The corporate treasury agenda continues to focus on cash visibility, liquidity centralization, bank/bank account rationalization, and finally digitization to enable greater operational and financial efficiencies. Digital transformation within corporate treasury is a must have, not a nice to have and with technology continuing to evolve, the potential opportunities to both accelerate and elevate performance has just been taken to the next level with ISO 20022 becoming the global language of payments. In this 6th article in the ISO 20022 XML series, Zanders experts Fernando Almansa, Eliane Eysackers and Mark Sutton provide some valuable insights around why this latest global industry move should now provide the motivation for corporate treasury to consider a cash management RFP (request for proposal) for its banking services.

Why Me and Why Now?

These are both very relevant important questions that corporate treasury should be considering in 2024, given the broader global payments industry migration to ISO 20022 XML messaging. This goes beyond the Swift MT-MX migration in the interbank space as an increasing number of in-country RTGS (real-time gross settlement) clearing systems are also adopting ISO 20022 XML messaging. Swift are currently estimating that by 2025, 80% of the domestic high value clearing RTGS volumes will be ISO 20022-based with all reserve currencies either live or having declared a live date. As more local market infrastructures migrate to XML messaging, there is the potential to provide richer and more structured information around the payment to accelerate and elevate compliance and reconciliation processes as well as achieving a more simplified and standardized strategic cash management operating model.

So to help determine if this really applies to you, the following questions should be considered around existing process friction points:

- Is your current multi-banking cash management architecture simplified and standardised?

- Is your account receivables process fully automated?

- Is your FX gain/loss calculations fully automated?

- Have you fully automated the G/L account posting?

- Do you have a standard ‘harmonized’ payments message that you send to all your banking partners?

If the answer is yes to all the above, then you are already following a best-in-class multi-banking cash management model. But if the answer is no, then it is worth reading the rest of this article as we now have a paradigm shift in the global payments landscape that presents a real opportunity to redefine best in class.

What is different about XML V09?

Whilst structurally, the XML V09 message only contains a handful of additional data points when compared with the earlier XML V03 message that was released back in 2009, the key difference is around the changing mindset from the CGI-MP (Common Global Implementation – Market Practice) Group1 which is recommending a more prescriptive approach to the banking community around adoption of its published implementation guidelines. The original objective of the CGI-MP was to remove the friction that existed in the multi-banking space as a result of the complexity, inefficiency, and cost of corporates having to support proprietary bank formats. The adoption of ISO 20022 provided the opportunity to simplify and standardize the multi-banking environment, with the added benefit of providing a more portable messaging structure. However, even with the work of the CGI-MP group, which produced and published implementation guidelines back in 2009, the corporate community has encountered a significant number of challenges as part of their adoption of this global financial messaging standard.

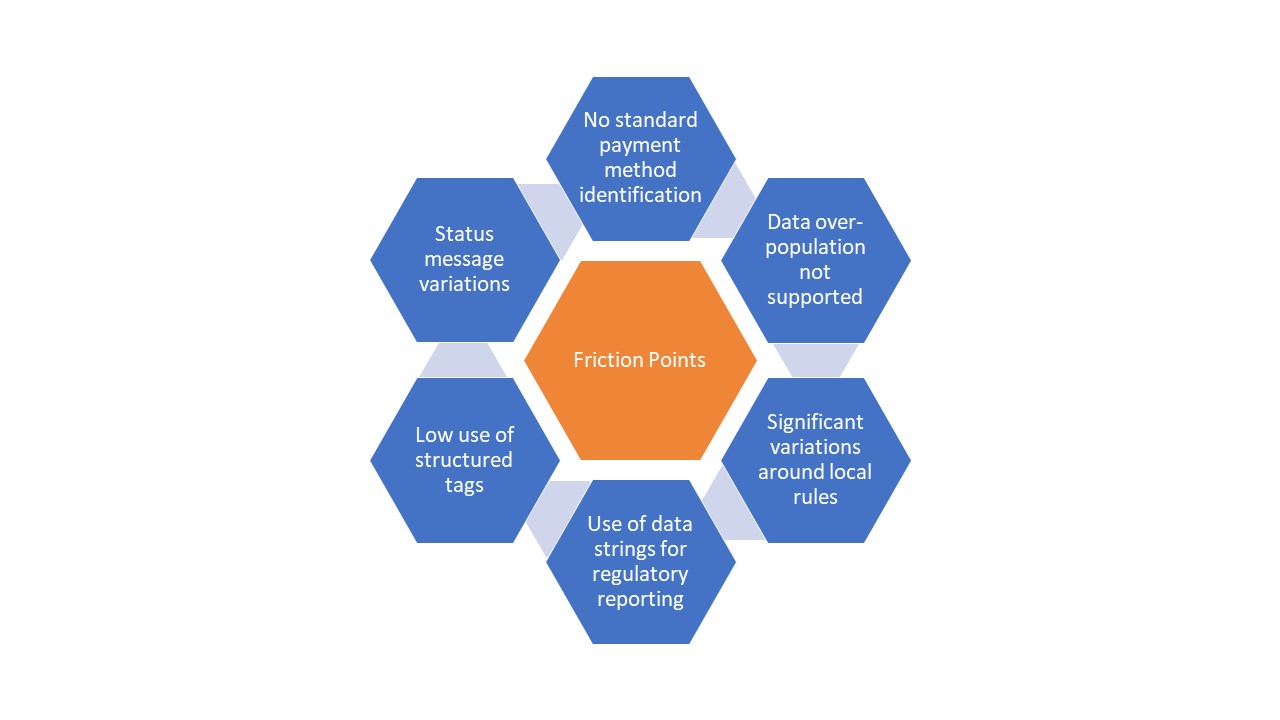

The key friction points are highlighted below:

Diagram 1: Key friction points encountered by the corporate community in adopting XML V03

The highlighted friction points have resulted in the corporate community achieving a sub-optimal cash management architecture. Significant divergence in terms of the banks’ implementation of this standard covers a number of aspects, from non-standard payment method codes and payment batching logic to proprietary requirements around regulatory reporting and customer identification. All of this translated into additional complexity, inefficiency, and cost on the corporate side.

However, XML V09 offers a real opportunity to simplify, standardise, accelerate and elevate cash management performance where the banking community embraces the CGI-MP recommended ‘more prescriptive approach’ that will help deliver a win-win situation. This is more than just about a global standardised payment message, this is about the end to end cash management processes with a ‘structured data first’ mindset which will allow the corporate community to truly harness the power of technology.

What are the objectives of the RFP?

The RFP or RFI (request for information) process will provide the opportunity to understand the current mindset of your existing core cash management banking partners. Are they viewing the MT-MX migration as just a compliance exercise. Do they recognize the importance and benefits to the corporate community of embracing the recently published CGI-MP guidelines? Are they going to follow a structured data first model when it comes to statement reporting? Having a clearer view in how your current cash management banks are thinking around this important global change will help corporate treasury to make a more informed decision on potential future strategic cash management banking partners. More broadly, the RFP will provide an opportunity to ensure your core cash management banks have a strong strategic fit with your business across dimensions such as credit commitment, relationship support to your company and the industry you operate, access to senior management and ease of doing of business. Furthermore, you will be in a better position to achieve simplification and standardization of your banking providers through bank account rationalization combined with the removal of non-core partner banks from your current day to day banking operations.

In Summary

The Swift MT-MX migration and global industry adoption of ISO 20022 XML should be viewed as more than just a simple compliance change. This is about the opportunity to redefine a best in class cash management model that delivers operational and financial efficiencies and provides the foundation to truly harness the power of technology.