Discover the full potential of bank connectivity with EBICS. From strategies for secure and cost-efficient bank connectivity to tips and quick wins and an update on EBICS 3.0, this article provides food for thought for sustainable and secure banking architecture.

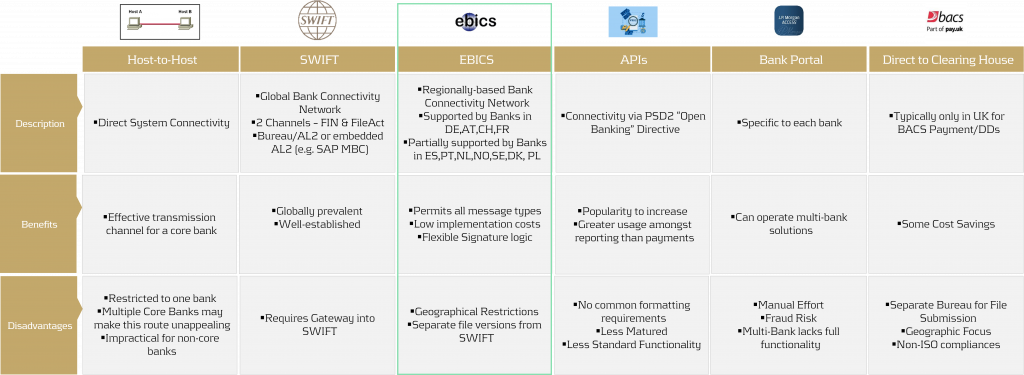

Security in payments is a priority that no corporation can afford to overlook. But how can bank connectivity be designed to be secure, seamless, and cost-effective? What role do local connectivity methods play today, and how sustainable are they? This article provides an overview of various bank connectivity methods, focusing specifically on the Electronic Banking Internet Communication Standard (EBICS). We'll examine how EBICS can be integrated into global bank connectivity strategies, while comparing it to alternative methods. The following section offers a comparison of EBICS with other connectivity solutions.

For a comprehensive overview of bank connectivity methods, including insights from an SAP perspective, we recommend the article Bank connectivity – Making the right choices.

Compared to alternatives, EBICS contracts are cost-effective, and EBICS connectors, along with supporting online banking software, are equally affordable. Whether through standalone solutions provided directly by banks or SAP ERP-integrated systems, EBICS consistently proves to be the most cost-effective option when compared to SWIFT or individual host-to-host connections.

The downside of EBICS? Outside the GSA region (Germany, Switzerland, Austria) and France, there are significant variations and a more diverse range of offerings due to EBICS' regional focus. In this article, we explore potential use cases and opportunities for EBICS, offering insights on how you can optimize your payment connectivity and security.

EBICS at a Glance

EBICS, as a communication standard, comes with three layers of encryption based on Hypertext Transfer Protocol Secure (HTTPS). In addition to a public and a private key, so-called EBICS users are initialized, which can present a significant advantage over alternative connection forms. Unlike Host-to-Host (H2H) and SWIFT, which are pure communication forms, EBICS has an intelligent signature process integrated into its logic, following the signing process logic in the GSA region. EBICS, developed by the German banking industry in 2006, is gaining increasing popularity as a standardized communication protocol between banks and corporates. The reason for this is simple—the unbeatable price-performance ratio achieved through high standardization.

Furthermore, EBICS offers a user-specific signature logic. Primary and secondary signatures can be designated and stored in the EBICS contract as so-called EBICS users. Additionally, deliveries can be carried out with so-called transport users (T-transport signature users).

In practice, the (T) transport signature user is used for tasks such as retrieving account statements, protocols, or sending payments as a file without authorization.

It is worth noting that for the intelligent connectivity of third-party systems or even service providers that create payments on behalf of clients, the T user can be utilized. For example, an HR service provider can send an encrypted payment file using the provided T user to the bank server. The payment file can be viewed and signed separately on the bank server via the relevant treasury or EBICS-compatible banking software.

Furthermore, through EBICS, individual records and thus personal data in the case of HR payments can be technically hidden. Only header data, such as the amount and the number of items, will be visible for approver.

Is the signature logic too maintenance-intensive? Fortunately, there is an alternative available to the maintenance of individual users. A so-called Corporate Seal User can be agreed upon with the bank. In this case, the bank issues an EBICS user based on company-related data in the (E) Single signature version. The (E) signature is transmitted directly to the bank for every internally approved payment, which is comparable to connectivity via SWIFT or Host-to-Host.

Strategic Adjustments with EBICS

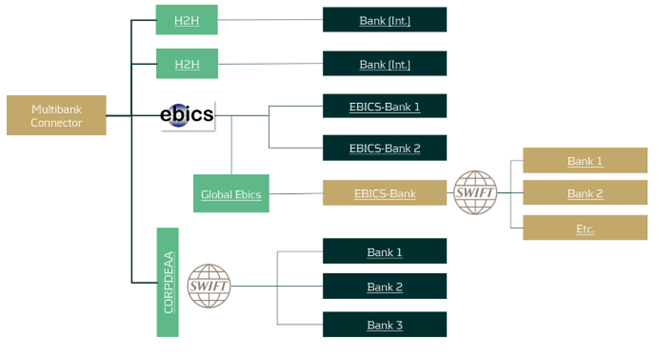

Regional standards like EBICS can be used to connect regional banks and send or receive messages over the bank's internal SWIFT network through a so-called request for forwarding, also known as European Gateway or SWIFT Forwarding. Using this service, it is not necessary to connect every bank directly via Host-to-Host or SWIFT in order to become cost-efficient in your corporate banking.

A SWIFT Forwarding agreement is drafted and signed with your individual bank. Payment files are sent to the bank via a defined order type intended solely for forwarding. The bank acts here as a mere transmitter of the message. Incidentally, the same principle can also be adapted for account statements. Several banks in the GSA-region and France proactively market the service as an additional cash management service to their corporate customers. Account statements are centrally collected via the bank's SWIFT network and sent to the corporate via the existing EBICS channel. This procedure saves implementation efforts and simplifies the maintenance.

We like to summarize the advantages and disadvantages of integrating SWIFT forwarding via the EBICS channel:

Advantages

- High maintenance Host-to-Host connections are avoided.

- A dedicated SWIFT connection can be avoided without neglecting the benefits.

Disadvantages

- A bank with a well-developed interbank network is required.

- Transport fees per message may apply.

In general, corporates can take advantage of this specific EBICS setup when dealing with banks that manage a small portion of their transaction volume or when the technical connections with certain banks are more challenging. This approach is especially beneficial for banks that are difficult to access through local connectivity methods and have medium-to-low transaction volumes. However, for banks with high transaction volumes, connectivity via Host-to-Host or even a dedicated SWIFT connection may be more appropriate. Each situation is unique, and we recommend evaluating the best banking connectivity setup on a case-by-case basis to ensure optimal performance and cost-efficiency.

Future of EBICS: Changes Until 11/2025

Since November 2023, banks have been offering EBICS 3.0 as the most recent and up-to-date version. This version is binding in the GSA (Germany, Switzerland, Austria) region until approximately November 2025.

Here is a summary of the most important changes:

- Increased Standardization: Local EBICS “flavors” are unified to simplify implementation.

- Enhanced Encryption: Since version 2.5, the minimum encryption level has been 2048 bits. This is continuously increased with the EBICS 3.X version.

- XML Only for EBICS-specifics: Protocols like PTK are migrated to pain.002 HAC.

The new version of EBICS increases the security of the communication standard and makes it more attractive in the EU given its updates. In addition to Germany, Austria, Switzerland, and France, we observe the communication standard is increasingly offered by banks in Spain, Portugal, the Netherlands, as well as in the Nordic countries. Recently, the first banks in Poland have started to offer this communication standard–a rising trend.

In summary, EBICS is a cost-effective and powerful standard that can do much more than just bank connectivity. For companies that mainly use Host-to-Host or SWIFT for bank connectivity within the Eurozone, it may be worthwhile to look at EBICS and consider switching their connectivity method, provided their banking partner offers EBICS.

When the impending maturity of C. Steinweg’s group credit facility prompted the company to re-evaluate another debt facility at the same time, Zanders provided the expertise to attract a new pool of banks and secure a more flexible financing structure for the business.

C. Steinweg Group is a market-leading logistics and warehousing company with over 6,250 employees and warehouses and terminals that span more than 100 locations in 55 countries worldwide. With 175 years plus experience of storage, handling, forwarding and chartering services throughout the world, the company is a renowned and respected logistics partner for the global commodity trade.

Over its long history, Steinweg has demonstrated agility and resilience, responding to market challenges through innovating its approach to logistics and warehousing services and showing relentless commitment to customer services. Over the years, the business has also diversified into commodity financing as an added value service to its logistics and warehousing activities. At the end of 2022, the company appointed Zanders to advise them on the refinancing of two debt facilities. The aim was to provide the business with the robust and flexible access to capital they needed to continue to support, scale and grow their international operations.

The refinancing project comprised of two core requirements:

- The refinancing of Steinweg’s group credit facility.

- A new, more flexible credit facility for the commodity finance subsidiary.

Due to an overlap in the counterparties invited to participate in the two transactions, Steinweg saw the efficiency potential of taking both of the transactions to market simultaneously. But this also added complexity in terms of arranging and managing the refinancing process and procedures.

It was not a standard refinancing

Pim Van Der Heijden, C. Steinweg Group

“There was a certain complexity to this project, because the refinancings were interrelated from various perspectives,” says Pim Van Der Heijden, Steinweg’s group treasurer and global head of commodity finance. “It was not a standard refinancing. Especially the commodity financing activity, where we didn't go for just a straightforward, typical trade financing credit facility. We were putting something in place which was not only new for us but also for lenders and the legal counsels involved—we had to get them a little bit out of the comfort zone.”

Steinweg recognised early that they would need external support from a debt advisor to help get banks on board with this more innovative structure and also to optimize the value they would get from the refinancing process as well as adding capacity to the team. Zanders had previously worked with Steinweg when its group credit facility was first renewed in 2017, and this experience contributed to the appointment of Zanders to assist them with the new refinancing transactions.

“We approached a few advisors, but we selected Zanders based on track record and pricing,” Van Der Heijden adds. “We know Zanders and we had a good relationship with them, so we had confidence that they could deliver what we were looking for.”

Advice grounded in robust understanding of market practice

As well as their history and established relationship with Steinweg, it was also Zanders’ experience in the market that influenced their appointment on this project. Whereas a company will go to the market every five or seven years to refinance facilities, Zanders is continuously working with lenders on these transactions. This empowers them with current know-how on market practice regarding terms and pricing. Steinweg recognized the value this could bring to their process.

“It really helps to have a debt advisor who has insights into what's happening in the market, what is possible and what is not possible based on actual transactions—they understand how banks work and what is achievable,” Van Der Heijden says. “When Zanders came up with this alternative structure for the commodity financing facility, there was a certain amount of risk involved with going forward with it. This was however one of the reasons that we started the process early, this gave us time to sound and refine the structure. In addition, we knew that we were in good hands, and we ended up getting the results we wanted from it in terms of gaining flexibility that previously wasn't available and might not have been available with a more conventional approach.”

With the maturity of the group credit facility looming in July 2024, this transaction was mission critical and the driving force behind the timing of the combined refinancing project.

“We wanted to start early, and we set the goal to have the new group financing in place before the end of the year 2023,” says Van Der Heijden. “We started preparing by selecting Zanders as a debt advisory partner at the end of 2022, ready to start the process in early 2023, leaving time to complete the transaction by the end of that year.”

A resilient process

The process started with Zanders sitting down with Steinweg to discuss their objectives and requirements for the refinancing. Various scenarios were then modelled before finalizing the structure and characteristics of the new facilities. The RFP documents were then issued to the group of banks identified as a good match. In this case, six banks were invited to pitch—Steinweg’s existing lenders and a selection of additional lenders that matched the required criteria. Zanders’ attention then turned to collecting responses and creating term sheets for the new credit facilities, starting with the group financing.

When it comes to refinancing processes, it’s always wise to prepare for all scenarios. In this case, particularly given the progressive structure of the new facilities, it was important to be prepared for the eventuality that a lender could opt to exit the process. For this reason, more banks than strictly required were invited to participate.

“The new structure was a bit off the beaten track and while we were keen to push new boundaries, we had to be prepared for the reality that some lenders might not share our enthusiasm,” remembers Van Der Heijden. “This approach paid off when an existing lender decided not to participate. Rather than unsettling the process, instead it served to reassure us that the strategy to include more than just our existing bank in the process was good. And it all worked out.”

Due to the highly structured approach and extensive project set-up, when changes occurred there were provisions in place to ensure they caused minimal disruption to the process. This approach ultimately enabled Steinweg to secure competitive pricing and terms for their new group facility. And importantly, this was achieved comfortably ahead of the deadline set by the maturity of their previous agreement.

While the two financing processes ran in parallel, due to the impending maturity of the group facility, securing this was the primary focus initially. Once the group facility was agreed, attention shifted to the commodity financing facility. Steinweg was looking to increase their credit facility, to give them scalable access to more flexible funding to finance commodities on behalf of its clients. Previously, bilateral loan agreements were used to fund this aspect of the business leading to funding inefficiencies. “We had some goals we wanted to achieve with this new funding structure,” says Van Der Heijden. “The most critical was, of course, securing scalable financial headroom, but flexibility was almost as important.”

To deliver this more scalable and flexible access to credit, Zanders modelled a facility that allowed multiple banks to provide funding for commodity financing under the same loan. As an atypical arrangement, it required Zanders to work closely with each counterparty to gain their support for this novel structure.

“The new structure was relatively off the beaten track, but it provided what we needed, which is a lot of flexibility,” says Van Der Heijden. “And the flexibility it gives us is now paying off daily. We can now have three banks participating in a loan and other banks can also be added to the structure as well.”

Reaping the benefits

The new commodity financing facility not only provides essential access to more sources of funding, but also enables Steinweg to react quicker to opportunities and deliver faster, more seamless commodity financing solutions to its customers.

“The group facility was a lifeline, whereas the credit facility for the commodity financing activities was more of a ‘nice to have’ but now it's really adding value in terms of enabling us to pursue growth,” says Van Der Heijden. “We no longer have to talk to our lenders every time we go to market and that really pays off. Previously, if we had a new commodity financing prospect, we sometimes had to wait two weeks to get an answer from our banks to see if we can use the funding. Now, as long as we’re comfortable that it's within the pre-agreed rules, we can pretty much reply to them the same day.”

Conclusion

This project was not only strategically critical for Steinweg but also represented a bold departure from their existing financing agreements. With Zanders’ guidance, they were able to pursue this ambitious approach with confidence and conclude both of the refinancing projects before the end of 2023. This gave the team the peace of mind that their funding was agreed well ahead of their group facility maturing.

This project underscores the value of having an independent debt advisor to navigate your company through the complexities of structuring credit facilities. From ensuring essential deadlines are achieved and developing innovative structures to maintaining the momentum for the process and securing the most beneficial terms with banks. For more information on Zanders' debt advisory and refinancing expertise, contact Koen Reijnders and visit our Corporate finance page.

We explore six common challenges facing treasuries today and how Zanders’ Treasury Business Services could help you to ride out the storm.

In brief

- Despite an upturn in the economic outlook, uncertainty remains ingrained into business operations today.

- As a result, most corporate treasuries are experiencing operational challenges that are beyond their control.

- Treasuries that adapt by embedding more resilience and flexibility into their operations will be the ones that forge ahead.

- Zanders created Treasury Business Services to provide a customizable suite of niche expertise and flexible resourcing options for treasuries.

Treasuries today are expected to adapt faster than ever to challenges that are largely beyond their control. Here we outline the six most pressing issues affecting treasuries today that you not only need to be aware of, but also proactively planning for.

The financial headwinds that have weighed down on investment activity, liquidity, and returns in recent times are gradually easing. And while optimism is creeping back into our outlooks, it’s not necessarily an end to uncertainty for treasury teams. That appears to be here to stay. Talent shortages, a more transient workforce, an expanding treasury role, large-scale digitalization, the lingering impact of recent global crises and unexpected opportunities too. Deeply engrained uncertainty means there are a lot of plates to keep spinning when you’re running a treasury function today. The following six challenges are making this balancing act more arduous for the corporate treasurer, emphasizing the urgent need to build greater resilience and agility into their operations.

1. Peak load scenarios where performance is non-negotiable

There are situations where treasury simply must deliver. Period. Even when it does not have the resources. M&A and IT-related projects are good examples but there are many more. When these peak load scenarios occur, treasuries need to be prepared to handle them in a fast, flexible, and efficient way.

2. Demand for specialist treasury IT knowledge

A 2023 Treasury Technology survey found 53% of respondents were already using a TMS and a further 16% planned to implement within the next two years. It’s undeniable that technology now commands a dominant role in treasury processes, with investment in ERPs, TMSs, payment factories and e-banking portals a priority across the industry. However, the talent to implement and manage these complex IT systems is scarce, and costly to recruit and retain. And even when someone with the right skills and experience is identified and convinced to join, it often becomes apparent that a dedicated full-time employee might be excessive for the requirements of the role. This makes it even more difficult to fill this critical skills gap effectively and cost-efficiently.

3. The paradox of lowering labor costs while delivering more

Treasury has never been a department with a high headcount, but it’s still not immune to company-wide edicts to reduce labor expenditure. In this cost-cutting environment, the best most treasuries can hope for is a cap on their existing headcount. So, while treasuries are increasingly called on to deliver more and faster, they’re required to perform this expanded role without increasing headcount.

4. The evolution from a cost center to a performance-oriented business partner

Like the rest of your company, treasury must show a tangible contribution to the improvement of productivity and performance. This was the subject of our recent white paper – Treasury 4.x, the Age of Productivity, Performance & Steering. There are lots of ways to enable treasury to transition into this new more value-driven role – from introducing more automation, improving methodologies, and increasing use of data, to outsourcing certain activities. But all this comes with additional demands on budget, skills, and resources.

5. The talent pool isn’t sufficient to keep treasuries today afloat

The 2023 Association for Financial Professionals (AFP) Compensation Report suggests it has become increasingly difficult to fill open treasury positions. According to the survey, almost 60% of treasury and finance professionals said their organization was tackling a talent shortage. There are many reasons given for this. A competitive job market is certainly a dominant cause (as stated by 73% of organizations in the survey). But treasury is also facing a dearth of candidates with the necessary skills for their roles (indicated by 47% of organizations in the survey). As a result, treasury talent shortages are not only due to the general demographic challenges affecting all companies but also because treasury remains underrepresented in the higher education system.

6. A continually expanding treasury agenda

ESG, increased regulatory demands, the burden of administering digital payments – a constantly shifting treasury landscape not only requires additional resources but also niche skillsets and significant cross-departmental collaboration. In addition, the unprecedented challenges businesses have faced in recent years have placed a spotlight on treasury management as a critical resource for businesses. In 2022, an AFP survey found 35-43% treasury professionals were reporting a consistent increase in communication between treasury and the CFO. Further to this, a 2023 TIS survey found almost 50% of treasury professionals have become strategic partners with the CFO. This is further fueling an expanded and more complex treasury agenda, creating another pressure on skillsets and resources.

Uncertainty meets its match

These challenges are triggering uncertainty in treasuries. Do you have the resources and skill profiles you need? How can you give your team more bandwidth to deliver a constantly expanding treasury role? Who is going to manage the TMS you’ve just implemented? And what would happen if you unexpectedly lost a member of your team? We created our Treasury Business Services solution to support you as you maneuver uncertainty, enabling you to execute rapid performance improvements when you need them most.

TBS is a special unit of Zanders offering a wide range of niche treasury expertise and flexible resourcing options to treasuries. From running your treasury-IT platform and covering routine back-office tasks, to taking care of highly specialized activities and filling your temporary resource needs – our service is deliberately broad to give you optimal flexibility and more control to shape the support you need.

To find out more contact Carsten Jäkel.

A webinar by SAP and Zanders explored optimizing treasury processes with SAP S/4HANA, focusing on enhanced cash management, automation, and compliance.

On the 22nd of August, SAP and Zanders hosted a webinar on the topic of optimizing your treasury processes with SAP S/4HANA, with the focus on how to benefit from S/4HANA for the cash & banking processes at a corporate. In this article, we summarize the main topics discussed during this webinar. The speakers came from both SAP, the software supplier of SAP S/4HANA, and from Zanders, which is providing advisory services in Treasury, Risk and Finance.

The ever-evolving Treasury landscape demands modern solutions to address complex challenges such as real-time visibility, regulatory compliance, and efficient cash management. Recognizing this need, the webinar offered an informative platform to discuss how SAP S/4HANA can be a game-changer for Treasury operations and, in specific, to bring efficiency and security to cash & banking processes.

To set the stage, the pressing issues faced by today's Treasury departments are navigating an increasingly complex regulatory environment, achieving real-time cash visibility, automating repetitive tasks, and managing banking communications efficiently. This introduction underscored the indispensable role that a robust technology platform like SAP S/4HANA can play in overcoming these challenges. The maintenance of consistent bank master data was given as an example of how challenging this management can be with a scattered ERP landscape.

Available below: Webinar Slides & Recording.

SAP S/4HANA: A New Era in Treasury Management

SAP S/4HANA, a next-generation enterprise resource planning (ERP) suite, stands out by offering integrated modules designed to handle various facets of treasury management, thus providing a consolidated view of financial data and enabling a single source of truth.

SAP S/4HANA's Treasury and Risk Management capabilities encompass cash management, financial risk management, payment processing, and liquidity forecasting. These tools are critical for a contemporary Treasury function looking to enhance visibility and control over financial operations.

Streamlined Cash Management

The core of the webinar focused on how SAP S/4HANA revolutionizes cash management. Real-time data analytics and predictive modeling were emphasized as the cornerstones of the platform’s cash management capabilities. The session elaborated on:

- Enhanced Cash Positioning: SAP S/4HANA provides real-time cash positioning, allowing Treasury departments to track cash flows across multiple bank accounts instantly. With the development of the new Fiori app, instant balances can be retrieved directly into the Cash Management Dashboard. This immediate visibility helps in making informed decisions regarding investments or borrowing needs.

- Liquidity Planning and Forecasting: By leveraging historical data and machine learning algorithms, SAP S/4HANA can provide accurate liquidity forecasts. The use of advanced analytics ensures you can anticipate cash shortages and surpluses well ahead of time, thereby optimizing working capital.

Efficient Banking Communications & Payment Processing

Managing communications with multiple banking partners can be a daunting task. SAP S/4HANA’s capabilities in automating and streamlining these communications through seamless integration. In addition to this integration, SAP S/4HANA facilitates efficient payment processing by consolidating payment requests and transmitting them to relevant banks through secure channels. This integration not only accelerates transaction execution but also ensures compliance with global payment standards.

Security and Compliance

Data security and compliance with regulatory standards are pivotal in Treasury operations. The experts detailed SAP S/4HANA’s robust security protocols and compliance tools designed to safeguard sensitive financial information. The features highlighted were:

- Data Encryption: End-to-end data encryption ensures that financial data remains secure both in transit and at rest. This is critical for protecting against data breaches and unauthorized access.

- Compliance Monitoring: The platform includes built-in compliance monitoring tools that help organizations adhere to regulatory requirements. Automated compliance checks and audit trails ensure that all Treasury activities are conducted within the legal framework.

S/4HANA sidecar for C&B processes

But how to make use of all these new functionalities in a scattered landscape corporates often have and how to efficiently execute such a project. By integrating with existing ERP systems, the sidecar facilitates centralized bank statement processing, automatic reconciliation, and efficient payment processing. Without disrupting the core functionality in the underlying ERP systems, it supports bank account and cash management, as well as Treasury operations. The sidecar's scalability and enhanced data insights help businesses optimize cash utilization, maintain compliance, and make informed financial decisions, ultimately leading to more streamlined and efficient cash and banking operations. The sidecar allows for a step-stone approach supporting an ultimate full migration to S/4HANA. This was explained again by a business case on how users can now update the posting rules themselves in S/4HANA, supported by AI, running in the background, making suggestions for an improved posting rule.

Conclusion & Next Steps

The webinar concluded with a strong message: SAP S/4HANA provides a transformative solution for Treasury departments striving to enhance their cash and banking processes. By leveraging its comprehensive suite of tools, organizations can achieve greater efficiency, enhanced security, and improved strategic insight into their financial operations.

To explore further how SAP S/4HANA can support your Treasury processes, we encourage you to reach out for personalized consultations. Embrace the future of treasury management with SAP S/4HANA and elevate your cash and banking operations to unprecedented levels of efficiency and control. If you want to further discuss how to make use of SAP S/4HANA or to discuss deployment options and how to get there, please contact Eliane Eysackers.

Defining the challenges that prevent increased Treasury participation in the commodity risk management strategy and operations and proposing a framework to address these challenges.

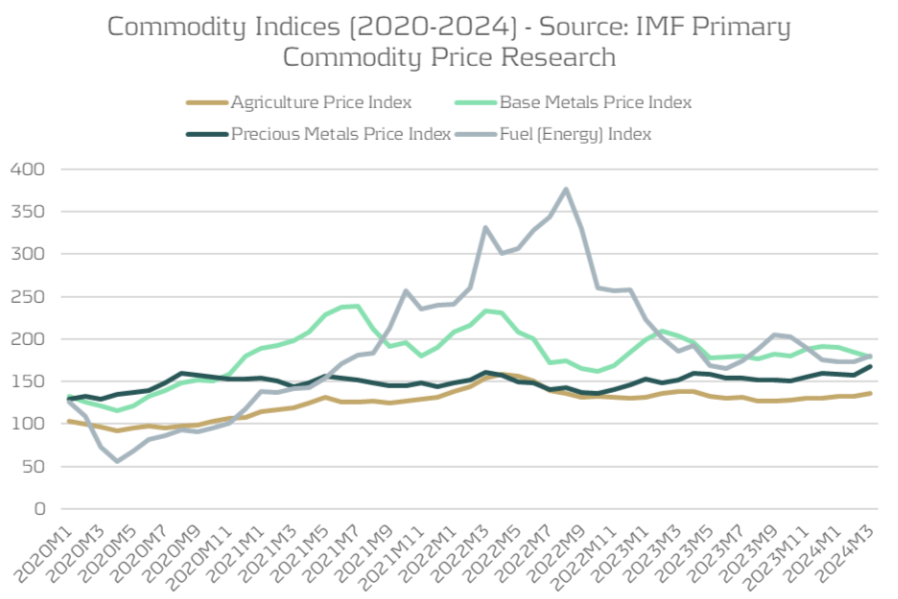

The heightened fluctuations observed in the commodity and energy markets from 2021 to 2022 have brought Treasury's role in managing these risks into sharper focus. While commodity prices stabilized in 2023 and have remained steady in 2024, the ongoing economic uncertainty and geopolitical landscape ensures that these risks continue to command attention. Building a commodity risk framework that is in-line with the organization’s objectives and unique exposure to different commodity risks is Treasury’s key function, but it must align with an over-arching holistic risk management approach.

Figure 1: Commodity index prices (Source: IMF Primary Commodity Price Research)

Traditionally, when treasury has been involved in commodity risk management, the focus is on the execution of commodity derivatives hedging. However, rarely did that translate into a commodity risk management framework that is fully integrated into the treasury operations and strategy of a corporate, particularly in comparison to the common frameworks applied for FX and interest rate risk.

On the surface it seems curious that corporates would have strict guidelines on hedging FX transaction risk, while applying a less stringent set of guidelines when managing material commodity positions. This is especially so when the expectation is often that the risk bearing capacity and risk appetite of a company should be no different when comparing exposure types.

The reality though is that commodity risk management for corporates is far more diverse in nature than other market risks, where the business case, ownership of tasks, and hedging strategy bring new challenges to the treasury environment. To overcome these challenges, we need to address them and understand them better.

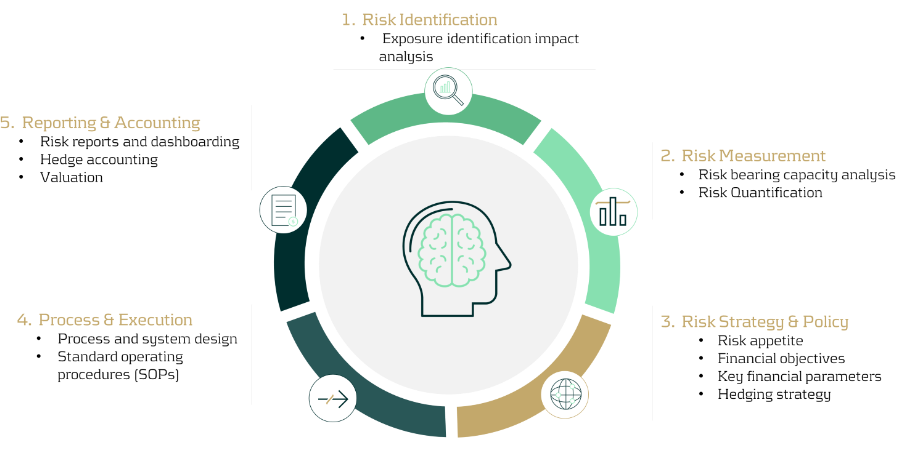

Risk management framework

To first identify all the challenges, we need to analyze a typical market risk management framework, encompassing the identification, monitoring and mitigation aspects, in order to find the complexities specifically related to commodity risk management.

Figure 2: Zanders’ Commodity Risk Management Framework.

In the typical framework that Zanders’ advocates, the first step is always to gain understanding through:

- Identification: Establish the commodity exposure profile by identifying all possible sources of commodity exposure, classifying their likelihood and impact on the organization, and then prioritizing them accordingly.

- Measurement: Risk quantification and measurement refers to the quantitative analysis of the exposure profile, assessing the probability of market events occurring and quantifying the potential impact of the commodity price movements on financial parameters using common techniques such as sensitivity analysis, scenario analysis, or simulation analysis (pertaining to cashflow at risk, value at risk, etcetera).

- Strategy & Policy: With a clear understanding of the existing risk profile, the objectives of the risk management framework can be defined, giving special consideration to the specific goals of procurement teams when formulating the strategy and policy. The hedging strategy can then be developed in alignment with the established financial risk management objectives.

- Process & Execution: This phase directly follows the development of the hedging strategy, defining the toolbox for hedging and clearly allocating roles and responsibilities.

- Monitoring & Reporting: All activities should be supported by consistent monitoring and reporting, exception handling capabilities, and risk assessments shared across departments.

We will discuss each of these areas next in-depth and start to consider how teams of various skillsets can be combined to provide organizations with a best practice approach to commodity risk management.

Exposure identification & measurement is crucial

A recent Zanders survey and subsequent whitepaper revealed that the primary challenge most corporations face in risk management processes is data visibility and risk identification. Furthermore, identifying commodity risks is significantly more nuanced compared to understanding more straightforward risks such as counterparty or interest rate exposures.

Where the same categorization of exposures between transaction and economic risk apply to commodities (see boxout), there are additional layers of categorization that should be considered, especially in regard to transaction risk.

Transactions and economic risks affect a company's cash flows.

While transaction risk represents the future and known cash flows,

Economic risk represents the future (but unknown) cash flows.

Direct exposures: Certain risks may be viewed as direct exposures, where the commodity serves as a necessary input within the manufacturing supply chain, making it crucial for operations. In this scenario, financial pricing is not the only consideration for hedging, but also securing the delivery of the commodity itself to avoid any disruption to operations. While the financial risk component of this scenario sits nicely within the treasury scope of expertise, the physical or delivery component requires the expertise of the procurement team. Cross-departmental cooperation is therefore vital.

Indirect exposures: These exposures may be more closely aligned to FX exposures, where the risk is incurred only in a financial capacity, but no consideration is needed of physical delivery aspects. This is commonly experienced explicitly with indexation on the pricing conditions with suppliers, or implicitly with an understanding that the supplier may adjust the fixed price based on market conditions.

As with any market risk, it is important to maintain the relationship with procurement teams to ensure that the exposure identifications and assumptions used remain true

Indirect exposures may provide a little more independence for treasury teams in exercising the hedging decision from an operational perspective, particularly with strong systems support, reporting on and capturing the commodity indexation on the contracts, and analyzing how fixed price contracts are correlating with market movements. However, as with any market risk, it is important to maintain the relationship with procurement teams to ensure that the exposure identifications and assumptions used remain true.

Only once an accurate understanding of the nature and characteristics of the underlying exposures has been achieved can the hedging objectives be defined, leading to the creation of the strategy and policy element in the framework.

Strategy & Policy

Where all the same financial objectives of financial risk management such as ‘predictability’ and ‘stability’ are equally applicable to commodity risk management, additional non-financial objectives may need to be considered for commodities, such as ensuring delivery of commodity materials.

In addition, as the commodity risk is normally incurred as a core element of the operational processes, the objective of the hedging policy may be more closely aligned to creating stability at a product or component level and incorporated into the product costing processes. This is in comparison to FX where the impact from FX risk on operations falls lower in priority and the financial objectives at group or business unit level take central focus.

The exposure identification for each commodity type may reveal vastly different characteristics, and consequently the strategic objectives of hedging may differ by commodity and even at component level. This will require unique knowledge in each area, further confirming that a partnership approach with procurement teams is needed to adequately create effective strategy and policy guidelines.

Process and Execution

When a strategy is in place, the toolbox of hedging instruments available to the organization must be defined. For commodities, this is not only limited to financial derivatives executed by treasury and offsetting natural hedges. Strategic initiatives to reduce the volume of commodity exposure through manufacturing processes, and negotiations with suppliers to fix commodity prices within the contract are only a small sample of additional tools that should be explored.

Both treasury and procurement expertise is required throughout the commodity risk management Processing and Execution steps. This creates a challenge in defining a set of roles and responsibilities that correctly allocate resources against the tasks where the respective treasury and procurement subject matter experts can best utilize their knowledge.

As best practice, Treasury should be recognized as the financial market risk experts, ideally positioned to thoroughly comprehend the impact of commodity market movements on financial performance. The Treasury function should manage risk within a comprehensive, holistic risk framework through the execution of offsetting financial derivatives. Treasurers can use the same skillset and knowledge that they already use to manage FX and IR risks.

Procurement teams on the other hand will always have greater understanding of the true nature of commodity exposures, as well as an understanding of the supplier’s appetite and willingness to support an organizations’ hedging objectives. Apart from procurements understanding of the exposure, they may also face the largest impact from commodity price movements. Importantly, the sourcing and delivery of the actual underlying commodities and ensuring sufficient raw material stock for business operations would also remain the responsibility of procurement teams, as opposed to treasury who will always focus on price risk.

Clearly both stakeholders have a role to play, with neither providing an obvious reason to be the sole owner of tasks operating in isolation of the other. For simplicity purposes, some corporates have distinctly drawn a line between the procurement and treasury processes, often with procurement as the dominant driver. In this common workaround, Treasury is often only used for the hedging execution of derivatives, leaving the exposure identification, impact analysis and strategic decision-making with the procurement team. This allocation of separate responsibilities limits the potential of treasury to add value in the area of their expertise and limits their ability to innovate and create an improved end-to-end process. Operating in isolation also segregates commodity risk from a greater holistic risk framework approach, which the treasury may be trying to achieve for the organization.

One alternative to allocating tasks departmentally and distinctly would be to find a bridge between the stakeholders in the form of a specialized commodity and procurement risk team with treasury and procurement acting together in partnership. Through this specialized team, procurement objectives and exposure analysis may be combined with treasury risk management knowledge to ensure the most appropriate resources perform each task in-line with the objectives. This may not always be possible with the available resources, but variations of this blended approach are possible with less intrusive changes to the organizational structure.

Conclusion

With treasury trends pointing towards adopting a holistic view of risk management, together with a backdrop of global economic uncertainty and geopolitical instability, it may be time to face the challenges limiting Treasury’s role in commodity risk management and set up a framework that addresses these challenges. Treasury’s closer involvement should best utilize the talent in an organization, gain transparency to the exposures and risk profile in times of uncertainty and enable agile end-to-end decision-making with improved coordination between teams.

These advantages carry substantial potential value in fortifying commodity risk management practices to uphold operational stability across diverse commodity market conditions.

Unlock Treasury Efficiency: Exploring SAP’s GROW and RISE Cloud Solutions

As organizations continue to adapt to the rapidly changing business landscape, one of the most pivotal shifts is the migration of enterprise resource planning (ERP) systems to the cloud. The evolution of treasury operations is a prime example of how cloud-based solutions are revolutionizing the way businesses manage their financial assets. This article dives into the nuances between SAP’s GROW (public cloud) and RISE (private cloud) products, particularly focusing on their impact on treasury operations.

The "GROW" product targets new clients who want to quickly leverage the public cloud's scalability and standard processes. In contrast, the "RISE" product is designed for existing SAP clients aiming to migrate their current systems efficiently into the private cloud.

Public Cloud vs. Private Cloud

The public cloud, exemplified by SAP's "GROW" package, operates on a shared infrastructure hosted by providers such as SAP, Alibaba, or AWS. Public cloud services are scalable, reliable, and flexible, offering key business applications and storage managed by the cloud service providers. Upgrades are mandatory and occur on a six-month release cycle. All configuration is conducted through SAP Fiori, making this solution particularly appealing to upper mid-market net new customers seeking to operate using industry-standard processes and maintain scalable operations.

In contrast, the private cloud model, exemplified by the “RISE” package, is used exclusively by a single business or organization and must be hosted at SAP or an SAP-approved hyperscaler of their choice. The private cloud offers enhanced control and security, catering to specific business needs with personalized services and infrastructure according to customer preferences. It provides configuration flexibility through both SAP Fiori and the SAP GUI. This solution is mostly preferred by large enterprises, and many customers are moving from ECC to S/4HANA due to its customizability and heightened security.

Key Differences in Cloud Approaches

Distinguishing between public and private cloud methodologies involves examining factors like control, cost, security, scalability, upgrades, configuration & customization, and migration. Each factor plays a crucial role in determining which cloud strategy aligns with an organization's vision for treasury operations.

- Control: The private cloud model emphasizes control, giving organizations exclusive command over security and data configurations. The public cloud is managed by external providers, offering less control but relieving the organization from day-to-day cloud management.

- Cost: Both the public and private cloud operate on a subscription model. However, managing a private cloud infrastructure requires significant upfront investment and a dedicated IT team for ongoing maintenance, updates, and monitoring, making it a time-consuming and resource-intensive option. Making the public cloud potentially a more cost-effective option for organizations.

- Security: Both GROW and RISE are hosted by SAP or hyperscalers, offering strong security measures. There is no significant difference in security levels between the two models.

- Scalability: The public cloud offers unmatched scalability, allowing businesses to respond quickly to increased demands without the need for physical hardware changes. Private clouds can also be scaled, but this usually requires additional hardware or software and IT support, making them less dynamic.

- Upgrades: the public cloud requires mandatory upgrades every six months, whereas the private cloud allows organizations to dictate the cadence of system updates, such as opting for upgrades every five years or as needed.

- Configuration and Customization: in the public cloud configuration is more limited with fewer BAdIs and APIs available, and no modifications allowed. The private cloud allows for extensive configuration through IMG and permits SAP code modification, providing greater flexibility and control.

- Migration: the public cloud supports only greenfield implementation, which means only current positions can be migrated, not historical transactions. The private cloud offers migration programs from ECC, allowing historical data to be transferred.

Impact on Treasury Operations

The impact of SAP’s GROW (public cloud) and RISE (private cloud) solutions on treasury operations largely hinges on the degree of tailoring required by an organization’s treasury processes. If your treasury processes require minimal or no tailoring, both public and private cloud options could be suitable. However, if your treasury processes are tailored and structured around specific needs, only the private cloud remains a viable option.

In the private cloud, you can add custom code, modify SAP code, and access a wider range of configuration options, providing greater flexibility and control. In contrast, the public cloud does not allow for SAP code modification but does offer limited custom code through cloud BADI and extensibility. Additionally, the public cloud emphasizes efficiency and user accessibility through a unified interface (SAP Fiori), simplifying setup with self-service elements and expert oversight. The private cloud, on the other hand, employs a detailed system customization approach (using SAP Fiori & GUI), appealing to companies seeking granular control.

Another important consideration is the mandatory upgrades in the public cloud every six months, requiring you to test SAP functionalities for each activated scope item where an update has occurred, which could be strenuous. The advantage is that your system will always run on the latest functionality. This is not the case in the private cloud, where you have more control over system updates. With the private cloud, organizations can dictate the cadence of system updates (e.g., opting for yearly upgrades), the type of updates (e.g., focusing on security patches or functional upgrades), and the level of updates (e.g., maintaining the system one level below the latest is often used).

To accurately assess the impact on your treasury activities, consider the current stage of your company's lifecycle and identify where and when customization is needed for your treasury operations. For example, legacy companies with entrenched processes may find the rigidity of public cloud functionality challenging. In contrast, new companies without established processes can greatly benefit from the pre-delivered set of best practices in the public cloud, providing an excellent starting point to accelerate implementation.

Factors Influencing Choices

Organizations choose between public and private cloud options based on factors like size, compliance, operational complexity, and the degree of entrenched processes. Larger companies may prefer private clouds for enhanced security and customization capabilities. Startups to mid-size enterprises may favor the flexibility and cost-effectiveness of public clouds during rapid growth. Additionally, companies might opt for a hybrid approach, incorporating elements of both cloud models. For instance, a Treasury Sidecar might be deployed on the public cloud to leverage scalability and innovation while maintaining the main ERP system on-premise or on the private cloud for greater control and customization. This hybrid strategy allows organizations to tailor their infrastructure to meet specific operational needs while maximizing the advantages of both cloud environments.

Conclusion

Migrating ERP systems to the cloud can significantly enhance treasury operations with distinct options through SAP's public and private cloud solutions. Public clouds offer scalable, cost-effective solutions ideal for medium-to upper-medium-market enterprises with standard processes or without pre-existing processes. They emphasize efficiency, user accessibility, and mandatory upgrades every six months. In contrast, private clouds provide enhanced control, security, and customization, catering to larger enterprises with specific regulatory needs and the ability to modify SAP code.

Choosing the right cloud model for treasury operations depends on an organization's current and future customization needs. If minimal customization is required, either option could be suitable. However, for customized treasury processes, the private cloud is preferable. The decision should consider the company's lifecycle stage, with public clouds favoring rapid growth and cost efficiency and private clouds offering long-term control and security.

It is also important to note that SAP continues to offer on-premise solutions for organizations that require or prefer traditional deployment methods. This article focuses on cloud solutions, but on-premises remains a viable option for businesses that prioritize complete control over their infrastructure and have the necessary resources to manage it independently.

If you need help thinking through your decision, we at Zanders would be happy to assist you.

Commodity risk management has become a top CFO priority in some companies recently. Mastering commodity risk requires an integrated approach across business functions. SAP’s comprehensive solution can make a difference.

The recent periods of commodity price volatility have brought commodity risk management to the spotlight in numerous companies, where commodities constitute a substantial component of the final product, but pricing arrangements prevented a substantial hit of the bottom line in the past calm periods.

Understanding Commodity Risk Management is ingrained in the individual steps of the whole value chain, encompassing various business functions with different responsibilities. Purchasing is responsible for negotiating with the suppliers: the sales or pricing department negotiates the conditions with the customers; and Treasury is responsible for negotiating with the banks to secure financing and eventually hedge the commodity risk on the derivatives market. Controlling should have clarity about the complete value chain flow and make sure the margin is protected. Commodity risk management should be a top item on the CFO's list nowadays.

SAP's Solution: A Comprehensive Overview

Each of these functions need to be supported with adequate information system functionality and integrated well together, bridging the physical supply chain flows with financial risk management.

SAP, as the leading provider of both ERP and Treasury and risk management systems, offers numerous functionalities to cover the individual parts of the process. The current solution is the result of almost two decades of functional evolution. The first functionalities were released in 2008 on the ECC 6.04 version to support commodity price risk in the metal business. The current portfolio supports industry solutions for agriculture, oil, and gas, as well as the metal business. Support for power trading is considered for the future. In the recent releases of S/4HANA, many components have been redeveloped to reflect the experience from the existing client implementations, to better cover the trading and hedging workflow, and to leverage the most recent SAP technological innovations, like HANA database and the ABAP RESTful Application Programming Model (RAP).

Functionalities of SAP Commodity Management

Let us take you on a quick journey through the available functionalities.

The SAP Commodity Management solution covers commodity procurement and commodity sales in an end-to-end process, feeding the data for commodity risk positions to support commodity risk management as a dedicated function. In the logistics process, it offers both contracts and orders with commodity pricing components, which can directly be captured through the integrated Commodity Price Engine (CPE). In some commodity markets, products need to be invoiced before the final price is determined based on market prices. For this scenario, provisional and differential invoicing are available in the solution.

The CPE allows users to define complex formulas based on various commodity market prices (futures or spot prices from various quotation sources), currency exchange translation rules, quality and delivery condition surcharges, and rounding rules. The CPE conditions control how the formula results are calculated from term results, e.g., sum, the highest value, provisional versus final term. Compound pricing conditions can be replicated using routines: Splitting routines define how the formula quantity will be split into multiple terms, while Combination routines define how multiple terms will be combined together to get the final values.

Pricing conditions from active contracts and orders for physical delivery of commodities constitute the physical exposure position. Whether in procurement, in a dedicated commodity risk management department, or in the treasury department, real-time recognition and management of the company’s commodity risk positions rely on accurate and reliable data sources and evaluation functionalities. This is provided by the SAP Commodity Risk Management solution. Leveraging the mature functionalities and components of the Treasury and Risk Management module, it allows for managing paper trades to hedge the determined physical commodity risk position. Namely, listed and OTC commodity derivatives are supported. In the OTC area, swaps, forwards, and options, including the Asian variants with average pricing periods, are well covered. These instruments fully integrate into the front office, back office, and accounting functionalities of the existing mature treasury module, allowing for integrated and seamless processing. The positions in the paper deals can be included within the existing Credit Risk Analyser for counterparty risk limit evaluation as well as in the Market Risk Analyser for complex market risk calculations and simulations.

Managing Commodity Exposures

Physical commodity exposure and paper deals are bundled together via the harmonized commodity master data Derivative Contract Specification (DCS), representing individual commodities traded on specific exchanges or spot markets. It allows for translating the volume information of the physical commodity to traded paper contracts and price quotation sources.

In companies with extensive derivative positions, broker statement reconciliation can be automated via the recent product SAP Broker Reconciliation for Commodity Derivatives. This cloud-based solution is natively integrated into the SAP backend to retrieve the derivative positions. It allows for the automatic import of electronic brokers' statements and automates the reconciliation process to investigate and resolve deviations with less human intervention.

To support centralized hedging with listed derivatives, the Derivative Order and Trade execution component has been introduced. It supports a workflow in which an internal organizational unit raises a Commodity Order request, which in turn is reviewed and then fully or partially fulfilled by the trader in the external market.

Innovations in SAP Commodity Management

Significant innovations were released in the S/4HANA 2022 version.

The Commodity Hedge Cockpit supports the trader view and hedging workflow.

In the area of OTC derivatives (namely commodity swaps and commodity forwards), the internal trading and hedging workflow can be supported by Commodity Price Risk Hedge Accounting. It allows for separating various hedging programs through Commodity Hedging areas and defining various Commodity Hedge books. Within the Hedge books, Hedge specifications allow for the definition of rules for concluding financial trades to hedge commodity price exposures, e.g., by defining delivery period rules, hedge quotas, and rules for order utilization sequence. Individual trade orders are defined within the Hedge specification. Intercompany (on behalf of) trading is supported by the automatic creation of intercompany mirror deals, if applicable.

Settings under the hedge book allow for automatically designating cash flow hedge relationships in accordance with IFRS 9 principles, documenting the hedge relationships, running effectiveness checks, using valuation functions, and generating hedge accounting entries. All these functions are integrated into the existing hedge accounting functionalities for FX risk available in SAP Treasury and Risk Management.

The underlying physical commodity exposure can be uploaded as planned data reflecting the planned demand or supply from supply chain functions. The resulting commodity exposure can be further managed (revised, rejected, released), or additional commodity exposure data can be manually entered. If the physical commodity exposure leads to FX exposure, it can be handed over to the Treasury team via the automated creation of Raw exposures in Exposure Management 2.0.

Modelled deals allow for capturing hypothetical deals with no impact on financial accounting. They allow for evaluating commodity price risk for use cases like exposure impact from production forecasts, mark-to-intent for an inventory position (time, location, product), and capturing inter-strategy or late/backdated deals.

Even though a separate team can be responsible for commodity risk management (front office) - and it usually is - bundling together the back office and accounting operations under an integrated middle and back office team can help to substantially streamline the daily operations.

Last but not least, the physical commodity business is usually financed by trade finance instruments. SAP has integrated Letters-of-Credit, as well as Guarantees into the Treasury module and enhanced the functionality greatly in 2016.

All-in-all, every commodity-driven business, upstream or downstream, consumer or producer, works under different setups and business arrangements. The wide variety of available functionalities allows us to define the right solution for every constellation. Especially with commodity management functionalities active in the supply chain modules of the ERP system, SAP commodity risk management can offer a lot of efficiencies in an integrated and streamlined solution. We are happy to accompany you on the journey of defining the best solution for your enterprise.

Mergers, divestments, and other M&A activities reshape Treasury management, posing strategic challenges for Treasurers as they navigate disentanglement and build Treasury functions for stand-alone companies.

The corporate landscape is continuously reshaped by strategic realignments such as mergers, divestments, and other M&A activities, wherein a company divests a portion of its business or acquires other businesses to refocus its operations or unlock shareholder value. These transactions greatly affect Treasury management, influencing cash flow, banking structures, financial risk management, financing, and technology. This article explores the challenges Treasurers face during the disentanglement or carve-out process, emphasizing the need for strategic realignment of Treasury activities and focusing on the Treasury perspective of a divesting company. It acknowledges the transitional complexities that arise and the demand for agile response strategies to safeguard against financial instability. We will have a look at the special carve-out situation of building a Treasury function for a stand-alone company in a second part of this article.

Treasury Challenges in Carve-Out Situations

In the dynamic world of corporate restructuring, carve-outs present both a new frontier of opportunity and a multifaceted challenge for Treasurers. While divesting a part of an organization can streamline focus and potentially increase shareholder value, it can place unique pressures on treasury management to reassess and realign financial strategies.

When a corporation decides to execute a carve-out, the Treasury immediately takes on the critical task of separating financial operations and managing transitional service agreements. From the perspective of the divesting company, preserving liquidity and ensuring compliance with financial covenants is a key priority. This intricate division process demands the disentanglement of complex cash flows, re-evaluation and unwinding of cash pooling and internal as well as external debt structures, as well as a review of financial risk and investment policies. Such an endeavour requires rigorous planning and flawless execution to ensure that operational continuity is maintained. Additionally, it requires going into the details, such as the allocation of planning objects (e.g., vendor contracts, machines, vehicles) to the right business for purposes of liquidity forecasting.

Our experience shows that factors like company revenue, industry complexity, and operating countries affect the volume and frequency of treasury transactions. This can increase complexity and workload, especially for intricate transactions. An interesting remark is that carve-out transactions also impact the remaining group. Potentially, the geographic footprint is smaller, or the number of individual business models within the group is less than before – with a significant impact on Treasury.

The Role of Technology in Carve-Outs

A key component in the disentanglement process is represented by Treasury technology. In evaluating treasury technology during a carve-out, scrutiny of the landscape and meticulous planning are paramount to ensuring a smooth transition. The systems must not only handle specific needs such as segmenting data, independent entity reporting, and tracking discrete cash flows and risks, but they must also facilitate a seamless detachment and swift reconfiguration for the newly autonomous entities in the course of the disentanglement of a business. It is essential that these systems support operational independence and continuity with minimal disruptions during the restructuring process.

Implementing the right technology for the new entity, e.g., to cover stand-alone requirements, is crucial. It must meet current transaction needs and be robust enough to handle future demands. Given our breadth of experience across various technological domains and in various M&A scenarios, we have enriched many discussions on which solutions possess the adaptability and scalability necessary to accommodate the evolving needs of a redefined business. 'Right-sizing' the systems, structures, and processes, tailored specifically to the unique contours of the carved-out entity, is a decisive factor for laying the groundwork for sustainable success post-divestiture.

Strategic Realignment for Treasury

Any M&A transaction significantly changes the Treasury Process Map for both the remaining group and the carved-out entity. It has inherited risk and different risk types. We think that Treasury should deal with operational risks first, such as filling resource needs and/or stabilizing business operations. The resource issue requires an analysis of the available employees and their specific skill sets. Onboarding interim resources and back-filling resource gaps until the onboarding of dedicated new staff are alternative options to cover shortfalls.

The operational issue focuses on the impact on cash management and payment operations. Treasury needs to assess the impact on the existing banking and cash management structure and on liquidity as funds received by one entity are required by another. Bank relationships are foundational to Treasury operations and must be revisited and sometimes reinvented. Treasuries must work diligently to maintain trust and communication with old and new banking partners, articulating changes in the company's profile, needs, objectives, and strategies. Beyond negotiation and administration, the process often entails renegotiating terms and ensuring that the newly formed entity's financial needs will continue to be met effectively. The technical and operational ability to execute and receive payments through the company’s (new) bank accounts is a core requirement, which needs to be at the top of the list of priorities. Next, centralization of liquidity and cash structures is essential to avoid cash drag if inflows cannot be invested and/or concentrated in a relatively short time.

Treasury may also deal with different types of financial risk, such as interest rate or foreign exchange exposures. The financial risk management perspective is a crucial one for companies, but in the context of carve-out activities, it is often a second-order priority (depending on the financial risk profile of a company). However, proper identification and assessment of financial risk shall always be a top priority in a disentanglement process. Process implementation can be approached following the establishment of sound business and treasury processes if there is no significant financial risk.

If your organization is contemplating or in the midst of a carve-out, contact Zanders for support. Our consultative expertise in Treasury is your asset in ensuring financial stability and strategic advantage during and post-carve-out. Let Zanders be your partner in transforming challenges into successes.

Explore the crucial role of treasury in value creation and financial performance in private equity.

The evolving economic landscape has placed a spotlight on the critical role of treasury in value creation. Our latest roundtable, themed ‘Treasury’s Role in Value Creation,’ delved into the challenges and strategies private equity firms must navigate to enhance financial performance and prepare for successful exits. This event gathered industry leaders to discuss the expectations from treasury functions, the integration of post-merger processes, and the use of innovative technologies to drive growth. Read more as we explore the insights and key takeaways from this engaging and timely discussion, offering a roadmap for treasurers to elevate their impact within portfolio companies.

Roundtable theme: Treasury’s Role in Value Creation

The roundtable’s theme, ‘Treasury’s Role in Value Creation,’ was chosen to address the pressing economic and operational challenges that resulted in longer holding periods and slowed exits in 2023. In this context, private equity firms are increasingly focusing on growth and optimization strategies to drive long-term financial performance improvements, positioning their portfolio companies for successful exits once deal markets rebound. Key questions explored included: What is expected from the treasury function? How can treasurers navigate priorities and challenges to deliver productivity, financial performance, and value-added analysis to their company and PE sponsor? How can successful treasury post-merger integration be achieved in a buy & build scenario? And how should one prepare for an exit?

Key Insights and Strategic Directions

One of the significant discussion points was the value of cash management as a directly measurable lever of value creation. The panel emphasized the importance of focusing on free cash flow, EBITDA, and debt levels, which form the backbone of a successful investment. These metrics are crucial during due diligence, as they are scrutinized by Limited Partners (LPs). The consensus advocated for a focus on organic growth and business transformation over multiple expansions, which can signal stability and long-term value to LPs, and therefore add significant value to PE firms.

Moreover, it was discussed that, LPs intensely evaluate the financial models of portfolio companies, focusing on recurring revenue, Capex, margins, and debt levels. These factors often determine the soundness of an investment. The robustness of financial operations and the sophistication of the technologies employed are crucial in investment decisions, underscoring the important role of treasury in due diligence.

Enhancing ‘Buy and Build’ Strategies

Effective cash management was highlighted as a key factor influencing the success of ‘buy and build’ strategies, which involve acquiring companies and then integrating and growing them to enhance value. Effective cash management ensures the necessary liquidity and financial oversight during the integration and growth phases. An attendee noted that firms often "buy but forget to build." Quantifying the impact of effective treasury management is essential to addressing this gap.

A way of realizing operational improvements is through increased automation. Despite some pushback from PE firms on automating treasury functions, there are instances where sponsors are willing to invest in technologies to support the treasury function. For instance, an attendee mentioned receiving a sponsor’s support to invest in technology that will improve cash flow forecasting. Additionally, the approach to value creation at the portfolio company level depends on the sponsor's type and level of commitment.

The use of Artificial Intelligence (AI) in search of value creation was also discussed. Notably, various tangible use cases for AI in Treasury are envisaged. One example highlighted was ASML’s use of AI for forecasting optimization. Even though the large chip-manufacturer is not PE-owned, ASML’s use of AI for forecasting optimization served as a prime example in the discussion. In 2023, ASML implemented an AI-powered material intake forecast model to enhance the effectiveness and efficiency of its purchase FX hedging program1. This sharpened focus on FX risk management is a visible trend across private market firms. Deploying more sophisticated tools to increase FX hedging effectiveness at the PE fund or portfolio company level is an area worth exploring.

Looking Ahead

We reflect on a successful inaugural edition of the Private Equity Roundtable. We learned that effective cash management is crucial for value creation, focusing on free cash flow, EBITDA, and debt levels to ensure liquidity and financial oversight, particularly in ‘buy and build’ strategies. Moreover, automation and technology investments in treasury functions, such as improved cash flow forecasting, are essential for operational improvements and enhancing value creation in portfolio companies. After the event, participants shared that the event added significant value to their roles as treasurers of PE-owned companies. The positive feedback energizes us to organize similar sessions in other countries.

Is your company about to be or already owned by private equity? We can share our experiences regarding the added complexities of being a treasurer for a PE-owned company. For further information, you can reach out to Pieter Kraak.

As businesses continue to face challenges and uncertainty, it’s time to pick up the pace of change. And to do this corporate treasury requires a new roadmap.

This article highlights key points mentioned in our whitepaper: Treasury 4.x - The age of productivity, performance and steering. You can download the full whitepaper here.

Summary: Resilience amid uncertainty

Tectonic geopolitical shifts leading to fragile supply chains, inflation, volatility on financial markets and adoption of business models, fundamental demographic changes leading to capacity and skill shortages on relevant labor markets – a perpetual stream of disruption is pushing businesses to their limits, highlighting vulnerabilities in operations, challenging productivity, and leading to damaging financial consequences. Never has there been a greater need for CFOs to call on their corporate treasury for help steering their business through the persistent market and economic volatility. This is accelerating the urgency to advance the role of treasury to perform this broadened mandate. This is where Treasury 4.x steps in.

Productivity. Performance. Steering.

Treasury deserves a well-recognized place at the CFO's table - not at the edge, but right in the middle. Treasury 4.x recognizes the measurable impact treasury has in navigating uncertainty and driving corporate success. It also outlines what needs to happen to enable treasury to fulfil this strategic potential, focusing on three key areas:

1. Increasing productivity: Personnel, capital, and data – these three factors of production are the source of sizeable opportunities to drive up efficiency, escape an endless spiral of cost-cutting programs and maintain necessary budgets. This can be achieved by investing in highly efficient, IT-supported decision-making processes and further amplified with analytics and AI. Another option is outsourcing activities that require highly specialized expert knowledge but don’t need to be constantly available. It’s also possible to reduce the personnel factor of production through substitution with the data factor of production (in this context knowledge) and the optimization of the capital factor of production. We explain this in detail in Chapter 4 – Unlocking the power of productivity.

2. Performance enhancements: Currency and commodity price risk management, corporate financing, interest rate risk management, cash and liquidity management and, an old classic, working capital management – it’s possible to make improvements across almost all treasury processes to achieve enhanced financial results. Working capital management is of particular importance as it’s synonymous with the focus on cash and therefore, the continuous optimization of processes which are driving liquidity. We unpick each of these performance elements in Chapter 5 – The quest for peak performance.

3. Steering success: Ideologically, the door has opened for the treasurer into the CFO’s room. But many uncertainties remain around how this role and relationship will work in practice, with persistent questions around the nature and scope of the function’s involvement in corporate management and decision-making. In this document, we outline the case for making treasury’s contribution to decision-making parameters available at an early stage, before investment and financing decisions are made. The concept of Enterprise Liquidity Performance Management (ELPM) provides a more holistic approach to liquidity management and long-needed orientation. This recognizes and accounts for cross-function dependencies and how these impact the balance sheet, income statement and cash flow. Also, the topic of company ratings bears further opportunities for treasury involvement and value-add: through optimization of both tactical and strategic measures in processes such as financing, cash management, financial risk management and working capital management. These are the core subjects we debate in Chapter 6 – The definition of successful steering.

The foundations for a more strategic treasury have been in place for years as part of a concept which is named Treasury 4.0 . But now, as businesses continue to face challenges and uncertainty, it’s time to pick up the pace of change. And to do this corporate treasury requires a new roadmap.