Sulzer’s new market data platform

Sulzer was looking for a cloud platform to collect its market data. The Swiss company decided to use Zanders’ market data platform to bridge the source systems and target systems.

The new data system now takes care of the storage, conversion and application of data needed for treasury, to determine the rates for its loans, forwards or swaps.

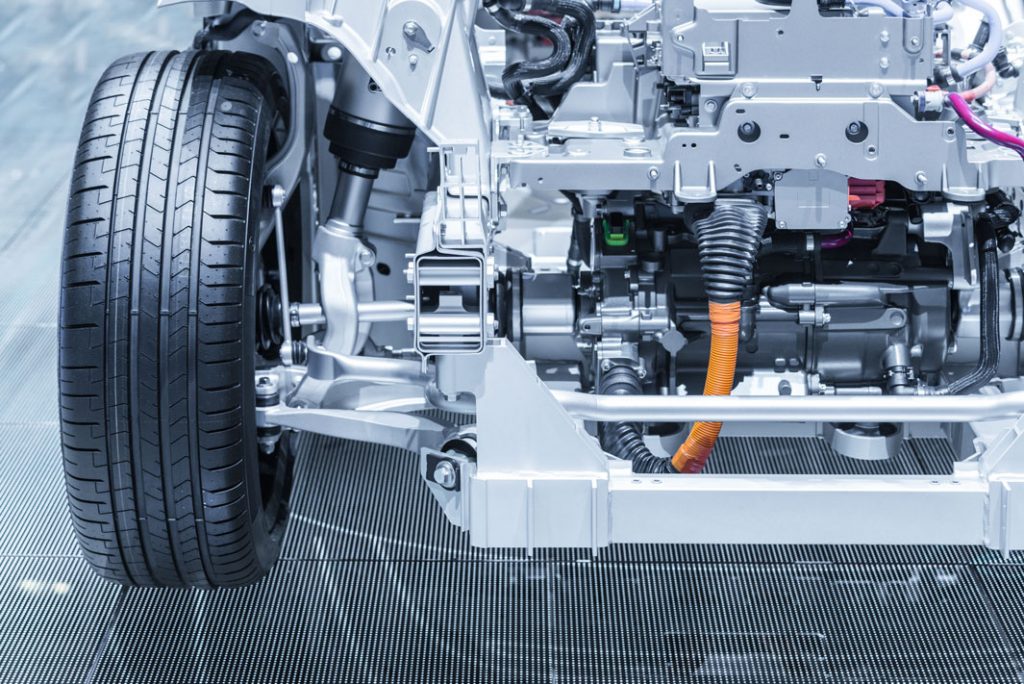

Sulzer is a Swiss industrial engineering and manufacturing firm that specializes in pumping solutions and offers services for rotating equipment and technology for separation, mixing and application. The company, established in 1834 as Sulzer Brothers, now has a network of over 180 production and service sites in around 50 countries around the world.

“As a company we have concentrated our activities and divided these into four divisions,” says Alexander Sika, senior treasury manager at Sulzer. “There are four of these divisions and they are quite diverse. One produces centrifugal pumps and mixers for a broad range of industries. The second one offers services and repair solutions for rotating equipment such as turbines, pumps, compressors, motors and generators. The third division is called Chemtech and offers components and services for separation columns and static mixing. And the fourth, a relatively new division, delivers mixing and dispensing systems for liquid applications, for healthcare markets, amongst others. So, it’s all very diverse from a treasury perspective.”

We wanted an automated, more secure and stable framework for our financial data.

Alexander Sika, Senior Treasury Manager

Challenge

The perfect edge

Sulzer aimed for a unified ERP to support all its data-driven processes. “It was required to have rate visibility and to automate our treasury,” explains Sika. “To improve the rate visibility and automate our treasury we started to look for partners. We have been teaming up with Zanders since 2008, so we knew what they could deliver. They could implement the middleware, bridging the operating system to the database and applications. First it was a manual process, so we wanted an automated, more secure and stable framework for our financial data – that was rather important for our treasury activities.”

Once the system was implemented, the organization needed to take the next step: a solution to collect market rate data. Within our network we heard about Brisken as an approved designer and developer of rate apps.

“We saw a demo from Brisken and they offered exactly what we wanted,” Sika says. “Flexible and web-based, without the requirement to code, independent maintenance and up- or download of rates without from internal or external help. Zanders wanted to team up with Brisken, so it came out that Zanders could offer us the software that we would have chosen anyways. It was the perfect edge for us.”

Solution

How to share the data

Market data often is retrieved from external sources, so an interface needs to be built and maintained. Then, these raw data cannot be used directly in applications and needs transformation into the right formats. Sika selected Bloomberg to provide all market data. “The data we need is interest rates, FX rates and VOLA rates,” he explains. “A data provider like Bloomberg can supply us with these data. We have been partners of Bloomberg since many years and as we are used to the terminals, we decided to go for the Data License as well. Best price, easiest logic and one partner for market data were the factors that made the decision.”

First, Sulzer checked with Bloomberg how to share the data and to discuss how it would be visualized. “That’s when we reached out to Zanders and Brisken to set up the strategy; this is what we want, and this is how we’ll set it up,” notes Sika. “We rolled out the project plan and coordinated between Bloomberg, Zanders and ourselves to set up the cloud and its users. It was a rather hands-on approach in which we designed our needs; what data do we need, when do we need it, how should it be checked and when should it be sent to whom? The timeline was pushed a little, but that was no problem. In October, we did the final tests to see whether all data was activated well and integrated with our treasury management system (TMS) IT2 and other system elements. These tests were all successful, so we then implemented the Zanders Market Data Platform, went live and completed our first month-end process in November.”

It was a rather hands-on approach in which we designed our needs.

Alexander Sika, Senior Treasury Manager

Performance

System independency

The data from Bloomberg can now be collected from the cloud platform that was designed and developed by Brisken. “As we were building our partnership with Zanders, it was a great opportunity to become part of this,” says Dirk Neumann, executive director at Brisken. “It’s good to hear that all features of the portal and the needs for the customer are identical. Zanders has shown to be very good at sourcing and managing data and to bring it into place with this system. They offered the flexibility; the market data pool is always well managed. There may be other parts in the organization that can benefit from this too. And with the system it can grow further into the future.”

On behalf of Zanders, Joanne Koopman joined the project in early 2019 to support on the system tests and choices. Then the set ups took place to give an impression of the data flows via the new platform.

“We needed specific data from Bloomberg, which formed a very technical part of the project,” says Sika. “Zanders arranged the data on the platform. In August, Zanders started training sessions to show us the new system and all possible data flows on the new platform.”

The aim of the training was to increase the system independency, Koopman explains: “When the company wants to make any changes, it should be able to deal with them itself. But advice is, of course, always available if needed.”

SAP integration

So, what are the next steps? “So far we have loaded the rates into the system, making them ready to be sent to target systems,” says Sika. “We receive all data daily via the cloud platform, which works on a very stable process. During the last six years, we have strengthened our treasury strategy and systems, working towards the basic goals of providing the service that we should provide as a treasury department. First, we didn’t have a real treasury roadmap, now we have one and we are thinking about making a new one. We now want to extend what we have been doing already, with a new system, new functions for a broader user base. We plan another update of our IT2 TMS – we expect to enhance our system in terms of function and user accessibility. As an organization, we were early in developing our treasury. But now, in terms of technical level and straight-through processing (STP), we have quite some more treasury ambitions.”