Taulia’s Supply Chain Finance Solution

What does Taulia offer to clients using SAP?

Efficiently managing working capital becomes more and more important for corporates in the current challenging economic conditions and disruptions in the supply chain. As a result, the market has seen an increased demand for early payments of receivables from corporates. Managing working capital is essential in maintaining the health or even the survival of the business, especially in difficult economic times. Furthermore, efficient working capital management could benefit the growth of the company.

Working capital management includes the act of improving the cash conversion cycle. The cash conversion cycle expresses the length in days that it takes to convert cash outflow from purchasing supplies into cash inflow from sales. The cash conversion cycle (CCC) is defined as Days Sales (Receivable) Outstanding + Days Inventory Outstanding – Days Payables Outstanding (CCC = DSO + DIO – DPO). Decreasing DSO and DIO and increasing DPO lowers the cash conversion cycle, accelerates cash flow and improves a company’s liquidity position.

What is Supply Chain Finance?

The most popular method to manage working capital efficiently is using Supply Chain Finance (SCF). We distinguish the following SCF solutions:

- Static discounting: Option for the buyer (using the buyer’s own funds) to get a discount on the invoice if it is paid early. If the option is used, the supplier receives its money earlier than the due date. The discount for the supplier is determined upfront and fixed for a specific number of days.

- Dynamic Discounting: Similar to static discounting using the buyer’s own funds. The difference is that the discount rate is not fixed for a specific number of days. The buyer decides when it wants to pay the invoice. The earlier the invoice is paid, the higher the discount will be.

- Factoring: The supplier is selling its account receivables to a third party. The funding party pays the invoices early (i.e. well before the due date) to the supplier, benefiting the supplier. The interest paid on this solution is based on the credit rating of the supplier.

- Reverse Factoring: The buyer offers the supplier the opportunity to sell its receivables on its SCF platform, so the supplier will receive its money earlier than the due date (from the SCF party). This benefits both the supplier and the buyer, as the buyer will try to extend payment terms with the supplier and therefore pay later than the original due date.

An SCF program is financed by a third-party funder, which is usually a bank or an investing company. Additionally, SCF is often facilitated by technology to facilitate the selling of the supplier’s receivable in an automated fashion.

Reverse factoring

An example of reverse factoring is an automobile manufacturer that is buying various automobile parts from various suppliers. The automobile manufacturer will use a reverse factoring solution to pay the part suppliers earlier and extend the payment terms with these suppliers. Reverse factoring works best when the buyer has a better credit rating than the seller, as the costs of receiving the payment in advance is based on the credit rating of the buyer (which is higher than the credit rating of the seller), the seller receives funding at a more favorable rate than it would receive in the external capital market. This advantage gives the buyer the opportunity to negotiate better payment terms with the seller (higher DPO), while the seller could receive payments of the sale transaction in advance (lower DSO), decreasing the cash conversion cycle of both parties. Effectively, reverse factoring encourages collaboration between the buyer and the seller and potentially leads to a true win-win between buyers and suppliers. The buyer succeeds in its desire to delay payments, while the seller will be satisfied with advanced payments. However, the win for the supplier depends on how the costs of the program are split between the corporate (buyer) and its supplier. Usually, the costs are borne solely by the supplier. Therefore, the program is only desirable for a supplier if the program costs (interest to pay on the SCF funding based on the buyer’s credit rating and the program fee) is lower than the opportunity costs of the supplier. The opportunity costs are defined as the costs of lending funds against an interest rate which is based on its own credit rating.

Benefits and Risks

The benefits of SCF are the following:

- Suppliers can control their incoming cash flows with prepayment of invoices;

- Quick access to funding for the supplier in case of a liquidity crisis;

- Buyer-seller relationship is strengthened due to the collaboration in an SCF program;

- Reduced need of traditional (trade) finance;

- With reverse factoring, the buyer can negotiate extended payment terms with the supplier, providing the prepayment option to the supplier;

- With reverse factoring, suppliers have access to funding with lower interest rates as the pricing of the financing is based on the buyer’s credit rating.

Supply Chain Finance also has risks:

- Reporting ambiguity: Although corporates are obliged under IFRS to disclose additional information about their SCF arrangements (such as Terms and Conditions and carrying amounts of liabilities that are part of the SCF program), reverse factoring can mask true overall debt levels for the supplier when significant amounts of factoring does not have to be classified as debt but as trade payables. Accounting principles IFRS and US GAAP are regularly updated to reflect the latest guidelines around the classification of SCF programs as either trade payables or debt.

- Dependency on SCF: If the SCF program is of a substantial size, a withdrawal of the SCF facility can have dramatic consequences for liquidity and create terminal collateral damage through the supplier network. The US securities regulators warn that reverse factoring is not cycle-tested, which means that it is unclear what might happen in an economic downturn. However, a multi-funder structure makes it easy to replace or add funders in case of a facility withdrawal without disruption to suppliers.

What is Taulia?

Zanders sees a lot of movement in the SCF market. One interesting development is the acquisition of Taulia by SAP. Taulia is a leading supply chain software provider founded in 2009 with over 2 million business users. The rationale behind this acquisition is to expand SAP’s business network further and strengthen the SAP solutions in the financial area. The takeover of Taulia is understandable as more than 80% of the customer base of Taulia runs SAP as their ERP system. Taulia will both be tightly integrated into the SAP software as well as continue to be available as a standalone solution. It will operate as an independent company with its own brand within the SAP Group. Unique in the software business is that Taulia earns a percentage fee of each prepaid invoice that flows through the platform, instead of a fixed fee per transaction or a monthly fee, which is what we usually observe in the market of software vendors. When an invoice is selected for prepayment, the vendor receives a lower amount than the amount of the original invoice. The difference between these amounts is partly compensation for the investor and partly income for Taulia. Taulia offers solutions for all SCF options mentioned earlier: static discounting, dynamic discounting, factoring, and reverse factoring. It is a multi-funder platform on which any and as many banks as desired can be engaged, including the relationship banks of a corporate.

Supply Chain Finance Example

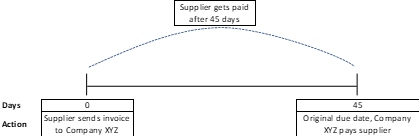

Original situation

In this example, the supplier and Company XYZ have a payment term of 45 days in place. This is the ‘original situation’:

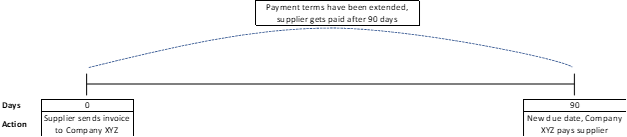

Payment term extension (optional)

Company XYZ starts negotiations with the supplier to extend the payment terms. They agree on a new payment term of 90 days. This step is optional.

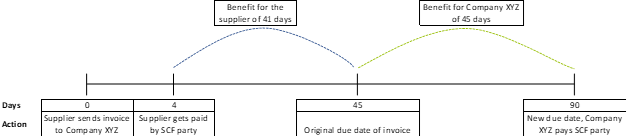

Supplier joins SCF program

The supplier joins the SCF program. Due to the SCF program, the supplier benefits from early payment. The interest that the supplier needs to pay is based on the (strong) credit rating of Company XYZ. In other words, the supplier can finance at lower interest rates.

Features of a Supply Chain Finance program

The features of a best practice SCF program such as Taulia are the following:

- A self-service portal with the branding of your company is provided to your suppliers. Suppliers can be onboarded on this portal, where they select invoices that they would like to receive in advance. When selecting an invoice, the supplier will be quoted with the prepayment costs immediately.

- Automated and near real-time integration with your ERP system, ensuring manual adjustments are redundant and data integrity is maintained. Integration is possible via multiple connectivity solutions or middleware applications. The integration of Taulia with SAP ERP is fully automated. Taulia has its own name space within SAP, although there are no changes in the core SAP code. In this name space, it is amongst others possible to run reconciliation reports. For more information about integration of a SCF platform to SAP, please read this article that we published earlier this year.

- Automatic netting of credit notes against future early payments or block early payments when a credit note is outstanding.

- Leverage real-time private and public data with machine learning in a dashboard to track performance and to make informed decision on your SCF program. This could include scenario analysis of different SCF rates and the effect on adoption rate of your suppliers. Additionally, the dashboard provides benchmarking of payment terms to industry standards.

- Automated solution to automatically accept early payments for suppliers (called ‘CashFlow’ in the Taulia solution). This solution will accept the early payment automatically if the discount is better or equivalent to a pre-set rate curve.

Accounts Receivable solution

Next to the reversed factoring solution, Taulia offers a solution for accounts receivable (AR) financing, also known as factoring. This solution works slightly differently than the reversed factoring solution as your customers do not need to be onboarded on the platform. AR invoices can be sold to a third-party funder, who pays the face value of the invoice less the proposed discount. The actual AR invoice payment from the buyer at maturity date will be collected in a collection account and send back to the investor.

To conclude

The ultimate goal of an SCF program is to unlock working capital for your company. With the choice for an appropriate SCF solution, and a successful implementation including integration to your ERP, the benefits of an SCF program can be achieved. Taulia could be the appropriate solution for you.

If you would like to know more about Supply Chain Finance and/or SAP Taulia, contact Mart Menger at +31 88 991 02 00.