Global disruptions demand Treasuries to act fast

What is the impact of a disruption caused by a vessel blocking a canal on a company’s working capital and its direct liquidity needs?

In today’s world, supply chain disruptions are consequences of operating in an integrated and highly specialized global economy. Along with affecting the credit risk of impacted suppliers, these disruptions are demanding Treasuries to operate with increased working capital.

In March 2021, a vessel was forced aground due to intense winds at Egypt’s Suez Canal, creating a bottleneck involving 100 ships. Given that the Suez Canal accommodates 12% of global trade and the fact that one-tenth of the daily total global oil consumption was caught in the bottleneck, it was no surprise that the international oil market was rattled, and numerous supply chains were affected.1

A butterfly effect

This is reminiscent of a concept known as butterfly effect, where a minor fluctuation such as a butterfly flapping its wings proves to have an effect, however small, on the path a tornado takes on the other side of the globe.

To further complicate matters, this disruption transpired when the global shipping industry was already destabilized due to the coronavirus pandemic.2 This pandemic affected the global economy and supply chains in particular like no other event in the past several decades. Entire cities were locked down and many businesses were at a standstill. It may be impossible to predict black swan events that disrupt global supply chains. However, it is possible to reach fairly accurate assumptions about certain supply chains based on knowledge at hand.

Leveraging supply chains

The Russian invasion of Ukraine will no doubt impact the industries that have suppliers in Ukraine. Another lockdown in China will have repercussions for the supply chains intertwined there. With these types of constraints on the supply chains, procurement divisions are stocking up on inventory and raw materials, which in turn further aggravates the inflation problem the global economy is currently facing. Issues like these are demanding many treasurers to operate with increased working capital, along with affecting the credit risk of impacted suppliers. Treasurers around the world should act fast to take advantage of the financial benefits that today’s global economy is bestowing on organizations that are quick to adapt to the constantly changing business environment. Treasurers can even start leveraging supply chains to work in their favor by utilizing Supply Chain Finance (SCF) solutions.

Decreasing the DSO

What does the concept of SCF mean and what are its implications? Let’s start with the different parties involved in a typical SCF transaction, like reverse factoring. We have the supplier, the buyer, and the bank. Let’s suppose the buyer enters an agreement to purchase goods from the supplier. In most cases, the supplier will ship the goods to the buyer on credit. The payment terms may vary from 10 days to 60 or more days. The average number of days it takes a company to receive payment for a sale is known as days sales outstanding (DSO). The objective of companies is to keep the DSO as low as possible. This implies that the supplier is receiving its payments quickly from the buyer and has a positive effect on the cash conversion cycle (CCC) of the supplier. The CCC indicates how many days it takes a company to convert cash into inventory and back into cash during the sales process. Unfortunately, many companies struggle with a high DSO, which suggests they are either experiencing delays in receiving payments or have long payment terms. A high DSO can lead to cash flow problems, but implementing a SCF solution might be wise response. Having a healthy working capital is a cornerstone to building a successful business, especially for growing and/or leveraged companies.

Why cash flow is crucial

American billionaire businessman Michael Dell once acknowledged: “We were always focused on our profit and loss statement. But cash flow was not a regularly discussed topic. It was as if we were driving along, watching only the speedometer, when in fact we were running out of gas.3

A company may be profitable, but if it has poor cash flow, it will struggle to meet its liabilities or properly invest its excess cash. Because cash is a crucial element to a successful business, companies will strategically hold onto it as long as possible. If their credit terms indicate that they have 30 days to pay an invoice, it is quite likely that they will wait as close to the deadline as possible before they make the payment.

Furthermore, a buyer with a strong credit rating and powerful brand recognition may demand more generous credit terms. These considerations affect a financial ratio known as days payable outstanding (DPO). The DPO indicates the average time that a company takes to pay its invoices. A higher DPO implies that a company can maximize its working capital by retaining cash for a longer duration. This cash can be used for short-term investments or other purposes that a company determines will optimize its finances. However, a high DPO can also indicate that the company is struggling to meet its financial obligations.

An example

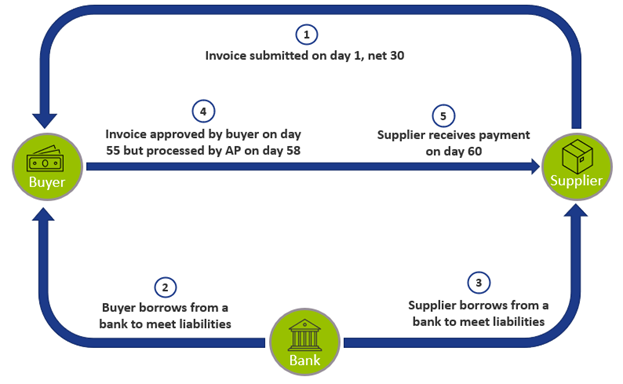

The diagram below depicts a scenario where the supplier invoices the buyer, hoping to receive payment in 30 days. Unfortunately, the buyer needs funds for its operating activities, and furthermore must borrow from the bank to meet its liabilities. It is also possible that the buyer pays late so it can hold onto cash longer or due to roadblocks in the invoice approval process. In the meantime, the supplier is also experiencing cash flow challenges, and it too borrows from the bank. (Of course, both the buyer and the supplier could also use a revolving credit line to access capital, but to simplify this example, we will assume they are borrowing from the bank). The buyer eventually approves the invoice for payment on day 55 and the supplier receives the payment on day 60. The buyer has a high DPO at the expense of the supplier also having a high DSO.

Figure 1: A scenario of a supplier hoping to receive payment in 30 days.

Reverse factoring

What can a company do if it is struggling with its working capital? Suppose a supplier has a dozen buyers, some which pay on time, but others unfortunately are facing their own cash flow problems and are not able to pay within the agreed terms. Wouldn’t it be nice to receive payment within a week from some of the buyers to avoid having a cash flow problem? SCF offers a solution.

To help illustrate this concept, let’s explore a more familiar financial concept known as factoring. With factoring, a company sells its accounts receivable to a third party. SCF is sometimes knowns as ‘reverse factoring’, because a supplier will leverage a buyer’s strong credit rating and select certain invoices to be paid early by a third-party financier, typically a bank. The buyer would then be responsible for paying the bank. In certain types of SCF arrangements, instead of paying an invoice in 30 days, the bank will offer the buyer to pay in, let’s say, 60 days – but for a fee. This could potentially increase the buyer’s DPO.

The supplier, on the other hand, receives its payment sooner from the bank – reducing its DSO – than it would have from the buyer, but at a discount. It is important to note that the discount should be less than the interest the supplier would have incurred if it had borrowed from the bank. This is possible because the discount is calculated based on the creditworthiness of the buyer, instead of the supplier. Many suppliers who lack credit or have poor credit would find this an advantageous option to access cash. However, not all suppliers may be able to reap the benefits of an SCF agreement. For them, borrowing from a bank or factoring receivables are additional options they can explore.

Dynamic discounting

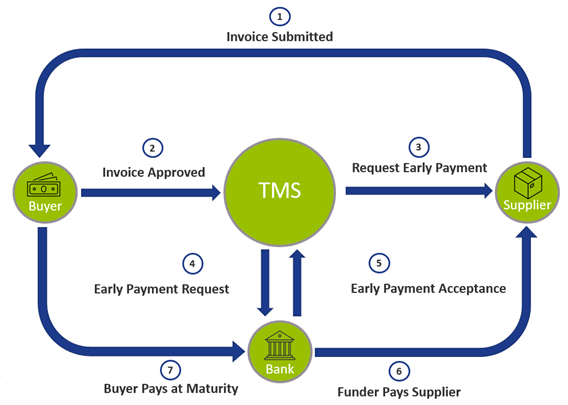

Another term often used when discussing these types of financing options is dynamic discounting. This is similar to reverse factoring in that a supplier receives early payment on an invoice at a discount. However, unlike SCF, dynamic discounting is financed by the buyer as opposed to a third-party financier. Due to the complexity of SCF arrangements between the suppler, the buyer, and the bank, a company often uses the expertise of banks or the capability of a Treasury Management System (TMS). Below is a diagram of what an SCF solution would look like utilizing a TMS:

Whether a company should implement a TMS, which vendor it should utilize, and determining if SCF is a viable solution for that organization are complex questions. Furthermore, because of the globalized environment that companies operate in and the impact of crises like the coronavirus pandemic or a bottleneck at a major canal, an increasing number of organizations are turning to the expertise of consultants to help navigate these intricate matters.

Zanders’ SCF solutions

Zanders is a world-leading consultancy firm specializing in treasury, risk, and finance. It employs over 250 professionals in 9 countries across 4 continents. Powered by almost 30 years of experience and driven by innovation, Zanders has an extensive track record of working with corporations, financial institutions, and public sector entities. Leveraging this extensive background, Zanders can evaluate the assorted options that organizations are exploring to enhance their treasury functions.

With its unique market position, Zanders is able to engage in projects ‘from ideas to implementation’. Whether organizations are trying to stay afloat in today’s challenging global economy or seeking to stay ahead of the curve, they should reap the benefits of modern technology and various SCF solutions that are currently being offered in today’s dynamic business environment. Amid a rapidly changing world being transformed by technological advancement, Zanders welcomes the opportunity to assist clients achieve their treasury and finance objectives.

If you’re interested in learning more about Supply Chain Finance and how your Treasury can properly anticipate disruptions in global supply chains, please reach out to Arif Ali via +1 6467703875.

Footnotes:

[1] https://www.nytimes.com/2021/03/24/world/middleeast/suez-canal-blocked-ship.html