Digital transformation through a corporate treasury lens

The corporate landscape is being redefined by a plethora of factors, from new business models and changing regulations to increased competition from digital natives and the acceleration of the consumer digital-first mindset.

The new landscape is all about a digital real-time experience which is creating the need for change in order to stay relevant and ideally thrive. If we reflect on the various messages from the numerous industry surveys, it’s becoming crystal clear that a digital transformation is now an imperative.

We are seeing an increasing trend that recognizes technological progress will fundamentally change an organization and this pressure to move faster is now becoming unrelenting. However, to some corporates, there is still a lack of clarity on what a digital transformation actually means. In this article we aim to demystify both the terminology and relevance to corporate treasury as well as considering the latest trends including what’s on the horizon.

What is digital transformation?

There is no one-size-fits-all view of a digital transformation because each corporate is different and therefore each digital transformation will look slightly different. However, a simple definition is the adoption of the new and emerging technologies into the business which deliver operational and financial efficiencies, elevate the overall customer experience and increase shareholder value.

Whilst these benefits are attractive, to achieve them it’s important to recognize that a digital transformation is not a destination – it’s a journey that extends beyond the pure adoption of technology. Whilst technology is the enabler, in order to achieve the full benefits of this digital transformation journey, a more holistic view is required.

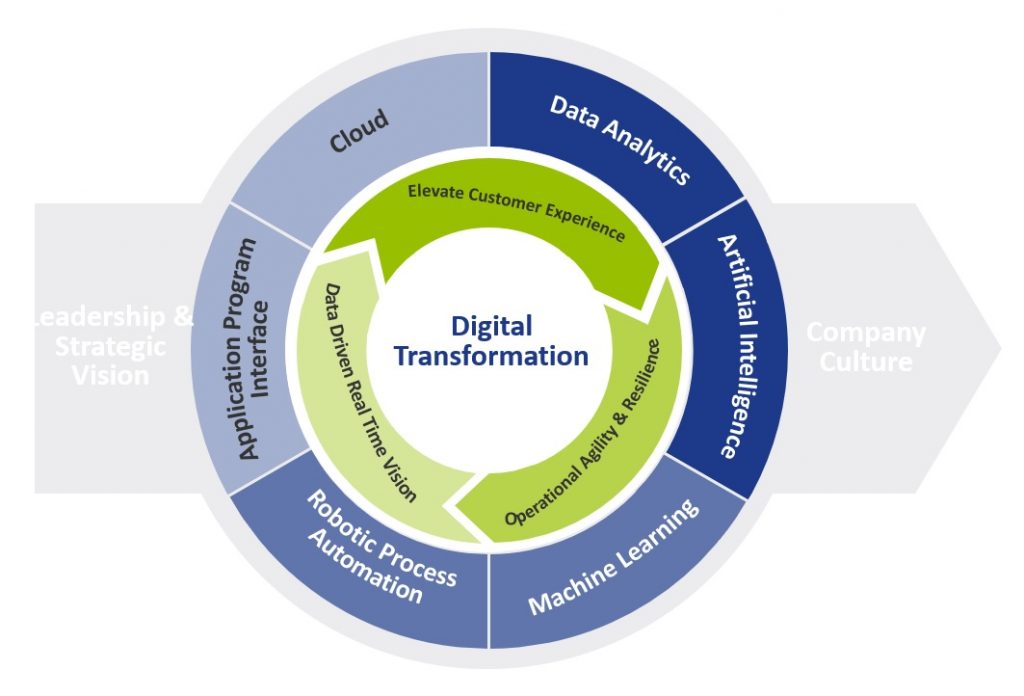

Figure 1 provides a more holistic view of a digital transformation, which embraces the importance of cultural change like the adoption of the ‘fail fast’ philosophy that is based on extensive testing and incremental development to determine whether an idea has value.

In terms of the drivers, we see four core pillars providing the motivation:

- Elevate the customer experience

- Operational agility and resilience

- Data driven real time vision

- Workforce enablement

Figure 1: Digital Transformation View

What is the relevance to corporate treasury?

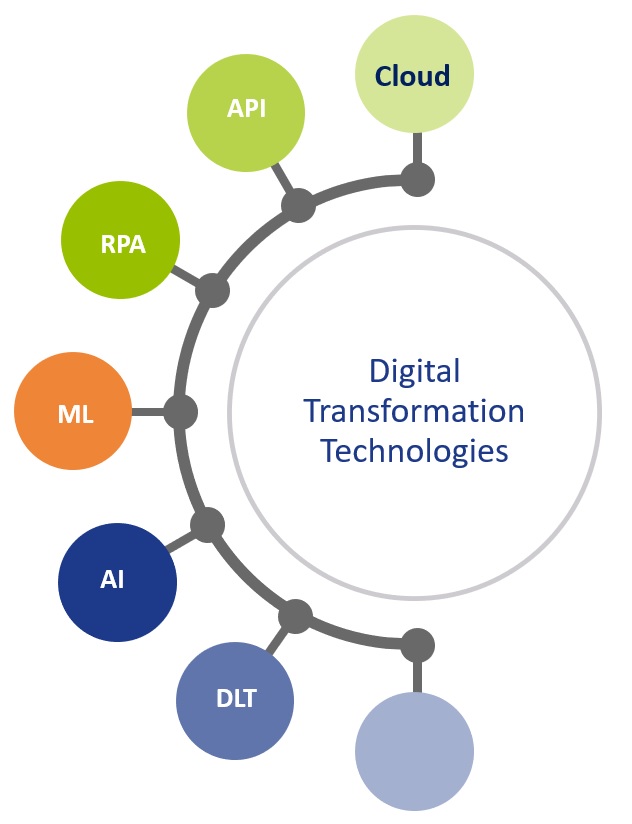

Considering the digital transformation journey, it’s important to understand the relevance of the technologies available.

Whilst figure 2 highlights the foundational technologies, it’s important to note that these technologies are all at a different stage of evolution and maturity. However, they all offer the opportunity to re-define what is possible, helping to digitize and accelerate existing processes and elevate overall treasury performance.

Figure 2: Core Digital Transformation Technologies

To help polarize the potential application and value of these technologies, we need to look through two lenses.

Firstly, what are some of today’s mainstream challenges that currently impact the performance of the treasury function, and secondly, how these technologies provide the opportunity to both optimize and elevate the treasury function.

The challenges and opportunities to optimize

Considering some of the major challenges that still exist within corporate treasury, the new and emerging technologies will provide the foundation for the digital transformation within corporate treasury as they will deliver the core capabilities to elevate overall performance. Figure 3 below provides some insights into why these technologies are more than just ‘buzzwords’, providing a clear opportunity to elevate current performance.

Figure 3: Common challenges within corporate treasury

Cognitive cash flow forecasting systems can learn and adapt from the source data, enabling automatic and continuous improvements in the accuracy and timeliness of the forecasts. Additionally, scenario analysis accelerates the informed decision-making process. Focusing on currency risk, the cognitive technology is on a continuous learning loop and therefore continues to update its decision-making process which helps improve future predictions.

Moving onto working capital, these new cognitive technologies combined with advanced optical character recognition/intelligent character recognition can automate and accelerate key processes within both the accounts payables (A/P) and account receivables (A/R) functions to contribute to overall working capital management. On the A/R side, these technologies can read PDF and email remittance information as well as screen scrape data from customer portals. This data helps automate and accelerate the cash application process with levels exceeding 95% straight through reconciliation now being achieved. Applying cash one day earlier has a direct positive impact on days sales outstanding (DSO) and working capital. On the A/P side, the technology enables greater compliance, visibility and control providing the opportunity for ‘autonomous A/P’. With invoice approval times now down to just 10.4 business hours*, it provides a clear opportunity to maximize early payment discounts (EPDs).

Whilst artificial intelligence/machine learning technologies will play a significant role within the corporate treasury digital transformation, the increased focus on real-time treasury also points to the power of financial application program interfaces (APIs). API technology will play an integral part of an overall blended solution architecture. Whilst API technology is not new, the relevance to finance really started with Europe’s PSD2 (Payment Services Directive 2) Open Banking initiative, with API technology underpinning this. There are already several use cases for both Treasury and the SSC (shared service center) to help both digitize and importantly accelerate existing processes where friction currently exists. This includes real time balances, credit notifications and payments.

The latest trends

Whilst a number of these new and emerging technologies are expected to have a profound impact on corporate treasury, when we consider the broader enterprise-wide adoption of these technologies, we are generally seeing corporate treasury below these levels. However, in terms of general market trends we see the following:

- Artificial intelligence/machine learning is being recognized as a key enabler of strategic priorities, with the potential to deliver both predictive and prescriptive analytics. This technology will be a real game-changer for corporate treasury not only addressing a number of existing and longstanding pain-points but also redefining what is possible.

- Whilst robotic process automation (RPA) is becoming mainstream in other business areas, this technology is generally viewed as less relevant to corporate treasury due to more complex and skilled activities. That said, Treasury does have a number of typically manually intensive activities, like manual cash pooling, financial closings and data consolidations. So, broader adoption could be down to relative priorities.

- Adoption of API technology now appears to be building momentum, given the increased focus around real time treasury. This technology will provide the opportunity to automate and accelerate processes, but a lack of industry standardization across financial messaging, combined with the relatively slow adoption and limited API banking service proposition across the global banking community, will continue to provide a drag on adoption levels.

What is on the horizon?

Over the past decade, we have seen a tsunami of new technologies that will play an integral part in the digital transformation journey within corporate treasury. Given that, it has taken approximately ten years for cloud technology to become mainstream from the initial ‘what is cloud?’ to the current thinking ‘why not cloud?’ We are currently seeing the early adoption of some of these foundational transformational technologies, with more corporates embarking on a digital first strategy. This is effectively re-defining the partnership between man and machine, and treasury now has the opportunity to transform its technology, approach and people which will push the boundaries on what is possible to create a more integrated, informed and importantly real-time strategic function.

However, whilst these technologies will be supporting critical tasks, assisting with real-time decision-making process and reducing risk, to truly harness the power of technology a data strategy will also be foundational. Data is the fuel that powers AI, however most organizations remain heavily siloed, from a system, data, and process perspective. Probably the biggest challenge to delivering on the AI promise is access to the right data and format at the right time.

So, over the next 5-10 years, we expect the solutions underpinned by these new foundational technologies to evolve, leveraging better quality structured data to deliver real time data visualization which embraces both predictive and prescriptive analytics. What is very clear is that this ecosystem of modern technologies will effectively redefine what is possible within corporate treasury.

*) Coupa 2021 Business Spend Management Benchmark Report