformed into three main treasury center models by standardizing, simplifying, and automating treasury operations across all the treasury centers.”

Mr. Ishiguro served as the project owner, led the project management team, and worked together with the project members from overseas based in eight countries. With the introduction of the METRO Project, Sony Group built a Treasury Management System (TMS) that supports all segments of the Sony Group’s business domain, excluding finance segment, providing treasury services for nearly 350 companies worldwide in Sony Group. The METRO Project was set in motion.

Technology risk

The legacy in-house systems had a technology risk, because it was developed with old programming languages and had been in operation since 2000.

Mr. Ishiguro also comments: “In the project planning phase, it was a challenge to justify the importance of METRO Project and to justify IT investment for TMS. Technology risk urged us to start the planning phase to kick off the METRO Project. Our previous legacy treasury systems were in-house systems developed long time ago. The technology risk would be a real risk at the end of December 2020, so we needed to take urgent action to transform the existing legacy systems into a new TMS. We needed to have a very solid and stable TMS to manage the cash management and FX risk management for Sony’s global businesses. This meant a large scale of IT investment.”

Solution

Choosing SAP and Zanders

Sony decided to choose SAP S/4HANA Treasury, as the “best” TMS fitting well with Sony’s requirements based on the FIT & GAP analysis.

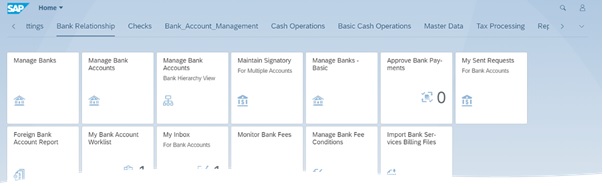

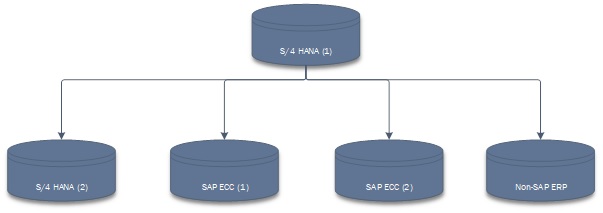

Mr. Takehiro Yagi, Senior Project Manager of SGC HQ Fin, explains why: “We performed a fit-gap analysis on various options, including ERP type treasury systems like SAP, treasury-specialized TMS, and an inhouse developments. Zanders gave us a lot of valuable insights into each TMS at the FIT&GAP analysis. SAP S/4HANA Treasury was chosen as the best fit for Sony’s Treasury as a result. SAP S/4 HANA Treasury would ‘FIT’ with most of our requirements to cover Sony’s global treasury services with multiple treasury centers model. SAP had flexibility to achieve Sony’s unique requirements with custom enhancements. Furthermore, SAP S/4HANA Treasury could achieve integration with accounting systems effectively, because a lot of Sony group companies have been using SAP as an accounting platform.”

The most important condition was to choose SAP Treasury experts who have deep knowledge and wide experiences in global implementation of SAP S/4 HANA Treasury for both TRM and IHC modules for regional treasury centers. Zanders won the RFP process in a shortlist of world-famous SAP partner companies. As a result, Sony decided to select Zanders as the SAP implementation partner.

Sony faced serious shortage of SAP Treasury experts. In fact, the lack of SAP experts was one of the biggest challenges for METRO Project. It caused significant delays from the original master schedule, and it caused quality issues from the lack of knowledge and expertise in SAP Treasury. The close collaboration between Sony and Zanders proved to be a key success factor of the METRO Project.

Mr. Ishiguro adds: “As of 2017, there were only few experts in Japan who could develop SAP Treasury related modules in global implementation projects. We evaluated several global consulting firms and analyzed their proposals and considered if they can deliver what we wanted to achieve. However, in many cases their proposals were limited to a general update. Zanders comprehensively understood our treasury requirements in each key operation area and provided appropriate and concrete proposals.”

SAP global implementation in two waves

Then the project started with the planning phase. Mr. Takaaki Miura, Finance Manager in SGC HQ Fin, explains: “In order to obtain official approval, we developed comprehensive project plans. To minimize any impacts to Sony group companies at the ‘Go-Live’, we decided to implement SAP Treasury in two waves, as recommended by Zanders. We started explaining our project plan and built good consensus across the major stakeholders within Sony Group HQ. ROI was the most important factor when discussing with the Sony’s management. METRO Project obtained the official approval from Sony management in May 2018.”

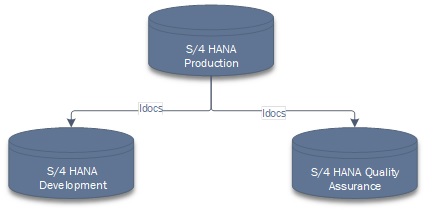

In February 2020, the SAP IHC module was implemented in Sony Group globally as Wave 1. In August 2020, the TRM module was implemented globally as Wave 2.

To finalize user requirements, all the key members gathered in Tokyo from around the world to discuss on a face-to-face basis. Project team also visited Sony IS teams in India to discuss business requirements directly and to resolve critical issues effectively in Wave 1. To kick-start User Acceptance Tests, the project team visited each office of treasury centers for deep-dive discussions and user trainings, also in Wave 1.

Mr. Ishiguro explains: “Wave 1 go-live was just before the COVID-19 global pandemic. Up to the Wave 1 implementation we could do all the work in face-to-face meetings in Tokyo, the Netherlands, USA, UK or India. So, we have accumulated our experiences by implementing Wave 1 on a face-to-face basis. The COVID-19 virus spread around the world, affecting Wave 2 of METRO Project. It was a tough time for us to proceed with all the preparation activities on a remote basis. But by making the best use of our comprehensive implementation experiences from Wave 1, we could successfully proceed with all the activities for Wave 2, even on a remote basis.”

Zanders gave us a lot of valuable insights into each TMS at the FIT&GAP analysis.

Takehiro Yagi, Senior Project Manager of Sony Group Corporation HQ Finance

Performance

More sophisticated treasury operations

Now, Sony’s Treasury team is looking back with satisfaction on the project.

Mr. Yagi explains: “Now, we have visibility into global treasury activities from all regions, which is a real improvement. The treasury management system, METRO, was implemented as our global treasury platform with sophisticated technologies, greatly improved from the previous legacy in-house TMS systems. Our project members gained huge insights and experiences during the project, by working closely together with the Zanders team, all the partner banks, our IT teams and all the treasury members. That proved to be significant contributions to the development of human resources who can globally promote DX projects in the finance and treasury fields, which will continue to be needed in the future.”

Mr. Ishiguro agrees: “It is very important for both finance/treasury members and IT members to collaborate closely. It is also very important to promote young and mid-career employees actively, to provide opportunities for good trainings and for good ‘learning’ by direct and active participation to the project tasks.”

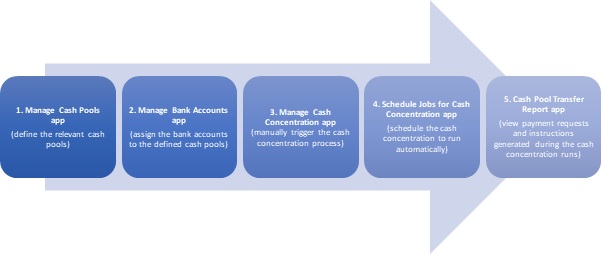

Mr. Miura adds: “One of the benefits of implementing METRO is that we can operate straight-through-processing (STP) in the FX trading process. Previously a lot of manual inputs needed to execute an FX trade with a bank, here and there, for the same deal. Now FX dealers can execute FX deals with banks who quoted best price effectively in a fully automated manner. We experience the improvements every day.”

Mr. Yagi agrees: “Our new SAP S/4HANA Treasury is much more advanced than our previous legacy treasury systems. SAP is much faster, more transparent and designed more effectively and efficiently, fully automated in various operations. Our previous application did not have any payment functionalities, so we had to enter payments separately manually into a separate E-banking system. SAP makes payment runs automatically, with timely status update of payment files. We have fewer issues or errors in METRO, all operations are run in a transparent manner, which prevents from fraud and other risks. The treasury system makes it possible to disclose financial information quickly to Sony management, the external auditor or investors if necessary.”

Mr. Ishiguro: “I strongly feel that we have been enjoying benefits of standardized treasury operations across regional treasury centers after the implementation of SAP Treasury. All three main treasury centers – in Japan, USA and UK – have been using the same treasury platform, and achieved a very good and stable operation, from various perspectives.”

A unique project

Apart from the pandemic restrictions, several elements made this project unique.

Firstly, the METRO Project was the first global IT system implementation project involving all business segments (except the Financial Services segment) of Sony Group. The project was unique because both Wave 1 and Wave 2 went live in a Big-Bang go-live approach around the world.

Secondly, it is unique because it was a ‘GLOBAL’ treasury transformation project with project members from eight countries. Treasury teams were in Tokyo, Singapore, Malaysia, UK, Poland and USA, and IT teams were in Bangalore, India, and the Zanders team was mainly in the Netherlands. As a result, the members of various nationalities have established a truly global project structure in which each project member was in charge of each task across the countries.

Ms Laura Koekkoek, partner at Zanders: “That global approach of this project, in which all regions and their personnel were combined, was really unique. And the whole collaboration between the different regions was really successful.”

Zanders partner, Ms Judith van Paassen adds: “The old systems already had the ambition of best practices processes in them but contained a technology risk. Now that there is a system to fully centralize, standardize and automate all processes is a big achievement.”

Mr. Ishiguro: “Whenever we discuss with Zanders, I remember we had very useful information available on key items, sometimes to deliver to the Sony senior management, or sometimes to resolve critical issues with a reasonable and solid solution, so we were able to proceed with the project with deep insights from SAP treasury experts.”

Next steps: From its new stable treasury basis, Sony's treasury is now ready for further steps for the future. In 2021, the system will be rolled out to Sony Group Corporation in Tokyo. Mr. Ishiguro lastly adds: “SAP S/4 HANA Treasury proved to be a very good TMS application for us. We would like to promote DX further, with close collaborations across our own Treasury members in each treasury center and our own SAP IT members, taking advantage of our experiences cultivated through METRO Project, in line with the mission of Sony Group Corporation, to ’lead and support the evolution of business through people and technology’."