Blog

IFRS 18: What Treasury Needs to Know Now

IFRS 18 introduces significant changes to FX classification and reporting requirements by January 2027. Despite that this adoption date still feels quite far away, there is quite some time

Find out more

Learn how banks can reduce capital charges under FRTB by using proxies, external data, and customized risk factor bucketing to minimize non-modellable risk factors (NMRFs).

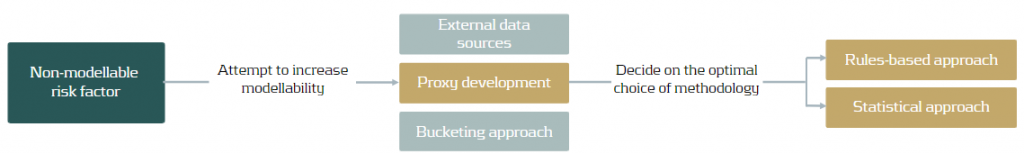

Non-modellable risk factors (NMRFs) have been shown to be one of the largest contributors to capital charges under FRTB. The use of proxies is one of the methods that banks can employ to increase the modellability of risk factors and reduce the number of NMRFs. Other potential methods for improving the modellability of risk factors is using external data sources and modifying risk factor bucketing approaches.

A proxy is utilised when there is an insufficient historical data for a risk factor. A lack of historical data increases the likelihood of the risk factor failing the Risk Factor Eligibility Test (RFET). Consequently, using proxies ensures that the number of NMRFs is reduced and capital charges are kept to a minimum. Although the use of proxies is allowed, regulation states that their usage must be limited, and they must have sufficiently similar characteristics to the risk factors which they represent.

Banks must be ready to provide evidence to regulators that their chosen proxies are conceptually and empirically sound. Despite the potential reduction in capital, developing proxy methodologies can be time-consuming and require considerable ongoing monitoring. There are two main approaches which are used to develop proxies: rules-based and statistical.

Proxy decomposition

FRTB regulation allows NMRFs to be decomposed into modellable components and a residual basis, which must be capitalised as non-modellable. For example, credit spreads for small issuers which are not highly liquid can be decomposed into a liquid credit spread index component, which is classed as modellable, and a non-modellable basis or spread.

To test modellability using the RFET, 12-months of data is required for the proxy and basis components. If the basis between the proxy and the risk factor has not been identified and properly capitalised, only the proxy representation of the risk factor can be used in the Risk Theoretical P&L (RTPL). However, if the capital requirement for a basis is determined, either: (i) the proxy risk factor and the basis; or (ii) the original risk factor itself can be included in the RTPL.

Banks should aim to produce preliminary analysis on the cost benefits of proxy development – does the cost and effort of developing proxies outweigh the capital which could be saved by increasing risk factor modellability? For example, proxies which are highly volatile may also result in increasing NMRF capital charges.

Both rules-based and statistical approaches to developing proxies require considerable effort. Banks should aim to develop statistical approaches as they have been shown to be more accurate and also more efficient in reducing capital requirements for banks.

Rules-based approach

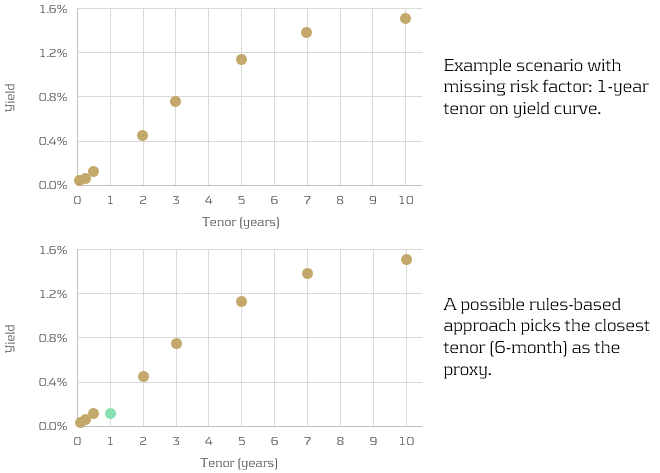

Rules-based approaches are more simplistic, however are less accurate than the statistical approaches. They find the “closest fit” modellable risk factor using somewhat more qualitative methods. For example, picking the closest tenor on a yield curve (see below), using relevant indices or ETFs, or limiting the search for proxies to the same sector as the underlying risk factor.

Similarly, longer tenor points (which may not be traded as frequently) can be decomposed into shorter-tenor points and cross-tenor basis spread.

Statistical approach

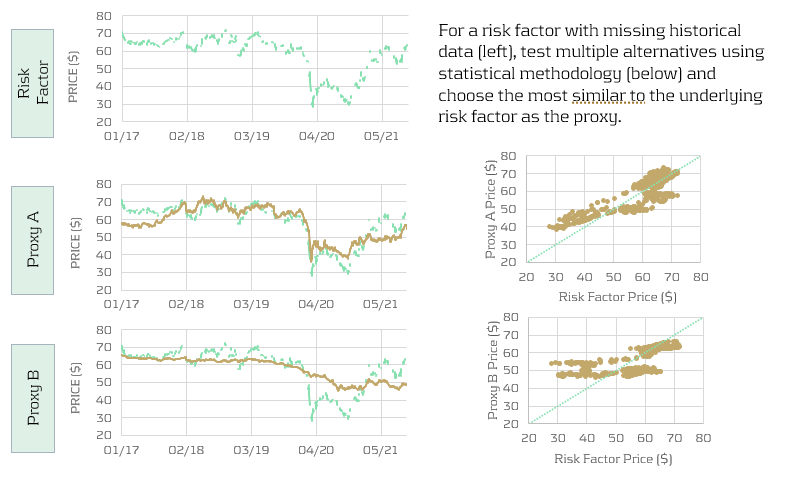

Statistical approaches are more quantitate and more accurate than the rules-based approaches. However, this inevitably comes with computational expense. A large number of candidates are tested using the chosen statistical methodology and the closest is picked (see below).

For example, a regression approach could be used to identify which of the candidates are most correlated with the underlying risk factor. Studies have shown that statistical approaches not only produce the more accurate proxies, but can also reduce capital charges by almost twice as much as simpler rules-based approaches.

Risk factor modellability is a considerable concern for banks as it has a direct impact on the size of their capital charges. Inevitably, reducing the number of NMRFs is a key aim for all IMA banks. In this article, we show that developing proxies is one of the strategies that banks can use to minimise the amount of NMRFs in their models. Furthermore, we describe the two main approaches for developing proxies: rules-based and statistical. Although rules-based approaches are less complicated to develop, statistical approaches show much better accuracy and hence have the potential to better reduce capital charges.

IFRS 18 introduces significant changes to FX classification and reporting requirements by January 2027. Despite that this adoption date still feels quite far away, there is quite some time

Find out moreBuilding on the June 2024 launch of the new EU AML/CFT framework and the creation of the Anti-Money Laundering Authority (AMLA), SupTech (short for Supervisory Technology) now stands as a key

Find out moreAs the European Union increasingly emphasizes robust digital resilience within the financial sector as of January 17th 2025, the Digital Operational Resilience Act (DORA) has become a critical

Find out moreManaging banking book risk remains a critical challenge in today’s financial markets and regulatory environment. There are many strategic decisions to be made and banks are having trouble

Find out moreOn July 2nd, the European Banking Authority (EBA) published a Consultation Paper proposing amendments to its 2016 Guidelines on the application of the definition of default (DoD). As part of the

Find out moreArtificial intelligence (AI) is advancing rapidly, particularly with the emergence of large language models (LLMs) such as Generative Pre-trained Transformers (GPTs). Yet, in quantitative risk

Find out moreIn an industry where growth is often measured in multiples, and value creation is expected to be both scalable and repeatable, operational excellence is no longer a supporting function—it’s

Find out moreWith extreme weather events becoming more frequent and climate policy tightening across jurisdictions, banks are under increasing pressure to understand how climate change will impact their

Find out moreWith the introduction of CRR3, effective from January 1, 2025, the ‘extra’ guarantee on Dutch mortgages – known as the Dutch National Mortgage Guarantee (NHG) – will no longer be

Find out moreAccording to the IFRS 9 standards, financial institutions are required to model probability of default (PD) using a Point-in-Time (PiT) measurement approach — a reflection of present

Find out moreInflows from open reverse repos In May 2024 the EBA stated1 that inflows from open reverse repos cannot be recognised in LCR calculations unless the call option has already been

Find out moreThis article is intended for finance, risk, and compliance professionals with business and system integration knowledge of SAP, but also includes contextual guidance for broader audiences. 1.

Find out moreOur team at Zanders has been at the forefront of implementing BACS AUDDIS (Automated Direct Debit Instruction Service) with SAP S/4HANA, helping clients to streamline their direct debit

Find out moreThailand's e-Withholding Tax (e-WHT) system officially launched on October 27, 2020, in collaboration with 11 banks, marking a significant digital transformation with far-reaching benefits for

Find out moreIn today’s rapidly evolving financial landscape, fortifying the Financial Risk Management (FRM) function remains a top priority for CFOs. Zanders has identified a growing trend among

Find out moreEmergence of Artificial Intelligence and Machine Learning The rise of ChatGPT has brought generative artificial intelligence (GenAI) into the mainstream, accelerating adoption across

Find out moreIntroduction In December 2024, FINMA published a new circular on nature-related financial (NRF) risks. Our main take-aways: NRF risks not only comprise climate-related risks,

Find out moreAs mid-sized corporations expand, enhancing their Treasury function becomes essential. International growth, exposure to multiple currencies, evolving regulatory requirements, and increased

Find out moreIndustry surveys show that FRTB may lead to a 60% increase in regulatory market risk capital requirements, placing significant pressure on banks. As regulatory market risk capital requirements

Find out moreFirst, these regions were analyzed independently such that common trends and differences could be noted within. These results were aggregated for each region such that these regions could be

Find out more

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired Fintegral.

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired RiskQuest.

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired Optimum Prime.

You need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More Information