Estee Lauder’s European Treasury Center is responsible for managing cash and liquidity management for the group and its subsidiaries over multiple continents by providing intercompany loans and liquidity facilities to local entities.

In an effort to continuously improve and automate its internal processes, the American multinational cosmetics company wanted to leverage technology and further enhance the Transfer Pricing compliance of financial transactions. As a result, it engaged Zanders to use its cloud-based Transfer Pricing Suite.

Estee Lauder has been Zanders’ client for quite some years. “We have been working with Zanders before in some projects and that always worked very well. In this instance too”, says Bart Taeymans, Vice President Global Treasury Operations. “They helped to draft and execute the bank selection RfP and restructure our European banking structure, and supported with the implementation of SAP Inhouse Cash and Bank Communication Management. And recently, they supported us with their Zanders Inside Transfer Pricing Suite.”

In view of the changed regulatory environment, we wanted to increase control of the entire process. Zanders Transfer Pricing Suite looked as a sustainable tool to automatize the process, while maintaining a robust technical methodology compliant with the OECD TP Guidelines.

Bart Taeymans, Vice President Global Treasury Operations

Challenge

New OECD Transfer Pricing guidelines

With the release of Chapter X by the OECD, the company wanted to implement a new process in order to comply with its Transfer Pricing obligations in-house, without depending on external parties, Taeymans explains. “In view of the changed regulatory environment, we wanted to increase control of the entire process. Zanders Transfer Pricing Suite looked as a sustainable tool to automatize the process, while maintaining a robust technical methodology compliant with the OECD TP Guidelines’’.

Solution

Sophisticated tool

Treasury Director Marc Vandewaeter: “Zanders’ Transfer Pricing Suite is very sophisticated. In addition, during the onboarding process, Zanders added some additional currencies to the tool that were not there yet for us to cover additional regions. Another important thing for us is that we are able to instantly generate the Transfer Pricing reports – including the supporting documents providing details on the economic analyses.”

Due to the tool’s flexibility, Estee Lauder had a managed transition phase. “It’s challenging to change processes, but the tool supported the transition phase in a controlled manner.”

Having all the information in one tool helps us understanding the approach followed and financial information considered for each case. This is important for us as we need to make sure that we fully understand the details.

Marc Vandewaeter, Treasury Director

Performance

Timely implementation

Taeymans: “I think it’s been a great integrated implementation. The team was very supportive, providing clarifications where needed and support when required – all to ensure timely implementation of the new procedure, focused on the start of our new fiscal year.”

Vandewaeter: “The challenge of importing the financial data was that it needed to be implemented in the Zanders Inside tool format, which is required to determine a rating. Luckily all financial data from all our affiliates is already standardized. That makes it easier to reproduce and implement this data. That saves quite a lot of time.”

“The benefit we have is that we are on one SAP instance globally”, adds Taeymans. “That helps us to great extent in retrieving the financial information in a structured manner. So once we had the templates to convert to the information required by Zanders, everything went very well.”

The entire process in one user-friendly platform

Vandewaeter has been intimately involved in working with the tool. “We wanted to make sure that Zanders’ tool would provide a consistent approach for all transactions, in line with what we had done before, and that potential differences in the results could be explained. Having all the information in one tool helps us understanding the approach followed and financial information considered for each case. This is important for us as we need to make sure that we fully understand the details.”

Taeymans: “To have that entire process – from the financial information, credit rating analyses, benchmark rates, to the final reports – featured in one tool is obviously what we’ve been looking for. It’s very important to have it all in one system generating a full report on an entity basis. Of course, you need to know what to enter and what to select. But as a web-based tool it is very user-friendly, easy to navigate and well designed. It is quite easy to extract the pricing for a certain loan. And from an operational point of view, it is also useful to do a simulation and it doesn’t take much time to do that. You need to upload all the financial statements, but it is more dynamic and the pricing update is based on current data. In addition, the support received from Zanders team is very good.”

In a changing global floriculture market, Royal FloraHolland created a new digital platform where buyers and growers can connect internationally. As part of its strategy to offer better international payment solutions, the cooperative of flower growers decided to look for an international cash management bank.

Royal FloraHolland is a cooperative of flower and plant growers. It connects growers and buyers in the international floriculture industry by offering unique combinations of deal-making, logistics, and financial services. Connecting 5,406 suppliers with 2,458 buyers and offering a solid foundation to all these players, Royal FloraHolland is the largest floriculture marketplace in the world.

The company’s turnover reached EUR 4.8 billion (in 2019) with an operating income of EUR 369 million. Yearly, it trades 12.3 billion flowers and plants, with an average of at least 100k transactions a day.

The floriculture cooperative was established 110 years ago, organizing flower auctions via so-called clock sales. During these sales, flowers were offered for a high price first, which lowered once the clock started ticking. The price went down until one of the buyers pushed the buying button, leaving the other buyers with empty hands.

The floriculture market is changing to trading that increasingly occurs directly between growers and buyers. Our role is therefore changing too.

Wilco van de Wijnboom, Manager Corporate Finance

Challenge

The Floriday platform

Around twenty years ago, the clock sales model started to change. “The floriculture market is changing to trading that increasingly occurs directly between growers and buyers. Our role is therefore changing too,” Wilco van de Wijnboom, Royal FloraHolland’s manager corporate finance, explains. “What we do now is mainly the financing part – the invoices and the daily collection of payments, for example. Our business has developed both geographically and digitally, so we noticed an increased need for a platform for the global flower trade. We therefore developed a new digital platform called Floriday, which enables us to deliver products faster, fresher and in larger amounts to customers worldwide. It is an innovative B2B platform where growers can make their assortment available worldwide, and customers are able to transact in various ways, both nationally and internationally.”

The Floriday platform aims to provide a wider range of services to pay and receive funds in euros, but also in other currencies, and across different jurisdictions. Since it would help treasury to deal with all payments worldwide, Royal FloraHolland needed an international cash management bank too. Van de Wijnboom: “It has been a process of a few years. As part of our strategy, we wanted to grow internationally, and it was clear we needed an international bank to do so. At the same time, our commercial department had some leads for flower business from Saudi-Arabia and Kenya. Early in 2020, all developments – from the commercial, digital and financing points of view – came together.”

Solution

RfP track record

Royal FloraHolland’s financial department decided to contact Zanders for support. “Selecting a cash management bank is not something we do every day, so we needed support to find the right one,” says Pim Zaalberg, treasury consultant at Royal FloraHolland. “We have been working together with Zanders on several projects since 2010 and know which subject matter expertise they can provide. They previously advised us on the capital structure of the company and led the arranging process of the bank financing of the company in 2017. Furthermore, they assisted in the SWIFT connectivity project, introducing payments-on-behalf-of. They are broadly experienced and have a proven track record in drafting an RfP. They exactly know which questions to ask and what is important, so it was a logical step to ask them to support us in the project lead and the contact with the international banks.”

Zanders consultant Michal Zelazko adds: “We use a standardized bank selection methodology at Zanders, but importantly this can be adjusted to the specific needs of projects and clients. This case contained specific geographical jurisdictions and payment methods with respect to the Floriday platform. Other factors were, among others, pre-payments and the consideration to have a separate entity to ensure the safety of all transactions.”

Strategic partner

The project started in June 2020, a period in which the turnover figures managed to rebound significantly, after the initial fall caused by the corona pandemic. Van de Wijnboom: “The impact we currently have is on the flowers coming from overseas, for example from Kenya and Ethiopia. The growers there have really had a difficult time, because the number of flights from those countries has decreased heavily. Meanwhile, many people continued to buy flowers when they were in lockdown, to brighten up their new home offices.”

Together with Zanders, Royal FloraHolland drafted the goals and then started selecting the banks they wanted to invite to find out whether they could meet these goals. All questions for the banks about the cooperative’s expected turnover, profit and perspectives could be answered positively. Zaalberg explains that the bank for international cash management was also chosen to be a strategic partner for the company: “We did not choose a bank to do only payments, but we needed a bank to think along with us on our international plans and one that offers innovative solutions in the e-commerce area. The bank we chose, Citibank, is now helping us with our international strategy and is able to propose solutions for our future goals.”

The Royal FloraHolland team involved in the selection process now look back confidently on the process and choice. Zaalberg: “We are very proud of the short timelines of this project, starting in June and selecting the bank in September – all done virtually and by phone. It was quite a precedent to do it this way. You have to work with a clear plan and be very strict in presentation and input gathering. I hope it is not the new normal, but it worked well and was quite efficient too. We met banks from Paris and Dublin on the same day without moving from our desks.”

Van de Wijnboom agrees and stresses the importance of a well-managed process: “You only have one chance – when choosing an international bank for cash management it will be a collaboration for the next couple of years.”

We have been working together with Zanders on several projects since 2010 and know which subject matter expertise they can provide.

Pim Zaalberg, Treasury Consultant

Performance

Future plans

The future plans of the company are focused on venturing out to new jurisdictions, specifically in the finance space, to offer more currencies for both growers and buyers. “This could go as far as paying growers in their local currency,” says Zaalberg. “Now we only use euros and US dollars, but we look at ways to accommodate payments in other currencies too. We look at our cash pool structure too. We made sure that, in the RfP, we asked the banks whether they could provide cash pooling in a way that was able to use more currencies. We started simple but have chosen the bank that can support more complex setups of cash management structures as well.” Zelazko adds: “It is an ambitious goal but very much in line with what we see in other companies.”

Also, in the longer term, Royal FloraHolland is considering connecting the Floriday platform to its treasury management system. Van de Wijnboom: “Currently, these two systems are not directly connected, but we could do this in the future. When we had the selection interviews with the banks, we discussed the prepayments situation – how do we make sure that the platform is immediately updated when there is a prepayment? If it is not connected, someone needs to take care of the reconciliation.”

There are some new markets and trade lanes to enter, as Van de Wijnboom concludes: ”We now see some trade lanes between Kenya and The Middle East. The flower farmers indicate that we can play an intermediate role if it is at low costs and if payments occur in US dollars. So, it helps us to have an international cash management bank that can easily do the transactions in US dollars.”

With subsidiaries all over the world, ASICS wanted to standardize and make its treasury operations more efficient. To optimize its treasury function, ASICS Europe (AEB) decided to implement the SAP Treasury and Risk Management module in 2017.

With this came the decision to set up a new company code to separate ASICS Europe’s treasury activities from its commercial activities. Apart from the pros, it raised new challenges too.

ASICS stands for ‘Anima Sana In Corpore Sano’, loosely translated ‘a sound mind in a sound body’. This Japanese company was founded by Kihachiro Onitsuka in 1949. He felt that Japanese youth, who had lived through World War II, were in the process of being derailed and had too few pursuits. Onitsuka wanted to bring back the healthy life through sports, which demanded proper sportswear. And so, he decided to produce basketball shoes under the name Onitsuka Tiger.

Inventive like octopus

Onitsuka strived for perfection and innovation. One of the anecdotes about the origin of the ASICS basketball shoes is that he came up with an inventive idea when eating octopus salad from a bowl. During that diner, a leg of the animal stuck to the side of the bowl. When Onitsuka realized this was because of the animal’s suction cups, he decided to design basketball shoes with tiny suction cups on the sole for more grip. It turned out to be a revolutionary idea.

Another remarkable fact is that Nike-founder Phil Knight started his career at ASICS. When he visited the Onitsuka Tiger office in 1963, he was impressed by the inventive sports shoes and asked Onitsuka to become their sales agent in the US. After a few years working for ASICS Knight decided to start his own sports brand.

The tiger stripes go global

During the years after foundation, the range of sports activities provided by Onitsuka expanded to include a variety of Olympic styles used by athletes around the world. The current ASICS brand signature, the crossed stripes that appear on the side of all the shoes, was first introduced in 1966 during the pre-Olympic trials for the 1968 Summer Olympics in Mexico City. Martial arts star Bruce Lee was the first international celebrity to popularize this design. In 1977, Onitsuka Tiger merged with GTO and JELENK to form ASICS Corporation. Despite the name change, a vintage range of ASICS shoes is still produced and sold internationally under the Onitsuka Tiger label.

In 1977, ASICS opened a first small European office in Düsseldorf, in the home garage of a representative. This German city had a relatively large Japanese community and was centrally located in Europe. In 1995, ASICS Europe, Middle East and Africa (EMEA) relocated to a new headquarters in the Netherlands, from where more subsidiaries were established, and the ASICS network further expanded. The company built and rented several large distribution centers in Europe. In addition, the sales channels broadened from traditional wholesale to opening ASICS stores – first outlet stores, followed by a flagship store and e-commerce. Today, the brand sells all items through omnichannel.

The first implementation of the SAP system involved communication with the bank via the SWIFT platform.

Eugene Tjemkes, Head of Global Business Transformation Finance

Challenge

The implementation of SAP modules

In 2017, to further optimize their treasury function, ASICS Europe decided to implement the treasury management functionality of SAP. “That is when our cooperation with Zanders started”, says Eugene Tjemkes, Head of Global Business Transformation Finance. “The first implementation of the SAP system involved communication with the bank via the SWIFT platform, an in-house cash system with all kinds of automatic entries where Treasury acts as a payment factory – also on behalf of the subsidiaries.”

The Japanese headquarters opted for more or less the same treasury solution as those of the EMEA countries. “The other regions did not choose it, either because of their small size, or since they are single country regions (such as Australia) or because foreign currency plays a lesser role, such as in the US. In Europe, on the other hand, we are involved in currency transactions and hedging every day.”

Treasury as a separate company

Besides the SAP Treasury and Risk Management (TRM) module, ASICS Europe also implemented SAP Cash Management (CM), SAP In-House Cash (IHC) and the SAP Bank Communication Manager (BCM) in 2017. With this came the decision to set up a new company code that would separate the treasury functionality of ASICS Europe BV (AEB) from its commercial activities, as tax rules only allowed AEB to provide services and do business in Europe. In addition, the new company code, AEB Treasury, ensured global reach and provided cost savings and standardization due to the foreseen treasury activities in the EMEA region, Japan, and the Americas.

Tjemkes explains: “As a legal part of AEB, it was not possible for Treasury to do anything for ASICS US or ASICS Asia. Transforming our treasury functionality into a separate legal entity would make it possible to develop treasury activities outside the EMEA region too. Therefore, there were plans to separate the treasury functionality from the existing corporate structure and make it a global subsidiary of the Japanese headquarters. From that vision, that treasury functionality would be housed in a separate legal entity, we started implementing our treasury system in 2017. The system was set up accordingly; AEB Treasury became a separate company in SAP, although it was not a legally separated entity.”

Bringing back the treasury activities under AEB

However, the plan to service the company’s entities in other regions with an inhouse bank operating from Europe, did not go as planned. Instead, different regions of ASICS were supported with a local solution. And therefore, splitting into two company codes became irrelevant.

Tjemkes: “Due to the separated treasury functionality, the accounting department had to consolidate the reports to get them into one financial statement. After using SAP TRM, CM, IHC and BCM for a few years, we discovered that a legal entity administered in two different company codes appeared to be time-consuming while executing our day-to-day processes. Initially, the plan was to do this temporarily, with the idea that Treasury would become a separate entity. But unfortunately, the plan was ultimately not adopted by the head office – from their perspective the advantages were not that great.”

This left AEB with the artificial situation that there were still two company codes in which it had to deal with all kinds of currencies, with different balance sheet items, and problems with the redistribution results. “That finally made us decide to remove that artificial separation of company codes and bring the treasury activities back under AEB. That also meant an adjustment in our TMS. We asked Zanders to support us in that project.”

Solution

Streamlining Treasury Processes

To solve the shortcomings of the artificial separation, Zanders proposed various alternatives. After conducting a few workshops with the treasury department, it was decided to discontinue all the current processes (TRM, IHC, GL accounting) in the company code representing AEB Treasury and re-implement it in company code representing AEB. Hence, a single company code for the single legal entity.

Magda Bleker, Treasury Specialist at ASICS EMEA: “This would save us time on labor-intensive activities, such as replicating accounting entries into company code representing AEB. Further, as internal dealing only occurred between company codes representing AEB and AEB treasury, ASICS would no longer have to use the internal dealing functionality by merging the two company codes. Removal of these activities would make the processes more efficient.”

Zanders and ASICS identified that the proposed solution would require high implementation effort. It would also lose the flexibility to quickly split the TRM and IHC processes into a new legal entity. However, as the pros outweighed the cons, ASICS decided to go ahead with the merging of the two company codes. The project started with Zanders updating the decision forms, configuration, and master data conversion documents created in 2017 during the SAP TRM and IHC implementation project, which reflected the changes, risks, and implications of migration. After which, the new functionality was configured and tested in a development system, ensuring that it would not disrupt the treasurers’ daily activities and to keep the payment structure intact and valid. Once the configuration had been updated in the system, the previous configuration documents were also updated to reflect the new changes in the system.

This would save us time on labor-intensive activities, such as replicating accounting entries into company code representing AEB.

Magda Bleker, Treasury Specialist

Performance

Improving further

Tjemkes: “Around 2016, we implemented SAP Fashion management system (FMS) ourselves in our European offices as a pilot for the whole world. FMS is an industry-specific solution, and we were the first company to go live with it. In addition to Europe, our branches in the US, Canada, China and Australia, among others, are now on this platform. But to properly implement the treasury system we really needed a specialist. Zanders is a very professional service provider, who knows very well what modern treasury is and how treasury systems work. We couldn’t have done this without them. They did the project management for us, helped write the project plan and created a test plan.”

Despite the corona pandemic in 2020, ASICS had a turnover of 328,784 million yen, which is more than 2.5 billion euro. The company took a great deal to investigate their current processes and see what was working and what was not. Like in sports, ASICS showed how one can still move forward when taking a step back, improving their processes and making them more efficient.

Next step for AEB is to expand its functionality around hedging. “The hedge contracts are now recorded in the system. We want to further optimize the transparency and efficiency of the closing of our hedge deals with banks, to mitigate all associated risks. We also want to improve the valuation of the hedge contracts. There are functionalities in SAP that allow us to better value hedges. But we have already taken many, very important steps.”

Sony Group implemented the SAP S/4HANA Treasury system successfully around the world in 2020. This project is called METRO Project in Sony Group.

Sony decided to start Digital Transformation (DX) of global treasury functions by launching the METRO Project officially in May 2018 and completed it by October 2020, working remotely under the COVID-19 global pandemic.

One of the biggest achievements of this project is the automation of the FX trading process. It is impressive to see how Sony’s FX dealers can trade large volume of FX deals with banks efficiently and effectively within a few minutes by using SAP S/4HANA Treasury and SAP’s TPI (Trading Platform Integration) connecting automatically with 360T Trading platform.

In this article, Sony’s project management team and Zanders partners will explain about this project.

Power of creativity and technology

Sony strives to fulfil its purpose to “fill the world with emotion, through the power of creativity and technology”, under its corporate direction of “getting closer to people”. To evolve and grow further, Sony strives to provide innovative products and contents full of emotional experiences in order to enrich people’s lives through the power of technology, across its six business segments consist of Game & Network Services, Music, Pictures, Electronics Products & Solutions, Imaging & Sensing Solutions, and Financial Services.

New-generation technologies made it possible for Sony Group to improve the global treasury platforms such as Payment-On-Behalf Of (POBO), Zero Balance Accounts (ZBA) sweeping, and Internal cash-less payments, Internal FX and Money Market deals settled via In-House-Cash accounts.

To improve FX hedging process, Sony introduced cutting-edge technologies such as SAP S/4HANA Treasury, SAP’s TPI connecting automatically with 360T Trading platform, to achieve the end-to-end automation of FX trading process.

To improve banking connectivity, Sony adopted the most advanced generation of banking technologies such as SWIFT for Corporates and ISO 20022 standards to connect with global banks smoothly for payment requests and bank statements via SWIFT network, which makes it possible for Sony’s cash management teams to grasp the latest status of cash position in a timely manner, even when the employees are forced to work from home in a tele-commuting era under COVID-19.

Additionally, Sony has implemented SAP In-House-Cash (IHC) for its treasury centers as In-House-Banks to support Sony subsidiaries in each region.

Sony’s journey for global treasury transformation

Sony Group has been making impressive efforts in the field of finance and treasury for a long time. Since 2000, Sony Global Treasury Services Plc (SGTS UK) has been established and operated in the United Kingdom as a global treasury center for Sony Group. SGTS UK has been providing POBO, ZBA sweeping, Internal cash-less payments, Internal FX and MM deals settled via internal accounts for Sony Group companies based on in-house treasury system developed by the Sony IS team. Cash and FX risk management were centralized in SGTS UK.

As Sony’s business grew in various business segments globally, it was necessary and rational to centralize funds and foreign exchange risks into SGTS UK. Before 1999, each regional finance/treasury center had managed FX and cash management individually, so it was a significant improvement by centralizing into SGTS UK. SGTS UK was deemed to be one of the most advanced in-house-bank of its kind around the world.

In 2016, SGTS UK transferred cash management functions for group companies in the USA to Sony Capital Corporation (SCC), to strengthen access to the US capital market, and to enhance flexibility to any changes in laws and regulations in the USA.

We departed from single global treasury center model and transformed into three main treasury center models by standardizing, simplifying, and automating treasury operations across all the treasury centers.

Hiroyuki Ishiguro, General Manager of Sony Group Corporation HQ Finance

Challenge

Decision to transform

In October 2017, Sony started a project planning to rebuild its global treasury management structures across the globe. By December 2017, after an RFP process among the shortlisted SAP consultants, Sony decided that Zanders would be the best SAP Treasury expert to advise and support in this project. Together with Zanders, Sony opted for SAP S/4HANA Treasury based on ‘Fit & Gap’ analysis.

In May 2018, Sony decided to start the METRO Project officially.

Mr. Hiroyuki Ishiguro, General Manager of Sony Group Corporation HQ Finance (‘SGC HQ Fin’), explains: “We decided to start DX in Sony’s global treasury operations, considering more diversified business segments in Sony Group, rapid changes of corporate treasury and banking activities in each region, innovations of financial technologies, and limitations of legacy treasury systems that could not so effectively support Sony’s group companies especially in the USA and Japan. We departed from single global treasury center model and transformed into three main treasury center models by standardizing, simplifying, and automating treasury operations across all the treasury centers.”

Mr. Ishiguro served as the project owner, led the project management team, and worked together with the project members from overseas based in eight countries. With the introduction of the METRO Project, Sony Group built a Treasury Management System (TMS) that supports all segments of the Sony Group’s business domain, excluding finance segment, providing treasury services for nearly 350 companies worldwide in Sony Group. The METRO Project was set in motion.

Technology risk

The legacy in-house systems had a technology risk, because it was developed with old programming languages and had been in operation since 2000.

Mr. Ishiguro also comments: “In the project planning phase, it was a challenge to justify the importance of METRO Project and to justify IT investment for TMS. Technology risk urged us to start the planning phase to kick off the METRO Project. Our previous legacy treasury systems were in-house systems developed long time ago. The technology risk would be a real risk at the end of December 2020, so we needed to take urgent action to transform the existing legacy systems into a new TMS. We needed to have a very solid and stable TMS to manage the cash management and FX risk management for Sony’s global businesses. This meant a large scale of IT investment.”

Solution

Choosing SAP and Zanders

Sony decided to choose SAP S/4HANA Treasury, as the “best” TMS fitting well with Sony’s requirements based on the FIT & GAP analysis.

Mr. Takehiro Yagi, Senior Project Manager of SGC HQ Fin, explains why: “We performed a fit-gap analysis on various options, including ERP type treasury systems like SAP, treasury-specialized TMS, and an inhouse developments. Zanders gave us a lot of valuable insights into each TMS at the FIT&GAP analysis. SAP S/4HANA Treasury was chosen as the best fit for Sony’s Treasury as a result. SAP S/4 HANA Treasury would ‘FIT’ with most of our requirements to cover Sony’s global treasury services with multiple treasury centers model. SAP had flexibility to achieve Sony’s unique requirements with custom enhancements. Furthermore, SAP S/4HANA Treasury could achieve integration with accounting systems effectively, because a lot of Sony group companies have been using SAP as an accounting platform.”

The most important condition was to choose SAP Treasury experts who have deep knowledge and wide experiences in global implementation of SAP S/4 HANA Treasury for both TRM and IHC modules for regional treasury centers. Zanders won the RFP process in a shortlist of world-famous SAP partner companies. As a result, Sony decided to select Zanders as the SAP implementation partner.

Sony faced serious shortage of SAP Treasury experts. In fact, the lack of SAP experts was one of the biggest challenges for METRO Project. It caused significant delays from the original master schedule, and it caused quality issues from the lack of knowledge and expertise in SAP Treasury. The close collaboration between Sony and Zanders proved to be a key success factor of the METRO Project.

Mr. Ishiguro adds: “As of 2017, there were only few experts in Japan who could develop SAP Treasury related modules in global implementation projects. We evaluated several global consulting firms and analyzed their proposals and considered if they can deliver what we wanted to achieve. However, in many cases their proposals were limited to a general update. Zanders comprehensively understood our treasury requirements in each key operation area and provided appropriate and concrete proposals.”

SAP global implementation in two waves

Then the project started with the planning phase. Mr. Takaaki Miura, Finance Manager in SGC HQ Fin, explains: “In order to obtain official approval, we developed comprehensive project plans. To minimize any impacts to Sony group companies at the ‘Go-Live’, we decided to implement SAP Treasury in two waves, as recommended by Zanders. We started explaining our project plan and built good consensus across the major stakeholders within Sony Group HQ. ROI was the most important factor when discussing with the Sony’s management. METRO Project obtained the official approval from Sony management in May 2018.”

In February 2020, the SAP IHC module was implemented in Sony Group globally as Wave 1. In August 2020, the TRM module was implemented globally as Wave 2.

To finalize user requirements, all the key members gathered in Tokyo from around the world to discuss on a face-to-face basis. Project team also visited Sony IS teams in India to discuss business requirements directly and to resolve critical issues effectively in Wave 1. To kick-start User Acceptance Tests, the project team visited each office of treasury centers for deep-dive discussions and user trainings, also in Wave 1.

Mr. Ishiguro explains: “Wave 1 go-live was just before the COVID-19 global pandemic. Up to the Wave 1 implementation we could do all the work in face-to-face meetings in Tokyo, the Netherlands, USA, UK or India. So, we have accumulated our experiences by implementing Wave 1 on a face-to-face basis. The COVID-19 virus spread around the world, affecting Wave 2 of METRO Project. It was a tough time for us to proceed with all the preparation activities on a remote basis. But by making the best use of our comprehensive implementation experiences from Wave 1, we could successfully proceed with all the activities for Wave 2, even on a remote basis.”

Zanders gave us a lot of valuable insights into each TMS at the FIT&GAP analysis.

Takehiro Yagi, Senior Project Manager of Sony Group Corporation HQ Finance

Performance

More sophisticated treasury operations

Now, Sony’s Treasury team is looking back with satisfaction on the project.

Mr. Yagi explains: “Now, we have visibility into global treasury activities from all regions, which is a real improvement. The treasury management system, METRO, was implemented as our global treasury platform with sophisticated technologies, greatly improved from the previous legacy in-house TMS systems. Our project members gained huge insights and experiences during the project, by working closely together with the Zanders team, all the partner banks, our IT teams and all the treasury members. That proved to be significant contributions to the development of human resources who can globally promote DX projects in the finance and treasury fields, which will continue to be needed in the future.”

Mr. Ishiguro agrees: “It is very important for both finance/treasury members and IT members to collaborate closely. It is also very important to promote young and mid-career employees actively, to provide opportunities for good trainings and for good ‘learning’ by direct and active participation to the project tasks.”

Mr. Miura adds: “One of the benefits of implementing METRO is that we can operate straight-through-processing (STP) in the FX trading process. Previously a lot of manual inputs needed to execute an FX trade with a bank, here and there, for the same deal. Now FX dealers can execute FX deals with banks who quoted best price effectively in a fully automated manner. We experience the improvements every day.”

Mr. Yagi agrees: “Our new SAP S/4HANA Treasury is much more advanced than our previous legacy treasury systems. SAP is much faster, more transparent and designed more effectively and efficiently, fully automated in various operations. Our previous application did not have any payment functionalities, so we had to enter payments separately manually into a separate E-banking system. SAP makes payment runs automatically, with timely status update of payment files. We have fewer issues or errors in METRO, all operations are run in a transparent manner, which prevents from fraud and other risks. The treasury system makes it possible to disclose financial information quickly to Sony management, the external auditor or investors if necessary.”

Mr. Ishiguro: “I strongly feel that we have been enjoying benefits of standardized treasury operations across regional treasury centers after the implementation of SAP Treasury. All three main treasury centers – in Japan, USA and UK – have been using the same treasury platform, and achieved a very good and stable operation, from various perspectives.”

A unique project

Apart from the pandemic restrictions, several elements made this project unique.

Firstly, the METRO Project was the first global IT system implementation project involving all business segments (except the Financial Services segment) of Sony Group. The project was unique because both Wave 1 and Wave 2 went live in a Big-Bang go-live approach around the world.

Secondly, it is unique because it was a ‘GLOBAL’ treasury transformation project with project members from eight countries. Treasury teams were in Tokyo, Singapore, Malaysia, UK, Poland and USA, and IT teams were in Bangalore, India, and the Zanders team was mainly in the Netherlands. As a result, the members of various nationalities have established a truly global project structure in which each project member was in charge of each task across the countries.

Ms Laura Koekkoek, partner at Zanders: “That global approach of this project, in which all regions and their personnel were combined, was really unique. And the whole collaboration between the different regions was really successful.”

Zanders partner, Ms Judith van Paassen adds: “The old systems already had the ambition of best practices processes in them but contained a technology risk. Now that there is a system to fully centralize, standardize and automate all processes is a big achievement.”

Mr. Ishiguro: “Whenever we discuss with Zanders, I remember we had very useful information available on key items, sometimes to deliver to the Sony senior management, or sometimes to resolve critical issues with a reasonable and solid solution, so we were able to proceed with the project with deep insights from SAP treasury experts.”

Next steps: From its new stable treasury basis, Sony's treasury is now ready for further steps for the future. In 2021, the system will be rolled out to Sony Group Corporation in Tokyo. Mr. Ishiguro lastly adds: “SAP S/4 HANA Treasury proved to be a very good TMS application for us. We would like to promote DX further, with close collaborations across our own Treasury members in each treasury center and our own SAP IT members, taking advantage of our experiences cultivated through METRO Project, in line with the mission of Sony Group Corporation, to ’lead and support the evolution of business through people and technology’."

As a worldwide supplier in the global vehicle industry, Kongsberg Automotive needed to transform its treasury function.

In a short period, the company took several steps in maturing its treasury, so successfully that it received an Adam Smith Award. How did Kongsberg Automotive manage to achieve this?

Since the late 1950’s, Kongsberg Automotive has developed from a Scandinavian automotive parts supplier to a global leader in one of the most competitive and complex industries in the world. With more than 11,000 employees in 19 countries worldwide (European countries, USA, Canada, Mexico, South Korea, India and China), the company provides high-quality products to the global vehicle industry, such as custom powertrain and chassis solutions, interior comfort systems, cables and actuators for passenger cars.

When Abraham Geldenhuys joined Kongsberg Automotive as Group Treasurer in October 2017, the company’s treasury function needed further development. “At that time our treasury department was very administrative of nature,” he says. “It is key for treasurers and CFOs to know their company’s cash balance. That was partly not at our disposal. There was a clear need for a treasury transformation, with better cash visibility, cash flow forecasting and control over payments and liquidity. Due to our global activities, these things were hard to combine and tough to control – they needed to be centralized.”

At that time our treasury department was very administrative of nature. It is key for treasurers and CFOs to know their company’s cash balance. That was partly not at our disposal.

Abraham Geldenhuys, Group Treasurer

Challenge

Road map

Kongsberg Automotive’s treasury therefore started a journey to become more mature. Geldenhuys: “During the 2017 EuroFinance Conference, I met some Zanders people. The conference was full of buzzwords like blockchain, machine learning and RPA. We were talking about all these new technologies but most of us still have a lot to innovate in that area. It was clear that, like many companies, we need to get rid of repetitive, Excel-based ways of doing treasury. It was time to clearly define and then centralize, standardize and automate treasury processes. Technology is evidently the enabler to bring all this together. You can’t be strategic when your house is not in order.”

Shortly after joining Kongsberg Automotive, Geldenhuys formulated a three-year strategic Treasury Transformation roadmap to determine where the treasury was today and where it wanted to be tomorrow. “In our roadmap I described the vision, function, building blocks of treasury, a road map time line and existing risks,” he explains. “In January 2018, I presented this roadmap to our CFO. We agreed that cash visibility was key and that we needed daily cash reports to be able to make the right decisions. The roadmap also included refinancing the group. We needed to ensure our capital structure and financing was in order and finally decided to refinance by issuing a corporate bond. The transaction was done in a very short space of time. Timing was critical and the transaction were concluded in July 2018. We then really started our journey, together with Zanders, to achieve centralization, standardization and optimization of our treasury activities.”

Solution

Pricing tool

Two main steps in the treasury transformation journey were a complete bank reorganization and the implementation of a new treasury management system (TMS). “In May 2018, we completed the solution design and a blueprint for our Treasury Transformation and after presenting our business case, I got final approval in early November 2018,” Geldenhuys says. “I was challenged to have the new structure up and running by June 2019. With this very short timeline the big challenge was without a doubt: will we be able to go live in June? We effectively officially kicked off in mid-November 2018 with our selected TMS partner and in January 2019 with our new selected corporate banking partners.”

Kongsberg Automotive’s treasury also needed a solution to leverage technology for arm’s length transfer pricing of financial transactions. Geldenhuys: “If you have a global zero balance cash pool and intercompany loans, the pricing needs to be in order and set. The focus on these intercompany transactions has increased in the past couple of years. With the current focus of tax authorities globally, we need to make sure that we are ahead of the curve. So, we shared our thoughts with Zanders and the idea was to have a full-proof, state-of-the-art pricing to meet all requirements. Their solution was a Transfer Pricing Solution. With a new Intercompany Rating & Pricing (ICRP) tool we were able to price our cash pool and our intercompany loans.”

Packaged and presented

Next to bank reorganization, the implementation of a new TMS and the ICRP tool, the company took it a step further to enhance and standardize cash application. Geldenhuys explains: “Redesigning this process, we went from having people manually print out all bank statements and manually booking all to pushing these statements to the ERP environment and achieving automated reconciliation to a larger extent. We’ve made great strides. Together with the cash pool and the TMS we also implemented an in-house bank. One of the big achievements of this project was that we – the central treasury team – are now releasing the majority of Kongsberg Automotive’s payment traffic after validating these payments against the global liquidity and currency positions and planning. Soon, in addition to this, we will further streamline our payment traffic by going live with Payments on behalf of (POBO).”

The next question was how to put these massive changes to the organization. “The biggest challenge is bringing the people with you on the journey,” says Geldenhuys. “The coaching, teaching and showing was a daily job. All of the new tools had to be packaged and presented within the organization – the users of these tools. And we managed to do so through new technologies – again the enabler.”

In terms of cash visibility and liquidity planning, the treasury organization is now able and equipped to effectively manage the cash needs of the group. “All these things were previously done in Excel, but now completely captured in the TMS,” Geldenhuys adds. “We make sure to utilize as much functionality in our new TMS as possible. We really have a one-stop solution for all treasury activities.”

We’ve made great strides. Together with the cash pool and the TMS we also implemented an in-house bank.

Abraham Geldenhuys, Group Treasurer

Performance

Extensive Journey

The new TMS went live in June 2019. “Keeping the timeline in mind this was an immensely intense period,” says Geldenhuys. “Two things were absolutely key. Support from our in-house project management function and the role of our consultants as a reliable, trusted partner. From the blue print stage to the system selection and bank reorganization, to a tool that can do the pricing of your cash pool and intercompany loans. That journey has been an extensive one; Accounting, Legal, Tax (Transfer pricing), Change Management, Implementation teams and Technical teams on banking and payments were involved – apart from the dreaded KYC procedures that accompany a bank reorganization. So, all in all implementing completely new features and solutions to treasury – all to be able to say that the foundation has been laid. It’s been an intense journey containing a lot of details, a journey that could not have been taken on by ourselves.”

One of the final steps to take, and quite a tedious one according to Geldenhuys, is the transition from the old to the new banking environment, so ensuring that customers pay to the new accounts. “But when you get to the point where we are now, focusing on closing legacy bank accounts, it’s rewarding to see that the entire picture and plan has come together and is starting to lean towards a real transformation.”

A good foundation

Doing a treasury transformation – implementing a new global cash pool, a new system and really centralizing payments – takes a lot of effort and commitment, Geldenhuys emphasizes. “But it’s worth it, absolutely! It’s been a tremendous journey, from the start to where we are right now. It is important that your C-suite believes in it and that it delivers its fruits – a project of this scale needs to be justified. Although technology is the key to standardize, centralize, automate and combine all treasury activities, processdesign and effectiveness still ranks at the top of my treasury foundation, and it’s exactly here where I believe in leveraging the technology to ensure that we have a real treasury function. It is process married with technology.”

Zanders was part of this project in six different areas, according to Geldenhuys: group advisory, system selection, bank reorganization and negotiation, change management and operational support. “Also, they did a lot of sound boarding. We went from nothing to today having daily bank statement reporting, full control over our payments and much more details around this. That is probably the most important part: if the foundation of your house is not solid, forget about the rest.”

Sulzer was looking for a cloud platform to collect its market data. The Swiss company decided to use Zanders’ market data platform to bridge the source systems and target systems.

The new data system now takes care of the storage, conversion and application of data needed for treasury, to determine the rates for its loans, forwards or swaps.

Sulzer is a Swiss industrial engineering and manufacturing firm that specializes in pumping solutions and offers services for rotating equipment and technology for separation, mixing and application. The company, established in 1834 as Sulzer Brothers, now has a network of over 180 production and service sites in around 50 countries around the world.

“As a company we have concentrated our activities and divided these into four divisions,” says Alexander Sika, senior treasury manager at Sulzer. “There are four of these divisions and they are quite diverse. One produces centrifugal pumps and mixers for a broad range of industries. The second one offers services and repair solutions for rotating equipment such as turbines, pumps, compressors, motors and generators. The third division is called Chemtech and offers components and services for separation columns and static mixing. And the fourth, a relatively new division, delivers mixing and dispensing systems for liquid applications, for healthcare markets, amongst others. So, it’s all very diverse from a treasury perspective.”

We wanted an automated, more secure and stable framework for our financial data.

Alexander Sika, Senior Treasury Manager

Challenge

The perfect edge

Sulzer aimed for a unified ERP to support all its data-driven processes. “It was required to have rate visibility and to automate our treasury,” explains Sika. “To improve the rate visibility and automate our treasury we started to look for partners. We have been teaming up with Zanders since 2008, so we knew what they could deliver. They could implement the middleware, bridging the operating system to the database and applications. First it was a manual process, so we wanted an automated, more secure and stable framework for our financial data – that was rather important for our treasury activities.”

Once the system was implemented, the organization needed to take the next step: a solution to collect market rate data. Within our network we heard about Brisken as an approved designer and developer of rate apps.

“We saw a demo from Brisken and they offered exactly what we wanted,” Sika says. “Flexible and web-based, without the requirement to code, independent maintenance and up- or download of rates without from internal or external help. Zanders wanted to team up with Brisken, so it came out that Zanders could offer us the software that we would have chosen anyways. It was the perfect edge for us.”

Solution

How to share the data

Market data often is retrieved from external sources, so an interface needs to be built and maintained. Then, these raw data cannot be used directly in applications and needs transformation into the right formats. Sika selected Bloomberg to provide all market data. “The data we need is interest rates, FX rates and VOLA rates,” he explains. “A data provider like Bloomberg can supply us with these data. We have been partners of Bloomberg since many years and as we are used to the terminals, we decided to go for the Data License as well. Best price, easiest logic and one partner for market data were the factors that made the decision.”

First, Sulzer checked with Bloomberg how to share the data and to discuss how it would be visualized. “That’s when we reached out to Zanders and Brisken to set up the strategy; this is what we want, and this is how we’ll set it up,” notes Sika. “We rolled out the project plan and coordinated between Bloomberg, Zanders and ourselves to set up the cloud and its users. It was a rather hands-on approach in which we designed our needs; what data do we need, when do we need it, how should it be checked and when should it be sent to whom? The timeline was pushed a little, but that was no problem. In October, we did the final tests to see whether all data was activated well and integrated with our treasury management system (TMS) IT2 and other system elements. These tests were all successful, so we then implemented the Zanders Market Data Platform, went live and completed our first month-end process in November.”

It was a rather hands-on approach in which we designed our needs.

Alexander Sika, Senior Treasury Manager

Performance

System independency

The data from Bloomberg can now be collected from the cloud platform that was designed and developed by Brisken. “As we were building our partnership with Zanders, it was a great opportunity to become part of this,” says Dirk Neumann, executive director at Brisken. “It’s good to hear that all features of the portal and the needs for the customer are identical. Zanders has shown to be very good at sourcing and managing data and to bring it into place with this system. They offered the flexibility; the market data pool is always well managed. There may be other parts in the organization that can benefit from this too. And with the system it can grow further into the future.”

On behalf of Zanders, Joanne Koopman joined the project in early 2019 to support on the system tests and choices. Then the set ups took place to give an impression of the data flows via the new platform.

“We needed specific data from Bloomberg, which formed a very technical part of the project,” says Sika. “Zanders arranged the data on the platform. In August, Zanders started training sessions to show us the new system and all possible data flows on the new platform.”

The aim of the training was to increase the system independency, Koopman explains: “When the company wants to make any changes, it should be able to deal with them itself. But advice is, of course, always available if needed.”

SAP integration

So, what are the next steps? “So far we have loaded the rates into the system, making them ready to be sent to target systems,” says Sika. “We receive all data daily via the cloud platform, which works on a very stable process. During the last six years, we have strengthened our treasury strategy and systems, working towards the basic goals of providing the service that we should provide as a treasury department. First, we didn’t have a real treasury roadmap, now we have one and we are thinking about making a new one. We now want to extend what we have been doing already, with a new system, new functions for a broader user base. We plan another update of our IT2 TMS – we expect to enhance our system in terms of function and user accessibility. As an organization, we were early in developing our treasury. But now, in terms of technical level and straight-through processing (STP), we have quite some more treasury ambitions.”

Over the past 15 years, the 240-year-old Japanese multinational pharmaceutical company Takeda has made a number of key acquisitions which have positioned them as a leader in the global patient-focused market.

To standardize banking connectivity worldwide, record all financial instruments and increase cash visibility, Takeda implemented Kyriba Treasury as its TMS back in 2019. Subsequent to this initial implementation, a second phase of the project – to implement the Payments module of the TMS – was embarked upon in 2022. For this, Takeda enlisted the help of Zanders.

Takeda has a long history, dating back to 1781 when its founder Chobei Takeda I began selling traditional Japanese and Chinese herbal medicines in Osaka’s medicine district, Doshomachi. He quickly gained a reputation for business integrity and quality products and services, values that have continued through the years and are now integral to Takeda’s corporate philosophy.

Today, Takeda is a patient-focused, values-driven biopharmaceutical company committed to improving the lives of patients worldwide. The company has six key product areas: Oncology, Rare diseases, Neuroscience, Gastroenterology, Plasma-derived therapies, and Vaccines. With approximately 48,000 employees across 80 different countries, Takeda operates in Japan, the USA, Europe & Canada (EUCAN), and Growth and Emerging Markets (GEM). These four regions are responsible for providing access to Takeda’s entire portfolio in the countries where it operates. In terms of revenue split, half of the revenue comes from the US market, 21% from EUCAN, 18% from Japan, and 12% from GEM.

“Our company is values-based,” explains Fiona Foley, VP and Assistant Treasurer, Treasury Operations at Takeda. “We are guided by the principles of what we call Takeda-ism, which incorporates four tenets: integrity, fairness, honesty, and perseverance. These values are brought to life through our actions which are based on patient, trust, reputation, and business – in that order.”

The project was a combination of various specialties, including treasury, IT, languages, and process and cultural alignment.

Fiona Foley, VP and Assistant Treasurer

Challenge

Integrating treasuries

In January 2019, Takeda acquired Shire PLC, a UK-founded and Irish-based pharmaceutical company specializing in rare diseases. With the earlier acquisition of Swiss pharmaceutical company Nycomed in 2011, Takeda now has three treasury centers located in Tokyo, Zurich, and Dublin.

Foley explains that they have a three-pillar treasury approach. “The first pillar is the Treasury Operations team which looks after all the day-to-day cash management, intercompany liquidity, pooling, cash centralization, and cash forecasting. The Financial Risk management pillar is responsible for all financial risks, such as FX, interest rate, credit and counterparty risks, and also manages trade finance and bank guarantees. Finally, the Capital Markets pillar is responsible for new sources of funding and managing the company’s significant debt portfolio.”

Before the merger, Takeda and Shire were very different companies in terms of operational culture and functional structures. Foley notes that both companies had different degrees of centralization. “Shire was much more centralized in terms of its Treasury, while Takeda was more decentralized. As a combined company there were many fragmented and non-integrated data sources for treasury, particularly in the areas of bank accounts and cash visibility, leading to poor forecast accuracy. Furthermore, there were numerous banking connectivity routes, different electronic banking systems, and a large number of applications.”

Neither company used a TMS for day-to-day cash management, and the TMS systems that were in place hadn’t been updated in quite some time and were only used for recording a specific set of financial instruments. The newly formed treasury team recognized the need to address these issues and began preparing a request for proposal (RFP) for a new TMS. Foley: “We wanted to move away from an overreliance on Excel for cash positioning, forecasting and reporting which exposed us to the risk of input error and manipulation of data by different users.”

Given the company’s size and the complexity of the challenges they were facing, they needed a TMS that was adaptable, met their requirements, and future-proofed them for integrated activity. As a result, Takeda implemented Kyriba Treasury, including the Payments module, to standardize banking connectivity globally, increase cash visibility, and centralize its payments. Zanders was asked to help with the Payments implementation which followed after all other modules.

Solution

Creating visibility

Takeda’s implementation of Kyriba Treasury was done in a modular manner, with the first phase focusing on banking and cash management to create visibility. Kyriba was able to gather bank statements, enabling the company to manage their cash on a day-to-day basis. The subsequent modules involved integrating investments, risk management (FX, interest rate and counterparty risk), and managing debt portfolio and capital market activity. Payments settlement was not included in the initial implementation scope.

To address this as part of a second project phase, Takeda moved into the lifecycle of the Payments module, explains Meliosa O’Byrne, Associate Director Treasury Operations at Takeda. “We recognized the need to standardize and harmonize payments for all the banks. We faced challenges due to the lack of connectivity and the absence of a standard approval process in place. To address these issues, we decided to use Kyriba and organized a workshop with the Zanders team to gain better understanding. This was followed by a phased approach to implement the Payments module with seven key global core cash management banks.”

Specific challenges per phase

The first phase started with Deutsche Bank – the primary bank in Europe – as pilot. The focus was to understand the Payment module in Kyriba, processes, and flows. O’Byrne: “A key decision factor to start with Deutsche bank was that our hedging program was migrating to our Treasury entity in Zurich and the volume of payments to support this being the most significant Treasury flows each month.”

Phase two involved Citibank, which covered all Takeda regions (EUCAN, Japan, USA) and Sumitomo Mitsui Banking Corporation (SMBC) which was Japan-centric. During this phase, training sessions were provided by Zanders in local language for the Japanese users, which was key element to the success of the project. The EUCAN team was already trained during phase one.

O’Byrne explains: “We started from Europe and then engaged Japan team for phase two. They were working with our back office team to make sure we continued the standardization and harmonization approach identified for Deutsche Bank. SMBC is one of the main banks for Japan and Zanders’ Katsuo Sekikawa became part of the team that managed the implementation from Japan.”

Keisuke Suzuki, Lead Treasury Solutions of Takeda Japan: “With Katsuo Sekikawa, Zanders offered solid practical experience in the banking sector in Japan and knowledge of the Kyriba system – a great contribution with respect to the Japanese banks going live with Kyriba Payments.”

With the implementation of Kyriba, Takeda was able to fully automate the process of treasury payments, explains Suzuki: “This allowed us to have improved treasury payment automation. The centralized data provided by Kyriba enabled us to easily track our transactions, which was particularly important due to our significant amount of external debt, bonds, derivative and ICO contracts.”

We faced challenges due to the lack of connectivity and the absence of a standard approval process in place.

Meliosa O'Byrne, Associate Director Treasury Operations

Performance

Successfully live

During the user acceptance testing (UAT) and penny testing for Citi and SMBC, phase three was initiated in the background, specifically for the remaining four banks – Mizuho Bank and MUFG (both for Japan), Nordea (Europe) and JP Morgan (USA). Each bank encountered its own challenges in terms of time perspective, but all followed the agreed-upon eight-stage process with Kyriba and Zanders.

O’Byrne: “Upon completion of each phase, there was a hypercare period of five days after going live, which was supported by Zanders. By the end of September, all phases were successfully live, with a few minor bumps along the way. All stakeholders were extremely happy with the results.”

The comfortable and confident relationships built between Zanders and the various teams in Europe and Japan were an important foundation for the success of the project, according to Foley: “With three project phases focusing on different parts of the world, the project was a combination of various specialties, including treasury, IT, languages, and process and cultural alignment. Working with multiple internal and external stakeholders, and different banking partners, made the project complex. Despite the challenges posed by different time zones, the project was successfully completed in the timeframe agreed at the outset.”

Takeda now has a bank-agnostic approach to deliver the benefits of automated payments workflow while addressing local operating requirements. Foley: “The standardization and alignment of processes from all regions has been tremendous with respect to the overall Takeda approach. Kyriba allows for fully integrated payment systems, enabling Takeda to make large transactions with the security of robust system support. This allows us to turn all our attention to our day-to-day cash & liquidity planning to ensure that funds are in the right place at the right time and all risks are properly hedged.”

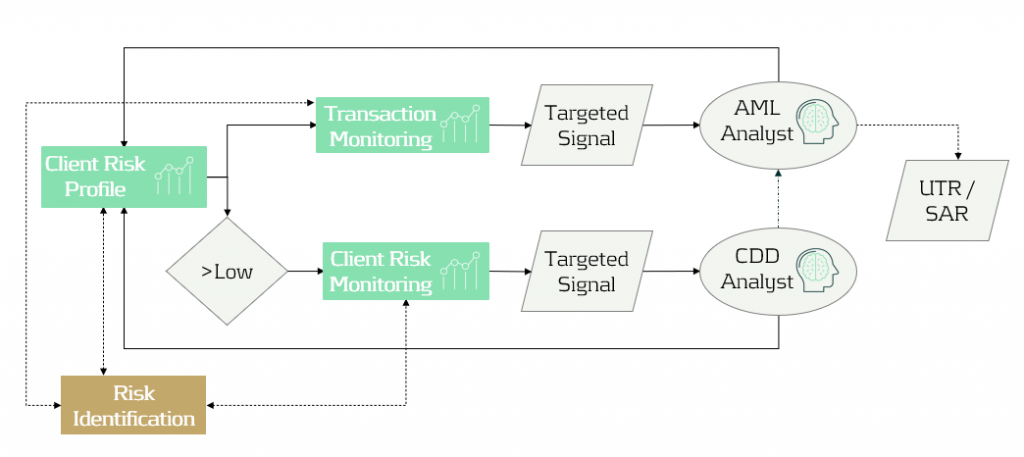

MODEC, the world’s largest independent operator of offshore floating production systems for the oil and gas industry, was managing its foreign exchange (FX) hedging process manually.

In 2020, the company decided to automate this process, successfully reducing the time spent on it from three days to within one day.

Headquartered in Tokyo, MODEC is a general contractor for the engineering, procurement, construction and installation (EPCI) of floating systems for deep-sea oil production. These systems include FPSO (floating production storage and offloading) units, FSO (floating storage and offloading) units, floating liquefied natural gas (FLNG) facilities, tension-leg platforms (TLPs), semi-submersible platforms, mooring systems and new technologies to meet the challenges of gas production floaters.

As largest independent operator of FPSO’s in the world, MODEC specializes in units for offshore deep sea oil production. “Then we either sell it to our clients or own and operate it on client’s behalf for 20 to 25 years,” says Qiurong Chong, Financial Planning & Treasury Manager at MODEC. Her business unit is located in Singapore and handles the conversion and EPCI of the FPSOs. From there, majority of the constructed FPSOs are handed over to MODEC’s business unit in Brazil responsible for the operations and maintenance of the vessels. “Our operations are therefore substantially in Brazil. But we do have presence in Australia, Ghana and Vietnam too.”

Since our functional currency is US dollars, we are exposed to a significant FX risk.

Qiurong Chong, Financial Planning & Treasury Manager

Challenge

Need for automation

As a global company, MODEC deals with a lot of vendors and major equipment suppliers. Chong: “Our vendors are located everywhere. Some are in China, where we usually do our transactions in US dollars. The major equipment vendors are located in Europe, such as Italy, Germany and The Netherlands. Therefore, the euro is one of the main foreign currencies. And since our functional currency is US dollars, we are exposed to a significant FX risk.”

MODEC’s finance department was managing the FX hedging process manually with the use of spreadsheets. By the end of 2019, there were approximately 350 outstanding FX forwards hedging the future cash flows of the purchase orders (POs) associated with MODEC’s projects. “The POs contain the information we need from the vendors for the FX process, including the cost in dollar value, the breakdown of the payment milestones and the expected payment date,” Chong explains.

The PO information was extracted from its system to be incorporated in an Excel overview driving their hedging activities. This was a labor-intensive process and since the expected number of FX transactions increased, MODEC decided to automate this process. Chong: “With Excel you have less control over the data integrity and only a few people had access to the account data. There were quite some governance concerns on this manual spreadsheet. We wanted to improve this process. And as our company grows, with an increasing number of projects running at the same time, the effort that we spend on updating and maintaining hundreds of transactions was too much.”

SAP TRM for straight-through-processing

Previously, all FX forwards were communicated via email, letter or phone and processed through a single cash centre between two banks. Bank accounts exist within each bank for all the currencies transacted, which total around eight for each bank. Monthly valuations are provided by the banks and upon settlement the bank automatically debits and credits MODEC’s bank accounts accordingly. GL journal entries were manually created in SAP. In the coming years, the number of FX forwards is expected to grow to 500 or more.

In the summer of 2020, MODEC Finance decided to implement SAP TRM for the straight-through-processing of FX forwards. Chong: “We asked around in the market about what system they used for their FX transactions. Our accounting migrated to SAP in 2017, which is quite recent. And since our information on vendors and POs are all in SAP, we thought: why not integrate everything together? That is why we decided to choose SAP TRM.”

Solution

Meeting the requirements

Thereafter, the new system needed to be integrated and automated. “We had been working with SAP successfully for some time and they recommended Zanders to support us. We reached out and asked Zanders for a demo. During that demo the team showed us the flow and functionalities that the TRM module in SAP could offer. It met our requirements, and we felt comfortable as Zanders could explain what we did not understand. It is important to be able to communicate with consultants in very simple terms and things that our department could understand. That is why we chose Zanders to support us in this project.”

Chong then asked Zanders to customize a program that could correctly capture the exposure positions and hedge relationships with the FX forward contracts. “Once a new PO is created, it can read that information and integrate it into the treasury module. We had quite some difficulties in trying to make the program to what it should be. The way we use SAP is not very standard, at some points, things got quite complex, but Zanders was able to resolve the complexities. Now the program is running very well. This process is expected to provide hedge accounting documentation under IFRS 9 and generate GL journal entries for monthly valuations and settlement.”

We thought: why not integrate everything together?

Qiurong Chong, Financial Planning & Treasury Manager

Performance

Connected

“We kicked off the project in August 2020 with a key user training, which was very useful – it prepared us well for the whole process. After that we had four weeks of requirements gathering, which was quite intensive but very productive. We had a few challenging areas that required additional effort by Zanders to do some research. Eventually all challenges were resolved, and we went live in February this year, so the project took about a half year.”

The systems are now connected. “So far, the systems are running well. There have been some small issues here and there – then we reached out to Zanders to resolve it. Zanders consultants Michiel and Mart were really very helpful throughout the whole process. Even our hedge accounting entries are done by the system. The automation reduces the processing time from an average of three days to within one day. The main beneficial part for us is that the business has the hedge documentation available from the system. In the past, we spent hours on computing effectiveness for the hundreds of transactions. When we were using Excel, we were only doing this on a quarterly basis. Now we can do it every month.”

Next steps

Are there still any challenges to be met for MODEC Finance? Chong: “We are still trying to stabilize the work process and get the hang of the new system. Once everything is more stable, there are some things we may explore. Automating this FX transaction was a first step for us in the treasury department. We are still doing many other reports manually for our headquarters in Japan. By bringing our HQ onboard this TRM module, we can have a seamless flow of information between us and them, which reduces any lag time and the need for us to extract the reports for them.”

After taking a long hard look at its treasury function, Accell Group took the plunge by investing in a treasury management system (TMS) and improving bank connectivity with a payment hub solution.

So how exactly did the European market leader in bicycles achieve these goals? Accell Group is the European market leader in the mid- and upper-segments for high-quality bicycles and associated parts and accessories (XLC). Employing over 3,000 people across 18 countries, Accell Group manages a strong portfolio of national and international (sports) brands, each with its own distinctive positioning.

In 2018 the company sold 1.1 million bicycles, realizing a turnover of €1.1 billion and a net profit of €20.3 million. The bicycle brands in the Accell Group stable include Haibike, Winora, Ghost, Lapierre, Babboe, Batavus, Sparta, Koga, Diamondback and Raleigh. They are manufactured in several locations in the Netherlands, Hungary, Turkey and China.

Bicycles, and particularly e-bikes, are increasingly being seen as a key contributor in addressing issues such as urban congestion, hazardous city traffic, rising CO₂ emissions and our desire to live healthier lifestyles. For this reason, the bicycle market represents excellent potential for further worldwide growth.

“Given that we focus on new, clean and safe mobility solutions, we are certainly in the right business in terms of market potential,” agrees Jonas Fehlhaber, Treasurer at Accell Group, “Furthermore, there is a growing trend for large cities to adapt their infrastructures to offer cyclists more space and make them safer.”

Given that we focus on new, clean and safe mobility solutions, we are certainly in the right business in terms of market potential.

Jonas Fehlhaber, Treasurer at Accell Group

Omnichannel approach

Initially, Accell Group was a small holding company with decentralized management. Fehlhaber joined the Group in 2013 as its first treasurer, but his responsibilities soon expanded to encompass cash management, currency risk management and credit insurance. At the same time, the structure of the company changed. Based on a new strategy defined in 2016, the most important change was that the company wanted to shift from a manufacturing-driven approach to a consumer-centric one. In other words, everything must revolve around the consumer.

“In the past our sales channel was mainly defined by the dealers but now, thanks to experience centers and the use of e-commerce, this is changing into an omnichannel approach,” says Fehlhaber. “The dealers still play the most important role, but with more and more functions being provided centrally, the size of the holding has grown substantially. For the past two-and-a-half years we have had a strong supply chain organization, and our finance team, just like the Treasury, has expanded.”

Challenge

Treasury roadmap

After centralizing several components and rationalizing the bank portfolio, Accell asked Zanders to carry out a quick scan of the Treasury department. In the context of this scan, the treasury function was examined and several potential risks and possible improvement areas were identified.

“To further professionalize the Treasury, we worked with Zanders to start a project in 2017 to establish a treasury roadmap,” adds Fehlhaber. “In this project our strategic goals, along with what we wanted to achieve with them, were laid out. All in all it was an intensive undertaking in which all the respective processes were documented.”

The outcome was reconciled into three pillars: organization, systems and treasury policy. To limit the organizational vulnerability of what would otherwise have been a single-person department, Accell used Zanders’ Treasury Continuity Service (TCS) and appointed an additional treasury employee. An element of the Treasury Continuity Service is a TMS, Integrity, with which processes can be automated and standardized, while risks are simultaneously minimized.

“The Treasury Continuity Service allowed us to implement the system quickly, without the need to go through an RfP [Request for Proposal] process,” says Fehlhaber. “Zanders had already made advance agreements with the supplier, FIS, giving us a partially pre-configured system that could be quickly implemented. Moreover, the support days that we are allocated can be used for advice, for example, or if there is temporary understaffing. We acted on the advice to start up our new payment hub, from the RfP to the actual selection and, if necessary, the implementation too.”

The final improvement was to set up a comprehensive treasury policy, which has injected more structure and transparency into the daily treasury activities.

Solution

More Complete and more interactive