Accurately attributing changes in counterparty credit exposures is essential for understanding risk profiles and making informed decisions. However, traditional approaches for exposure attribution often pose significant challenges, including labor-intensive manual processes, calculation uncertainties, and incomplete analyses.

In this article, we discuss the issues with existing exposure attribution techniques and explore Zanders’ automated approach, which reduces workloads and enhances the accuracy and comprehensiveness of the attribution.

Our approach to attributing changes in counterparty credit exposures

The attribution of daily exposure changes in counterparty credit risk often presents challenges that strain the resources of credit risk managers and quantitative analysts. To tackle this issue, Zanders has developed an attribution methodology that efficiently automates the attribution process, improving the efficiency, reactivity and coverage of exposure attribution.

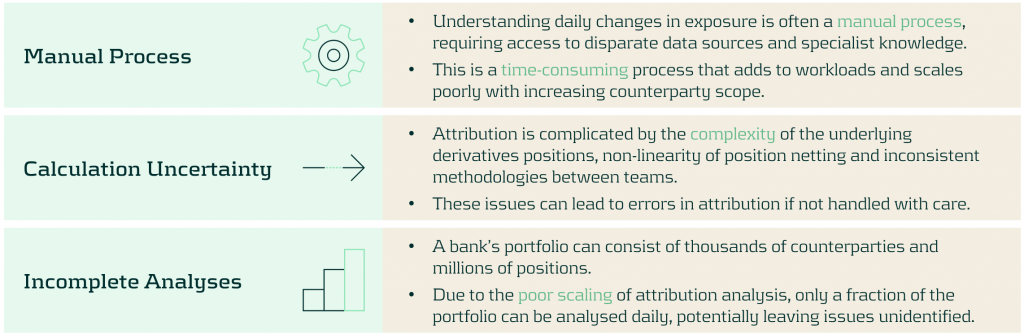

Challenges in Exposure Attribution

Credit risk managers monitor the evolution of exposures over time to manage counterparty credit risk exposures against the bank’s risk appetite and limits. This frequently requires rapid analysis to attribute the changes to exposures, which presents several challenges:

Zanders’ approach: an automated approach to exposure attribution

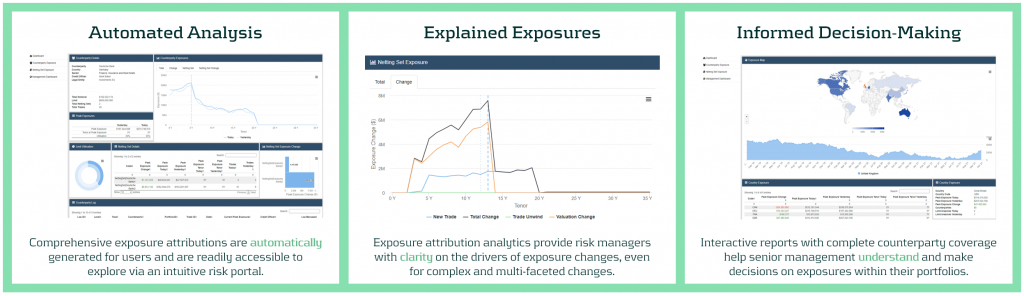

Our methodology resolves these problems with an analytics layer that interfaces with the risk engine to accelerate and automate the daily exposure attribution process. The results can also be accessed and explored via an interactive web portal, providing risk managers and senior management with the tools they need to rapidly analyze and understand their risk.

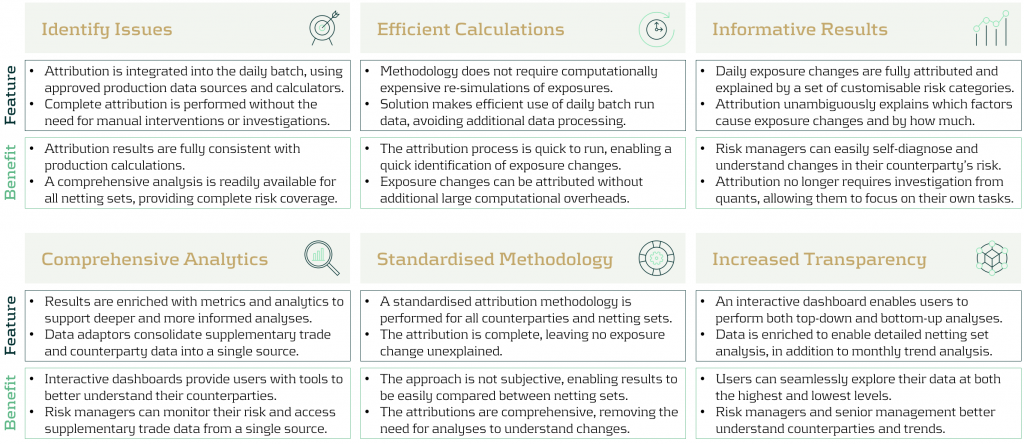

Key features and benefits of our approach

Zanders’ approach provides multiple improvements to the exposure attribution process. This reduces the workloads of key risk teams and increases risk coverage without additional overheads. Below, we describe the benefits of each of the main features of our approach.

Zanders Recommends

An automated attribution of exposures empowers banks teams to better understand and handle their counterparty credit risk. To make the best use of automated attribution techniques, Zanders recommends that banks:

- Increase risk scope: The increased efficiency of attribution should be used to provide a more comprehensive and granular coverage of the exposures of counterparties, sectors and regions.

- Reduce quant utilization: Risk managers should use automated dashboards and analytics to perform their own exposure investigations, reducing the workload of quantitative risk teams.

- Augment decision making: Risk managers should utilize dashboards and analytics to ensure they make more timely and informed decisions.

- Proactive monitoring: Automated reports and monitoring should be reviewed regularly to ensure risks are tackled in a proactive manner.

- Increase information transfer: Dashboards should be made available across teams to ensure that information is shared in a transparent, consistent and more timely manner.

Conclusion

The effective management of counterparty credit risk is a critical task for banks and financial institutions. However, the traditional approach of manual exposure attribution often results in inefficient processes, calculation uncertainties, and incomplete analyses. Zanders' innovative methodology for automating exposure attribution offers a comprehensive solution to these challenges and provides banks with a robust framework to navigate the complexities of exposure attribution. The approach is highly effective at improving the speed, coverage, and accuracy of exposure attribution, supporting risk managers and senior management to make informed and timely decisions.

For more information about how Zanders can support you with exposure attribution, please contact Dilbagh Kalsi (Partner) or Mark Baber (Senior Manager).