FRTB: Profit and Loss Attribution (PLA) Analytics

Under FRTB, banks must pass the PLA test to ensure alignment between Front Office and Risk P&L, or face higher capital charges and potential use of the standardised approach.

Under FRTB regulation, PLA requires banks to assess the similarity between Front Office (FO) and Risk P&L (HPL and RTPL) on a quarterly basis. Desks which do not pass PLA incur capital surcharges or may, in more severe cases, be required to use the more conservative FRTB standardised approach (SA).

What is the purpose of PLA?

PLA ensures that the FO and Risk P&Ls are sufficiently aligned with one another at the desk level. The FO HPL is compared with the Risk RTPL using two statistical tests. The tests measure the materiality of any simplifications in a bank’s Risk model compared with the FO systems. In order to use the Internal Models Approach (IMA), FRTB requires each trading desk to pass the PLA statistical tests. Although the implementation of PLA begins on the date that the IMA capital requirement becomes effective, banks must provide a one-year PLA test report to confirm the quality of the model.

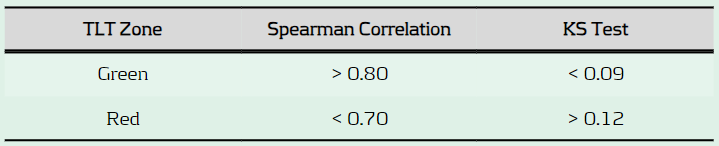

Which statistical measures are used?

PLA is performed using the Spearman Correlation and the Kolmogorov-Smirnov (KS) test using the most recent 250 days of historical RTPL and HPL. Depending on the results, each desk is assigned a traffic light test (TLT) zone (see below), where amber desks are those which are allocated to neither red or green.

What are the consequences of failing PLA?

Capital increase: Desks in the red zone are not permitted to use the IMA and must instead use the more conservative SA, which has higher capital requirements. Amber desks can use the IMA but must pay a capital surcharge until the issues are remediated.

Difficulty with returning to IMA: Desks which are in the amber or red zone must satisfy statistical green zone requirements and 12-month backtesting requirements before they can be eligible to use the IMA again.

What are some of the key reasons for PLA failure?

Data issues: Data proxies are often used within Risk if there is a lack of data available for FO risk factors. Poor or outdated proxies can decrease the accuracy of RTPL produced by the Risk model. The source, timing and granularity also often differs between FO and Risk data.

Missing risk factors: Missing risk factors in the Risk model are a common cause of PLA failures. Inaccurate RTPL values caused by missing risk factors can cause discrepancies between FO and Risk P&Ls and lead to PLA failures.

Roadblocks to finding the sources of PLA failures

FO and Risk mapping: Many banks face difficulties due to a lack of accurate mapping between risk factors in FO and those in Risk. For example, multiple risk factors in the FO systems may map to a single risk factor in the Risk model. More simply, different naming conventions can also cause issues. The poor mapping can make it difficult to develop an efficient and rapid process to identify the sources of P&L differences.

Lack of existing processes: PLA is a new requirement which means there is a lack of existing infrastructure to identify causes of P&L failures. Although they may be monitored at the desk level, P&L differences are not commonly monitored at the risk factor level on an ongoing basis. A lack of ongoing monitoring of risk factors makes it difficult to pre-empt issues which may cause PLA failures and increase capital requirements.

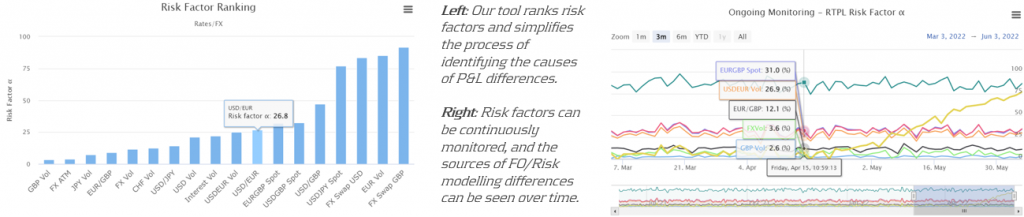

Our approach: Identifying risk factors that are causing PLA failures

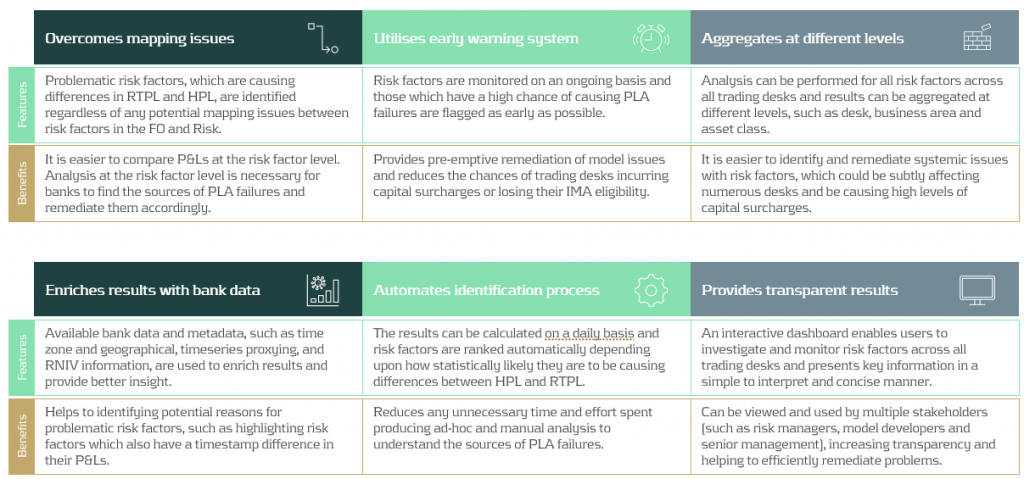

Zanders’ approach overcomes the above issues by producing analytics despite any underlying mapping issues between FO and Risk P&L data. Using our algorithm, risk factors are ranked depending upon how statistically likely they are to be causing differences between HPL and RTPL. Our metric, known as risk factor ‘alpha’, can be tracked on an ongoing basis, helping banks to remediate underlying issues with risk factors before potential PLA failures.

Zanders’ P&L attribution solution has been implemented at a Tier-1 bank, providing the necessary infrastructure to identify problematic risk factors and improve PLA desk statuses. The solution provided multiple benefits to increase efficiency and transparency of workstreams at the bank.

Conclusion

As it is a new regulatory requirement, passing the PLA test has been a key concern for many banks. Although the test itself is not considerably difficult to implement, identifying why a desk may be failing can be complicated. In this article, we present a PLA tool which has already been successfully implemented at one of our large clients. By helping banks to identify the underlying risk factors which are causing desks to fail, remediation becomes much more efficient. Efficient remediation of desks which are failing PLA, in turn, reduces the amount of capital charges which banks may incur.