Performance of Dutch banks in the 2023 EBA stress test

At the end of July, the European Banking Authority (EBA) released the results on the latest installment of the EU-wide stress test that is performed every two years.

Seventy banks have been considered, which is an increase of twenty banks compared to the previous exercise. The portfolios of the participating banks contain around three quarters of all EU banking assets (Euro and non-Euro).

Interested in how the four Dutch banks participating in this EBA stress test exercise performed? In this short note we compare them with the EU average as represented in the results published [1].

General comments

The general conclusion from the EU wide stress test results is that EU banks seem sufficiently capitalized. We quote the main 5 points as highlighted in the EBA press release [1]:

- The results of the 2023 EU-wide stress test show that European banks remain resilient under an adverse scenario which combines a severe EU and global recession, increasing interest rates and higher credit spreads.

- This resilience of EU banks partly reflects a solid capital position at the start of the exercise, with an average fully-loaded CET1 ratio of 15% which allows banks to withstand the capital depletion under the adverse scenario.

- The capital depletion under the adverse stress test scenario is 459 bps, resulting in a fully loaded CET1 ratio at the end of the scenario of 10.4%. Higher earnings and better asset quality at the beginning of the 2023 both help moderate capital depletion under the adverse scenario.

- Despite combined losses of EUR 496bn, EU banks remain sufficiently apitalized to continue to support the economy also in times of severe stress.

- The high current level of macroeconomic uncertainty shows however the importance of remaining vigilant and that both supervisors and banks should be prepared for a possible worsening of economic conditions.

For further details we refer to the full EBA report [1].

Dutch banks

Making the case for transparency across the banking sector, the EBA has released a detailed breakdown of relevant figures for each individual bank. We use some of this data to gain further insight into the performance of the main Dutch banks versus the EU average.

CET1 ratios

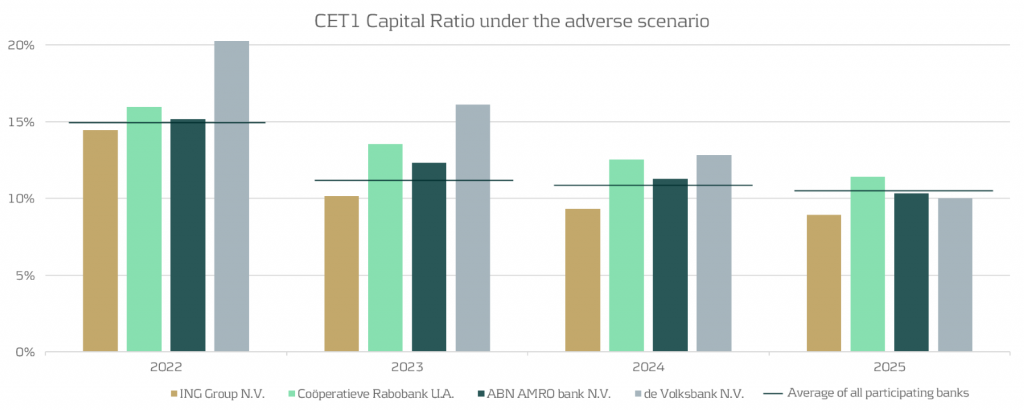

Using the data presented by EBA [2], we display the evolution of the fully loaded CET1 ratio for the four banks versus the average over all EU banks in the figure below. The four Dutch banks are: ING, Rabobank, ABN AMRO and de Volksbank, ordered by size.

From the figure, we observe the following:

- Compared to the average EU-wide CET1 ratio (indicated by the horizontal lines in the graph above), it can be observed that three out of four of the banks are very close to the EU average.

- For the average EU wide CET1 ratio we observe a significant drop from year 1 to year 2, while for the Dutch banks the impact of the stress is more spread out over the full scenario horizon.

- The impact after year 4 of the stress horizon is more severe than the EU average for three out of four of the Dutch banks.

Evolution of retail mortgages during adverse scenario

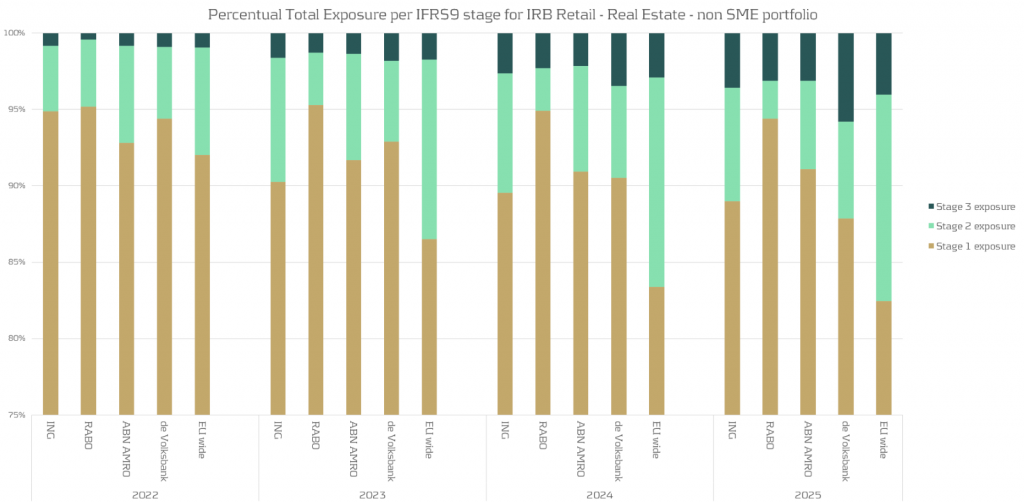

The most important product the four Dutch banks have in common are the retail mortgages. We look at the evolution of the retail mortgage portfolios of the Dutch banks compared to the EU average. Using EBA data provided [2], we summarize this in the following chart:

Based on the analysis above , we observe:

- There is a noticeable variation between the banks regarding the migrations between the IFRS stages.

- Compared to the EU average there are much less mortgages with a significant increase in credit risk (migrations to IFRS stage 2) for the Dutch banks. For some banks the percentage of loans in stage 2 is stable or even decreases.

Conclusion

This short note gives some indication of specifics of the 2023 EBA stress applied to the four main Dutch banks.

Should you wish to go deeper into this subject, Zanders has both the expertise and track record to assist financial organisations with all aspects of stress testing. Please get in touch.

References

Zanders listed on Swift Customer Security Programme (CSP) Assessment Providers directory

At the end of July, the European Banking Authority (EBA) released the results on the latest installment of the EU-wide stress test that is performed every two years.

The CSP helps reinforce the controls protecting participants from cyberattack and ensures their effectivity and that they adhere to the current Swift security requirements.

*Swift does not certify, warrant, endorse or recommend any service provider listed in its directory and Swift customers are not required to use providers listed in the directory.

Swift Customer Security Programme

A new attestation must be submitted at least once a year between July and December, and also any time a change in architecture or compliance status occurs. Customer attestation and independent assessment of the CSCF v2023 version is now open and valid until 31 December 2023. July 2023 also marks the release of Swifts CSCF v2024 for early consultation, which is valid until 31 December 2024.

Swift introduced the Customer Security Programme to promote cybersecurity amongst its customers with the core component of the CSP being the Customer Security Controls Framework (CSCF). Independent assessment has been introduced as a prerequisite for attestation to enhance the integrity, consistency, and accuracy of attestations. Each year, Swift releases an updated version of the CSCF that needs to be attested to with support of an independent assessment.

The Attestation is a declaration of compliance with the Swift Customer Security Controls Policy and is submitted via the Swift KYC-SA tool. Dependent on the Swift Architecture used, the number of controls to be implemented vary; of which certain are mandatory, and others advisory.

Further details on the Swift CSCF can be found on their website:

- https://www.swift.com/myswift/customer-security-programme-csp

- https://www.swift.com/myswift/customer-security-programme-csp/find-external-support/directory-csp-assessment-providers

Our services

Do you have arrangements in place to complete the independent assessment required to support the attestation?

Zanders has experience with and can support the completion of an independent external assessment of your compliance to the Swift Customer Security Control Framework that can then be used to fully complete and sign-off the Swift attestation for this year.

With an extensive track record of designing and deploying bank integrations, our intricate knowledge of treasury systems across both IT architecture as well as business processes positions us well to be a trusted independent assessor. We draw on past projects and assessments to ask the right questions during the assessment phase, aligning our customers with the framework provided by Swift.

The Swift attestation can also form part of a wider initiative to further optimise your banking landscape, whether that be increasing the use of Swift within your organisation, bank rationalization or improving your existing processes. The availability of your published attestation and its possible consultation with counterparties (upon request) helps equally in performing day-to-day risk management.

Approach

Planning

We start with rigorous planning of the assessment project, developing a scope of work and planning resources accordingly. Our team of experts will work with clients to formulate an Impact Assessment based on the most recent version of the Swift Customer Security Controls Framework.

Architecture Classification

A key part of our support will be working with the client to formulate a comprehensive overview of the system architecture and identify the applicable controls dictated by the CSCF.

Perform Assessment

Using our wide-ranging experience, we will test the individual controls against specific scenarios designed to root out any weaknesses and document evidence of their compliance or where they can be improved.

Independent Assessment Report

Based on the evidence collected, we will prepare an Independent Assessment report which includes status of the compliance against individual controls, baselining them against the CSCF and recommendations for improvement areas within the system architecture.

Post Assessment Activities

Once completed, the Independent Assessment report will support you with the submission of the Attestation in line with the requirements of the CSCF version in force, which is required annually by Swift. In tandem, Zanders can deliver a plan for implementation of the recommendations within the report to ensure compliance with current and future years’ attestations. Swift expects controls compliance annually, together with the submission of the attestation by 31 December at the latest, in order to avoid being reported to your supervisor. Non-compliant status is visible to your counterparties.

Do you need support with your Swift CSP Independent Assessment?

We are thrilled to offer a Swift CSP Independent Assessment service and look forward to supporting our clients with their attestations, continuing their commitment to protecting the integrity of the Swift network, and in doing so supporting their businesses too. If you are interested in learning more about our services, please contact us directly.

Cryptocurrencies and Blockchain: Navigating Risk, Compliance, and Future Opportunities in Corporate Treasury

At the end of July, the European Banking Authority (EBA) released the results on the latest installment of the EU-wide stress test that is performed every two years.

As a result of the growing importance of this transformative technology and its applications, various regulatory initiatives and frameworks have emerged, such as Markets in Crypto-Assets Regulation (MiCAR), the Distributed Ledger Technology (DLT) Pilot Regime, and the Basel Committee on Banking Supervision (BCBS) crypto standard were launched, demonstrating the growing importance and adoption at both a global and national level. Given these trends, treasuries will be impacted by Blockchain one way or the other – if they aren’t already.

With the advent of cryptocurrencies and digital assets, it is important for treasurers to understand the issues at hand and have a strategy in place to deal with them. Based on our experience, typical questions that a treasurer faces are how to deal with the volatility of cryptocurrencies, how cryptocurrencies impact FX management, the accounting treatment for cryptocurrencies as well as KYC considerations. These developments are summarized in this article.

FX Risk Management and Volatility

History has shown that cryptocurrencies such as Bitcoin and Ether are highly volatile assets, which implies that the Euro value of 1 BTC can fluctuate significantly. Based on our experience, treasurers opt to sell their cryptocurrencies as quickly as possible in order to convert them into fiat currency – the currencies that they are familiar and which their cost basis is typically in. However, other solutions exist such as hedging positions via derivatives traded on regulated financial markets or conversions into so-called stablecoins1.

Accounting Treatment and Regulatory Compliance

Cryptocurrencies, including stablecoins, require careful accounting treatment and compliance with regulations. In most cases cryptocurrencies are classified as “intangible assets” under IFRS. For broker-traders they are, however, classified as inventory, depending on the circumstances. Inventory is measured at the lower of cost and net realizable value, while intangible assets are measured at cost or revaluation. Under GAAP, most cryptocurrencies are treated as indefinite-lived intangible assets and are impaired when the fair value falls below the carrying value. These impairments cannot be reversed. CBDCs, however, are not considered cryptocurrencies. Similarly, and the classification of stablecoins depends on their status as financial assets or instruments.

KYC/KYT Considerations

The adoption of cryptocurrencies and Blockchain technology introduces challenges for corporate treasurers in verifying counterparties and tracking transactions. When it comes to B2C transactions, treasurers may need to implement KYC (Know Your Customer) processes to verify the age and identity of individuals, ensuring compliance with age restrictions and preventing under-aged purchases, among other regulatory requirements. Whilst the process differs for B2B (business-to-business) transactions, the need for KYC exists nevertheless. However in the B2B space, the KYC process is less likely to be made more complex by transactions done in cryptocurrencies, since the parties involved are typically well-established companies or organizations with known identities and reputations.

Central Bank Digital Currencies

(CBDCs) are emerging as potential alternatives to privately issued stablecoins and other cryptocurrencies. Central banks, including the European Central Bank and the Peoples Banks of China, are actively exploring the development of CBDCs. These currencies, backed by central banks, introduce a new dimension to the financial landscape and will be another arrow in the quiver of end-customers – along with cash, credit and debit cards or PayPal. Corporate treasurers must prepare for the potential implications and opportunities that CBDCs may bring, such as changes in payment options, governance processes, and working capital management.

Adapting to the Future

Corporate treasurers should proactively prepare for the impact of cryptocurrencies and Blockchain technology on their business operations. This includes educating themselves on the basics of cryptocurrencies, stablecoins, and CBDCs, and investigating how these assets can be integrated into their treasury functions. Understanding the infrastructure, processes, and potential hedging strategies is crucial for treasurers to make informed decisions regarding their balance sheets. Furthermore, treasurers must evaluate the impact of new payment options on working capital and adjust their strategies accordingly.

Zanders understands the importance of keeping up with emerging technologies and trends, which is why we offer a comprehensive range of Blockchain services. Our Blockchain offering covers supporting our clients in developing their Blockchain strategy including developing proofs of concept, cryptocurrency integration into Corporate Treasury, support on vendor selection as well as regulatory advice. For decades Zanders has helped corporate treasurers navigate the choppy seas of change and disruption. We are ready to support you during this new era of disruption, so reach out to us today.

Meet the team

Zanders already has a well-positioned, diversified Blockchain team in place, consisting of Blockchain developers, Blockchain experts and business experts in their respective fields. In the following you will find a brief introduction of our lead Blockchain consultants.

ISO 20022 XML (Pain.001.001.09) – Introduction of the Structured Address

At the end of July, the European Banking Authority (EBA) released the results on the latest installment of the EU-wide stress test that is performed every two years.

However, possibly the most important point for corporates to be aware of is the planned move towards explicit use of the structured address block. In this second article in the ISO 20022 series, Zanders experts Eliane Eysackers and Mark Sutton provide some valuable insights around this industry requirement, the challenges that exists and an important update on this core topic.

What is actually happening with the address information?

One of the key drivers around the MT-MX migration are the significant benefits that can be achieved through the use of structured data. E.g., stronger compliance validation and support STP processing. The SWIFT PMPG1 (Payment Market Practice Group) had advised that a number of market infrastructures2 are planning to mandate the full structured address with the SWIFT ISO migration. The SWIFT PMPG had also planned to make the full structured address mandatory for the interbank messages – so effectively all cross-border payments. The most important point to note is that the SWIFT PMPG had also advised of the plan to reject non-compliant cross border payment messages from November 2025 in line with the end of the MT-MX migration. So, if a cross border payment did not include a full structured address, the payment instruction would be rejected.

What are the current challenges around supporting a full structured address?

Whilst the benefits of structured data are broadly recognised and accepted within the industry, a one size approach does not always work, and detailed analysis conducted by the Zanders team revealed mandating a full structured address would create significant friction and may ultimately be unworkable.

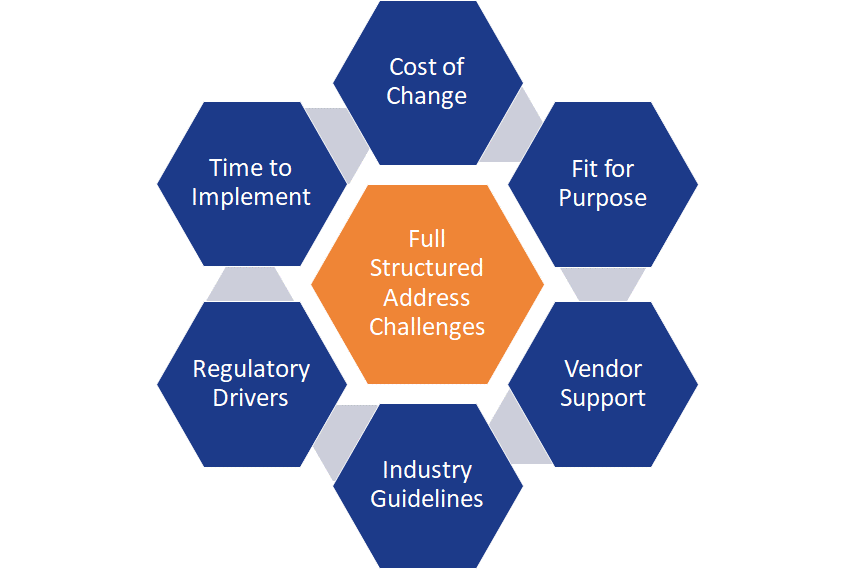

Diagram 1: Challenges around the implementation of the full structured address.

From the detailed analysis performed by the Zanders team, we have identified multiple problems that are all interconnected, and need to be addressed if the industry is to achieve its stated objective of a full structured address. These challenges are summarized below:

- Cost of change: The 2021 online TMI poll highlighted that 70% of respondents confirmed they currently merge the building name, building number, and street name in the same address line field. The key point to note is that the data is not currently separated within the ERP (Enterprise Resource Planning) system. Furthermore, 52% of these respondents highlighted a high impact to change this data, while 26% highlighted a medium impact. As part of Zanders’ continued research, we spoke to two major corporates to gain a better sense of their concerns. Both provided a high-level estimate of the development effort required for them to adapt to the new standard: ½ million euros.

- Fit for Purpose: From the ISO 20022 expert group discussions, it was recognized that the current XML Version 9 message would need a significant re-design to support the level of complexity that exists around the address structure globally.

- Vendor Support: Whilst we have not researched every ERP and TMS (Treasury Management System) system, if you compare the current structured address points including field length in the XML Version 9 message with the master data records currently available in the ERP and TMS systems, you will see gaps in terms of the fields that are supported and the actual field length. This means ERP and TMS software vendors will need to update the current address logic to fully align with the ISO standard for payments – but this software development cannot logically start until the ISO address block has been updated to avoid the need for multiple software upgrades.

- Industry Guidelines: Whilst industry level implementation guidelines are always a positive step, the current published SWIFT PMPG guidelines have primarily focused on the simpler mainstream address structures for which the current address structure is fine. By correctly including the more complex local country address options, it will quickly highlight the gaps that exist, which mean compliance by the November 2025 deadline looks unrealistic at this stage.

- Regulatory Drivers: At this stage, there is still no evidence that any of the in-country payments regulators have actually requested a full structured address. However, we have seen some countries start to request minimum address information (but not structured due to the MT file format), such as Canada and US.

- Time to Implement: We must consider the above dependencies that need to be addressed first before full compliance can logically be considered, which means a new message version would be required. Whilst industry discussions are ongoing, the next ISO maintenance release is November 2023, which will result in XML version 13 being published. If we factor in time for banks to adopt this new version (XML Version 13), time for software vendors to develop the new full structured address including field length and finally, for the corporates to then implement this latest software upgrade and test with their banking partners, the November 2025 timeline looks unrealistic at this point in time.

A very important update

Following a series of focused discussions around the potential address block changes to the XML Version 9 message, including the feedback from the GLEIF3 the ISO payment expert group questioned the need to support a significant redesign of the address block to enable the full structured address to be mandated. The Wolfsberg Group4 also raised concerns about scale of the changes required within the interbank messaging space.

Given this feedback, the SWIFT PMPG completed a survey with the corporate community in April. The survey feedback highlighted a number of the above concerns, and a change request has now been raised with the SWIFT standards working group for discussion at the end of June. The expectation is that the mandatory structured address elements will now be limited to just the Town/City, Postcode, and country, with typical address line 1 complexity continuing to be supported in the unstructured address element. This means a blended address structure will be supported.

Is Corporate Treasury Impacted by this structured address compliance requirement?

There are a number of aspects that need to be considered in answering this question. But at a high level, if you are currently maintaining your address data in a structured format within the ERP/TMS and you are currently providing the core structured address elements to your banking partners, then the impact should be low. However, Zanders recommends each corporate complete a more detailed review of the current address logic as soon as possible, given the current anticipated November 2025 compliance deadline.

In Summary

The ISO 20022 XML financial messages offer significant benefits to the corporate treasury community in terms more structured and richer data combined with a more globally standardised design. The timing is now right to commence the initial analysis so a more informed decision can be made around the key questions.

Notes:

- The PMPG (payment market practice group) is a SWIFT advisory group that reports into the Banking Services Committee (BSC) for all topics related to SWIFT.

- A Market Infrastructure is a system that provides services to the financial industry for trading, clearing and settlement, matching of financial transactions, and depository functions. For example, in-country real-time gross settlement (RTGS) operators (FED, ECB, BoE).

- Global Legal Entity Identifier Foundation (Established by the Financial Stability Board in June 2014, the GLEIF is tasked to support the implementation and use of the Legal Entity Identifier (LEI).

- https://www.wolfsberg-principles.com/sites/default/files/wb/pdfs/wolfsberg-standards/1.%20Wolfsberg-Payment-Transparency-Standards-October-2017.pdf

ESG-related derivatives: regulation & valuation

At the end of July, the European Banking Authority (EBA) released the results on the latest installment of the EU-wide stress test that is performed every two years.

The most popular financial instruments in this regard are sustainability-linked loans and bonds. But more recently, corporates also started to focus on ESG-related derivatives. In short, these derivatives provide corporates with a financial incentive to improve their ESG performance, for instance by linking it to a sustainable KPI. This article aims to provide some guidance on the impact of regulation around ESG-related derivatives.

As covered in our first ESG-related derivatives article, a broad spectrum of instruments is included in this asset class, the most innovative ones being emission trading derivatives, renewable energy and fuel derivatives, and sustainability-linked derivatives (SLDs).

Currently, market participants and regulatory bodies are assessing if, and how new types of derivatives fit into existing derivatives regulation. In this regard, European and UK regulators are at the forefront of the regulatory review to foster activity and ensure safety of financial markets. Since it’s especially challenging for market participants to comprehend the impact of these regulations and the valuation implications of SLDs, we aim to provide guidance to corporates on these matters, with a special focus on the implications for corporate treasury.

Categorization & classification

When issuing an SLD, it’s important to understand which category the respective SLD falls in. That is, whether the SLD incorporates KPIs and the impact of cashflows in the derivatives instrument (category 1), or if the KPIs and related cashflows are stated in a separate agreement, in which the underlying derivatives transaction is mentioned for setting the reference amount to compute the KPI-linked cashflow (category 2). This categorization makes it easier to understand the regulations applying to the SLD, and the implications of those regulations.

In general, a category 1 SLD will be classified as derivative under European and UK regulations, and swap under US regulations, if the underlying financial contract is already classified as such. The addition of KPI elements to the underlying financial instrument is unlikely to change that classification.

Whether a category 2 SLD is classified as a derivative or swap is somewhat more complicated. In Europe, this type of SLD is classified as a derivative if it falls within the MIFID II catch-all provision, which must be determined on a case-by-case basis.

Overall, instruments that are classified as derivatives in Europe will also be classified as such in the UK. But to elaborate, a category 2 SLD will classified as a derivative in the UK if the payments of the financial instrument vary based on fluctuations in the KPIs.

When a category 2 SLD is issued in the US, it will only be classified as a swap if KPI-linked payments within the financial agreement go in two directions. Even if that is the case, the SLD may still be eligible for the status as commercial agreement outside of swaps regulation, but that is specific to facts and circumstances.

Apart from the classification as derivative or swap, it is also helpful to determine whether an SLD could be considered a hedging contract, so that it is eligible for hedging exemptions. The requirements for this are similar in Europe, the UK, and the US. Generally, category 1 SLDs are considered hedging contracts if the underlying instruments still follow the purpose of hedging commercial risks, after the KPI is incorporated. Category 2 SLDs are normally issued to meet sustainability goals, instead of hedging purposes. Therefore, it is unlikely that this category of SLDs will be classified as hedging contracts.

Regulation & valuation implications

When issuing an SLD that is classified as a derivative or swap, there are several regulatory and valuation implications relevant to treasury. These implications can be split up in six types which we will now explain in more detail. The six types (risk management, reporting, disclosure, benchmark-related considerations, prudential requirements, and valuation) are similar for corporates across Europe, the UK, and the US, unless otherwise mentioned.

Risk management

As is the case for other derivatives and swaps, corporate treasuries must meet confirmation requirements, undertake portfolio reconciliation, and perform portfolio compression for SLDs. Additionally, regulated companies are required to construct effective risk procedures for risk management, which includes documenting all risks associated with KPI-linked cashflows. While these points might be business as usual, it must also be determined if and how KPI-linked cashflows should be modeled for valuation obligations that apply to derivatives and swaps. For instance, initial margin models might need to be adjusted for SLDs, so they capture KPI-linked risks accurately.

Reporting

Corporate treasuries must report SLDs to trade repositories in Europe and the UK, and to swap data repositories in the US. Since these repositories require companies to report in line with prescriptive frameworks that do not specifically cover SLDs, it should be considered how to report KPI-linked features. As this is currently not clearly defined, issuers of SLDs are advised to discuss the establishment of clear reporting guidelines for this financial instrument with regulators and repositories. A good starting point for this could be the mark-to-market or mark-to-model valuation part of the EMIR reporting regulations.

Disclosure

Only Treasuries of European financial entities will be involved in meeting disclosure requirements of SLDs, as the legislation in the UK and US is behind on Europe in this respect, and non-financial market participants are not as strictly regulated. From January 2023, the second phase of the Sustainable Finance Disclosure Regulation (SFDR) will be in place, which requires financial companies to report periodically, and provide pre-contractual disclosures on SLDs. Treasuries of investment firms and portfolio managers are ought to contribute to this by reporting on sustainability-related impact of the SLDs compared to the impact of reference index and broad market index with sustainability indicators. In addition, they could leverage their knowledge of financial instruments to evaluate the probable impacts of sustainability risks on the returns of the SLDs.

Benchmark-related implications

In case the KPI of an SLD references or includes an index, it could be defined as a benchmark under European and UK legislation. In such cases, treasuries are advised to follow the same policy they have in place for benchmarks incorporated in other brown derivatives. Specific benchmark regulations in the US are currently non-existent, however, many US benchmark administrators maintain policies in compliance with the same principles as where the European and UK benchmark legislation is built on.

Prudential requirements

Since treasury departments of corporates around the world are required to calculate risk-weighted exposures for derivatives transactions as well as non-derivatives transactions, this is not different for SLDs. While there is currently little guidance on this for SLDs explicitly, that may change in the near future, as US prudential regulators are assessing the nature of the risk that is being assumed with in-scope market participants.

Valuation

The SLD market is still in its infancy, with SLD contracts being drawn up are often specific to the company issuing it, and therefore tailor made. The trading volume must go up, trade datasets are to be accurately maintained, and documentation should be standardized on a global scale for the market to reach transparency and efficiency. This will lead to the possibility of accurate pricing and reliable cashflow management of this financial instrument and increases the ability to hedge the ESG component.

To conclude

As aforementioned, the ESG-related derivatives market and the SLD market within it are still in the development phase. Therefore, regulations and their implications will evolve swiftly. However, the key points to consider for corporate treasury when issuing an SLD presented in this article can prove to be a good starting point for meeting regulatory requirements as well as developing accurate valuation methodology. This is important, since these derivatives transactions will be crucial for facilitating the lending, investment and debt issuance required to meet the ESG ambitions of Europe, the UK, and the US.

For more information on ESG issues, please contact Joris van den Beld or Sander van Tol.

How to setup a Vendor Supply Chain Finance Process in SAP

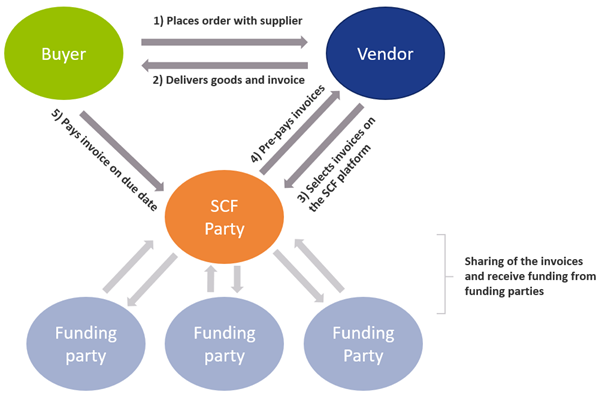

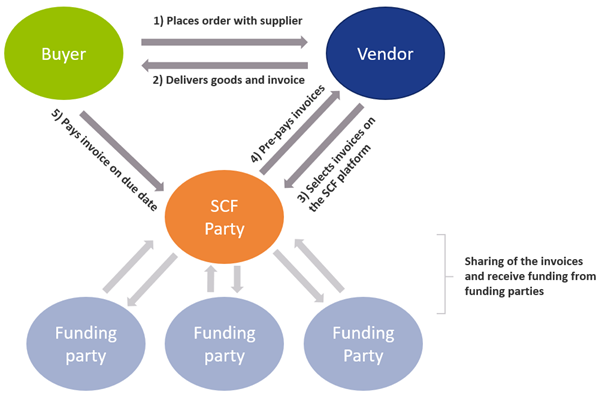

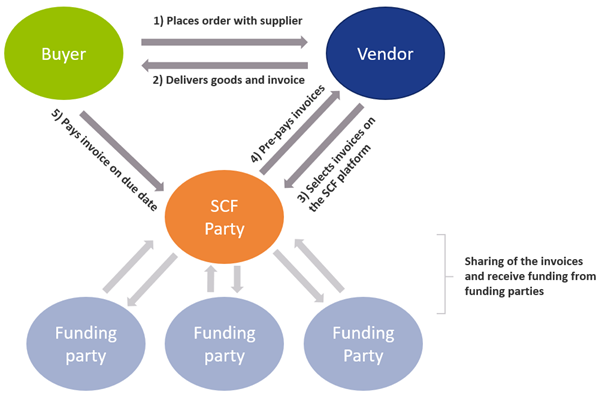

Vendor Supply Chain Finance (SCF) constitutes the transfer of a (trade) payable position towards the SCF underwriter (i.e. the bank). The beneficiary of the payment can then decide either to receive an invoice payment on due date or to receive the funds before, at the cost of a pre-determined fee.

The debtor’s bank account will only be debited on due date of the payable; hence the bank finances the differential between the due date and the actual payment date towards the beneficiary for this pre-determined fee. This article elaborates on why and how corporates set-up an SCF scheme with their suppliers.

The Vendor SCF construction can be depicted as:

There are multiple business rationales behind Supply Chain Finance. Why would a corporate want to setup an SCF scheme with its suppliers? The most prominent rationales are:

- Reduction of the need of more traditional trade finance

The need for individual line of credits and bank guarantees for each trade transaction is removed, making the trade process more efficient. - Sellers can flexibly and quickly fund short term financing needs

If working capital or financing is needed, the seller can quickly request for outstanding invoices to be paid out early (minus a fee). - Sharing the benefits of better credit rating from buyer towards seller

Because the financing is arranged by the buyer, the seller can enjoy the credit terms that were negotiated between buyer and financier/bank. - Streamlining the AP process

By onboarding various vendors into the SCF process, the buyer can enjoy a singular and streamlined payment process for these vendors. - Strengthening of trade relations

Because of the benefits of SCF, more competitive terms on the trade agreement itself can be negotiated.

SCF is typically considered a tool to improve the working capital position of a company, specifically to decrease the cash conversion cycle by increasing the payment terms with its suppliers without weakening the supply chain.

Set-up and onboarding

Typically, a set-up and onboarding process consists of the following steps. First a financing for SCF is obtained from, for example, a bank. In addition, an SCF provider must be selected and contracted. Most major banks have their own solutions but there are many third parties, for example fintechs, that provide solutions as well. Consequently, the SCF terms are negotiated, and the suppliers are onboarded to the SCF process. Lastly, your system should of course be able to process/register it. Therefore, the ERP accounts payable module needs to be adjusted, such that the AP positions eligible for SCF are interfaced into the SCF platform. Besides, your ERP system needs to be adjusted to be able to reconcile the SCF reports and bank statements.

Design considerations and Processing SCF in SAP

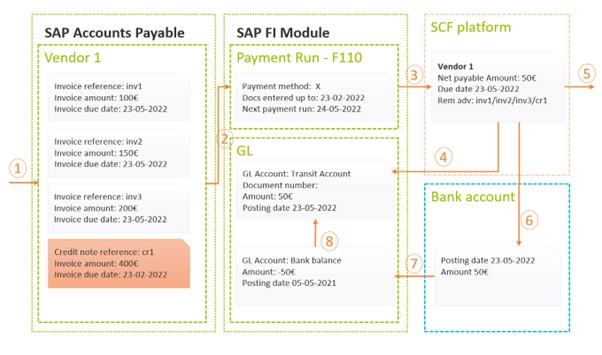

In the picture below we provide a high-level example of how a basic SCF process can work using basic modules in SAP. Note that, based on the design considerations and capabilities of the SCF provider, the picture may look a bit different. For each of the steps denoted by a number, we provide an explanation below the figure, going a little deeper into some of the possible considerations on which a decision must be made.

- Invoice and credit note data entry; In the first step, the invoices/credit notes will be entered, typically with payment terms sometime in the future, i.e. 90 days. Once entered and approved, these invoices are now available to the payment program.

- Payment run: The payment run needs to be engineered such that the invoices that are due in the future (i.e. 90 days from now) will be picked up already in today’s run. Some important considerations in this area are:

- Payment netting logic: the netting of invoices and credit notes is an important design consideration. Typically, credit notes are due immediate and the SCF invoices are due sometime in the future, i.e. 90 days from now. If one would decide to net a credit note due immediate with an invoice due in 90 days, this would have some adverse impact on working capital. An alternative is to exclude credit notes from being netted with SCF invoices and have them settled separately (i.e. request the vendor to pay it out separately or via a direct debit). Additionally, some SCF providers have certain netting logic embedded in their platform. In this case, the SAP netting logic should be fully disabled and all invoices should be paid out gross. Careful considerations should be taken when trying to reconcile the SCF settled items report as mentioned in step 4 though.

- Payment run posting: When executing the SAP payment run it is possible to either clear the underlying invoices on payment run date or to leave them open until invoice due date. If the invoices are kept open, they will be cleared once the SCF reporting is imported in SAP (see step 4). This is decision-driven by the accounting team and depends on where the open items should be rolling up in the balance sheet (i.e. payable against the vendor or payable against the SCF supplier).

- Payment file transfer: At this step, the payment file will be generated and sent to the SCF supplier. The design considerations are dependent on the SCF supplier’s capabilities and should be considered carefully while selecting an appropriate partner.

- File format: Most often we advise to implement a best practice payment file format like ISO pain.001. This format has a logical structure, is supported out of the box in SAP, while most SCF partners will support it too.

- Interface technology: The payment files need to be transferred into the SCF platform. This can be done via a multitude of ways; i.e. manual upload, automatically via SWIFT or Host2Host. This decision is often driven internally. Often the existing payment infrastructure can be leveraged for SCF payments as well.

- Remittance information: By following ISO pain.001 standard, the remittance information that remits which invoices are paid and cleared, can be provided in a structured format, irrespective of the volume of invoices that got cleared. This ensures that the beneficiary exactly knows which invoices were paid under this payment. Alternatively, an unstructured remittance can be provided but this often is limited to 140 characters maximum.

- Payment status reporting: Some SCF supplier will support some form of payment status reporting to provide immediate feedback on whether the payments were processed correctly. These reports can be imported in SAP; SAP can subsequently send notifications of payment errors to the key users who can then take corrective actions.

- SCF payment clearing reporting: At this step, the SCF platform will send back a report that contains information on all the cleared payments and underlying invoices for that specific due date. Most typically, these reports are imported in SAP to auto reconcile against the open items sitting in the administration.

- Auto import: If import of the statement into SAP is required, the report should be in one of SAP’s standard-supported formats like MT940 or CAMT.053.

- Auto reconciliation: If auto reconciliation of this report against line items in SAP is required, the reports line items should be matchable with the open line items in the SAP administration. Secondly, a pre-agreed identifier needs to be reported such that SAP can find the open item automatically (i.e. invoice reference, document number, end2endId, etc.). Very careful alignment is needed here, as slight differences in structure in the administration versus the reporting structure of SCF can lead to failed auto reconciliation and tedious manual post processing.

- Pay out to the beneficiary: Onboarded vendors can access the SCF platform and report on the pending payments and invoices. The vendor has the flexibility to have the invoices paid out early (before due date) by accepting the deduction of a pre-agreed fee. The SCF provider should ensure payment is made.

- Debiting bank account: At due date of the original invoice, the SCF provider will want to receive the funds.

- Payment initiation vs direct debit: The payment of funds can in principle be handled via two processes; either the SCF customer initiates the payment himself, or an agreement is made that the SCF provider direct debits the account automatically.

- Lump debit vs line items: Most typically, one would make a lump payment (or direct debit) of the total amount of all invoices due on that day. Some SCF providers may support line by line direct debiting although this might result in high transaction costs. Line by line debiting might be beneficial for the auto reconciliation process in SAP though (see step 7)

- Bank statement reporting: The bank statement of the cash account will be received and imported into SAP. Most often, the statements are received over the existing banking interface.

- Bank statement processing: Based on pre-configured posting rules and reconciliation algorithms in SAP, the open items in the administration are cleared and the bank balance is updated appropriately.

To conclude

If the appropriate SCF provider is selected and the process design and implementation in SAP is sound, the benefits of SCF can be achieved without introducing new processes and therefore creating a burden on the existing accounts payable team. It is fully possible to integrate the SCF processes with the regular accounts payable payments processes without adding additional manual process steps or cumbersome workarounds.

For more information, contact Ivo Postma at +31 88 991 02 00.

A roadmap to becoming a data-driven organization

Vendor Supply Chain Finance (SCF) constitutes the transfer of a (trade) payable position towards the SCF underwriter (i.e. the bank). The beneficiary of the payment can then decide either to receive an invoice payment on due date or to receive the funds before, at the cost of a pre-determined fee.

Developing a data strategy depends on using the various types of payment, market, cashflow, bank and risk data available to a treasury, and then considering the time implications of past historical data, present and future models, to better inform decision-making. We provide a roadmap and ‘how to’ guide to becoming a data-driven organization.

Why does this aim matter? Well, in this age of digitization, almost every aspect of the business has a digital footprint. Some significantly more than the others. This presents a unique opportunity where potentially all information can be reliably processed to take tactical and strategic decisions from a position of knowledge. Good data can facilitate hedging, forecasting and other key corporate activities. Having said all that, care must also be taken to not drown in the data lake1 and become over-burdened with useless information. Take the example of Amazon in 2006 when it reported that cross-selling attributed for 35% of their revenue2. This strategy looked at data from shopping carts and recommended other items that may be of interest to the consumer. The uplift in sales was achieved only because Amazon made the best use of their data.

Treasury is no exception. It too can become data-driven thanks to its access to multiple functions and information flows. There are numerous ways to access and assess multiple sets of data (see Figure 1), thereby finding solutions to some of the perennial problems facing any organization that wants to mitigate or harness risk, study behavior, or optimize its finances and cashflow to better shape its future.

Time is money

The practical business use cases that can be realized by harnessing data in the Treasury often revolve around mastering the time function. Cash optimization, pooling for interest and so on often depend on a good understanding of time – even risk hedging strategies can depend on the seasons, for instance, if we’re talking about energy usage.

When we look at the same set of data from a time perspective, it can be used for three different purposes:

I. Understand the ‘The Past’ – to determine what transpired,

II. Ascertain ‘The Present’ situation,

III. Predict ‘The Future’ based on probable scenarios and business projections.

I – The Past

“Study the past if you would define the future”

Confucius

The data in an organization is the undeniable proof of what transpired in the past. This fact makes it ideal to perform analysis through Key Performance Indicators (KPIs), perform statistical analysis on bank wallet distribution & fee costs, and it can also help to find the root cause of any irregularities in the payments arena. Harnessing historical data can also positively impact hedging strategies.

II – The Present

“The future depends on what we do in the present”

M Gandhi

Data when analyzed in real-time can keep stakeholders updated and more importantly provide a substantial basis for taking better informed tactical decisions. Things like exposure, limits & exceptions management, intra-day cash visibility or near real-time insight/access to global cash positions all benefit, as does payment statuses which are particularly important for day-to-day treasury operations.

III – The Future

“The best way to predict the future is to create it.”

Abraham Lincoln

There are various areas where an organization would like to know how it would perform under changing conditions. Simulating outcomes and running future probable scenarios can help firms prepare better for the near and long-term future.

These forecast analyses broadly fall under two categories:

Historical data: assumes that history repeats itself. Predictive analytics on forecast models therefore deliver results.

Probabilistic modelling: this creates scenarios for the future based on the best available knowledge in the present.

Some of the more standard uses of forecasting capabilities include:

- risk scenarios analysis,

- sensitivity analysis,

- stress testing,

- analysis of tax implications on cash management structures across countries,

- & collateral management based on predictive cash forecasting, adjusted for different currencies.

Working capital forecasting is also relevant, but has typically been a complex process. The predication accuracy can be improved by analyzing historical trends and business projections of variables like receivables, liabilities, payments, collections, sales, and so on. These can feed the forecasting algorithms. In conjunction with analysis of cash requirements in each business through studying the trends in key variables like balances, intercompany payments and receipts, variance between forecasts and actuals, this approach can lead to more accurate working capital management.

How to become a data-driven organization

“Data is a precious thing and will last longer than the systems themselves.”

Tim Berners-Lee

There can be many uses of data. Some may not be linked directly to the workings of the treasury or may not even have immediate tangible benefits, although they might in the future for comparative purposes. That is why data is like a gold mine that is waiting to be explored. However, accessing it and making it usable is a challenging proposition. It needs a roadmap.

The most important thing that can be done in the beginning is to perform a gap analysis of the data ecosystem in an organization and to develop a data strategy, which would embed importance of data into the organization’s culture. This would then act as a catalyst for treasury and organizational transformation to reach the target state of being data-driven.

The below roadmap offers a path to corporates that want to consistently make the best use of one of their most critical and under-appreciated resources – namely, data.

We have seen examples like Amazon and countless others where organizations have become data- driven and are reaping the benefits. The same can be said about some of the best treasury departments we at Zanders have interacted with. They are already creating substantial value by analyzing and making the optimum use of their digital footprint. The best part is that they are still on their journey to find better uses of data and have never stopped innovating.

The only thing that one should be asking now is: “Do we have opportunities to look at our digital footprint and create value (like Amazon did), and how soon can we act on it?”

References:

ESG-related derivatives: innovation or fad?

Vendor Supply Chain Finance (SCF) constitutes the transfer of a (trade) payable position towards the SCF underwriter (i.e. the bank). The beneficiary of the payment can then decide either to receive an invoice payment on due date or to receive the funds before, at the cost of a pre-determined fee.

Next to sustainable funding instruments, including both green and social, we also see that these KPI’s can be used for other financial instruments, such as ESG (Environmental, Social, Governance) derivatives. These derivatives are a useful tool to further drive the corporate sustainability strategy or support meeting environmental targets.

Since the first sustainability-linked derivative was executed in 2019, market participants have entered into a variety of ESG-related derivatives and products. In this article we provide you with an overview of the different ESG derivatives. We will touch upon the regulatory and valuation implications of this relatively new derivative class in a subsequent article, which will be published later this year.

Types of ESG-related derivatives products

Driven by regulatory pressure and public scrutiny, corporates have been increasingly looking for ways to manage their sustainability footprint. As a result of a blooming ESG funding market, the role of derivatives to help meet sustainability goals has grown. ESG-related derivatives cover a broad spectrum of derivative products such as forwards, futures and swaps. Five types (see figure 1) of derivatives related to ESG can be identified; of which three are currently deemed most relevant from an ESG perspective.

The first category consists of traditional derivatives such as interest rate swaps or cross currency swaps that are linked to a sustainable funding instrument. The derivative as such does not contain a sustainability element.

Sustainability-linked derivatives

Sustainability-linked derivatives are agreements between two counterparties (let’s assume a bank and a corporate) which contain a commitment of the corporate counterparty to achieve specific sustainability performance targets. When the sustainability performance targets are met by the corporate during the lifetime of the derivative, a discount is applied by the bank to the hedging instrument. When the targets are not met, a premium is added. Usually, banks invest the premium they receive in sustainable projects or investments. Sustainability-linked derivative transactions are highly customizable and use tailor-made KPIs to determine sustainability goals. Sustainability-linked derivatives provide market participants with a financial incentive to improve their ESG performance. An example is Enel’s sustainability-linked cross currency swap, which was executed in July 2021 to hedge their USD/EUR exchange rate and interest rate exposures.

Emission trading derivatives

Other ESG-related derivatives support meeting sustainable business models and consist of trading carbon offsets, emission trading derivatives, and renewable energy and renewable fuels derivatives, amongst others. Contrary to sustainability-linked derivatives, the use of proceeds of ESG-related derivatives are allocated to specific ESG-related purposes. For example, emissions trading is a market-based approach to reduce pollution by setting a (geographical) limit on the amount of greenhouse gases that can be emitted. It consists of a limit or cap on pollution and tradable instruments that authorize holders to emit a specific quantity of the respective greenhouse gas. Market participants can trade derivatives based on emission allowances on exchanges or OTC markets as spots, forwards, futures and option contracts. The market consists of mandatory compliance schemes and voluntary emission reduction programs.

Renewable energy and fuel derivatives

Another type of ESG-related derivatives are renewable energy and renewable fuel hedging transactions, which are a valuable tool for market participants to hedge risks associated with fluctuations in renewable energy production. These ESG-related credit derivatives encourage more capital to be contributed to renewable energy projects. Examples are Power Purchase Agreements (PPAs), Renewable Energy Certificate (REC) futures, wind index futures and low carbon fuel standard futures.

ESG related credit derivatives

ESG-related CDS products can be used to manage the credit risk of a counterparty when financial results may be impacted by climate change or, more indirectly, if results are affected due to substitution of a specific product/service. An example of this could be in the airline industry where short-haul flights may be replaced by train travel. Popularity of ESG-related CDS products will probably increase with the rising perception that companies with high ESG ratings exhibit low credit risk.

Catastrophe and weather derivatives

Catastrophe and weather derivatives are insurance-like products as well. Both markets have existed for several decades and are used to hedge exposures to weather or natural disasters. Catastrophe derivatives are financial instruments that allow for transferral of natural disaster risk between market participants. These derivatives are traded on OTC markets and enable protection from enormous potential losses following from natural disasters such as earthquakes to be obtained. The World Bank has designed catastrophe swaps that support the transfer of risks related to natural disasters by emerging countries to capital markets. An example if this is the swap issued for the Philippines in 2017. Weather derivatives are financial instruments that derive their value from weather-related factors such as temperature and wind. There derivatives are used to mitigate risks associated with adverse or unexpected weather conditions and are most commonly used in the food and agriculture industry.

What’s old, what’s new and what’s next?

ESG-related credit derivatives would be best applied by organizations with credit exposures to certain industries and financial institutions. Despite the link to an environmental element, we do not consider catastrophe bonds and weather derivatives as a sustainability-linked derivative. Neither is it an innovative, new product that is applicable to corporates in various sectors.

Truly innovative products are sustainability-linked derivatives, voluntary emissions trading and renewable energy and fuel derivatives. These products strengthen a corporate’s commitment to meet sustainability targets or support investments in sustainable initiatives. A lack of sustainability regulation for derivatives raises the question to what extent these innovative products are sustainable on their own? An explicit incentive for financial institutions to execute ESG-related derivatives, such as a capital relief, is currently absent. This implies that any price advantage will be driven by supply and demand.

Corporate Treasury should ensure they consider the implications of using ESG-related derivatives that affect the cashflows of derivatives transactions. Examples of possible regulatory obligations consist of valuation requirements, dispute resolution and reporting requirements. Since ESG-related derivatives and products are here to stay, Zanders recommends that corporate treasurers closely monitor the added value of specific instruments, as well as the regulatory, tax and accounting implications. Part II of this series, later in the year, will focus on the regulatory and valuation implications of this relatively new derivative class.

For more information on ESG issues, please contact Sander van Tol.

Three major benefits of S/4 HANA Bank Account Management

Vendor Supply Chain Finance (SCF) constitutes the transfer of a (trade) payable position towards the SCF underwriter (i.e. the bank). The beneficiary of the payment can then decide either to receive an invoice payment on due date or to receive the funds before, at the cost of a pre-determined fee.

Bank accounts can now be created and maintained by the cash and banking responsible team, giving them more control over the timing of opening or closing of an account as well as expediting the overall process and limiting the number of users involved in the maintenance of the accounts.

Figure 1 – Launchpad BankApplications

The advantages of using the full version of BAM are multiple, but below we highlight three of the main reasons full BAM is a must have for the companies using one or multiple SAP environments.

Flexible workflows

Maintenance of bank account data can trigger workflows based on the organization’s requirements and the approval processes in place. With the workflows the segregation of duties can be enforced when maintaining a bank account.

Even though workflows are not a new functionality in S/4HANA, the fact that workflow templates are available and can be amended by defining preconditions, step sequences and recipients improves the approval process of bank accounts.

The workflows can be created and activated as completely new ones or based on the already existing templates . You can create a new workflow by copying an existing one and updating the parameters according to the new requirements.

All the requests to release or approve bank account changes are available as of S/4HANA 2020 in the My Inbox for Bank Accounts app, the dedicated inbox app where users can check the status of each request initiated by the users themselves or sent to them and act upon.

Easy data replication

One of the challenges multiple organizations have, especially those operating various SAP environments, is data synchronization and replication. We often come across situations when banks, house banks and bank accounts are not maintained in all relevant environments creating data inconsistencies and making processes more difficult than they already are.

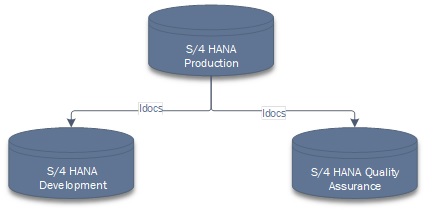

One of the ways of avoiding these types of situations is by replicating banks, house banks and bank accounts from production to quality assurance and to development environments using standard Idocs.

Figure 2 – Bank data replication in S/4 HANA

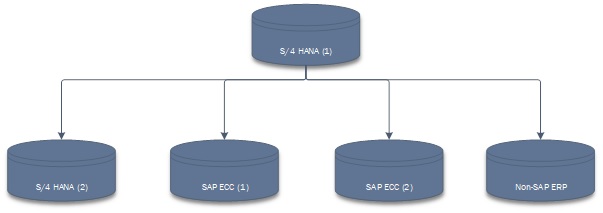

If the organization is operating on multiple SAP and non-SAP instances and running processes in a S/4 HANA side-car solution, the challenge of maintaining banks, house banks and bank accounts grows exponentially. Distributing the data via Idocs will not only keep all the systems coordinated, it will also decrease the amount of manual work and avoid situations when processes fail because of delays in keeping the data up to date in all relevant environments.

Figure 3 -Bank data replication across multiple environments

Simple way of managing cash pools

Cash pooling structures can easily be set up by the user and in this way the BAM solution is integrated with the process of making cash management transfers.

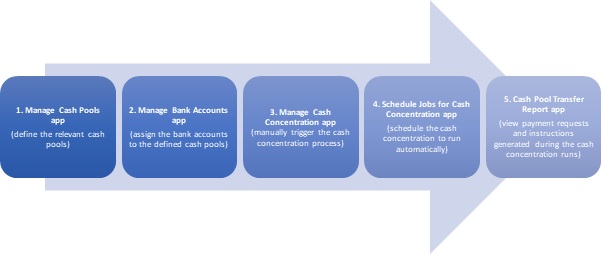

Even though the cash pooling and cash concentration in S/4HANA are managed using five different apps (shown in the figure below), the actual structure of the cash pool is defined directly in the Manage Bank Accounts app (Cash Pool tab).

Figure 4 – Five apps to manage cash pooling and cash concentration in S/4HANA

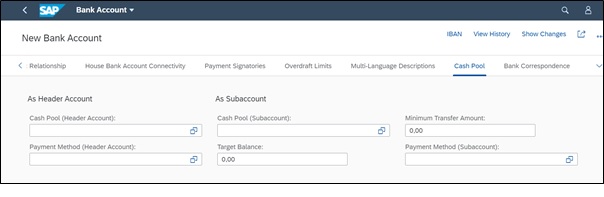

In the Cash Pool tab, the user can define the cash pool structure as per each company’s requirements. It is important to keep in mind the fact that a bank account can be assigned only to two different cash pools: once as the header account of a cash pool, and once in a different cash pool, as a subaccount.

The cash pools created in the system are not restricted to one company code but can be defined using various currency accounts belonging to multiple company codes. For each of the bank accounts included in a cash pool, a target balance as well as a minimum transfer amount can be defined in the Cash Pool tab of the Manage Bank Accounts app, with the mention that both (target balance as well as minimum transfer amounts) must be defined in the bank account currency.

During the cash concentration process, when bank transfers are generated, the payment methods defined in this tab will be picked up. Therefore, if required, two different payment methods can be assigned; the first for the structure where the bank account is acting as a header account and the second for the one where the account in scope is a subaccount. To pick them up from the drop-down list, the assigned payment methods must be initially setup in the system.

To conclude

Maintaining banks, house banks and bank accounts can be a difficult task especially in large organizations operating with different SAP and non-SAP environments. It can be time-consuming; it can involve multiple people from different parts of the organization (IT, master data, cash and banking etc.) and it can easily be prone to errors and mismatches if not correctly maintained and synchronized. Having one single source of truth for the bank accounts – which is easy to maintain, user-friendly, with appropriate controls in place and reporting capabilities, easy to replicate the data across different environments and which allows the user to create and maintain not only the bank accounts but also the cash pool structures – can save time, resources and simplify processes.

SAP Advanced Payment Management

Vendor Supply Chain Finance (SCF) constitutes the transfer of a (trade) payable position towards the SCF underwriter (i.e. the bank). The beneficiary of the payment can then decide either to receive an invoice payment on due date or to receive the funds before, at the cost of a pre-determined fee.

Intraday Bank Statements offers a cash manager additional insight in estimated closing balances of external bank accounts and therefore provides the information to manage the cash more tightly on the company’s bank accounts.

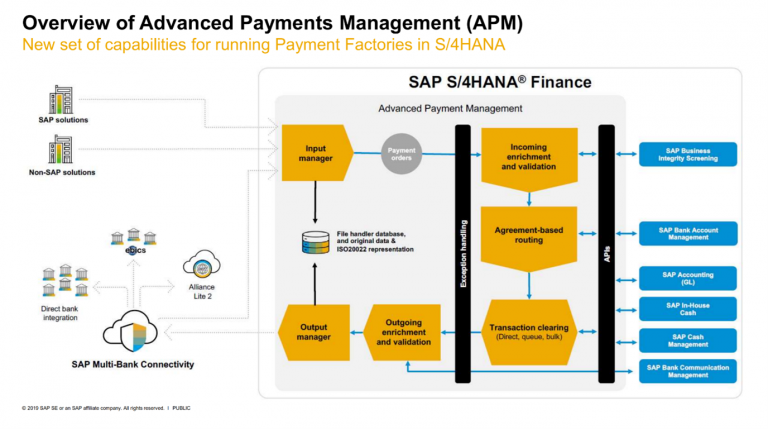

Whilst over the previous years, many corporates have endeavoured to move towards a single ERP system. There are many corporates who operate in a multi-ERP landscape and will continue to do so. This is particularly the case amongst corporates who have grown rapidly, potentially through acquisitions, or that operate across different business areas. SAP’s Central Finance caters for centralized financial reporting for these multi-ERP businesses. SAP’s APM similarly caters for businesses with a range of payment sources, centralizing into a single payment channel.

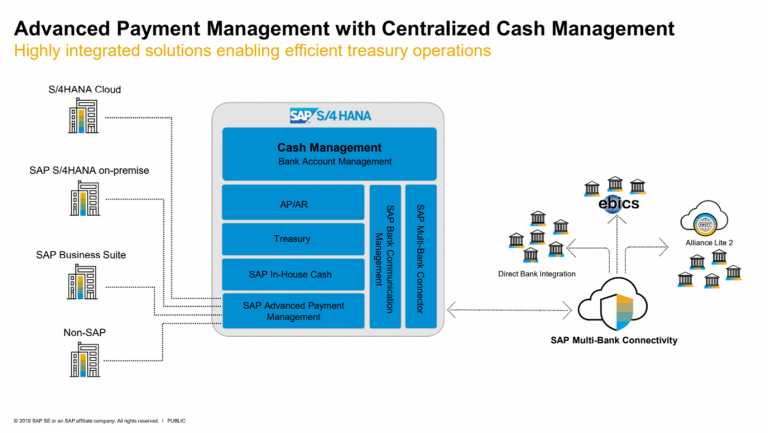

SAP APM acts as a central payment processing engine, connecting with SAP Bank Communication Management and Multi-Bank Connectivity for sending of external payment Instructions. For internal payments & payments-on-behalf-of, data is fed to SAP In-House Cash. Whilst at the same time, data is transmitted to S/4 HANA Cash Management to give centralized cash forecast data.

Figure 1 – SAP S/4 HANA Advanced Payment Management – Credit SAP

The framework of this product was built up as SAP Payment Engine, which is used for the processing of payment instructions at banking institutions. On this basis, it is a robust product, and will cater for the key requirements of corporate payment hubs, and much more beyond.

Building a business case

When building a business case for a centralized payment hub, it is important to look at the full range of the payment sources. This can include accounts payable/receivable (AP/AR) payments, but should also consider one-off (manual) payments, Treasury payments, as well as HR payments such as payroll. Whilst payroll is often outsourced, SAP APM can be a good opportunity to integrate payroll into a corporate’s own payment landscape (with the necessary controls of course!).

Using a centralized payment hub will help to reduce implementation time for new payment sources, which may be different ERPs. In particular, the ability of SAP APMs Input Manager to consume non-standard payment file formats helps to make this a smooth implementation process.

SAP APM applies a level of consistency across all payments and allows for a common payment control framework to be applied across the full range of payment sources.

A strength of the product is its flexible payment routing, which allows for payment routing to be adjusted according to the business need. This does not require specialist IT configuration or re-routing. It enables corporates to change their payment framework according to the need of the business, without the dependency on configuration and technology changes.

A central payment hub means no more direct bank integrations. This is particularly important for those businesses that operate in a multi-ERP environment, where the burden can be particularly heavy.

Lastly, as with most SAP products, this product benefits from native integration into modules that corporates may already be using. Payment data can be transferred directly into SAP In-House Cash using standard functionality in order to reflect intercompany positions. The richest level of data is presented to S/4 HANA Cash Management to provide accurate and up-to-date cash forecast data for Treasury front office.

Scenarios

SAP APM accommodates four different scenarios:

| Scenario | Description |

| Internal transfer | Payment from one subsidiaries internal account to the internal account of another |

| Payment on-behalf-of | Payment to external party from the internal account of a subsidiary |

| Payment in-name of | Payment to external party from the external account of a subsidiary. The derivation of the external account is performed in APM. |

| Payment in-name-of – forwarding only | Payment to external party from the external account of a subsidiary. The external account is pre-determined in the incoming payment instruction. |

A Working Example – Payment-on-behalf-of

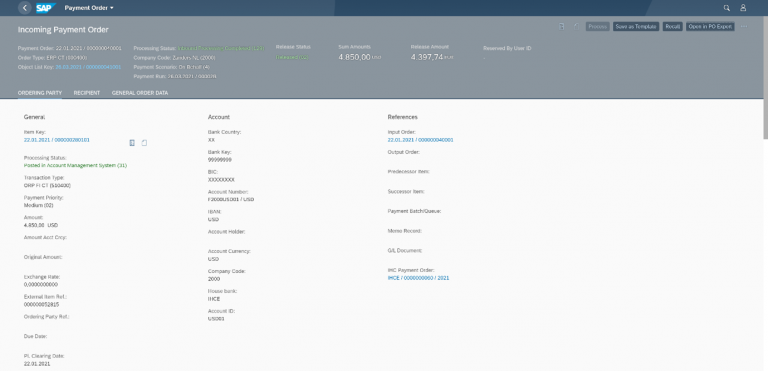

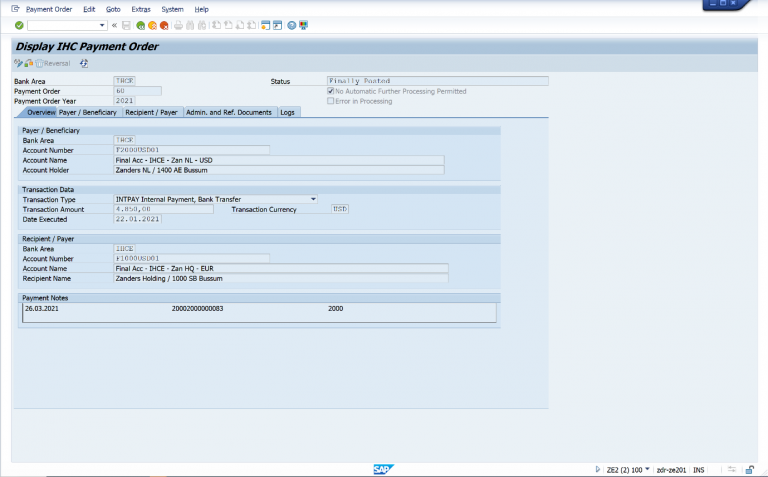

An ERP sends a payment instruction to the APM system via iDoc. This is consumed by the input manager, creating a payment order that is ready to be processed.

Figure 3 – Creation of Incoming Payment Order in APM

The payment order will normally be automatically processed immediately upon receipt. First the enrichment & validation checks are executed, which validate the integrity of the payment Instruction.

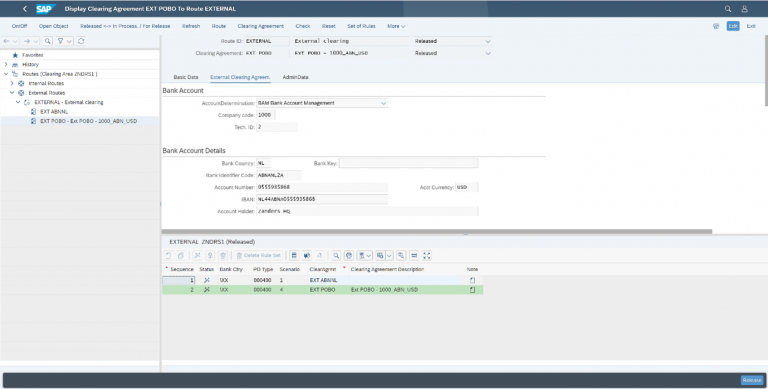

The payment routing is then executed for each payment item, according to the source payment data. The Payment Routing importantly selects the appropriate house bank account for payment and can be used to determine the prioritization of payments, as well as the method of clearing.

In the case of a payment-on-behalf-of, an external route will be used for the credit payment item to the third party vendor, whilst an internal route will be used to update SAP In-House Cash for the intercompany position.

Figure 4 – Maintenance of Routes

Clearing can be executed in batches, via queues or individual processing. The internal clearing for the debit payment item must be executed into SAP In-House Cash in order to reflect the intercompany position built up. The internal clearing for the credit payment Item can be fed into the general ledger of the paying entity.

Figure 5 – Update of In-House Cash for Payment-On-Behalf or Internal Transfer Scenarios

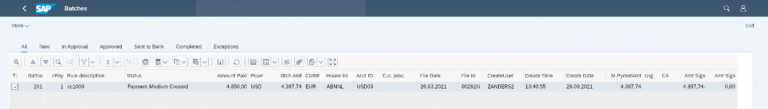

Outgoing payment orders are created once the routing & clearing is completed. At this stage, any further enrichment & validation can be executed and the data will be delivered to the output manager. The output manager has native integration with SAP’s DMEE Payment Engine, which can be used to produce an ISO20022 payment instruction file.

Figure 6 – Payment Instruction in SAP Bank Communication Management

The outgoing payment instruction is now visible in the centralized payment status monitor in SAP Bank Communication Management.

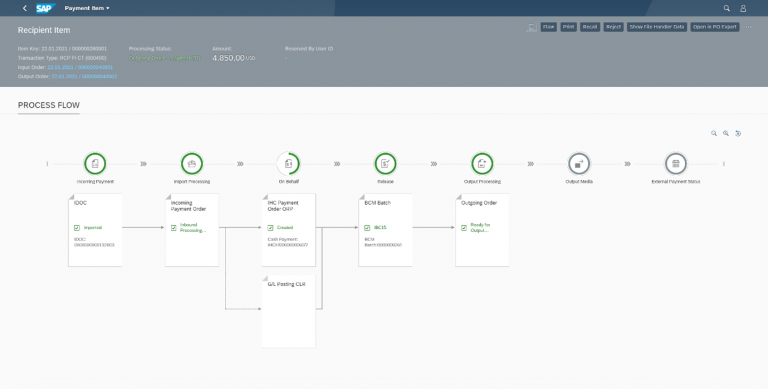

The full processing status of the payment is visible in SAP APM, including the points of data transfer.

Figure 7 – SAP APM Process Flow

Introduction to Functionality

SAP APM is comprised of 4 key function areas:

- Input manager & output manager

- Enrichment and validation

- Routing

- Transaction clearing

Figure 2 – SAP Advanced Payment Management Framework – Credit SAP

Input Manager

The input manager can flexibly import payment instruction data into APM. Standard converters exist for iDoc Payment Instructions (PEXR2002/PEXR2003 PAYEXT), ISO20022 (Pain.001.01.03) as well as for SWIFT MT101 messages. However, it is possible to configure new input formats that would cater for systems that may only be able to produce flat file formats.

Enrichment and Validation

Enrichment and validation can be used to perform integrity checks on payment items during the processing through APM. These checks could include checks for duplicate payment instructions. This feeds an initial set of data to S/4 HANA Cash Management (prior to routing) and can be used to return payment status messages (Pain.002) to the sending payment system.

Routing

Agreement-based routing is used to determine the selection of external accounts. This payment routing is highly flexible and permits the routing of payments according to criteria such as amounts and, beneficiary countries. The routing incorporates cut-off time logic and determines the priority of the payment as well as the sending bank account. This stage is not used for “forwarding-only” scenarios, where there is no requirement to determine the subsidiaries house bank account in the APM platform.

Clearing

Clearing involves the sending of payment data after routing to S/4 HANA Cash Management, in-house cash and onto the general ledger. According to selected route, payments can be cleared individually, or grouped into batches.

Further enrichment & validation can be performed, and external payments are routed via the output manager, which can re-use DMEE payment engines to produce payment files. These payment files can be monitored in SAP Bank Communication Management and delivered to the bank via SAP Multi-Bank Connectivity.