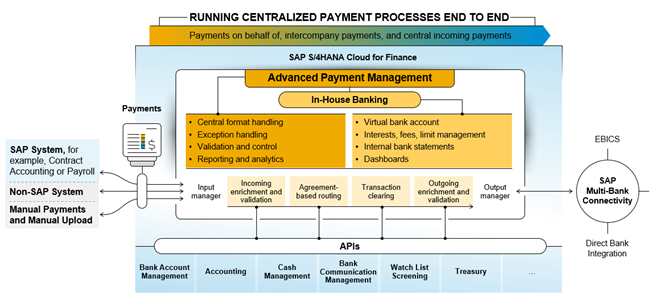

SAP In-House Cash (IHC) has enabled corporates to centralize cash, streamline payment processes, and recording of intercompany positions via the deployment of an internal bank. S/4 HANA In-House Banking (IHB) , released in 2022, in combination with Advanced Payment Management (APM), is SAP’s revamped internal banking solution.

This article will introduce IHB for corporates planning a new implementation and highlight some key considerations for those looking to transition from IHC.

IHB is embedded in APM and included in the same license. It leverages APM’s payment engine functionality and benefits from direct integration for end-to-end processing, monitoring/reporting, and exception handling.

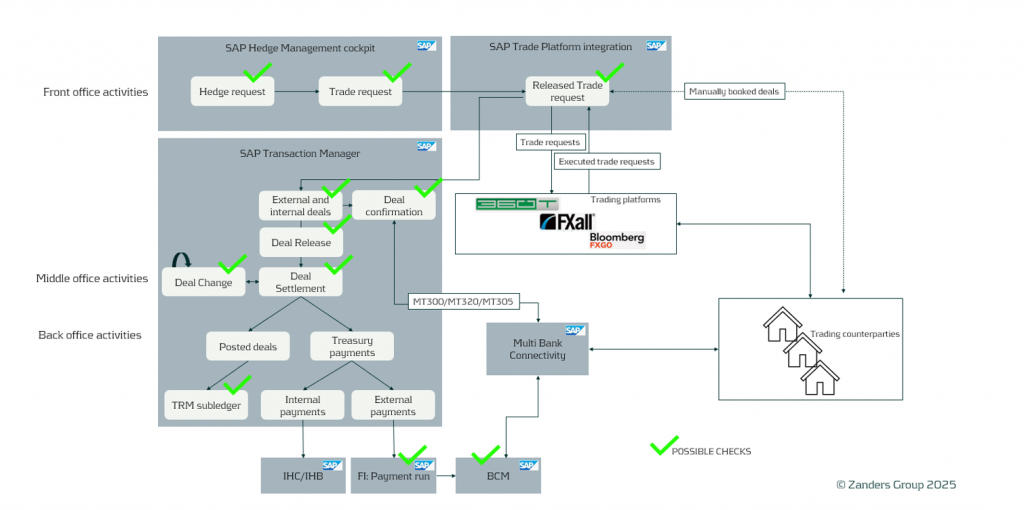

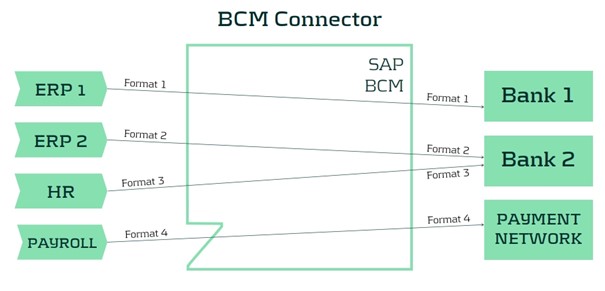

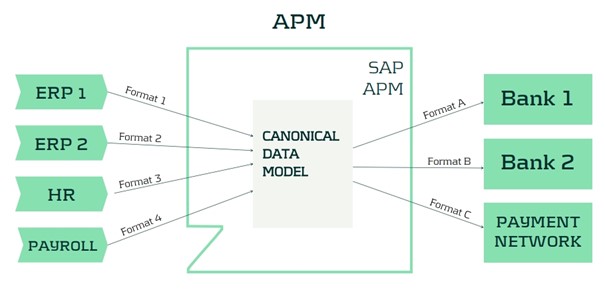

Figure 1: Solution architecture / Integration of In-House Banking (SAP, 2023)

IHC and IHB share several core functionalities, including a focus on managing intercompany financial transactions and balances effectively and ensuring compliance with regulatory requirements. Both solutions also integrate seamlessly with the broader SAP ecosystem and offer robust reporting capabilities.

However, there are significant differences between the two. While IHC relies on the traditional SAP GUI interface, IHB runs on the more modern and intuitive SAP Fiori interface, offering a better user experience. IHB overcomes limitations of IHC, namely in areas such as cut-off times and payment approval workflows and provides native support for withholding tax. Moreover, it also offers tools for managing master data, including the mass download and upload of IHB accounts, features that are otherwise missing in IHC.

Two key distinctions exist in payment routing flexibility and the closing process. IHB, when deployed with APM, manages payment routing entirely as master data, enabling organizations to more easily adapt to evolving business requirements, whereas IT involvement for configuration changes is required for those running IHC exclusively. Lastly, IHB supports multiple updates throughout the day, such as cash concentration, statement reporting, and transfers to FI, and is hence more in tune with the move towards real-time information, whereas IHC is restricted to a rigid end-of-day closing process.

Intrigued? Continue reading to delve deeper into how IHB compares with IHC.

Master data

2.1 Business Partners

The Business Partner (BP) continues to be a pre-requisite for the opening of IHB accounts, but new roles have been introduced.

Tax codes for withholding tax applicable to credit or debit interest can now be maintained at the BP level and feed into the standard account balancing process for IHB. The Withholding Tax set up under FI is leveraged and hence avoids the need for custom development as currently required for IHC.

2.2 In-House Bank Accounts

Relative to IHC, the process of maintaining accounts in IHB is simplified and more intuitive.

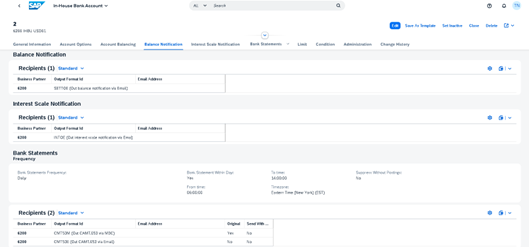

Statements can be sent to various recipients and in different formats (e.g., CAMT.53, PDF) based on settings maintained at account level. Intraday statement reporting functionality is included, as well as PDF notifications for balances on accounts and interest calculated as part of the account balancing process.

Figure 2: Maintaining IHB Account Correspondence

IHB offers native functionality for mass account download/upload, a feature that is missing in IHC. The mass download option allows data to be exported to Excel, adjusted offline, and subsequently loaded into BAM .

In the upcoming release, the bank account subledger concept will also be supported for IHB accounts managed in BAM.

2.3 Conditions

The underlying setup has been simplified and can now be performed entirely as master data, unlike for IHC, which in comparison requires some customization to be done as part of the implementation.

IHC technically offers slightly more interest conditions (e.g., commitment interest), but IHB covers the fundamentals for account balancing. More importantly, average/linear compound interest calculation methodology is available with IHB to support risk-free rates.

2.4 Workflows

Unlike IHC, which only offers the option of activating “dual control” for some processes (e.g., closure of IHC accounts), IHB introduces flexible workflows for all core master data attributes (e.g., accounts, conditions, limits, etc.).

IHB's flexible workflows allow for multiple approval steps and dynamic workflow recipient determination based on predefined conditions.

Transactional Data

3.1 Scenarios & payment integration/routing

The following set of scenarios are in scope for IHB:

- Intercompany payments

- Payments On-Behalf-Of (POBO)

- Central Incoming

- Cash Pooling

Payment integration is achieved via APM and supports several options, namely IDocs, connectors for Multi-Bank Connectivity (MBC ), file uploads, etc. Moreover, the connector for MBC can be used to support more elaborate integration scenarios, such as connecting decentralized AP systems or a public cloud instance to APM.

More noteworthy is that the flexible payment routing in APM is used to handle the routing of payments and is managed entirely according to business needs as master data. This is particularly relevant for corporates running IHC as a “payment factory” who are considering the adoption of APM & IHB, as routing is entirely configuration-based when using IHC exclusively. There are additional advantages of using APM as a payment factory, especially in terms of payment cut-offs and approval workflows. However, these benefits can be obtained by using APM in conjunction with IHB or IHC.

3.2 Foreign Currency Payments

A distinct set of bid/offer rates can be assigned per transaction type and used to convert between payment currency and IHC account currency at provisional and final posting stages. In contrast, for IHB, a single exchange rate type is maintained at the IHB Bank Area level and drives the FX conversion.

Compared to IHC, applying different rates depending on the payment scenario will require a different design, and special consideration is needed for corporates running complex multilateral netting processes in IHC that are planning to transition to IHB.

Intraday/End of Day Processing

4.1 End of Day Sequence

The end-of-day closing concept applies to IHB as well. Unlike IHC, IHB allows many of the related steps, such as intraday statement reporting, cash concentration, and transfers to FI, to be triggered throughout the day.

A dedicated app further streamlines processing by enabling the scheduling and management of jobs via pre-delivered templates.

4.2 Bank Statements

APM converters are leveraged to produce messages in the desired format (MT940, CAMT.53, or PDF ). Unlike IHC, FINSTA IDocs are no longer supported, which is an important factor to consider when migrating participants that are still on legacy ERP systems.

The settings maintained under the bank statement section of the IHB account drive the format and distribution method (e.g., delivery via MBC or email) to the participants.

4.3 General Ledger Transfer

The new Accounting Business Transaction Interface (ABTI) supports general ledger transfers from IHB to FI several times a day, unlike IHC, which is triggered only once at the end of the day.

Overall, the accounting schemas are more straightforward, which is reflected in the underlying setup required to support IHB. However, relative to IHC, there is technically less flexibility in determining the relevant G/Ls for end-of-day transfers to FI. Due diligence is recommended for corporates moving from IHC to ensure that existing processes are adapted to the new ways of working.

Conclusion

There is no official end-of-life support date for IHC, so corporates can still implement it with or without APM, though this approach presents challenges. Key considerations include

the lack of ongoing development for IHC, SAP’s focus on ensuring IHB matches IHC’s capabilities, and the fact that IHB is already included in the APM license, while IHC requires a separate license.

Initial issues with IHB are expected but will likely be resolved as more companies adopt the functionality and additional features are rolled out. For corporates with moderately complex requirements or those willing to align their processes with standard functionality, IHB is ultimately easier to implement and manage operationally.

To ensure a smooth transition to or adoption of IHB, Zanders offers expert implementation services. If your organization is contemplating IHB or transitioning from IHC, contact Zanders for guidance and support with any questions you may have.

References

SAP, 2023. Solution architecture - Integration of In-House Banking [Online] SAP. Available from: https://help.sap.com/docs/SAP_S4HANA_ON-PREMISE/e200555127f24878bed8d1481c9d5a0b/3dbe688b4c8840da8567f811be2bc1b4.html?locale=en-US&version=2023.001