ECB – Cyber Resilience Stress Test: Scope, Methodology and Scenario.

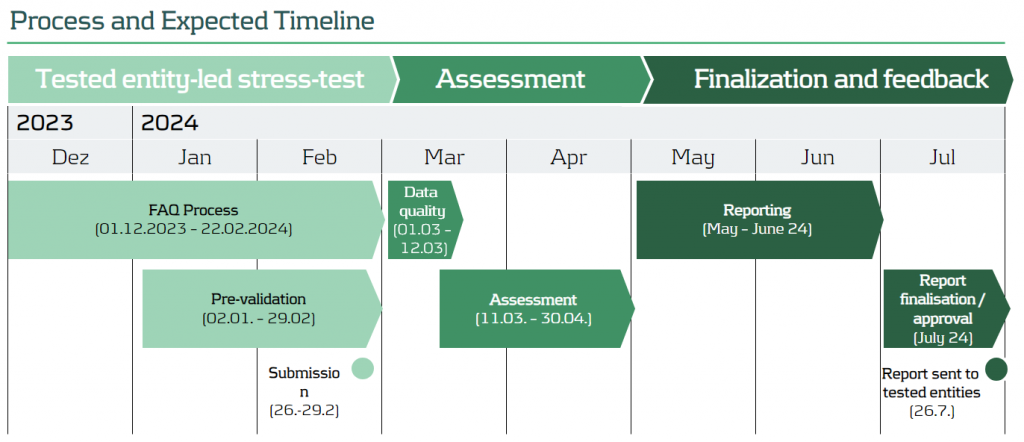

The European Central Bank (ECB) is charting new territories in the realm of financial security with a groundbreaking thematic stress test slated for 2024

In the stress test methodology, participating banks are required to evaluate the impact of a cyber attack. They must communicate their response and recovery efforts by completing a questionnaire and submitting pertinent documentation. Banks undergoing enhanced assessment are further mandated to conduct and report the results of IT recovery tests specific to the scenario. The reporting of the cyber incident is to be done using the template outlined in the SSM Cyber-incident reporting framework.

Assessing Digital Fortitude: Scope and Objectives

The ECB's decision to conduct a thematic stress test on cyber resilience in 2024 holds profound significance. The primary objective is to assess the digital operational resilience of 109 Significant Institutions, contemplating the impact of a severe but plausible cybersecurity event. This initiative seeks to uncover potential weaknesses within the systems and derive strategic remediation actions. Notably, 28 banks will undergo an enhanced assessment, heightening the scrutiny on their cyber resilience capabilities. The outcomes are poised to reverberate across the financial landscape, influencing the 2024 SREP OpRisk Score and shaping qualitative requirements.

General Overview and Scope

- Supervisory Board of ECB has decided to conduct a thematic stress test on „cyber resilience“ in 2024.

- Main objective is to assess the digital operational resilience in case of a severe but plausible cybersecurity event, to identify potential weaknesses and derive remediation actions.

- Participants will be 109 Significant Institutions (28 banks will be in scope of an enhanced assessment).

- The outcome will have an impact on the 2024 SREP OpRisk Score and qualitative requirements.

Navigating the Evaluation: Stress Test Methodology

Participating banks find themselves at the epicenter of this evaluative process. They are tasked with assessing the impact of a simulated cyber attack and meticulously reporting their response and recovery efforts. This involves answering a comprehensive questionnaire and providing relevant documentation as evidence. For those under enhanced assessment, an additional layer of complexity is introduced – the execution and reporting of IT recovery tests tailored to the specific scenario. The cyber incident reporting follows a structured template outlined in the SSM Cyber-incident reporting framework.

Stress Test Methodology

- Participating banks have to assess the impact of the cyber-attack and report their response and recovery by answering the questionnaire and providing relevant documentation as evidence.

- Banks under the enhanced assessment are additionally requested to execute and provide results of IT recovery tests tailored to the specific scenario.

- The cyber incident has to be reported by using the template of the SSM Cyber-incident reporting framework.

Setting the Stage: Scenario Unveiled

The stress test unfolds with a meticulously crafted hypothetical scenario. Envision a landscape where all preventive measures against a cyber attack have either been bypassed or failed. The core of this simulation involves a cyber-attack causing a loss of integrity in the databases supporting a bank's main core banking system. Validation of the affected core banking system is a crucial step, overseen by the Joint Supervisory Team (JST). The final scenario details will be communicated on January 2, 2024, adding a real-time element to this strategic evaluation.

Scenario

- The stress test will consist of a hypothetical scenario that assumes that all preventive measures have been bypassed or have failed.

- The cyber-attack will cause a loss of integrity of the database(s) that support the bank’s main core banking system.

- The banks have to validate the selection of the affected core banking system with the JST.

- The final scenario will be communicated on 2 January 2024.

Partnering for Success: Zanders' Service Offering

In the complex terrain of the Cyber Resilience Stress Test, Zanders stands as a reliable partner. Armed with deep knowledge in Non-Financial Risk, we navigate the intricacies of the upcoming stress test seamlessly. Our support spans the entire exercise, from administrative aspects to performing assessments that determine the impact of the cyber attack on key financial ratios as requested by supervisory authorities. This service offering underscores our commitment to fortifying financial institutions against evolving cyber threats.

Zanders Service Offering

- Our deep knowledge in Non-Financial Risk enables us to navigate smoothly through the complexity of the upcoming Cyber Resilience Stress Test.

- We support participating banks during the whole exercise of the upcoming Stress Test.

- Our Services cover the whole bandwidth of required activities starting from administrative aspects and ending up at performing assessments to determine the impact of the cyber-attack in regard of key financial ratios requested by the supervisory authority.