Blog

IFRS 18: What Treasury Needs to Know Now

IFRS 18 introduces significant changes to FX classification and reporting requirements by January 2027. Despite that this adoption date still feels quite far away, there is quite some time

Find out more

After the long-acknowledged fact that global warming has catastrophic consequences, it is also increasingly recognized that climate change will impact the financial industry.

The Bank of England is even of the opinion that climate change represents the tragedy of the horizon: “by the time it is clear that climate change is creating risks that we want to reduce, it may already be too late to act” [1]. This article provides a summary of the type of financial risks resulting from climate change, various initiatives within the financial industry relating to the shift towards a low-carbon economy, and an outlook for the assessment of climate change risks in the future.

At the December 2015 Paris Agreement conference, strict measures to limit the rise in global temperatures were agreed upon. By signing the Paris Agreement, governments from all over the world committed themselves to paving a more sustainable path for the planet and the economy. If no action is taken and the emission of greenhouse gasses is not reduced, research finds that per 2100, the temperature will have increased by 3°C to 5°C2.. Climate change affects the availability of resources, the supply and demand for products and services and the performance of physical assets. Worldwide economic costs from natural disasters already exceeded the 30-year average of USD 140 billion per annum in seven out of the last ten years. Extreme weather circumstances influence health and damage infrastructure and private properties, thereby reducing wealth and limiting productivity. According to Frank Elderson, Executive Director at the DNB, this can disrupt economic activity and trade, lead to resource shortages and shift capital from more productive uses to reconstruction and replacement3.

According to the Bank of England, financial risks from climate change come down to two primary risk factors4:

Increasing concerns about climate change has led to a shift in the perception of climate risk among companies and investors. Where in the past analysis of climate-related issues was limited to sectors directly linked to fossil fuels and carbon emissions, it is currently being recognized that climate-related risk exposures concern all sectors, including financials. Banks are particularly vulnerable to climate-related risks as they are tied to every market sector through their lending practices.

These two climate-related risk factors increase credit risk, market risk and operational risk and have distinctive elements from other risk factors that lead to a number of unique challenges. Firstly, financial risks from physical and transition risk factors may be more far-reaching in breadth and magnitude than other types of risks as they are relevant to virtually all business lines, sectors and geographies, and little diversification is present. Secondly, there is uncertainty in timing of when financial risks may be realized. The possibility exists that the risk impact falls outside of current business planning horizons. Thirdly, despite the uncertainty surrounding the exact impact of climate change risks, combinations of physical and transition risk factors do lead to financial risk. Finally, the magnitude of the future impact is largely dependent on short-term actions.

Many parties in the financial sector acknowledge that although the main responsibility for ensuring the success of the Paris Agreement and limiting climate change lies with governments, central banks and supervisors also have responsibilities. Consequently, climate change and the inherent financial risks are increasingly receiving attention, which is evidenced by the various recent initiatives related to this topic.

The Network of Central Banks and Supervisors for Greening the Financial System (NGFS) is an international cooperation between central banks and regulators6. NGFS aims to increase the financial sector’s efforts to achieve the Paris climate goals, for example by raising capital for green and low-carbon investments. NGFS additionally maps out what is needed for climate risk management. DNB and central banks and regulators of China, Germany, France, Mexico, Singapore, UK and Sweden were involved from the start of NGFS in 2017. The ECB, EBA, EIB and EIOPA are currently also part of the network. In the first progress report of October 2018, NGFS acknowledged that regulators and central banks increased their efforts to understand and estimate the extent of climate and environmental risks. They also noted, however, that there is still a long way to go.

In their first comprehensive report of April 2019, NGFS drafted the following six recommendations for central banks, supervisors, policymakers and financial institutions, which reflect best practices to support the Paris Agreement7:

All these recommendations require the joint action of central banks and supervisors. They aim to integrate and implement earlier identified needs and best practices to ensure a smooth transition towards a greener financial system and a low-carbon economy. Recommendations 1 and 5, which are two of the main recommendations, require further substantiation.

Future deliverables of NGFS consist of drafting a handbook on climate and environmental risk management, voluntary guidelines on scenario-based climate change risk analysis and best practices for including sustainability criteria into central banks’ portfolio management.

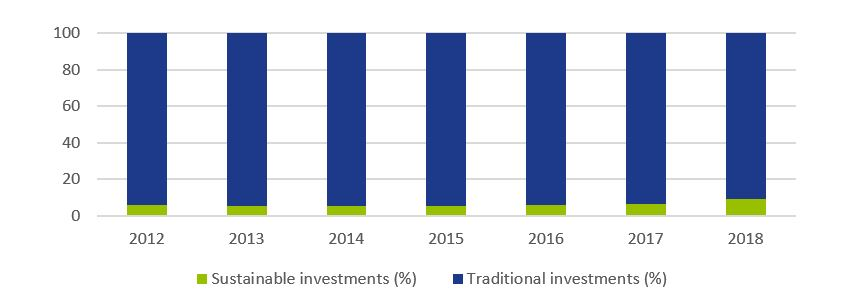

To achieve the climate goals of the Paris Agreement, €180 billion is required on an annual basis5. It is not possible to acquire such a large amount from the public sector alone and currently only a fraction of investor capital is being invested sustainably. Research from Morningstar shows that 11.6% of investor capital in the stock market and 5.6% in the bond market is invested sustainably9. Figure 1 shows that even though the percentage of capital invested in sustainable investment funds (stocks and bonds) is growing in recent years, it is still worryingly low.

Figure 1: Percentage of invested capital in Europe in traditional and sustainable investment funds (shares and bonds). Source: Morningstar [9].

The current levels of investment are not enough to support an environmentally and socially sustainable economic system. As a result, the European Commission (EC) has raised four initiatives through the Technical Expert Group on sustainable finance (TEG) that are designed to increase sustainable financing10. The first initiative is the issuance of two kinds of green (low-carbon) benchmarks. Offering funds or trackers on these indices would lead to an increase in cash flows towards sustainable companies. Secondly, an EU taxonomy for climate change mitigation and climate change adaptation has been developed. Thirdly, to enable investors to determine to what extent each investment is aligned with the climate goals, a list of economic activities that contribute to the execution of the Paris Agreement has been drafted. Finally, new disclosure requirements should enhance visibility of how investment firms integrated sustainability into their investment policy and create awareness of the climate risks the investors are exposed to.

Within the insurance sector, the Prudential Regulation Authority (PRA) requires insurers to follow a strategic approach to manage the financial risks from climate change. To support this, in July 2018, the Bank of England (BoE) formed a joint working group focusing on providing practical assistance on the assessment of financial risks resulting from climate changes. In May 2019, the working group issued a six-stage framework that helps insurers in assessing, managing and reporting physical climate risk exposure due to extreme weather events11. Practical guidance is provided in the form of several case studies, illustrating how considering the financial impacts can better inform risk management decisions.

Another initiative is the Climate Financial Risk Forum (CFRF), a joint initiative of the PRA and the Financial Conduct Authority (FCA)12. The forum consists of senior representatives of the UK financial sector from banks, insurers and asset managers. CFRF aims to build capacity and share best practices across financial regulators and the industry to enhance responses to the financial climate change risks. The forum set up four working groups focusing on risk management, scenario analysis, disclosure and innovation. The purpose of these working groups, which consist of CFRF members as well as other experts such as academia, is to provide practical guidance on each of the four focus areas.

On 5 June 2019, the TCFD published a Status Report assessing a disclosure review on the extent to which 1,100 companies included information aligned with these TCFD recommendations in their 2018 reports. The report also assessed a survey on companies’ efforts to live up to TCFD recommendations and users’ opinion on the usefulness of climate-related disclosures for decision-making13. Based on the disclosure review and the survey, TCFD concluded that, while some of the results were encouraging, not enough companies are disclosing climate change-linked financial information that is useful for decision-making. More specifically, it was found that:

Further, the BoE finds that despite the progress, there is still a long way to go: while many banks are incorporating the most immediate physical risks to their business models and assess exposures to transition risks, many of them are not there yet in their identification and measurement of the financial risks. They stress that governments, financial firms, central banks and supervisors should work together internationally and domestically, private sector and public sector, to achieve a smooth transition to a low-carbon economy. Mark Carney, Governor of the BoE, is optimistic and argues that, conditional on the amount of effort, it should possible to manage the financial climate risks in an orderly, effective and productive manner4.

With respect to the future, Frank Elderson made the following claim: “Now that European banking supervision has entered a more mature phase, we need to retain a forward-looking strategy and develop a long-term vision. Focusing on greening the financial system must be a part of this.”3.

References

1 https://www.bankofengland.co.uk/-/media/boe/files/speech/2019/avoiding-the-storm-climate-change-and-the-financial-system-speech-by-sarah-breeden.pdf

2 https://public.wmo.int/en/media/press-release/wmo-climate-statement-past-4-years-warmest-record

3 https://www.bankingsupervision.europa.eu/press/interviews/date/2019/html/ssm.in190515~d1ab906d59.en.html

4 https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/report/transition-in-thinking-the-impact-of-climate-change-on-the-uk-banking-sector.pdf

5 https://fd.nl/achtergrond/1294617/beleggers-moeten-met-de-billen-bloot-over-klimaatrisico-s

6 https://www.dnb.nl/over-dnb/samenwerking/network-greening-financial-system/index.jsp

7 https://www.banque-france.fr/sites/default/files/media/2019/04/17/ngfs_first_comprehensive_report_-_17042019_0.pdf

8 https://www.fsb-tcfd.org/publications/final-recommendations-report/

9 http://www.morningstar.nl/nl/

10 https://ec.europa.eu/info/publications/sustainable-finance-technical-expert-group_en

11 https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/publication/2019/a-framework-for-assessing-financial-impacts-of-physical-climate-change.pdf

12 https://www.bankofengland.co.uk/news/2019/march/first-meeting-of-the-pra-and-fca-joint-climate-financial-risk-forum

13 https://www.fsb-tcfd.org/wp-content/uploads/2017/06/FINAL-2017-TCFD-Report-11052018.pdf

IFRS 18 introduces significant changes to FX classification and reporting requirements by January 2027. Despite that this adoption date still feels quite far away, there is quite some time

Find out moreBuilding on the June 2024 launch of the new EU AML/CFT framework and the creation of the Anti-Money Laundering Authority (AMLA), SupTech (short for Supervisory Technology) now stands as a key

Find out moreAs the European Union increasingly emphasizes robust digital resilience within the financial sector as of January 17th 2025, the Digital Operational Resilience Act (DORA) has become a critical

Find out moreManaging banking book risk remains a critical challenge in today’s financial markets and regulatory environment. There are many strategic decisions to be made and banks are having trouble

Find out moreOn July 2nd, the European Banking Authority (EBA) published a Consultation Paper proposing amendments to its 2016 Guidelines on the application of the definition of default (DoD). As part of the

Find out moreArtificial intelligence (AI) is advancing rapidly, particularly with the emergence of large language models (LLMs) such as Generative Pre-trained Transformers (GPTs). Yet, in quantitative risk

Find out moreIn an industry where growth is often measured in multiples, and value creation is expected to be both scalable and repeatable, operational excellence is no longer a supporting function—it’s

Find out moreWith extreme weather events becoming more frequent and climate policy tightening across jurisdictions, banks are under increasing pressure to understand how climate change will impact their

Find out moreWith the introduction of CRR3, effective from January 1, 2025, the ‘extra’ guarantee on Dutch mortgages – known as the Dutch National Mortgage Guarantee (NHG) – will no longer be

Find out moreAccording to the IFRS 9 standards, financial institutions are required to model probability of default (PD) using a Point-in-Time (PiT) measurement approach — a reflection of present

Find out moreInflows from open reverse repos In May 2024 the EBA stated1 that inflows from open reverse repos cannot be recognised in LCR calculations unless the call option has already been

Find out moreThis article is intended for finance, risk, and compliance professionals with business and system integration knowledge of SAP, but also includes contextual guidance for broader audiences. 1.

Find out moreOur team at Zanders has been at the forefront of implementing BACS AUDDIS (Automated Direct Debit Instruction Service) with SAP S/4HANA, helping clients to streamline their direct debit

Find out moreThailand's e-Withholding Tax (e-WHT) system officially launched on October 27, 2020, in collaboration with 11 banks, marking a significant digital transformation with far-reaching benefits for

Find out moreIn today’s rapidly evolving financial landscape, fortifying the Financial Risk Management (FRM) function remains a top priority for CFOs. Zanders has identified a growing trend among

Find out moreEmergence of Artificial Intelligence and Machine Learning The rise of ChatGPT has brought generative artificial intelligence (GenAI) into the mainstream, accelerating adoption across

Find out moreIntroduction In December 2024, FINMA published a new circular on nature-related financial (NRF) risks. Our main take-aways: NRF risks not only comprise climate-related risks,

Find out moreAs mid-sized corporations expand, enhancing their Treasury function becomes essential. International growth, exposure to multiple currencies, evolving regulatory requirements, and increased

Find out moreIndustry surveys show that FRTB may lead to a 60% increase in regulatory market risk capital requirements, placing significant pressure on banks. As regulatory market risk capital requirements

Find out moreFirst, these regions were analyzed independently such that common trends and differences could be noted within. These results were aggregated for each region such that these regions could be

Find out more

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired Fintegral.

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired RiskQuest.

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired Optimum Prime.

You need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More Information