An introduction to IHB for companies planning a new implementation, along with key considerations for those transitioning from IHC.

SAP In-House Cash (IHC) has enabled corporates to centralize cash, streamline payment processes, and recording of intercompany positions via the deployment of an internal bank. S/4 HANA In-House Banking (IHB) , released in 2022, in combination with Advanced Payment Management (APM), is SAP’s revamped internal banking solution.

This article will introduce IHB for corporates planning a new implementation and highlight some key considerations for those looking to transition from IHC.

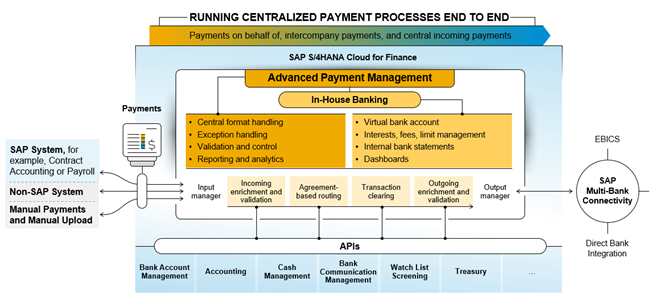

IHB is embedded in APM and included in the same license. It leverages APM’s payment engine functionality and benefits from direct integration for end-to-end processing, monitoring/reporting, and exception handling.

Figure 1: Solution architecture / Integration of In-House Banking (SAP, 2023)

IHC and IHB share several core functionalities, including a focus on managing intercompany financial transactions and balances effectively and ensuring compliance with regulatory requirements. Both solutions also integrate seamlessly with the broader SAP ecosystem and offer robust reporting capabilities.

However, there are significant differences between the two. While IHC relies on the traditional SAP GUI interface, IHB runs on the more modern and intuitive SAP Fiori interface, offering a better user experience. IHB overcomes limitations of IHC, namely in areas such as cut-off times and payment approval workflows and provides native support for withholding tax. Moreover, it also offers tools for managing master data, including the mass download and upload of IHB accounts, features that are otherwise missing in IHC.

Two key distinctions exist in payment routing flexibility and the closing process. IHB, when deployed with APM, manages payment routing entirely as master data, enabling organizations to more easily adapt to evolving business requirements, whereas IT involvement for configuration changes is required for those running IHC exclusively. Lastly, IHB supports multiple updates throughout the day, such as cash concentration, statement reporting, and transfers to FI, and is hence more in tune with the move towards real-time information, whereas IHC is restricted to a rigid end-of-day closing process.

Intrigued? Continue reading to delve deeper into how IHB compares with IHC.

Master data

2.1 Business Partners

The Business Partner (BP) continues to be a pre-requisite for the opening of IHB accounts, but new roles have been introduced.

Tax codes for withholding tax applicable to credit or debit interest can now be maintained at the BP level and feed into the standard account balancing process for IHB. The Withholding Tax set up under FI is leveraged and hence avoids the need for custom development as currently required for IHC.

2.2 In-House Bank Accounts

Relative to IHC, the process of maintaining accounts in IHB is simplified and more intuitive.

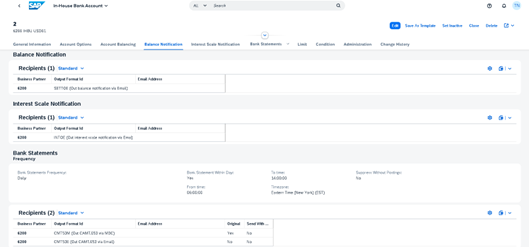

Statements can be sent to various recipients and in different formats (e.g., CAMT.53, PDF) based on settings maintained at account level. Intraday statement reporting functionality is included, as well as PDF notifications for balances on accounts and interest calculated as part of the account balancing process.

Figure 2: Maintaining IHB Account Correspondence

IHB offers native functionality for mass account download/upload, a feature that is missing in IHC. The mass download option allows data to be exported to Excel, adjusted offline, and subsequently loaded into BAM .

In the upcoming release, the bank account subledger concept will also be supported for IHB accounts managed in BAM.

2.3 Conditions

The underlying setup has been simplified and can now be performed entirely as master data, unlike for IHC, which in comparison requires some customization to be done as part of the implementation.

IHC technically offers slightly more interest conditions (e.g., commitment interest), but IHB covers the fundamentals for account balancing. More importantly, average/linear compound interest calculation methodology is available with IHB to support risk-free rates.

2.4 Workflows

Unlike IHC, which only offers the option of activating “dual control” for some processes (e.g., closure of IHC accounts), IHB introduces flexible workflows for all core master data attributes (e.g., accounts, conditions, limits, etc.).

IHB's flexible workflows allow for multiple approval steps and dynamic workflow recipient determination based on predefined conditions.

Transactional Data

3.1 Scenarios & payment integration/routing

The following set of scenarios are in scope for IHB:

- Intercompany payments

- Payments On-Behalf-Of (POBO)

- Central Incoming

- Cash Pooling

Payment integration is achieved via APM and supports several options, namely IDocs, connectors for Multi-Bank Connectivity (MBC ), file uploads, etc. Moreover, the connector for MBC can be used to support more elaborate integration scenarios, such as connecting decentralized AP systems or a public cloud instance to APM.

More noteworthy is that the flexible payment routing in APM is used to handle the routing of payments and is managed entirely according to business needs as master data. This is particularly relevant for corporates running IHC as a “payment factory” who are considering the adoption of APM & IHB, as routing is entirely configuration-based when using IHC exclusively. There are additional advantages of using APM as a payment factory, especially in terms of payment cut-offs and approval workflows. However, these benefits can be obtained by using APM in conjunction with IHB or IHC.

3.2 Foreign Currency Payments

A distinct set of bid/offer rates can be assigned per transaction type and used to convert between payment currency and IHC account currency at provisional and final posting stages. In contrast, for IHB, a single exchange rate type is maintained at the IHB Bank Area level and drives the FX conversion.

Compared to IHC, applying different rates depending on the payment scenario will require a different design, and special consideration is needed for corporates running complex multilateral netting processes in IHC that are planning to transition to IHB.

Intraday/End of Day Processing

4.1 End of Day Sequence

The end-of-day closing concept applies to IHB as well. Unlike IHC, IHB allows many of the related steps, such as intraday statement reporting, cash concentration, and transfers to FI, to be triggered throughout the day.

A dedicated app further streamlines processing by enabling the scheduling and management of jobs via pre-delivered templates.

4.2 Bank Statements

APM converters are leveraged to produce messages in the desired format (MT940, CAMT.53, or PDF ). Unlike IHC, FINSTA IDocs are no longer supported, which is an important factor to consider when migrating participants that are still on legacy ERP systems.

The settings maintained under the bank statement section of the IHB account drive the format and distribution method (e.g., delivery via MBC or email) to the participants.

4.3 General Ledger Transfer

The new Accounting Business Transaction Interface (ABTI) supports general ledger transfers from IHB to FI several times a day, unlike IHC, which is triggered only once at the end of the day.

Overall, the accounting schemas are more straightforward, which is reflected in the underlying setup required to support IHB. However, relative to IHC, there is technically less flexibility in determining the relevant G/Ls for end-of-day transfers to FI. Due diligence is recommended for corporates moving from IHC to ensure that existing processes are adapted to the new ways of working.

Conclusion

There is no official end-of-life support date for IHC, so corporates can still implement it with or without APM, though this approach presents challenges. Key considerations include

the lack of ongoing development for IHC, SAP’s focus on ensuring IHB matches IHC’s capabilities, and the fact that IHB is already included in the APM license, while IHC requires a separate license.

Initial issues with IHB are expected but will likely be resolved as more companies adopt the functionality and additional features are rolled out. For corporates with moderately complex requirements or those willing to align their processes with standard functionality, IHB is ultimately easier to implement and manage operationally.

To ensure a smooth transition to or adoption of IHB, Zanders offers expert implementation services and works with a variety of technology partners, including SAP. If your organization is contemplating IHB or transitioning from IHC, contact Zanders for guidance and support with any questions you may have.

References

SAP, 2023. Solution architecture - Integration of In-House Banking [Online] SAP. Available from: https://help.sap.com/docs/SAP_S4HANA_ON-PREMISE/e200555127f24878bed8d1481c9d5a0b/3dbe688b4c8840da8567f811be2bc1b4.html?locale=en-US&version=2023.001

BNG Bank, established to offer low-rate loans to the Dutch government and public interest institutions, helps lower the cost of public amenities, but its balance sheet’s sensitivity to financial market fluctuations highlights the need for a robust interest rate risk framework.

BNG Bank was founded more than 100 years ago – firstly under the name Gemeentelijke Credietbank – as a purchasing association with the main task of bundling the financing requirements of Dutch local authorities so that purchasing benefits could be obtained on capital markets. In 1922, the name was changed to Bank voor Nederlandsche Gemeenten and even today the main aim is, in essence, the same. What has changed is the role of local authorities, says John Reichardt, a member of the Board of BNG Bank. He explains: “Over the past few years they have diversified. Many of their responsibilities are now independent or even privatized. Hospitals, electricity boards and housing companies, for example, were in the hands of local authorities but now operate independently. They are, however, still our clients because they provide public services.”

Different to Other Banks

To satisfy the financing requirements of its clients, BNG Bank collects money on the international capital markets to realize ‘bundled’ purchasing benefits. “And we pass these benefits on to our customers,” says Reichardt. “While our customers have become more diverse over time, our product portfolio has widened. Some thirty years ago we became a bank, with a comprehensive banking license, and this meant we could take up short-term loans, make investments, and handle our customers’ payments. We try to be a full-service bank, but then only for services our customers need.”

The state holds half of the shares and the remainder belongs to local authorities and provinces/counties. “Because of this we always have the dilemma: should we go for more profit and more dividend, or should our strong purchasing position be reflected immediately in our prices by means of a moderate pricing strategy? Our goal is to be big in our market – we think we should keep 35 to 50 percent of the total outstanding debt on our balance sheet. We are not striving for maximum profit, and that differentiates us from many other banks. Although we are a private company, we do also feel we are a part of the government,” says Reichardt.

Changed Worlds

BNG Bank has only one branch in The Hague, with 300 employees. The bank has grown considerably, mainly over the past few years. As of the start of the financial crisis, a number of services from other parties have disappeared, so BNG Bank was often called upon to step in. Now, partly as a result of this, it has become one of the systematically important Dutch banks. “From a character point of view, we are more of a middle-sized company, but as far as the balance sheet is concerned, we are a large bank. We earn our money by buying cheaply, but also by trying to pass this on as cheaply as possible to our customers – with a small commission. This brings with it a strong focus on risk management, including managing our own assets and the associated risks. These are partly credit risks, but we have fewer risks than other banks – because, thanks to the government, our customers are usually very creditworthy.”

BNG Bank also runs certain interest rate risks that have to be controlled on a day-to-day basis. “We have done this in a certain way for a long time, but in the meantime the world has changed,” says Hans Noordam, head of risk management at BNG Bank. “So we thought it was time to give the method a face-lift to test whether we are doing it right, with the right instruments and whether we are looking at the right things? We also wanted someone else to take a good look at it.”

So BNG Bank concluded that the interest rate risk framework had to be revised. “Our approach once was state of the art but, as always with the dialectics of progress, we didn’t do enough ourselves to keep up with changes in that respect,” Reichardt explains. “When we looked at the whole management of interest rate risk, on the one hand it was about the departments involved, and on the other hand the measurement system – the instruments we used and everything associated with them used to produce information which enabled decision-making on our position strategy. That is a big project.

Project Harry

Over the past few years various developments have taken place in the area of market risk. When BNG Bank changed its products and methods, various changes also took place in the areas of risk management and valuation, including extra requirements from the regulator. “So we started a preliminary investigation and formed one unit within risk management,” says Reichardt. At the end of 2012, BNG Bank appointed Petra Danisevska as head of risk management/ALM (RM/ALM). “We agreed not to reinvent the wheel ourselves, but mainly to look closely at best market practices,” she says.

Zanders helped us with this. In May 2013 we started an investigation to find out which interest rate risks were present in the bank and where improvement levels could be made.

Petra Danisevska, Head of risk management/ALM (RM/ALM) at BNG Bank

Noordam explains that they agreed on suggested steps with the Asset Liability Committee (ALCO), which also provided input and expressed preferences. A plan was then made and the outlines sketched. To convert that into concrete actions, Noordam says that a project was initiated at the beginning of 2014: Project Harry. “This gets its name from BNG Bank’s location, also the home of a Dutch cartoon character, called Haagse Harry. He was the symbol of the whirlwind which was to whip through the bank,” says Noordam.

Within ALCO Limits

“During the (economic) crisis, all sorts of things happened which influenced the valuation of our balance sheet,” Reichardt explains. “They also had many effects on the measurement of our interest rate risk. We had to apply totally different curves – sometimes with very strange results. Our company is set up in a way that with our economic hedging and our hedge accounting, we can buy for X and pass it on to our customers for X plus a couple of basis points, which during the period of the loan reverts to us. We retain a small amount and on the basis of this pay out a dividend – our model is that simple. However, since the valuations were influenced by market changes, we were more or less obliged to take measures in order to stay within our ALCO limits. These measures, with respect to managing our interest position, would not have been realizable under our current philosophy; simply because they weren’t necessary. We knew we had to find a solution for that phenomenon in the project. After much discussion we were able to find a solution: to be more reliable within the technical framework of anticipating market movements which strongly influence valuation of financial instruments. In other words: the spread risk and the rate risk had to be separately measured and managed from one another. The world had changed and our interest rate risk management, as well as reporting and calculations based upon it, had to as well.”

After revision of the interest rate risk framework, as of the second half of 2015, all interest-rate risk measurements, their drivers and reporting were changed. The market risks as a result of the changes in interest rate curves, were then measured and reported on a daily basis by the RM/ALM department. “There is definitely better management of the interest rate risk; we generate more background data and create more possibilities to carry out analyses,” Danisevska explains. “We now have detailed figures that we couldn’t get before, with which we can show ALCO the risk and the accompanying, assumed return.”

More proactive

Noordam knew that Project Harry would involve a considerable effort. “The risk framework would inevitably suffer quite a lot. It had to be innovated on the basis of calculated conditions, while the implementation required a lot of internal resources and specific knowledge. Technical points had to be solved, while relationships had to be safeguarded; many elements with all sorts of expertise had to be integrated. The European Central Bank was stringent – that took up a lot of time and work. We had an asset quality review (AQR) and a stress test – that was completely new to us. Sometimes we were tempted to stay on known ground, but even during those periods we were able to carry on with the project. We rolled up our shirtsleeves and together we gained from the experience.”

Reichardt says: “It was a tough project for us, with complex subject matter and lots of different opinions. In total it took us seven quarters to complete. However, I think we have accomplished more than we expected at the beginning. With a combination of our own people and external expertise, we have managed to make up for lost ground. We have exchanged the rags for riches and we have been successful. Where do we stand now? As well as the required numbers, we have a clear view of what our thoughts are on ‘what is interest rate risk and what isn’t’. The only thing we still have to do is to fine-tune the roles: what can you expect from risk managers and risk takers, and how will they react to this? We will continue to monitor it. RM/ALM as a department is in any case a lot more proactive – that was an important goal for us. We can be more successful, but the department is really earning its spurs within the bank and that means profit for everyone.”