We assisted a private Dutch bank in managing the overwhelming volume of queries from bankers regarding Know Your Customer (KYC) and Customer Due Diligence (CDD) by developing an AI-powered chatbot.

Challenge

Bankers frequently needed specific information to assess customer profiles, verify identities, and evaluate potential risks to comply with regulatory requirements and ensure due diligence. However, this information was scattered across approximately 30 documents in various formats, including Word documents and PDFs. As a result, CDD specialists were overwhelmed by a constant stream of queries, making the process inefficient and increasing the risk of inconsistent or inaccurate responses.

To address these inefficiencies, the client sought a solution to streamline information retrieval and provide accurate, consistent answers.

Solution

Zanders proposed a step-by-step approach to developing the CDD chatbot:

1 - Investigating requirements from CDD specialists and bankers.

2 - Developing the chatbot using Retrieval-Augmented Generation (RAG).

3 - Optimizing performance through rigorous validation.

4 - Deploying the chatbot for live use by the client.

In the initial phase, we held discussions with both CDD specialists and bankers to identify their key requirements. It became evident that the chatbot needed to deliver accurate, reliable information while ensuring response consistency. Given these requirements, the unstructured nature of the data, and the chatbot’s internal use case, we determined that a Generative AI (GenAI) chatbot would be the most effective solution.

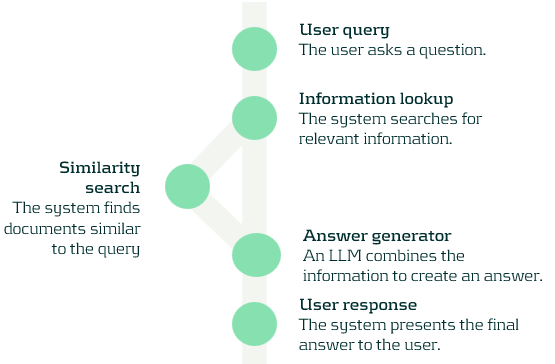

For development, we leveraged Retrieval-Augmented Generation (RAG), a method that combines fast and relevant information retrieval with the power of advanced AI to generate accurate, context-aware responses. This ensured a reliable and informative user experience. The processes in this approach are shown in the figure below.

To validate the chatbot’s performance, we created a dataset with expected responses, fine-tuned hyperparameters, and conducted extensive accuracy testing.

Finally, to ensure a seamless deployment, we established a structured system for development, deployment, and continuous improvement. By leveraging pre-trained large language models (LLMs), we were able to rapidly deploy the chatbot and refine it based on real-world user feedback.

Performance

As a result, the client successfully implemented the CDD chatbot, allowing users to query the document corpus directly and receive responses in plain English, along with a list of reference sources used by the LLM. Thanks to the RAG approach and thorough validation, the chatbot consistently produced accurate and reliable answers.

The chatbot has significantly improved efficiency, enabling CDD specialists to manage inquiries more effectively while helping bankers conduct due diligence with greater speed and accuracy. This has led to a more streamlined and reliable CDD process.

For more information, visit our Financial Crime Prevention page, or reach out to Johannes Lont, Senior Manager.