As a monetary policymaker your actions are examined closely. We add an extra layer of analytical vigor and independent risk insight to how you form policy and manage assets.

Maintaining stability in monetary systems has never been more complex for central banks. We empower you with frameworks and modeling to help detect risks early, add resilience to how you enforce guidance and giving you the clarity to proactively address any looming threats to financial stability.

We bring an objective dose of analytical vigour combined with banking and markets knowledge to help you review risk and apply market best practice in a robust and pragmatic way.

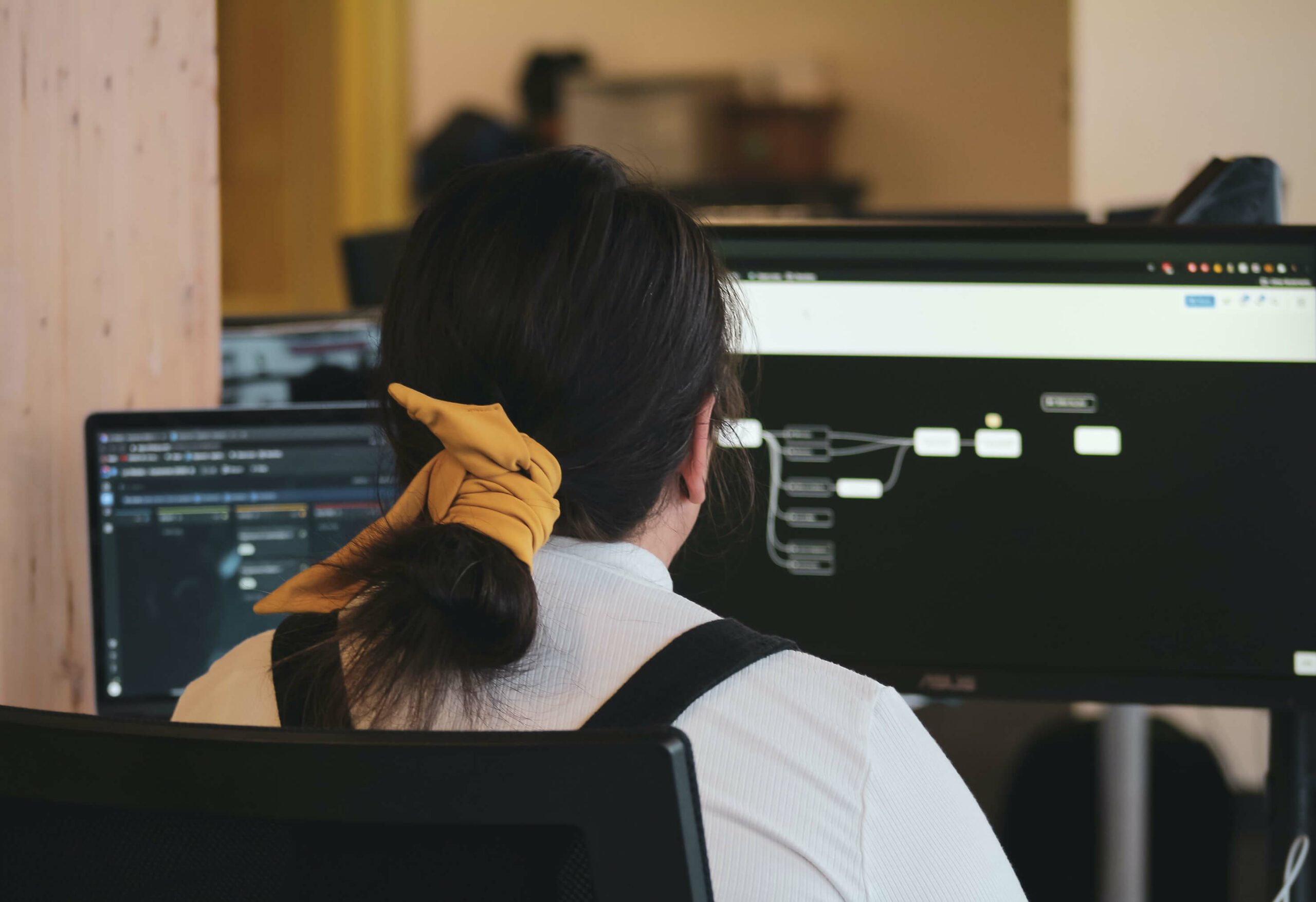

From data modelers and risk experts, to bankers with real world experience of loan book and quality reviews – when you need to adapt quickly to changing situations and understand the impact of emerging challenges, we provide niche expertise to support your team.