In this article, we explore this stablecoin payments trial, examine the advantages of digital currencies and how they could provide a matching solution to tackle the hurdles of international transactions.

Cross-border payment challenges

While cross-border payments form an essential part of our globalized economy today, they have their own set of challenges. For example, cross-border payments often involve various intermediaries, such as banks and payment processors, which can result in significantly higher costs compared to domestic payments. The involvement of multiple parties and regulations can lead to longer processing times, often combined with a lack of transparency, making it difficult to track the progress of a transaction. This can lead to uncertainty and potential disputes, especially when dealing with unfamiliar payment systems or intermediaries. Last but not least, organizations must ensure they meet the different regulations and compliance requirements set by different countries, as failure to comply can result in penalties or delays in payment processing.

Advantages of digital currencies

Digital currencies have gained significant interest in recent years and are rapidly adopted, both globally and nationally. The impact of digital currencies on treasury is no longer a question of ‘if’ but ‘when’, as such it is important for treasurers to be prepared. While we address the latest developments, risks and opportunities in a separate article, we will now focus on the role digital currencies can play in cross-border transactions.

The notorious volatility of traditional crypto currencies, which makes them less practical in a business context, has mostly been addressed with the introduction of stablecoins and central bank digital currencies. These offer a relatively stable and safe alternative for fiat currencies and bring some significant benefits.

These digital currencies can eliminate the need for intermediaries such as banks for payment processing. By leveraging blockchain technology, they facilitate direct host-to-host transactions with the benefit of reducing transaction fees and near-instantaneous transactions across borders. Transactions are stored in a distributed ledger which provides a transparent and immutable record and can be leveraged for real-time tracking and auditing of cross-border transactions. Users can have increased visibility into the status and progress of their transactions, reducing disputes and enhancing trust. At a more advanced level, compliance measures such as KYC, KYS or AML can be directly integrated to ensure regulatory compliance.

SAP Digital Currency Hub

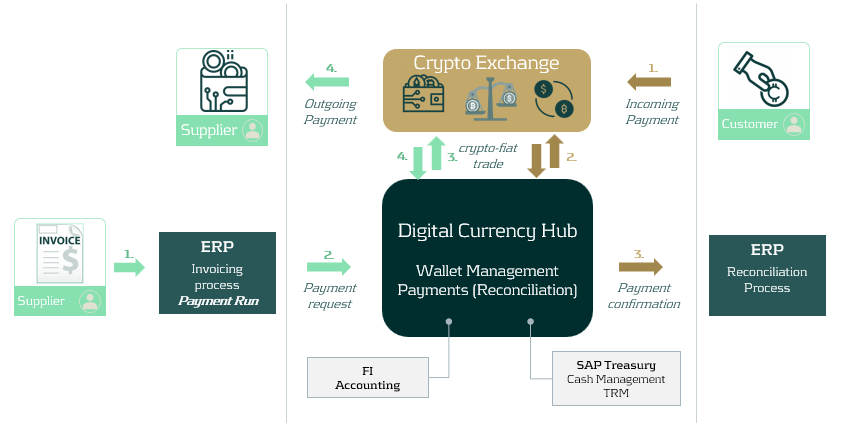

Earlier this year, SAP launched its Digital Currency Hub as a pilot to further explore the future of cross-border transactions using crypto or digital currencies. The Digital Currency Hub enables the integration of digital currencies to settle transactions with customers and suppliers. Below we provide a conceptual example of how this can work.

- Received invoices are recorded into the ERP and a payment run is executed.

- The payment request is sent to SAP Digital Currency Hub, which processes the payment and creates an outgoing payment instruction. The payment can also be entered directly in SAP Digital Currency Hub.

- The payment instruction is sent to a crypto exchange, instructing to transfer funds to the wallet of the supplier.

- The funds are received in the supplier’s wallet and the transaction is confirmed back to SAP Digital Currency Hub.

In a second example, we have a customer paying crypto to our wallet:

- The customer pays funds towards our preferred wallet address. Alternatively, a dedicated wallet per customer can be set up to facilitate reconciliation.

- Confirmation of the transaction is sent to SAP Digital Currency Hub. Alternatively, a request for payment can also be sent.

- A confirmation of the transaction is sent to the ERP where the open AR item is managed and reconciled. This can be in the form of a digital bank statement or via the use of an off-chain reference field.

Management of the wallet(s) can be done via custodial services or self-management. There are a few security aspects to consider, on which we recently published an interesting article for those keen to learn more.

While still on the roadmap, SAP Digital Currency Hub can be linked to the more traditional treasury modules such as Cash and Liquidity Management or Treasury and Risk Management. This would allow to integrate digital currency payments into the other treasury activities such as cash management, forecasting or financial risk management.

Conclusion

With the introduction of SAP Digital Currency Hub, there is a valid solution for addressing the current pain points in cross-border transactions. Although the product is still in a pilot phase and further integration with the rest of the ERP and treasury landscape needs to be built, its outlook is promising as it intends to make cross-border payments more streamlined and transparent.