We restructured the Financial Crime Prevention (FCP) model landscape of a bank with over 500 billion in assets to prioritize efficient model development and reduce analyst workloads.

Challenge

Despite having a mature and well-resourced FCP department, this Dutch bank’s existing model landscape was overly complex. It lacked transparency in the alert generation process and produced too many unnecessary alerts. Additionally, the model development process was extremely time-consuming, causing a lengthy delay between development and implementation. This resulted in frustration within the department and exposed the bank to operational risks.

Our mandate was to develop a model landscape that:

- Improves the effectiveness of models within the landscape

- Enhances the efficiency of the model development process

Model Development

Any mature model development process follows key stages: data preparation, experimentation/modeling, implementation (e.g., within a pre-existing codebase), and model validation.

By developing a landscape where preparation, implementation, and validation are streamlined, model developers can dedicate more time to in-depth analysis and leverage cutting-edge modeling techniques. The result is a landscape populated by high-performing, advanced models.

To achieve this, we provided several key recommendations:

- Model Validation: By enacting a toll-gated approach to model validation, potential issues can be flagged earlier in the development process.

- Data: By emphasizing reusable and well-documented data elements (e.g., through feature stores or derived layers), features and tables can be shared, drastically reducing data preparation time.

- Implementation: By standardizing the model design process and adopting a robust MLOps framework, model implementation can become seamless and consistent.

Model Landscape

Within such a complex domain, having high-quality models is only the first step in tackling the risks associated with financial crime. To be truly effective, models must have minimal overlap while collectively maximizing coverage of perceived risks.

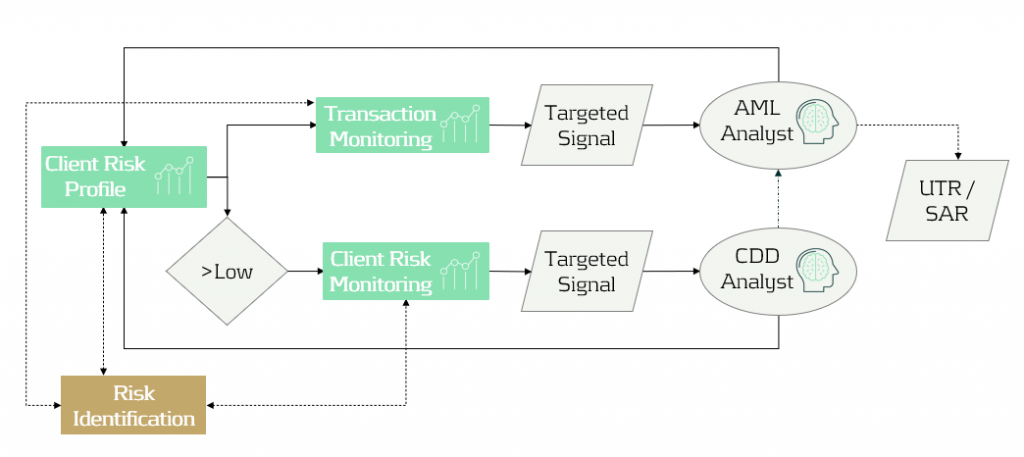

Once this balance is achieved, models can be embedded into a landscape designed for targeted signals (i.e., ongoing due diligence) rather than the former periodic review regime.

Below is a schematic view of a best-practice FCP model landscape. The trigger-based approach ensures that analysts assess only those clients or transactions worth investigating. This shift results in higher-quality Suspicious Activity Reports (SARs) and more engaged analysts.

Implementing our recommendations would reduce the time-to-market for a model in development from 24 months to 9 months, significantly decreasing analyst workloads while improving the efficiency and effectiveness of financial crime detection.

For more information, visit our Financial Crime Prevention page, or reach out to Johannes Lont, Senior Manager.