This exemption has been applied in a diverse way by supervisors and therefore, the treatment of Structural FX risk has been updated in recent regulatory publications. In this article we discuss these publications and market practice around Structural FX risk based on an analysis of the policies applied by the top 25 banks in Europe.

Based on the 1996 amendment to the Capital Accord, banks that apply for the exemption of Structural FX positions can exclude these positions from the Pillar 1 capital requirement for market risk. This exemption was introduced to allow international banks with subsidiaries in currencies different from the reporting currency to employ a strategy to hedge the capital ratio from adverse movements in the FX rate. In principle a bank can apply one of two strategies in managing its FX risk.

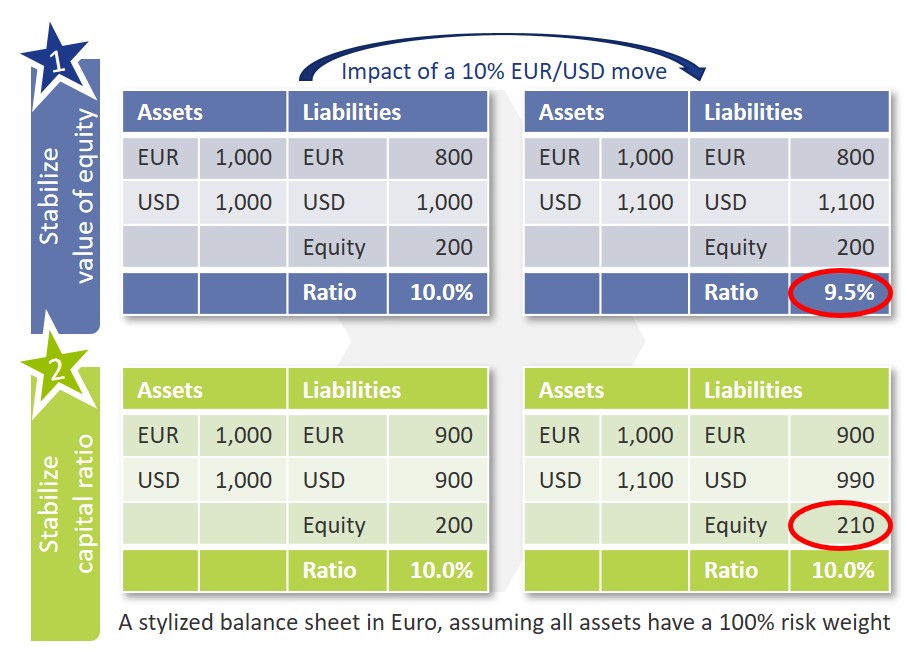

- In the first strategy, the bank aims to stabilize the value of its equity from movements in the FX rate. This strategy requires banks to maintain a matched currency position, which will effectively protect the bank from losses related to FX rate changes. Changes in the FX rate will not impact the equity of a bank with e.g. a consolidated balance sheet in Euro and a matched USD position. The value of the Risk-Weighted Assets (RWAs) is however impacted. As a result, although the overall balance sheet of the bank is protected from FX losses, changes in the EUR/USD exchange rate can have an adverse impact on the capital ratio.

- In the alternative strategy, the objective of the bank is to protect the capital adequacy ratio from changes in the FX rate. To do so, the bank deliberately maintains a long, open currency position, such that it matches the capital ratio. In this way, both the equity and the RWAs of the bank are impacted in a similar way by changes in the EUR/USD rate, thereby mitigating the impact on the capital ratio. Because an open position is maintained, FX rate changes can result in losses for the bank. Without the exemption of Structural FX positions, the bank would be required to hold a significant amount of capital for these potential losses, effectively turning this strategy irrelevant.

As can also be seen in the exhibit below, the FX scenario that has an adverse impact on the bank differs between both strategies. In strategy 1, an appreciation of the currency will result in a decrease of the capital ratio, while in the second strategy the value of the equity will increase if the currency appreciates. The scenario with an adverse impact on the bank in strategy 2 is when the foreign currency depreciates.

Until now, only limited guidance has been available on e.g. the risk management framework, (number of) currencies that can be in scope of the exemption and the maximum open exposure that can be exempted. As a result, the practical implementation of the Structural FX exemption varies significantly across banks. Recent regulatory publications aim to enhance regulatory guidance to ensure a more standardized application of the exemption.

Regulatory Changes

With the publication of the Fundamental Review of the Trading Book (FRTB) in January 2019, the exemption of Structural FX risk was further clarified. The conditions from the 1996 amendment were complemented to a total of seven conditions related to the policy framework required for FX risk and the maximum and type of exposure that can be in scope of the exemption. Within Europe, this exemption is covered in the Capital Requirements Regulation under article 352(2).

To process the changes introduced in the FRTB and to further strengthen the regulatory guidelines related to Structural FX, the EBA has issued a consultation paper in October 2019. A final version of these guidelines was published in July 2020. The date of application was pushed back one year compared to the consultation paper and is now set for January 2022.

The guidelines introduced by EBA can be split in three main topics:

- Definition of Structural FX.

The guidelines provide a definition of positions of a structural nature and positions that are eligible to be exempted from capital. Positions of a structural nature are investments in a subsidiary with a reporting currency different from that of the parent (also referred to as Type A), or positions that are related to the cross-border nature of the institution that are stable over time (Type B). A more elaborate justification is required for Type B positions and the final guidelines include some high-level conditions for this.

- Management of Structural FX.

Banks are required to document the appetite, risk management procedures and processes in relation to Structural FX in a policy. Furthermore, the risk appetite should include specific statements on the maximum acceptable loss resulting from the open FX position, on the target sensitivity of the capital ratios and the management action that will be applied when thresholds are crossed. It is moreover clarified that the exemption can in principle only be applied to the five largest structural currency exposures of the bank.

- Measurement of Structural FX.

The guidelines include requirements on the type and the size of the positions that can be in scope of the exemption. This includes specific formulas on the calculation of the maximum open position that can be in scope of the exemption and the sensitivity of the capital ratio. In addition, banks will need to report the structural open position, maximum open position, and the sensitivity of the capital ratio, to the regulator on a quarterly basis.

One of the reasons presented by the EBA to publish these additional guidelines is a growing interest in the application of the Structural FX exemption in the market.

Market Practice

To understand the current policy applied by banks, a review of the 2019 annual reports of the top 25 European banks was conducted. Our review shows that almost all banks identify Structural FX as part of their risk identification process and over three quarters of the banks apply a strategy to hedge the CET1 ratio, for which an exemption has been approved by the ECB. While most of the banks apply the exemption for Structural FX, there is a vast difference in practices applied in measurement and disclosure. Only 44% of the banks publish quantitative information on Structural FX risk, ranging from the open currency exposure, 10-day VaR losses, stress losses or Economic Capital allocated.

The guideline that will have a significant impact on Structural FX management within the bigger banks of Europe is the limit to include only the top five open currency positions in the exemption: of the banks that disclose the currencies in scope of the Structural FX position, 60% has more than 5 and up to 20 currencies in scope. Reducing that to a maximum of five will either increase the capital requirements of those banks significantly or require banks to move back to maintaining a matched position for those currencies, which would increase the capital ratio volatility.

Conclusion

The EBA guidelines on Structural FX that will to go live by January 2022 are expected to have quite an impact on the way banks manage their Structural FX exposures. Although the Structural FX policy is well developed in most banks, the measurement and steering of these positions will require significant updates. It will also limit the number of currencies that banks can identify as Structural FX position. This will make it less favourable for international banks to maintain subsidiaries in different currencies, which will increase the cost of capital and/or the capital ratio volatility.

Finally, a topic that is still ambiguous in the guidelines is the treatment of Structural FX in a Pillar 2 or ICAAP context. Currently, 20% of the banks state to include an internal capital charge for open structural FX positions and a similar amount states to not include an internal capital charge. Including such a capital charge, however, is not obvious. Although an open FX position will present FX losses for a bank which would favour an internal capital charge, the appetite related to internal capital and to the sensitivity of the capital ratio can counteract, resulting in the need for undesirable FX hedges.

The new guidelines therefore present clarifications in many areas but will also require banks to rework a large part of their Structural FX policies in the middle of a (COVID-19) crisis period that already presents many challenges.