Introduction

In December 2024, FINMA published a new circular on nature-related financial (NRF) risks. Our main take-aways:

- NRF risks not only comprise climate-related risks, but also other nature-related risks (such as loss of biodiversity, invasive species and degradation in the quality of air, water and soil). However, risks other than climate-related risks only need to be covered in 2028, whereas climate-related risks need to be covered by 2026 (for large institutions) and 2027 (for small institutions).

- All institutions independent of size need to perform a risk identification and materiality assessment of NRF risks.

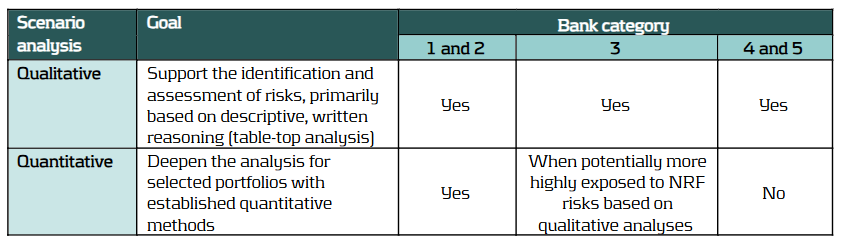

- As part of the materiality assessment, banks need to perform scenario analysis. Small institutions may limit themselves to qualitative scenario analysis, whereas large banks need to perform quantitative scenario analysis.

In this blog we summarize the contents of the circular as applicable to banks, including the additional guidance provided by FINMA (“Erläuterungen”).

FINMA states the following aims for publishing the circular:

- Clarify expectations about the management of nature-related financial (NRF) risks by supervised institutions, based on existing laws and regulations.

- Support supervised institutions to adequately identify, assess, limit and monitor these risks.

- Be lean, principle-based, proportional, technology-neutral, and internationally aligned1.

The circular applies to both banks and insurance companies in Switzerland, including branches of foreign institutions.

The scope of application depends on the bank category:

- Category 4 and 5 banks that are very well capitalized and very liquid (‘Kleinbankenregime’) are exempted from implementation of the circular.

- Other category 4 and 5 banks are exempted from quantitative scenario analysis, whereas category 3 banks only need to perform quantitative scenario analysis for portfolios with heightened exposure to NRF risks.

- Category 3, 4 and 5 banks are exempted from consideration of material NRF risks in stress tests.

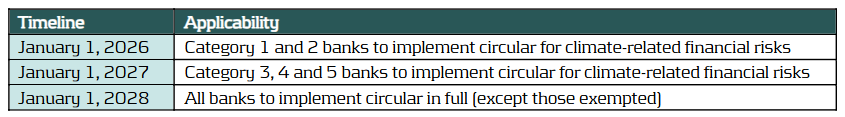

The circular has to be implemented in full by January 1, 2028, for all banks in scope. However, implementation for climate-related risks needs to be completed earlier, as outlined in the table below, reflecting the greater maturity in the assessment of climate-related risks:

FINMA emphasizes that banks will need to have completed their risk identification & materiality assessment well before the overall implementation timeline to allow sufficient time to embed material NRF risks in the overall risk management framework in line with the other parts of the circular.

Definitions

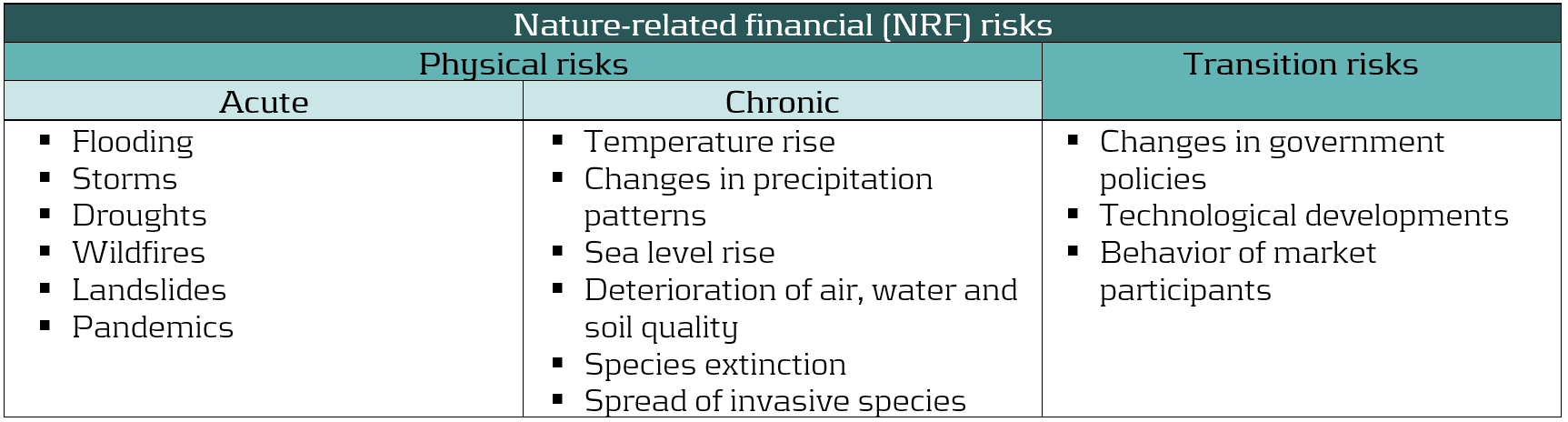

FINMA distinguishes the following types and examples of NRF risks:

The circular does not adopt a ‘double materiality’ perspective but focuses on the potential financial impact of NRF risks on a financial institution. However, FINMA emphasizes that the impact of an institution on its environment (e.g., through the lending and investment activities) can influence the relevance of NRF risks for the institution.

General expectations

The circular emphasizes that all banks need to perform a risk identification and materiality assessment of NRF risks, independent of size and bank category. Implementation of the other parts of the circular depends on whether and which material NRF risks have been identified.

Governance

As all banks need to perform a risk identification and materiality assessment of NRF risks, all banks also need to set up an appropriate governance under which this takes place, including definition and documentation of tasks, competencies and responsibilities. This needs to cover the management and supervisory boards as well as the independent control functions. For management and supervisory boards, it is specifically important to reflect material NRF risks in the business and risk strategy. The nature of the governance arrangements can reflect the size and complexity of the institution (proportionality).

Risk identification and materiality assessment

Each bank needs to identify all NRF risks that may impact the institution’s risk profile and assess the potential financial materiality. This should include

- the potential strategic impact, driven by changing expectations from the public and authorities and consequential changes in markets and technologies, as well as

- potential legal and reputational risks through lawsuits against the bank’s counterparties or the bank itself as well as through increasing regulation

The risk identification needs to be performed on a gross (inherent) basis. A net (residual) risk can be considered in addition if the effectiveness of risk mitigation measures can be substantiated.

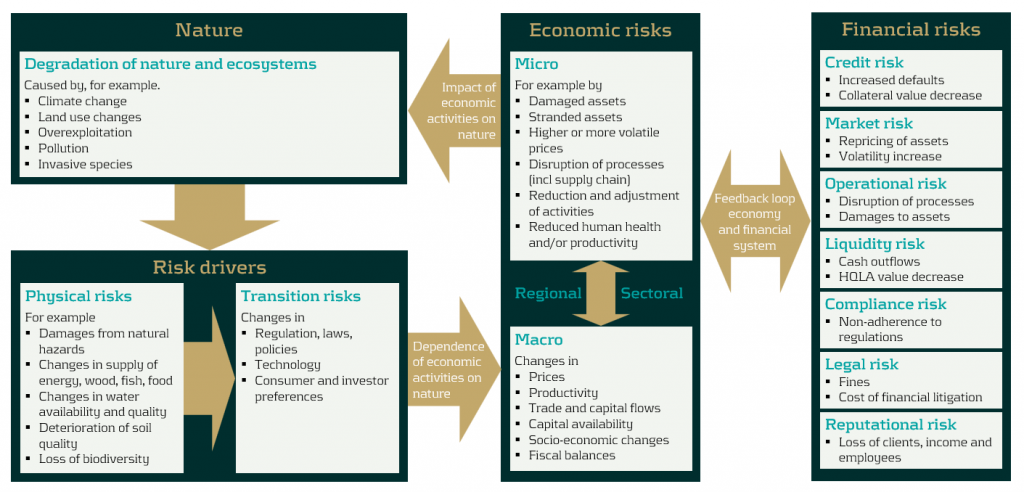

FINMA emphasizes that NRF risks need to be considered as risk drivers of existing risk types, rather than as new stand-alone risks. For the existing risk types, at least credit, market, liquidity, operational, compliance, legal and reputational risk need to be considered. Moreover, concentration risks driven by NRF risks need to be considered both within and across the existing risk types. For example, transition risks can simultaneously lower the creditworthiness of counterparties (credit risk), decrease the value of investment positions (market risk) and affect the reputation of the institution (reputation risk). Hence, significant exposure to sectors that are sensitive to transition risk, such as fossil fuel and transport, can lead to additional concentration risk.

To assess the financial materiality, institutions are expected to understand the transmission channels through which NRF risks can materialize in financial risks. The following chart provides an illustration of possible transmission channels.

Source: Adapted from Figure 2 in NGFS, Nature-related Financial Risks: a Conceptual Framework to guide Action by Central Banks and Supervisors, July 2024.

In performing the materiality assessment, the institution should consider all relevant internal and external information, consider the indirect impact of NRF risks through clients and related third parties and pay attention to its exposure to sectors, regions and jurisdictions with heightened NRF risks.

The process and results of the risk identification and materiality assessment need to be clearly documented, including:

- Criteria and assumptions used, such as scenarios and time horizons considered

- Physical and transition risks considered and their impact on traditional risk types

- The applicable time horizon for the financial materiality

- NRF risks that were assessed as non-material

The risk identification and materiality assessment needs to be updated regularly, for which FINMA suggests linking it to the annual business planning process.

FINMA emphasizes the central role that scenario analysis plays in the materiality assessment. In this respect it expects banks to

- Use at least qualitative considerations how adverse scenarios could impact the business model

- Consider multiple scenarios, including those with a low probability and possibly large impact

- Consider direct impacts and indirect impacts (e.g., on clients and suppliers and their supply chains) from NRF risks

- Use multiple relevant time horizons (short, medium and long term)

In the additional guidance, FINMA indicates that publicly available scenarios can be used (such as those from the NGFS) but they may need to be tailored to the characteristics of the institution.

FINMA expects all banks to perform qualitative scenario analyses, but expects quantitative scenario analysis only at larger institutions, as summarized in the following table.

In addition to scenario analysis, FINMA expects banks to use other quantitative approaches (such as sector exposures) to substantiate the materiality assessment.

Risk Management

Material NRF risks need to be integrated in the existing processes for the management, monitoring, controlling and reporting of existing risk types. Risk tolerances for exposure to material NRF risks need to be reflected in risk indicators with warning levels and limits and include forward-looking indicators. For example, risk tolerance for transition risk can be expressed in terms of the nominal exposure and/or financed CO2 emissions in sectors that are sensitive to transition risks, including targets for a reduction in the exposure over time.

To account for the large uncertainty in existing methods and data, institutions are expected to apply a margin of conservatism in the risk tolerances (“Vorsichtsprinzip”). Furthermore, they are expected to regularly evaluate, and when necessary, amend, the data, methods and processes needed to manage material NRF risks. This evaluation needs to take national and international developments into account. In the additional guidance, FINMA emphasizes the importance of describing in the existing documentation of the risk management and control processes how material NRF risks are managed, including required data such as transition plans and physical locations of counterparties as well as assumptions, approximations and estimates used when proper data is still lacking.

In addition, firms are expected to verify regularly whether their publicly disclosed sustainability objectives are aligned with their business strategy, risk tolerance, risk management and legal requirements, such as national or international commitments to reduce emissions and protect biodiversity. Any such misalignments would increase legal and reputational risks. To reduce the risk of such misalignments, FINMA suggests to include the publicly stated objectives in the annual targets for business lines and employees and embed them in the internal control reviews.

Stress testing

Category 1 and 2 banks with material NRF risks need to integrate these in their stress test and the internal capital adequacy assessment. To define stress tests, scenarios that have been used for the materiality assessment can be used as basis, but they may need to be broadened in scope and made more severe.

Expectations per risk type

The FINMA expectations per risk type below apply to material NRF risks only.

Credit risk

NRF risks that are assessed as material in relation to a bank’s credit risk need to be monitored throughout the full lifecycle of credit risk positions. The bank is expected to consider measures to control or reduce the exposure to these NRF risks, for example by

- Adjusting the lending criteria and, if applicable, acceptable collateral. As part of this, the bank can consider providing incentives to counterparties to reduce exposure to NRF risks.

- Adjusting client or transaction ratings.

- Lending restrictions, such as shorter maturities, lower lending limits and discounted asset values for clients materially exposed to NRF risks.

- Client engagement, encouraging sustainable business practices and enhanced external disclosures about exposures to NRF risks and transition plans.

- Setting thresholds or other risk mitigation techniques for activities, counterparties, sectors and regions which are not in line with the risk tolerance. For example, in highly sensitive sectors, the bank may restrict exposures to those counterparties with credible transition plans.

Market risk

Institutions with material NRF risk exposure in their market risk positions need to assess the loss potential and the impact of increased volatility in relation to the potential materialization of NRF risks. Category 1 to 3 banks with material NRF risks need to do so regularly. The market risk positions cover both trading book positions (bonds, equities, FX, commodities) and banking book investments.

The loss potential can be assessed using scenario analyses and stress tests that

- Are forward looking and also cover medium and long-term horizons

- Consider the impact of a sudden shock on the value of financial instruments

- Reflect dependencies between market variables

- Embed forward-looking assumptions rather than historical distributions

- Take into account the prices and availability of hedges under different scenarios (e.g., in a ‘disorderly transition’ scenario)

FINMA notes that the impact of NRF risks on managed investments can lead to business risk (lower revenues) when other institutions are better managing them for their clients.

Liquidity risk

Examples of the potential impact of NRF risks on a bank’s liquidity position are clients hoarding cash ahead of, or withdrawing funds for repairs after, a natural disaster. FINMA stipulates that banks with material exposure to NRF risks need to evaluate the impact in normal and adverse situations. Material impacts need to be controlled or mitigated.

To assess the potential impact, FINMA suggests that banks can consider a combined market-wide and idiosyncratic stress situation in combination with the occurrence of a natural disaster (e.g., a flooding). Not only cash outflows need to considered, but also the impact on the value of financial instruments that are part of the stock of high-quality liquid assets (HQLA). Any material impact needs to be considered in the calibration of the necessary amount of HQLA and the management of liquidity risks.

Operational risk

Banks with material NRF risks in relation to operational risks need to consider these in risk and control assessments (RCA) for operational risk and in the management of operational risks, where appropriate. This is aligned with the expectations in the FINMA Circular 2023/1 “Operational risks and resilience – Banks”.

Category 1 to 3 institutions that perform a systematic collection and analysis of loss data according to FINMA Circular 2023/1 need to clearly show losses and events in relation to NRF risks in relevant reports.

Furthermore, material NRF risks in relation to operational risks that may impair critical functions need to be documented and considered in the operational resilience of the institution as reflected in business-continuity plans and disaster-recovery plans. An example could be the unavailability of a data center due to a natural disaster such as a flooding or severe storm.

Compliance, legal and reputational risk

FINMA sees heightened compliance, legal and reputation risks in relation to NRF risks due to high expectations from society and the government for banks to contribute to achieving society’s sustainability goals. For example, the Swiss government is obliged by law to ensure that the Swiss Financial Sector contributes to a low-emission and climate-resilient development. FINMA expects banks to explicitly assess the potential impact of NRF risks on legal and compliance costs as well as the bank’s reputation. Any such material risks need to embedded in relevant processes and controls.

As potential sources of reputation risks for banks, FINMA mentions the nature of investments and lending, the composition of investment portfolios, project financing, client advisory and marketing campaigns. Reputation risk will have a financial impact when clients and/or the public in general lose trust and stop doing business with the institution, leading to lower revenues. Reputation risk should therefore also be considered in new product development and go-to-market, new business initiatives and new marketing campaigns. FINMA also expects institutions to elaborate on the impact of NRF risks on reputation risk in their external disclosure.

Implementation

To prepare for the implementation of the new FINMA circular, we advise banks to take the steps as outlined below.

1 - Design a process to perform a risk identification and materiality assessment of NRF risks, including the universe of NRF risks to be considered

2 - Execute the process and document the results. This needs to include:

- Identify possible transmission channels for each combination of NRF risk and existing risk type

- Assess potential financial materiality for all transmission channels, using internal and external expertise as well as scenario analysis. For this purpose, suitable scenarios need to be identified.

3 - Decide on metrics (KRIs) for the material NRF risks and identify sources of required data

4 - Agree on risk tolerances for exposure to NRF risks, including KRIs

5 - Embed material NRF risks in internal risk management, monitoring and reporting processes for all relevant risk types (credit, market, liquidity, operational, legal, compliance and reputation risk)

6 - Collect required data and include KRIs in relevant reports

7 - Prepare external disclosure

Based on our experience, completing the steps may well take up to a year, including the time needed for internal discussion and decision taking. Although this can be shortened if the bank has already taken initial steps, we advise banks to start timely with the implementation of the circular.

If you would like to discuss our proposed approach or are looking for an experienced partner to support you in this process, please reach out to Pieter Klaassen.