How can banks manage climate-related and environmental financial risks

Climate and environmental changes are viewed among the most important risks in society at present.

As the financial sector is key for the transition towards a low-carbon and more circular economy, financial institutions have to deal with climate-related and environmental financial risks (C&E risks). At the same time, the increased importance of these C&E risks also presents new business opportunities for the financial sector. Therefore, to support banks in their self-assessment and action plans, Zanders developed a Scan & Plan Solution on C&E risks.

According to the 2021 World Economic Forum Global Risk Report1, extreme weather, climate action failure, human environmental damage and biodiversity loss are ranked as four of the top five global risks by highest likelihood and four of the six global risks with the largest impact. It is not surprising that over the past years, numerous articles on C&E risks have been published and many initiatives have been taken to identify, measure and manage these risks. The Paris Agreement2, the United Nations 2030 Agenda for Sustainable Development3 and more recently the European Green Deal4 are the main examples of international governmental responses to address C&E risks.

The financial sector is considered key for the transition towards a low-carbon and more circular economy. This is illustrated by the fact that the European Central Bank (ECB) has identified climate-related risks as a key risk driver for the euro area banking system in their Single Supervisory Mechanism Risk Map5. At the same time, the increased importance of C&E risks also presents new business opportunities for the financial sector, such as providing sustainable financing solutions and offering new financial instruments that facilitate C&E risk management. To illustrate, the UN’s Intergovernmental Panel on Climate Change6 (IPCC) estimates that the required investment for alignment with the Paris Agreement would be at least $3.5tn per year until 2050 for the energy sector alone.

To address C&E risks, the ECB published a Guide on climate-related and environmental risks7 for banks that describes the ECB’s supervisory expectations related to risk management and disclosure. Banks are required by the ECB to perform a self-assessment with respect to the supervisory expectations and to draft an action plan in 2021. The self-assessments and plans will subsequently be reviewed and challenged by the ECB as part of the supervisory dialogue. In 2022, the ECB will conduct a full supervisory review of bank’s practices related to C&E risks.

The Zanders Scan & Plan Solution provides clear insights into gaps with the ECB expectations and proposes practical actions that are tailored to a bank’s nature, scale and complexity. This article provides a brief explanation of C&E risks, outlines a few specific ECB supervisory expectations and elaborates on the Solution.

Definition of C&E risk

Financial risks from climate and environmental change arise from two primary risk categories:

- Physical risks. The first risk category concerns physical risks caused by acute (direct events) or chronic (longer-term events which cause gradual deterioration) C&E events. Examples of acute events are floods, wildfires and heatwaves, whereas chronic events relate to the likes of rising sea levels, acidity and biodiversity losses, for example.

- Transition risks. The second risk category comprises transition risks resulting from the process of moving towards a low-carbon economy. Changes in policy, regulation, technology, market sentiment and consumer sentiment could destabilize markets, tighten financial conditions and lead to procyclicality of losses.

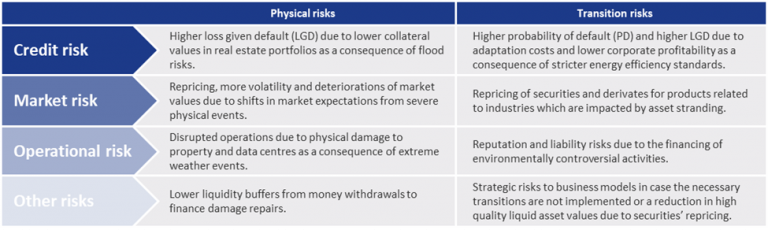

These two risk categories are distinct from other risk categories in the following aspects: 1) they have a correlated and non-linear impact on all business lines, sectors and geographies, 2) they have a long-term nature and 3) the future impact is largely dependent on short-term actions. The risk categories are, among others, drivers of credit, market and operational risk, as shown in Figure 1.

Figure 1: Examples of the impact of physical risks and transition risks on traditional risk types from the ECB Guide on climate-related and environmental risks.

ECB Supervisory Expectations

In the Guide on climate-related and environmental risks7, published in November 2020, the ECB explains that banks are expected to reflect C&E risks as drivers of existing risk categories (e.g., credit risk, market risk, operational risk) rather than as a separate risk type. This indicates that not only efforts should be made by banks to develop risk management practices related to C&E risks but that these practices should also be integrated in existing risk management frameworks, models and policies.

The ECB Guide covers four main areas. First, in relation to ‘business models and strategy’, the ECB expects banks to understand the impact of C&E risks on their business environment and integrate C&E risks in their business strategy. Secondly, the guide addresses ‘governance and risk appetite’. The ECB expects a bank’s management to include C&E risks in the risk appetite framework, assign responsibilities related to C&E risks to the three lines of defense and establish internal reporting. Thirdly, in relation to ‘risk management’, the ECB expects that banks integrate C&E risks into their existing risk management framework. Finally, regarding ‘disclosures’, the ECB expects banks to disclose meaningful information and metrics on C&E risks. The four above-mentioned areas are covered in 13 expectations, which are in turn further divided in 46 sub-expectations. Banks are required by the ECB to perform a self-assessment with respect to the supervisory expectations and to draft an action plan in 2021. The self-assessments and plans will subsequently be reviewed and challenged by the ECB as part of the supervisory dialogue. The ECB recommends National Competent Authorities, in their supervision of less significant institutions, to apply these expectations proportionate to the nature, scale and complexity of the bank’s activities.

Zanders has thoroughly analyzed all (sub)-expectations and has highlighted a few specific expectations including possible actions below.

Expectation 4.2: Institutions are expected to develop appropriate key risk indicators (KRI) and set appropriate limits for effectively managing climate-related and environmental risks in line with their regular monitoring and escalation arrangements.

Here, the ECB expects institutions to monitor and report their exposures to C&E risks based on current data and forward-looking estimations. In addition, institutions are expected to assign quantitative metrics to C&E risks. It is however acknowledged that, since definitions, taxonomies and methodologies are still under development, qualitative metric or proxy data can be used as long as specific quantitative metrics are not yet available. The ECB deems that the metrics should reflect the long-term nature of climate change, and explicitly consider different paths for temperature and greenhouse gas emissions. Finally, the ECB expects institutions to define limits on the metrics based on the risk appetite regarding C&E risks.

This expectation has various elements to it, and Zanders has defined as the most important and first step to identify the internal and external data availability related to C&E risks. If the data availability allows it, an institution should set up quantitative metrics and limits on these metrics that reflect C&E risks. A first step to achieve this would be to define several firmwide KRIs, for example by limiting the carbon emission of the whole portfolio in line with the Paris Agreement2 or other (inter)national climate agreements. These KRIs can then be cascaded down to business lines and/or portfolios, such as limiting the exposure to specific sectors with large carbon footprints or substantial use of water. If the current data availability does not allow for quantitative metrics, the bank should identify which data is still lacking and assess ways to collect this data from internal data sources or external data providers in the course of time. In the meantime, qualitative metrics or proxies could be developed such as a qualitative score for the sophistication of the climate strategy of large corporates in the portfolio.

Should a bank already have some metrics in place, Zanders advises to evaluate if these metrics sufficiently cover all material physical and transition C&E risks that the bank is expected to face and if there are ways to increase the sophistication of these metrics, for example by including forward-looking estimations. Finally, Zanders advises banks to create a monitoring procedure to ensure that these metrics and their limits are evaluated regularly.

Expectation 8.1: Climate-related and environmental risks are expected to be included in all relevant stages of the credit-granting process and credit processing.

In this expectation, the ECB underlines that banks should identify and assess material factors that affect the default risk of loan exposures. The quality of the client’s own management of C&E risks may be taken into account in this case. In addition, banks are expected to consider changes in the credit risk profiles based on sectors and geographical areas.

The way to address this expectation is highly dependent on the nature of the bank, on the existing credit granting process and on the availability of data. Some examples of including C&E risk in the credit granting process in a qualitative way, which Zanders has observed in the market, are the development of shadow PD models that trigger mitigating actions in case of large discrepancies with the regular PDs, or the introduction of a scorecard based on quantitative as well as qualitative aspects.

It should be noted that these and other solutions are not mutually exclusive and that multiple approaches can be adopted for different parts of the portfolio. Also, the efforts for several individual expectations can be combined. For example, taking C&E risks into account in the credit granting process could also be linked to the qualitative and quantitative metrics set as part of expectation 4.2 (see above). The quality of the client’s own management of C&E risks can for instance be measured based on the qualitative score for the climate strategy sophistication of large corporates mentioned above.

Expectation 11: Institutions with material climate-related and environmental risks are expected to evaluate the appropriateness of their stress testing, with a view to incorporating them into their baseline and adverse scenarios.

This expectation indicates that banks should evaluate the appropriateness of their stress testing in relation to C&E risks. In this evaluation, the bank should take into account the following considerations: i) how will the bank be affected by physical and transition risks, ii) how will C&E risks evolve under various scenarios (thereby taking into account that these risks may not fully be reflected in historical data), and iii) how may C&E risks materialize in the short-, medium- and long-term. Based on these considerations and on scientific climate change pathways as well as on assumptions that fit with their risk profile and individual specification, banks should incorporate C&E risks in their baseline and adverse scenarios.

To address this recommendation, Zanders advises banks to first identify C&E risks scenarios with different severities based on the materiality of C&E risks for the bank. Examples of this include early or late transition to a low-carbon economy (transition risk), introduction of a carbon tax (transition risk) or staying below or above a 2°C temperature increase (physical risk). These scenarios could be based on scientific scenarios from the IPCC8 or the International Energy Agency9. The next step is to translate these scenarios into macro-economic variables, such as GDP, inflation and loan valuations, over a range of relevant sectors and geographies. Since there is not yet a single methodology to do this, banks need to be creative and combine new qualitative and quantitative approaches with existing modeling methodologies.

Zanders Scan & Plan Solution

To manage C&E risks, to seize new business opportunities and to meet the regulatory expectations related to C&E risks, it is crucial for banks to have transparency about their exposure to these risks. To support banks with this, the Zanders Scan & Plan Solution is available. The Scan assesses the gaps between the bank’s current practices and each of the expectations in the ECB guide. These gaps are scored based on a pre-defined scoring system and are shown in a heatmap that is easy to interpret. Subsequently, the Plan proposes possible actions to close the identified gaps. These possible actions will be tailored to the nature, scale, and complexity of the bank and to the level of sophistication of the bank in the field of C&E risks. The Scan & Plan will be provided in the form of a detailed report.

Zanders has previously supported clients on topics related to climate change, published market insights and supported research. In addition, Zanders has broad experience in supporting clients in each of the areas of the ECB guide: business models and strategy, governance and risk appetite, risk management and disclosure. Hence, Zanders is in an excellent position to also support banks with the implementation of the proposed actions from the Scan & Plan or with shaping new business activities related to C&E risks.

To learn more about the Zanders Scan & Plan solution and how Zanders can support your institution with managing C&E risks, please contact Petra van Meel, Marije Wiersma or Pieter Klaassen.