In our previous article 'Navigating the Financial Complexity of Carve-Outs: The Treasury Transformation Challenge and Zanders’ Expert Solution' we outlined that in a carve-out, the TOM for the new Treasury function must be tailored to the unique characteristics of the newly formed entity. This includes considerations such as operational scale, geographical footprint and risk profile, aligned with investor preferences. To achieve this, the TOM will outline how the Treasury function will operate, including its governance structure, team size and composition, service delivery model, and its evolving role within the future organization.

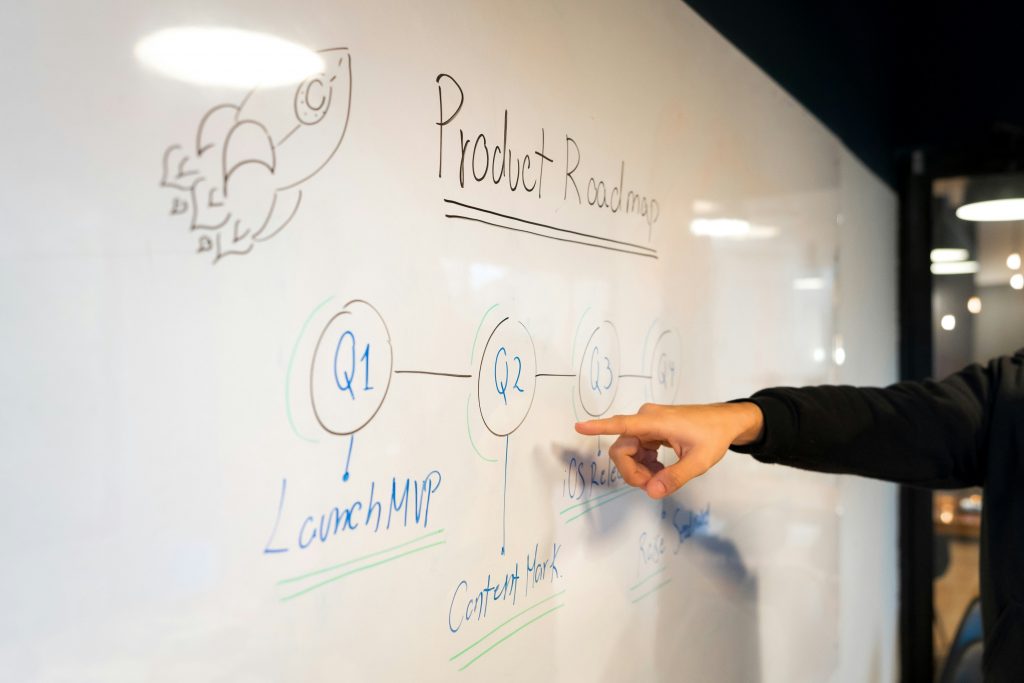

Hence, a clear and prioritized TOM provides a roadmap for Treasury, ensuring the function is ready for its new challenges and addressing the carved-out entity’s needs. Furthermore, it ensures that Treasury’s role as a value-adding partner is fully realized, helping to drive long-term success.

So, where do you start with right-sizing the new Treasury organization? Below, we outline the key strategic and transactional topics to consider.

Shaping the Future of Treasury: Priorities and Strategic Objectives

The TOM of a Treasury function serves three essential purposes:

- (1) Ensuring the minimum viable design is in place for seamless operations from day one.

- (2) Defining how the Treasury function will actively drive value and align with the business’s strategic goals.

- (3) Creating a roadmap for growth: Laying the groundwork for Treasury’s future scalability and maturity as the business evolves.

From the outset, defining the TOM presents a key opportunity for Treasury to evolve from a purely operational support function to a strategic advisor. This transformation allows Treasury to play a pivotal role in decision-making, particularly in areas like working capital optimization, capital allocation, and future M&A activities. Moreover, it ensures that Treasury’s objectives are closely aligned with the broader goals of the organization, including growth, operational efficiency, and risk mitigation.

To achieve these objectives, a well-defined governance structure is essential. Governance provides the authority, alignment, and oversight necessary for effective risk management, cash flow optimization, and other core activities – transforming strategic aspirations into tangible results.

Governance Structure: Striking the Right Balance

Fundamentally a goal of the Treasury function is how it supports the broader business in achieving financial stability, operational efficiency and strategic objectives. Achieving this requires a governance structure that balances centralized control with local autonomy, tailored to the organization’s global footprint. The TOM serves as a unifying framework, aligning processes not only across Treasury but also with other functions to ensure consistency and collaboration.

This can be done by deciding where Treasury activities will be performed and applying either a centralized model (managed at a headquarters level) or decentralized model (with regional or local autonomy under a defined framework). With the need to keep agility in mind it’s a balancing act to ensure a lean but skilled Treasury team is in place to handle immediate requirements, with contingency plans for scaling as the business grows. Therefore, in most carve-outs a hybrid model is preferred initially, allowing for centralized oversight of critical activities (e.g., funding and risk management) while empowering local teams to handle region-specific cash and banking needs.

To complement this structure, clearly defining roles and responsibilities is crucial. Treasury teams must have well-delineated duties across areas like cash management, risk management, funding, financial reporting, and technology operations, ensuring effective decision-making and accountability. Equally important is the design of Treasury processes. As a central pillar of the organizational landscape, Treasury processes should prioritize standardization across regions to streamline operations and mitigate risks. Further, as a logical consequence of defined roles and responsibilities as well as of well-designed Treasury processes, the new TOM as offers an opportunity to clearly define and implement process and data interfaces between Treasury and other corporate functions, such as accounting and procurement, fostering seamless collaboration and enhancing overall efficiency.

Unveiling the Future: Day 1 Readiness and the Launch of a Bold Treasury Operating Model

As the governance structure is established, the next critical milestone in the carve-out process is ensuring readiness for Day 1 - when the responsibility officially shifts from the parent company to the newly independent entity. A well-designed TOM provides not only the governance framework but also the operational infrastructure needed for a seamless transition. This includes setting up the foundational capabilities that will allow the Treasury to operate without disruption, from basic cash visibility and banking relationships to staffing and technology setups.

- (1) Cash Visibility and Control with basic structures in place to ensure real-time visibility into cash positions across bank accounts, usually brought about by establishing processes for daily cash reconciliations, payment approvals and funding allocations.

- (2) Banking Relationships with the core banking partners onboarded and the account structures in place to manage inflows, outflows, and currency requirements. This may also include transferring the existing banking arrangements from the parent company or establishing new core banks.

- (3) Technology Setup comprising of a basic Treasury Management System (TMS) or interim solution in place to support key processes.

- (4) An appropriate level of Staffing and Expertise with a lean but skilled Treasury team in place to handle immediate requirements, with contingency plans for scaling as the business grows.

Underpinning these areas is the formalisation of a Treasury Policy and Procedures including essentials such as policies for cash management, payment processing and risk management to ensure compliance and mitigation of operational risks.

A Roadmap for achieving Treasury Maturity

While the minimum viable design outlines Day 1 functionality, the TOM also provides a clear pathway for scaling and maturing the Treasury function as the business evolves. Viewing the TOM as a strategic concept enables the business to set a target trajectory from the outset and identify and prioritise areas for long-term maturity. The design of a well-balanced – i.e. of appropriate complexity but with scope to grow – function at this stage is a critical tactical decision, something that Zanders does by taking into account development trends using our proprietary Treasury Risk Maturity Model.

Following the carve-out activity and as the new entity stabilises there will naturally be a move towards greater centralization and standardization of core Treasury functions, whose deployment can be improved by addressing them in the TOM. In turn, a centralization will result in the streamlining of processes such as cash pooling, intercompany funding, and hedging activities to improve efficiency and reduce costs.

To support these optimization processes after the transaction, designing the TOM to be agile enables the Treasury to scale operations both seamlessly in response to business growth or market changes but also to standardise by introducing consistent policies and processes. For example these could include those for cash management, risk mitigation, and compliance across all regions to enhance control and visibility across the function.

Ultimately the implementation of a well-defined TOM from the outset will be beneficial on both a functional and wider level. Taking Treasury as an intrinsic need of the business and therefore as a strategic function (as opposed to siloed and complimentary) empowers the broader finance department’s contributions to the strategic moves of the company overall.

Strategic evolution to Treasury excellence

Building a Treasury function for a carved-out entity is a complex yet rewarding process that requires strategic planning across all Treasury and finance areas. A clear TOM not only ensures operational readiness from Day 1 but also provides a robust framework for Treasury’s evolution. By defining how the Treasury function will serve the business, establishing a minimum design for immediate needs, and outlining a roadmap for maturity, the TOM ensures alignment with the carved-out entity’s goals. Over time, this approach positions Treasury as a strategic enabler, driving financial stability, operational efficiency, and long-term growth.

Zanders’ experts for Treasury M&A can help you in assessing and designing fit-for-purpose TOM models and considering the relevant aspects of their implementation, thereby realizing the specific benefits identified in the design phase. We bring extensive experience in M&A transactions and will effectively navigate you through the process of establishing a new Treasury function. Reach out to discuss your case with us.

In the next edition of this series, we look at implementing effective Cash and Liquidity Management practices within the newly carved-out entity, key areas of focus and the risks involved.

If you would like to learn more about how to build a Treasury function for a Carved-Out Business - please reach out to our Director Stephan Plein.