Blog

IFRS 18: What Treasury Needs to Know Now

IFRS 18 introduces significant changes to FX classification and reporting requirements by January 2027. Despite that this adoption date still feels quite far away, there is quite some time

Find out more

Are you aware of the advancements in centralized processing of custom payment formats within SAP systems?

Historically, SAP faced limitations in this area, but recent innovations have addressed these challenges. This article explores how the XML framework within SAP’s Advanced Payment Management (APM) now effectively handles complex payment formats, streamlining and optimizing treasury functions.

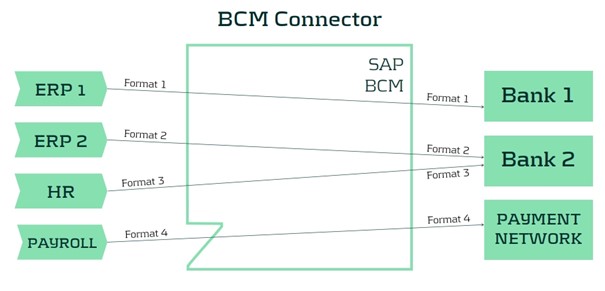

SAP Bank Communication Management (BCM) has been SAP’s solution for integrating a corporate’s SAP system with their banks. It is offering a seamless and secure connection to either a payment network or directly to the bank’s host-to-host solution. Payment and collection files generated from the Payment Medium Workbench can be transferred directly to the external systems, and status messages and bank statements can be received and processed into the SAP application.

The BCM solution has proven to be successful, and corporates wanted to leverage the solution also for transferring messages that do not have their origin in the SAP itself. For example, payment files coming from an HR system or from a legacy ERP system need to be transferred via the same connection that has been established with the BCM setup. For this requirement, SAP introduced the SAP Bank Communication Management option for multisystem payment consolidation, more commonly referred to as the BCM Connector. This add-on made it possible to process payment files generated in external modules or systems into SAP BCM.

However, the BCM Connector has an important limitation: it can only forward the exact format received to external parties. This means that if a legacy system provides a payment file in a proprietary format, it cannot be converted to a more commonly accepted (e.g., XML) format. As a result, compliance with bank requirements regarding payment formats lies with the originating application, limiting the ability to manage payment formats centrally from within the SAP system.

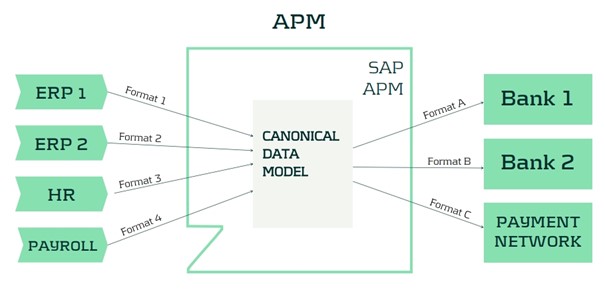

SAP has recognized this limitation and has been focusing on developing a new module to support organizations with a need for centralized payment processing. This solution is called SAP Advanced Payment Management (APM) and offers support for several scenarios for managing payments and payment formats in a centralized environment.

One of the main features of the APM solution is the file handling, which is implemented through an XML Framework. In short, this means that all payment files that need to be processed are handled as an XML message in a canonical data model. This allows for standardized payment processing across various incoming formats.

The main advantages of the XML framework are:

The solution can also be used for non-XML messages. This requires a preprocessing step where the source file is converted to an XML representation of the file. After this step, the message can be processed like any other XML file including the validation and parallel processing options.

Implementing this solution for XML and non-XML formats is a technical exercise that requires ABAP-skills and knowledge of the SAP enhancement framework . However, SAP has made it easier to implement custom formats with the framework while fully utilizing the capabilities of the APM module.

For organizations seeking to enhance their payment processing capabilities through centralized management and innovative solutions like SAP Advanced Payment Management, our team is equipped to provide expert guidance. To explore how APM can support your treasury operations and ensure seamless financial integration, please reach out to us at [email protected].

IFRS 18 introduces significant changes to FX classification and reporting requirements by January 2027. Despite that this adoption date still feels quite far away, there is quite some time

Find out moreBuilding on the June 2024 launch of the new EU AML/CFT framework and the creation of the Anti-Money Laundering Authority (AMLA), SupTech (short for Supervisory Technology) now stands as a key

Find out moreAs the European Union increasingly emphasizes robust digital resilience within the financial sector as of January 17th 2025, the Digital Operational Resilience Act (DORA) has become a critical

Find out moreManaging banking book risk remains a critical challenge in today’s financial markets and regulatory environment. There are many strategic decisions to be made and banks are having trouble

Find out moreOn July 2nd, the European Banking Authority (EBA) published a Consultation Paper proposing amendments to its 2016 Guidelines on the application of the definition of default (DoD). As part of the

Find out moreArtificial intelligence (AI) is advancing rapidly, particularly with the emergence of large language models (LLMs) such as Generative Pre-trained Transformers (GPTs). Yet, in quantitative risk

Find out moreIn an industry where growth is often measured in multiples, and value creation is expected to be both scalable and repeatable, operational excellence is no longer a supporting function—it’s

Find out moreWith extreme weather events becoming more frequent and climate policy tightening across jurisdictions, banks are under increasing pressure to understand how climate change will impact their

Find out moreWith the introduction of CRR3, effective from January 1, 2025, the ‘extra’ guarantee on Dutch mortgages – known as the Dutch National Mortgage Guarantee (NHG) – will no longer be

Find out moreAccording to the IFRS 9 standards, financial institutions are required to model probability of default (PD) using a Point-in-Time (PiT) measurement approach — a reflection of present

Find out moreInflows from open reverse repos In May 2024 the EBA stated1 that inflows from open reverse repos cannot be recognised in LCR calculations unless the call option has already been

Find out moreThis article is intended for finance, risk, and compliance professionals with business and system integration knowledge of SAP, but also includes contextual guidance for broader audiences. 1.

Find out moreOur team at Zanders has been at the forefront of implementing BACS AUDDIS (Automated Direct Debit Instruction Service) with SAP S/4HANA, helping clients to streamline their direct debit

Find out moreThailand's e-Withholding Tax (e-WHT) system officially launched on October 27, 2020, in collaboration with 11 banks, marking a significant digital transformation with far-reaching benefits for

Find out moreIn today’s rapidly evolving financial landscape, fortifying the Financial Risk Management (FRM) function remains a top priority for CFOs. Zanders has identified a growing trend among

Find out moreEmergence of Artificial Intelligence and Machine Learning The rise of ChatGPT has brought generative artificial intelligence (GenAI) into the mainstream, accelerating adoption across

Find out moreIntroduction In December 2024, FINMA published a new circular on nature-related financial (NRF) risks. Our main take-aways: NRF risks not only comprise climate-related risks,

Find out moreAs mid-sized corporations expand, enhancing their Treasury function becomes essential. International growth, exposure to multiple currencies, evolving regulatory requirements, and increased

Find out moreIndustry surveys show that FRTB may lead to a 60% increase in regulatory market risk capital requirements, placing significant pressure on banks. As regulatory market risk capital requirements

Find out moreFirst, these regions were analyzed independently such that common trends and differences could be noted within. These results were aggregated for each region such that these regions could be

Find out more

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired Fintegral.

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired RiskQuest.

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired Optimum Prime.

You need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More Information