Introduction: Faster, smarter, and future-proof

In the fast-paced financial industry , speed and accuracy are paramount. Banks are tasked with the complex calculation of XVAs (‘X-Value Adjustments’) on a daily basis, which often involve computationally expensive Monte Carlo simulations. These calculations, while crucial, can become a bottleneck, slowing down decision-making processes and affecting efficiency. What if there is a faster and smarter way to handle these calculations? In this article, we explore a revolutionary approach that uses neural networks to drastically accelerate XVA calculations, promising significant speed-ups without sacrificing accuracy.

The traditional approach: Monte Carlo simulations and their limitations

Traditionally, banks have relied on Monte Carlo simulations to calculate XVAs. These simulations involve numerous complex scenarios, requiring substantial computational power and time. Imagine running simulations endlessly, with every tick of the clock translating to computing expenses. The problem? Time and resources. These calculations must be repeated daily, leading to significant delays and costs, potentially hindering your bank's responsiveness and decision-making agility.

Despite bringing precision, this traditional method poses challenges. Given that the rates offered by banks do not fluctuate dramatically within days, repeating these extensive simulations seems redundant. This redundancy leads us to seek a solution that can deliver both speed and efficiency, paving the way for innovation.

A new era: Leveraging Neural Networks for speed and efficiency

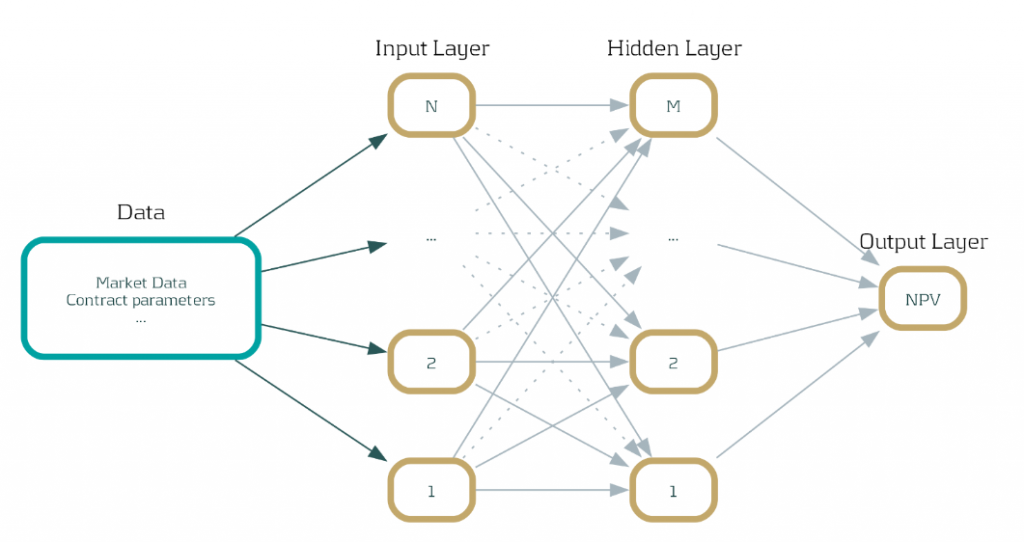

Enter neural networks—an innovative technology that promises a solution to the Monte Carlo conundrum. By training these networks on Monte Carlo simulations conducted early in the week, such as on a Monday, the model can predict outcomes for the rest of the days. This approach sidesteps the need to perform cumbersome computations daily.

Here’s how it works: The neural network learns from initial data, absorbing patterns and information that remain relatively constant through the week. This enables it to approximate net present value calculations with astonishing speed and accuracy. A practical example? Our integration of this technique into the Open-source Risk Engine resulted in a remarkable 600% increase in speed when assessing interest rate swap exposure in a stable market.

Benefits of our solution: Integration and acceleration

- Seamless Integration: Our solution can be seamlessly integrated with any existing systems, as long as they provide net present value outputs for some simulations.

- Scalability with GPUs: Neural network calculations can harness the parallel processing power of GPUs, exponentially increasing inference speed. Imagine every inference equating to calculations for numerous trades simultaneously.

- Feasibility and Reliability: With approximation of net present values being a commonly accepted practice in finance, this approach is both feasible and reliable for banks striving for rapid insights.

Zanders Recommends: A strategic approach to implementation

At Zanders, we believe in empowering banks with cutting-edge technology that aligns with their growth ambitions. Here is what we recommend:

1- Assessment Phase: Evaluate the current computational model and identify areas that can benefit from the implementation of neural networks.

2- Pilot Programs: Start with small-scale implementations to address specific bottlenecks and measure impact.

3- Utilize GPUs: Leverage the parallelization capabilities of GPUs not just for neural networks but also for Monte Carlo simulations themselves, if needed.

4- Continuous Improvement: Regularly update neural network models to ensure accuracy as market conditions evolve.

Our extensive experience with high-performance computing, particularly the use of GPUs for parallelization, positions us as a trusted partner for banks navigating this transformation journey.

Expertise spotlight: High-Performance Computing and AI solutions

In addition to revolutionizing XVA calculations, Zanders offers robust high-performance computing solutions that maximize the capabilities of GPUs across various applications, including Monte Carlo simulations. Our expertise also extends into AI technologies such as chatbots, where we implement and validate models, ensuring banks remain at the forefront of innovation.

Conclusion: Embrace the future of banking technology

As the financial world evolves, so must the technologies that drive it. By leveraging neural networks, banks can achieve unprecedented speed and efficiency in XVA calculations, providing them with the agility needed to navigate today's dynamic markets. Now is the time to embrace a solution that is not only faster but smarter. At Zanders, we're ready to guide you through this transformation. Get in touch with Steven van Haren to learn how we can elevate your XVA calculations and ensure your bank stays competitive in an ever-changing financial landscape.