SAP S/4 HANA Deployment Options for Treasury Management – Cloud, On-Premise or Hybrid?

With SAP recently focusing heavily on developing its S/4HANA Cloud solutions, now is an opportune time for corporate executives to investigate the deployment options and weigh up the investment versus the benefit of each.

Changing IT infrastructure and systems is costly, and executives need the right knowledge to make informed decisions to best meet their current and future demands at the optimal price point. What are the best options?

We will start by looking at the features of the various options before taking a deeper dive into what the differences are specifically for Treasury Management on SAP S/4HANA and how that might influence decisions.

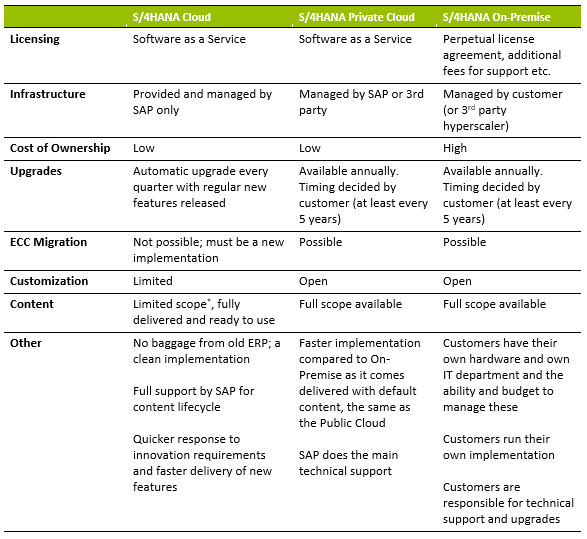

The main features are summarized in the table below:

*Scope covered should be sufficient for small to medium corporate treasuries, depending on complexity

Treasury Management on S/4HANA

In terms of selecting the right platform for treasury management on S/4HANA, there are many considerations, and the needs of each organization will differ. SAP has been working to ensure that the Public Cloud for Treasury Management has wider instrument coverage for corporate customers.

A development that could notably sway more corporates to consider the cloud-based options, is the inclusion of the new in-house banking component in the best practice offering from August 2022. In this module, which is embedded into Advanced Payment Management, SAP offers a completely rewritten solution, with advantages even over the traditional In-House Cash (IHC) module. IHC was previously not available to Public Cloud customers and this gap in the offering has no-doubt been a factor in customers deciding not to select the Public Cloud edition. These larger companies often need the payment functionalities available within IHC (such as payments on Behalf of, routing and internal transfers) and the lack of them is limiting. The addition of the in-house banking component makes for a more complete in-house bank functionality when paired with Advanced Payment Management (which is a prerequisite) and Treasury and Risk Management. This new in-house banking solution will also be made available to On-Premise customers during 2022 and with improved features and functionality, should be considered during upgrade decisions.

In Cash Management, S/4HANA Cloud comes standard with Basic Cash Management (Basic Bank Account Management and Basic Cash Operations). Advanced Cash Management, which delivers essentially the same as the On-Premise edition, barring one or two smaller features, is available, although an additional license is required. Liquidity Planning is only available if a customer has an SAP Analytics Cloud license.

SAP Treasury & Risk Management (TRM) is where the most differences currently exist between the Public Cloud and the Private Cloud or On-Premise editions. The Public Cloud has less instruments that are supported, although SAP is continually adding to the list.

Looking at the other most notable differences per area in TRM, the impact of the following in respect of the Public Cloud version should be discussed further with the customer:

- Hedge management – Reference-based hedging is currently not supported.

- Risk analyzers – Portfolio Analyzer is not offered, and SAP has no plans to include it. This is not generally required by corporate treasuries, so should not be an issue if the Public Cloud is selected.

- Securities – the offering is limited, although SAP is working to bridge the gaps. Asset-backed and mortgage-backed securities will be available in the August 2022 release.

- Derivatives – only interest rate swaps and cross currency swaps are possible, with no option to configure your own instruments.

- Position management – limited due to the reduced scope of instruments available in the cloud.

- Treasury analytics – FX reporting in SAP Analytics Cloud is limited but is being improved and customers can expect FX Hedging Area reports to be available by early 2023.

Making the Choice

Based on the above, the Public Cloud option makes sense for new businesses or smaller organizations that do not have the budget or resources to implement and support a customized solution. It would also suit organizations that need their systems to be responsive to market changes. Content is delivered as-is from SAP with minimal customization options, however, the cost of ownership is lower. It should also be noted that currently the Public Cloud edition of S/4HANA has been configured with local requirements for 43 countries. No more countries will be added; however, SAP is working on a tool which will enable customers to copy an existing country and create the settings for an additional country. This feature should be released in 2023.

In terms of treasury management, the Public Cloud would suit organizations with a vanilla treasury function and those that are looking to do a completely new implementation with no need to migrate from an existing system. This option does, however, require what SAP calls a “cloud mindset”, where customers cannot expect the system to fit into their existing processes but instead should look at how their organizational requirements can be met by SAP’s standard offerings.

The On-Premise solution would better suit larger organizations with well-established IT infrastructure and resources, as well as businesses using a broad spectrum of financial instruments that require customization. The On-Premise solution gives the customer full control and maximum freedom in terms of content, configuration, and timings of upgrades although there is a higher cost of ownership.

An attractive choice in the treasury space particularly is the hybrid one, i.e., the Private Cloud. Here customers would outsource their infrastructure management to SAP or another third party, whilst still ensuring they have the flexibility of options around treasury management scope.

With the Private Cloud and On-Premise, customers can still make use of Best Practice content as an accelerator. This content is available online for download and contains the likes of Process Flow diagrams and Test Scripts, helping customers to save time in an implementation. The Cloud’s Starter system is also provided as a way to see content before needing to configure it, thereby allowing the customer to test functionality upfront.

Zanders has in-depth knowledge and experience of Treasury Management on SAP S/4HANA and can help customers to analyze their requirements and ensure they make the best selection between Public Cloud, Private Cloud and On-Premise, or even a combination of the options.